Market Overview

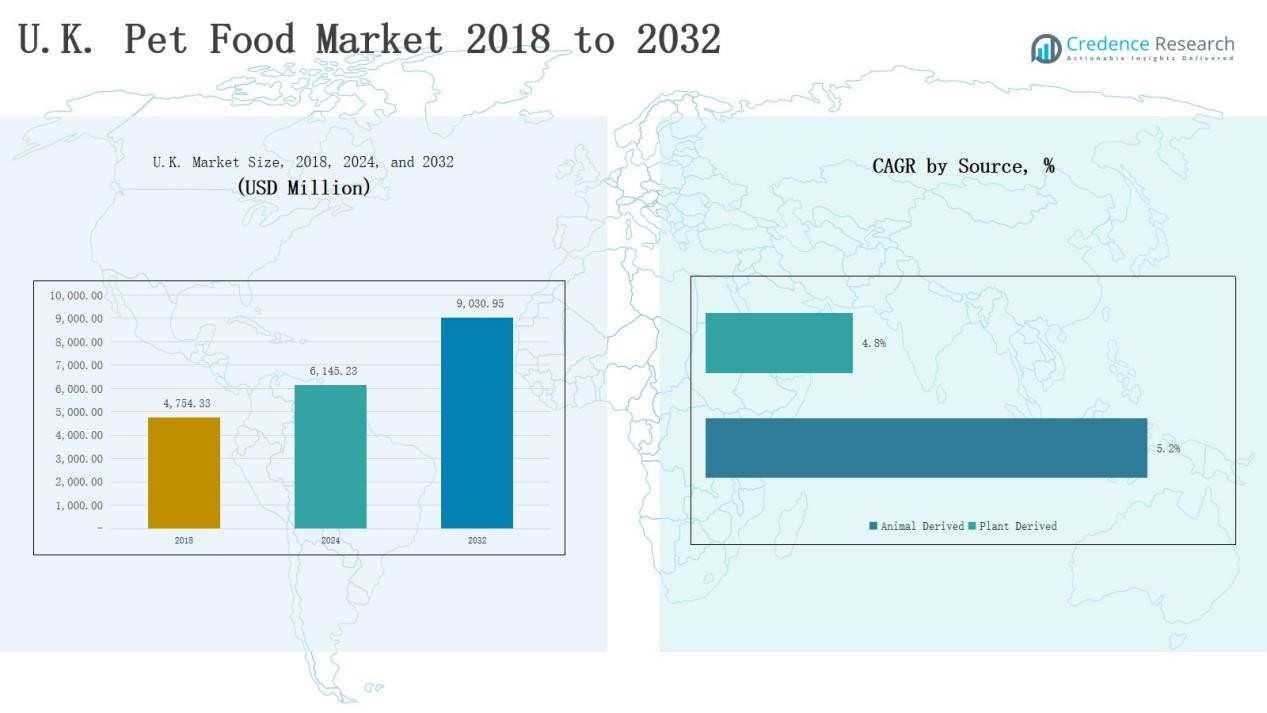

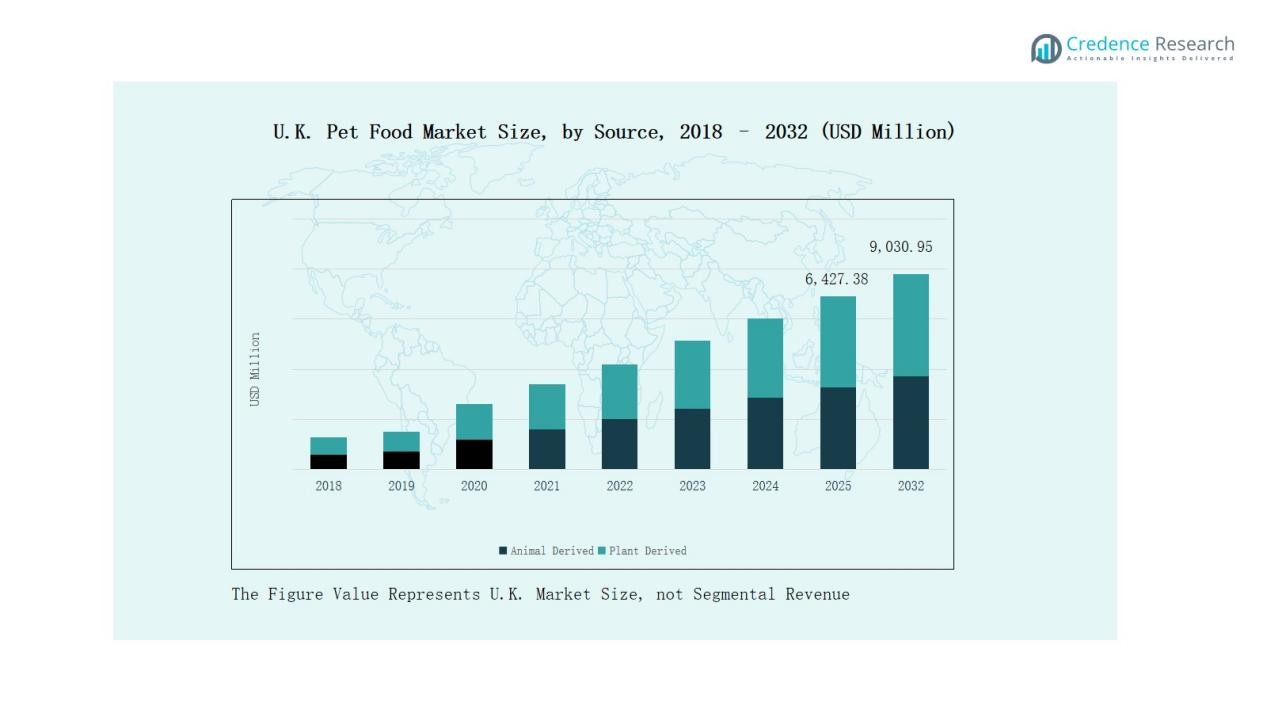

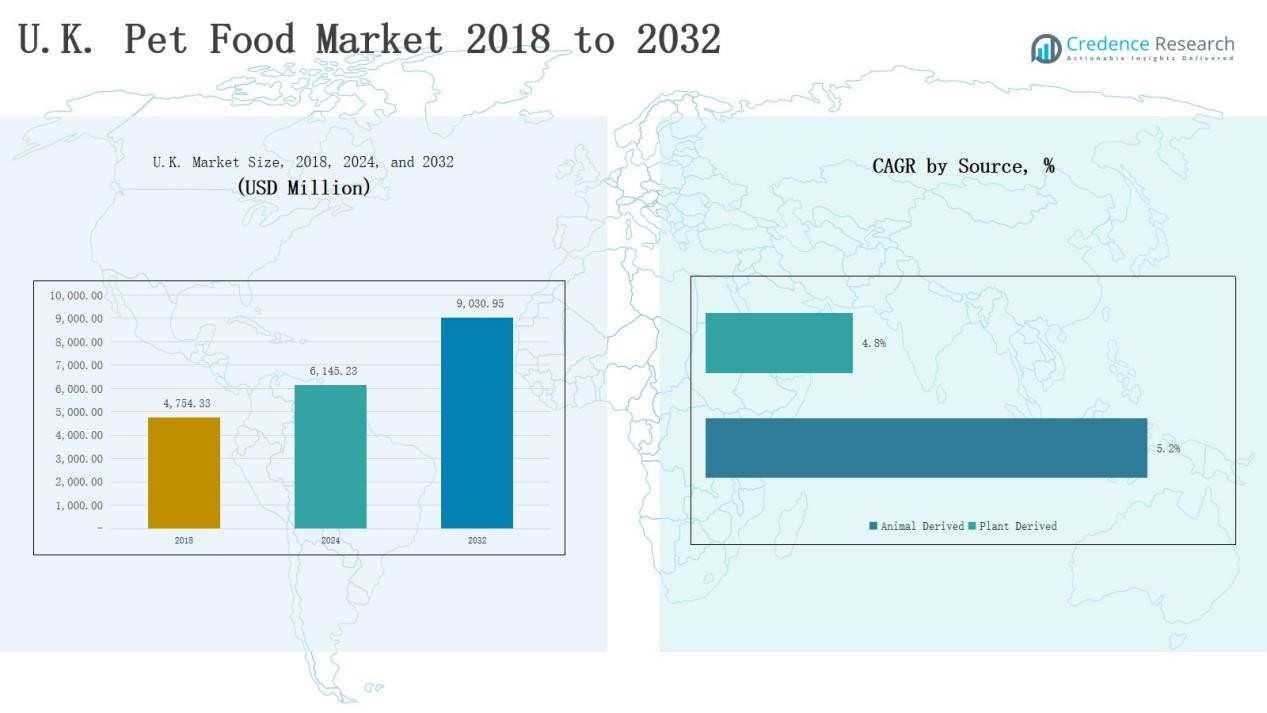

