Market Overview

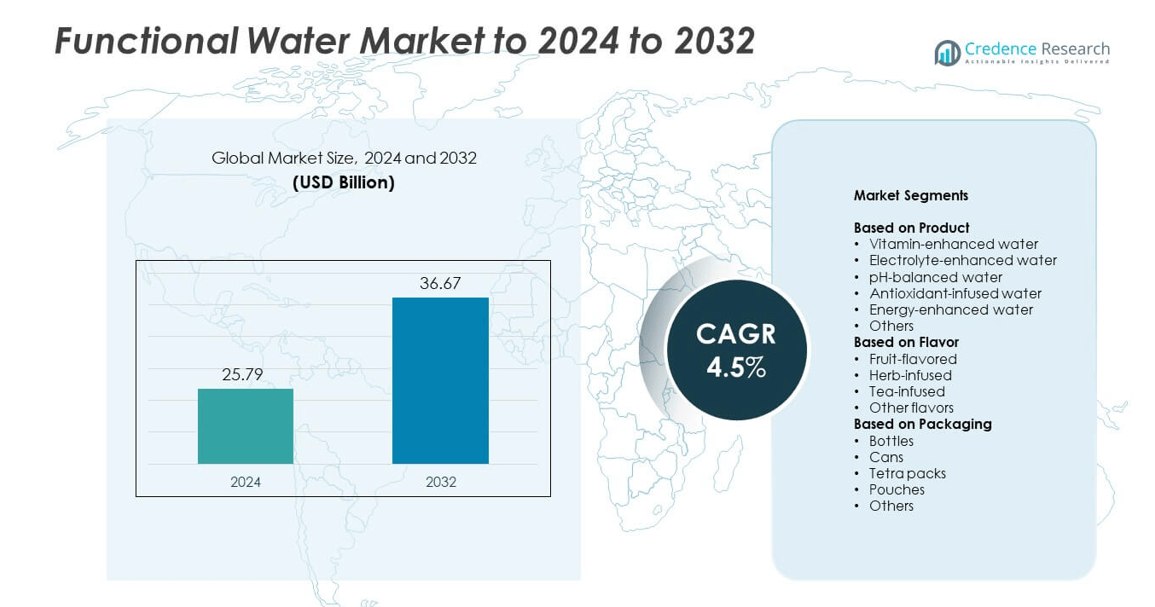

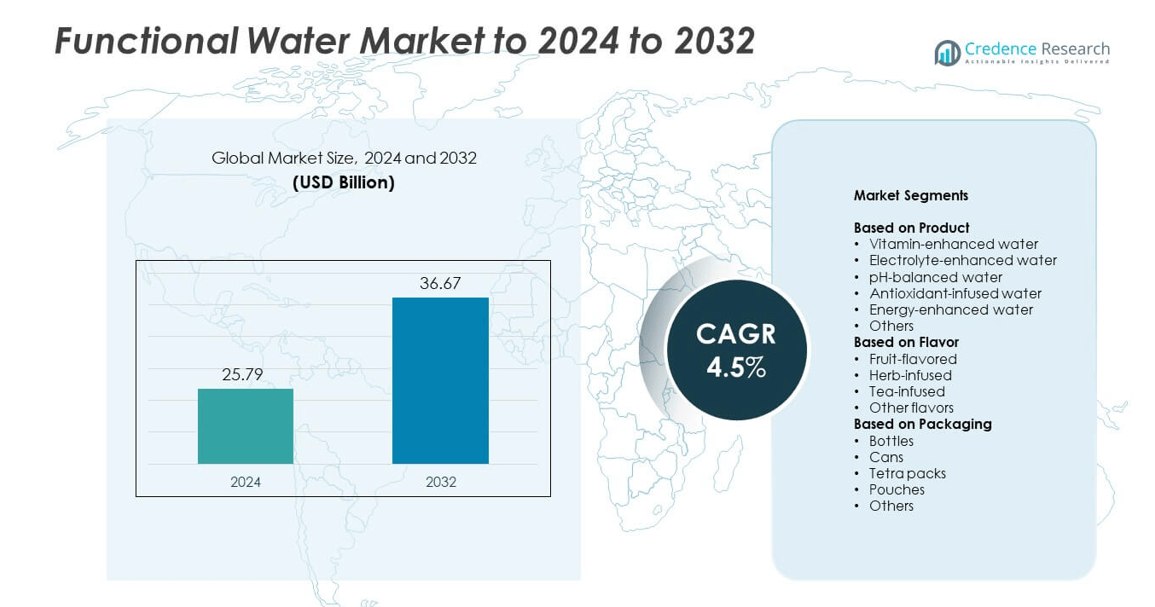

The Functional Water Market size was valued at USD 25.79 billion in 2024 and is anticipated to reach USD 36.67 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Water Market Size 2024 |

