Market Overview

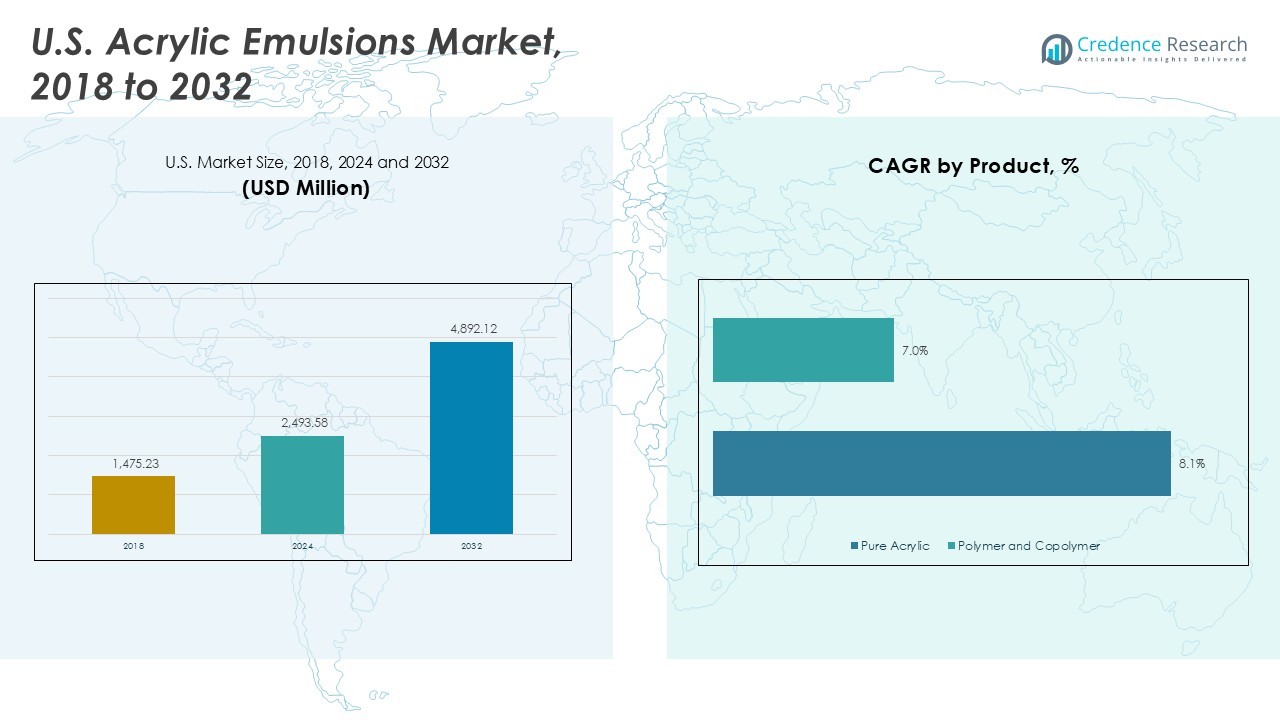

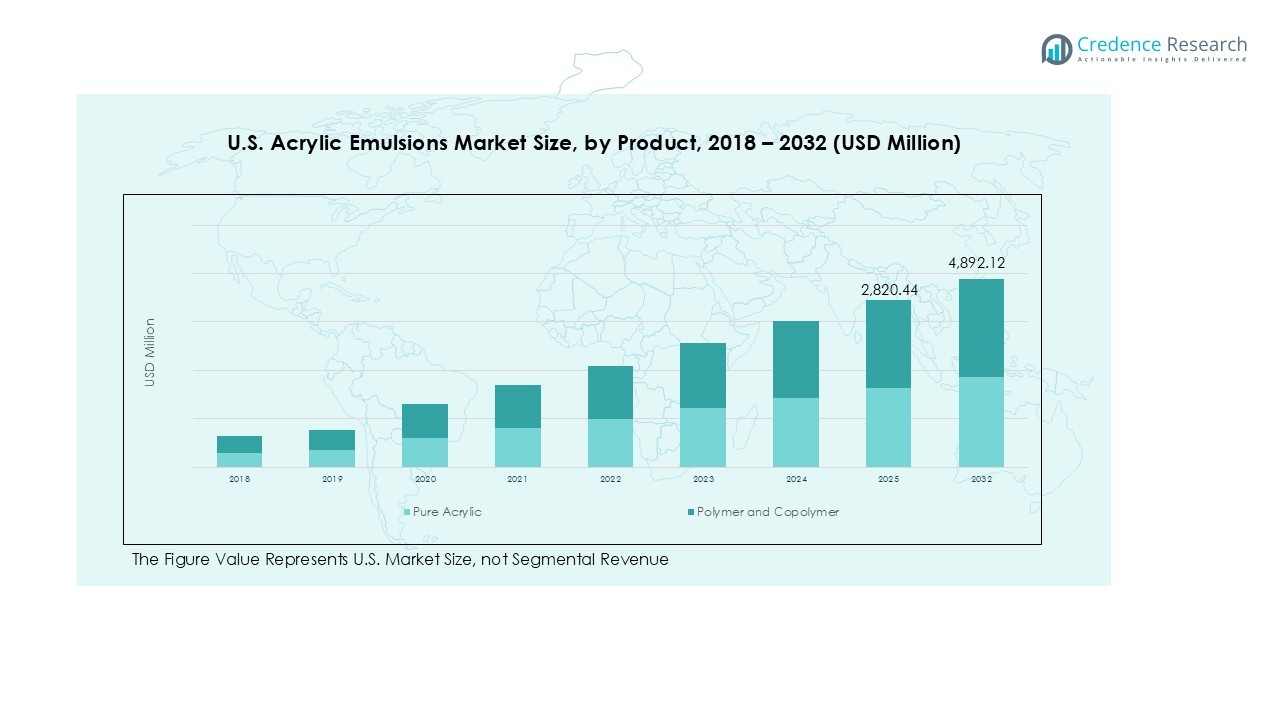

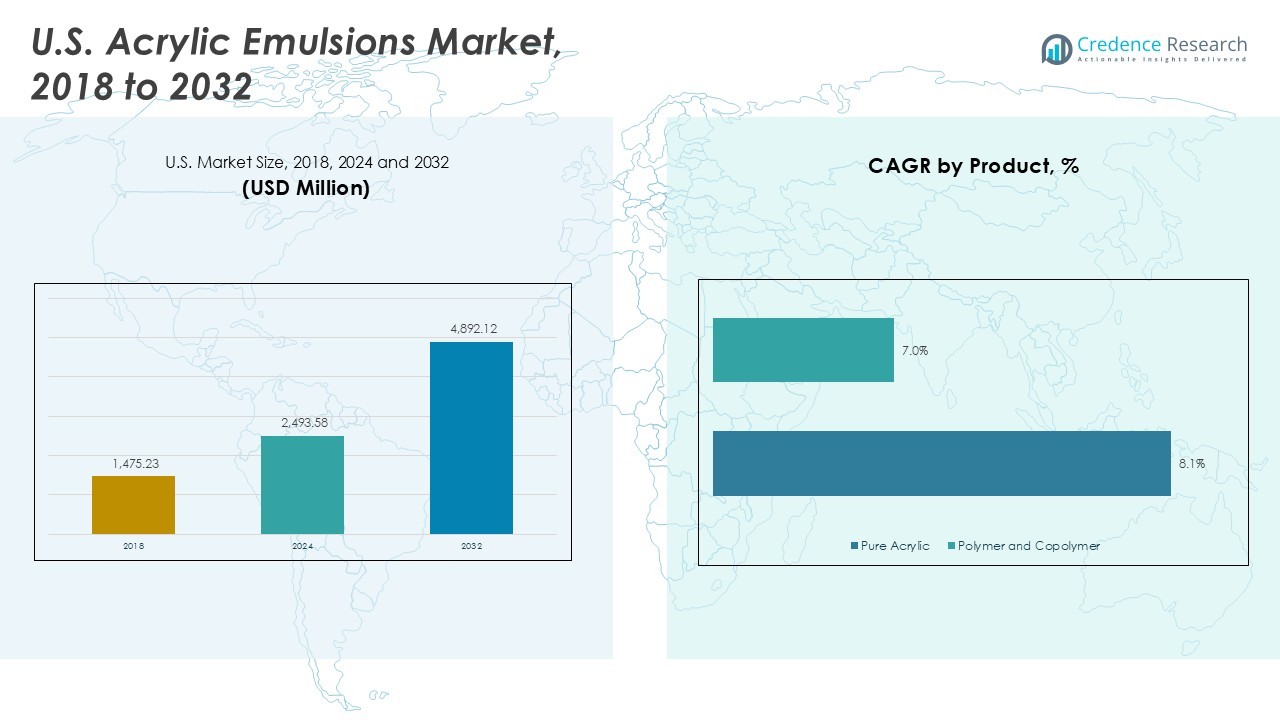

