Market overview

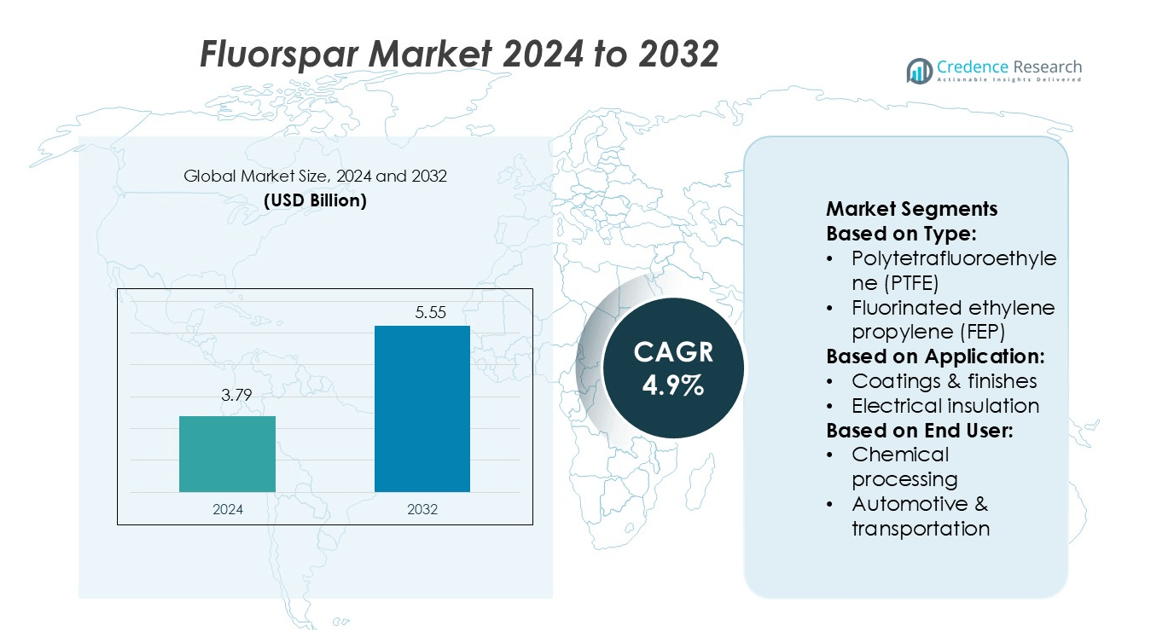

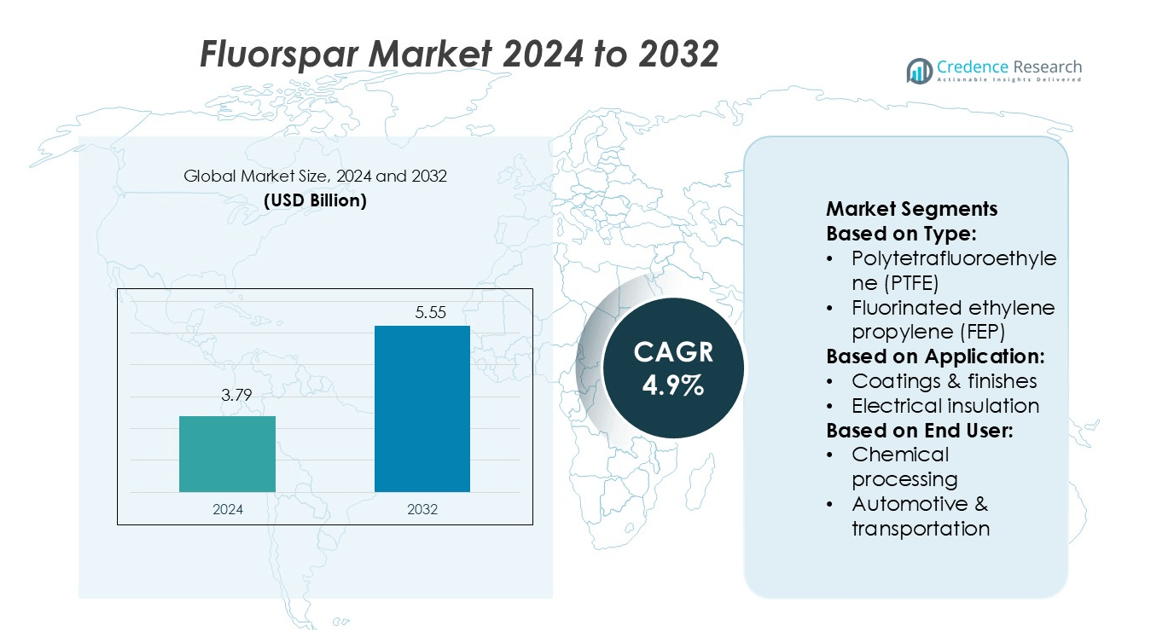

Fluorspar Market size was valued USD 3.79 billion in 2024 and is anticipated to reach USD 5.55 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorspar Market Size 2024 |

