Market Overviews

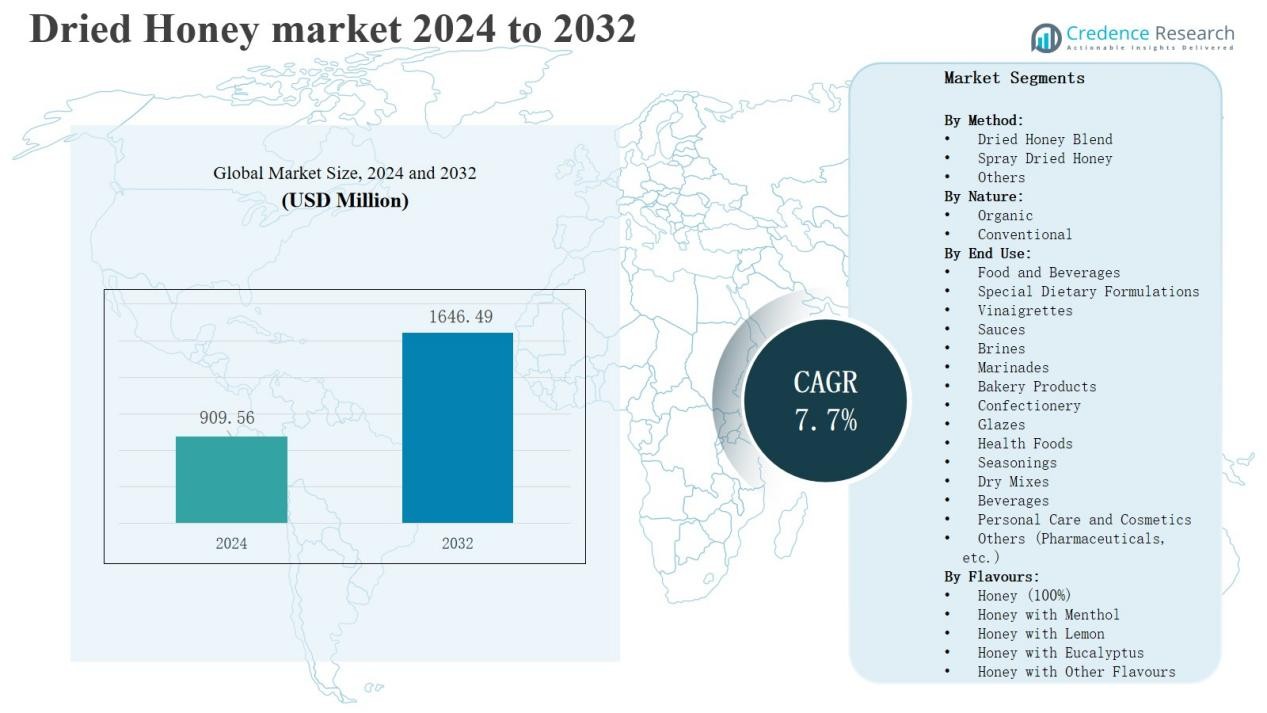

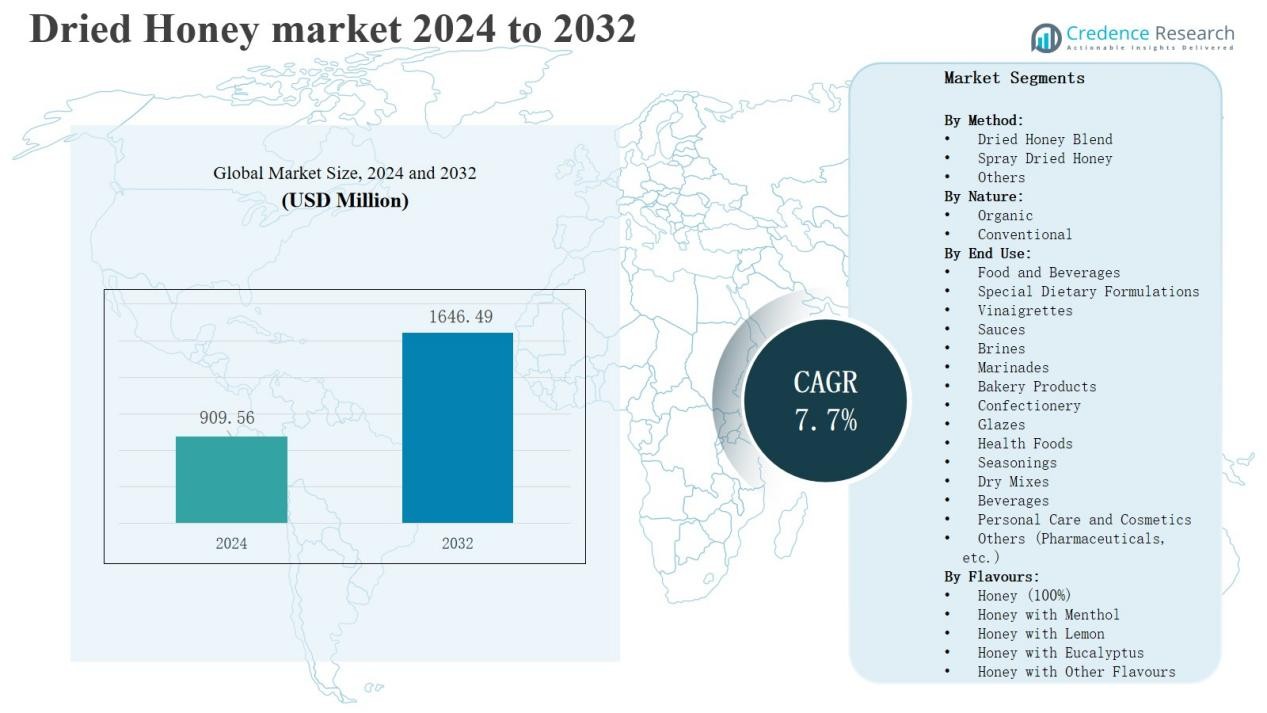

The Global Dried Honey Market size was valued at USD 909.56 million in 2024 and is anticipated to reach USD 1,646.49 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dried Honey Market Size 2024 |

USD 909.56 Million |

| Dried Honey Market, CAGR |

7.7% |

| Dried Honey Market Size 2032 |

USD 1,646.49 Million |

The Dried Honey Market is led by key players such as Lamex Food Group Limited, The Archer Daniels Midland Company (ADM), Norevo GmbH, Wuhu Deli Foods Co., Ltd., Sweet Harvest Foods Inc., Bulk Natural Foods, Nature Nate’s Honey Co., Hoosier Hill Farm LLC, Kanegrade Limited, and Augason Farms. These companies focus on product innovation, quality improvement, and sustainable sourcing to meet the rising global demand for natural sweeteners. Technological advancements in spray drying and strong distribution partnerships enhance their competitiveness across diverse applications. North America remains the leading region, holding 32% of the global market share, driven by high consumer preference for clean-label products and strong industrial demand from bakery, confectionery, and beverage sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Dried Honey Market was valued at USD 909.56 million in 2024 and is projected to reach USD 1,646.49 million by 2032, growing at a CAGR of 7.7%.

- Spray Dried Honey dominates the market with a 56% share, favored for its stability, long shelf life, and easy use in large-scale food production.

- The Conventional segment holds 72% share in 2024, driven by affordability and strong adoption across commercial food and beverage applications.

- North America leads the market with a 32% share, supported by high demand for clean-label sweeteners and strong food manufacturing infrastructure.

- Key players such as ADM, Lamex Food Group, Norevo GmbH, Wuhu Deli Foods, and Sweet Harvest Foods focus on innovation, sustainability, and advanced drying technology to enhance market competitiveness.

