Market Overview:

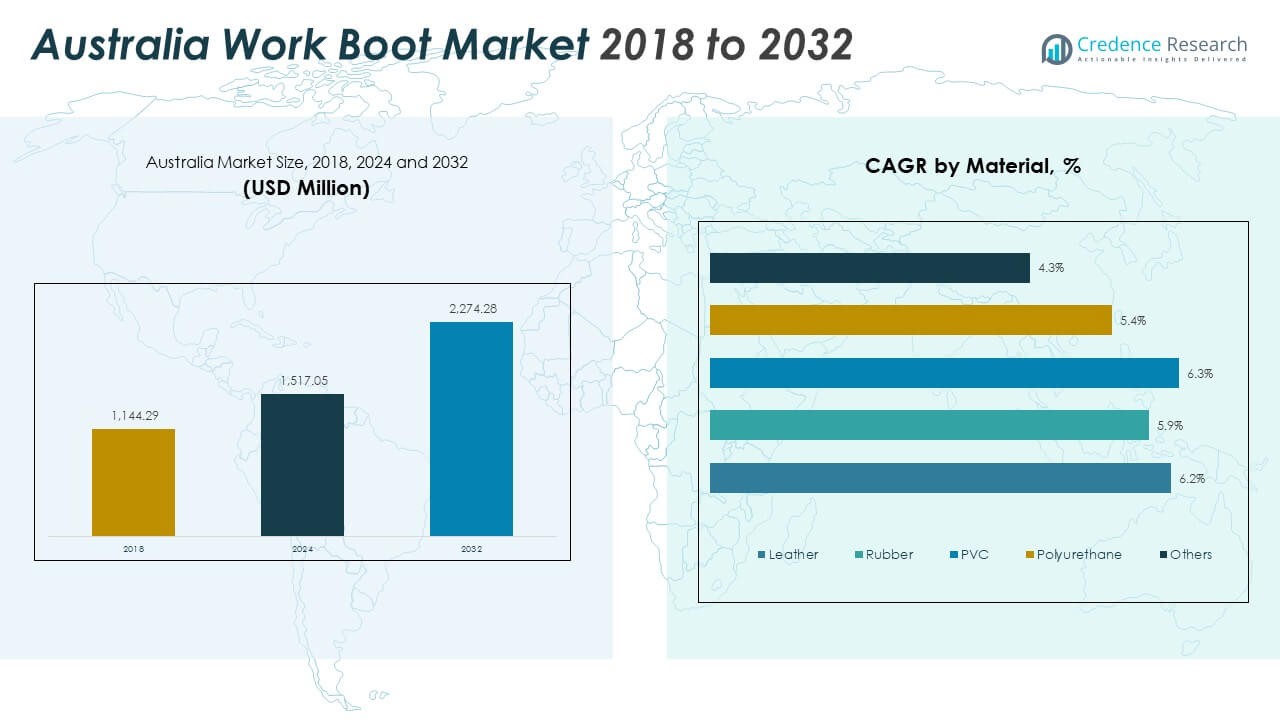

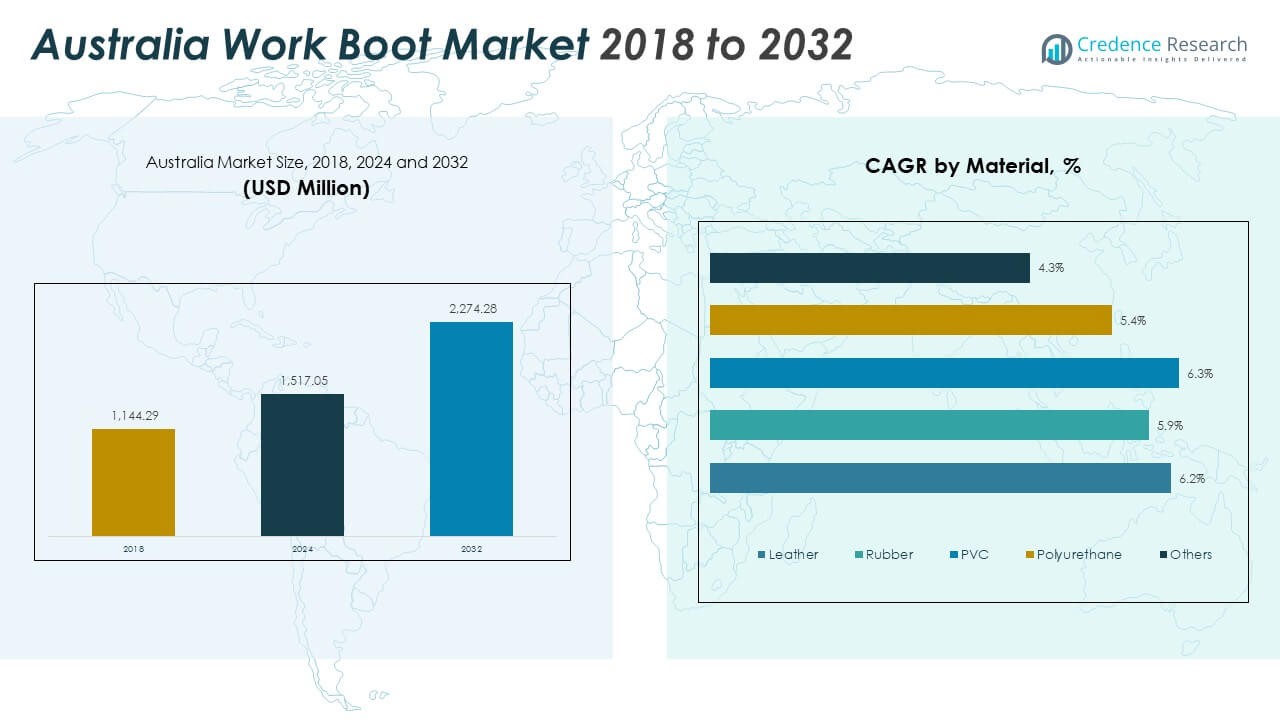

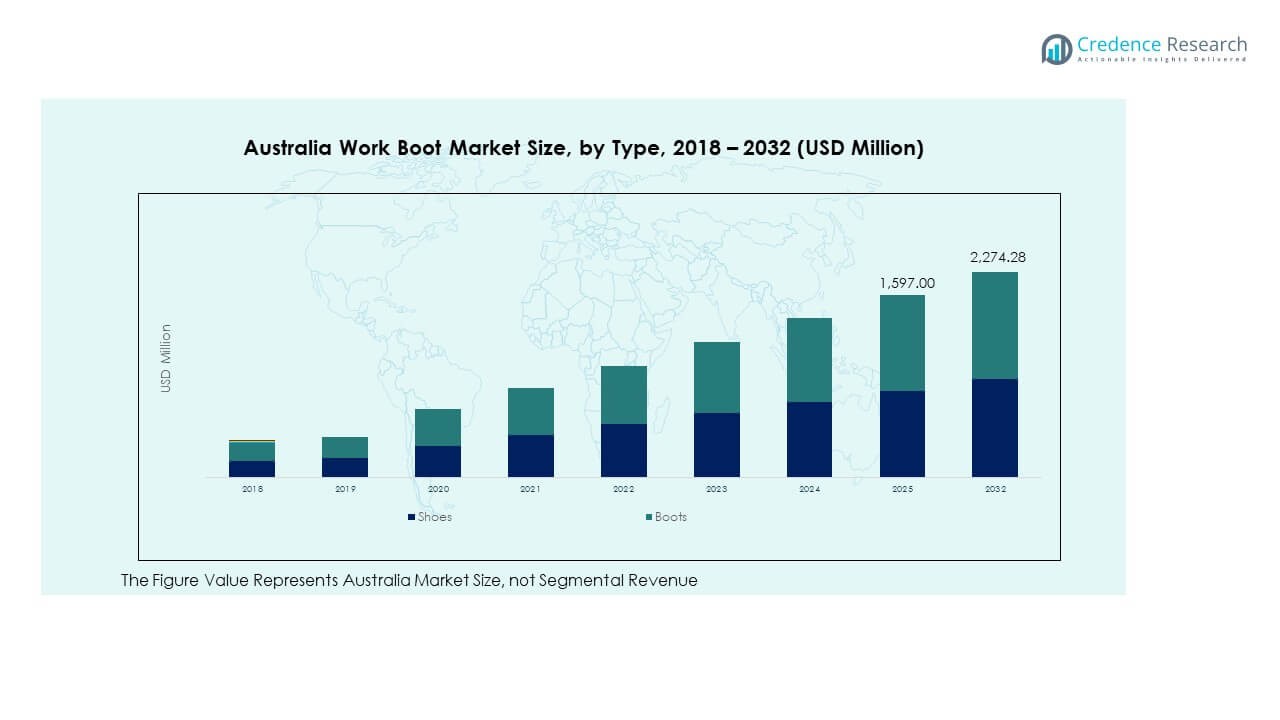

The Australia Work Boot Market size was valued at USD 1,144.29 million in 2018, grew to USD 1,517.05 million in 2024, and is anticipated to reach USD 2,274.28 million by 2032, at a CAGR of 5.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Work Boot Market Size 2024 |

