Market Overview

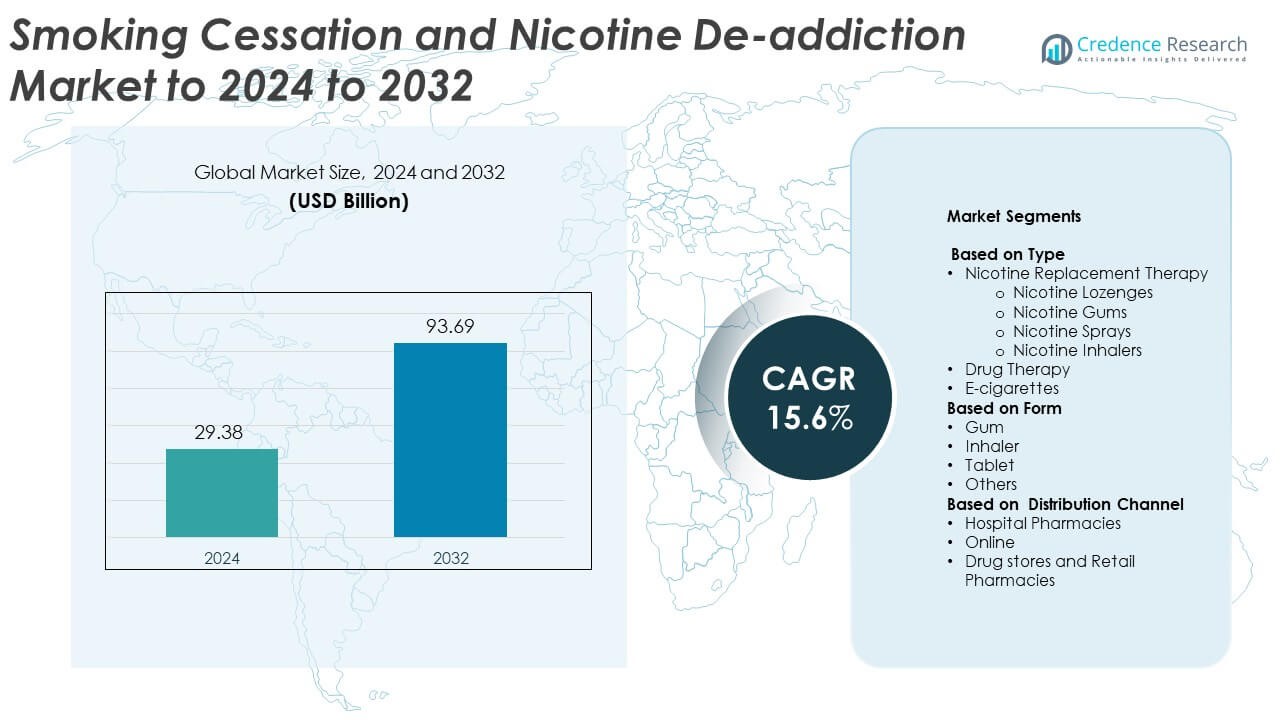

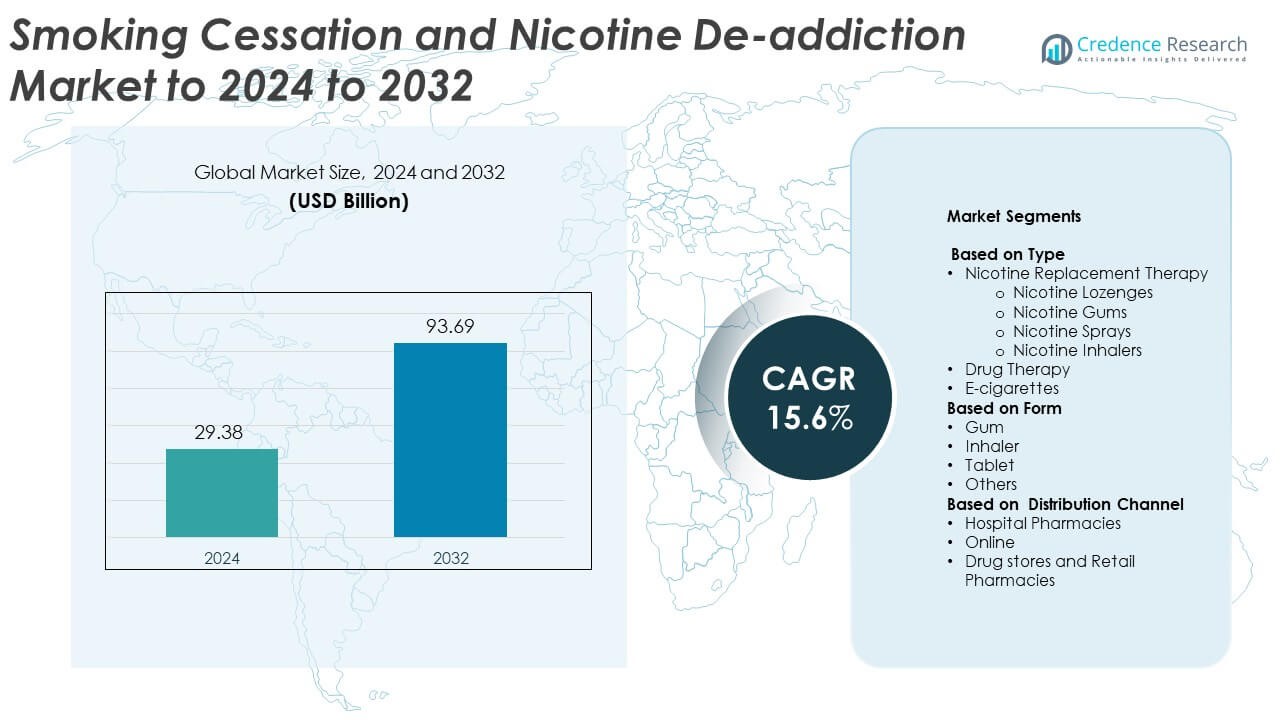

The smoking cessation and nicotine de-addiction market size was valued at USD 29.38 billion in 2024 and is anticipated to reach USD 93.69 billion by 2032, at a CAGR of 15.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smoking Cessation and Nicotine De-Addiction Market Size 2024 |

USD 29.38 Billion |

| Smoking Cessation and Nicotine De-Addiction Market, CAGR |

15.6% |

| Smoking Cessation and Nicotine De-Addiction Market Size 2032 |

USD 93.69 Billion |

The smoking cessation and nicotine de-addiction market is led by major players including Johnson and Johnson Inc, British American Tobacco Plc, Cipla Ltd, Imperial Brands Plc, GlaxoSmithKline Plc, Dr. Reddy’s Laboratories Ltd, Rusan Pharma Ltd, Altria, Perrigo Company Plc, Zydus Group, and NJOY, LLC. These companies focus on developing advanced nicotine replacement therapies, prescription drugs, and e-cigarette solutions to reduce tobacco dependence. North America led the global market in 2024 with a 38.6% share, supported by high awareness levels, favorable healthcare initiatives, and strong retail and digital distribution networks driving widespread product adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smoking cessation and nicotine de-addiction market was valued at USD 29.38 billion in 2024 and is projected to reach USD 93.69 billion by 2032, growing at a CAGR of 15.6%.

- Rising health awareness, government-led anti-smoking campaigns, and innovation in nicotine replacement therapies are driving market growth globally.

- Growing adoption of e-cigarettes, digital cessation tools, and online distribution platforms is shaping new market trends.

- The market remains competitive with companies focusing on advanced nicotine delivery systems and strategic collaborations to expand reach.

