Market Overview

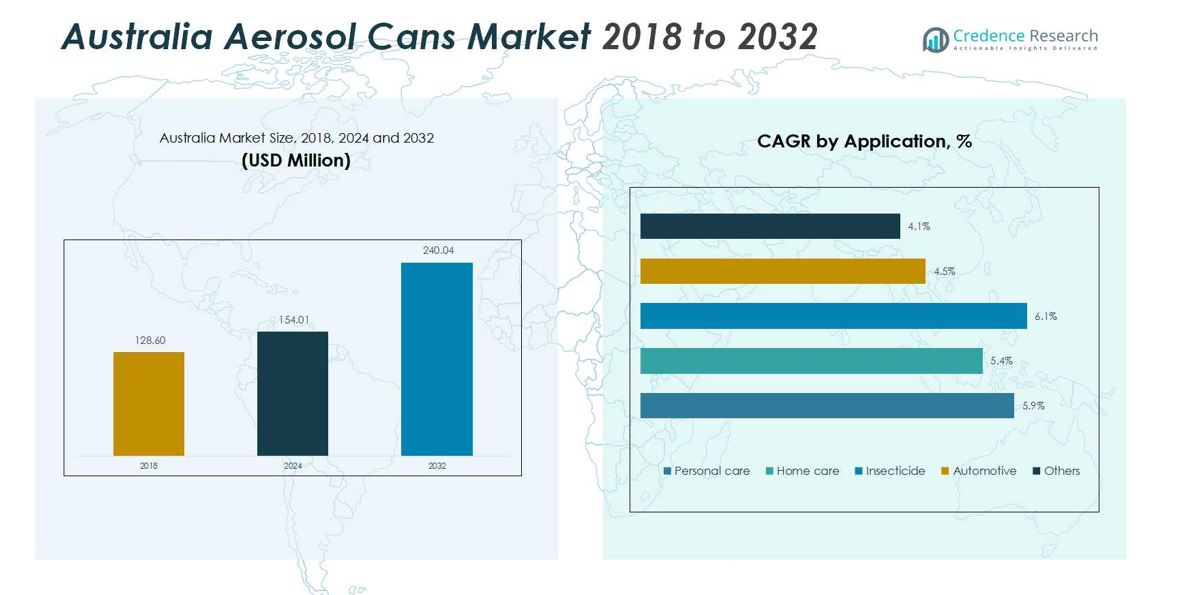

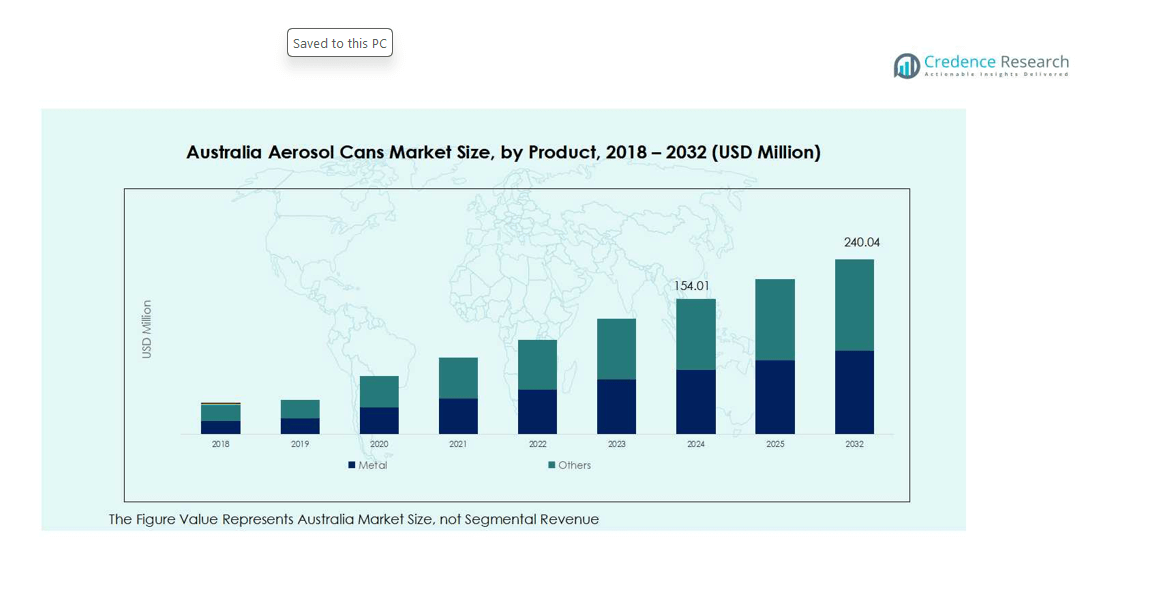

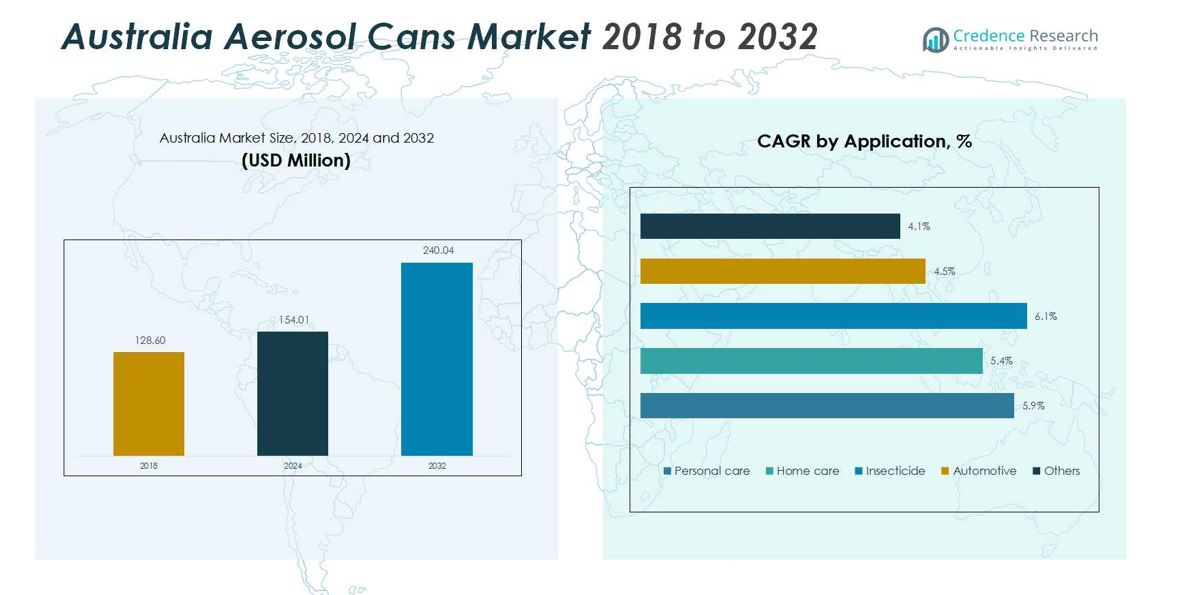

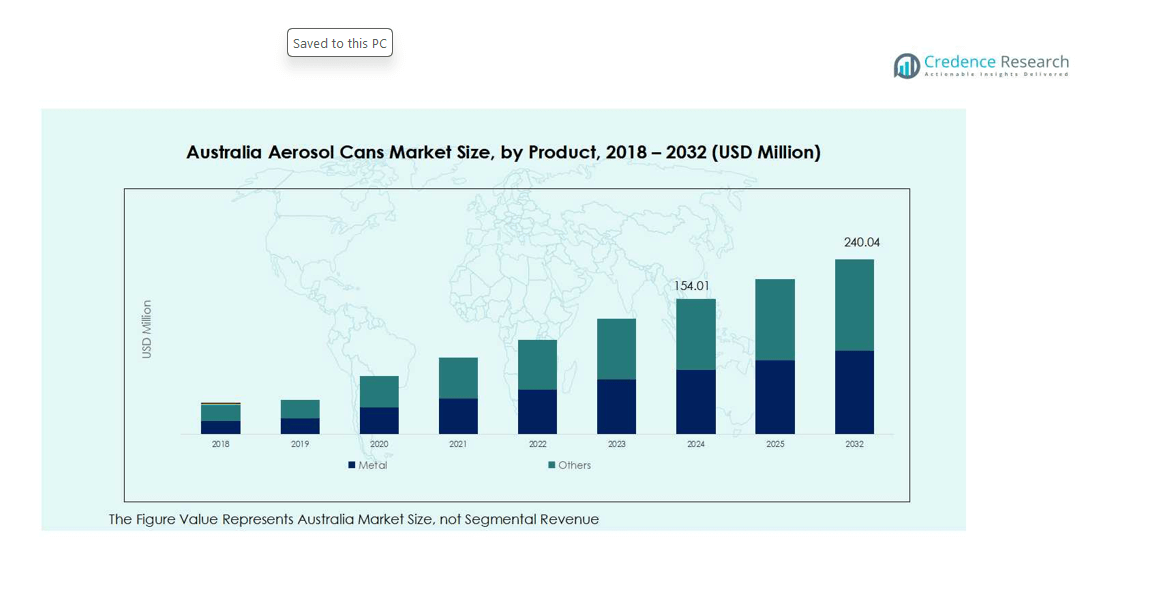

Australia Aerosol Cans Market size was valued at USD 128.60 million in 2018 and increased to USD 154.01 million in 2024. It is anticipated to reach USD 240.04 million by 2032, growing at a CAGR of 5.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Aerosol Cans Market Size 2024 |

USD 154.01 million |

| Australia Aerosol Cans Market, CAGR |

5.70% |

| Australia Aerosol Cans Market Size 2032 |

USD 240.04 million |

The Australia Aerosol Cans Market is dominated by key players such as Ardagh Metal Packaging, Ball Corporation, Crown Holdings Inc., Trivium Packaging, Nampak Ltd., APL Aerosols Pty Ltd., Pacific Packaging (Aust) Pty Ltd., Alucon Public Company Limited, Coster Group, and Shanghai