Market Overview

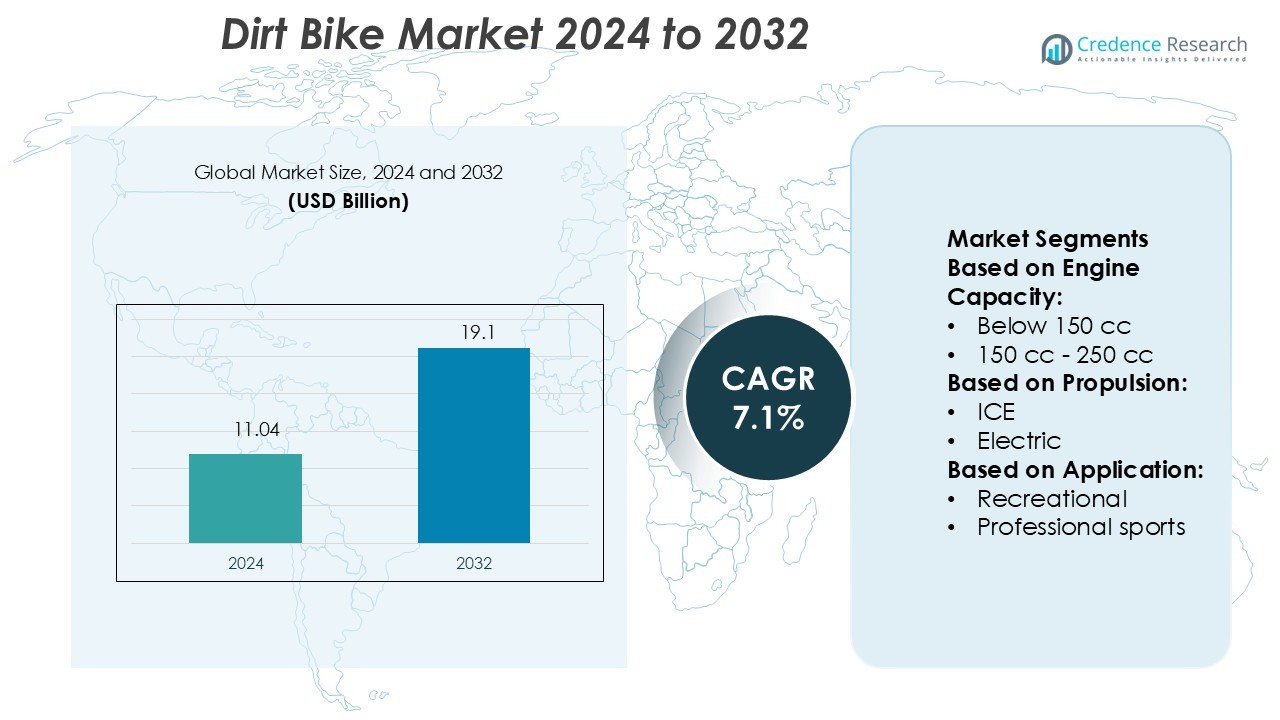

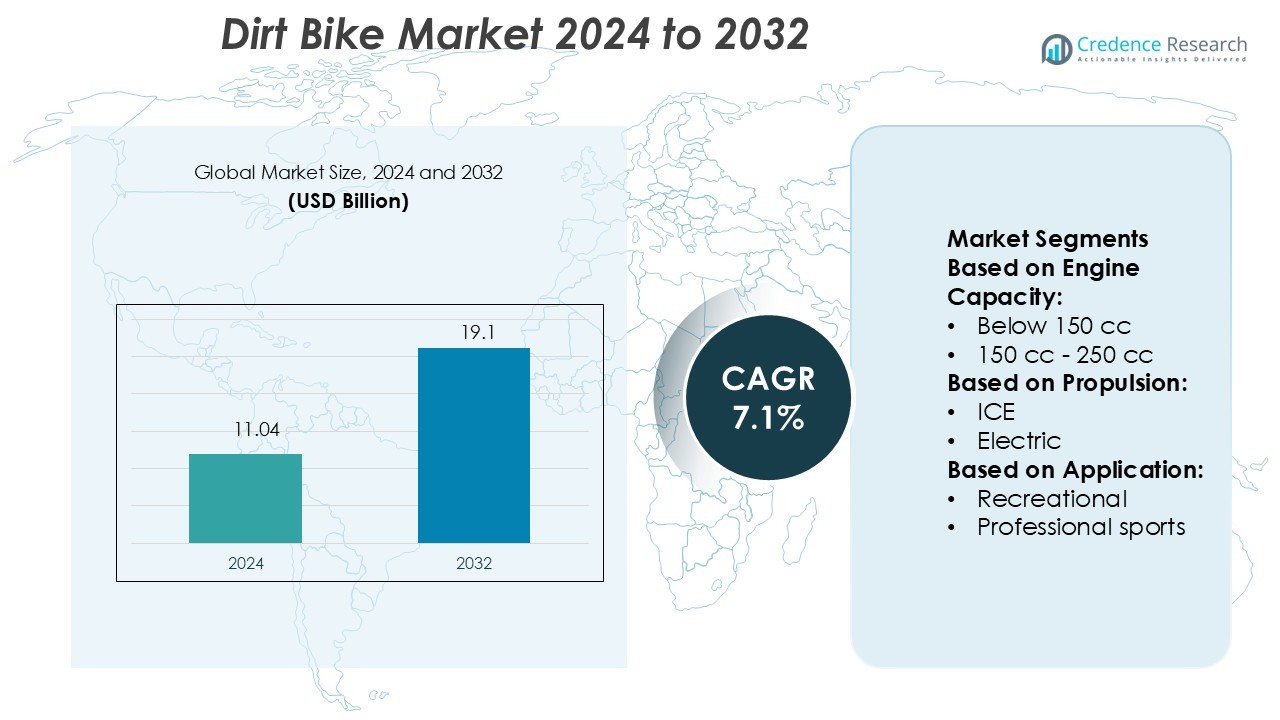

Dirt Bike Market size was valued USD 11.04 billion in 2024 and is anticipated to reach USD 19.1 billion by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dirt Bike Market Size 2024 |

USD 11.04 Billion |

| Dirt Bike Market, CAGR |

7.1% |

| Dirt Bike Market Size 2032 |

USD 19.1 Billion |

The Dirt Bike Market is led by key manufacturers such as Hyosung, Beta Group, KTM, Honda, Yamaha, Kawasaki, Sherco, Suzuki, AJP, and SSR Motorsports. These companies drive competition through performance upgrades, product innovation, and global distribution networks. Leading players invest in lightweight frames, electric models, and advanced suspension systems to enhance riding experience and meet growing recreational demand. North America dominates the global market with a 38% share, supported by a strong motocross culture, developed racing infrastructure, and increasing youth participation. The region benefits from established brands, organized racing events, and high consumer spending on off-road vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dirt Bike Market was valued at USD 11.04 billion in 2024 and is expected to reach USD 19.1 billion by 2032, growing at a CAGR of 7.1%.

- Strong demand from recreational riders and professional racing is driving market growth, supported by rising interest in adventure sports and enhanced product features.

- Key players such as Hyosung, Beta Group, KTM, Honda, Yamaha, Kawasaki, Sherco, Suzuki, AJP, and SSR Motorsports focus on electric models, performance upgrades, and wide distribution to stay competitive.

- High costs of dirt bikes and maintenance, along with strict emission norms, remain major restraints, slowing adoption in developing regions.

- North America leads with a 38% regional share due to strong racing infrastructure and consumer spending, while the 250 cc–450 cc engine capacity segment holds the highest share, driven by its balance of power and performance.

Market Segmentation Analysis:

By Engine Capacity

The 250 cc–450 cc segment dominates the dirt bike market with a strong market share. This range provides an ideal balance between power and control, attracting both professional and advanced recreational riders. High torque and performance make these bikes suitable for motocross, enduro racing, and trail riding. Manufacturers are enhancing engine efficiency and reducing weight, improving handling and acceleration. Below 150 cc bikes hold steady demand among beginners due to lower costs and easy maneuverability, while above 450 cc models cater to niche segments focused on extreme sports and professional racing.