- North America led with a 38.6% share in 2024, followed by Europe at 27.4%, while the nicotine replacement therapy segment dominated with 52.7% share due to strong product acceptance and accessibility.

Market Segmentation Analysis:

By Type

The nicotine replacement therapy segment dominated the smoking cessation and nicotine de-addiction market in 2024, accounting for a 52.7% share. Its leadership stems from widespread adoption of lozenges, gums, sprays, and inhalers that help manage nicotine withdrawal symptoms safely. Nicotine gums held the largest share within this category due to easy availability, low cost, and fast onset of craving relief. Growing consumer preference for self-administered and over-the-counter products further boosts demand. Rising awareness campaigns by healthcare organizations promoting NRT use also strengthen segment growth across developed and emerging economies.

- For instance, Dr. Reddy’s said the Nicotinell/Nicabate/Habitrol portfolio it’s acquiring is sold in 30+ markets worldwide, underscoring broad NRT adoption.

By Form

The gum segment led the market in 2024 with a 39.8% share, driven by convenience and faster nicotine absorption. Chewing gums offer controlled nicotine release, making them a preferred option for gradual withdrawal. Their discreet use and availability in multiple flavors increase compliance among users. Manufacturers are introducing sugar-free and long-lasting formulations to enhance effectiveness and appeal. The ease of distribution through both online and offline channels and supportive recommendations by health professionals sustain the dominance of nicotine gums in the overall market.

- For instance, in July 2021, Philip Morris International (PMI) acquired Danish-based Fertin Pharma, a major contract development and manufacturing organization specializing in oral and intra-oral delivery technologies, including nicotine gums. In 2020, before the acquisition, Fertin Pharma reported net revenues of approximately 1.1 billion Danish kroner

By Distribution Channel

Drug stores and retail pharmacies dominated the market in 2024, capturing a 46.3% share. Their strong presence, easy accessibility, and established trust among consumers drive this leadership. Retail pharmacies provide a broad product range, including nicotine gums, lozenges, and prescription drugs, supporting wider consumer reach. Expansion of pharmacy chains in urban and semi-urban regions enhances market penetration. Additionally, pharmacist-led smoking cessation programs and counseling initiatives increase product adoption. The combination of professional guidance and immediate product availability continues to position retail pharmacies as the leading distribution channel.

Key Growth Drivers

Rising Awareness of Health Risks Associated with Smoking

Growing awareness about the health hazards of tobacco use is a major driver of market growth. Governments and health organizations are conducting campaigns highlighting smoking-related diseases such as lung cancer and heart disease. Increased awareness has encouraged individuals to adopt nicotine replacement and drug therapies. Initiatives by the World Health Organization and national health agencies to reduce tobacco use have significantly expanded the adoption of smoking cessation products, particularly in urban populations seeking healthier lifestyles.

- For instance, Kenvue reports that its “Total Quit™” campaign referenced internal data showing “1 in 5 nicotine users start by using products such as electronic cigarettes or nicotine pouches instead of traditional cigarettes.

Technological Advancements in Nicotine Replacement Products

Innovation in nicotine delivery systems is enhancing product safety and user convenience. Companies are developing advanced gums, lozenges, and inhalers that offer controlled nicotine release and improved absorption rates. E-cigarettes with smart temperature controls and flavor regulation are gaining traction as transition tools for smokers. These innovations address side effects associated with traditional cessation products and improve adherence rates, which drives overall market expansion.

- For instance, British American Tobacco (BAT)’s R.J. Reynolds Vapor Company received U.S. FDA marketing authorization in July 2024 for the Vuse Alto device and 6 tobacco-flavored pods. The authorization covers the device and pods in “Golden Tobacco” and “Rich Tobacco” flavors, each in three nicotine strengths (1.8%, 2.4%, and 5%), based on a Premarket Tobacco Product Application.

