Market Overview:

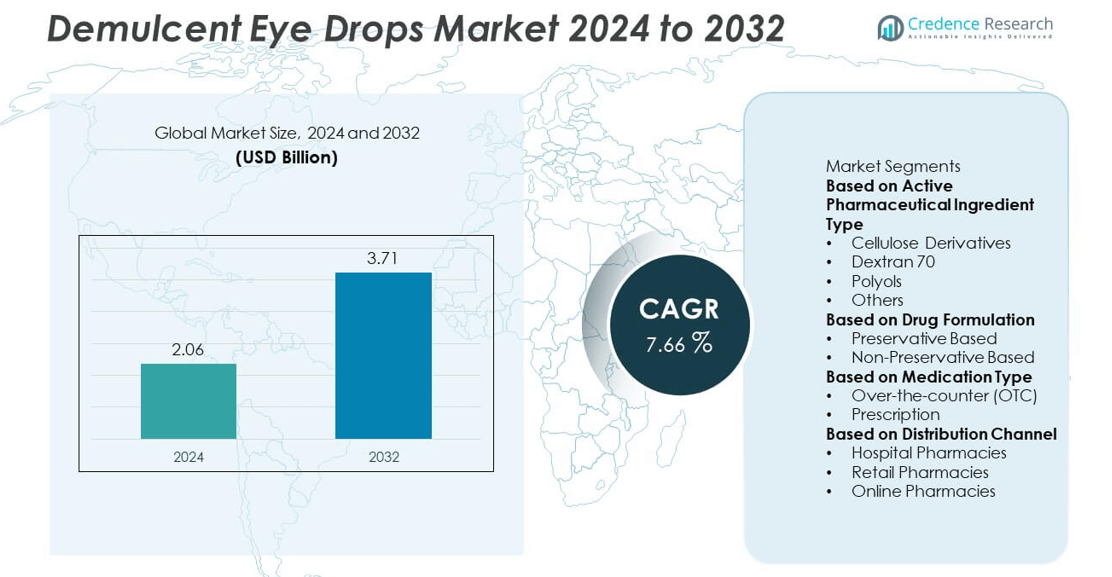

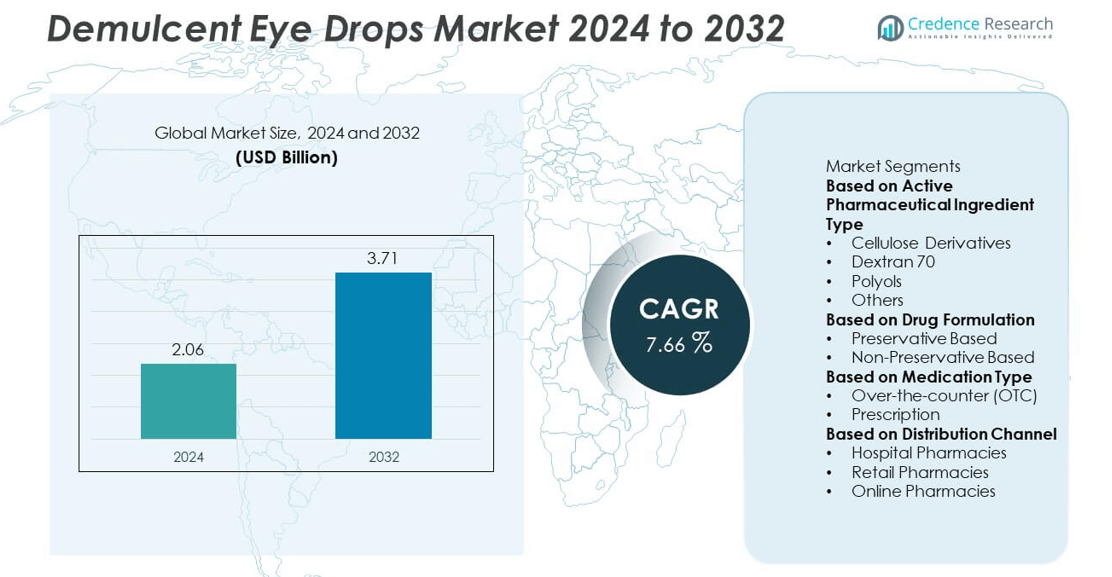

The global demulcent eye drops market was valued at USD 2.06 billion in 2024 and is expected to reach USD 3.71 billion by 2032, expanding at a CAGR of 7.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Demulcent Eye Drops Market Size 2024 |