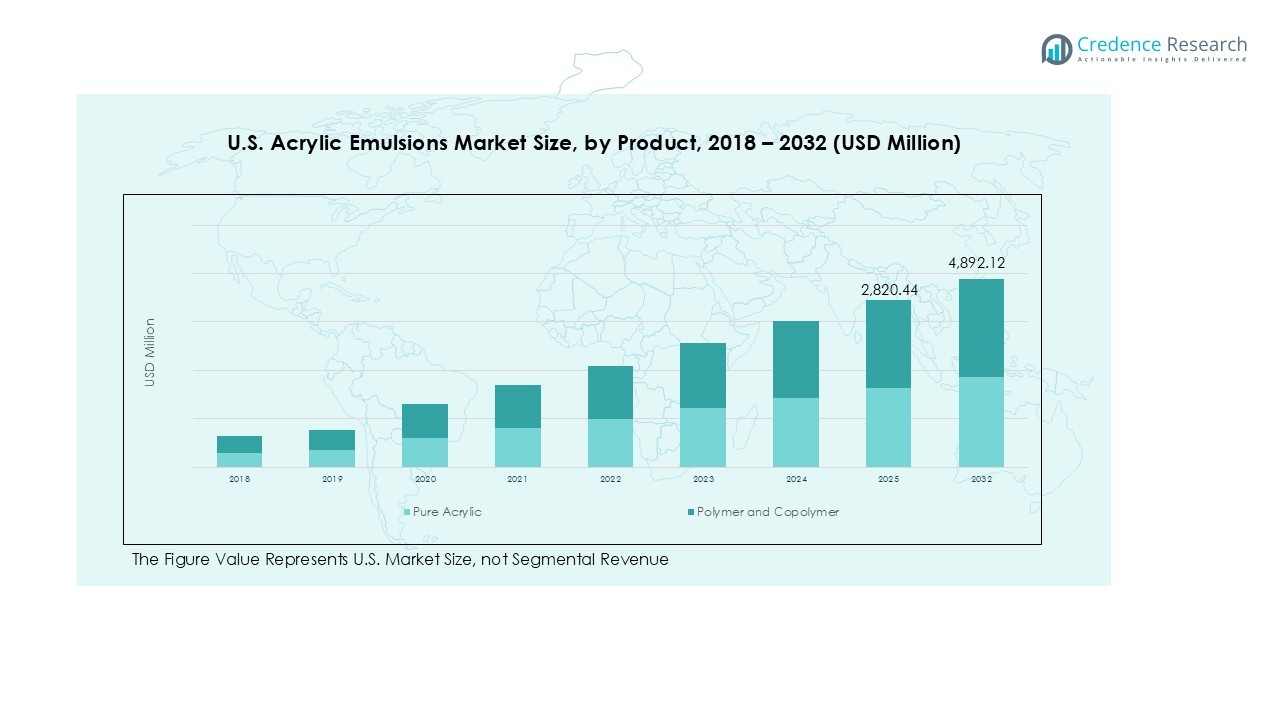

The U.S. Acrylic Emulsions market size was valued at USD 1,475.23 million in 2018 and increased to USD 2,493.58 million in 2024. It is anticipated to reach USD 4,892.12 million by 2032, growing at a CAGR of 8.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Acrylic Emulsions Market Size 2024 |