USD 1,517.05 Million |

| Australia Work Boot Market, CAGR |

5.18% |

| Australia Work Boot Market Size 2032 |

USD 2,274.28 Million |

Growth in the Australia Work Boot Market is driven by expanding industrial and construction activities. Rising workplace safety awareness and strict government regulations on protective footwear boost demand. The mining and oil & gas industries continue to be major consumers due to their safety standards. Increasing product innovation, including lightweight and waterproof designs, also strengthens the market outlook. Consumer preference for durable and comfortable boots supports growth across professional and recreational users.

Regionally, Western Australia and Queensland dominate due to large-scale mining and infrastructure projects. New South Wales and Victoria are emerging regions with increasing demand from manufacturing, logistics, and service sectors. Expanding urban development and rising labor-intensive jobs drive adoption across both established and emerging regions, reflecting the country’s ongoing industrial and construction expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Work Boot Market was valued at USD 1,144.29 million in 2018, reached USD 1,517.05 million in 2024, and is expected to attain USD 2,274.28 million by 2032, growing at a CAGR of 5.18% during 2024–2032.

- Western Australia (32%), Queensland (25%), and New South Wales (21%) dominate due to strong mining, infrastructure, and manufacturing bases that create continuous demand for safety footwear.

- Victoria, holding 15%, is the fastest-growing region, driven by expanding logistics and manufacturing sectors, coupled with rising investment in renewable energy infrastructure.

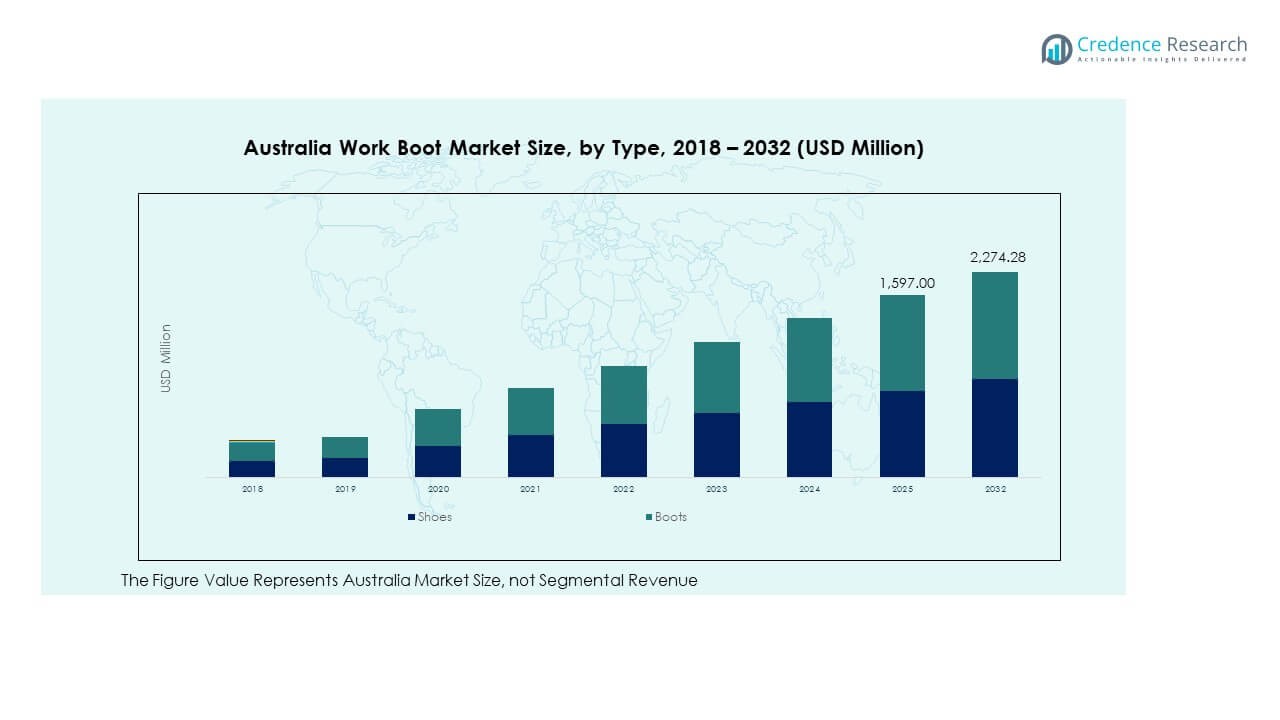

- The boots segment accounts for nearly 65% of total market revenue, reflecting their widespread use across heavy industries requiring enhanced protection.

