Market Overview:

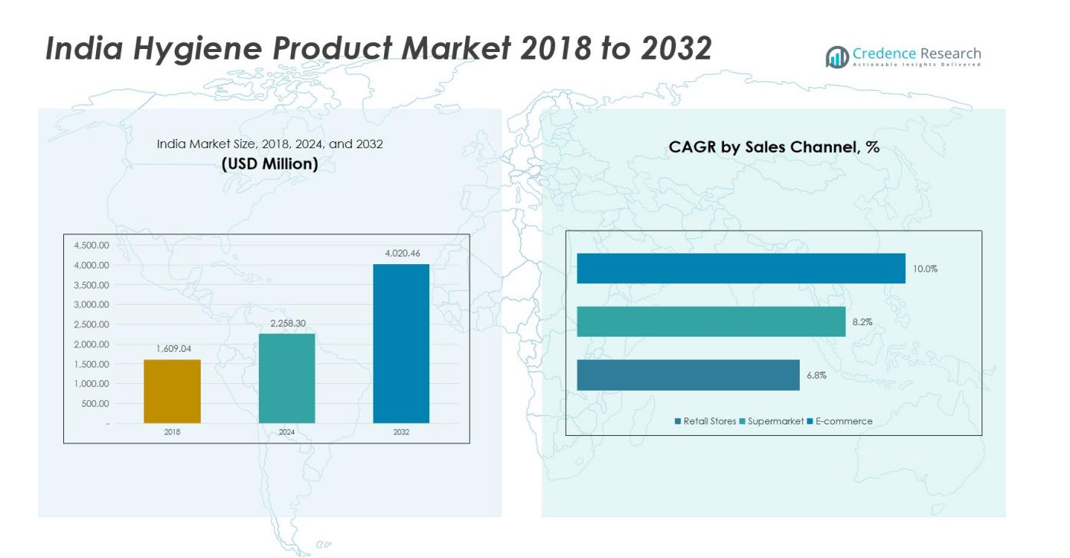

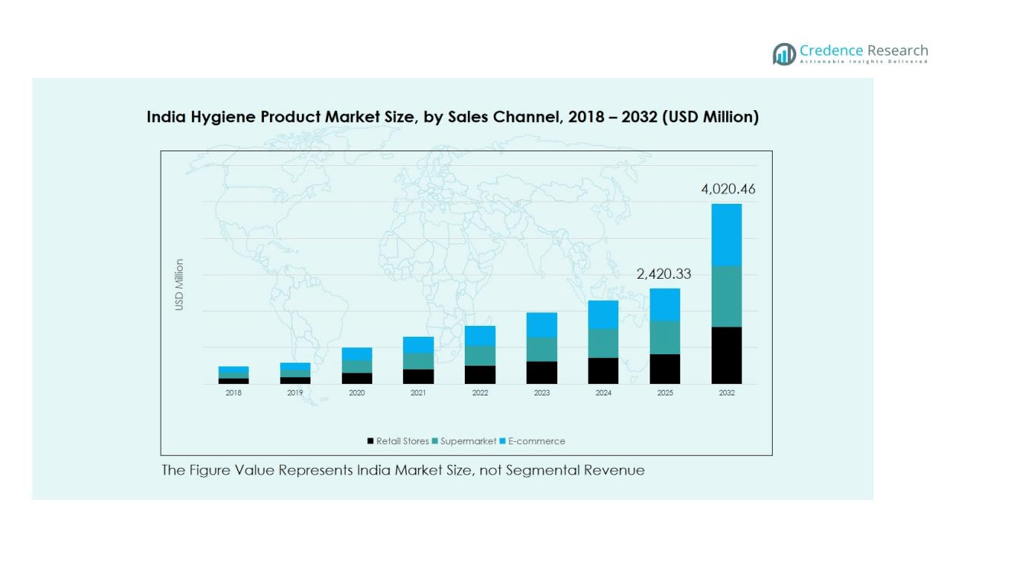

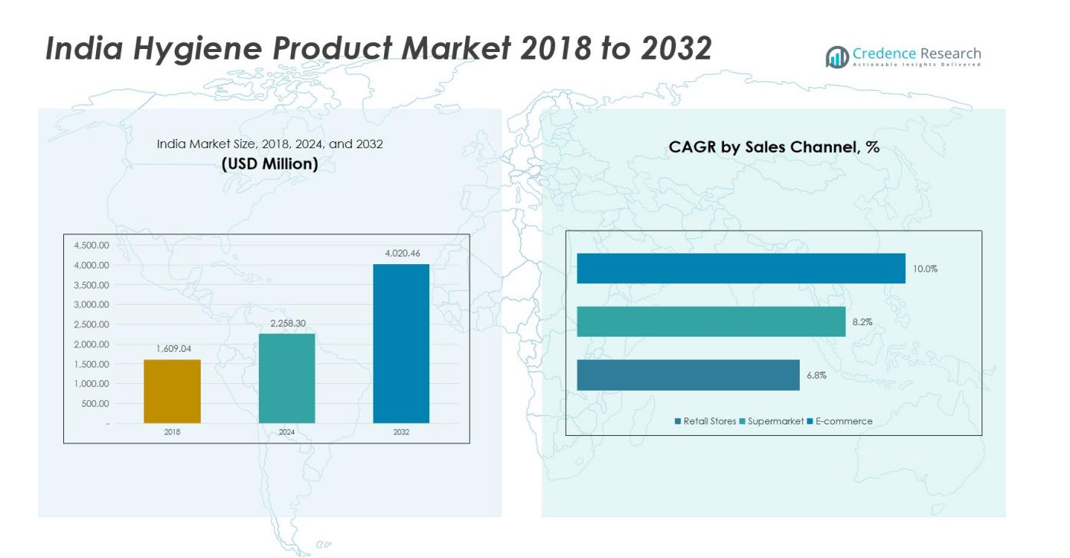

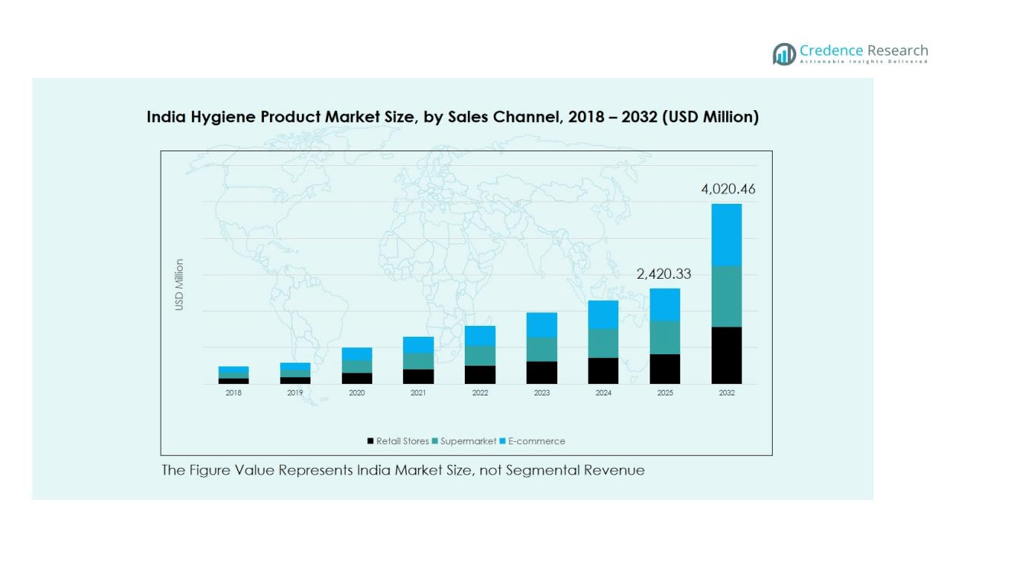

The India Hygiene Product Market size was valued at USD 1,609.0 million in 2018 to USD 2,258.3 million in 2024 and is anticipated to reach USD 4,020.5 million by 2032, at a CAGR of 6.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Hygiene Product Market Size 2024 |

USD 2,258.3 million |

| India Hygiene Product Market, CAGR |

6.85% |

| India Hygiene Product Market Size 2032 |

USD 4,020.5 million |

Market growth is driven by rising health consciousness, urbanization, and government initiatives promoting sanitation and menstrual hygiene. The rapid penetration of e-commerce, growing female workforce participation, and the availability of affordable hygiene products are further boosting consumption. Companies are investing in sustainable packaging, organic ingredients, and product innovation to meet the evolving needs of Indian consumers.

