Market Overview

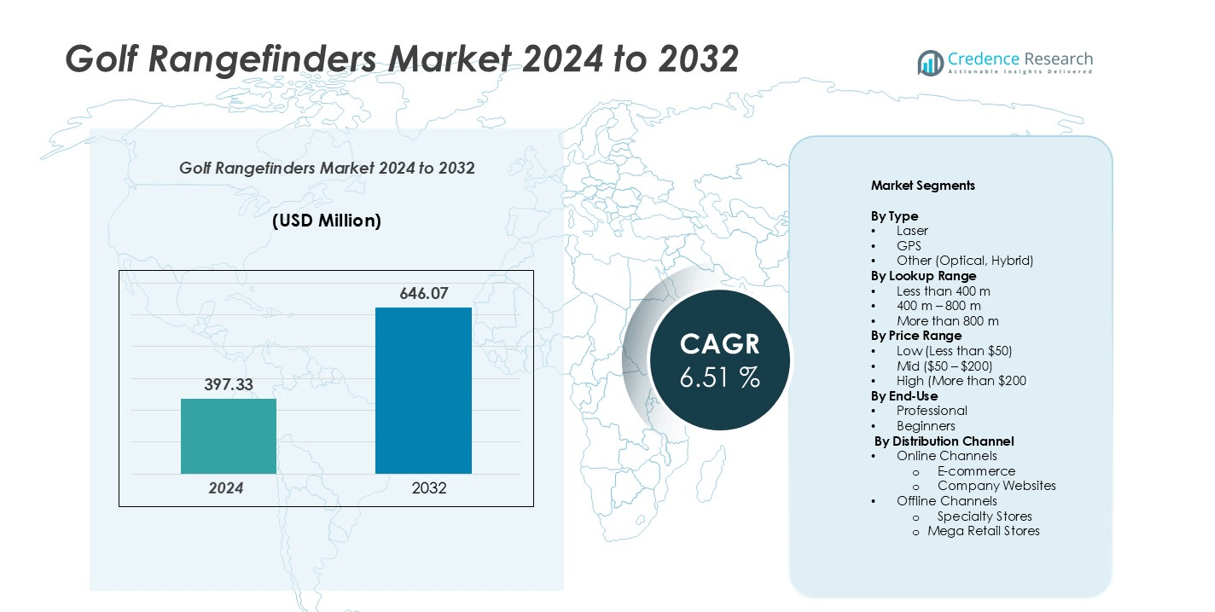

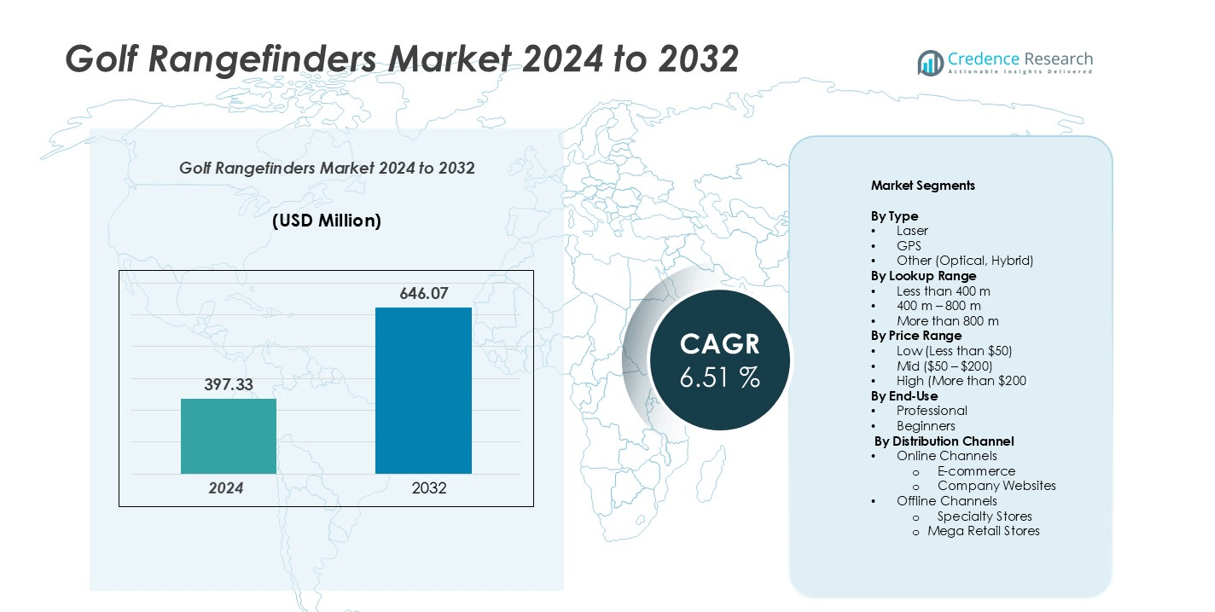

Golf rangefinders market size was valued at USD 397.33 million in 2024 and is anticipated to reach USD 646.07 million by 2032, at a CAGR of 6.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Golf Rangefinders Market Size 2024 |

USD 397.33 million |

| Golf Rangefinders Market, CAGR |

6.51% |

| Golf Rangefinders Market Size 2032 |

USD 646.07 million |

The golf rangefinders market is dominated by key players such as Bushnell Corporation, Nikon Corporation, Callaway, Laser Link, Leupold & Stevens, Skyhawk Technologies LLC, and ZEISS International. These companies focus on technological innovation, product differentiation, and strategic partnerships to strengthen their market positions. North America leads the global market with a 35% share, driven by high golf participation, advanced technological adoption, and strong consumer spending. Europe follows with a 28% share, supported by a mature golfing culture and growing recreational adoption. Asia-Pacific, with a 20% share, is emerging rapidly due to rising disposable incomes, urbanization, and increasing golf popularity. These leading regions, combined with competitive product offerings and multi-channel distribution strategies, position the top players to capture significant market growth during the forecast period.

Market Insights

- The golf rangefinders market was valued at USD 397.33 million in 2024 and is projected to reach USD 646.07 million by 2032, growing at a CAGR of 6.51%.

- Market growth is driven by increasing adoption among professional and amateur golfers, rising participation in recreational golf, and growing demand for precision and performance-enhancing devices.