- The shoes segment contributes around 35%, supported by increasing demand in light manufacturing, logistics, and service-oriented workplaces prioritizing comfort and flexibility.

Market Drivers:

Growing Industrial and Construction Activities Across Key Sectors

The Australia Work Boot Market experiences strong growth due to expanding industrial, mining, and construction sectors. These industries demand durable protective footwear that meets strict safety standards. Rising government investments in infrastructure, including rail, road, and renewable projects, sustain high product demand. Mining operations in Western Australia and Queensland generate continuous replacement needs due to harsh working environments. Employers prioritize worker protection, leading to mandatory adoption of certified work boots. The increasing workforce in oil, gas, and utilities also supports consistent market consumption. Manufacturers enhance boot durability and ergonomics to meet industry expectations. This widespread industrial expansion keeps demand steady across Australia.

- For instance, Blundstone expanded its RotoFlex safety boot line in 2025 with models like RotoFlex 8002featuring composite toe caps and GripTek HD outsoles. These new boots are verified as Australian Made and marketed for heavy industry work under conditions such as mining and construction according to October 2025 Google-verified product listings.

Rising Focus on Workplace Safety and Regulatory Compliance

Government authorities enforce occupational health and safety regulations that emphasize mandatory protective gear. This regulatory framework drives strong demand for certified work boots in manufacturing, logistics, and construction sites. The Australia Work Boot Market benefits from continuous safety awareness programs initiated by both public and private entities. Employers prefer products that comply with Australian and ISO standards to avoid penalties and ensure worker safety. Growth in small and medium enterprises boosts volume sales through institutional procurement. The focus on injury prevention and risk management strengthens the need for high-quality boots. Manufacturers invest in safety certifications and material testing to maintain credibility. Continuous regulatory monitoring sustains product innovation focused on compliance.

- For instance, Steel Blue, one of Australia’s primary work boot producers, continues to maintain AS/NZS 2210.3:2019 and ISO 20345-certified models such as the Southern Cross Zip Scuff Cap. According to recent official publications, the company’s boots are verified for electrical hazard resistance and puncture protection, ensuring compliance with Safe Work Australia’s PPE standards.

Technological Innovations in Product Design and Material Development

Manufacturers invest in advanced materials such as thermoplastic polyurethane soles, composite toe caps, and waterproof membranes. These innovations improve comfort, durability, and resistance against harsh conditions. The market witnesses growing integration of breathable fabrics and lightweight designs that enhance user experience. The Australia Work Boot Market benefits from technological upgrades that align with global performance standards. Companies develop boots offering puncture resistance, slip protection, and electrical hazard safety. Digital tools in manufacturing allow customization and precision in design. Sustainability in material sourcing also gains traction among leading producers. The use of 3D scanning and ergonomic modeling enhances production efficiency and product reliability.

Expanding E-Commerce Channels and Retail Availability

Online retail platforms provide consumers with greater product access and price transparency. Increased internet penetration and digital payment adoption drive strong online sales growth. Retailers enhance brand visibility through virtual fitting tools and customer feedback systems. The Australia Work Boot Market gains from hybrid distribution models combining online platforms and offline retail networks. Leading brands collaborate with distributors to ensure wide coverage across industrial hubs. Seasonal promotions and bulk discounts encourage institutional buyers to switch to digital procurement. Product comparison tools support informed buying among professional users. This omni-channel approach enhances consumer reach and sustains competitive advantage for brands across regions.

Market Trends:

Shift Toward Lightweight, Ergonomic, and Comfort-Driven Footwear

Manufacturers focus on ergonomically designed boots that reduce fatigue during long work hours. The trend toward lightweight materials enhances mobility and comfort without compromising safety. Workers prefer boots with flexible midsoles and moisture-wicking linings for better wearability. The Australia Work Boot Market adapts to changing workforce needs by integrating advanced cushioning and ventilation systems. Brands introduce anatomically shaped insoles that support arch alignment and posture correction. Industrial buyers prioritize comfort features to improve worker productivity. The fusion of protection and comfort continues to redefine product development strategies. This trend supports brand differentiation and boosts end-user loyalty in competitive markets.