USD 25.79 billion |

| Functional Water Market, CAGR |

4.5% |

| Functional Water Market Size 2032 |

USD 36.67 billion |

The functional water market is shaped by leading players such as PepsiCo Inc, Nestlé Water, The Coca-Cola Company, Danone S.A, and Essentia Water LLC. These companies focus on expanding portfolios through vitamin-infused, electrolyte-balanced, and low-calorie products catering to wellness-driven consumers. Strategic investments in sustainable packaging, marketing partnerships, and retail distribution strengthen their global reach. North America emerged as the dominant region in 2024, accounting for 37% of the total market share, supported by high health awareness and strong product availability. Continuous innovation and regional expansion efforts position these players for sustained growth through 2032.

Market Insights

- The Functional Water Market was valued at USD 25.79 billion in 2024 and is expected to reach USD 36.67 billion by 2032, growing at a CAGR of 4.5%.

- Rising health consciousness and demand for nutrient-enriched beverages are driving growth, supported by innovations in clean-label and natural ingredient formulations.

- Emerging trends include the adoption of eco-friendly packaging, product diversification with botanical and probiotic infusions, and expanding e-commerce sales channels.

- The market remains moderately consolidated, with global brands focusing on innovation, sustainability, and strategic partnerships to enhance competitiveness.

- North America led with a 37% share, followed by Europe at 29% and Asia Pacific at 24%, while the vitamin-enhanced water segment dominated overall with a 41% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The vitamin-enhanced water segment dominated the functional water market in 2024 with a 41% share. This segment leads due to rising consumer preference for convenient, nutrient-rich hydration options that support immunity and metabolism. The inclusion of vitamins B, C, and D has increased its popularity among fitness and health-conscious consumers. Leading brands are expanding product lines with natural ingredients and low-calorie formulations to meet clean-label demands. The strong appeal among millennials and athletes continues to strengthen the segment’s market dominance across developed and emerging economies.

- For instance, a single 20 fl oz bottle of Coca-Cola’s Glacéau Vitaminwater Essential Orange provides 100 calories and contains 27 grams of added sugars.

By Flavor

Fruit-flavored functional water held the largest market share of 46% in 2024. The dominance is driven by high consumer acceptance of natural fruit-based tastes such as lemon, berry, and orange. These variants offer refreshing flavors while delivering added nutrients, aligning with the shift toward sugar-free, low-calorie beverages. Manufacturers are launching innovative combinations and seasonal variants to attract wider audiences. The popularity of fruit-flavored drinks in retail and fitness centers supports steady sales across major markets including North America and Europe.

- For instance, Bai Kula Watermelon shows 10 calories and 1 g sugar per bottle, aligning with low-sugar fruit flavors.

By Packaging

The bottles segment accounted for a 55% share of the functional water market in 2024. Bottles remain the preferred packaging format due to their convenience, portability, and compatibility with mass distribution channels. PET and recycled plastic bottles are widely used for their cost efficiency and durability. Leading companies are adopting lightweight and eco-friendly bottle designs to reduce carbon footprints. Increasing availability in retail stores, gyms, and vending machines continues to make bottles the dominant packaging choice for functional water globally.

Key Growth Drivers

Rising Health and Wellness Awareness

Growing consumer focus on health and wellness is a major growth driver for the functional water market. Consumers are shifting away from sugary carbonated drinks toward healthier hydration alternatives with added vitamins, minerals, and electrolytes. Increasing awareness of preventive healthcare and active lifestyles has boosted demand for nutrient-infused beverages. Functional water fits well within the trend of clean-label, low-calorie, and natural products, making it a preferred choice among fitness enthusiasts and urban consumers seeking convenient health benefits through everyday hydration.

- For instance, Karma Probiotic Water delivers 2 billion CFU, 100% of six vitamins, and 20 calories per bottle.

