Market Overview

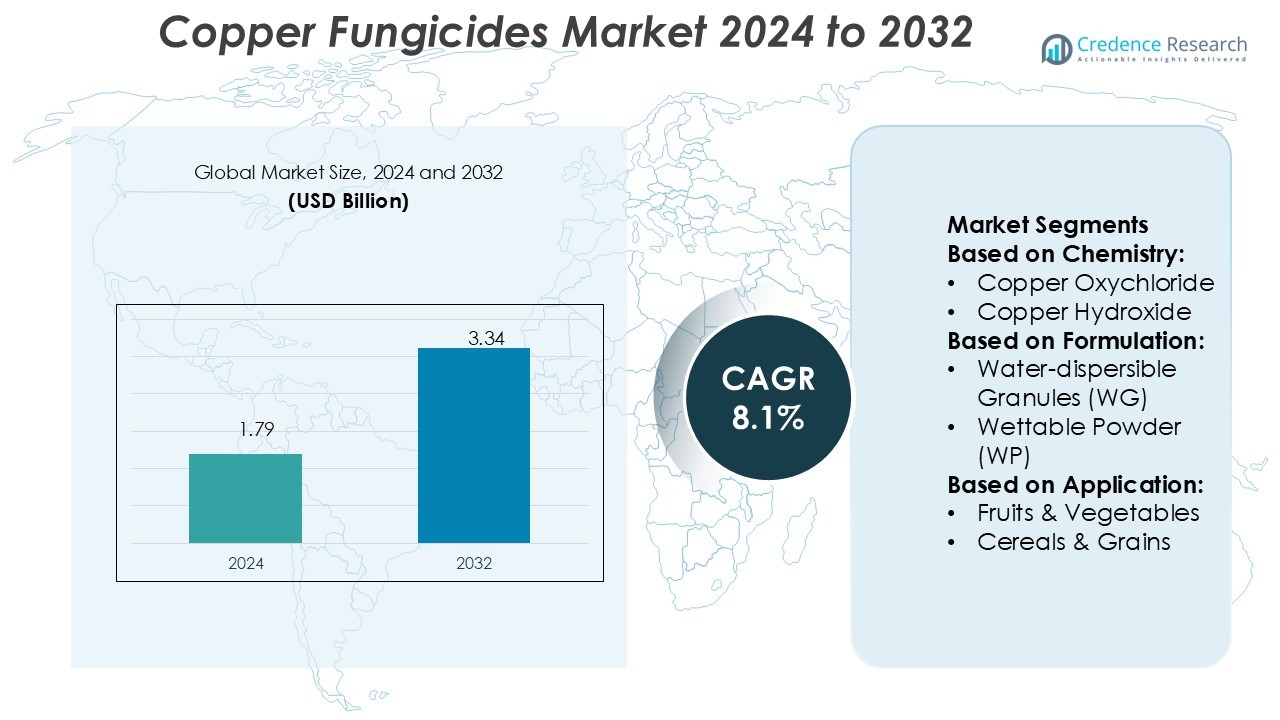

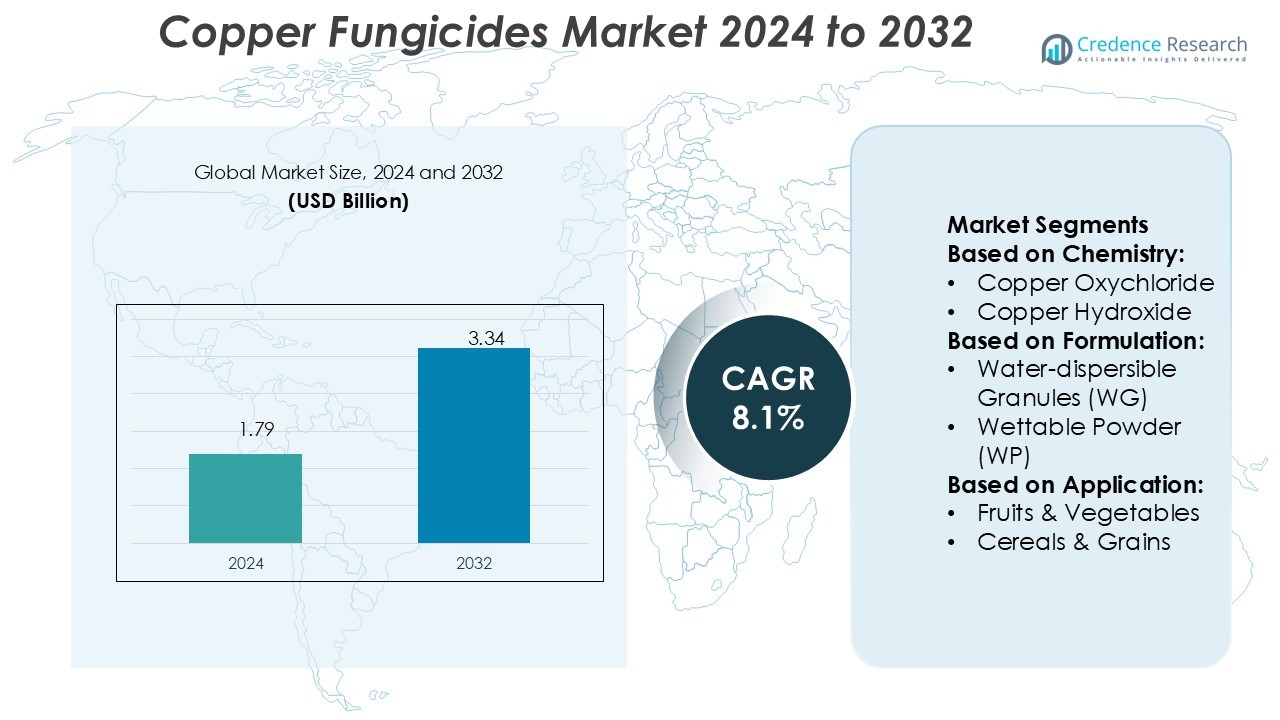

Copper Fungicides Market size was valued USD 1.79 billion in 2024 and is anticipated to reach USD 3.34 billion by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Copper Fungicides Market Size 2024 |

USD 1.79 Billion |

| Copper Fungicides Market, CAGR |

8.1% |

| Copper Fungicides Market Size 2032 |

USD 3.34 Billion |

The copper fungicides market is shaped by leading players such as Bayer AG, Corteva, Quimetal, Cosaco, Isagro S.p.A, Nordox AS, Cinkarna Celje dd, Albaugh LLC, Certis USA L.L.C, and ADAMA. These companies focus on expanding their product portfolios, enhancing formulation efficiency, and strengthening distribution networks to capture a larger market share. Strategic investments in sustainable solutions and regulatory compliance are central to their growth strategies. Asia Pacific leads the global copper fungicides market with a 31% share, driven by extensive crop cultivation, increasing disease incidence, and strong adoption of cost-effective fungicide solutions. The region’s rapid agricultural modernization and rising export demand further consolidate its dominance in the global landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The copper fungicides market was valued at USD 1.79 billion in 2024 and is projected to reach USD 3.34 billion by 2032, growing at a CAGR of 8.1%.

- Rising crop disease incidence and increasing organic farming adoption are driving strong market demand across major agricultural economies.

- Asia Pacific holds a dominant 31% share, supported by rapid agricultural modernization and high usage in fruits and vegetables cultivation.

- Key players are focusing on sustainable formulations, regulatory alignment, and stronger distribution networks to maintain competitiveness.

- Market restraints include regulatory pressure on copper usage and the growing shift toward biological alternatives in some developed regions.

Market Segmentation Analysis:

By Chemistry

Copper Oxychloride holds the dominant share of the Copper Fungicides Market, accounting for over 34% in 2024. Its broad-spectrum effectiveness against fungal diseases and cost-efficiency make it a preferred option among growers. Copper Hydroxide follows closely, valued for its fine particle size that ensures better adhesion and coverage on plant surfaces. Cuprous Oxide and Copper Sulphate are gaining traction in high-value crop protection programs due to their rapid disease control. The consistent demand for Copper Oxychloride is driven by its stability, long shelf life, and ease of formulation.