- Key trends include the integration of GPS and laser technology, smart connectivity with mobile applications, and the development of lightweight and ergonomic devices for enhanced portability.

- Competitive players such as Bushnell Corporation, Nikon Corporation, Callaway, Laser Link, Leupold & Stevens, Skyhawk Technologies LLC, and ZEISS International are investing in R&D, product innovation, and multi-channel distribution strategies to expand market presence.

- Regionally, North America dominates with a 35% share, followed by Europe at 28%, Asia-Pacific 20%, Latin America 10%, and MEA 7%, while the Laser segment leads in type and the mid-price range segment captures the largest consumer adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The golf rangefinders market is segmented into Laser, GPS, and Other types, including optical and hybrid devices. Among these, the Laser segment dominates the market, accounting for the largest share due to its high accuracy, long-range capability, and reliability in diverse weather conditions. Laser rangefinders are preferred by professional golfers and serious enthusiasts for precise distance measurements, enabling improved game strategy. The increasing adoption of advanced laser technology and growing awareness among golfers about performance optimization are key drivers supporting the segment’s growth during the forecast period.

- For instance, the Bushnell R5 Laser Rangefinder is that it offers a range of up to 2,000 yards with ±1 yard accuracy and features Angle Range Compensation. However, its onboard Applied Ballistics Ultralite software provides ballistic solutions for precise elevation and wind adjustments only up to 800 yards. The device uses Bluetooth to connect to the Bushnell Ballistics app for more advanced calculations.

