Market Overview

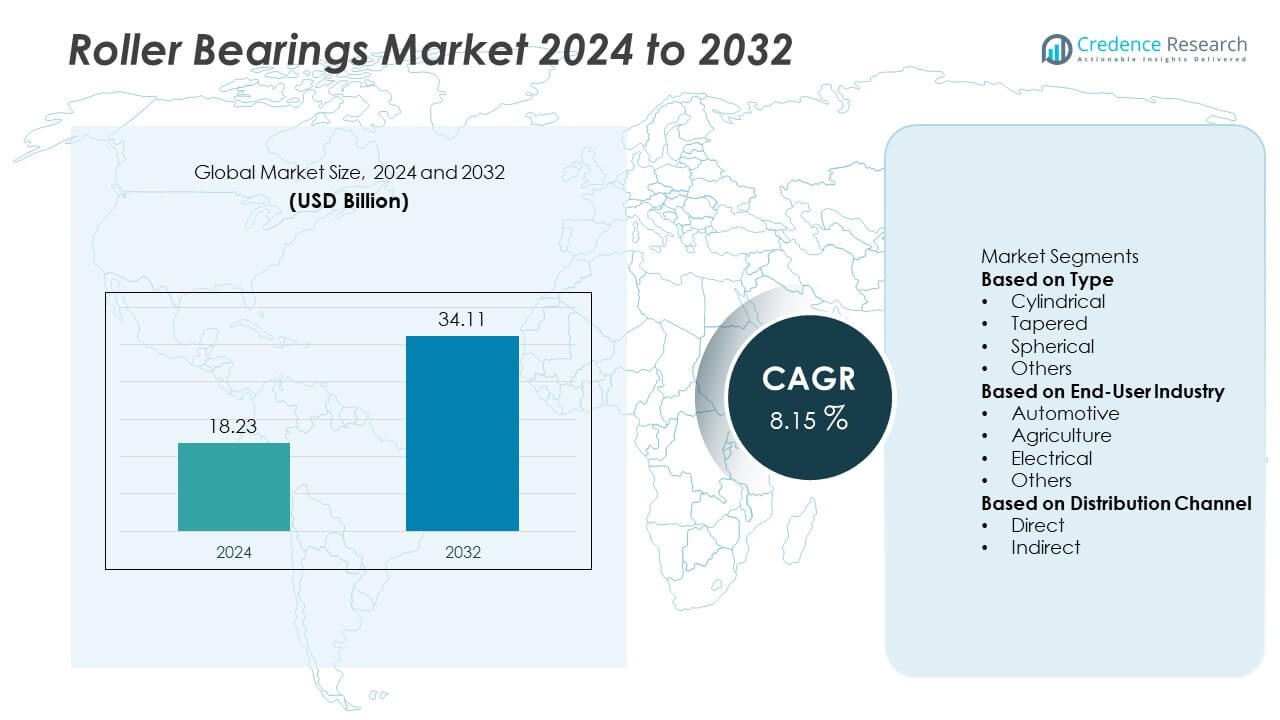

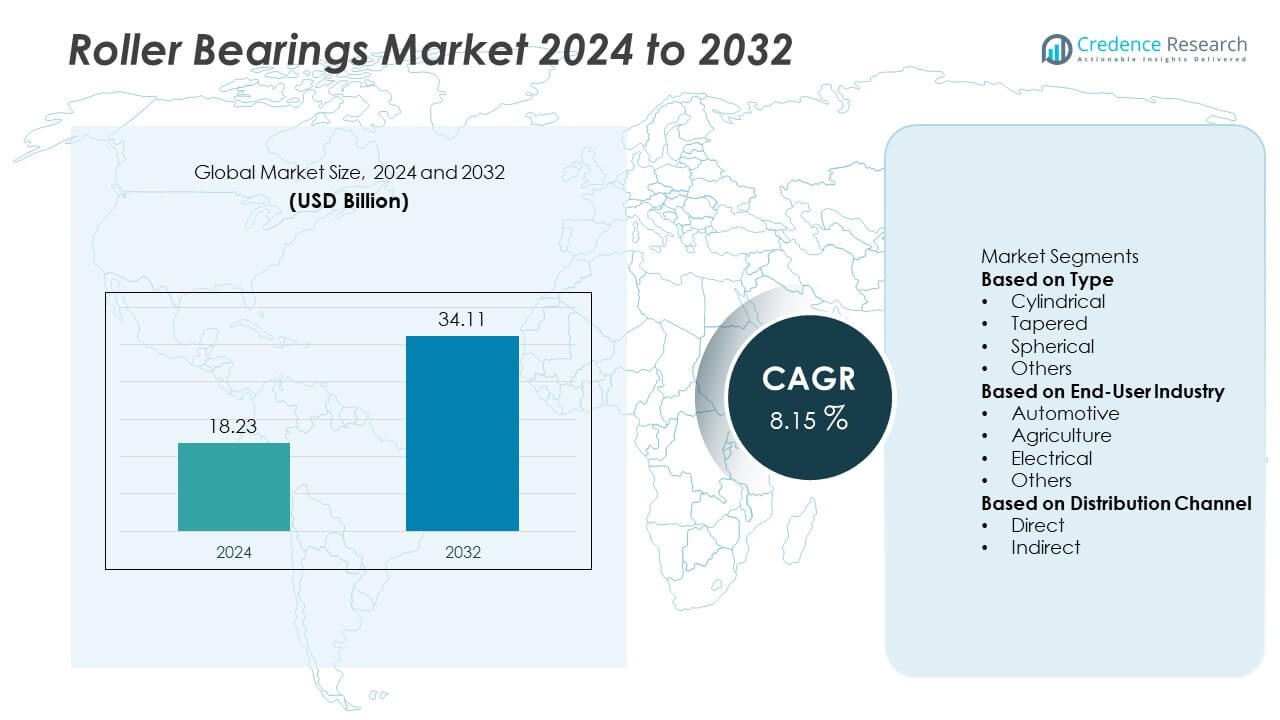

The global roller bearings market was valued at USD 18.23 billion in 2024 and is projected to reach USD 34.11 billion by 2032, growing at a CAGR of 8.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roller Bearings Market Size 2024 |

USD 18.23 Billion |

| Roller Bearings Market, CAGR |

8.15% |

| Roller Bearings Market Size 2032 |

USD 34.11 Billion |

The roller bearings market is led by major players including JTEKT, Harbin Bearing Manufacturing, NBI Bearings Europe, Brammer, C&U Group, Luoyang LYC Bearing, Minebea, NSK, HKT Bearings, and Daido Metal. These companies dominate through innovation in precision engineering, material strength, and advanced lubrication systems. Asia-Pacific led the global market with a 34% share in 2024, driven by large-scale automotive production and expanding industrial automation in China, India, and Japan. North America followed with a 29% share, supported by strong demand from manufacturing and aerospace sectors. Continuous R&D investments and expansion of digitalized, smart bearing solutions enhance global competitiveness across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global roller bearings market was valued at USD 18.23 billion in 2024 and is projected to reach USD 34.11 billion by 2032, growing at a CAGR of 8.15% during the forecast period.

- Market growth is driven by expanding automotive and industrial production, increased demand from renewable energy projects, and advancements in precision engineering technologies.

- Key trends include the integration of smart bearings with IoT sensors, adoption of lightweight hybrid materials, and growing use of predictive maintenance systems.

- The competitive landscape is led by JTEKT, NSK, Minebea, Harbin Bearing Manufacturing, and C&U Group, focusing on innovation in high-load and energy-efficient bearing solutions.

- Asia-Pacific held 34%, North America 29%, and Europe 27% market shares in 2024, while the tapered roller bearings segment dominated with 38% share, driven by its widespread use in automotive, rail, and heavy machinery applications.