- For instance, Mongrel Boots introduced new lightweight K9 K91070 Vintage Brownmodels in 2025 featuring soft midsoles and non-safety toe variants designed for long-duration wear. These boots gained traction in the Australian market as per verified listings published online in October 2025.

Sustainability and Eco-Friendly Production Practices

Companies adopt sustainable production processes using recycled and biodegradable materials. Environmental regulations encourage low-emission manufacturing and reduced waste generation. The Australia Work Boot Market aligns with sustainability goals through eco-certified leather and renewable materials. Brands promote carbon-neutral facilities and water-efficient tanning methods. Consumers increasingly favor eco-friendly footwear that reduces their environmental footprint. Recycled packaging and eco-labeling enhance brand perception among corporate buyers. Manufacturers invest in green chemistry for adhesives and dyes used in production. The growing focus on sustainability reshapes long-term market positioning for global and domestic brands.

Increased Customization and Smart Technology Integration

Customization options such as adjustable fits, specialized soles, and gender-specific designs gain popularity. Workers seek personalized comfort and performance in footwear suited to specific job roles. The Australia Work Boot Market incorporates sensor-based technologies for temperature and pressure monitoring. Smart boots offering real-time fatigue alerts and hazard detection enter niche industrial applications. Manufacturers integrate connected solutions to track product usage and wear conditions. Corporate buyers adopt customized procurement systems for employee-specific sizing. This personalization enhances safety compliance and reduces workplace injuries. Such advancements create a new benchmark for smart, adaptive safety footwear.

Rising Demand From Non-Industrial and Lifestyle Segments

Work boots transition beyond traditional industrial use toward casual and outdoor applications. Consumers adopt rugged footwear styles for fashion and outdoor activities. The Australia Work Boot Market expands its base by catering to lifestyle and adventure enthusiasts. Retailers promote dual-purpose boots that blend protection with urban aesthetics. This crossover appeal strengthens brand presence in retail stores and online platforms. The durability and comfort of safety boots attract non-industrial customers seeking reliability. Collaborations with fashion brands and influencers promote premium collections. This trend blurs the line between functional footwear and lifestyle fashion, driving broader market acceptance.

Market Challenges Analysis:

Price Competition and Market Saturation Among Domestic and Global Brands

The Australia Work Boot Market faces pricing pressure due to the presence of numerous domestic and international players. Established brands compete with low-cost imports that replicate design features at reduced prices. This intense competition limits profit margins for manufacturers and distributors. Smaller companies struggle to maintain quality while matching aggressive pricing from global brands. Supply chain disruptions and fluctuating raw material costs further squeeze profitability. Industrial buyers often prioritize cost over advanced safety features, reducing premium product demand. The growing number of brands increases consumer confusion and reduces brand loyalty. Maintaining differentiation through innovation and quality assurance becomes essential to survive in a price-sensitive market.

Challenges in Material Sourcing and Regulatory Compliance Costs

Manufacturers encounter difficulties in sourcing high-grade leather and eco-friendly raw materials locally. Import dependence increases exposure to currency fluctuations and logistic delays. The Australia Work Boot Market endures rising compliance costs linked to safety certifications and testing standards. Stricter environmental laws increase investment in sustainable production systems. Smaller firms face financial challenges adapting to these evolving regulations. Maintaining consistent product quality while adhering to safety benchmarks becomes complex for mid-sized producers. Growing expectations from institutional buyers for eco-certified products intensify competitive pressure. These combined challenges constrain operational flexibility and delay new product launches.

Market Opportunities:

Rising Adoption of Technologically Advanced and Sustainable Work Boots

Manufacturers have significant growth opportunities by introducing energy-absorbing soles, smart sensors, and eco-friendly materials. These innovations meet evolving consumer and corporate safety standards. The Australia Work Boot Market benefits from increasing interest in smart wearables that monitor foot health. Sustainable designs attract environmentally conscious buyers across industries. Investments in green technology improve long-term brand positioning. Collaborations with research institutes foster development of next-generation materials. This direction enhances brand differentiation and aligns with national sustainability goals.

