Market Overview

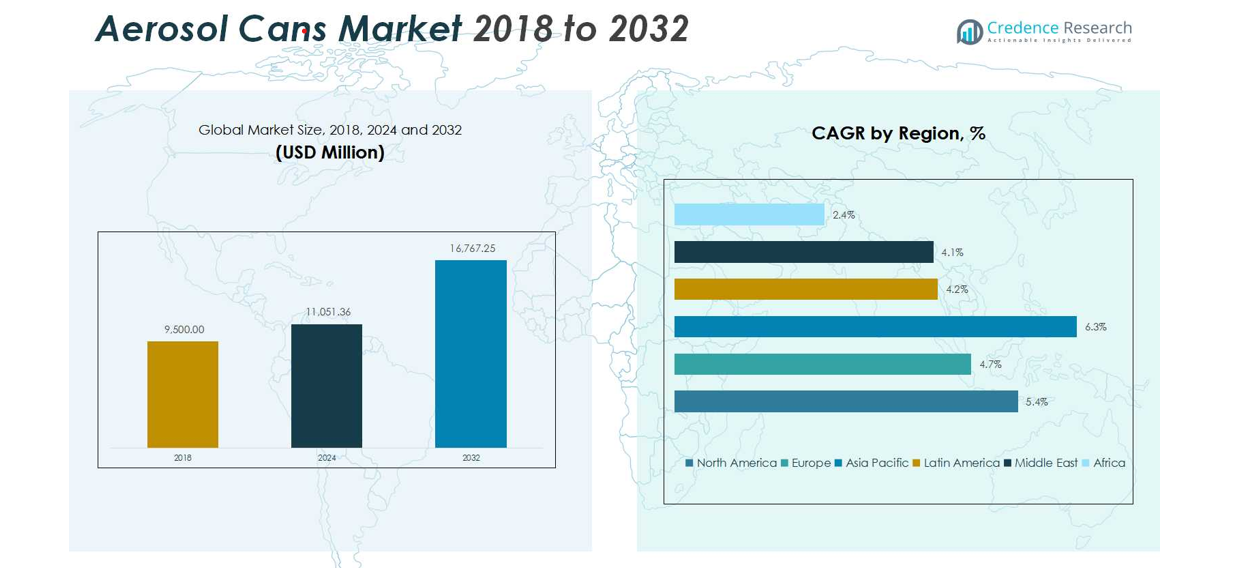

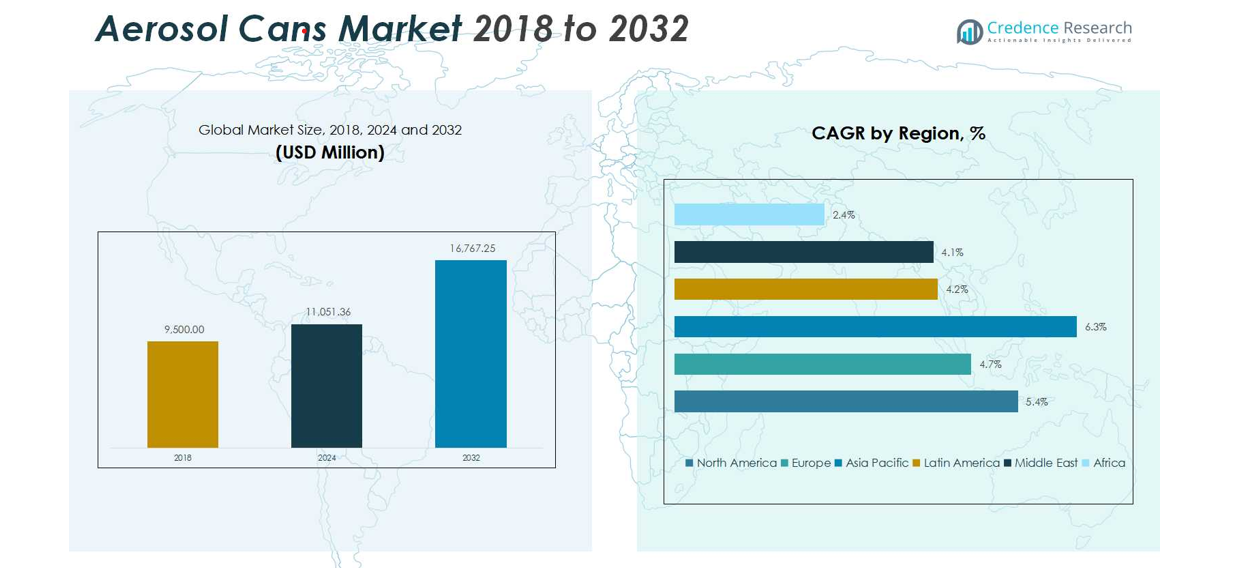

Aerosol Cans Market size was valued at USD 9,500.00 Million in 2018 and is projected to reach USD 11,051.36 Million in 2024. The market is anticipated to grow to USD 16,767.25 Million by 2032, exhibiting a CAGR of 5.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aerosol Cans Market Size 2024 |

USD 11,051.36 Million |

| Aerosol Cans Market , CAGR |

5.42% |

| Aerosol Cans Market Size 2032 |

USD 16,767.25 million |

The Aerosol Cans Market is dominated by key players such as BALL Corporation, Crown Holding Inc., ARDAGH Packaging, Nampak, CCL Container, EXAL, DS Container, Jamestrong Packaging, and ITW Sexton Can Company, Inc. These companies focus on product innovation, sustainable packaging, and regional expansion to strengthen market presence. Asia Pacific leads the global market with a 30% share, driven by rapid urbanization, rising disposable income, and strong demand for personal care, household, and industrial aerosol products. North America follows with 28% share, supported by high consumer preference for convenience and advanced manufacturing infrastructure. Europe commands 25% share, fueled by stringent environmental regulations and premium product consumption. Latin America, the Middle East, and Africa together account for 17%, with growth fueled by emerging demand for hygiene, automotive, and industrial aerosol applications. Strategic investments and sustainable product offerings remain key growth drivers for these leading players.

Market Insights

- The Aerosol Cans Market was valued at USD 11,051.36 Million in 2024 and is projected to reach USD 16,767.25 Million by 2032, growing at a CAGR of 5.42%.

- Rising demand in personal care and home care products is driving market growth, supported by urbanization, higher disposable incomes, and lifestyle-oriented consumption.

- Market trends include the adoption of low-VOC, solvent-free, and eco-friendly formulations, as well as multifunctional aerosol products combining fragrance, cleaning, and protection.

- Competitive analysis shows dominance by key players such as BALL Corporation, Crown Holding Inc., ARDAGH Packaging, and Nampak, focusing on innovation, sustainable packaging, and expansion in emerging markets.

- Regional analysis highlights Asia Pacific leading with 30% share, followed by North America at 28% and Europe at 25%, while Latin America, the Middle East, and Africa together hold 17%. The Metal segment commands 78% share, with Personal Care applications at 34%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