USD 3.79 billion |

| Fluorspar Market, CAGR |

4.9% |

| Fluorspar Market Size 2032 |

USD 5.55 billion |

The Fluorspar Market is dominated by major players such as Seaforth Mineral & Ore Co, British Fluorspar Ltd, Steyuan Mineral Resources Group Ltd, Mexichem, RUSAL, Minersa Group, Kenya Fluorspar Company Ltd, Zhejiang Wuyi Shenglong Flotation Co., Ltd, Centralfluor Industries Group, Inc, and China Kings Resources Group Co., Ltd. These companies focus on expanding production capacity, securing long-term supply contracts, and investing in high-purity processing technologies. Strategic partnerships with downstream industries in fluorochemicals, aluminum, and steel support their strong market positions. Asia Pacific leads the market with a 41.6% share, driven by extensive mining capacity, strong industrial demand, and growing exports. Continuous investment in refining technologies, sustainable mining practices, and diversified sourcing strategies is expected to further strengthen the region’s dominance and enhance the global competitiveness of top producers.

Market Insights

- The Fluorspar Market was valued at USD 3.79 billion in 2024 and is projected to reach USD 5.55 billion by 2032, growing at a CAGR of 4.9%.

- Market growth is driven by rising demand from fluorochemical, aluminum, and steel industries, supported by increasing industrialization and clean energy adoption.

- Leading players are expanding capacity, investing in refining technologies, and forming strategic partnerships to strengthen global supply chains.

- Regulatory constraints and supply chain volatility remain key challenges, pushing companies to focus on sustainable sourcing and diversified supply strategies.

- Asia Pacific leads the market with a 41.6% share, followed by Europe with 24.7% and North America with 21.3%, while the coatings and finishes segment dominates by application, supported by rising industrial use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Polytetrafluoroethylene (PTFE) holds the largest share in the Fluorspar Market, accounting for a significant portion of demand. PTFE’s high chemical resistance, non-reactive nature, and low friction properties make it ideal for industrial sealing, coatings, and gaskets. Its wide use in automotive, electronics, and chemical industries supports consistent market growth. Increasing investments in advanced manufacturing and demand for lightweight, durable components further boost PTFE adoption. Other types such as FEP, PFA, PVDF, and ETFE are also gaining traction due to their superior temperature and weather resistance in specialized applications.

- For instance, British Fluorspar, operating at Milldam, reported a permitted run-of-mine ore production ceiling of 150,000 t per annum due to planning constraints. Separately, increasing investments in advanced manufacturing and a growing demand for lightweight, durable components contribute to the broader adoption of PTFE.

By Application

Coatings & finishes dominate the Fluorspar Market by application segment, capturing the highest market share. PTFE-based coatings provide low surface energy, chemical resistance, and non-stick properties, making them critical in industrial machinery, consumer products, and protective layers. Demand from sectors like automotive, aerospace, and electronics is rising as manufacturers focus on enhanced durability and performance. Electrical insulation and additives are also expanding due to their growing use in high-voltage applications and corrosion-resistant materials.

- For instance, Steyuan has a lump fluorspar product production capacity of 300 tons per day of 10–70 mm sizing. Separately, the markets for electrical insulation and additives are expanding due to their growing use in high-voltage applications and corrosion-resistant materials.

By End User

Chemical processing represents the largest end-user segment in the Fluorspar Market, holding a major market share. Fluoropolymers derived from fluorspar are key raw materials in producing high-performance chemicals and compounds. The segment benefits from rising demand for corrosion-resistant equipment, specialty coatings, and heat-tolerant components in industrial processes. Automotive & transportation and electronics are also emerging as strong end-user industries due to the growing use of fluoropolymer-based insulation, seals, and lightweight components in EVs and high-performance electronics.

Key Growth Drivers

Rising Demand from Fluorochemical Production

The Fluorspar Market is driven by its critical role in producing hydrofluoric acid and fluorochemicals. These compounds are essential for manufacturing refrigerants, aluminum fluoride, lithium batteries, and specialty coatings. Expanding production of fluoropolymers such as PTFE and PVDF strengthens demand from automotive, electronics, and construction industries. Growing HVAC system installations and advanced battery production further support this trend. Industrialization and rapid urban growth in Asia Pacific and North America amplify consumption, creating stable revenue streams for suppliers and manufacturers.

