Market overview

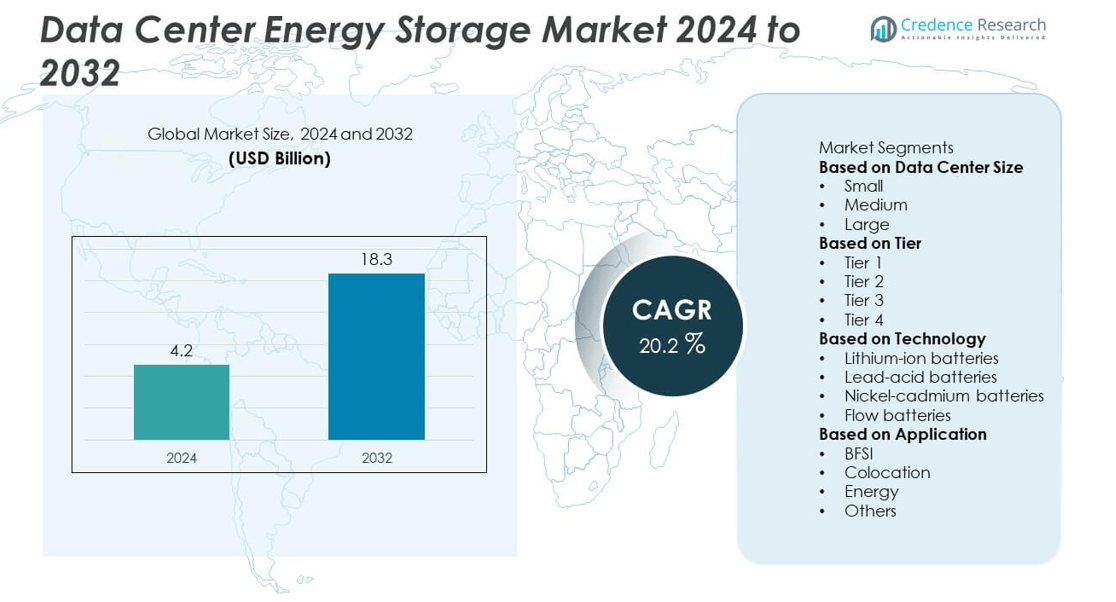

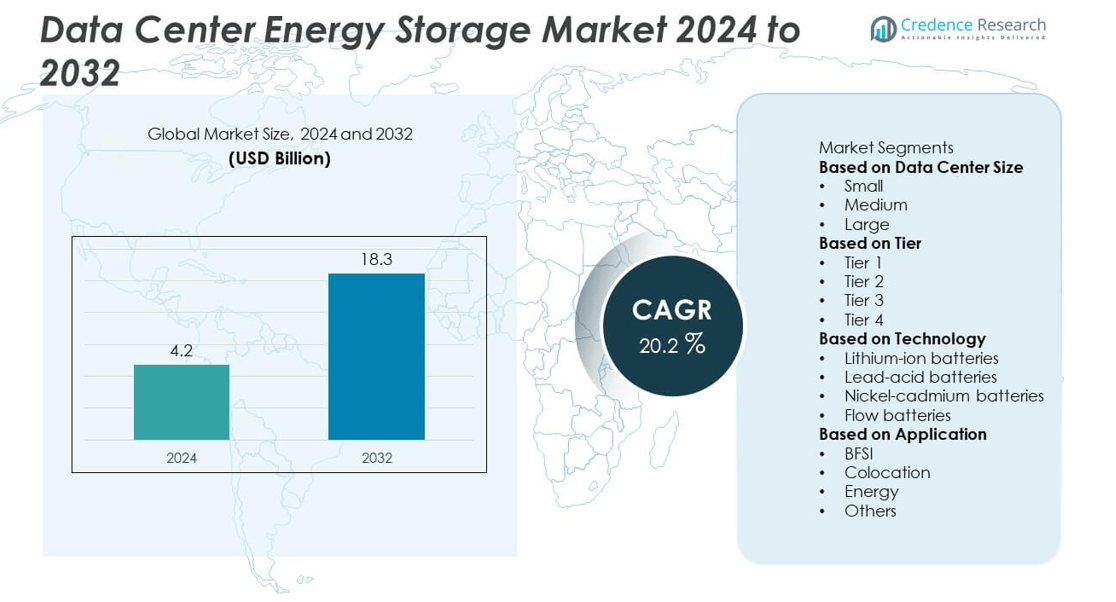

The data center energy storage market was valued at USD 4.2 billion in 2024 and is projected to reach USD 18.3 billion by 2032, growing at a CAGR of 20.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Energy Storage Market Size 2024 |