Expansion Across Emerging Sectors and Untapped Regional Markets

Rapid industrialization in regional Australia presents new demand centers for work boots. Growth in renewable energy, agriculture, and logistics sectors widens the customer base. The Australia Work Boot Market gains opportunities from the rising number of small businesses investing in safety gear. Retail expansion in remote industrial towns boosts accessibility for new customers. Increasing participation of women in industrial roles encourages demand for gender-specific designs. Partnerships with online platforms enhance visibility in underrepresented regions. These developments create multiple entry points for manufacturers aiming to scale operations nationwide.

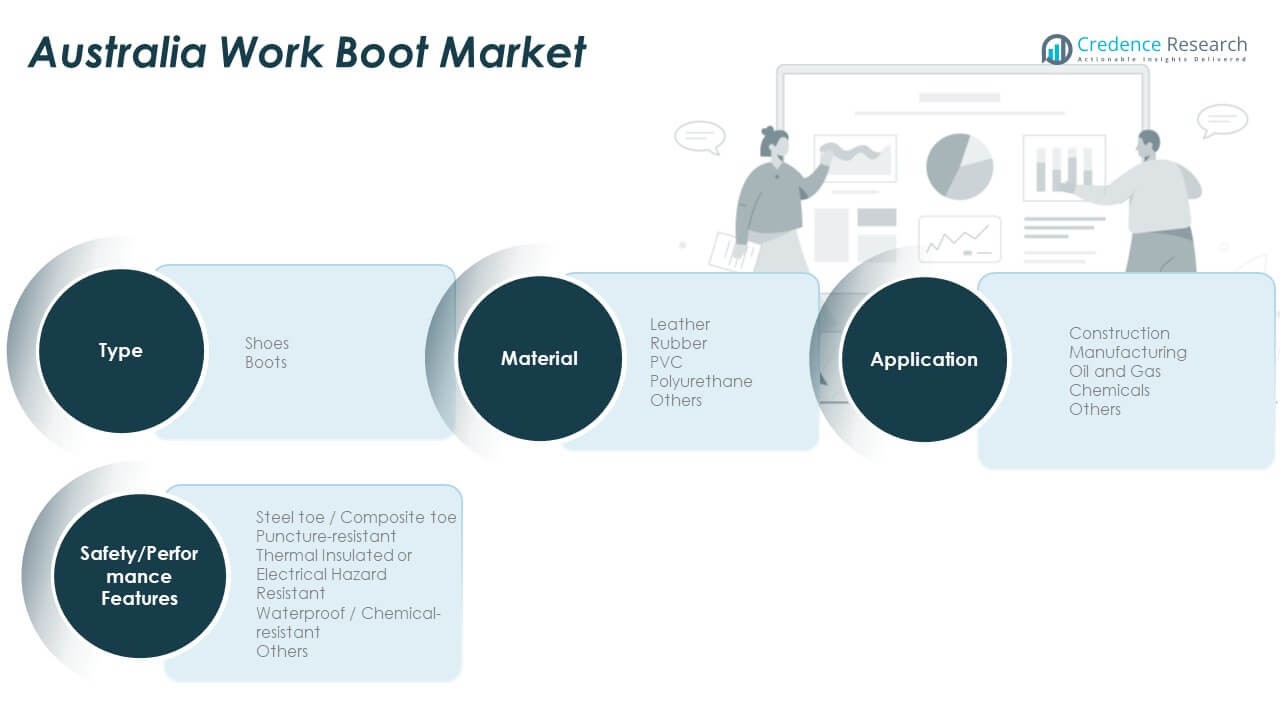

Market Segmentation Analysis:

