Market Overview

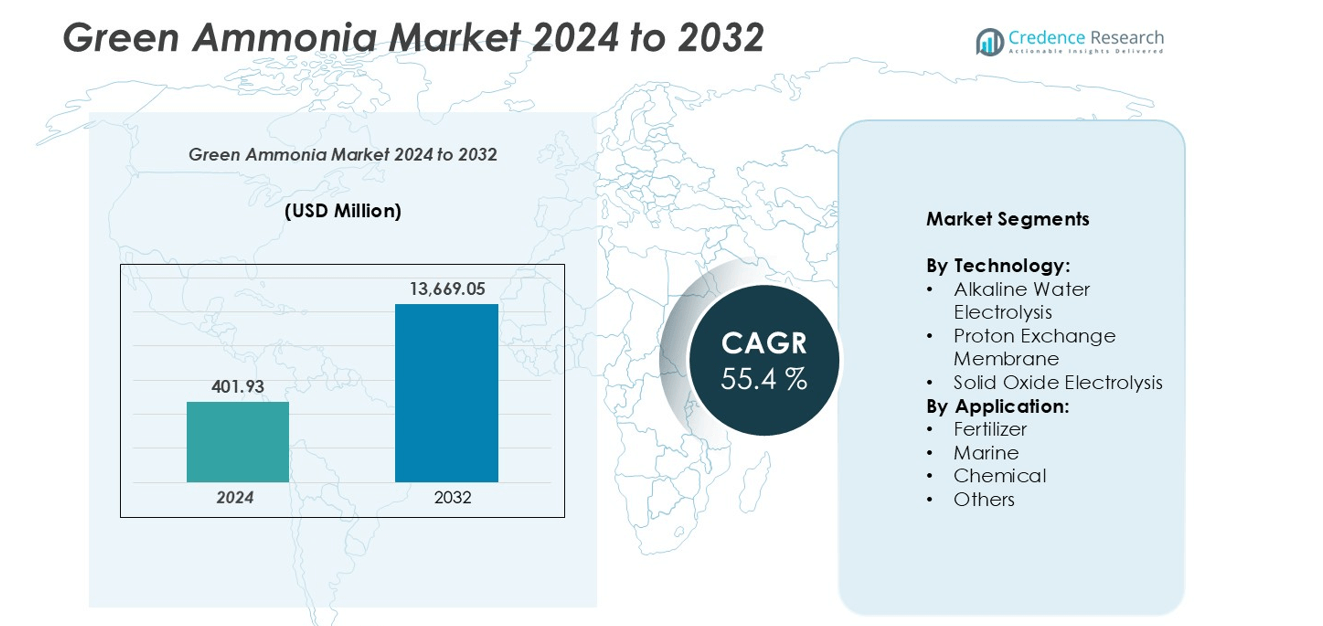

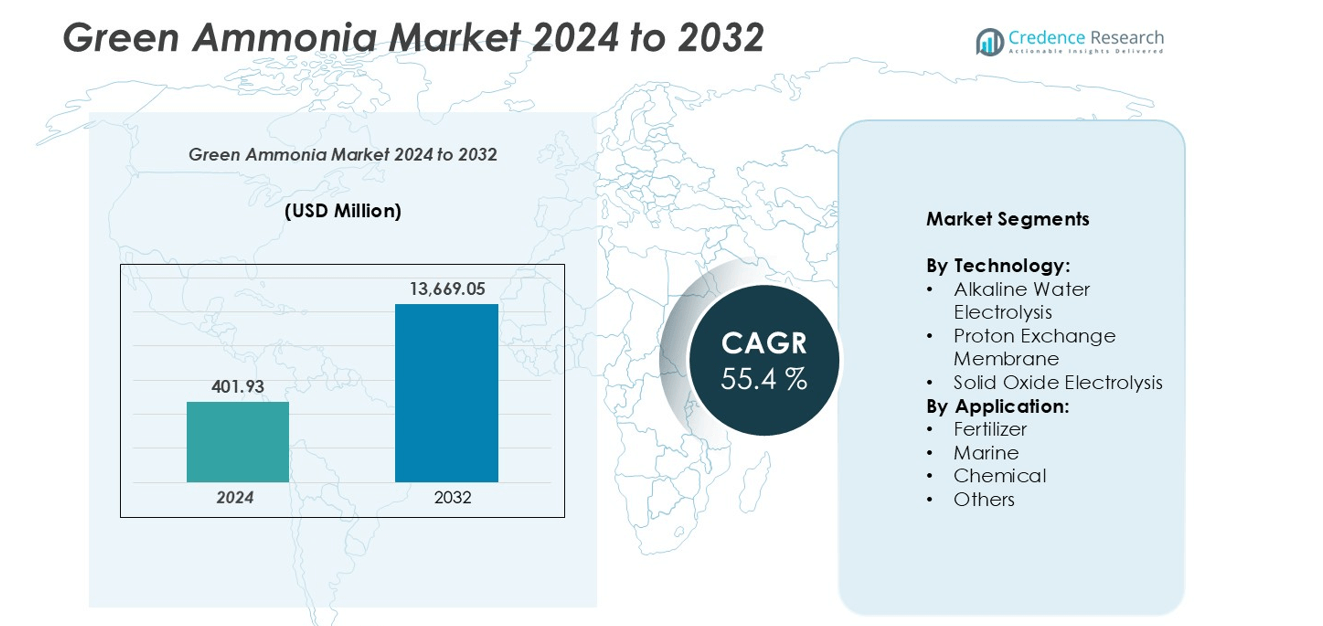

Green ammonia market size was valued at USD 401.93 million in 2024 and is anticipated to reach USD 13,669.05 million by 2032, at a CAGR of 55.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Ammonia Market Size 2024 |

USD 401.93 million |

| Green Ammonia Market, CAGR |

55.4% |

| Green Ammonia Market Size 2032 |

USD 13,669.05 million |

The green ammonia market is dominated by key global players, including Nel Hydrogen (Norway), Siemens Energy (Germany), Yara International ASA (Norway), First Ammonia (U.S.), ENGIE (France), ITM Power PLC (UK), Iberdrola (Spain), and MAN Energy Solutions (Germany). These companies focus on advancing electrolysis technologies, expanding production capacities, and forming strategic partnerships to strengthen their market positions. Regionally, Europe leads the market with a 30% share in 2024, driven by stringent environmental regulations, renewable energy integration, and government incentives. North America follows with 25%, supported by large-scale renewable-powered projects and strong industrial adoption, while Asia-Pacific accounts for 28%, propelled by rising fertilizer demand and renewable energy investments. Collectively, these players and leading regions shape the competitive dynamics, drive technological innovation, and facilitate the adoption of green ammonia across industrial, marine, and fertilizer applications.

Market Insights

- The green ammonia market was valued at USD 401.93 million in 2024 and is projected to reach USD 13,669.05 million by 2032, growing at a CAGR of 55.4%.

- Market growth is driven by rising demand for sustainable fertilizers, decarbonization of industrial and marine sectors, and technological advancements in electrolysis processes. Alkaline Water Electrolysis dominates the technology segment, while fertilizers hold the largest application share.

- Key trends include integration of green ammonia production with renewable energy sources, expansion into marine fuel and energy storage applications, and strategic partnerships supported by policy incentives to reduce carbon emissions.