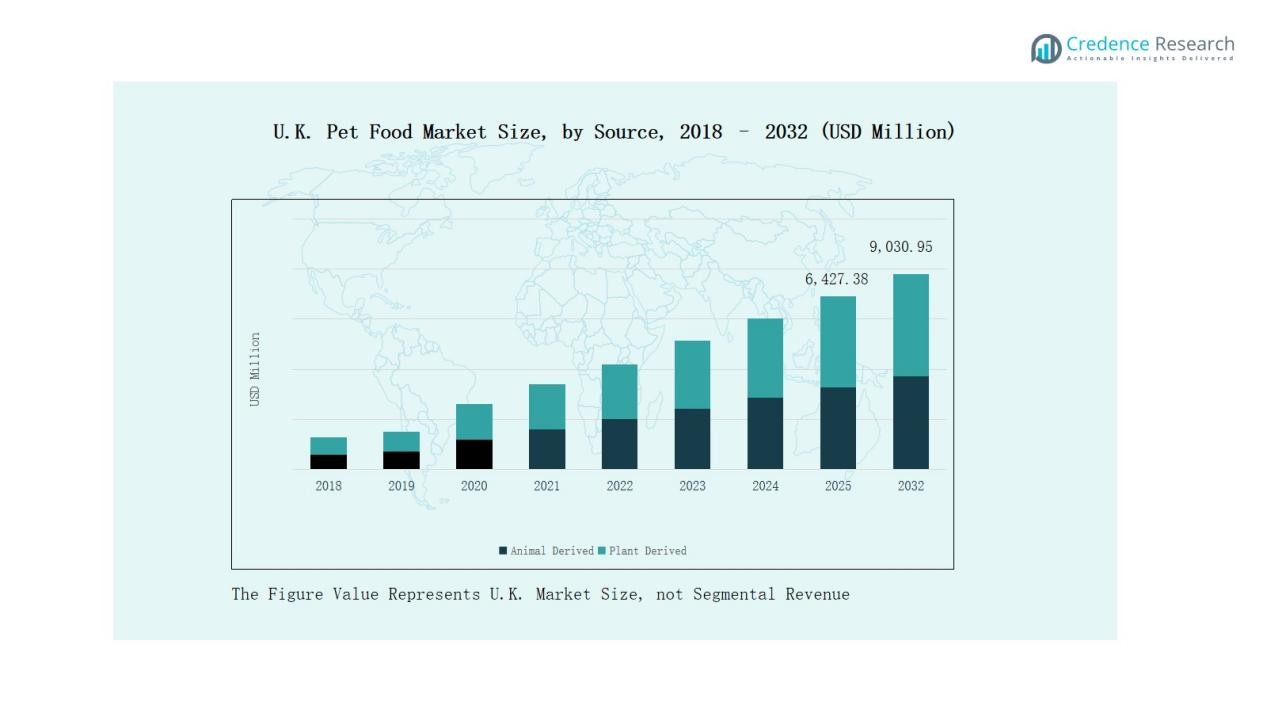

UK Pet Food Market size was valued at USD 4,754.33 million in 2018, increased to USD 6,145.23 million in 2024, and is anticipated to reach USD 9,030.95 million by 2032, growing at a CAGR of 4.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Pet Food Market Size 2024 |