Market Segmentation Analysis:

By Type

The tapered roller bearings segment dominated the roller bearings market with a 38% share in 2024, driven by their extensive use in automotive wheel hubs, heavy machinery, and industrial equipment. These bearings support both radial and axial loads, making them ideal for high-load and high-speed applications. The growing production of commercial vehicles and construction equipment continues to fuel demand. Advancements in heat-treated steel and precision manufacturing enhance durability and load-bearing capacity. Increasing adoption in railways, mining, and gearboxes further reinforces this segment’s leading position in the global market.

- For instance, NSK developed its 7th-generation low-friction tapered roller bearings featuring optimized internal geometry and proprietary heat-treated steel. The design achieves a 20% reduction in rotational friction torque and operates with surface roughness under 0.03 micrometers Ra.

By End-User Industry

The automotive segment held the largest share of 44% in 2024, supported by the rising demand for high-performance vehicles and electric mobility solutions. Roller bearings play a key role in reducing friction, improving fuel efficiency, and enhancing durability in engines, transmissions, and wheel systems. The shift toward lightweight and energy-efficient designs boosts adoption across both passenger and commercial vehicles. Continuous investment by manufacturers in precision-engineered and low-noise bearings strengthens product performance. Expanding vehicle production in Asia-Pacific and Europe further drives this segment’s dominance.

- For instance, JTEKT Corporation has developed advanced bearings, including hybrid ceramic versions and those designed for high-temperature and high-speed operation, to address the specific demands of EV powertrains.

By Distribution Channel

The direct distribution channel accounted for a 53% share in 2024, emerging as the preferred mode for large-scale industrial and OEM customers. Manufacturers favor direct sales to ensure product authenticity, customization, and technical support for specialized applications. This channel allows companies to build long-term partnerships with clients in automotive, aerospace, and manufacturing sectors. Increasing adoption of digital platforms and direct e-commerce portals enhances customer reach and efficiency. The focus on supply chain transparency, competitive pricing, and after-sales services continues to strengthen the dominance of direct distribution globally.

Key Growth Drivers

Expanding Automotive and Industrial Production

The rapid expansion of automotive manufacturing and industrial automation is a major growth driver for the roller bearings market. Bearings are essential for improving motion efficiency and reducing friction in engines, transmissions, and assembly machinery. Increasing demand for electric vehicles (EVs) and high-performance components enhances product usage. Growth in construction, mining, and railways further drives adoption. Manufacturers are developing precision-engineered bearings with improved load-carrying capacity to support modern vehicle designs and heavy-duty equipment, fueling consistent market growth.

- For instance, MinebeaMitsumi, a leading manufacturer of high-precision bearings, produces components for electric vehicle (EV) applications, leveraging advanced materials like vacuum-degassed high-carbon chromium bearing steel and offering bearings with seals to prevent lubricant leakage.

Technological Advancements and Smart Bearing Adoption

Advancements in sensor-based and condition-monitoring roller bearings are transforming industrial operations. Smart bearings equipped with IoT and AI capabilities enable real-time performance tracking, reducing downtime and maintenance costs. The trend toward predictive maintenance in manufacturing and transportation sectors is boosting adoption. Companies are integrating temperature, vibration, and load sensors to enhance reliability. These innovations improve operational efficiency and safety, supporting long-term demand across industries adopting Industry 4.0 and digital manufacturing systems.

- For instance, SKF launched its Insight Roller Bearing equipped with an embedded wireless sensor module operating at 2.4 GHz for vibration and temperature monitoring. Each bearing measures surface temperature up to 120°C with ±1°C accuracy and vibration levels between 10 Hz and 10 kHz.

Rising Demand from Renewable Energy and Heavy Equipment Sectors

The growth of wind energy and heavy-duty equipment industries is significantly contributing to market expansion. Roller bearings are critical in wind turbines, where they ensure stability and efficiency under extreme conditions. The construction and mining sectors also rely on high-load-bearing solutions to support heavy machinery and conveyors. Rising global investments in renewable infrastructure and large-scale industrial projects continue to boost demand. The shift toward durable, high-performance bearings capable of operating under harsh environments strengthens market resilience and diversification.