Expansion of Fitness and Sports Nutrition Sector

The rapid expansion of gyms, fitness clubs, and sporting events worldwide is fueling higher consumption of functional water. Athletes and fitness-conscious individuals prefer hydration products that help maintain energy balance and electrolyte levels. The segment benefits from partnerships between beverage brands and sports organizations, promoting product visibility. Enhanced formulations offering endurance and recovery support have further increased adoption rates. The rising culture of active living across both developed and emerging markets continues to drive steady functional water sales.

- For instance, Nestlé Pure Life launched a 700 ml bottle made with 100% recycled PET in North America.

Innovation in Product Formulation and Packaging

Ongoing innovation in flavor development, bioactive ingredients, and sustainable packaging is a crucial growth driver. Companies are introducing formulations infused with antioxidants, probiotics, and adaptogens to target specific health needs. Advances in biodegradable and recyclable packaging materials also appeal to eco-conscious consumers. Digital marketing campaigns emphasizing product transparency and clean nutrition further strengthen brand engagement. Such innovations enable differentiation in a competitive beverage landscape and attract a broader consumer base seeking functional benefits beyond hydration.

Key Trends and Opportunities

Shift Toward Natural and Clean-Label Ingredients

Consumers increasingly prefer functional waters made from natural extracts and plant-based additives over synthetic compounds. This shift presents an opportunity for manufacturers to leverage organic certifications and transparent labeling. Brands incorporating natural antioxidants, fruit essences, and botanical infusions are experiencing stronger brand loyalty. Clean-label positioning, combined with minimal sugar and preservative-free claims, supports premiumization. This trend also aligns with broader global movements toward sustainable and health-focused consumer choices, offering significant market expansion potential.

- For instance, Hint Water lists zero sugar, zero calories, and zero diet sweeteners per 16 fl oz bottle on its product pages.

Growth of E-commerce and Direct-to-Consumer Sales

Rising digitalization is opening new growth opportunities for functional water brands. E-commerce and direct-to-consumer (D2C) platforms allow brands to engage with customers directly and promote product customization. Subscription-based models and online wellness campaigns enhance repeat purchases. Social media marketing plays a key role in educating consumers about product benefits and functional ingredients. With digital convenience and targeted advertising, online channels are becoming a dominant sales driver, particularly among tech-savvy and younger demographics seeking innovative hydration options.

- For instance, Waterdrop reports 40+ stores and ~40% average year-over-year growth, reflecting strong digital and retail expansion.

Key Challenges

High Production and Distribution Costs

The functional water market faces challenges from high costs associated with ingredient fortification, quality testing, and premium packaging. Maintaining the stability of vitamins and minerals during processing increases manufacturing complexity. Additionally, cold-chain logistics and advanced packaging requirements raise transportation and storage expenses. These factors limit competitive pricing against regular bottled water. Smaller manufacturers face profitability constraints, especially in emerging markets where price sensitivity remains high, restricting wider adoption and scalability across diverse retail channels.

Regulatory and Labeling Compliance Issues

Compliance with regional food safety and labeling regulations poses significant challenges for functional water producers. Authorities closely monitor claims related to nutritional benefits, leading to frequent formulation revisions and certification costs. Mislabeling or exaggerated health claims can attract legal scrutiny, damaging brand credibility. Variations in standards across countries complicate product launches in international markets. To overcome this, manufacturers must invest in regulatory expertise and transparent communication to maintain consumer trust and ensure long-term market sustainability.

Regional Analysis

North America

North America held a 37% share of the functional water market in 2024, driven by strong consumer awareness of fitness and hydration benefits. The United States dominates due to rising demand for nutrient-rich and low-calorie beverages among health-conscious populations. Major brands focus on vitamin-enhanced and electrolyte-infused products supported by widespread retail availability. The region’s developed infrastructure and strong marketing by beverage giants such as PepsiCo and Nestlé support continued growth. Increasing interest in clean-label and organic formulations further boosts premium product adoption across the United States and Canada.

Europe

Europe accounted for a 29% share of the global functional water market in 2024, supported by the rising popularity of natural and fortified beverages. Demand is growing across Germany, the United Kingdom, and France as consumers prioritize healthier hydration choices over soft drinks. Stringent regulations on sugar content and synthetic additives are encouraging innovation in natural formulations. Companies are introducing plant-based and pH-balanced options to meet wellness trends. Expanding distribution through supermarkets and fitness centers continues to drive consistent growth in the region’s premium hydration category.