Regionally, North India holds the largest share of the India Hygiene Product Market, supported by higher awareness and organized retail presence. Western and Southern India are emerging as key growth hubs due to expanding distribution networks and rising adoption of premium hygiene products. Eastern India shows promising potential, driven by government campaigns and increasing rural access to basic hygiene solutions.

Market Insights:

- The India Hygiene Product Market was valued at USD 1,609.0 million in 2018, reached USD 2,258.3 million in 2024, and is projected to reach USD 4,020.5 million by 2032, growing at a CAGR of 6.85%.

- North India holds around 32% of the market share due to strong awareness and retail infrastructure, followed by Western India with 27% and Southern India with 22%, supported by industrial growth and urban consumer spending.

- Eastern India is the fastest-growing region with nearly 12% market share, driven by rural hygiene awareness, NGO programs, and expanding e-commerce networks.

- By product segment, baby diapers lead with around 30% share, supported by rising parental focus on infant hygiene and availability of affordable products.

- Sanitary pads hold nearly 25% share, driven by expanding menstrual health programs, government initiatives, and urban lifestyle adoption among women.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Awareness of Health and Hygiene Standards

Increasing awareness about hygiene and preventive health is a major growth factor in the India Hygiene Product Market. Campaigns promoting handwashing, menstrual hygiene, and sanitation have improved product acceptance across all demographics. Social media platforms and government programs such as Swachh Bharat Mission are influencing consumer behavior toward regular hygiene maintenance. It continues to gain traction as consumers link hygiene to overall well-being and disease prevention.

- For instance, Ujaas, an initiative by Aditya Birla Education Trust, launched the ‘Ujaas Menstrual Health Express’ in January 2024, deploying a van to cover 25 states and 106 cities across over 10,000 kilometres, distributing more than 250,000 sanitary pads and training over 25 women in sustainable cloth pad production through self-help groups.

Expanding Urbanization and Lifestyle Transformation

Rapid urbanization and lifestyle changes have led to higher demand for convenient and disposable hygiene products. Busy urban consumers prefer ready-to-use and travel-friendly options, driving sales of wipes, tissues, and feminine hygiene products. Rising employment among women has also accelerated adoption of personal hygiene solutions. The market benefits from increasing exposure to global brands and better product accessibility through modern retail.

- For instance, Neutrogena introduced 100% plant-based makeup removal wipes using Veocel fibers from sustainably managed forests, which are home-compostable within 35 days while maintaining effective micelle-infused cleaning performance.

Government Support and Public Health Initiatives

Government initiatives focused on sanitation and female health are fostering growth in the India Hygiene Product Market. Programs distributing sanitary pads in rural areas and school-based awareness campaigns are broadening market penetration. Public-private collaborations are improving product availability and affordability. It benefits from favorable policy frameworks that encourage manufacturing and awareness at the community level.

E-Commerce Expansion and Product Innovation

The strong growth of online retail channels is transforming product distribution and accessibility. E-commerce platforms are enabling consumers to compare, customize, and purchase hygiene products conveniently. Companies are investing in eco-friendly materials, herbal formulations, and biodegradable packaging to attract health-conscious buyers. The market continues to evolve through innovation that aligns with sustainability and affordability goals.

Market Trends:

Growing Preference for Sustainable and Biodegradable Hygiene Solutions

Sustainability has become a defining trend in the India Hygiene Product Market, with consumers shifting toward eco-friendly and biodegradable products. Manufacturers are introducing plant-based sanitary pads, compostable diapers, and plastic-free packaging to appeal to environmentally conscious buyers. This shift is influenced by rising environmental awareness and government efforts to reduce plastic waste. It encourages companies to adopt greener production processes and transparent sourcing practices. The use of organic cotton, bamboo fiber, and recycled materials is becoming common in personal hygiene categories. Growing emphasis on clean labeling and safety certification further boosts consumer confidence in sustainable brands.

- For Instance, Ahmedabad-based Saathi converts banana stem waste into biodegradable pads that compost within six months. The company has eliminated over 38 metric tonnes of plastic waste and saved over 45 metric tonnes of CO2 emissions as of late 2024.