By Lookup Range:

The market is categorized by lookup range into less than 400 m, 400 m – 800 m, and more than 800 m. The 400 m – 800 m sub-segment holds the largest market share, driven by its suitability for standard golf courses and wide user adaptability. Golfers favor this range for its balanced performance, offering sufficient distance coverage while maintaining accuracy. Factors such as the rising popularity of mid-range devices among both professional and amateur golfers, coupled with technological advancements enhancing precision over moderate distances, continue to fuel growth in this segment.

- For instance, the Garmin Approach G80 GPS rangefinder provides precise distance measurements for standard golf courses, enhancing user adaptability and performance.

By Price Range:

Golf rangefinders are classified by price into low (less than $50), mid ($50 – $200), and high (more than $200) categories. The mid-price segment dominates, accounting for the largest market share, as it offers an optimal combination of affordability, features, and performance. This segment attracts a broad user base, including beginners seeking reliable tools and professionals requiring cost-effective solutions. Key drivers include the increasing availability of feature-rich mid-range products, rising disposable income, and growing e-commerce penetration that enhances accessibility for consumers across regions.

Key Growth Drivers

Increasing Adoption Among Professional and Amateur Golfers

The rising adoption of golf rangefinders among both professional and amateur players is a primary growth driver. Golfers are increasingly leveraging advanced devices to measure distances accurately, analyze course layouts, and enhance strategic decision-making. The proliferation of golf courses globally and growing participation in golfing tournaments have further fueled demand. Professionals seek precision tools for competitive advantage, while beginners and recreational players prefer user-friendly devices to improve gameplay. The combination of technological sophistication, affordability, and ease of use is driving widespread adoption, contributing significantly to the market’s growth during the forecast period.

- For instance, the Bushnell R5 2000 AB Laser Rangefinder offers a maximum laser range of up to 2000 yards with an accuracy of ±1 yard. It features Angle Range Compensation (ARC) and includes Applied Ballistics Ultralite (ABU) for custom ballistic solutions. However, the onboard ABU provides solutions for precise elevation and wind adjustments for distances up to 800 yards, not the full 2000-yard range.

Technological Advancements in Rangefinder Devices

Rapid technological innovations, such as integrated GPS, laser-assisted distance measurement, slope compensation, and hybrid functionalities, are propelling market growth. Manufacturers are focusing on miniaturization, lightweight designs, and enhanced battery life to improve user experience. Features such as weather resistance, high-resolution optics, and real-time feedback attract golfers seeking performance enhancement. Continuous R&D investments and the integration of smart connectivity with mobile apps are expanding device capabilities, enabling golfers to track performance metrics and plan strategies effectively. These technological advancements act as a critical market driver by increasing adoption across various skill levels.

- For instance, The Garmin Approach G80 provides precise GPS-based distance measurements for standard golf courses and features an integrated launch monitor that tracks key metrics like ball speed and clubhead speed, enhancing user adaptability and performance during practice and play.

Rising Golf Tourism and Recreational Participation

The growth of golf tourism and recreational participation is significantly boosting market demand. As golf becomes more popular in emerging economies and leisure travel increases, the need for portable, high-performance rangefinders has risen. Resorts and golf courses are promoting enhanced golfing experiences by encouraging the use of advanced devices. Additionally, corporate events, sports clubs, and golf academies are driving sales by integrating rangefinder usage into training and tournaments. This expanding user base, combined with the growing disposable income of recreational players, continues to support consistent market growth.

Key Trends & Opportunities

Integration of Smart Technology and Mobile Applications

A prominent trend in the golf rangefinders market is the integration of smart technology and mobile connectivity. Devices now often link to mobile applications to provide real-time data, performance tracking, and course mapping. This convergence of technology offers golfers personalized insights and enhances engagement, creating opportunities for manufacturers to differentiate their products. The adoption of AI-enabled features, such as predictive shot analysis and digital score tracking, is gaining traction. This trend presents lucrative opportunities to expand product offerings, improve user experience, and target tech-savvy golfers seeking advanced, interactive solutions.