Asia Pacific

Asia Pacific captured a 24% share of the functional water market in 2024, fueled by rising disposable incomes and rapid urbanization. Consumers in China, Japan, and India are increasingly adopting functional beverages for hydration and wellness. Growing gym memberships and awareness of active lifestyles are accelerating product penetration. Regional players and global brands are expanding through convenience stores and online platforms. Innovation in local flavors such as green tea and tropical fruits enhances appeal. Government initiatives promoting health and nutrition further support steady market expansion across the region.

Latin America

Latin America held a 6% share of the global functional water market in 2024, driven by increasing urban health awareness and demand for convenient wellness beverages. Brazil and Mexico lead consumption due to growing fitness participation and changing dietary habits. Local producers are introducing affordable fortified water options to capture middle-income consumers. Rising retail investments and promotional campaigns by multinational brands strengthen market visibility. The region’s young population and growing inclination toward sugar-free drinks are expected to sustain gradual market growth over the forecast period.

Middle East and Africa

The Middle East and Africa accounted for a 4% share of the functional water market in 2024, supported by expanding retail networks and rising interest in hydration products. Increasing health awareness in Gulf countries like the UAE and Saudi Arabia is driving adoption of premium bottled and electrolyte-enhanced water. Hot climatic conditions also contribute to higher per capita water consumption. Global beverage companies are investing in local production facilities to reduce import dependency. Marketing emphasizing fitness and wellness benefits continues to create new growth opportunities across urban centers.

Market Segmentations:

By Product

- Vitamin-enhanced water

- Electrolyte-enhanced water

- pH-balanced water

- Antioxidant-infused water

- Energy-enhanced water

- Others

By Flavor

- Fruit-flavored

- Herb-infused

- Tea-infused

- Other flavors

By Packaging

- Bottles

- Cans

- Tetra packs

- Pouches

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major players such as PepsiCo Inc, Nestlé Water, The Coca-Cola Company, Danone S.A, Essentia Water LLC, Bodyarmor, Bai Brands LLC, Neuro Brands LLC, Kyowa Hakko USA, Karma Culture LLC, and Waterdrop Inc collectively define the competitive landscape of the functional water market. The market remains moderately consolidated, with global brands focusing on innovation, ingredient enhancement, and sustainable packaging to strengthen their portfolios. Companies are investing in vitamin-enriched and electrolyte-balanced formulations to meet growing consumer demand for health-oriented hydration. Expanding digital marketing strategies, fitness partnerships, and retail distribution networks support brand visibility. Continuous R&D efforts target the development of clean-label, low-calorie, and plant-based options. Sustainability and recyclable materials have become key differentiators, while mergers and acquisitions help leading firms expand into emerging markets. Strategic product diversification, backed by strong promotional campaigns, enables these players to maintain leadership positions and attract a broad health-conscious customer base globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PepsiCo Inc

- Nestlé Water

- The Coca-Cola Company

- Danone S.A

- Essentia Water LLC

- Bodyarmor (The Coca-Cola Company)

- Bai Brands LLC

- Neuro Brands LLC

- Kyowa Hakko USA

- Karma Culture LLC

- Waterdrop Inc.

Recent Developments

- In 2024, Essentia launched its new flavored functional water line, Essentia Hydroboost.

- In 2024, Waterdrop Inc. Launched its groundbreaking X Series Reverse Osmosis system. This product features biodegradable packaging and innovative technology that simulates natural mineral water formation.

- In 2023, Kyowa Hakko USA and sparkling beverage company Centr debuted Centr Enhanced, a sparkling water that features a blend of nootropic and adaptogenic ingredients.

- In 2023, Bodyarmor (The Coca-Cola Company) launched BODYARMOR FLASH I.V., a rapid rehydration drink formulated with an optimal carb-to-electrolyte ratio

Report Coverage

The research report offers an in-depth analysis based on Product, Flavor, Packaging and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing consumer focus on preventive health will continue to boost functional water adoption.

- Innovation in nutrient blends and natural ingredients will enhance product differentiation.

- Expansion of fitness and sports nutrition markets will drive consistent consumption growth.

- Increasing preference for clean-label and low-calorie beverages will shape future product portfolios.

- Technological advancements in sustainable packaging will improve environmental performance.

- Rising e-commerce penetration will strengthen direct-to-consumer sales channels.

- Strategic partnerships between beverage brands and wellness companies will expand market reach.

- Emerging economies in Asia and Latin America will offer new growth opportunities.

- Product diversification with botanical and probiotic infusions will attract niche consumers.

- Ongoing regulatory alignment and labeling transparency will build stronger consumer trust globally.