USD 6,145.23 Million |

| UK Pet Food Market, CAGR |

4.89% |

| UK Pet Food Market Size 2032 |

USD 9,030.95 Million |

The UK Pet Food Market is led by major companies such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, J.M. Smucker Co., and General Mills, Inc., which dominate through strong product portfolios and nationwide distribution. These players focus on premium, functional, and sustainable pet food offerings to meet evolving consumer demands. Regional manufacturers such as United Petfood, Albion Pet Foods Ltd, Farmina Pet Foods, Pets Choice, and MPM Products strengthen competition through locally sourced and affordable solutions. Among regions, England held the largest market share of 62% in 2024, driven by high pet ownership, advanced retail infrastructure, and rising adoption of premium and organic formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Pet Food Market grew from USD 4,754.33 million in 2018 to USD 6,145.23 million in 2024 and is projected to reach USD 9,030.95 million by 2032, expanding at a CAGR of 4.89%.

- Dry pet food dominated with a 58% share in 2024, supported by convenience, affordability, and long shelf life, while wet and raw pet foods gain traction through premium, natural formulations.

- Animal-derived products led with a 67% share, driven by high protein demand and nutritional value, while plant-based options rise among eco-conscious and vegan pet owners.

- Dog food held 62% of the market in 2024, followed by cat food at 30%, reflecting growing spending on breed-specific, grain-free, and functional nutrition options.

- England led the market with a 62% share, benefiting from advanced retail networks, strong pet ownership, and high adoption of premium and organic pet food brands.

Market Segment Insights

By Food Type:

Dry pet food dominated the UK Pet Food Market in 2024 with a 58% share, driven by its convenience, longer shelf life, and affordability. Pet owners favor dry food for easy storage and portion control, especially for dogs and cats. Manufacturers focus on fortified formulations with protein, vitamins, and probiotics to enhance nutrition. Growth in premium and grain-free dry food products supports demand, while wet and raw pet food segments expand through natural and gourmet ingredient innovations.

- For instance, Hill’s Pet Nutrition launched Science Plan Perfect Digestion Dry Cat Food in European markets, featuring an ActivBiome+ formula to enhance gut microbiome balance and nutrient absorption.

By Source:

Animal-derived pet food led the UK Pet Food Market in 2024 with a 67% share, supported by high demand for meat-based protein and essential amino acids in pet diets. Consumers associate animal-based ingredients with better taste and improved health outcomes. Major producers invest in sustainable and traceable meat sourcing to meet ethical preferences. Plant-derived pet food, gaining 33% share, grows among vegan pet owners and environmentally conscious consumers seeking alternative protein options.

- For instance, VAFO Group expanded its Brit Care Sustainable Dog Food portfolio in 2024, using animal proteins from certified farms and fish from responsible aquaculture to meet the EU’s evolving sustainability standards.

By Pet Type:

Dog food held the largest share of 62% in the UK Pet Food Market in 2024, supported by high dog ownership and spending on premium, breed-specific, and functional nutrition products. Manufacturers innovate with digestive-friendly, grain-free, and life-stage-based formulations. The cat food segment captured 30% share, driven by demand for wet and natural recipes. Fish and other pet food categories, together contributing 8%, grow steadily due to niche consumer adoption and improved specialty feed availability.

Key Growth Drivers

Rising Pet Humanization and Premiumization

The growing emotional bond between pet owners and their animals drives spending on premium pet food. Consumers increasingly view pets as family members, prioritizing health, taste, and nutrition. This shift fuels demand for organic, grain-free, and functional formulations enriched with vitamins and probiotics. Brands such as Mars and Nestlé Purina leverage this trend by launching premium and tailored diets. Expanding product availability across online and retail platforms further boosts the UK Pet Food Market’s long-term growth.