Market Segment Insights

By Method:

Spray Dried Honey dominates the Dried Honey Market, accounting for around 56% share in 2024. Its popularity stems from ease of handling, extended shelf life, and consistent flavor retention. Food and beverage manufacturers prefer spray drying for large-scale production due to cost efficiency and quick solubility in dry mixes and beverages. The Dried Honey Blend segment, with about 32% share, serves niche applications requiring customized flavor profiles and controlled sweetness levels.

- For instance, Sweet Harvest Foods launched a spray-dried honey ingredient for bakery mixes, offering standardized moisture control to improve product shelf stability

By Nature:

The Conventional segment leads the market with approximately 72% share in 2024, driven by its wide availability, lower production costs, and strong presence in commercial food applications. Organic dried honey, holding around 28% share, is gaining traction as consumers increasingly seek natural and clean-label ingredients. Rising awareness of organic certification and eco-friendly sourcing practices continues to fuel demand growth in premium food products and nutraceutical formulations.

- For instance, Apis India Limited launched organic honey sourced from certified organic lands in Kashmir in January 2024, offering a 450g glass bottle priced competitively and highlighting sustainable sourcing practices.

By End Use:

Food and Beverages represent the largest end-use segment, capturing about 61% market share in 2024. Its dominance is supported by extensive use in bakery, confectionery, sauces, and dry mixes for flavor enhancement and natural sweetness. The health foods and personal care sectors are emerging as high-growth areas, driven by consumer preference for natural, nutrient-rich ingredients and honey’s antibacterial and antioxidant properties. Pharmaceutical applications are also expanding, contributing to steady overall market growth.

Market Overview

Key Growth Driver

Rising Demand for Natural Sweeteners

Growing consumer awareness of artificial sugar substitutes’ health risks is driving demand for natural alternatives like dried honey. It offers nutritional benefits such as antioxidants and enzymes, aligning with the clean-label and wellness trends. Food and beverage companies are increasingly incorporating dried honey in snacks, cereals, and baked goods to enhance flavor and reduce refined sugar content. Its ease of blending in dry formulations further supports adoption across health-focused product lines and packaged food manufacturing.

Expanding Applications in Food Processing Industry

The food processing industry’s shift toward natural flavoring and preservation agents boosts dried honey utilization. It is widely used in confectionery, bakery, sauces, and beverages for its stability and flavor-enhancing properties. The ingredient’s powder form allows precise dosing and longer shelf life compared to liquid honey, making it ideal for large-scale production. Demand from manufacturers seeking consistent sweetness and improved texture in processed foods continues to strengthen market expansion across global food sectors.

- For instance, Paula Ingredients reported that powdered honey blends seamlessly with dry ingredients in energy bars, breakfast cereals, and baked goods, ensuring consistent sweetness and texture.

Growth of Functional and Nutraceutical Products

The rising popularity of functional foods and nutraceuticals supports demand for dried honey as a natural additive. It is used in protein powders, energy bars, and dietary supplements due to its antimicrobial and antioxidant benefits. Consumers increasingly prefer ingredients offering both taste and wellness benefits. The expansion of the sports nutrition and dietary supplement markets in regions like North America and Europe is further accelerating the inclusion of dried honey in health-oriented product formulations.

- For instance, Eatopia has incorporated dried honey in its Fruit Minis Dry Fruits Protein Bars, emphasizing natural sweetness and functional benefits with no artificial chemicals.

Key Trend & Opportunity

Shift Toward Organic and Clean-Label Formulations

The market is witnessing a clear shift toward organic dried honey driven by consumer demand for transparency and natural sourcing. Manufacturers are investing in certified organic production and sustainable beekeeping practices. This trend opens opportunities for brands offering eco-friendly, chemical-free products catering to health-conscious buyers. The clean-label movement encourages innovation in organic honey blends and powder forms suitable for vegan, gluten-free, and allergen-free food applications across developed and emerging economies.

- For instance, Bagrry’s Organic Wild Honey is sustainably sourced from certified organic farms and harvested with ethical beekeeping practices. The brand is committed to purity and innovation, providing a completely natural product free from chemical treatments.