Sunhome Industrial Co., Ltd. These companies leverage advanced manufacturing technologies, extensive distribution networks, and sustainable product innovations to maintain a competitive edge. The market’s growth is concentrated in New South Wales, which holds 32% of total demand, followed by Victoria with 26% and Queensland at 18%. The dominance of these regions is driven by strong industrial infrastructure, high urban population density, and robust consumer demand for personal care, home care, and industrial aerosol products. Leading players continue to invest in eco-friendly packaging, digital printing, and regional production facilities to enhance market penetration and address evolving regulatory and sustainability requirements.

Market Insights

- The Australia Aerosol Cans Market was valued at USD 154.0 million in 2024 and is projected to reach USD 240.04 million by 2032, growing at a CAGR of 5.70%. The metal segment dominates the market with 67.3% share, while personal care leads applications with 58% share.

- Rising demand from personal care and home care products, coupled with increasing adoption of sustainable and recyclable packaging, is driving market growth. Urbanization and lifestyle changes are further boosting aerosol consumption across Australia.

- Key trends include the development of eco-friendly low-emission propellants, lightweight metal cans, and expansion into automotive and industrial applications, offering opportunities for innovation and market diversification.

- The market is highly competitive, with leading players such as Ardagh Metal Packaging, Ball Corporation, Crown Holdings, and Trivium Packaging focusing on sustainability, advanced manufacturing technologies, and strategic partnerships to strengthen market position.