- For instance, Orbia’s fluorinated solutions business (under the trade name Koura) was awarded a U.S. Department of Energy grant of US $100 million to build the first U.S. manufacturing facility for lithium-hexafluorophosphate (LiPF₆) with a design capacity of 10,000 metric tons per year, to support battery-grade electrolyte production.

Expanding Applications in Clean Energy Technologies

Fluorspar plays a key role in clean energy applications such as solar panels, fuel cells, and lithium-ion batteries. Its use in producing high-performance materials like fluoropolymers improves efficiency and durability in renewable energy systems. Government initiatives promoting electric vehicles and solar infrastructure accelerate market growth. Increasing investments in battery storage and hydrogen production also boost demand for fluorspar-based materials. This expanding energy transition creates strong long-term opportunities for producers focused on supplying high-purity fluorspar grades.

- For instance, Minersa has a planned expansion programme that could increase its acid-grade fluorspar capacity to “up to 440,000 metric tons per year,” depending on market demand.

Strong Demand from Aluminum and Steel Industries

Fluorspar is widely used as a flux agent in steelmaking and aluminum smelting to lower melting points and remove impurities. Rapid infrastructure projects and automotive manufacturing growth increase steel consumption, directly driving fluorspar demand. Lightweight aluminum components in electric vehicles also contribute to rising usage. Major producers are expanding supply capacity to meet these industrial requirements. Global emphasis on energy-efficient smelting processes enhances the importance of fluorspar in metal processing applications.

Key Trends & Opportunities

Shift Toward High-Purity Fluorspar Grades

Industries increasingly prefer acid-grade fluorspar for advanced applications in chemicals, polymers, and clean energy. High-purity grades enable better process efficiency and lower emissions in chemical production. Manufacturers are investing in refining technologies and advanced beneficiation methods to achieve improved quality levels. Demand from electronics and fluorochemical sectors reinforces this trend, supporting premium pricing and value-added market opportunities.

- For instance, China Kings Resources states that it has developed a proprietary technology to produce hydrofluoric acid from low-grade fluorite fine powder, with a designed annual output of 300,000 tons of hydrofluoric acid.

Expansion of Green Mining Practices

Producers are adopting sustainable mining technologies to reduce emissions, waste, and energy use in fluorspar extraction. Governments are tightening regulations on mineral sourcing, pushing companies toward environmentally responsible operations. Digital monitoring, energy-efficient beneficiation, and water recycling systems are improving operational efficiency. These practices not only meet compliance standards but also enhance brand reputation, creating new opportunities in global supply chains focused on sustainable sourcing.

- For instance, the technical data-sheet for Dyneon PTFE Compound TF 3236 lists a bulk density of 440 g/l, tensile strength of 15.5 MPa, and elongation at break of 70%.

Rising Strategic Partnerships and Capacity Expansions

Global companies are forming strategic partnerships to secure long-term fluorspar supply. Investments in new mining sites and processing facilities are rising, especially in China, Mexico, and Africa. Downstream manufacturers in chemicals and EV industries are signing agreements with suppliers to stabilize pricing and secure raw material flow. This consolidation strengthens the value chain and ensures market stability.

Key Challenges

Environmental and Regulatory Constraints

Fluorspar mining and processing face strict environmental regulations due to concerns over water pollution, habitat loss, and emissions. Compliance with these standards raises operational costs for producers. Delays in obtaining permits also slow expansion projects. These regulatory pressures require continuous investment in cleaner technologies and monitoring systems. Companies failing to adapt face reduced competitiveness and limited export opportunities.

Supply Chain Volatility and Pricing Pressure

The fluorspar market experiences fluctuations in raw material prices due to geopolitical risks, trade restrictions, and uneven global supply. Concentration of reserves in a few countries makes the supply chain vulnerable to disruptions. Transportation bottlenecks and currency fluctuations further increase costs. These factors create pricing instability, impacting profit margins for both producers and end users. Developing diversified sourcing strategies is essential to manage these risks effectively.

Regional Analysis

North America

North America holds a 21.3% share of the Fluorspar Market, driven by strong demand from chemical and metallurgical industries. The U.S. leads the region with large consumption in aluminum smelting, fluorochemical production, and steel manufacturing. Expanding EV infrastructure and rising adoption of energy-efficient refrigerants further support growth. Key players are focusing on securing domestic supply chains to reduce import dependence. Government support for critical mineral development also strengthens market stability. Continuous investments in mining modernization and high-purity processing enhance the region’s competitive advantage in meeting advanced industrial requirements.

Europe

Europe accounts for 24.7% of the global market, supported by strong demand from construction, automotive, and chemical sectors. Germany, the U.K., and France lead in fluoropolymer applications, including coatings, refrigerants, and advanced materials. Strict environmental regulations are driving investments in sustainable mining and low-emission processing technologies. The region benefits from established aluminum and steel industries, boosting fluorspar use as a fluxing agent. Growing demand for clean energy solutions and stricter refrigerant regulations are also pushing producers toward higher-value acid-grade fluorspar. Strategic import partnerships secure stable raw material supply across the EU.