USD 2.06 billion |

| Demulcent Eye Drops Market, CAGR |

7.66% |

| Demulcent Eye Drops Market Size 2032 |

USD 3.71 billion |

The demulcent eye drops market features major players such as Santen Pharmaceutical Co. Ltd., Alcon Inc., Otsuka Pharmaceutical Co. Ltd., Prestige Consumer Healthcare Inc., Bausch Health Companies Inc., Johnson and Johnson Services Inc., Sentiss Pharma Pvt. Ltd., Aurolab, OASIS Medical, and Allergan (AbbVie Inc.). These companies lead through strong product portfolios, advanced R&D capabilities, and global distribution networks. North America dominated the market with a 38% share in 2024, supported by high adoption of OTC eye care products and advanced healthcare infrastructure. Europe followed with 29%, driven by growing demand for preservative-free and polymer-based formulations. Asia Pacific emerged as the fastest-growing region with 23% share, fueled by expanding retail networks and rising consumer awareness of digital eye strain.

Market Insights

- The demulcent eye drops market was valued at USD 2.06 billion in 2024 and is projected to reach USD 3.71 billion by 2032, growing at a CAGR of 7.66%.

- Rising prevalence of dry eye syndrome, increasing screen exposure, and growing aging populations are driving product demand across global markets.

- The shift toward preservative-free and polymer-based formulations is a key trend, improving ocular comfort and long-term safety.

- Leading players such as Santen Pharmaceutical Co. Ltd., Alcon Inc., and Bausch Health Companies Inc. focus on innovation, mergers, and expanding online retail presence to strengthen competitiveness.

- North America dominated with 38% market share in 2024, followed by Europe with 29% and Asia Pacific with 23%; among ingredients, cellulose derivatives held 46% share, highlighting their superior lubrication and longer ocular retention.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Active Pharmaceutical Ingredient Type

The cellulose derivatives segment dominated the demulcent eye drops market with a 46% share in 2024. Its dominance stems from wide use of carboxymethylcellulose and hydroxypropyl methylcellulose, which offer superior viscosity and prolonged ocular surface retention. These ingredients help stabilize tear film and reduce evaporation, improving comfort for patients with chronic dry eye. Rising cases of digital eye strain and aging-related dryness drive demand for cellulose-based drops. Manufacturers continue to develop optimized formulations combining cellulose derivatives with osmoprotectants for extended relief and reduced dosing frequency.

- For instance, Alcon Inc. produces Systane® Ultra, which is formulated with polyethylene glycol 400 and propylene glycol for dry eye relief. Alcon’s newer product, Systane® Complete, is advertised to deliver hydration for up to 8 hours.

By Drug Formulation

The preservative-based segment accounted for the largest share of 58% in 2024, supported by affordability and long shelf life. These formulations are preferred for mild to moderate dry eye treatment in retail and hospital pharmacies. Benzalkonium chloride and polyquaternium preservatives ensure microbial safety, making them common in multi-dose containers. However, rising awareness of preservative-induced irritation is encouraging gradual transition toward preservative-free options. Major producers are launching novel packaging solutions that maintain sterility while avoiding preservative exposure, supporting market balance between cost-effectiveness and ocular safety.

- For instance, Johnson & Johnson’s Blink® Tears line includes formulations containing 0.01 % polyquaternium-1 preservative and is distributed to more than 60 countries worldwide.

By Medication Type

The over-the-counter (OTC) segment held the leading 64% market share in 2024, driven by increasing self-medication trends and accessibility through retail pharmacies and e-commerce channels. OTC demulcent eye drops offer quick relief for dryness caused by digital screens, pollution, and contact lens use. Their growing adoption is supported by brand availability and physician recommendations for mild symptoms. Expanding marketing by consumer healthcare companies and rising screen time among younger populations continue to fuel demand. Enhanced awareness of eye wellness and comfort-oriented daily-use formulations further strengthen OTC segment dominance.

Key Growth Drivers

Rising Prevalence of Dry Eye Syndrome

The increasing incidence of dry eye syndrome remains a major driver of market growth. Factors such as aging populations, extended digital screen exposure, and air pollution contribute to ocular surface dryness and irritation. According to global health estimates, over 30% of adults experience symptoms linked to dry eye conditions. This growing patient base supports higher prescription and OTC eye drop usage. Continuous product innovation and awareness campaigns on eye health further expand demand for demulcent formulations in both developed and emerging markets.

- For instance, Santen Pharmaceutical introduced Hyalein® Mini, containing 0.1% purified sodium hyaluronate to combat dry eye syndrome. This active ingredient has a high water-retention ability, which increases tear film stability and promotes corneal wound healing.