- New South Wales holds 32% of the market, followed by Victoria at 26%, Queensland at 18%, Western Australia at 14%, South Australia at 7%, and Tasmania & Northern Territory together at 3%, reflecting regional consumption and industrial concentration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The metal segment dominates the Australia aerosol cans market, accounting for about 67.3% of the total share in 2024. Its leadership stems from superior durability, recyclability, and pressure resistance, making it ideal for personal care and household applications. Steel cans hold the largest share within this category due to cost efficiency and compliance with sustainability standards. Meanwhile, the others segment, which includes plastic and hybrid cans, represents nearly 32.7% of the market. Its growth is driven by lightweight designs, flexible shapes, and increasing demand for eco-friendly packaging in cosmetics and low-pressure products.

- For instance, DS Containers manufactures two-piece tin-free steel cans with polymer coatings that reduce carbon emissions by eliminating solvent linings and copper seams, improving sustainability by 10% compared to traditional designs

By Application

The personal care segment leads the market with around 58% share, driven by high consumption of deodorants, hair sprays, and dry shampoos among Australia’s urban population. The home care segment follows, holding nearly 20% share, supported by growing hygiene awareness and rising use of aerosol air fresheners and disinfectants. Other notable segments include automotive (8–12%), propelled by DIY maintenance trends; insecticide (5–10%), supported by vector control initiatives; and others (5–8%), which encompass industrial and medical sprays catering to specialized applications.

- For instance, Unilever introduced Schmidt’s natural aerosol deodorant line in Australia, featuring eco-friendly aluminum packaging to meet rising consumer demand for sustainable hygiene products.

Key Growth Drivers

Rising Demand from Personal Care and Home Care Sectors

The personal care and home care industries are driving steady growth in the Australia aerosol cans market. Rising consumption of deodorants, hair sprays, and household cleaners has boosted the need for convenient, hygienic, and easy-to-use packaging. Urbanization, growing grooming awareness, and lifestyle changes are reinforcing demand for aerosols across consumer categories. Innovation in product design and improved spray mechanisms further enhance user convenience, making aerosol cans a preferred choice among Australian consumers.

- For instance, in a packaging breakthrough, Alternative Packaging Solutions developed twistMist™, a reusable aerosol dispensing system capable of 10,000 spray cycles, reducing environmental impact by removing propellants and enabling full recyclability.

Shift Toward Sustainable and Recyclable Packaging

The market is witnessing a strong shift toward sustainable and recyclable aerosol packaging, influenced by Australia’s environmental regulations and consumer preferences. Metal aerosol cans, especially aluminum and steel, are increasingly favored for their infinite recyclability and lower carbon footprint. Manufacturers are investing in refillable packaging solutions and eco-friendly propellants to align with national recycling goals. This sustainability-driven approach strengthens brand reputation while supporting the transition toward a circular packaging economy.

- For instance, Ball Corporation introduced aluminum aerosol cans containing up to 50 percent recycled content and smelted with renewable hydroelectric energy, cutting carbon emissions by nearly half compared to standard cans.

Advancements in Manufacturing and Design Technologies

Continuous innovation in aerosol can manufacturing is enhancing efficiency, design, and performance. Lightweight alloys, improved valve systems, and digital printing technologies allow greater product differentiation and reduced material waste. Automation and robotics have streamlined production, ensuring precision and quality consistency. These advancements enable brands to meet evolving consumer expectations while maintaining cost efficiency. As a result, modernized manufacturing practices are contributing significantly to the market’s expansion across multiple end-use sectors.

Key Trends & Opportunities

Expansion of Eco-Friendly Aerosol Solutions

A growing trend in the Australian market is the development of eco-friendly aerosol formulations using low-emission propellants and biodegradable materials. Brands are prioritizing sustainable options such as water-based sprays and recyclable metal cans to reduce environmental impact. This trend aligns with government emission targets and offers companies opportunities to strengthen their green branding. Collaborations between packaging innovators and FMCG producers are driving the evolution of sustainable, high-performance aerosol solutions.

- For instance, Jamestrong, an Australian aluminium aerosol can producer, which has partnered with UNSW SMaRT Centre to integrate advanced recycling technology, enabling the manufacture of aerosol cans from recycled and mixed-material waste, thus cutting environmental impact.