- For instance, Corteva markets Kocide® Blue Xtra™, a copper hydroxide formulation containing 350 g/kg copper (Cu) as cupric hydroxide. In field trials on tomatoes, that formulation delivered rain-fast protection lasting 7 days post-application.

By Formulation

Water-dispersible Granules (WG) lead the market with a 39% share, supported by their superior handling, reduced dust formation, and improved solubility compared to other formulations. These characteristics enhance field application efficiency and minimize environmental contamination. Wettable Powder (WP) remains widely used in cost-sensitive markets, while Soluble Granules (SG) offer precise dosing and longer tank suspension times. The dominance of WG is strongly driven by rising adoption in commercial farming, where operational safety, reduced spillage, and better compatibility with modern sprayers are key advantages.

- For instance, Cosaco markets Funguran® progress, a WG formulation with 350 g/kg copper (hydroxide). Cosaco describes that this formulation ensures “excellent adhesion and rainfastness” through optimized particle size and redistribution.

By Application

Fruits & Vegetables represent the largest application segment, capturing 46% of the total market share. High susceptibility of crops like tomatoes, grapes, and potatoes to fungal diseases fuels this demand. Farmers prefer copper fungicides for their long residual activity and broad disease spectrum. Cereal & Grain applications are increasing steadily, particularly in wheat and rice cultivation. Oilseeds & Pulses adoption remains moderate but is expanding in developing markets. The fruits and vegetables segment dominates due to higher crop value, intensive farming practices, and stringent quality standards in export markets.

Key Growth Drivers

Rising Demand for Sustainable Crop Protection

The growing shift toward sustainable agriculture is driving copper fungicide adoption. Farmers increasingly prefer copper-based formulations due to their broad-spectrum activity and lower resistance risk. Regulatory bodies promote these solutions as safer alternatives to synthetic fungicides. This trend supports integrated pest management (IPM) programs across high-value crops such as fruits and vegetables. For example, EU and North American markets are expanding organic farming acreage, increasing the need for preventive fungal disease control. This environmental compatibility strongly positions copper fungicides in long-term crop protection strategies.

- For instance, Isagro S.p.A. reports that its Adria plant can produce 22,000 tons per year of copper-based fungicides, enabling scaling to support sustainable programs.In its sustainability report, Isagro describes “bio-optimized copper particles” used.

Increasing Incidence of Fungal Diseases

Rising global temperatures and irregular rainfall patterns are increasing fungal outbreaks in crops. Diseases like downy mildew, late blight, and anthracnose are spreading faster, reducing yields and farmer income. Copper fungicides offer effective control across a wide pathogen spectrum and help minimize crop loss. Their multi-site activity also lowers the risk of resistance buildup. High-value crops such as grapes, tomatoes, and potatoes see consistent application growth. Government-led agricultural support programs further boost fungicide demand, especially in emerging farming economies.

- For instance, Nordox AS sells Nordox 75 WG, a wettable granule formulation containing 75 % metallic copper—one of the highest concentrations among WG copper products. Nordox also offers Nordox 86 WG, with 860 g/kg cuprous oxide (equivalent to ~750 g/kg metallic copper).

Strong Government Support and Subsidy Programs

Government initiatives are promoting crop protection inputs to secure food production. Many countries offer subsidies on essential fungicides to encourage their use in smallholder farms. Extension programs and awareness campaigns also educate farmers on the benefits of early disease prevention. This structured support improves product accessibility and market penetration. In regions like Asia Pacific and Latin America, such initiatives are increasing product adoption rates. These programs ensure consistent demand even in price-sensitive farming communities, creating a stable market foundation.