Government Support and Regulatory Initiatives

Government-led initiatives and funding for tobacco control programs play a key role in market growth. Several countries have introduced taxation on tobacco products and provided subsidies for smoking cessation therapies. Regulatory frameworks promoting nicotine replacement therapies through approved healthcare channels have encouraged product accessibility. Supportive healthcare policies and smoking bans in public places further contribute to increasing demand for cessation and de-addiction solutions.

Key Trends and Opportunities

Growing Adoption of E-Cigarettes and Digital Cessation Tools

The rise of e-cigarettes as a transitional aid is shaping new market opportunities. Digital cessation tools such as mobile apps and virtual counseling platforms are becoming popular for personalized progress tracking. Integration of behavioral support with digital programs enhances treatment success rates. Technology-driven interventions are expected to expand the market scope among tech-savvy users, especially in North America and Europe.

- For instance, Pelago’s Quit Genius randomized trial showed 27.2% abstinence at 26 weeks and 22.6% at 52 weeks, outperforming brief advice.

Expansion in Online Sales Channels

Online pharmacies and e-commerce platforms are emerging as vital growth channels for nicotine de-addiction products. Consumers prefer online purchasing due to convenience, privacy, and wider product selection. Major companies are investing in digital marketing and subscription-based models for recurring sales. The increasing adoption of online healthcare services, coupled with growing digital literacy, continues to support market expansion across developing regions.

- For instance, Amazon Pharmacy confirms prescription delivery in all 50 U.S. states, enabling nationwide online access to cessation therapies.

Key Challenges

Concerns Over E-Cigarette Safety and Regulation

The growing debate over e-cigarette safety poses a significant challenge. Health authorities continue to raise concerns about vaping-related lung injuries and the addictive nature of flavored nicotine products. Regulatory uncertainty and periodic bans on e-cigarette sales in certain countries hinder consistent market growth. Manufacturers face the challenge of balancing innovation with compliance to evolving global health standards.

High Relapse Rates and Limited Long-Term Effectiveness

Despite increasing product availability, relapse rates among smokers remain high. Many users discontinue nicotine replacement or drug therapies due to side effects or lack of motivation. Limited behavioral support in some programs reduces long-term success rates. This challenge underscores the need for integrated solutions combining pharmacological, behavioral, and digital support systems to enhance patient adherence and sustained recovery.

Regional Analysis

North America

North America held the largest 38.6% share of the smoking cessation and nicotine de-addiction market in 2024. The region’s dominance is supported by strong healthcare infrastructure, high awareness levels, and government-backed anti-smoking initiatives. The United States leads the market with widespread adoption of nicotine replacement therapies and e-cigarettes. Favorable reimbursement policies and the presence of key players such as Pfizer and Johnson & Johnson further strengthen growth. Increasing use of digital cessation platforms and counseling programs also enhances treatment accessibility across both urban and rural populations.

Europe

Europe accounted for a 27.4% share of the global market in 2024. The region benefits from strict tobacco control regulations and growing acceptance of nicotine replacement therapies. The United Kingdom, Germany, and France are key contributors due to high adoption of e-cigarettes and government-supported quit-smoking campaigns. Expanding public healthcare coverage for cessation treatments and strong retail pharmacy networks continue to support product demand. Rising preference for non-invasive drug-free solutions also drives innovation and adoption among consumers seeking safer alternatives.

Asia Pacific

Asia Pacific captured a 22.8% share of the smoking cessation and nicotine de-addiction market in 2024. Rapid urbanization, increasing tobacco use, and growing government health awareness programs are driving demand for de-addiction products. Countries such as China, Japan, and India are experiencing a shift toward nicotine replacement therapies and digital cessation platforms. Expanding healthcare expenditure and local manufacturing capabilities are strengthening regional supply chains. The growing young population and rising online product availability further support strong market expansion across the region.