- For instance, Hyosung’s larger cruiser GV650 uses a 647 cc engine producing approximately 75 HP at 9,000 rpm and 61.2 Nm of torque at 7,500 rpm. This illustrates the high-capacity niche of cruisers beyond 450 cc.

By Propulsion

The Internal Combustion Engine (ICE) segment leads the propulsion category with a clear majority share. ICE dirt bikes remain the preferred choice due to their power output, long riding range, and robust aftermarket support. Strong presence in competitive sports and recreational use drives their sales. Electric dirt bikes are rapidly gaining momentum, supported by technological innovation and rising environmental awareness. Their lightweight design, low maintenance needs, and silent operation appeal to urban riders and young enthusiasts. Increasing investments in battery technology and charging infrastructure will support further adoption.

- For instance, Beta’s 2025 EVO 2T 125 (a trials bike) features a bore and stroke of 54.0 mm x 54.5 mm and a 15.9:1 compression ratio for its 124.8 cc engine.

By Application

The recreational segment holds the largest market share, driven by growing participation in off-road activities and trail riding. Affordable mid-range models and flexible financing options encourage wider consumer adoption. Professional sports contribute significantly, supported by global motocross and enduro racing events that drive brand visibility and performance demand. Adventure and touring is an emerging segment, gaining traction among long-distance riders who prefer lightweight, durable, and high-endurance bikes. Increasing leisure spending and the popularity of weekend adventure rides further boost the segment’s growth.

Key Growth Drivers

Rising Popularity of Off-Road Sports

The rising interest in off-road racing and adventure sports is boosting dirt bike sales. Enthusiasts increasingly participate in motocross events, enduro races, and recreational trail riding. Manufacturers introduce advanced bikes with improved suspension and lightweight frames to match this demand. Countries with growing motorsport communities, such as the U.S., Australia, and Japan, support frequent competitions. Media coverage and sponsorship also promote brand visibility. This growth in organized events drives consistent demand for high-performance bikes and accessories, strengthening market expansion across both professional and recreational user bases.

- For instance, KTM’s 2026 XC-W/EXC lineup includes the 449.9 cc 4-stroke engine in the 450 XCF-W, with a bore and stroke of 95 mm × 63.4 mm. The bike has a manufacturer-listed weight (without fuel) of 107.5 kg.

Technological Advancements in Bike Design

Modern dirt bikes are becoming lighter, more durable, and energy-efficient. Key brands invest in advanced suspension systems, fuel-efficient engines, and enhanced safety features. Electric propulsion models are gaining attention for low emissions and easy maintenance. Features such as adjustable suspensions and smart riding modes improve performance for beginners and professionals. These technological upgrades increase consumer appeal and expand usage in varied terrains. As manufacturers focus on rider experience, the integration of innovation directly supports higher adoption rates and market growth, especially in developed regions with strong motorsport cultures.

- For instance, Honda’s 2026 CRF450RWE features a 449.7 cc liquid-cooled Unicam® single-cylinder four-stroke engine with bore × stroke of 96.0 mm × 62.1 mm and compression ratio of 13.5 : 1.

Growing Youth Participation and Lifestyle Shifts

A growing number of young riders are entering the dirt biking community, driving new product demand. Social media and influencer marketing encourage youth participation, creating lifestyle appeal around off-road biking. Manufacturers offer entry-level models with accessible pricing and enhanced safety features to attract new riders. Training programs and dedicated motocross parks also support this trend. The increasing acceptance of dirt biking as a recreational activity strengthens its market base. This youth-driven lifestyle shift fuels long-term growth opportunities for brands and dealers across both developed and emerging markets.

Key Trends & Opportunities

Shift Toward Electric Dirt Bikes

The market is witnessing a strong shift toward electric propulsion due to environmental regulations and consumer demand for quieter, cleaner rides. Electric dirt bikes offer low maintenance, instant torque, and better control. Leading manufacturers are investing in battery technology and charging infrastructure to boost adoption. Adventure tourism operators also favor electric models for eco-friendly trail experiences. As governments promote sustainable transport, the electric segment creates new revenue opportunities. This trend positions electric dirt bikes as a major growth area within the global off-road vehicle industry.