Key Trends & Opportunities

Growing Adoption in Organic and Specialty Farming

The rapid expansion of organic farming presents new opportunities for copper fungicide suppliers. Organic certifications often permit limited copper use, making these products essential for disease prevention. Specialty crop segments like berries, grapes, and vegetables rely heavily on fungicide treatments to maintain quality standards. This demand is increasing particularly in Europe and North America, where organic farming acreage continues to rise. Companies that offer compliant formulations with lower residues are gaining a competitive edge in export-oriented markets.

- For instance, Cinkarna Celje d.d. markets Cuprablau Z 35 WG, a wettable granule copper oxychloride formulation designed for organic and integrated systems. WG formulation uses an “extremely fine particle size” that enables good adhesion and uniform leaf coverage even at lower per-hectare doses.

Innovation in Low-Dose and High-Efficiency Formulations

Manufacturers are investing in advanced formulations that deliver higher efficacy at lower application rates. Innovations such as micronized copper particles and water-dispersible granules reduce environmental impact while improving crop coverage. These new products help farmers meet stricter residue regulations and minimize application costs. For example, controlled-release technologies are extending protection duration, reducing spray frequency. This technological shift strengthens product competitiveness in both developed and emerging agricultural economies.

- For instance, Certis USA L.L.C. markets Kocide 3000-O, a copper hydroxide concentrate containing 46.1 % active ingredient that emphasizes high ion release per unit.

Expansion in High-Growth Emerging Markets

Rising crop production in Asia Pacific, Africa, and Latin America is creating new growth avenues. These regions are investing in modern crop protection to improve yield and reduce post-harvest losses. Growing exports of fruits and vegetables demand compliance with global quality standards. Copper fungicides offer reliable protection with proven field performance, supporting this expansion. Local manufacturing facilities and government-backed distribution networks further accelerate market penetration in rural farming communities.

Key Challenges

Stringent Environmental Regulations

Tightening environmental laws on copper usage pose a major challenge to market expansion. Excessive copper accumulation in soil can affect soil health and microbial balance. Several countries have imposed limits on annual copper application per hectare. Compliance with these restrictions forces manufacturers to innovate low-residue formulations. This regulatory pressure also increases R&D and registration costs. Companies must balance product efficacy with environmental performance to maintain market access in regulated economies.

Rising Competition from Biological Fungicides

The rapid growth of biological fungicides is intensifying competition. Biocontrol products offer residue-free solutions that align with stricter sustainability norms. As regulatory frameworks favor eco-friendly products, biologicals are gaining faster acceptance, especially in organic farming. Their increasing adoption in specialty crops could reduce copper fungicide demand in some regions. To counter this, producers must focus on hybrid solutions, enhanced formulations, and precision application technologies to maintain market relevance.

Regional Analysis

North America

North America holds a 28% share of the global copper fungicides market. The region benefits from well-established agricultural practices and strict disease management protocols. The U.S. leads due to large-scale fruit and vegetable cultivation, particularly grapes and citrus crops. High adoption of copper oxychloride and hydroxide formulations drives demand. Regulatory focus on sustainable farming supports market stability. Technological integration in precision farming further enhances product usage efficiency. Expanding organic farming acreage is also boosting fungicide application volumes, making North America a mature but steadily growing regional market.

Europe

Europe accounts for 24% of the market. Countries like Spain, France, and Italy dominate due to extensive vineyards and orchards. Strict EU regulations on pesticide residues are pushing farmers toward copper-based fungicides as approved disease control options. Copper fungicides remain critical in organic farming, especially for controlling downy mildew in grapes and potatoes. Government-backed sustainability programs also support product usage. The region is witnessing gradual formulation innovation to reduce environmental impact while maintaining efficacy. This balanced regulatory and farming environment sustains steady market demand across Europe.

Asia Pacific

Asia Pacific leads the global market with a 31% share. China and India are the primary growth engines, supported by extensive crop cultivation areas and rising disease outbreaks in cereals, grains, and horticulture. Farmers rely heavily on copper sulphate and oxychloride for broad-spectrum protection. Increasing government initiatives for crop protection and higher awareness among growers are boosting adoption rates. Rapid agricultural modernization and precision farming tools are further accelerating demand. Export-oriented fruit and vegetable production in countries like Vietnam and Thailand strengthens the regional market’s long-term outlook.