- For instance, Nestlé Purina, another key player, launched Pro Plan LiveClear, a diet designed to reduce pet dander allergens using clinically proven nutrition, addressing health and wellness demands among premium pet food consumers.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online platforms have become a key sales driver, offering convenience and wider product choices. Consumers prefer subscription-based and doorstep delivery options for consistent pet food supply. E-commerce giants and specialized online retailers partner with premium brands to expand market reach. Direct-to-consumer models enable brands to collect real-time customer feedback and strengthen loyalty. The rising digitalization of retail channels significantly contributes to revenue growth and enhances accessibility across the UK Pet Food Market.

- For instance, British eGrocer Ocado launched “fine dining” pet meals like lamb with mint and salmon aimed at urban, mindful owners who seek diversity for their pets.

Growing Focus on Pet Health and Nutrition Awareness

Increased awareness of pet health and dietary needs encourages owners to choose high-quality, nutritionally balanced products. The shift toward protein-rich, low-allergen, and breed-specific diets supports product diversification. Veterinary recommendations also influence consumer preferences, boosting demand for functional and prescription-based pet food. Manufacturers emphasize research-backed formulations targeting digestive health, immunity, and weight management. This health-driven consumption behavior continues to reshape the UK Pet Food Market toward scientifically formulated and clean-label offerings.

Key Trends & Opportunities

Sustainability and Ethical Ingredient Sourcing

Eco-conscious consumers in the UK are increasingly choosing pet foods with sustainable and traceable ingredients. Brands adopt recyclable packaging, reduce carbon footprints, and source ethically produced meat and plant proteins. The trend aligns with growing national awareness of environmental impacts. Companies investing in green supply chains and transparency gain competitive advantage. This sustainability shift presents long-term opportunities for both multinational and local manufacturers to differentiate through eco-friendly and socially responsible practices.

- For instance, Meatly launched the world’s first cultivated pet food in February 2025, combining plant-based ingredients with cultivated meat to offer a nutritious and sustainable alternative, reducing land, water, and carbon footprints

Rising Demand for Functional and Customized Pet Nutrition

Personalized and functional pet nutrition is a growing opportunity within the UK market. Consumers seek solutions tailored to pets’ age, breed, or health needs such as joint care, digestion, and skin health. Companies introduce targeted formulations, supplements, and smart feeding systems to meet this demand. The rise of data-driven pet health platforms and subscription services also supports this trend. Customization and advanced nutrition technologies are expected to drive innovation and brand differentiation.

- For instancce, Nestlé Purina expanded its Just Right customized dog food line in the U.S. market, integrating an AI-driven evaluation tool that analyzes breed, size, and activity data to craft individualized meal plans.

Key Challenges

Fluctuating Raw Material Costs

The UK Pet Food Market faces cost pressure due to volatile prices of meat, grains, and packaging materials. Supply disruptions and inflation impact profit margins for manufacturers. Companies struggle to maintain competitive pricing while preserving quality. The reliance on imported ingredients further exposes producers to currency fluctuations and trade uncertainties. Managing procurement efficiency and adopting local sourcing strategies remain essential to mitigate the financial strain from rising input costs.

Strict Regulatory Compliance and Labeling Standards

Pet food manufacturers in the UK must comply with stringent safety, labeling, and traceability regulations. Post-Brexit policy changes add complexity to ingredient approval and trade documentation. Ensuring compliance with both domestic and international standards increases operational costs. Frequent audits, quality testing, and documentation demand additional investment. Small and medium enterprises often find it challenging to navigate these evolving rules, creating barriers to entry and slowing product innovation within the regulated market.