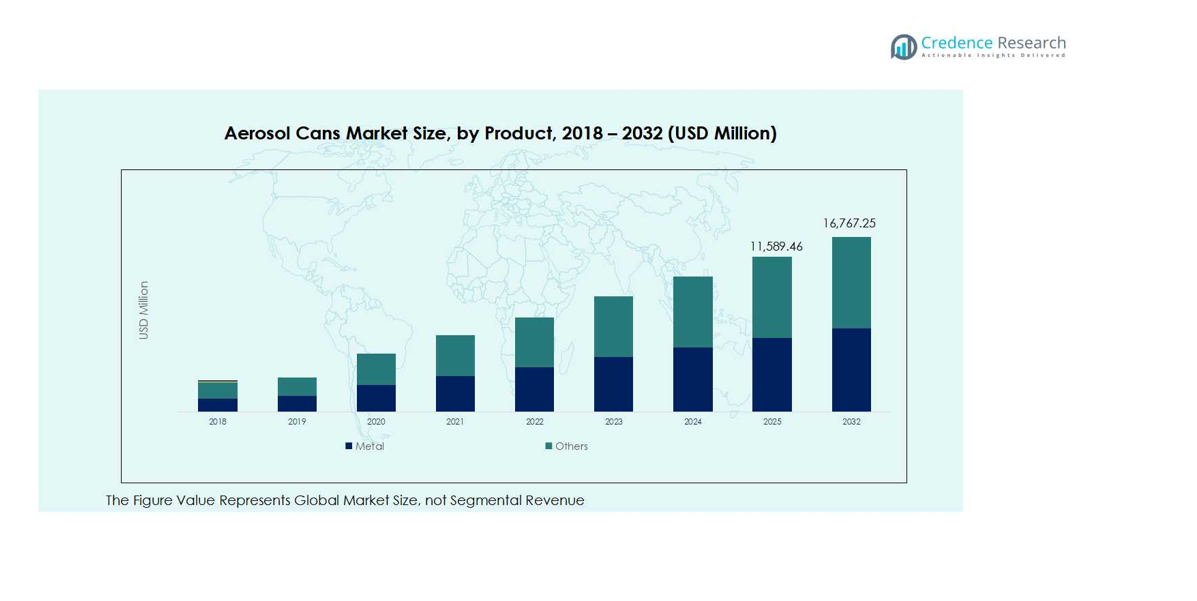

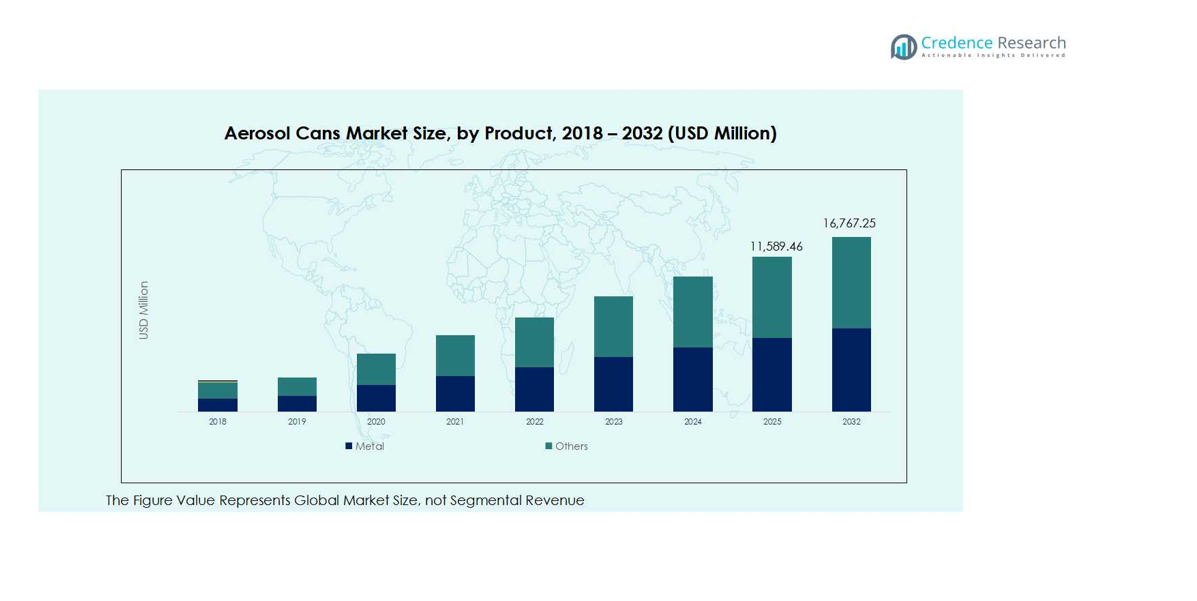

By Product

The Metal segment dominates the Aerosol Cans Market, capturing around 78% of the market share in 2024. Its growth is driven by durability, recyclability, and compatibility with diverse propellants and contents. Metal cans are widely preferred for long shelf-life products in personal care, household, and industrial applications. The Others sub-segment, including plastic and composite cans, accounts for 22% of the market, supported by demand for lightweight, cost-effective, and flexible packaging solutions, particularly in emerging regions. Increasing sustainability awareness continues to favor metal aerosol adoption globally.

- For instance, Unilever’s CIF disinfectant in Argentina adopted Trivium Packaging’s 59×200 aluminum aerosol can made from up to 10% recycled content and manufactured using 80% green energy under ISO 50001 and ISO 14001 certifications.

By Application

In the application category, Personal Care leads with approximately 34% market share, driven by rising demand for deodorants, hair sprays, and skincare products among urban consumers. Home Care holds 26% of the market, fueled by growth in aerosol-based cleaning sprays and air fresheners. Insecticide dominates with a 20% share, backed by heightened pest control awareness and vector-borne disease prevention. Automotive and Others sub-segments account for 12% and 14%, respectively, driven by vehicle maintenance, industrial applications, and niche aerosol usage across diverse sectors.\

- For instance, SC Johnson’s Raid® Flying Insect Killer Odourless 400G remains a popular aerosol product, providing fast eradication of flies, mosquitoes, and cockroaches with a low-odor formula suitable for indoor use.

Key Growth Drivers

Rising Demand in Personal Care and Household Products

The growing demand for personal care and household products is a primary driver for the aerosol cans market. Increasing urbanization, rising disposable incomes, and lifestyle-oriented consumption are boosting the adoption of deodorants, hair sprays, air fresheners, and cleaning products in aerosol formats. Consumers favor aerosols for their convenience, uniform spray, and extended shelf life. This trend is particularly strong in North America and Europe, where premium product consumption is high, and in Asia Pacific, where urban populations are rapidly expanding.