- Competitive dynamics are shaped by major players such as Nel Hydrogen, Siemens Energy, Yara International, First Ammonia, ENGIE, ITM Power, Iberdrola, and MAN Energy Solutions, focusing on technology innovation, capacity expansion, and global market penetration.

- Regionally, Europe leads with 30% market share, followed by Asia-Pacific at 28%, North America at 25%, Middle East & Africa at 10%, and Latin America at 7%, reflecting strong renewable energy adoption and supportive government policies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology:

The green ammonia market by technology is segmented into Alkaline Water Electrolysis, Proton Exchange Membrane (PEM), and Solid Oxide Electrolysis. Among these, Alkaline Water Electrolysis dominates the market, accounting for approximately 45% share in 2024. Its widespread adoption is driven by low capital costs, established industrial use, and operational stability in large-scale applications. PEM technology is gaining traction due to higher efficiency and faster response times, particularly for renewable energy integration. Solid Oxide Electrolysis, though less prevalent, is expected to grow due to its high-temperature efficiency and potential in long-term sustainable production strategies.

- For instance, Juno Joule Green Energy Pvt Ltd, in collaboration with Select Energy GmbH, is developing a green hydrogen and ammonia production facility in Andhra Pradesh.

By Application:

In terms of applications, the green ammonia market is classified into Fertilizer, Marine, Chemical, and Others. The fertilizer segment holds a dominant position with over 50% market share, propelled by rising global demand for nitrogen-based fertilizers and sustainable agriculture practices. The marine sector is emerging as a significant growth area due to stricter emission regulations and the adoption of ammonia as a zero-carbon fuel. Chemical production also contributes steadily, leveraging green ammonia as a feedstock in various processes. Other applications, such as energy storage and power generation, are expected to expand gradually.