USD 2,493.58 Million |

| U.S. Acrylic Emulsions Market, CAGR |

8.19% |

| U.S. Acrylic Emulsions Market Size 2032 |

USD 4,892.12 Million |

The U.S. Acrylic Emulsions market is dominated by key players such as BASF SE, Arkema, Dow, Celanese Corporation, Ashland, The Lubrizol Corporation, 3M Company, Synthomer plc, Kamsons Chemicals Pvt. Ltd., and Mallard Creek Polymers. These companies lead through product innovation, sustainable manufacturing practices, and strategic distribution networks, offering high-performance emulsions for paints, coatings, adhesives, and construction material additives. Regionally, the South U.S. emerges as the largest market, accounting for approximately 32% of total revenue, driven by rapid urbanization and industrial growth, followed by the West U.S. with around 27%, supported by stringent environmental regulations and high demand for low-VOC products. The Northeast and Midwest collectively contribute the remaining 41%, benefiting from construction activities and industrial applications. Strong regional presence and targeted product strategies help these players maintain competitive advantage and market leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Acrylic Emulsions market was valued at USD 2,493.58 million in 2024 and is projected to reach USD 4,892.12 million by 2032, growing at a CAGR of 8.19% during the forecast period.

- Growth is driven by increasing demand from paints and coatings, construction material additives, and adhesives, supported by rapid urbanization and infrastructure development across the country.

- Key trends include the adoption of eco-friendly, low-VOC emulsions, growth in specialty applications such as paper coatings and industrial adhesives, and rising innovation in hybrid copolymers for enhanced performance.

- The market is highly competitive, dominated by BASF SE, Arkema, Dow, Celanese, Ashland, Lubrizol, 3M, Synthomer, Kamsons Chemicals, and Mallard Creek Polymers, focusing on product innovation, sustainability, and regional expansion to strengthen market share.

- Regionally, the South U.S. leads with 32% share, followed by the West U.S. (27%), while the Northeast and Midwest collectively account for 41%, with pure acrylic and paints & coatings segments dominating demand.

Market Segmentation Analysis:

By Product:

In the U.S. Acrylic Emulsions market, the Pure Acrylic segment dominates with a significant revenue share of approximately 62%. Its superior adhesion, flexibility, and durability make it highly suitable for high-performance paints and coatings, driving widespread adoption. The Polymer and Copolymer segment, while smaller at around 38% share, continues to grow due to innovations in hybrid emulsions offering enhanced chemical resistance and stability. Increasing demand from architectural and industrial coatings applications further fuels growth, as manufacturers prioritize high-quality, environmentally friendly formulations.

- For instance, Arkema Group has reported success with its advanced copolymer emulsions that improve coating durability and drying time, meeting stringent environmental regulations.

By Application:

Within application segments, Paints and Coatings lead with a robust market share of nearly 55%, driven by the rising construction and renovation activities across the U.S. Acrylic emulsions provide excellent film formation, weather resistance, and aesthetic appeal, making them ideal for interior and exterior coatings. Construction Material Additives and Paper Coating follow with smaller shares, benefiting from growth in infrastructure development and specialty paper production. The expanding adhesives market and other niche applications, collectively holding about 20% share, contribute to steady demand, underpinned by industrial and commercial usage.

- For instance, PPG Industries and Sherwin-Williams have actively invested in acrylic-based exterior and interior coatings known for superior adhesion, UV resistance, and environmental safety, aligning with regulatory mandates for low-VOC paints.

By End-User:

The Architectural segment is the largest end-user, accounting for approximately 48% of the U.S. Acrylic Emulsions market, driven by rising residential and commercial construction projects. Acrylic emulsions are favored for paints, wall finishes, and protective coatings due to durability and low VOC content. The Industrial segment holds a 30% share, supported by use in adhesives, coatings, and specialty applications across manufacturing sectors. Commercial and Residential users together make up the remaining 22%, benefiting from aesthetic and functional advantages of acrylic-based products in infrastructure and home improvement projects.

Key Growth Drivers

Expanding Construction and Renovation Activities

The growing construction and renovation sector in the U.S. is a primary driver for acrylic emulsions. Rising demand for high-performance paints, coatings, and construction material additives fuels market growth. Architectural and commercial projects increasingly rely on acrylic-based formulations for their durability, weather resistance, and low maintenance requirements. The need for energy-efficient and aesthetically appealing buildings further supports adoption, particularly in residential housing and commercial infrastructure, strengthening the demand for pure acrylic and polymer-copolymer emulsions across the country.