- For instance, Henkel’s Schwarzkopf VOLUME Lift Hairspray now offers a collagen-infused aerosol formulation that adds body and UV protection while being available in recyclable aluminum cans, meeting consumer expectations for both performance and sustainability.

Sustainability and Recycling Initiatives

Metal aerosol cans are highly recyclable, which aligns with the increasing consumer and regulatory focus on sustainable packaging. Governments and manufacturers are promoting eco-friendly packaging solutions, and brands are adopting circular economy practices. This trend is accelerating the replacement of non-recyclable containers with metal aerosol cans. The recyclability factor not only appeals to environmentally conscious consumers but also drives brand loyalty, providing a strong growth engine for market expansion, particularly in developed regions with stringent environmental regulations.

Industrial and Automotive Applications Growth

The aerosol cans market is benefiting from increased demand in industrial and automotive sectors. Aerosol-based paints, lubricants, and protective coatings offer precision, convenience, and safety for industrial users. The automotive sector relies on aerosols for maintenance products, including spray paints, rust preventives, and cleaning agents. Rising vehicle production and aftermarket maintenance, especially in Asia Pacific and Latin America, are propelling growth. The ability of aerosol solutions to deliver consistent performance and ease of use underpins their expanding adoption in these industrial applications.

- For instance, Sherwin-Williams’ Sprayon WL738 Protective Coating aerosol delivers corrosion resistance using 100% type-316L stainless steel pigment; it withstands temperatures up to 400 °F, covers 10-15 sq ft per 12-oz can, and hardens overnight while curing to optimum strength over several days.