- For instance, the statement is a direct quote from the IFA’s “Public Summary Short-Term Fertilizer Outlook 2024–2025” report, which forecasts 1.3 million tonnes of green ammonia projects coming online by the end of 2025.

Key Growth Drivers

Rising Demand for Sustainable Fertilizers

The increasing global focus on sustainable agriculture is a major growth driver for the green ammonia market. Green ammonia serves as a zero-carbon alternative for nitrogen-based fertilizers, reducing the carbon footprint of conventional fertilizer production. Governments across regions are implementing stringent regulations to curb greenhouse gas emissions from the agriculture sector, encouraging adoption of eco-friendly fertilizers. Furthermore, the growing global population and the corresponding rise in food demand are driving higher fertilizer consumption, directly benefiting green ammonia production. Investment in renewable energy-powered electrolysis plants has also enhanced production efficiency, making green ammonia a viable and cost-effective option for large-scale fertilizer applications.

- For instance, NTPC Renewable Energy Ltd has secured a contract to supply 70,000 tonnes of renewable ammonia annually to Krishna Phoschem Ltd in Madhya Pradesh over a ten-year period, at a fixed price of ₹51.80 per kilogram.

Decarbonization of Industrial and Marine Sectors

Industrial and marine sectors are increasingly prioritizing decarbonization, which significantly propels the green ammonia market. Green ammonia offers a clean fuel alternative for shipping and industrial processes, helping reduce reliance on fossil fuels and meet international emission reduction targets. Maritime adoption is fueled by stricter IMO regulations on sulfur and carbon emissions, prompting companies to explore ammonia as a zero-carbon fuel. In parallel, industries such as chemicals and power generation are transitioning to green ammonia to lower carbon intensity in their operations. Rising awareness of climate change and sustainability initiatives has intensified investment in infrastructure and technology, positioning green ammonia as a core component of global decarbonization strategies.

- For instance, in August 2025, Jakson Green won an auction to supply green ammonia to facility in Kakinada, Andhra Pradesh. The bid was under the Indian government’s Strategic Interventions for Green Hydrogen Transition (SIGHT) scheme.

Advancements in Electrolysis Technologies

Technological advancements in electrolysis processes, including Alkaline Water Electrolysis, Proton Exchange Membrane, and Solid Oxide Electrolysis, are driving market growth. Improved efficiency, reduced energy consumption, and scalability of these technologies make green ammonia production increasingly economically viable. Innovations such as high-temperature electrolysis and integration with renewable energy sources enhance production output while minimizing environmental impact. Governments and private enterprises are investing heavily in research and development to optimize electrolyzer performance, reduce operational costs, and enable large-scale deployment. These technological improvements not only support existing applications in fertilizers and chemicals but also open opportunities for marine fuel and energy storage markets, strengthening the overall growth trajectory of green ammonia.

Key Trends & Opportunities

Integration with Renewable Energy Sources

A notable trend in the green ammonia market is the integration of production facilities with renewable energy sources such as solar and wind power. This approach reduces the carbon intensity of ammonia synthesis, positioning it as a truly sustainable fuel and chemical feedstock. Coupling electrolyzers with renewable energy not only improves cost efficiency but also addresses energy intermittency issues, enabling continuous production. Companies are increasingly exploring hybrid models that leverage on-site solar and wind resources to produce ammonia, creating opportunities in regions with abundant renewable energy potential. This integration also aligns with global carbon-neutral targets and government incentives, making green ammonia an attractive investment for both industrial and energy sectors.

- For instance, AM Green has placed India’s largest electrolyzer order with John Cockerill Hydrogen for its one-million-ton green ammonia project in Kakinada, Andhra Pradesh.

Expansion into Marine Fuel and Energy Storage Applications

Green ammonia is emerging as a viable alternative fuel for marine transport and a medium for hydrogen energy storage. Shipping companies are exploring ammonia-based propulsion systems to comply with International Maritime Organization regulations, reducing sulfur oxide and carbon emissions. Additionally, ammonia’s hydrogen content enables it to function as a dense, transportable energy carrier, creating opportunities in hydrogen-based power generation and long-term energy storage. Investments in ammonia bunkering infrastructure and energy storage technologies are expanding globally, presenting lucrative market potential. As technology matures and production scales up, green ammonia is positioned to become a key player in sustainable transportation and energy storage solutions.