- For instance, Yamaha’s prototype TY‑E 2.0 features a newly developed lithium-ion battery with about 2.5 times the capacity of its predecessor, while keeping the weight increase down to roughly 20 %.

Integration of Smart Features and Connectivity

Connectivity features such as GPS tracking, ride analytics, and smartphone integration are becoming common in new dirt bike models. Riders use these technologies to monitor performance, track trails, and enhance safety. Manufacturers are leveraging IoT and telematics to offer personalized riding experiences. These smart features attract tech-savvy consumers and support brand differentiation in a competitive market. The integration of connectivity solutions also enables subscription-based services and upgrades, opening new business opportunities for OEMs and aftermarket providers across key regions.

- For instance, KX™ 250 features Bluetooth® connectivity via the RIDEOLOGY THE APP KX™, which allows users to view engine rpm, throttle angle, intake pressure, coolant temperature and ignition offset from their smartphone.

Expansion of Organized Adventure Tourism

Adventure tourism is expanding rapidly, creating strong demand for dirt bikes in rental and touring services. Tour operators in regions like Southeast Asia, Europe, and Latin America are adding off-road biking packages. Improved infrastructure, such as dedicated trails and safety facilities, supports this growth. Governments are also promoting adventure sports to boost tourism revenue. This expansion offers brands opportunities to supply fleet solutions and maintenance services. It strengthens market visibility and attracts new riders, increasing overall sales volumes and recurring service revenues.

Key Challenges

High Cost of Ownership and Maintenance

Dirt bikes require frequent servicing, specialized parts, and performance upgrades, leading to high ownership costs. Advanced suspension systems, tires, and engine components increase repair expenses. These costs often limit adoption among price-sensitive consumers, especially in emerging markets. Electric bikes also face expensive battery replacement and limited charging support. This financial barrier restricts market penetration, particularly for youth and first-time buyers. Addressing cost challenges through modular designs, affordable financing, and subscription-based ownership models will be key to unlocking wider adoption.

Regulatory and Environmental Restrictions

Strict emission regulations, noise restrictions, and land-use policies affect dirt biking activities in many regions. Governments often limit off-road riding areas to protect ecosystems, reducing event frequency and trail access. This impacts both recreational and professional segments. Manufacturers face additional compliance costs related to emission standards and noise control technologies. These regulatory pressures can delay product launches and reduce consumer participation. Balancing environmental protection with market growth will require investment in sustainable technologies and strategic engagement with regulatory authorities.

Regional Analysis

North America

North America leads the dirt bike market with a 36% share, driven by its strong motorsport culture and extensive off-road infrastructure. The U.S. and Canada host several national motocross events, supporting high consumer engagement. Key manufacturers maintain a strong retail network, offering advanced models and financing options. The region’s high disposable income also drives premium bike sales. Electric dirt bikes are gaining popularity due to strict emission regulations. Government support for recreational sports and adventure tourism further strengthens market growth. This mature and well-structured market is expected to maintain its leadership position over the forecast period.

Europe

Europe holds a 29% market share, supported by a deep-rooted off-road racing tradition and organized motocross leagues. Countries such as Germany, France, and the U.K. dominate regional demand. Strong regulatory frameworks encourage the adoption of electric and low-emission dirt bikes. Manufacturers also focus on launching lightweight and connected models for enthusiasts and professionals. Expanding eco-trails and tourism initiatives create new opportunities for rentals and tour operators. Favorable government policies for green mobility further drive segment growth. The region’s commitment to sustainability positions it as a leading hub for electric dirt bike adoption.

Asia Pacific

Asia Pacific accounts for a 22% market share, driven by growing youth participation and rising disposable incomes. Countries like Australia, Japan, and India are witnessing increased interest in recreational off-road biking. Affordable entry-level models and growing availability of training facilities support adoption. Manufacturers are expanding dealer networks and launching region-specific bikes to meet demand. Adventure tourism is rapidly expanding in Southeast Asia, creating opportunities for fleet-based businesses. Supportive tourism policies and increasing event sponsorships boost the market outlook. This region is expected to record the fastest growth due to its expanding middle-class consumer base.