- For instance, The Bushnell R5 2000 AB Laser Rangefinder does feature Bluetooth connectivity and integrates with the Bushnell Ballistics app.

Rising Demand for Lightweight and Compact Devices

Consumers increasingly prefer lightweight and compact rangefinders that are easy to carry during play. Portability, ergonomic design, and compact dimensions are becoming major decision-making factors, particularly among beginners and recreational golfers. Manufacturers are investing in materials and designs that reduce size without compromising performance or battery life. This shift in consumer preference opens opportunities for product innovation, catering to a broader audience seeking convenience alongside accuracy. The trend aligns with global lifestyle changes emphasizing mobility, efficiency, and smart device adoption.

- For instance, The Garmin Approach G80 GPS handheld features a slim design with quick button access to its integrated radar. This allows golfers to easily switch to the launch monitor function to track key swing metrics during a round or practice session.

Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present substantial growth opportunities for the golf rangefinders market. Increasing urbanization, rising disposable incomes, and growing interest in recreational sports are contributing to market expansion. Golf is gaining popularity as a lifestyle sport in these regions, with investments in golf courses and clubs increasing. Manufacturers can capitalize on these untapped markets by offering affordable, feature-rich devices tailored to local needs. Strategic partnerships and regional distribution channels can further accelerate penetration and revenue growth.

Key Challenges

High Device Costs and Price Sensitivity

Despite technological advancements, the high cost of premium golf rangefinders remains a significant challenge. Price-sensitive consumers, especially in emerging markets, may prefer low-cost alternatives or traditional distance measurement methods. The affordability barrier limits the adoption of high-end devices among beginners and recreational players. Additionally, competition from low-priced substitutes, such as smartphone apps with GPS functionalities, exerts pressure on pricing strategies. Manufacturers need to balance feature offerings with cost efficiency to maintain market growth and attract a broader consumer base.

Technological Complexity and Learning Curve

Advanced features in modern golf rangefinders, such as laser measurement, GPS mapping, and slope compensation, can pose a learning curve for new users. Novice golfers may find sophisticated devices challenging to operate, which can hinder adoption. Misuse or incorrect readings can affect gameplay satisfaction, leading to reduced repeat purchases. To overcome this challenge, manufacturers must focus on user-friendly interfaces, intuitive designs, and comprehensive instructional support. Addressing complexity through training, tutorials, and simplified device functionality is crucial for expanding the market across all user segments.

Regional Analysis

North America

North America dominates the golf rangefinders market with an estimated market share of 35% in 2024. The U.S. and Canada are primary contributors, driven by high golf participation, advanced technological adoption, and a strong presence of professional and recreational golfers. The demand for precision and feature-rich devices, including laser and GPS rangefinders, remains robust. Golf tourism, smart device integration, and organized tournaments further support growth. High disposable incomes and the preference for performance-enhancing devices ensure North America maintains its leading position throughout the forecast period.

Europe

Europe holds a significant market share of 28%, led by countries such as the UK, Germany, and France, where golf has deep-rooted popularity. The region benefits from a mature consumer base with high awareness of precision-enhancing rangefinder devices. Recreational golf growth, golf tourism, and professional tournaments drive adoption, particularly of mid- to high-range devices. Technological advancements, including slope compensation and hybrid devices, further bolster market growth. Rising disposable incomes and the presence of numerous golf courses contribute to Europe’s sustained prominence in the global market.

Asia-Pacific

Asia-Pacific is an emerging market with an estimated market share of 20%, exhibiting strong growth potential. Countries like China, Japan, South Korea, and India are witnessing rising disposable income, urbanization, and growing interest in recreational sports. Expansion of golf courses, adoption of affordable mid-range devices, and integration of digital features are fueling demand. The region’s increasing focus on leisure and corporate golfing, along with growing awareness of performance-enhancing equipment, is expected to drive a higher CAGR during the forecast period, positioning Asia-Pacific as a key growth region.