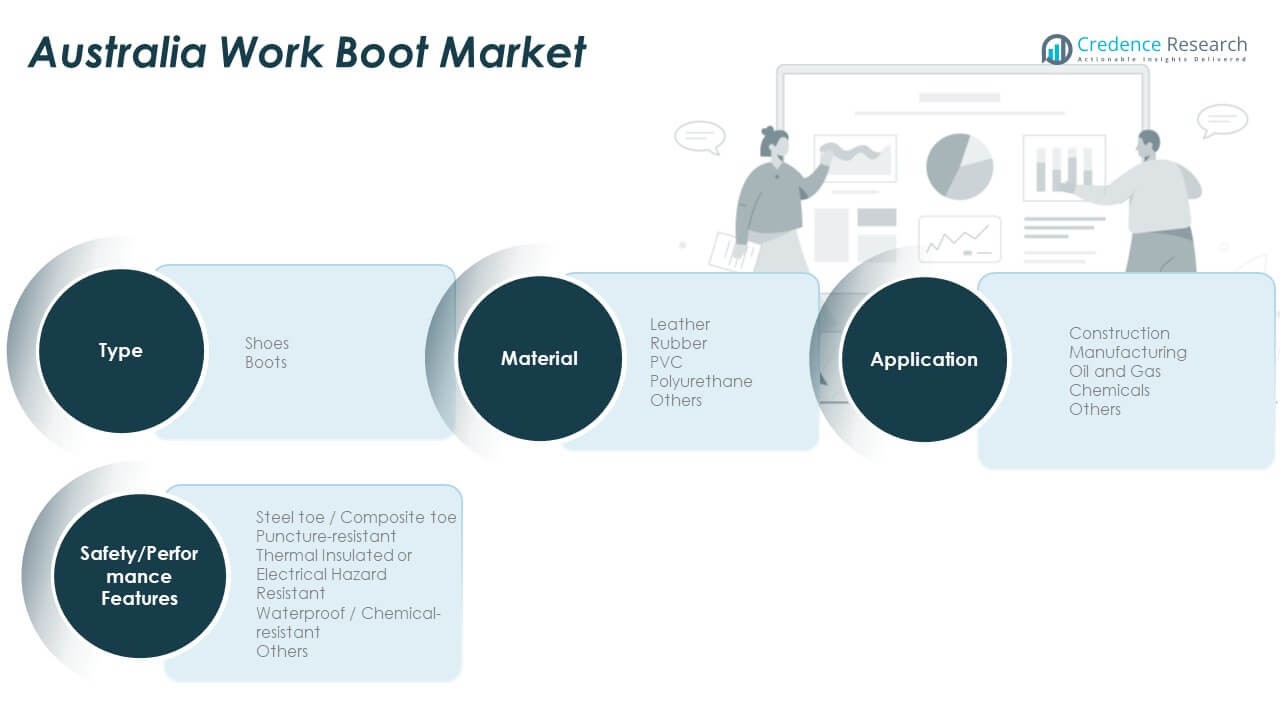

By Type

The Australia Work Boot Market is segmented into shoes and boots. Boots hold a larger share due to their superior protection, durability, and suitability for industrial environments. Safety boots are widely used in construction, mining, and oil and gas sectors where impact resistance is critical. Shoes are gaining adoption in light manufacturing and service sectors that require comfort and moderate protection. Brands continue to introduce hybrid designs combining athletic comfort with industrial-grade safety, appealing to diverse professional users.

- For instance, Blundstone’s #200 Elastic Sided Work Boot is verified by Australian retail distributors as a durable, all-purpose work boot, while the #152 Men’s Heritage Chelsea Boot is a dress boot with a non-safety leather sole. For heavy industry and mechanical work, Blundstone offers separate, safety-certified styles with features like steel toe caps.

By Application

Construction remains the leading application segment driven by ongoing infrastructure projects and workforce expansion. Manufacturing follows closely, supported by safety compliance requirements across production facilities. The oil and gas sector demands specialized boots resistant to heat, chemicals, and slippage. Chemical industries prefer waterproof and chemical-resistant variants to safeguard against hazardous spills. Other sectors, including logistics and agriculture, contribute to steady product demand through continuous workforce mobility and outdoor exposure.

- Steel Blue Australia, for instance, reported continued supply to large-scale projects such as BHP and Fortescue operations, with its Southern Cross Zip Scuff Cap and Argyle series safety boots regularly deployed on major construction and mining sites.

By Material

Leather dominates the market due to its durability, breathability, and adaptability to harsh climates. Rubber and polyurethane materials are gaining traction for waterproofing and shock absorption properties. PVC-based boots cater to cost-sensitive users and chemical industries requiring non-reactive footwear. Continuous innovation in composite materials enhances flexibility and lifespan, ensuring reliable performance across diverse conditions.

By Safety/Performance Features

Steel toe and composite toe boots represent the most preferred category, ensuring impact protection. Puncture-resistant soles and insulated designs address site-specific hazards. Waterproof and chemical-resistant variants support operations in wet and corrosive environments, ensuring user safety and product longevity.

