Market Overview

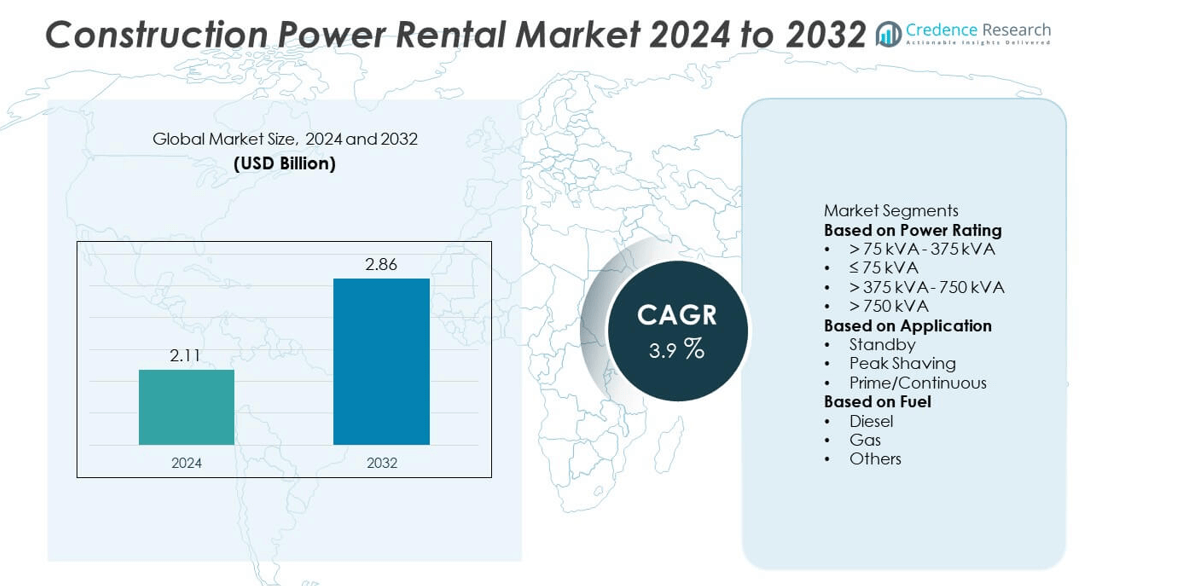

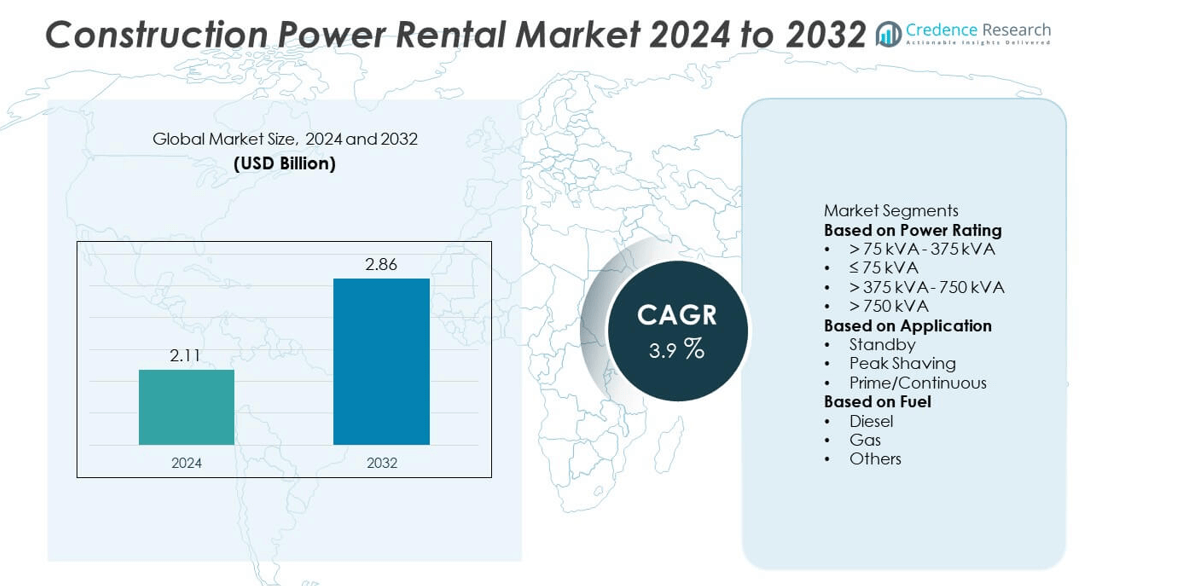

The global construction power rental market was valued at USD 2.11 billion in 2024 and is projected to reach USD 2.86 billion by 2032, growing at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Power Rental Market Size 2024 |