Increasing Adoption in Automotive and Industrial Applications

The expanding automotive and industrial sectors are creating new opportunities for aerosol can adoption. Aerosol-based lubricants, coatings, and cleaners offer precision, portability, and reduced wastage, making them ideal for maintenance and repair operations. The rise in vehicle customization and industrial maintenance activities further supports this growth. Manufacturers are leveraging advanced spray technology to deliver controlled application performance, enabling broader use across technical and professional markets.

- For instance, Fuchs, a leading lubricant manufacturer, offers aerosol-based lubricants that provide targeted application for engine maintenance, door hinges, and brake systems, improving efficiency and reducing waste in automotive repair operations.

Key Challenges

Regulatory Pressure on Chemical Propellants

Stringent environmental regulations targeting volatile organic compounds (VOCs) and greenhouse emissions pose challenges for aerosol manufacturers. Companies are required to reformulate products using safer propellants, which increases production costs and lengthens development timelines. Adapting to these regulatory changes demands significant R&D investments, particularly for small and mid-sized producers. Although these efforts promote sustainability, they place financial and operational strain on manufacturers in the short term.

Fluctuating Raw Material Costs

Volatile prices of key raw materials, including aluminum, steel, and propellant gases, continue to challenge market profitability. Supply chain disruptions and energy cost fluctuations amplify production expenses, pressuring margins for aerosol can manufacturers. Companies are responding by exploring recycling-based sourcing, alternative materials, and long-term supplier contracts. Despite these efforts, ongoing raw material instability remains a major obstacle to maintaining price stability and predictable growth in the Australian aerosol cans market.

Regional Analysis

New South Wales

New South Wales holds the largest share of the Australia aerosol cans market, accounting for 32% of total demand in 2024. The region benefits from a strong manufacturing base, high population density, and robust demand for personal care and household products. Sydney serves as a central hub for FMCG production and packaging innovation, attracting major industry players. The growing preference for recyclable aluminum cans and eco-friendly formulations supports continued growth. Rising consumer spending and expanding retail networks further reinforce New South Wales’ dominant position in the national market.

Victoria

Victoria captures 26% of the Australia aerosol cans market, driven by its well-established industrial infrastructure and significant cosmetics and automotive manufacturing sectors. Melbourne’s strong consumer base and advanced logistics network enhance distribution efficiency for aerosol products. The region is also witnessing rising adoption of sustainable metal packaging, supported by local recycling initiatives and government environmental programs. Growing investment in advanced aerosol filling facilities and increased exports of personal care items continue to strengthen Victoria’s role as a key contributor to Australia’s overall aerosol packaging demand.

Queensland

Queensland accounts for 18% of the aerosol cans market, supported by rising demand across the home care, insecticide, and automotive maintenance categories. The state’s humid climate and seasonal pest issues drive strong insecticide aerosol consumption, while urban expansion fuels demand for personal and household products. Brisbane’s expanding industrial zones and logistics connectivity enable efficient distribution across eastern Australia. Government initiatives promoting recycling and eco-friendly packaging practices are also boosting adoption of metal aerosols. The region’s steady population growth and lifestyle shifts contribute to sustained market expansion.

Western Australia

Western Australia represents 14% of the Australia aerosol cans market, with growth largely fueled by industrial and automotive applications. Perth serves as a key distribution hub for aerosol-based lubricants, coatings, and maintenance sprays used in the state’s mining and resource sectors. Consumer demand for personal care aerosols is also increasing as urban centers expand. However, the region’s vast geography and limited manufacturing concentration pose logistical challenges. Ongoing infrastructure development and investment in localized packaging facilities are helping manufacturers improve supply efficiency and capture greater market share.