- For instance, in May 2025, a non-binding Memorandum of Understanding (MoU) was signed between Coal India Limited (CIL) and AM Green Ammonia (India) Pvt Ltd for the supply of 4,500 MW of renewable energy.

Strategic Partnerships and Policy Support

The green ammonia market is benefiting from collaborations between technology providers, energy companies, and governments. Strategic partnerships enable shared investment in production infrastructure, research, and supply chain optimization. Policy support in the form of subsidies, tax incentives, and carbon credit programs further encourages green ammonia adoption. Such collaboration accelerates commercialization, reduces financial risk, and enhances access to new markets. This trend is expected to foster innovation, lower production costs, and expand applications across fertilizers, chemicals, and energy sectors, creating significant opportunities for market growth over the forecast period.

Key Challenges

High Production Costs and Capital Expenditure

The primary challenge in the green ammonia market is the high cost of production and capital-intensive infrastructure. Electrolysis-based ammonia production requires substantial investment in electrolyzers, renewable energy integration, and storage facilities. Compared to conventional ammonia production from fossil fuels, the cost of green ammonia remains higher, limiting immediate adoption in price-sensitive markets. Operational costs, such as electricity and maintenance, also impact profitability. Until large-scale production and technological efficiency improve, cost barriers could constrain market growth, especially in regions lacking robust renewable energy infrastructure or financial incentives.

Limited Infrastructure and Distribution Networks

Another critical challenge is the underdeveloped infrastructure and distribution network for green ammonia. Transporting and storing ammonia requires specialized equipment, safety protocols, and regulatory compliance. Many regions lack adequate bunkering, pipeline, or storage facilities, particularly for applications like marine fuel or energy storage. The absence of standardized global infrastructure slows market penetration and increases logistical costs. Overcoming these barriers requires significant investment, policy alignment, and technological solutions to ensure safe and efficient supply chain management, which remains a hurdle for widespread adoption of green ammonia.

Regional Analysis

North America

North America holds a significant share of the green ammonia market, accounting for around 25% in 2024. The region benefits from well-established industrial infrastructure, advanced technological adoption, and strong governmental support for decarbonization initiatives. The U.S. leads in renewable energy integration with large-scale electrolysis projects, while Canada invests in ammonia as a clean fuel for fertilizers and industrial applications. Rising demand for sustainable agriculture and zero-emission marine solutions is fueling market growth. Key market players are actively expanding production capacities and forming strategic partnerships, solidifying North America’s position as a dominant and innovative region in the green ammonia landscape.

Europe

Europe represents approximately 30% of the green ammonia market, driven by stringent environmental regulations, ambitious carbon neutrality targets, and substantial investments in renewable energy infrastructure. Germany, the Netherlands, and Scandinavia are leading in large-scale green ammonia projects for fertilizers, marine fuels, and industrial chemicals. Strong policy support, including subsidies and carbon credit programs, encourages private sector participation and accelerates adoption. Europe’s focus on sustainable shipping and chemical production fosters market expansion, while advancements in electrolysis technologies enhance production efficiency. Collaborative initiatives between governments, technology providers, and energy companies further strengthen Europe’s market position and growth prospects in green ammonia.

Asia-Pacific

Asia-Pacific accounts for nearly 28% of the green ammonia market, driven by rapid industrialization, growing fertilizer demand, and increasing renewable energy deployment. Countries such as China, Japan, South Korea, and Australia are investing in large-scale ammonia production facilities powered by solar and wind energy. Rising awareness of sustainable agriculture practices and stricter emission standards in the shipping sector are accelerating green ammonia adoption. Technological advancements, government incentives, and strategic partnerships further support market expansion. The region is expected to witness robust growth during the forecast period, emerging as a key contributor to global green ammonia production and a hub for innovative applications.

Middle East & Africa

The Middle East & Africa (MEA) holds around 10% of the green ammonia market, with significant growth potential due to abundant renewable energy resources, particularly solar and wind. Countries like Saudi Arabia, the UAE, and South Africa are focusing on green ammonia as a means to diversify energy portfolios and reduce carbon emissions from industrial and fertilizer sectors. Investments in large-scale electrolysis plants, coupled with favorable government policies, are attracting global partnerships. While infrastructure challenges exist, increasing adoption of green ammonia for chemical production, fertilizers, and export-oriented projects is driving regional market growth and positioning MEA as an emerging player in the global green ammonia landscape.