USD 2.11 billion |

| Construction Power Rental Market, CAGR |

3.9% |

| Construction Power Rental Market Size 2032 |

USD 2.86 billion |

The construction power rental market is led by major players including HIMOINSA, Byrne Equipment Rental, Cummins, Bredenoord, Aggreko, APR Energy, Herc Rentals, Caterpillar, Atlas Copco, and Generac Power Systems. These companies maintain strong global positions through extensive rental networks, advanced power solutions, and reliable service support. They focus on hybrid, fuel-efficient, and low-emission generators to meet evolving sustainability requirements. Asia-Pacific emerged as the leading regional market with a 34% share in 2024, driven by rapid infrastructure expansion and industrialization. North America followed with a 32% share, supported by modernization projects, smart construction initiatives, and strong adoption of temporary power systems across large-scale commercial and industrial developments.

Market Insights

- The construction power rental market was valued at USD 2.11 billion in 2024 and is projected to reach USD 2.86 billion by 2032, growing at a CAGR of 3.9% during the forecast period.

- Rising infrastructure investments, urbanization, and large-scale construction projects are driving demand for temporary and reliable power rental solutions globally.

- Market trends highlight the growing adoption of hybrid and energy-efficient generators, along with the integration of digital monitoring and fleet management systems.

- The market is moderately consolidated, with key players such as Aggreko, Caterpillar, Cummins, and Atlas Copco expanding through partnerships, product innovations, and sustainable rental solutions.

- Asia-Pacific led the market with a 34% share in 2024, followed by North America at 32% and Europe at 27%, while the >75 kVA–375 kVA power rating segment dominated with a 43% share due to its versatility across mid- to large-scale construction projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The >75 kVA – 375 kVA segment dominated the construction power rental market in 2024 with a 43% share, driven by its wide application across mid-sized construction sites and infrastructure projects. These generators provide optimal power output for tools, lighting, and heavy equipment used in commercial and residential construction. Their flexibility, cost-effectiveness, and easy mobility make them ideal for short-term and large-scale operations. Increasing investment in infrastructure modernization and expanding construction activities in developing economies continue to drive demand for medium-capacity rental generators.

- For instance, Aggreko deployed modular generators for Qatar’s North Field Expansion Project, providing a 17.4 MW modular power solution with reduced fuel consumption through the integration of load-on-demand technology.

By Application

The prime/continuous segment held a 46% share of the market in 2024, supported by the rising need for uninterrupted power supply at construction sites operating in remote or off-grid areas. These generators ensure stable energy flow for heavy-duty equipment and large-scale infrastructure development projects. Growing reliance on rented power for continuous operations, particularly in road and bridge construction, further boosts segment growth. The standby power segment also shows consistent demand, providing emergency power backup during grid outages or project downtime.

- For instance, Cummins West Africa, a joint venture with A.G. Leventis, manufactures power generation systems in Nigeria. Eko Atlantic City is a real estate development in Lagos with its own independent power supply.

By Fuel

The diesel segment accounted for a 69% share of the market in 2024, attributed to its high reliability, efficiency, and cost-effectiveness for on-site power generation. Diesel generators are preferred for their durability and ability to operate under varying load conditions, making them suitable for construction projects of all scales. The widespread availability of diesel fuel and the low maintenance requirements of modern engines support continued adoption. Meanwhile, gas-based rental generators are gaining attention for their lower emissions and alignment with global sustainability goals, particularly in environmentally regulated markets.

Key Growth Drivers

Rising Infrastructure Development and Urbanization

Increasing investments in infrastructure development, including highways, rail networks, and commercial complexes, are driving demand for temporary power solutions. Rapid urbanization in emerging economies has accelerated construction activities, creating a consistent need for reliable power at job sites. Rental power systems offer flexibility, cost efficiency, and ease of deployment, making them essential for large-scale and remote projects. Governments’ focus on smart city projects and industrial expansion continues to strengthen market growth across both developed and developing regions.

- For instance, HIMOINSA delivered a fleet of generator units, specifically including the HMW 405 T6 model, for the Mecca-Medina High-Speed Rail project in Saudi Arabia, ensuring operational continuity under extreme heat conditions exceeding 45°C.