Latin America

Latin America accounts for an estimated market share of 10%, led by Brazil, Mexico, and Argentina. The market growth is supported by rising interest in golf among the middle and upper-income population, increasing recreational participation, and investments in golf infrastructure. Adoption is primarily among professional golfers and enthusiasts seeking accurate distance measurement. Availability of mid- and low-priced rangefinders is expanding accessibility. While growth is moderate compared to other regions, the expansion of golf tourism and local tournaments continues to provide steady revenue opportunities.

Middle East & Africa (MEA)

The MEA region holds an estimated market share of 7%, with key contributions from the UAE, Saudi Arabia, and South Africa. Growth is driven by golf tourism, luxury resorts, and rising recreational participation. Affluent consumers favor premium, technologically advanced devices, including laser and hybrid rangefinders. Corporate tournaments and professional golfing events further support market adoption. Challenges such as limited awareness in some areas and high device costs exist, but the growing lifestyle popularity of golf continues to fuel steady demand and incremental revenue growth in the region.

Market Segmentations:

By Type

- Laser

- GPS

- Other (Optical, Hybrid)

By Lookup Range

- Less than 400 m

- 400 m – 800 m

- More than 800 m

By Price Range

- Low (Less than $50)

- Mid ($50 – $200)

- High (More than $200)

By End-Use

By Distribution Channel

- Online Channels

- E-commerce

- Company Websites

- Offline Channels

- Specialty Stores

- Mega Retail Stores

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The golf rangefinders market is highly competitive, characterized by the presence of both established global players and emerging regional manufacturers. Key companies, including Bushnell Corporation, Nikon Corporation, Callaway, Laser Link, Leupold & Stevens, Skyhawk Technologies LLC, and ZEISS International, are focusing on innovation, product differentiation, and strategic partnerships to strengthen their market positions. These players invest heavily in R&D to develop advanced laser, GPS, and hybrid rangefinders with enhanced accuracy, ergonomic designs, and smart connectivity features. Companies are also leveraging omnichannel distribution strategies, including e-commerce platforms, specialty stores, and direct-to-consumer channels, to expand reach. Competitive pricing, after-sales support, and marketing initiatives targeting professional and recreational golfers further intensify rivalry. Continuous product launches, technological advancements, and strategic collaborations remain key strategies for maintaining market share and driving growth in this evolving landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2023, Shot Scope, introduced the new and improved PRO LX and PRO LX+. The PRO LX+ provides golfers the ultimate on-course distance measuring device – a fast, accurate rangefinder with a built-in extra strong buggy magnet, combined with a powerful GPS and performance tracking system to gain valuable insights from every on-course game.

- In 2023, Bushnell plans to launch the Tour V6 and the Tour V6 Shift rangefinders. Both models feature new and sharp designs and a new colorway along with the latest golf tech to give the most accurate yardages possible on a golf course

Report Coverage

The research report offers an in-depth analysis based on Type, Lookup Range, Price Range, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of advanced laser and GPS rangefinders will continue to increase among professional and recreational golfers.

- Integration of smart technology with mobile applications will drive enhanced user engagement and data tracking.

- Lightweight, compact, and ergonomic designs will gain popularity for improved portability and convenience.

- Growth in golf tourism and leisure participation will expand demand across emerging markets.

- Mid-price and feature-rich devices will see higher adoption among beginners and amateur players.

- Technological innovations such as slope compensation, hybrid functionality, and AI-based shot analysis will influence purchasing decisions.

- Expansion of e-commerce and online sales channels will improve product accessibility worldwide.

- Manufacturers will focus on product differentiation through R&D and innovative feature offerings.

- Rising awareness of performance optimization tools will drive market penetration in new regions.

- Strategic partnerships, collaborations, and regional distribution expansion will strengthen competitive positioning globally.