Asia Pacific

Asia Pacific dominates the Fluorspar Market with a 41.6% share, led by China, India, and Japan. Strong industrial manufacturing, rapid urbanization, and major aluminum production facilities drive high fluorspar demand. China remains the largest producer and consumer, supported by extensive mining capacity and fluorochemical industries. Expanding renewable energy and EV adoption also strengthen market prospects. Local suppliers are investing in refining technologies to produce high-purity grades. Regional governments promote domestic resource development to meet growing industrial demand, making Asia Pacific the central hub for global fluorspar production and exports.

Latin America

Latin America holds a 6.8% market share, with Mexico leading as a major fluorspar exporter. The region benefits from abundant mineral reserves, lower production costs, and increasing foreign investments in mining infrastructure. Demand is primarily driven by chemical, construction, and metallurgy industries. Mexico’s strategic role in supplying fluorspar to North American and European markets ensures strong trade flows. Governments are also encouraging sustainable extraction practices to align with global environmental standards. Expanding downstream processing capabilities offers new opportunities for value-added exports and regional economic growth.

Middle East & Africa

The Middle East & Africa region represents 5.6% of the global Fluorspar Market, supported by emerging mining activities and growing industrial demand. South Africa and Kenya are key producers, supplying both metallurgical and acid-grade fluorspar to global markets. The region’s strategic location near major trade routes supports export growth. Industrialization, particularly in construction and manufacturing, is gradually increasing domestic demand. Ongoing investments in mining modernization, infrastructure development, and partnerships with global firms enhance the region’s production capacity. MEA’s role as an emerging supply hub is expected to strengthen further in the coming years.

Market Segmentations:

By Type:

- Polytetrafluoroethylene (PTFE)

- Fluorinated ethylene propylene (FEP)

By Application:

- Coatings & finishes

- Electrical insulation

By End User:

- Chemical processing

- Automotive & transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fluorspar Market is shaped by key players such as Seaforth Mineral & Ore Co, British Fluorspar Ltd, Steyuan Mineral Resources Group Ltd, Mexichem, RUSAL, Minersa Group, Kenya Fluorspar Company Ltd, Zhejiang Wuyi Shenglong Flotation Co., Ltd, Centralfluor Industries Group, Inc, and China Kings Resources Group Co., Ltd. The Fluorspar Market is defined by rising investments in mining, refining, and value-added processing. Companies are expanding their production capacity to meet the growing demand from fluorochemical, steel, and aluminum industries. Advanced beneficiation technologies and sustainable extraction practices are becoming central strategies to enhance quality and reduce environmental impact. Many producers are also focusing on geographic diversification to secure raw material supply and reduce dependency on a single region. Long-term supply agreements with downstream industries in refrigerants, fluoropolymers, and clean energy applications are strengthening market positioning and ensuring stable revenue streams.

Key Player Analysis

Recent Developments

- In December 2024, Masan High-Tech Materials signed an MoU with Fluorine Korea to supply up to 70,000 tons of acid-grade fluorspar annually for a South Korean AHF plant slated for 2026 start-up.

- In August 2024, AGC, a manufacturer of glass, chemicals, and advanced materials, introduced a groundbreaking method for producing fluoropolymers without relying on surfactants. With this new technology, AGC intends to ensure a consistent and reliable supply of fluoropolymers, which are essential for the development of a carbon-neutral and digital society.

- In July 2024, GMM Pfaudler JDS celebrated the grand re-opening of its Americus, GA facility, marking a milestone in its growth and innovation. The newly equipped facility showcases enhanced capabilities and a customer-centric approach.

- In August 2023, Kureha Group announced plans to increase its production capacity for polyvinylidene fluoride (PVDF) at its Iwaki Plant in Fukushima, Japan. The expansion has been planned to align with the growing demand for PVDF, used as an adhesive material for lithium-ion batteries (LiB) and as an engineering plastic for various industrial applications

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth from increasing fluorochemical production.

- Clean energy technologies will boost demand for high-purity fluorspar.

- Expansion in aluminum and steel industries will sustain steady consumption levels.

- Asia Pacific will remain the leading hub for production and exports.

- Advanced refining methods will enhance product quality and efficiency.

- Sustainable mining practices will become more important to meet regulations.

- Strategic partnerships will strengthen global supply chains.

- Rising EV adoption will increase the use of fluoropolymers and refrigerants.

- Investment in downstream processing will create new value opportunities.

- Supply diversification will help reduce market volatility and pricing risks.