Growing Demand for Reliable Power Supply at Construction Sites

Frequent power outages and inadequate grid access at construction sites have boosted the need for dependable rental power equipment. Contractors prefer rental generators to ensure uninterrupted operations and meet project deadlines efficiently. These systems provide flexibility for varying power loads and are easily scalable based on site requirements. The growing complexity of construction projects and the demand for continuous power supply in remote or urban redevelopment areas are fueling market expansion.

- For instance, Byrne Equipment Rental is a real company that provides temporary power and other equipment in the Middle East. They and other firms like them supply equipment for large-scale construction projects across the region, which often rely on temporary power solutions during peak phases.

Cost Efficiency and Operational Flexibility of Rental Solutions

The cost-effectiveness of rental power compared to equipment ownership is a key growth driver in the construction industry. Renting eliminates capital expenditure, maintenance costs, and storage issues, making it an attractive option for contractors managing multiple short-term projects. Rental companies offer customized service packages, quick delivery, and technical support, enhancing operational reliability. The trend toward outsourcing power generation needs is gaining traction as builders prioritize efficient resource allocation and project-based financial management.

Key Trends and Opportunities

Shift Toward Hybrid and Energy-Efficient Power Systems

The market is witnessing a transition toward hybrid generator systems combining diesel and renewable energy sources to enhance efficiency and reduce emissions. These solutions lower fuel consumption and align with global sustainability goals. Manufacturers are developing advanced generators with remote monitoring, load management, and automatic synchronization features. The integration of clean energy technology within rental fleets presents an opportunity for companies to cater to environmentally conscious clients and meet regulatory standards for low-carbon construction operations.

- For instance, Atlas Copco introduced the ZBP 45 battery energy storage system capable of delivering 45 kVA continuous output with zero emissions, paired with its QAS 630 generator line, reducing CO₂ output by 50 metric tons annually during hybrid site operations.

Integration of Digital Monitoring and Smart Fleet Management

Advancements in telematics and IoT are enabling digital monitoring of rental power equipment for improved performance tracking and predictive maintenance. Fleet management platforms allow operators to remotely control power usage, track fuel levels, and monitor real-time performance metrics. These technologies improve equipment uptime and reduce operational costs. The adoption of connected solutions also enhances safety compliance and allows rental companies to offer data-driven service models, creating opportunities for enhanced customer satisfaction and long-term partnerships.

- For instance, Generac Power Systems offers its PowerZone® Pro control platform, enabling real-time monitoring of voltage, load, and runtime data for industrial and rental units, a feature used to enhance service alerts and help improve equipment uptime.

Key Challenges

Stringent Emission Regulations and Environmental Concerns

Tightening environmental regulations on diesel emissions are posing challenges for rental power providers. Many regions have implemented strict emission norms, increasing compliance costs and limiting the use of older generator models. The need for cleaner, low-emission equipment has led to rising investment in eco-friendly technologies, which can increase operational costs. Balancing cost efficiency with environmental responsibility remains a key challenge as companies transition toward sustainable power rental solutions.

Fluctuating Fuel Prices and High Maintenance Costs

Volatility in global fuel prices directly affects the operational expenses of rental power systems, influencing rental rates and profit margins. Additionally, maintaining generator fleets to ensure reliability requires significant investment in servicing, parts replacement, and skilled labor. Construction companies often face higher rental costs when fuel prices spike, impacting project budgets. Rental providers must adopt efficient fuel management systems and explore alternative energy options to mitigate these cost-related challenges while maintaining service quality.

Regional Analysis

North America

North America held a 32% share of the construction power rental market in 2024, supported by ongoing infrastructure upgrades and strong demand from large-scale commercial and residential projects. The United States leads the region, driven by investments in transportation, industrial facilities, and renewable energy construction. Rental power solutions are preferred for flexibility and reliability during peak project phases. Canada also contributes to market growth through energy-efficient construction practices and infrastructure expansion. Increasing adoption of hybrid rental generators and digital monitoring systems further strengthens market presence across the region.

Europe

Europe accounted for a 27% share of the global construction power rental market in 2024, fueled by strict emission regulations and the rising adoption of sustainable power solutions. Countries such as Germany, the United Kingdom, and France are major contributors, emphasizing eco-friendly construction practices and low-emission generator usage. The growth of smart city and green infrastructure projects drives continuous demand for temporary power systems. Rental companies are focusing on hybrid and gas-powered generators to comply with environmental standards. Government-funded infrastructure redevelopment programs also support steady market expansion across the region.