Key Trends & Opportunities

Shift Toward Lightweight and Energy-Efficient Materials

The market is witnessing a strong shift toward lightweight, energy-efficient bearings made from advanced alloys and composite materials. These innovations reduce energy loss, enhance wear resistance, and extend operational lifespan. Manufacturers are focusing on hybrid bearings using ceramic rolling elements to achieve higher rotational speeds. Growing emphasis on sustainable and low-friction materials aligns with the automotive sector’s fuel efficiency goals and global emission reduction targets, presenting lucrative opportunities for technology-driven suppliers.

- For instance, Schaeffler offers hybrid bearings (e.g., designated with the prefix HC) combining bearing steel rings and silicon nitride (Si₃N₄) ceramic rolling elements for high-performance applications, such as electric motors, with superior durability and higher speed capabilities than standard steel bearings.

Increasing Use of Automation and Predictive Maintenance Systems

Automation and predictive maintenance are creating new opportunities in the roller bearings industry. Integration of digital monitoring tools and AI-powered analytics enables real-time fault detection and performance optimization. Industrial plants and transportation systems are adopting these technologies to enhance reliability and operational uptime. Manufacturers offering data-enabled bearing solutions gain a competitive advantage by reducing lifecycle costs for end-users. The ongoing shift toward smart factories and connected production lines is expected to accelerate demand for intelligent bearing systems.

- For instance, ABB developed its Ability Smart Sensor system for mounted bearings, which monitors vibration levels up to 1.6 kHz and temperature with an accuracy of ±2 °C. The device stores data internally at user-defined intervals and transmits condition data via Bluetooth or optionally through a gateway using LoRaWAN to ABB’s cloud-based platform.

Key Challenges

High Manufacturing and Maintenance Costs

The production of precision roller bearings requires advanced materials, machining, and heat treatment processes, leading to high manufacturing costs. Price volatility of raw materials like steel and ceramics further impacts profitability. Maintenance of large industrial bearings also adds significant operational expenses. Small and medium enterprises often face cost barriers to adopting high-end bearing technologies. Manufacturers are investing in automation and efficient production methods to minimize expenses while maintaining performance standards and competitiveness in the global market.

Stringent Quality Standards and Market Competition

Compliance with international quality standards such as ISO and ASTM poses a challenge for smaller manufacturers. Bearings used in critical applications—like aerospace, railways, and wind turbines—demand high precision and reliability. Failure to meet these standards can lead to costly recalls or operational failures. Additionally, intense competition from low-cost regional producers pressures established brands to innovate while maintaining affordability. Continuous R&D investment and stringent testing processes are essential for sustaining market credibility and long-term growth.

Regional Analysis

North America

North America held a 29% share in 2024, driven by strong demand from the automotive, aerospace, and industrial machinery sectors. The U.S. leads the market with extensive manufacturing capabilities and adoption of advanced bearing technologies. Growth is supported by the expansion of electric vehicle production and industrial automation projects. Manufacturers are investing in sensor-integrated and low-friction bearings to improve energy efficiency and performance. Rising focus on precision engineering, along with the presence of major OEMs and distributors, continues to strengthen North America’s dominance in the global roller bearings market.

Europe

Europe accounted for a 27% share in 2024, supported by the region’s strong automotive and renewable energy industries. Germany, France, and Italy are key contributors due to their established manufacturing bases and technological innovation. The growing use of roller bearings in wind turbines, railways, and heavy machinery boosts market growth. Strict regulations promoting energy-efficient and sustainable solutions encourage adoption of advanced materials. European companies are focusing on hybrid bearings and digital monitoring systems to enhance reliability. The region’s ongoing industrial modernization and focus on precision equipment sustain steady market demand.

Asia-Pacific

Asia-Pacific dominated the roller bearings market with a 34% share in 2024, led by rapid industrialization and infrastructure development. China, India, and Japan are major markets, driven by expanding automotive, rail, and manufacturing sectors. The region benefits from large-scale production facilities, low-cost labor, and increasing export volumes. Investments in renewable energy and construction equipment also enhance market prospects. Local manufacturers are focusing on producing high-performance bearings to meet rising domestic and international demand. Continuous growth in electric mobility and industrial automation further strengthens Asia-Pacific’s position as the global market leader.