Latin America

Latin America represents approximately 7% of the global green ammonia market, supported by growing agricultural demand and renewable energy potential. Brazil, Argentina, and Chile are investing in solar- and wind-powered ammonia production projects to supply sustainable fertilizers and industrial chemicals. Government initiatives promoting low-carbon technologies and export-oriented strategies are fostering adoption, while partnerships with global technology providers enhance production capabilities. Despite challenges such as high initial capital costs and underdeveloped infrastructure, rising awareness of environmental sustainability and agricultural productivity is propelling market growth. The region is poised for gradual expansion, leveraging renewable energy resources to strengthen its position in the green ammonia market.

Market Segmentations:

By Technology:

- Alkaline Water Electrolysis

- Proton Exchange Membrane

- Solid Oxide Electrolysis

By Application:

- Fertilizer

- Marine

- Chemical

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The green ammonia market is highly competitive, characterized by the presence of key global players actively investing in production capacity, technological innovation, and strategic partnerships. Leading companies such as Nel Hydrogen, Siemens Energy, Yara International ASA, First Ammonia, ENGIE, ITM Power, Iberdrola, and MAN Energy Solutions focus on developing efficient electrolysis technologies, scaling up green ammonia production, and expanding their market presence across fertilizers, marine fuels, and chemical applications. Companies are leveraging collaborations, joint ventures, and government-backed projects to enhance technological capabilities and reduce production costs. The competitive dynamics are also driven by R&D initiatives aimed at improving electrolyzer efficiency and integrating renewable energy sources. Strategic expansions in North America, Europe, and Asia-Pacific further strengthen market positions. Overall, the landscape is defined by innovation, sustainability-focused investments, and aggressive expansion strategies to capture emerging opportunities in the rapidly growing green ammonia market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nel Hydrogen (Norway)

- Siemens Energy (Germany)

- Yara International ASA (Norway)

- First Ammonia (U.S.)

- ENGIE (France)

- ITM Power PLC (UK)

- Iberdrola (Spain)

- MAN Energy Solutions (Germany)

Recent Developments

- In June 2024, ITM Power announced the inauguration of Yara’s renewable hydrogen plant at Herøya Industrial Park, currently the largest facility of its kind in Europe. The 24 MW plant is designed to produce enough green hydrogen to generate 20,500 tons of ammonia annually, which can be transformed into between 60,000 and 80,000 tons of green fertilizer.

- In January 2024, Engie and Enaex partnered on the HyEx project in Antofagasta (Chile), where Engie would produce renewable hydrogen, and Enaex would manufacture green ammonia to support the subsequent production of mining explosives.

- In December 2023, ENGIE and POSCO were awarded a green ammonia project in Oman with a capacity of up to 1.2 mtpa, planned for export to Korea by 2030. This initiative would incorporate approximately 5 GW of new wind and solar energy capacity, along with a Battery Energy Storage System (BESS) and a renewable hydrogen plant capable of producing up to 200 kilotons annually.

- In November 2023, DAI signed an MoU with Siemens Energy to collaborate on the production of green hydrogen derived from renewable energy sources in East Port Said, Egypt. As part of this agreement, Siemens Energy would provide electrolyzers, auxiliary plant systems, and essential equipment to form the hydrogen island for the project. DAI’s project, known as Ra, is set to achieve a total production capacity of 2 million tons per year (mtpa) of green ammonia, with production expected to commence in 2028.

- In October 2023, thyssenkrupp Uhde was contracted by Hive Energy Limited to provide a pre-FEED (Pre-Front End Engineering Design) for the development of Hive’s inaugural green hydrogen and ammonia production facility in Spain. This contract was awarded following an extensive techno-economic analysis conducted for the power-to-ammonia plant.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of green ammonia is expected to increase across fertilizers, marine fuels, and chemical industries.

- Integration with renewable energy sources like solar and wind will drive sustainable production.

- Electrolysis technologies, including Alkaline, PEM, and Solid Oxide, will see continuous efficiency improvements.

- Industrial and marine sectors will increasingly adopt green ammonia to meet decarbonization targets.

- Strategic partnerships and joint ventures will expand production capacity and global market reach.

- Government incentives and favorable policies will accelerate market growth in key regions.

- Technological innovations will reduce production costs and enhance scalability.

- Asia-Pacific and Europe will remain leading regions due to strong renewable energy investments and regulatory support.

- Energy storage applications will create new market opportunities for green ammonia.

- Increased awareness of carbon neutrality and climate change will sustain long-term market demand.