Key Trends & Opportunities

Innovation in Product Formulations

Manufacturers are increasingly investing in innovative aerosol formulations, such as low-VOC, solvent-free, and organic products, to cater to health-conscious consumers and regulatory compliance. These innovations enhance safety, reduce environmental impact, and expand usage across sensitive applications like cosmetics and household cleaners. The trend toward multifunctional aerosol products, combining cleaning, fragrance, or protection in one can, opens new market opportunities. Brands that differentiate with innovative formulations are gaining competitive advantage while tapping into emerging markets globally.

- For instance, Topas GmbH has developed devices for generating defined aerosols to improve studies and experiments, with a focus on controlling aerosol parameters like pressure and filtration efficiency, advancing research and therapeutic applications.

Expansion in Emerging Markets

Emerging economies, particularly in Asia Pacific, Latin America, and the Middle East, present significant growth opportunities for aerosol cans. Rapid urbanization, rising income levels, and increased awareness of hygiene and convenience products are driving consumption. Companies are expanding distribution networks and local manufacturing to meet regional demand efficiently. Additionally, increasing adoption in non-traditional applications such as insecticides, automotive care, and industrial sprays further fuels market growth. Strategic investments in these regions are expected to deliver long-term revenue gains.

- For instance, Crown Holdings Inc. exemplifies investment in Latin America, becoming the first company in Colombia certified for responsible sourcing, signaling expansion in sustainable manufacturing practices.

Key Challenges

Regulatory and Environmental Constraints

Stringent environmental regulations regarding volatile organic compounds (VOCs), propellants, and packaging materials pose a significant challenge to the aerosol cans market. Compliance requirements increase production costs and may restrict certain formulations. Companies need to invest in research and development to create compliant and eco-friendly alternatives, particularly in Europe and North America. Non-compliance risks fines and market restrictions, making regulatory adherence a critical hurdle for manufacturers seeking to maintain profitability while meeting evolving environmental standards.

Rising Raw Material Costs

Fluctuating costs of raw materials such as aluminum, tinplate, and propellants impact the overall pricing and profitability of aerosol cans. Metal price volatility, influenced by global supply-demand dynamics, increases production costs and can affect market competitiveness. Smaller manufacturers are particularly vulnerable to price swings, which may limit their ability to invest in growth or expand product offerings. Companies must optimize supply chains and explore alternative materials to mitigate cost pressures while sustaining market growth.

Regional Analysis

North America

North America holds a 28% share of the global Aerosol Cans Market, driven by strong demand in personal care, home care, and automotive applications. The U.S. dominates the region, fueled by rising consumer preference for convenient and hygienic aerosol products. Advanced manufacturing infrastructure, high disposable income, and regulatory support for recyclable packaging further enhance market growth. Canada and Mexico contribute to the regional expansion through growing industrial and household aerosol applications. Manufacturers are investing in innovation and sustainability initiatives to meet consumer expectations, making North America a key growth hub for the global aerosol cans market.

Europe

Europe accounts for 25% of the global aerosol cans market, led by strong adoption in personal care, home care, and industrial applications. Germany, France, and the UK dominate the regional demand, supported by high consumer awareness and premium product consumption. Strict environmental regulations drive the shift toward recyclable metal cans and low-VOC formulations. The growing industrial sector and automotive maintenance requirements further propel market expansion. Manufacturers in Europe are leveraging sustainability initiatives and technological innovation to differentiate their offerings, maintaining competitive advantage and supporting consistent growth in the region over the forecast period.

Asia Pacific

Asia Pacific holds a 30% share of the global aerosol cans market, driven by rapid urbanization, rising disposable income, and expanding consumer awareness of personal care and household products. China, Japan, and India lead regional demand, supported by increasing industrial applications, automotive maintenance, and hygiene-focused consumption. Emerging markets in Southeast Asia are also witnessing growth due to lifestyle changes and the adoption of premium aerosol products. The region offers significant opportunities for market players through local manufacturing and distribution expansion, with a focus on sustainable, innovative, and multifunctional aerosol solutions to meet evolving consumer needs.