Innovation and Digital Transformation in Product Distribution

Technological advancements and digital retail growth are reshaping product reach and consumer engagement. Online platforms, subscription-based services, and digital marketing are enhancing product accessibility across urban and rural areas. The India Hygiene Product Market benefits from data-driven insights that help companies personalize product offerings and target specific consumer segments. It also witnesses a growing collaboration between e-commerce firms and FMCG brands for faster product delivery. New product formats such as compact wipes, refillable containers, and smart packaging enhance convenience and functionality. Increasing adoption of digital payment systems and online awareness campaigns continues to strengthen market penetration and brand loyalty.

- For Instance, Dabur India has been partnered with Swiggy Instamart since at least April 2020 to deliver its personal hygiene and other products. This partnership was part of a larger push by Swiggy into grocery delivery and has continued, with Dabur expanding its direct supply relationship to Swiggy warehouses by late 2024 to significantly improve last-mile fulfillment speed. Swiggy Instamart offers rapid delivery, typically within 10–30 minutes, across more than 20 cities.

Market Challenges Analysis:

Limited Awareness and Affordability in Rural Areas

Low awareness and limited affordability remain key barriers in the India Hygiene Product Market. Many rural consumers lack education on the importance of personal hygiene and continue to rely on traditional methods. High product costs and irregular supply chains restrict access to essential items such as sanitary pads and diapers. It faces difficulty expanding into lower-income groups due to limited distribution infrastructure. Seasonal income patterns and cultural taboos surrounding hygiene topics further limit regular product use. Overcoming these challenges requires consistent awareness campaigns and affordable product innovations.

Rising Raw Material Costs and Environmental Concerns

Fluctuating prices of raw materials such as cotton, pulp, and packaging materials affect manufacturing costs and profitability. Many producers struggle to balance cost efficiency with quality and sustainability goals. The India Hygiene Product Market faces increasing pressure to reduce plastic content and manage waste responsibly. It must adapt to new regulations promoting recyclable and biodegradable alternatives. Smaller manufacturers often lack resources to upgrade to eco-friendly production technologies. Meeting environmental standards while maintaining affordability remains a major operational challenge for the industry.

Market Opportunities:

Expanding Rural Penetration and Awareness Programs

Growing government and NGO initiatives focused on hygiene education create strong opportunities in the India Hygiene Product Market. Expanding awareness about menstrual and personal hygiene in rural communities is increasing acceptance and demand. Low-cost product lines and micro-distribution networks are helping brands reach untapped consumers. It can achieve long-term growth by partnering with local organizations and leveraging government schemes. Affordable sanitary pads, soaps, and disinfectants designed for rural needs can capture new market segments. Continuous engagement through school programs and women-led distribution channels strengthens brand trust and visibility.

Innovation in Product Design and Sustainable Solutions

Rising consumer preference for eco-friendly and skin-safe products is opening new growth avenues. The India Hygiene Product Market can benefit from introducing biodegradable materials, herbal ingredients, and refillable packaging systems. Companies focusing on research and product customization can enhance customer retention and competitiveness. It has opportunities to expand through smart packaging and digital marketing that improve convenience and transparency. Collaborations with e-commerce platforms and health startups can extend product reach. The growing trend of clean-label and environment-conscious consumption supports long-term sustainability and premiumization in the market.

Market Segmentation Analysis:

By Product Segment

The India Hygiene Product Market is segmented into baby diapers, sanitary pads, adult diapers, wipes, cotton swabs, and tampons and menstrual cups. Baby diapers hold a major share due to high birth rates and increasing parental awareness of infant hygiene. Sanitary pads also account for a large portion, driven by growing menstrual health education and government distribution programs. Adult diapers are gaining steady demand due to rising elderly populations and improved healthcare access. It continues to see growth in wipes and tampons segments supported by lifestyle changes, travel convenience, and product innovation focused on comfort and sustainability.

- For Instance, Huggies relaunched its Huggies Nature Care diaper range in India. The diapers feature a soft bubble bed liner made with 100% organic cotton, along with other materials. Huggies promotes the range as offering up to 12 hours of absorption and claims its breathable material is clinically proven to help prevent diaper rash.

By Sales Channel Segment

Retail stores dominate the sales channel segment, supported by strong consumer reach and established supply chains across urban and semi-urban markets. Supermarkets are expanding their presence with organized product displays and attractive promotions that enhance brand visibility. The e-commerce channel is growing rapidly due to increased smartphone usage, internet access, and preference for discreet, convenient purchases. It benefits from subscription models, online discounts, and wide product variety that appeal to younger, urban consumers. Companies are strengthening omnichannel strategies to balance traditional and digital distribution for broader market coverage and improved consumer engagement.