USD 4.2 billion |

| Data Center Energy Storage Market, CAGR |

20.2% |

| Data Center Energy Storage Market Size 2032 |

USD 18.3 billion |

The data center energy storage market is led by major players including Siemens, Vertiv, Delta, Tesla, Legrand, Mitsubishi, Huawei, Eaton Corporation, ABB, and Schneider Electric. These companies dominate through advanced energy storage technologies, modular battery systems, and smart grid integration solutions designed for hyperscale and colocation facilities. North America leads the global market with a 39% share, driven by large-scale data center deployments and renewable energy integration. Europe follows with a 27% share, supported by strict sustainability mandates and strong grid modernization efforts. Asia-Pacific holds a 24% share, fueled by rapid digitalization, growing cloud adoption, and expanding infrastructure investments.

Market Insights

- The data center energy storage market was valued at USD 4.2 billion in 2024 and is projected to reach USD 18.3 billion by 2032, expanding at a CAGR of 20.2% during the forecast period.

- Rising demand for uninterrupted power supply in hyperscale and colocation data centers is driving large-scale adoption of battery energy storage systems.

- The growing trend toward renewable integration and smart grid connectivity is accelerating the shift to lithium-ion and flow battery technologies.

- Key players such as Siemens, Vertiv, Schneider Electric, and Tesla are investing in hybrid systems and modular designs to improve energy efficiency and sustainability.

- North America holds a 39% share, followed by Europe with 27% and Asia-Pacific with 24%, while the large data center segment dominates with 58% share, supported by strong investment in cloud infrastructure and energy optimization solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Data Center Size

The large data center segment dominated the data center energy storage market in 2024 with a 58% share. This dominance is driven by the increasing deployment of hyperscale facilities supporting cloud computing, AI workloads, and high-performance computing. Large data centers require robust and scalable energy storage systems to ensure uninterrupted operations and meet sustainability targets. The growing integration of renewable energy sources such as solar and wind also strengthens demand for advanced storage solutions. Major operators like Amazon Web Services and Microsoft are investing in battery-based energy storage to reduce reliance on diesel generators.

- For instance, Microsoft has deployed lithium-ion battery storage systems in its data centers in Dublin and Quincy to support its diesel-free initiative and enhance renewable energy utilization.

By Tier

The Tier 4 segment held the largest market share of 44% in 2024, supported by its critical infrastructure requirements and high uptime standards. Tier 4 data centers rely heavily on advanced energy storage systems to achieve continuous availability with redundancy across power and cooling systems. The segment benefits from growing enterprise demand for zero-downtime operations in BFSI, telecom, and cloud sectors. Increasing adoption of modular and hybrid battery systems helps maintain efficiency during grid fluctuations. Investments in resilient infrastructure and strict service-level agreements (SLAs) continue to fuel Tier 4 dominance in energy storage adoption.

- For instance, Equinix’s SG5 facility in Singapore uses innovative surface cooling technology to support high-density customers. The facility also features robust electrical and cooling system redundancy to help ensure reliable operation.

By Technology

The lithium-ion battery segment led the data center energy storage market in 2024, capturing a 63% share. Its leadership is attributed to higher energy density, faster charging, longer life cycles, and lower maintenance compared to lead-acid and nickel-cadmium systems. Data center operators prefer lithium-ion batteries for efficient power backup and integration with renewable energy grids. Growing adoption of liquid-cooled battery packs and AI-driven battery management systems further enhances reliability. Continuous cost reduction and safety improvements by manufacturers like Tesla and Samsung SDI are driving widespread deployment of lithium-ion technology across both hyperscale and colocation data centers.

Key Growth Drivers

Rising Demand for Uninterrupted Power Supply

The increasing dependency on data centers for cloud services, AI operations, and edge computing is driving demand for reliable energy backup systems. Outages can lead to severe operational and financial losses, prompting operators to adopt advanced storage solutions. Energy storage systems ensure uninterrupted power and enhance uptime during grid failures. The need for stable power delivery in hyperscale and colocation facilities continues to expand, strengthening investments in battery-based energy infrastructure to support 24/7 operation and seamless digital service continuity.

- For instance, Google partnered with Centrica Business Solutions and Fluence to deploy a 2.75 MW battery storage system at its data center in Saint-Ghislain, Belgium, designed to reduce reliance on diesel generators during power outages and to stabilize grid frequency through smart energy dispatch technology.