Growing Use of Digital Devices

Rising screen time from smartphones, computers, and tablets has amplified cases of digital eye strain, accelerating demand for lubricating eye drops. Professionals and students spending long hours on digital devices face reduced blink rates, leading to dryness and discomfort. Manufacturers respond by introducing formulations designed for daily use with minimal side effects. Increasing awareness about preventive eye care and the availability of preservative-free products also encourage regular usage among tech-driven consumers worldwide.

- For instance, Allergan (AbbVie Inc.) developed Refresh Optive® Mega-3, a lubricant eye drop containing 0.5% carboxymethylcellulose and flaxseed oil, which has been shown in a clinical study to significantly increase tear lipid layer thickness in patients with dry eye.

Expansion of E-commerce and OTC Accessibility

Widespread availability of demulcent eye drops through e-commerce platforms and retail pharmacies supports market expansion. Consumers prefer online purchases due to convenience, easy price comparison, and subscription-based product deliveries. Leading healthcare companies enhance product visibility through digital marketing and awareness initiatives. The shift toward self-care and over-the-counter options strengthens demand, especially for mild eye dryness. Growing sales in online pharmacies across North America, Europe, and Asia further accelerate the market’s distribution network and consumer reach.

Key Trends & Opportunities

Shift Toward Preservative-Free Formulations

A notable trend in the market is the shift toward preservative-free demulcent eye drops. Prolonged use of preservatives like benzalkonium chloride may cause corneal irritation, prompting manufacturers to develop preservative-free multi-dose systems. This shift aligns with consumer preference for gentle, long-term ocular care. Companies are adopting advanced bottle designs with filtration systems to maintain sterility. The trend creates opportunities for premium product differentiation, especially in chronic dry eye management.

- For instance, OASIS Medical’s Oasis TEARS PF Plus line features a patented multi-dose bottle with a valve and air venting system, maintaining sterility for up to 90 days after opening.

Innovation in Polymer-Based Ingredients

Technological advancement in polymer chemistry is enabling longer-lasting and more comfortable eye drop formulations. Modern cellulose derivatives, carbomers, and polyols improve tear film stability and enhance hydration retention on the ocular surface. These advanced ingredients allow extended relief and reduced application frequency. Opportunities exist for developing hybrid formulations combining polymers and osmoprotectants, which can address severe and evaporative dry eye conditions effectively.

- For instance, Prestige Consumer Healthcare’s Clear Eyes® Triple Action lubricant contains polyvinyl alcohol and povidone, which are demulcents that provide soothing comfort for up to 12 hours by moisturizing and relieving dry, irritated eyes under conditions of high digital exposure.

Key Challenges

Regulatory Barriers and Stringent Approval Processes

Stringent regulatory requirements for ophthalmic products present a major challenge for manufacturers. Demulcent eye drops must meet strict sterility, safety, and efficacy standards before approval. The complexity of obtaining certifications from agencies such as the FDA and EMA increases time-to-market and compliance costs. Smaller companies often face financial and procedural constraints in product development and registration. These regulatory hurdles slow innovation and market entry, especially in regions with evolving pharmaceutical frameworks.

Price Sensitivity and Generic Competition

High competition from low-cost generic products challenges branded eye drop manufacturers. Price-sensitive consumers, especially in emerging markets, often opt for generics, limiting premium product sales. Additionally, local players offer similar formulations at lower prices, reducing profit margins for multinational brands. This competitive pressure encourages companies to focus on differentiation through preservative-free lines and advanced packaging. Maintaining balance between affordability and innovation remains critical for sustaining long-term market share.

Regional Analysis

North America

North America led the demulcent eye drops market with a 38% share in 2024. The dominance is driven by a high prevalence of dry eye syndrome, advanced healthcare infrastructure, and widespread access to OTC eye care products. Increasing screen exposure among working professionals and strong adoption of preservative-free formulations further boost demand. The U.S. remains the primary contributor, supported by established brands and continuous R&D by companies investing in long-acting lubricants. Rising awareness about preventive eye care and digital device-related eye strain continues to sustain regional market leadership.

Europe

Europe accounted for a 29% share of the demulcent eye drops market in 2024, supported by aging demographics and high incidence of ocular surface diseases. Demand is reinforced by strong healthcare reimbursement systems and consumer preference for preservative-free and natural ingredient-based formulations. The U.K., Germany, and France represent key markets with growing awareness of digital eye fatigue. Increased adoption of online pharmacies and self-care products further supports growth. Continuous innovation by regional pharmaceutical companies and adherence to strict safety regulations maintain Europe’s strong market position.