Latin America

Latin America holds a 10% share of the global copper fungicides market. Brazil and Argentina dominate due to large commercial plantations of fruits, vegetables, and soybeans. High disease incidence in tropical and subtropical climates drives consistent fungicide use. Copper-based products are widely preferred for cost-effectiveness and broad protection. Farmers increasingly adopt water-dispersible granules to enhance application efficiency. Government support for sustainable pest management practices also aids market growth. The region shows strong potential for future expansion with increasing export crop volumes.

Middle East & Africa

The Middle East & Africa account for a 7% share of the global market. Adoption is rising in South Africa, Egypt, and Morocco due to expanding fruit and vegetable production. Arid climates create favorable conditions for specific crop diseases, boosting fungicide use. Copper hydroxide formulations are popular for their effectiveness and compatibility with diverse crops. Limited regulatory barriers and rising agricultural investments also support market penetration. Government programs focused on improving food security are further encouraging adoption of cost-efficient fungicides in the region.

Market Segmentations:

By Chemistry:

- Copper Oxychloride

- Copper Hydroxide

By Formulation:

- Water-dispersible Granules (WG)

- Wettable Powder (WP)

By Application:

- Fruits & Vegetables

- Cereals & Grains

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the copper fungicides market features key players such as Bayer AG, Corteva, Quimetal, Cosaco, Isagro S.p.A, Nordox AS, Cinkarna Celje dd, Albaugh LLC, Certis USA L.L.C, and ADAMA. The copper fungicides market is characterized by strong product innovation, regulatory compliance, and expanding global distribution networks. Leading manufacturers focus on developing advanced formulations such as water-dispersible granules and low-residue solutions to enhance disease control and reduce environmental impact. Companies are investing in precision farming technologies to improve application efficiency and optimize dosage. Strategic partnerships with distributors and cooperatives support deeper market penetration, especially in high-growth regions like Asia Pacific and Latin America. Emphasis on sustainable agriculture and organic farming practices is driving continuous R&D investment. Market competition is intensifying as firms prioritize differentiation through innovation, regulatory alignment, and regional expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bayer AG

- Corteva

- Quimetal

- Cosaco

- Isagro S.p.A

- Nordox AS

- Cinkarna Celje dd

- Albaugh LLC

- Certis USA L.L.C

- ADAMA

Recent Developments

- In July 2024, FMC India introduced COSUIT, a copper fungicide containing Copper Hydroxychloride, designed to control fungal and bacterial diseases in grapes, paddy, tomato, chili, tea, fruits, vegetables, and ornamentals.

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya’s active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields.

- In August 2023, Bayer AG announced a significant in a new research and development facility at its Monheim site, marking its largest commitment to Crop Protection in Germany in 40 years. This state-of-the-art facility focuses on developing innovative fungicides and other chemicals that prioritize environmental and human safety.

- In March 2023, Corteva Agriscience announced the commercial launch of Adavel Active. This innovative fungicide has recently obtained product registrations in Australia, Canada, and South Korea. Adavel Active is distinguished by its unique mode of action, which protects against various diseases that can significantly impact crop yields.

Report Coverage

The research report offers an in-depth analysis based on Chemistry, Formulation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger demand from expanding organic farming practices.

- Advanced formulations will gain traction to meet stricter environmental regulations.

- Precision farming technologies will improve application efficiency and reduce wastage.

- Rising crop disease incidence will increase reliance on copper-based solutions.

- Emerging markets in Asia Pacific and Latin America will drive future growth.

- Companies will invest more in R&D to develop low-residue and eco-friendly products.

- Digital agriculture platforms will enhance product adoption and field management.

- Regulatory alignment across regions will shape new product launches and approvals.

- Strategic partnerships and distribution networks will support wider market penetration.

- Sustainability goals will push manufacturers toward cleaner and safer copper fungicide solutions.