- For instance, Dow’s PRIMAL™ EC-4811 acrylic emulsion is widely used in elastomeric roof and wall coatings, offering outstanding flexibility, water resistance, and long-term energy efficiency by reducing dirt pickup on light-colored roof coatings.

Increasing Demand from Paints and Coatings Industry

The U.S. paints and coatings industry significantly drives acrylic emulsions growth, accounting for the largest application segment. Acrylic emulsions provide superior film formation, flexibility, and long-lasting color retention, making them ideal for interior and exterior coatings. Rising consumer preference for eco-friendly, low-VOC paints and regulatory support for sustainable formulations enhances market adoption. Manufacturers are innovating with specialty emulsions to meet performance and environmental standards, which expands applications in industrial, architectural, and commercial coatings, reinforcing consistent market expansion.

- For instance, Dow’s PRIMAL™ AC-261 Acrylic Emulsion demonstrates excellent adhesion on various surfaces, including wood and concrete, along with strong resistance to abrasion, UV, and alkali, ensuring long-lasting exterior durability.

Technological Advancements and Product Innovation

Continuous innovation in acrylic emulsion formulations supports market growth. Development of hybrid copolymers, enhanced adhesives, and specialty additives improves chemical resistance, stability, and performance in diverse applications. Advanced manufacturing processes ensure consistent quality, lower VOC content, and sustainable production practices. These innovations attract end-users across industrial, residential, and commercial sectors, enabling broader application in coatings, adhesives, paper coatings, and construction materials. Product differentiation and superior functionality drive higher adoption, positioning the U.S. market for sustained growth.

Key Trends & Opportunities

Shift Towards Eco-Friendly and Low-VOC Emulsions

A growing focus on environmental sustainability is driving the development and adoption of low-VOC and bio-based acrylic emulsions. Manufacturers are investing in green chemistry solutions to comply with stringent U.S. environmental regulations and consumer demand for eco-friendly products. This trend opens opportunities in architectural coatings, adhesives, and specialty applications where low environmental impact and safety are critical. Companies offering sustainable emulsions gain a competitive edge while expanding market penetration in both residential and commercial segments.

- For instance, BASF has developed the ACRONAL® line of water-based acrylic emulsions featuring ultra-low VOC and low hazardous air pollutants (HAPS), enabling high-performance coatings with minimal environmental footprint.

Growth in Specialty Applications

Specialty applications, such as paper coatings, adhesives, and construction additives, present new opportunities for acrylic emulsions. Rising demand for high-performance emulsions with tailored properties supports innovation in these segments. Industrial sectors requiring heat resistance, chemical stability, and improved bonding benefit from specialized formulations, providing additional revenue streams for manufacturers. The ability to customize emulsions for niche applications strengthens market diversity and positions companies to capitalize on emerging industrial and commercial needs across the U.S.

- For instance, Dow produces RHOPLEX™ acrylic copolymer binders designed specifically for adhesives with controlled rheology, excellent wet-grab, and fast water release, meeting industry needs for tapes and labels with superior bonding.

Integration of Digital and Smart Coatings

Advancements in smart and functional coatings offer growth opportunities for acrylic emulsions. Integration of antimicrobial, self-cleaning, and energy-efficient properties in coatings is gaining traction across residential, commercial, and industrial sectors. This trend supports higher-value applications and encourages R&D investment in multifunctional emulsions. As urbanization and technological adoption increase, the demand for innovative, performance-enhancing coatings grows, enabling manufacturers to capture premium market segments and differentiate products from conventional emulsions.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of monomers and petrochemical feedstocks pose a significant challenge to the U.S. acrylic emulsions market. Cost variations affect production margins and pricing strategies, impacting profitability for manufacturers. Companies may struggle to maintain competitive pricing without compromising product quality, particularly in bulk applications like paints, adhesives, and construction additives. This volatility encourages manufacturers to optimize supply chains, adopt alternative raw materials, and invest in cost-efficient processes to sustain market growth despite price uncertainties.

Stringent Environmental and Regulatory Compliance

Strict U.S. regulations regarding VOC emissions, chemical safety, and environmental sustainability create compliance challenges for acrylic emulsion manufacturers. Meeting these standards requires continuous monitoring, reformulation, and investment in green manufacturing technologies. Non-compliance can lead to fines, reputational damage, and restricted market access. Companies must balance performance, cost, and environmental responsibility while innovating products to comply with evolving regulations, which can slow product development cycles and increase operational complexity.