Latin America

Latin America held an 8.2% share of the global market in 2024, led by Brazil and Mexico. Government-led tobacco control campaigns and awareness drives are encouraging product adoption. Expanding access to over-the-counter nicotine gums and patches is increasing sales through retail and online channels. However, limited affordability and lower healthcare penetration restrain faster growth. The rising popularity of e-cigarettes and mobile health applications presents new opportunities for smoking cessation programs in urban centers across the region.

Middle East and Africa

The Middle East and Africa region accounted for a 3.0% share of the market in 2024. Growth is primarily driven by increasing awareness of smoking-related health issues and gradual introduction of anti-tobacco regulations. Countries such as South Africa, Saudi Arabia, and the United Arab Emirates are witnessing growing interest in nicotine gums and lozenges. Despite limited healthcare access in some parts, expanding pharmaceutical distribution networks and rising disposable income levels are improving product availability. The region offers long-term growth potential through government partnerships promoting tobacco harm reduction.

Market Segmentations:

By Type

- Nicotine Replacement Therapy

- Nicotine Lozenges

- Nicotine Gums

- Nicotine Sprays

- Nicotine Inhalers

- Drug Therapy

- E-cigarettes

By Form

- Gum

- Inhaler

- Tablet

- Others

By Distribution Channel

- Hospital Pharmacies

- Online

- Drug stores and Retail Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smoking cessation and nicotine de-addiction market is highly competitive, with key players such as Johnson and Johnson Inc, British American Tobacco Plc, Cipla Ltd, Imperial Brands Plc, GlaxoSmithKline Plc, Dr. Reddy’s Laboratories Ltd, Rusan Pharma Ltd, Altria, Perrigo Company Plc, Zydus Group, and NJOY, LLC leading the industry. Companies are focusing on expanding product portfolios through advanced nicotine replacement therapies, innovative drug formulations, and e-cigarette technologies. Strategic mergers, acquisitions, and partnerships with healthcare providers are enhancing market reach and customer engagement. Many manufacturers are investing in R&D to develop non-addictive nicotine alternatives and behavioral support tools integrated with digital platforms. Regulatory compliance and clinical validation remain top priorities to meet global safety standards. Firms are also strengthening their online distribution networks and leveraging data analytics to track consumer behavior. Increasing emphasis on personalized treatment and technological integration is reshaping the competitive landscape toward evidence-based, user-centric solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson and Johnson Inc

- British American Tobacco Plc

- Cipla Ltd

- Imperial Brands Plc

- GlaxoSmithKline Plc

- Reddy’s Laboratories Ltd

- Rusan Pharma Ltd

- Altria

- Perrigo Company Plc

- Zydus Group

- NJOY, LLC

Recent Developments

- In 2023, Perrigo received final U.S. FDA approval for its generic nicotine-coated mint lozenges in 2 mg and 4 mg strengths, expanding its over-the-counter (OTC) NRT offerings.

- In 2023, Imperial Brands, a tobacco and nicotine company, acquired nicotine pouches from TJP Labs to enter the U.S. market and expand its non-traditional nicotine products.

- In 2023, Altria completed its acquisition of NJOY Holdings, Inc., and the e-cigarette company is a key component of Altria’s strategy to move beyond traditional combustible cigarettes into the smoke-free market.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing government funding for anti-smoking campaigns will drive higher product adoption.

- Advancements in nicotine replacement formulations will improve user compliance and treatment success.

- Digital health platforms and mobile cessation apps will expand behavioral support access.

- Rising youth awareness and health-conscious lifestyles will reduce smoking initiation rates.

- Expansion of online pharmacies will strengthen product distribution and global reach.

- Strategic collaborations between pharma and tech firms will accelerate product innovation.

- Regulatory approvals for novel nicotine delivery systems will boost market penetration.

- Integration of AI-based tracking tools will enhance personalized cessation programs.

- Growing preference for herbal and non-nicotine alternatives will diversify product portfolios.

- Emerging markets in Asia Pacific and Latin America will offer significant growth potential.