- For instance, British supermarket chain Morrisons has partnered with VusionGroup to deploy 10.8 million smart electronic shelf labels across its 497 outlets beginning in early 2026, automating price updates and reducing paper waste.

Segmentations:

By Product Segment:

- Baby Diapers

- Sanitary Pads

- Adult Diapers

- Wipes

- Cotton Swabs

- Tampons and Menstrual Cups

By Sales Channel Segment:

- Retail Stores

- Supermarket

- E-commerce

Regional Analysis:

Dominance of Northern and Western India

Northern India holds the leading share in the India Hygiene Product Market due to higher urbanization, stronger retail infrastructure, and better consumer awareness. States like Delhi, Haryana, and Uttar Pradesh show significant adoption of baby care and feminine hygiene products. Western India, led by Maharashtra and Gujarat, benefits from industrial growth, organized retail expansion, and high disposable incomes. It also enjoys a strong presence of domestic and international hygiene brands that ensure consistent product supply. Demand for premium and sustainable hygiene products continues to rise in both regions, driven by lifestyle upgrades and consumer education.

Growing Consumption in Southern India

Southern India is witnessing rapid market growth fueled by literacy, healthcare access, and a rising working population. The region shows strong adoption of eco-friendly and innovative hygiene products due to high health awareness. States such as Tamil Nadu, Karnataka, and Kerala are key contributors to market expansion through active retail penetration and manufacturing investments. It benefits from a mix of domestic producers and global FMCG players establishing regional hubs. Increasing digital engagement and awareness programs are enhancing product accessibility and demand consistency.

Emerging Potential in Eastern and Central India

Eastern and Central India are emerging as high-potential markets supported by government hygiene initiatives and improving rural connectivity. States including West Bengal, Odisha, and Madhya Pradesh are witnessing increased adoption of sanitary and personal hygiene products. The India Hygiene Product Market is expanding in these regions through low-cost product lines and awareness campaigns. It is gaining traction through NGO-led programs promoting hygiene education among women and children. Better logistics, e-commerce expansion, and community-based distribution networks are expected to accelerate future market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Unicharm Corporation

- Nobel Hygiene Pvt. Ltd

- Ginni Filaments Limited

- Kimberly-Clark

- Wellify

- JNTL Consumer Health (India)

- H R Hygiene Pvt. Ltd

- Madhav Manufacturers (GLISS)

- Procter & Gamble

- Sirona Hygiene Private Limited

Competitive Analysis:

The India Hygiene Product Market features strong competition among established and emerging players offering diverse product portfolios. Key participants include Unicharm Corporation, Nobel Hygiene Pvt. Ltd, Ginni Filaments Limited, Kimberly-Clark, Wellify, and JNTL Consumer Health (India). It is driven by product innovation, brand positioning, and price competitiveness across both urban and rural markets. Companies are focusing on expanding manufacturing capacity, improving distribution networks, and introducing sustainable, skin-friendly materials. Strategic advertising and digital engagement help brands build consumer trust and market presence. Local manufacturers are gaining ground through affordable offerings, while global players continue to dominate premium segments through innovation and quality assurance.

Recent Developments:

- In September 2025, The company won the Excellence Award in the ESG category at the Sustainable Japan Award 2025 for its horizontal recycling initiatives, marking its first win in this category.

- In May 2025, The firm also recorded a valuation markdown in its latest funding round while reaffirming its leadership in India’s adult diaper category backed by Quadria Capital and Sixth Sense Ventures.

Report Coverage:

The research report offers an in-depth analysis based on Product and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer focus on personal health and hygiene will continue to drive market expansion.

- Brands will increase investments in biodegradable and eco-friendly product innovations.

- Digital retail and subscription-based models will strengthen online hygiene product sales.

- Growing awareness in rural areas will open new opportunities for affordable hygiene solutions.

- Government initiatives promoting sanitation and menstrual health will improve market penetration.

- Companies will adopt localized manufacturing to reduce costs and improve regional accessibility.

- Sustainability and waste management regulations will encourage product redesign and packaging shifts.

- Technological integration in production will enhance efficiency and product consistency.

- Collaborations between FMCG brands and healthcare providers will enhance consumer education.

- Rising disposable incomes and lifestyle modernization will sustain long-term growth momentum in the India Hygiene Product Market.