Technological Advancements in Drying Techniques

Advances in spray drying and vacuum drying technologies are improving honey powder quality, solubility, and nutritional retention. Manufacturers are developing innovative encapsulation techniques to preserve volatile compounds and aroma. These innovations expand dried honey’s usability in high-temperature food processes and instant beverage formulations. The ability to customize particle size, moisture level, and flavor intensity provides new product development opportunities for food, cosmetic, and pharmaceutical applications seeking stable and high-quality natural sweeteners.

- For instance, BÜCHI Labortechnik AG unveiled the Mini Spray Dryer B-290 Advanced, designed to optimize encapsulation efficiency for heat-sensitive and aromatic food ingredients, enhancing the retention of natural honey volatiles during production.

Key Challenge

High Production and Processing Costs

Dried honey manufacturing involves energy-intensive drying and filtration processes, leading to higher production costs than liquid honey. The need for temperature-controlled environments and advanced drying equipment adds to operational expenses. These factors can limit affordability for small manufacturers and reduce market penetration in price-sensitive regions. Balancing cost efficiency with product quality remains a key challenge, prompting producers to explore improved process optimization and alternative drying technologies.

Supply Chain Disruptions and Honey Authenticity Issues

The global honey supply chain faces risks from adulteration, counterfeit products, and irregular supply due to environmental factors. Seasonal changes and declining bee populations affect raw honey availability, impacting dried honey production. Quality inconsistencies and authenticity concerns erode consumer trust and regulatory confidence. Ensuring traceability through certified sourcing, quality testing, and transparent labeling is crucial for maintaining credibility and sustaining growth in the international dried honey market.

Competition from Alternative Natural Sweeteners

The dried honey market faces growing competition from stevia, agave syrup, and maple sugar. These substitutes often provide lower-calorie options and stable pricing, appealing to health-conscious consumers. Food manufacturers may prefer these ingredients due to easier processing and predictable supply chains. To remain competitive, dried honey producers must emphasize its unique nutritional profile, rich flavor, and natural origin, while investing in marketing strategies that highlight sustainability and superior product performance.

Regional Analysis

North America

North America holds the largest share of 32% in the Dried Honey Market. Strong consumer demand for natural sweeteners and clean-label products supports regional dominance. The United States leads consumption due to a mature food processing industry and high adoption of functional food ingredients. Rising use of dried honey in bakery, confectionery, and beverage sectors strengthens market growth. Manufacturers invest in innovative honey powder blends and sustainable sourcing to meet evolving preferences. The region’s strong retail distribution network and rising health awareness continue to drive consistent demand.

Europe

Europe accounts for 27% of the market share, driven by established food and beverage industries emphasizing product transparency and quality. The region’s preference for natural, chemical-free sweeteners fuels steady adoption in bakery and dairy applications. Countries like Germany, France, and the United Kingdom lead consumption, supported by growing organic product portfolios. The rising focus on clean-label ingredients enhances demand across premium confectionery and health food sectors. Investments in advanced drying technology and sustainable honey sourcing strengthen Europe’s market position.

Asia-Pacific

Asia-Pacific captures 24% of the Dried Honey Market, fueled by expanding food manufacturing and rising disposable incomes. China, India, and Japan are major consumers due to the popularity of honey-based foods and beverages. Growing awareness of nutritional benefits and the increasing number of functional food producers support regional expansion. Local players are focusing on cost-efficient production and product diversification. The region also benefits from abundant honey resources, which lower sourcing costs. Rising urbanization and dietary changes further enhance demand across end-use industries.

Latin America

Latin America holds 10% of the global share, supported by developing food processing industries and growing health-conscious populations. Brazil and Mexico lead regional adoption, with increasing demand for natural ingredients in packaged foods. The region is witnessing investments in local honey processing facilities, promoting sustainable and value-added production. Rising consumption of bakery and beverage products containing natural sweeteners supports long-term growth.