Growing Competition and Market Saturation

The UK Pet Food Market is highly competitive, with multinational corporations dominating shelf space alongside emerging niche brands. Continuous product launches intensify the fight for consumer attention. Established brands focus on premium innovation, while smaller firms compete through local sourcing and price differentiation. This saturation limits growth potential in mature segments such as dry pet food. To sustain profitability, companies must prioritize differentiation through innovation, branding, and digital engagement strategies.

Regional Analysis

England

England dominated the UK Pet Food Market in 2024 with a 62% share, supported by its large pet population and strong retail infrastructure. The region’s demand is driven by high awareness of pet nutrition and preference for premium and organic products. Leading manufacturers such as Mars, Nestlé Purina, and Hill’s Pet Nutrition maintain significant operations and distribution networks in the country. E-commerce platforms and supermarkets provide broad access to branded and private-label options. Growth in small pet adoption and tailored nutrition products continues to strengthen England’s market position.

Scotland

Scotland held a 16% share in the UK Pet Food Market in 2024, supported by growing ownership of dogs and cats and increasing disposable income. Consumers favor high-quality, natural ingredients sourced locally, driving demand for sustainable and region-specific formulations. Pet care stores and independent manufacturers cater to rural and urban needs through premium and functional food lines. Strong awareness of animal welfare supports the shift toward organic and ethical brands. Local players are expanding distribution partnerships to improve product reach across Scottish cities and rural communities.

Wales

Wales accounted for a 12% share of the UK Pet Food Market in 2024, driven by steady pet adoption rates and the rise of small-scale domestic manufacturers. Demand for cost-effective and balanced nutrition supports sales in dry and mid-range food categories. Growing urbanization and digital retail adoption strengthen consumer access to premium and imported brands. Local producers emphasize sustainability and regional ingredient sourcing to gain competitive edge. Expansion of online pet supply platforms continues to improve market penetration across urban centers.

Northern Ireland

Northern Ireland captured a 10% share in the UK Pet Food Market in 2024, supported by increasing consumer preference for high-protein and health-focused formulations. Pet ownership trends in both urban and semi-rural areas contribute to consistent growth. Retail expansion through supermarkets and online stores enhances product accessibility across the region. Local and cross-border trade with Ireland support diverse product availability. It continues to show potential for premium and functional pet food categories, driven by evolving lifestyles and health-conscious pet owners.