Growing Integration of Renewable Energy Sources

The global push for sustainability and carbon neutrality is encouraging data centers to integrate renewable energy with storage systems. Solar and wind power generation require stable backup to manage fluctuations in supply. Energy storage technologies like lithium-ion and flow batteries balance load and store excess power for peak usage. Leading operators are deploying hybrid systems combining renewables and batteries to reduce emissions and energy costs. This trend supports green data center initiatives and accelerates the shift toward low-carbon digital infrastructure.

- For instance, Amazon Web Services (AWS) operates numerous solar and wind projects across Virginia and Ireland as part of its global commitment to match its operations with 100% renewable energy.

Expansion of Hyperscale and Colocation Facilities

The rapid growth of hyperscale and colocation data centers is a major driver for energy storage adoption. Cloud providers such as AWS, Google, and Microsoft are expanding global infrastructure to meet surging data traffic and AI-driven workloads. These large-scale facilities demand high-capacity storage for energy reliability and load management. Energy storage helps optimize power distribution, reduce grid dependency, and maintain operational efficiency. Continuous infrastructure investments in emerging regions like Asia-Pacific and the Middle East further boost energy storage deployments to ensure scalability and sustainability.

Key Trends and Opportunities

Adoption of Lithium-Ion and Flow Battery Technologies

The shift from traditional lead-acid batteries to lithium-ion and flow batteries marks a key technological trend. These solutions offer superior energy density, faster recharge cycles, and longer operational life. Flow batteries, in particular, provide scalable storage with enhanced thermal stability, suitable for large data centers. Manufacturers are introducing smart monitoring and AI-based battery management systems to optimize performance. This shift toward advanced battery chemistries opens new opportunities for efficient, sustainable, and cost-effective power backup solutions in modern data centers.

- For instance, Huawei’s SmartLi UPS system, based on lithium-ion batteries, is deployed in data centers, including in the Asia-Pacific region. The system features a long cycle lifespan of up to 5,000 cycles, and some sources note a potential 10 to 15-year lifespan, which is significantly longer than typical lead-acid systems.

Rising Investments in Modular and Hybrid Energy Systems

Data centers are adopting modular and hybrid energy storage systems to improve scalability and resilience. Modular systems allow flexible capacity expansion, while hybrid configurations combine multiple storage technologies for optimized energy use. This approach reduces operational costs and supports renewable integration. Increasing investment from major energy storage providers and data center operators highlights the growing preference for adaptable infrastructure. These systems enable real-time energy balancing, ensuring efficient load management and supporting sustainability targets across hyperscale and enterprise facilities.

- For instance, Vertiv offers a range of power and grid support solutions, including options for integrating lithium-ion battery energy storage with UPS systems to provide backup power for critical data center loads.

Key Challenges

High Capital and Maintenance Costs

The installation of large-scale energy storage systems involves significant upfront investment in batteries, converters, and cooling infrastructure. Lithium-ion and flow batteries, though efficient, require specialized maintenance and monitoring systems. Smaller data centers face cost challenges when adopting advanced storage solutions. High operational costs, coupled with limited budget flexibility, often delay modernization projects. As competition intensifies, manufacturers must focus on cost reduction through localized production, modular design, and long-life energy systems to ensure affordability and market expansion across all data center tiers.

Regulatory and Safety Compliance Issues

Stringent safety standards and varying regional regulations pose major challenges in deploying energy storage systems. Lithium-ion batteries require careful management to prevent overheating, fire risks, and chemical hazards. Differences in certification norms across North America, Europe, and Asia complicate deployment for global data center operators. Additionally, achieving environmental compliance for large-scale installations adds to project complexity. Developing standardized safety frameworks and improving battery recycling processes are essential steps to ensure sustainable and compliant growth in the data center energy storage market.

Regional Analysis

North America

North America dominated the data center energy storage market in 2024 with a 39% share, driven by extensive hyperscale expansion and early adoption of lithium-ion technology. The U.S. leads the region due to large cloud infrastructure networks operated by Amazon, Google, and Microsoft. Increasing focus on renewable energy integration and grid stabilization is accelerating the use of advanced battery storage systems. Government initiatives promoting energy efficiency and carbon reduction further strengthen regional growth. Continuous investments in modular and hybrid storage systems are enhancing data center resilience and supporting sustainability goals across major U.S. and Canadian facilities.

Europe

Europe accounted for a 27% share of the data center energy storage market in 2024, supported by strong environmental policies and investments in renewable energy infrastructure. Countries such as Germany, the U.K., and the Netherlands are leading due to their growing hyperscale and colocation networks. The European Union’s carbon neutrality goals encourage data centers to adopt clean energy storage systems to reduce emissions. Rising deployment of modular batteries and smart grid integration solutions further boosts regional adoption. Strategic partnerships among energy firms and data center operators continue to enhance operational efficiency and energy sustainability across Europe.