Asia-Pacific

Asia-Pacific dominated the construction power rental market with a 34% share in 2024, driven by rapid industrialization, urbanization, and expanding construction activities in China, India, and Southeast Asia. Massive infrastructure projects, including smart cities, transportation corridors, and industrial zones, are propelling demand for reliable temporary power solutions. The shortage of stable grid connectivity in rural and remote areas further increases reliance on rental generators. Rising investments in public infrastructure and manufacturing facilities are boosting equipment utilization rates. Competitive pricing and growing local rental fleets continue to strengthen the region’s leading position.

Latin America

Latin America captured a 4% share of the global construction power rental market in 2024, supported by expanding construction in commercial, energy, and infrastructure sectors. Brazil and Mexico are leading contributors due to their strong focus on urban development and road modernization. The increasing use of rental generators for remote projects and oilfield construction enhances operational flexibility. Economic recovery and foreign investment in construction projects are also driving demand. Rental providers are expanding service networks to meet the growing power requirements of regional contractors and industrial developers.

Middle East and Africa

The Middle East and Africa region held a 3% share of the construction power rental market in 2024, driven by the development of large-scale infrastructure and energy projects. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are leading adopters due to ongoing investments in smart cities, industrial complexes, and transportation networks. High temperatures and challenging site conditions increase the demand for reliable power backup solutions. The rise of renewable construction projects and expanding oil and gas infrastructure continue to create opportunities for rental power service providers across the region.

Market Segmentations:

By Power Rating

- > 75 kVA – 375 kVA

- ≤ 75 kVA

- > 375 kVA – 750 kVA

- > 750 kVA

By Application

- Standby

- Peak Shaving

- Prime/Continuous

By Fuel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the construction power rental market includes key players such as HIMOINSA, Byrne Equipment Rental, Cummins, Bredenoord, Aggreko, APR Energy, Herc Rentals, Caterpillar, Atlas Copco, and Generac Power Systems. These companies dominate the market through extensive rental fleets, wide geographic reach, and strong service networks. They focus on providing reliable, energy-efficient, and environmentally compliant generator solutions for diverse construction needs. Strategic initiatives such as partnerships, product innovations, and fleet expansions are strengthening market presence. Companies are also investing in hybrid and low-emission technologies to meet global sustainability standards. Enhanced digital fleet management, remote monitoring, and predictive maintenance capabilities are improving operational efficiency and customer satisfaction. With growing infrastructure investments and smart construction projects worldwide, leading players continue to expand their rental capacities and service offerings to maintain competitiveness in this evolving market.

Key Player Analysis

- HIMOINSA

- Byrne Equipment Rental

- Cummins

- Bredenoord

- Aggreko

- APR Energy

- Herc Rentals

- Caterpillar

- Atlas Copco

- Generac Power Systems

Recent Developments

- In June 2025, Aggreko expanded its “Greener Upgrades” portfolio by introducing three natural gas generators (350 kW, 1,500 kW, and a rapid-deploy 1,500 kW trailer unit) to support low-emissions power rental solutions.

- In June 2025, HIMOINSA strengthened its international rental strategy by emphasizing the new HGY series and expanding its reach across key markets.

- In October 2024, HIMOINSA launched its HGY Series generators (powered by Yanmar engines) with outputs between 1,250 kVA and 3,500 kVA, designed for mission-critical applications like data centers and hospitals.

- In 2023, HIMOINSA announced it had produced its 100,000th generator set powered by Yanmar engines, scaling up production to about 60 units per day in key lines

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with ongoing global infrastructure and urban development projects.

- Demand for hybrid and low-emission rental generators will increase due to stricter environmental regulations.

- Technological advancements will enhance remote monitoring and predictive maintenance capabilities.

- Construction firms will prefer flexible rental models over equipment ownership for cost efficiency.

- The integration of renewable power sources into rental fleets will expand sustainability efforts.

- Asia-Pacific will remain the fastest-growing region driven by industrialization and smart city projects.

- North America will continue adopting advanced digital fleet management systems for efficiency.

- Partnerships between rental providers and construction firms will strengthen long-term service contracts.

- Increased investment in large public infrastructure projects will boost generator rental demand.

- Companies will focus on expanding their service networks to meet rising power needs in emerging markets.