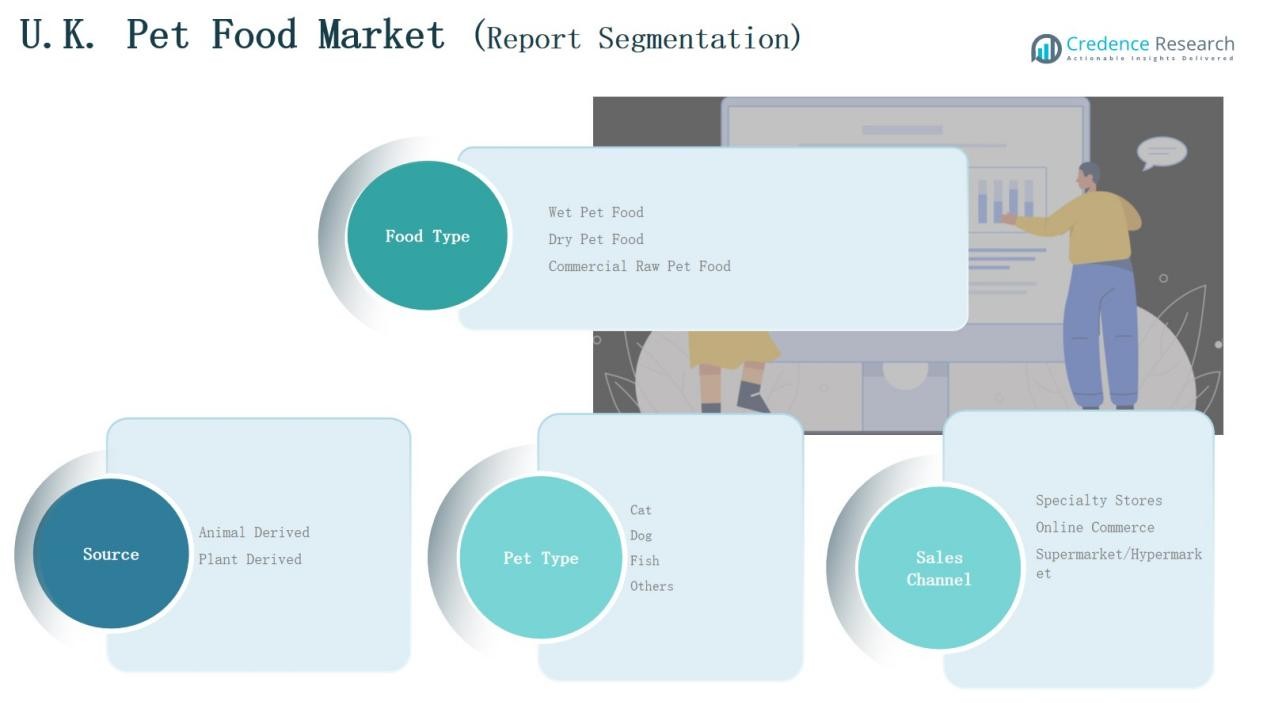

Market Segmentations:

By Food Type:

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source:

- Animal Derived

- Plant Derived

By Pet Type:

By Sales Channel:

- Specialty Stores

- Online Commerce

- Supermarket/Hypermarket

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Pet Food Market features strong competition between multinational corporations and regional manufacturers, with brands striving for innovation, sustainability, and consumer loyalty. Leading players such as Mars, Nestlé Purina PetCare, Hill’s Pet Nutrition, and J.M. Smucker Co. dominate through extensive product portfolios, strong distribution networks, and brand recognition. They focus on premium, organic, and functional formulations to meet evolving pet owner expectations. Domestic companies like United Petfood, Albion Pet Foods, and Pets Choice strengthen competition by offering locally sourced, affordable, and customized solutions. E-commerce expansion enables both global and niche brands to reach wider audiences. Strategic initiatives such as partnerships, acquisitions, and product innovations remain central to maintaining market leadership. Sustainability practices, traceable ingredients, and recyclable packaging are increasingly becoming key differentiators. This diverse and innovation-driven competitive environment continues to shape product development and intensify rivalry within the UK Pet Food Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Albion Pet Foods Ltd

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- M. Smucker Co.

- United Petfood

- Farmina Pet Foods

- Elmira Pet Products

- Pets Choice

- MPM Products

- Other Key Players

Recent Developments

l On June 17, 2025, Partners Group acquired MPM Products, a premium cat food business based in the UK, to accelerate its growth across Europe and North America.

l On May 5, 2025, Prefera Petfood (Italy) acquired the UK-based alternative-protein pet food brand THE PACK, aiming to scale its presence in the UK and Europe and deepen its product portfolio.

l On February 7, 2025, Meatly launched Chick Bites, the world’s first cultivated-meat pet food (dog treats), in partnership with The Pack, offered via Pets at Home in the UK.

l In 2025, Inspired Pet Nutrition (UK) proposed acquiring Ultra Premium Direct (UPD), a France-based online premium pet food brand, to expand their international and digital capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material Composition, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and functional pet food will continue to rise across all categories.

- Online sales and subscription-based delivery models will expand their market presence.

- Manufacturers will focus more on sustainable sourcing and recyclable packaging materials.

- Growth in pet ownership among millennials will support steady long-term market expansion.

- Innovation in breed-specific and age-specific nutrition will drive product diversification.

- Plant-based and alternative protein formulations will gain stronger consumer acceptance.

- Private-label and locally produced brands will strengthen competition in mid-priced segments.

- Investment in veterinary-recommended and prescription-based nutrition will increase.

- Digital marketing and data-driven personalization will reshape brand-customer engagement.

- Strategic collaborations and acquisitions will intensify to enhance market reach and innovation.