Middle East & Africa

The Middle East & Africa region accounts for 7% of the market, driven by rising urbanization and interest in natural food alternatives. Gulf countries such as Saudi Arabia and the UAE are key markets due to strong import demand for honey-based products. It benefits from expanding retail channels and growing awareness of healthy lifestyles. Emerging opportunities in cosmetics and pharmaceuticals are further strengthening the market outlook.

Market Segmentations:

By Method:

- Dried Honey Blend

- Spray Dried Honey

- Others

By Nature:

By End Use:

- Food and Beverages

- Special Dietary Formulations

- Vinaigrettes

- Sauces

- Brines

- Marinades

- Bakery Products

- Confectionery

- Glazes

- Health Foods

- Seasonings

- Dry Mixes

- Beverages

- Personal Care and Cosmetics

- Others (Pharmaceuticals, etc.)

By Flavours:

- Honey (100%)

- Honey with Menthol

- Honey with Lemon

- Honey with Eucalyptus

- Honey with Other Flavours

By Form:

By Sales Channel:

- Direct Sales/B2B

- Indirect Sales/B2C

- Supermarket/Hypermarket

- Retail Stores

- Specialty Stores

- General Grocery Stores

- Online Stores

By Region

-

- UK

- Germany

- France

- Italy

- Spain

- Russia

-

- China

- India

- Japan

- South Korea

- Australia

-

- UAE

- Saudi Arabia

- South Africa

Competitive Landscape

The competitive landscape of the Dried Honey Market is characterized by the presence of both global and regional manufacturers focusing on product quality, innovation, and distribution expansion. Leading companies such as Lamex Food Group Limited, The Archer Daniels Midland Company, Norevo GmbH, Wuhu Deli Foods Co., Ltd., and Sweet Harvest Foods Inc. dominate through extensive product portfolios and strong supply chains. These players emphasize technological advancements in spray-drying processes to enhance product stability and solubility. Strategic partnerships with food and beverage manufacturers help strengthen their global presence. Emerging participants from Asia-Pacific and Latin America are expanding market access through cost-effective production and customized blends. Competition is intensifying around organic and clean-label dried honey variants, aligning with the growing health-conscious consumer base. Continuous investment in R&D, sustainability initiatives, and quality certifications remains key to securing long-term growth and brand credibility in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Lamex Food Group Limited

- The Archer Daniels Midland Company (ADM)

- Norevo GmbH

- Wuhu Deli Foods Co., Ltd.

- Sweet Harvest Foods Inc.

- Bulk Natural Foods

- Nature Nate’s Honey Co.

- Hoosier Hill Farm LLC

- Kanegrade Limited

- Augason Farms

Recent Developments

- On March 3, 2025, New Water Capital acquired Dutch Gold Honey and related businesses, strengthening its position in honey supply chains.

- On May 28, 2025, Swiss FoodYoung Labs acquired MeliBio, the U.S. “bee-free honey” technology company, gaining the Mellody brand and IP.

- In August 2025, Florenz Limited, which owns Wedderspoon brand, announced its intent to acquire Comvita, a New Zealand mānuka honey producer.

- On June 16, 2025, Sir David Beckham partnered to launch BEEUP, a snack line using honey as natural energy source.

Report Coverage

The research report offers an in-depth analysis based on Method, Nature, End Use, Flavours, Form, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label sweeteners will continue to drive market expansion.

- Food and beverage manufacturers will increase the use of dried honey in processed and packaged products.

- Organic dried honey will gain stronger traction with rising consumer health awareness.

- Technological improvements in spray drying will enhance product quality and shelf stability.

- Functional food and nutraceutical applications will become major growth contributors.

- Asia-Pacific will witness strong growth due to expanding food manufacturing industries.

- E-commerce and retail chains will strengthen distribution and global accessibility.

- Producers will focus on sustainable sourcing and traceable supply chains to build trust.

- Competition from alternative natural sweeteners will encourage product diversification.

- Innovation in flavor blends and packaging formats will support market differentiation and premiumization.