Latin America

Latin America contributes 9% to the global aerosol cans market, with Brazil and Argentina driving regional growth. The market benefits from rising demand for personal care, home care, and insecticide products, particularly in urban centers. Increasing awareness of hygiene, convenience, and vector-borne disease prevention supports aerosol adoption. Growth in industrial and automotive applications also adds to the market momentum. Manufacturers are expanding distribution networks and local production capabilities to capitalize on regional opportunities. Investments in environmentally friendly and lightweight aerosol solutions are expected to further enhance market share and strengthen the region’s position in the global market.

Middle East

The Middle East accounts for 4% of the global aerosol cans market, supported by demand in personal care, household, and industrial segments. GCC countries, Turkey, and Israel are major contributors, driven by urbanization, rising disposable income, and lifestyle-oriented consumption. Industrial applications, including automotive and protective coatings, are also expanding in the region. Market growth is further encouraged by government initiatives promoting sustainable packaging and environmental compliance. Manufacturers are focusing on product innovation and regional partnerships to cater to diverse consumer requirements while maintaining compliance with environmental regulations, creating a steady growth trajectory in the Middle East market.

Africa

Africa holds a 4% share of the global aerosol cans market, with South Africa and Egypt as key contributors. Market growth is driven by rising demand for personal care products, home care sprays, and insecticides, fueled by increasing urban population and awareness of hygiene. Industrial and automotive applications are gradually expanding, supporting market diversification. Challenges such as supply chain limitations and price sensitivity are addressed through local manufacturing and strategic partnerships. Adoption of sustainable and cost-effective aerosol solutions is increasing, creating growth opportunities. Manufacturers targeting this region focus on affordability, accessibility, and multifunctional aerosol products to capture market share.

Market Segmentations:

By Product

By Application

- Personal Care

- Home Care

- Insecticide

- Automotive

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Aerosol Cans Market features key players such as BALL Corporation, Crown Holding Inc., ARDAGH Packaging, Nampak, CCL Container, EXAL, DS Container, Jamestrong Packaging, and ITW Sexton Can Company, Inc. The market is characterized by the presence of both global and regional manufacturers focusing on product innovation, sustainable packaging, and strategic partnerships to enhance market share. Companies are investing in advanced manufacturing technologies, low-VOC formulations, and recyclable metal cans to meet regulatory compliance and growing consumer demand. Expansion into emerging markets, along with mergers and acquisitions, strengthens regional footprints and distribution networks. High competition drives pricing strategies, while brand differentiation through quality, sustainability, and multifunctional products remains a key growth tactic. Overall, the market shows steady consolidation with leading players dominating while new entrants focus on niche segments and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, Ball Corporation acquired Alucan to expand its sustainable impact in extruded aluminum packaging, strengthening its position in the aerosol cans market.

- In June 2024, Sonoco announced the acquisition of Eviosys, creating a leading global platform for metal food cans and aerosol packaging, enhancing its market reach and operational capabilities.

- In January 2025, Ball Corporation partnered with Meadow to introduce MEADOW KAPSUL™, a fully recyclable aluminum refill can designed for beauty and home-care refills.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for metal aerosol cans will continue to rise due to sustainability and recyclability trends.

- Personal care and home care segments are expected to drive significant market growth globally.

- Emerging markets in Asia Pacific and Latin America will offer substantial expansion opportunities.

- Manufacturers will increasingly focus on innovative, low-VOC, and eco-friendly product formulations.

- Industrial and automotive aerosol applications will expand with rising vehicle production and maintenance needs.

- Strategic partnerships, mergers, and acquisitions will strengthen regional distribution networks.

- Companies will invest in advanced manufacturing technologies to improve efficiency and product quality.

- Consumer preference for convenience and multifunctional aerosol products will shape product development.

- Regulatory compliance and environmental standards will influence market dynamics and product offerings.

- Lightweight and cost-effective packaging solutions will gain traction in price-sensitive regions.