Regional Analysis

Northeast U.S.

The Northeast U.S. is a significant market for acrylic emulsions, driven by high urbanization, infrastructure development, and residential construction projects. Major cities like New York, Boston, and Philadelphia are witnessing increased demand for architectural and industrial coatings. The paints and coatings segment dominates, supported by growing renovation activities and commercial building projects. Industrial usage, including adhesives and specialty coatings, also contributes to regional growth. The presence of key manufacturers and distributors ensures robust supply chains, while stringent environmental regulations encourage the adoption of low-VOC and sustainable acrylic emulsions, supporting steady market expansion.

Midwest U.S.

The Midwest U.S. exhibits strong demand for acrylic emulsions, largely driven by manufacturing hubs, industrial facilities, and expanding construction activities in states like Illinois, Ohio, and Michigan. Architectural coatings dominate the end-user segment, while industrial applications, including adhesives and paper coatings, are increasingly significant. Growing commercial infrastructure and renovation projects fuel paints and coatings consumption, while the adoption of eco-friendly formulations aligns with environmental standards. Regional manufacturers focus on providing high-performance emulsions to meet both commercial and residential needs, ensuring a steady growth trajectory. The region benefits from an established logistics network and proximity to raw material suppliers.

South U.S.

The Southern U.S. market for acrylic emulsions is expanding due to rapid urbanization, residential construction, and industrial development in states such as Texas, Florida, and Georgia. The architectural segment dominates, driven by paints, coatings, and construction material additives for commercial and residential buildings. The region also witnesses increased use of emulsions in adhesives and specialty applications within the industrial sector. Rising demand for durable, weather-resistant, and low-VOC products supports growth. Regional manufacturers are investing in production facilities and sustainable formulations to meet growing demand. Favorable business policies and infrastructure investments further enhance market opportunities in the South.

West U.S.

The Western U.S., including California, Washington, and Oregon, is a prominent market for acrylic emulsions due to strong construction activity, industrial expansion, and environmental awareness. Architectural coatings lead consumption, supported by residential and commercial building projects. The industrial segment, including adhesives, specialty coatings, and paper coating applications, continues to grow with manufacturing advancements. High demand for sustainable and low-VOC products aligns with strict state regulations. Regional suppliers focus on innovative emulsions with superior performance, including hybrid copolymers. Continuous investments in R&D, production capacity, and environmentally friendly products position the West as a dynamic and high-growth region within the U.S. market.