Asia-Pacific

Asia-Pacific held a 24% share of the global data center energy storage market in 2024, fueled by rapid data center expansion in China, India, and Japan. The surge in digitalization, e-commerce, and cloud adoption is creating strong demand for reliable power storage solutions. Regional governments are investing in renewable integration and smart grid projects to support energy efficiency. Major operators are adopting large-scale lithium-ion and flow battery systems to meet high energy requirements. Growing hyperscale developments and local manufacturing of storage technologies continue to strengthen Asia-Pacific’s position as a high-growth market for data center energy storage.

Latin America

Latin America captured a 6% share of the data center energy storage market in 2024, driven by increasing investments in digital infrastructure and renewable energy integration. Brazil, Mexico, and Chile are emerging as key markets, supported by growing hyperscale data center construction. The rising need for stable energy supply and grid reliability is pushing operators toward advanced battery systems. Regional governments are promoting energy transition programs to encourage sustainable power storage solutions. Although infrastructure challenges remain, improving energy policies and foreign investments are gradually accelerating the adoption of modern energy storage technologies across Latin America.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the data center energy storage market in 2024, supported by expanding digital transformation initiatives and smart city projects. The UAE, Saudi Arabia, and South Africa are leading markets due to significant investment in cloud infrastructure and renewable energy. Data center operators are increasingly deploying hybrid battery systems to ensure uninterrupted power and reduce diesel dependency. Government efforts to diversify energy sources and attract global tech investments are strengthening growth. However, limited grid infrastructure in some African nations still poses challenges for large-scale adoption.

Market Segmentations:

By Data Center Size

By Tier

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Technology

- Lithium-ion batteries

- Lead-acid batteries

- Nickel-cadmium batteries

- Flow batteries

By Application

- BFSI

- Colocation

- Energy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the data center energy storage market is defined by strong technological innovation and large-scale infrastructure investments from leading companies such as Siemens, Vertiv, Delta, Tesla, Legrand, Mitsubishi, Huawei, Eaton Corporation, ABB, and Schneider Electric. These firms are focusing on developing advanced, energy-efficient storage systems to support the growing power demands of hyperscale and colocation data centers. Strategic partnerships between energy solution providers and data center operators are expanding the adoption of lithium-ion and flow battery systems. Companies are emphasizing grid integration, modular design, and smart monitoring technologies to enhance operational efficiency and sustainability. Additionally, many are investing in renewable-linked storage projects to achieve carbon neutrality goals. The ongoing transition toward hybrid and AI-powered energy management systems continues to intensify competition, with global players expanding their presence in emerging markets to capture increasing demand for reliable and resilient data center power solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens

- Vertiv

- Delta

- Tesla

- Legrand

- Mitsubishi

- Huawei

- Eaton Corporation

- ABB

- Schneider Electric

Recent Developments

- In 2025, Tesla launched its Megapack 3 battery system, delivering an upgraded capacity of over 1 MWh per unit compared to previous versions, enhancing scalability for hyperscale and AI-driven data centers.

- In May 2024, ABB introduced its Battery Energy Storage Systems-as-a-Service (BESSaaS) model to simplify renewable adoption for enterprises. The program includes installation, monitoring, and lifecycle management for large-scale energy storage assets in data centers.

- In March 2024, Vertiv expanded its Lithium-Ion UPS portfolio, enabling modular backup systems for hyperscale data centers, capable of delivering up to 500 kWh per rack.

- In 2024, Tesla achieved a milestone with 9.4 GWh of energy storage deployments across its global operations, marking a new quarterly record for the company’s energy division

Report Coverage

The research report offers an in-depth analysis based on Data Center Size, Tier, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of lithium-ion and flow battery systems will increase across hyperscale facilities.

- Integration of renewable energy sources will strengthen data center sustainability efforts.

- Hybrid energy storage systems will become standard for efficient load management.

- Modular battery designs will support scalable infrastructure expansion in large data centers.

- AI-powered energy management platforms will enhance monitoring and power optimization.

- Rising construction of green data centers will drive long-term energy storage demand.

- Strategic partnerships between tech and energy firms will accelerate technological innovation.

- Government incentives for carbon reduction will promote clean energy storage adoption.

- Emerging economies in Asia-Pacific will witness rapid deployment of advanced battery systems.

- Continuous R&D investments will improve battery lifespan, safety, and overall energy efficiency.