Segmentation:

By Type

By Application

- Construction

- Manufacturing

- Oil and Gas

- Chemicals

- Others

By Material

- Leather

- Rubber

- PVC

- Polyurethane

- Others

By Safety/Performance Features

- Steel Toe / Composite Toe

- Puncture-Resistant

- Thermal Insulated or Electrical Hazard Resistant

- Waterproof / Chemical-Resistant

- Others

Regional Analysis:

Western Australia – Leading Industrial and Mining Hub

Western Australia holds the largest market share of around 32% in the Australia Work Boot Market. The region’s dominance is driven by extensive mining, oil, and gas activities that demand high-performance protective footwear. The presence of large-scale industrial projects and remote workforce operations ensures steady demand for durable, safety-certified boots. It benefits from strong supplier networks and localized manufacturing units catering to harsh working conditions. Increasing infrastructure investments and new exploration activities strengthen regional growth. High safety compliance standards in mining and energy sectors sustain long-term consumption trends.

Queensland and New South Wales – Expanding Construction and Manufacturing Bases

Queensland captures about 25% of the market, supported by large construction and logistics sectors. It experiences consistent demand from residential and commercial development projects. New South Wales follows with a 21% share, fueled by rapid urbanization and strong industrial activity around Sydney and Newcastle. The Australia Work Boot Market benefits from regional diversification across these states, balancing industrial and service-sector needs. Construction workers, manufacturing employees, and tradespeople represent major consumer groups. The growing number of small enterprises investing in safety gear enhances sales stability. These regions continue to attract strong retail and distributor presence due to dense workforce clusters.

Victoria, South Australia, and Others – Emerging Demand Corridors

Victoria accounts for roughly 15% of the market, driven by its expanding manufacturing and service sectors. The state’s focus on advanced manufacturing and logistics supports steady adoption of safety footwear. South Australia and other territories together hold around 7%, reflecting gradual industrial recovery and rising occupational safety standards. The Australia Work Boot Market sees growing traction in these emerging zones due to renewable energy projects and agricultural modernization. Expanding infrastructure in regional areas and the shift toward sustainable industries stimulate fresh opportunities. These regions are expected to post faster growth rates, supported by safety awareness and modern workwear retail expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Oliver Footwear

- Steel Blue

- Redback Boots

- Mongrel Boots

- Rossi Boots

- Bata Industrials (Australia)

- KingGee

- Hard Yakka

- Mack Boots

- FXD Workwear

- CAT Work Boots

- Wolverine

Competitive Analysis:

The Australia Work Boot Market is highly competitive, with a mix of local and international brands striving for market dominance. Leading players such as Oliver Footwear, Steel Blue, Redback Boots, and Mongrel Boots hold strong brand loyalty through consistent product quality and innovation. Global brands like CAT Work Boots and Wolverine enhance competition through technology-driven designs and wide distribution networks. It emphasizes performance, durability, and compliance with safety standards. Companies invest in lightweight materials, ergonomic soles, and sustainable manufacturing to gain an edge. Retail and e-commerce expansion further intensify rivalry among brands targeting industrial and lifestyle segments. Continuous R&D and regional collaborations remain key to maintaining a competitive lead.

Recent Developments:

- In July 2025, Redback Boots initiated a strategic growth phase by appointing Rothschild & Co to explore equity investment opportunities. The family-owned brand sought capital infusion to expand manufacturing capacity and venture into lifestyle and corporate footwear segments, positioning itself alongside competitors such as Blundstone and Steel Blue.

- In May 2024, Hard Yakka partnered with sustainable fashion label Thrills to launch a new venture called Hard Yakka Create. The line debuted on May 9, 2024, blending industrial-grade workwear with contemporary streetwear aesthetics. According to the official release on Shop-Eat-Surf and Empire Ave, the collaboration delivers 32 apparel items and six accessories inspired by modern Australian creativity and craftsmanship.

Report Coverage:

The research report offers an in-depth analysis based on type, application, material, and safety/performance features. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising infrastructure and mining projects will drive continuous safety footwear demand.

- Increasing adoption of sustainable materials will redefine production standards.

- Smart boots with IoT sensors will gain traction in high-risk industries.

- E-commerce platforms will capture a growing share of professional footwear sales.

- Local manufacturers will expand through product diversification and export initiatives.

- Custom-fit and ergonomic innovations will enhance user safety and comfort.

- Government workplace safety policies will sustain mandatory adoption of protective gear.

- Emerging sectors like renewable energy and logistics will widen product applications.

- Female workforce participation in industrial jobs will drive gender-specific designs.

- Competitive branding through durability and comfort will shape consumer loyalty.