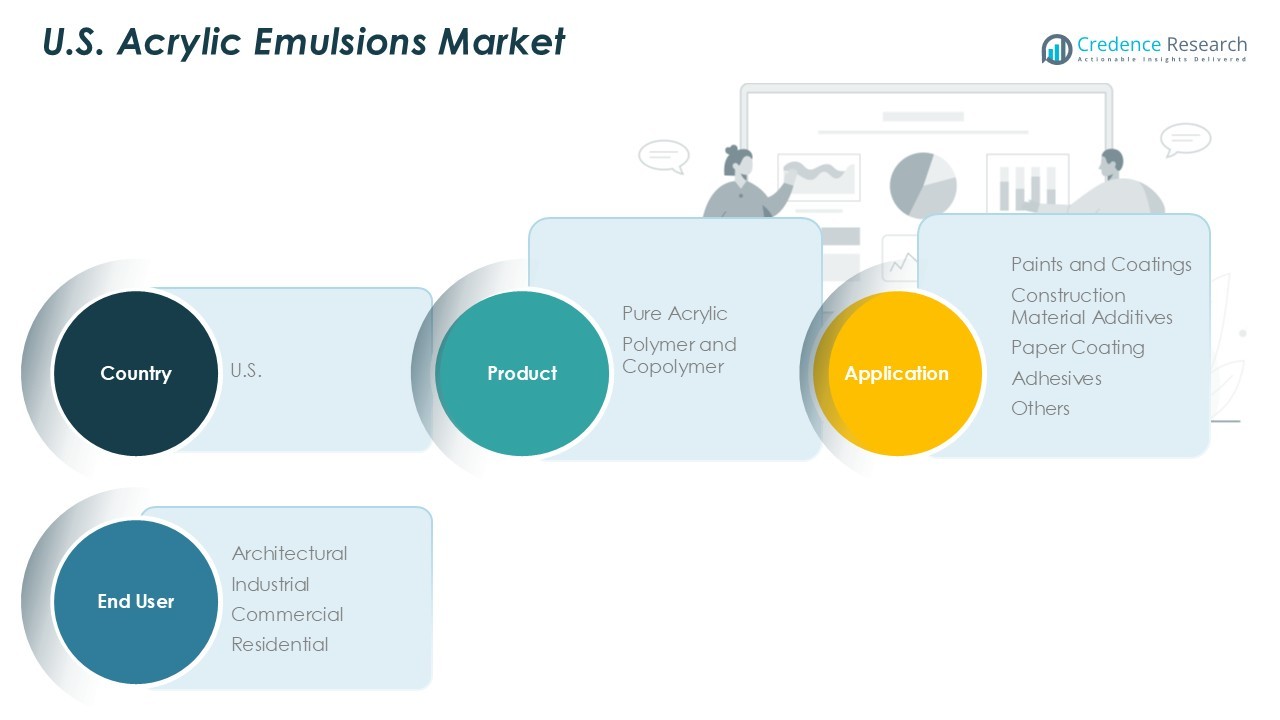

Market Segmentations:

By Product:

- Pure Acrylic

- Polymer and Copolymer

By Application:

- Paints and Coatings

- Construction Material Additives

- Paper Coating

- Adhesives

- Others

By End-User:

- Architectural

- Industrial

- Commercial

- Residential

By Region

- Northeast

- Midwest

- West

- South

Competitive Landscape

The competitive landscape of the U.S. Acrylic Emulsions market is characterized by the presence of leading players such as BASF SE, Arkema, Dow, Celanese Corporation, Ashland, The Lubrizol Corporation, 3M Company, Synthomer plc, Kamsons Chemicals Pvt. Ltd., and Mallard Creek Polymers. These companies focus on product innovation, strategic partnerships, and capacity expansion to maintain market leadership. Intense competition drives advancements in eco-friendly, low-VOC, and high-performance emulsions for paints, coatings, adhesives, and construction material additives. Manufacturers leverage technological expertise to offer customized solutions for architectural, industrial, commercial, and residential applications. Investments in sustainable manufacturing and R&D enhance product differentiation, while mergers, acquisitions, and collaborations help expand distribution networks and strengthen market share. Continuous innovation, coupled with responsive customer support, remains crucial for gaining a competitive edge in this rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Arkema

- Dow

- Celanese Corporation

- Ashland

- The Lubrizol Corporation

- 3M Company

- Synthomer plc

- Kamsons Chemicals Pvt. Ltd.

- Mallard Creek Polymers

Recent Developments

- Lubrizol announced a $20 million investment in April 2024 to enhance its acrylic emulsion production capacity with updated equipment.

- In January 2023, Univar Solutions did partner with Dow to distribute its PRIMAL™ acrylic emulsion polymers.

- In May 2025, Engineered Polymer Solutions (EPS) launched EPS 2731, a fluorosurfactant-free all-acrylic emulsion designed for interior and exterior architectural coatings, offering enhanced durability and dirt resistance.

Report Coverage

The research report offers an in-depth analysis based on Product Segments, Application Segment, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for acrylic emulsions is expected to grow steadily across architectural and industrial applications.

- Low-VOC and eco-friendly formulations will continue to gain prominence due to environmental regulations and sustainability initiatives.

- Growth in residential and commercial construction will drive increased consumption of paints, coatings, and construction additives.

- Specialty applications such as adhesives, paper coatings, and industrial products will offer new revenue opportunities.

- Technological advancements in hybrid copolymers and high-performance emulsions will support product differentiation.

- Manufacturers will focus on regional expansion to capture high-growth markets in the South and West U.S.

- Strategic collaborations, mergers, and acquisitions will strengthen distribution networks and market presence.

- R&D investment in sustainable and multifunctional emulsions will drive innovation-led growth.

- Increasing urbanization and infrastructure projects will boost demand from end-user segments.

- Competitive pressures will encourage continuous product quality improvement and operational efficiency.