Latin America

Latin America holds an 8% market share, supported by a rising interest in recreational motorsport activities. Brazil, Argentina, and Mexico are key contributors to regional demand. Economic improvements and affordable financing options are helping increase bike ownership. Off-road tourism is gaining popularity, particularly in rural and scenic landscapes. Manufacturers are entering partnerships with local distributors to expand their presence. Challenges such as limited racing infrastructure and regulatory hurdles still exist. However, strong youth interest and expanding trail networks offer significant long-term opportunities for market penetration and growth in this region.

Middle East & Africa

The Middle East & Africa region represents a 5% market share, with growing demand from the UAE, South Africa, and Saudi Arabia. Expanding adventure tourism and desert racing culture support market growth. Governments are investing in tourism infrastructure, creating favorable conditions for dirt bike events and rentals. Rising disposable income and lifestyle shifts among young consumers drive adoption. Limited local manufacturing and high import costs remain key barriers. However, increasing international partnerships and expansion of organized racing events are expected to strengthen market growth and brand presence over the coming years.

Market Segmentations:

By Engine Capacity:

- Below 150 cc

- 150 cc – 250 cc

By Propulsion:

By Application:

- Recreational

- Professional sports

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The dirt bike market include Hyosung, Beta Group, KTM, Honda, Yamaha, Kawasaki, Sherco, Suzuki, AJP, and SSR Motorsports. The dirt bike market is highly competitive, shaped by continuous innovation, strategic branding, and strong dealer networks. Manufacturers focus on developing lightweight, high-performance bikes with improved suspension systems and advanced control features. The growing demand for electric and hybrid dirt bikes is driving investment in battery technology and sustainable designs. Companies actively engage in sponsorships, motocross championships, and adventure tourism partnerships to strengthen brand visibility. Customization, connectivity integration, and enhanced rider safety features play key roles in gaining customer loyalty. Affordable financing, after-sales services, and global expansion strategies also intensify competition, making the market dynamic and innovation-driven.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hyosung

- Beta Group

- KTM

- Honda

- Yamaha

- Kawasaki

- Sherco

- Suzuki

- AJP

- SSR Motorsports

Recent Developments

- In February 2025, KTM received creditor approval for its restructuring plan, securing in fresh liquidity to resume full production while exploring additional shareholder investment.

- In July 2024, Yamaha announced its 2025 off-road motorcycle lineup, featuring significant updates. Targeting riders across all skill levels, the YZ250FX and WR250F are key highlights, both adapted from the YZ250F motocrosser and optimized for specific applications.

- In May 2024, Honda introduced extensive updates to its 2025 CRF450R and CRF250R motocross models, incorporating feedback from Team Honda HRC riders Jett and Hunter Lawrence. Chassis improvements enhance rigidity and handling, while engine upgrades provide controlled power. These advancements are also applied to the CRF450RX, CRF250RX, and the premium CRF450RWE.

- In November 2023, Kawasaki introduced two new models in the Indian market. The 2024 KX 85 and the KLX 300R are set to capture the attention of dirt bike enthusiasts. Priced at Rs 4.20 lakh and Rs 5.60 lakh (ex-showroom), respectively, these bikes promise high performance and durability.

Report Coverage

The research report offers an in-depth analysis based on Engine Capacity, Propulsion, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth in electric dirt bikes due to stricter emission norms.

- Manufacturers will focus on lightweight designs to improve performance and rider comfort.

- Adventure tourism and recreational riding will create new demand in emerging markets.

- Integration of smart features and connectivity will enhance user experience.

- Investment in battery technology will improve range and charging speed.

- Youth participation and motorsport events will continue to boost sales volumes.

- Companies will expand dealer networks to strengthen market access globally.

- Sustainable production practices will become a core strategy for leading brands.

- Financing and subscription models will make dirt bikes more accessible.

- Regulatory changes will drive innovation in low-noise and eco-friendly models.