Middle East & Africa

The Middle East & Africa held a 5% share in 2024, driven by infrastructure expansion, oil and gas projects, and industrial diversification. Countries such as Saudi Arabia, the UAE, and South Africa are investing in advanced machinery and construction equipment that rely on roller bearings. The demand for high-durability bearings in mining, energy, and transportation applications is growing. Regional manufacturers are focusing on partnerships with global bearing suppliers to enhance technological expertise. Increasing industrial automation and government initiatives supporting local manufacturing are expected to drive moderate market growth in the coming years.

Latin America

Latin America captured a 5% share in 2024, supported by growth in automotive, mining, and agricultural machinery industries. Brazil and Mexico are leading markets, driven by expanding vehicle production and modernization of industrial infrastructure. Rising adoption of energy-efficient and corrosion-resistant bearings enhances equipment reliability in challenging environments. The region benefits from increasing foreign investments in manufacturing and heavy engineering sectors. However, economic fluctuations and limited local production capacity pose challenges. Ongoing industrial automation and regional trade partnerships are expected to strengthen Latin America’s roller bearings market in the forecast period.

Market Segmentations:

By Type

- Cylindrical

- Tapered

- Spherical

- Others

By End-User Industry

- Automotive

- Agriculture

- Electrical

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the roller bearings market includes key players such as JTEKT, Harbin Bearing Manufacturing, NBI Bearings Europe, Brammer, C&U Group, Luoyang LYC Bearing, Minebea, NSK, HKT Bearings, and Daido Metal. These companies compete through technological innovation, product reliability, and global distribution networks. Leading manufacturers focus on developing high-precision, energy-efficient, and long-life roller bearings for automotive, industrial, and renewable energy applications. Continuous investment in R&D supports advancements in hybrid materials, lubrication systems, and smart bearing technologies with condition monitoring capabilities. Strategic mergers, collaborations, and capacity expansions enhance global reach and production efficiency. Companies are also emphasizing sustainable manufacturing practices and lightweight designs to meet energy efficiency standards. The growing use of customized and application-specific bearings further intensifies competition, driving manufacturers to innovate and maintain strong relationships with OEMs across multiple industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JTEKT

- Harbin Bearing Manufacturing

- NBI Bearings Europe

- Brammer

- C&U Group

- Luoyang LYC Bearing

- Minebea

- NSK

- HKT Bearings

- Daido Metal

Recent Developments

- In April 2025, MinebeaMitsumi Inc. announced the adoption of 15 of its miniature ball bearings (outer diameter 3.0 mm and 1.5 mm) for a luxury mechanical wrist-metronome, demonstrating ultra-precision manufacturing capabilities.

- In April 2024, NSK Ltd. introduced its 7th generation low-friction tapered roller bearings, which offer a friction reduction of about 20 % across the full rotation speed range in mobility applications.

- In 2024, NSK released a new series of spherical roller bearings for wind turbine main shafts, reducing raceway wear by more than 90 % compared to standard models.

- In 2024, NSK developed a high-performance bearing for servomotors that features ultra-low particle emission aimed at EV drive units and other precision applications.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User Industry, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand from automotive, industrial, and energy sectors.

- Smart bearings with IoT and AI integration will enhance predictive maintenance and performance.

- Lightweight and hybrid material bearings will gain traction for energy efficiency.

- Growth in renewable energy projects will increase usage in wind turbines and generators.

- Electric vehicle adoption will boost demand for high-precision and low-friction bearings.

- Asia-Pacific will remain the leading region due to large-scale manufacturing and infrastructure growth.

- Manufacturers will focus on sustainability and environmentally friendly lubrication technologies.

- Automation and robotics will drive innovation in high-speed, durable bearing systems.

- Strategic mergers and partnerships will strengthen global supply chains and production capacity.

- Continuous advancements in coating, sealing, and condition monitoring will improve bearing reliability and lifespan.