Asia Pacific

Asia Pacific held a 23% market share in 2024 and is the fastest-growing regional market. Rising population, increasing digital screen usage, and expanding urbanization are major growth factors. Japan, China, and India drive demand through expanding pharmaceutical retail networks and growing acceptance of OTC eye drops. Increasing healthcare spending and awareness campaigns about dry eye prevention enhance adoption. Local manufacturers are also entering the market with cost-effective formulations. The region’s high consumer base and expanding e-commerce channels make it a key future growth hub.

Latin America

Latin America captured an 6% share of the demulcent eye drops market in 2024. Market growth is influenced by improving access to eye care products and expanding retail pharmacy networks. Brazil and Mexico lead demand, driven by increasing cases of environmental eye irritation and digital screen exposure. Rising middle-class income and greater healthcare awareness promote adoption of OTC drops. However, limited healthcare infrastructure and low ophthalmic consultation rates hinder faster growth. Multinational companies are expanding presence through local partnerships and affordable product lines.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share in 2024, driven by increasing healthcare investments and rising awareness of ocular health. The United Arab Emirates, Saudi Arabia, and South Africa lead consumption due to growing digital device penetration and exposure to dry, dusty climates. Adoption of preservative-free and lubricant-rich formulations is rising, particularly in urban centers. However, limited product availability in rural areas and affordability challenges restrict broader market penetration. Ongoing retail expansion and government eye-care initiatives are expected to strengthen market development.

Market Segmentations:

By Active Pharmaceutical Ingredient Type

- Cellulose Derivatives

- Dextran 70

- Polyols

- Others

By Drug Formulation

- Preservative Based

- Non-Preservative Based

By Medication Type

- Over-the-counter (OTC)

- Prescription

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the demulcent eye drops market is characterized by strong presence of key players such as Santen Pharmaceutical Co. Ltd., Alcon Inc., Otsuka Pharmaceutical Co. Ltd., Prestige Consumer Healthcare Inc., Bausch Health Companies Inc., Johnson and Johnson Services Inc., Sentiss Pharma Pvt. Ltd., Aurolab, OASIS Medical, and Allergan (AbbVie Inc.). These companies focus on developing advanced formulations that enhance ocular hydration and minimize preservative-related irritation. Major players invest heavily in R&D to introduce polymer-based and preservative-free variants catering to chronic dry eye conditions. Strategic initiatives such as product launches, acquisitions, and partnerships strengthen market penetration across hospitals, retail pharmacies, and online platforms. Regional manufacturers, particularly in Asia Pacific, emphasize affordability and wide distribution to compete with multinational brands. Growing consumer preference for non-irritating, long-lasting eye lubricants continues to drive innovation and intensify competition among established and emerging companies in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Santen Pharmaceutical Co. Ltd.

- Alcon Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Prestige Consumer Healthcare Inc.

- Bausch Health Companies Inc.

- Johnson and Johnson Services Inc.

- Sentiss Pharma Pvt. Ltd.

- Aurolab

- OASIS Medical

- Allergan (AbbVie Inc.)

Recent Developments

- In July 2025, Alcon Inc. launched TRYPTYR® (acoltremon ophthalmic solution) 0.003% in the U.S., the first-in‐class TRPM8 receptor agonist for dry‐eye disease, which demonstrated increased natural tear production as early as day 1.

- In June 2025, Santen Pharmaceutical Co., Ltd. announced that the Ryjunea® low-dose atropine eye drop (0.1 mg/mL) obtained market authorisation from the European Commission for children aged 3–14 with progressing myopia; this reflects expanded ophthalmic focus beyond demulcent drops.

- In August 2024, Alcon Inc. entered into a strategic agreement with OcuMension Therapeutics to transfer commercialization rights in China for its dry-eye portfolio including Systane® Ultra and other drops, enhancing regional reach of its lubricating-eyedrop assets

Report Coverage

The research report offers an in-depth analysis based on Active Pharmaceutical Ingredient Type, Drug Formulation, Medication Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for demulcent eye drops will continue rising due to growing dry eye prevalence.

- Expanding digital device usage will increase regular adoption among younger consumers.

- Preservative-free formulations will gain stronger market traction in chronic eye care.

- Manufacturers will focus on polymer-based and osmoprotectant-enhanced formulations for longer relief.

- E-commerce and retail pharmacy channels will play a greater role in global sales expansion.

- Regional manufacturers will invest in affordable, high-quality formulations to compete with global brands.

- Strategic partnerships between pharmaceutical and consumer health companies will increase product innovation.

- Awareness programs on digital eye strain and preventive eye care will boost market penetration.

- Regulatory harmonization will accelerate product approvals in developing economies.

- Continuous innovation in packaging and dosage systems will enhance user convenience and product shelf life.