South Australia

South Australia holds a 7% share of the national aerosol cans market, supported by a growing focus on sustainable packaging and niche product development. Adelaide’s manufacturing clusters contribute to the supply of metal aerosol containers for domestic and export markets. The state’s increasing participation in recycling programs and local innovation in eco-friendly propellants support gradual market expansion. Demand growth is steady across home care and personal grooming products, reflecting rising household income and consumer awareness. Collaborative projects between packaging firms and consumer goods manufacturers further enhance regional competitiveness.

Tasmania and Northern Territory

Tasmania and the Northern Territory together contribute 3% of the Australia aerosol cans market. Though smaller in scale, these regions are witnessing gradual growth fueled by increasing retail penetration and expanding urban populations. Tasmania’s focus on sustainable consumer goods aligns with the national trend toward eco-friendly aerosol packaging. Meanwhile, the Northern Territory’s tourism and hospitality sectors are driving demand for hygiene and insect control products. Limited local manufacturing remains a constraint; however, improved logistics connectivity and regional distribution networks are expected to enhance accessibility and market presence over time.

Market Segmentations:

By Product

By Application

- Personal Care

- Home Care

- Insecticide

- Automotive

- Others

By Region

- New South wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania and Northern Territor

Competitive Landscape

The competitive landscape of the Australia aerosol cans market features key players such as Ardagh Metal Packaging, Ball Corporation, Crown Holdings Inc., Nampak Ltd., Colep Packaging, and Trivium Packaging. These companies dominate the market through extensive product portfolios, advanced manufacturing technologies, and strong distribution networks. Competition primarily revolves around sustainability, material innovation, and cost efficiency. Leading manufacturers are focusing on lightweight aluminum cans, recyclable materials, and eco-friendly propellants to align with national sustainability goals. Strategic partnerships with FMCG and personal care brands are common, aimed at enhancing customization and design flexibility. Local players are increasingly adopting automation and digital printing technologies to strengthen competitiveness against global entrants. The market also reflects growing investment in regional production facilities, which reduces import dependence and improves supply chain resilience. Continuous innovation and alignment with environmental regulations remain the primary strategies shaping Australia’s aerosol cans market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ardagh Metal Packaging

- Ball Corporation

- Crown Holdings, Inc.

- Trivium Packaging

- Nampak Ltd.

- APL Aerosols Pty Ltd.

- Pacific Packaging (Aust) Pty Ltd.

- Alucon Public Company Limited

- Coster Group

- Shanghai Sunhome Industrial Co., Ltd.

Recent Developments

- In July 2025, Rexona (Unilever) introduced its Whole Body Deodorant aerosol in Australia through a collaboration with Martha Stewart, marking a major expansion of its personal care range.

- In April 2025, Amcor completed its acquisition of Berry Global through an all-stock transaction, creating one of the largest global packaging entities. The merger significantly strengthens Amcor’s position in the aerosol and dispensing packaging segment across the Australian and Asia-Pacific markets.

- In July 2023, Jamestrong entered into a partnership with the UNSW SMaRT Centre under Australia’s TRaCE (Trailblazer for Recycling and Clean Energy) program to launch the Green Aluminium MICROfactorie™ project.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia aerosol cans market is expected to witness steady growth driven by rising demand from personal care and home care sectors.

- Sustainability initiatives will continue to shape product development, emphasizing recyclable and eco-friendly aerosol packaging.

- Metal aerosol cans, particularly aluminum, will maintain dominance due to their durability and recyclability benefits.

- Increasing adoption of low-emission propellants will support the market’s shift toward environmentally compliant solutions.

- Technological advancements in manufacturing and valve design will enhance precision, efficiency, and aesthetic appeal.

- The automotive and industrial segments will experience gradual growth, driven by maintenance and spray coating applications.

- E-commerce expansion will boost retail sales of aerosol-based consumer products across urban and regional markets.

- Strategic collaborations between packaging firms and FMCG brands will accelerate innovation in product formats.

- Government recycling programs and public awareness campaigns will strengthen circular economy practices in packaging.

- Local manufacturing investments will enhance supply chain resilience and reduce dependence on imported aerosol cans.