Market Overview:

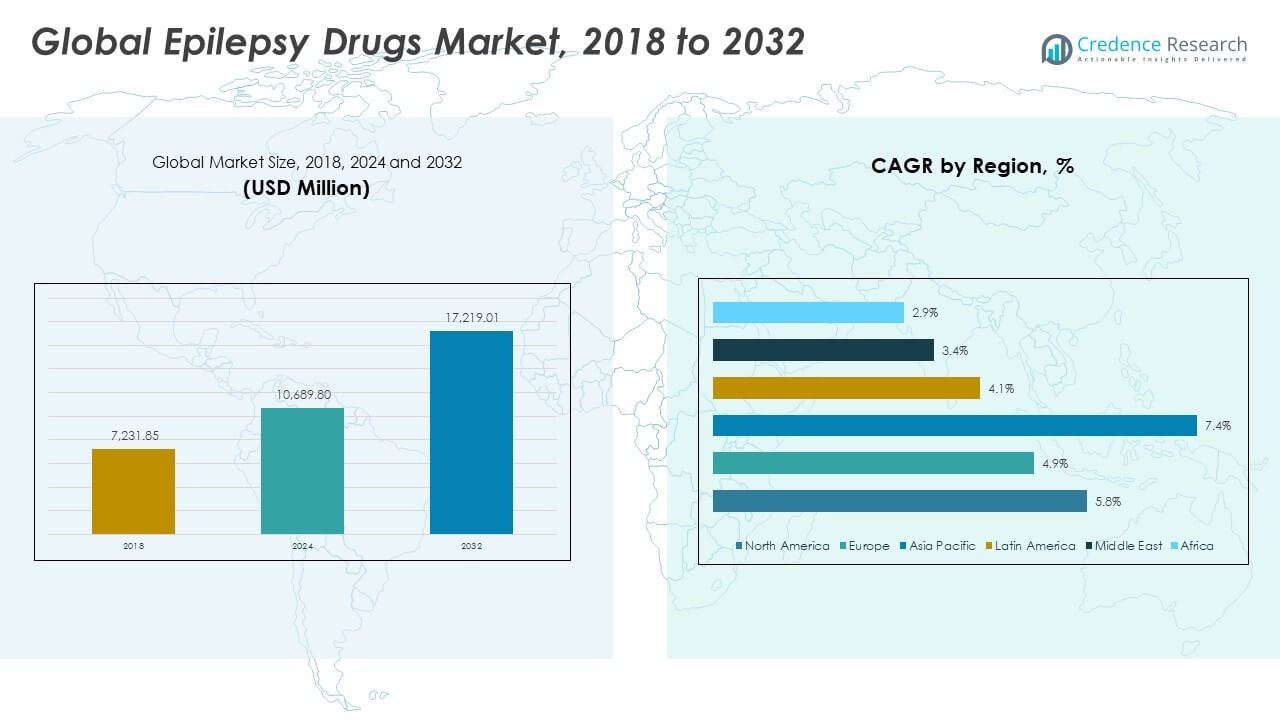

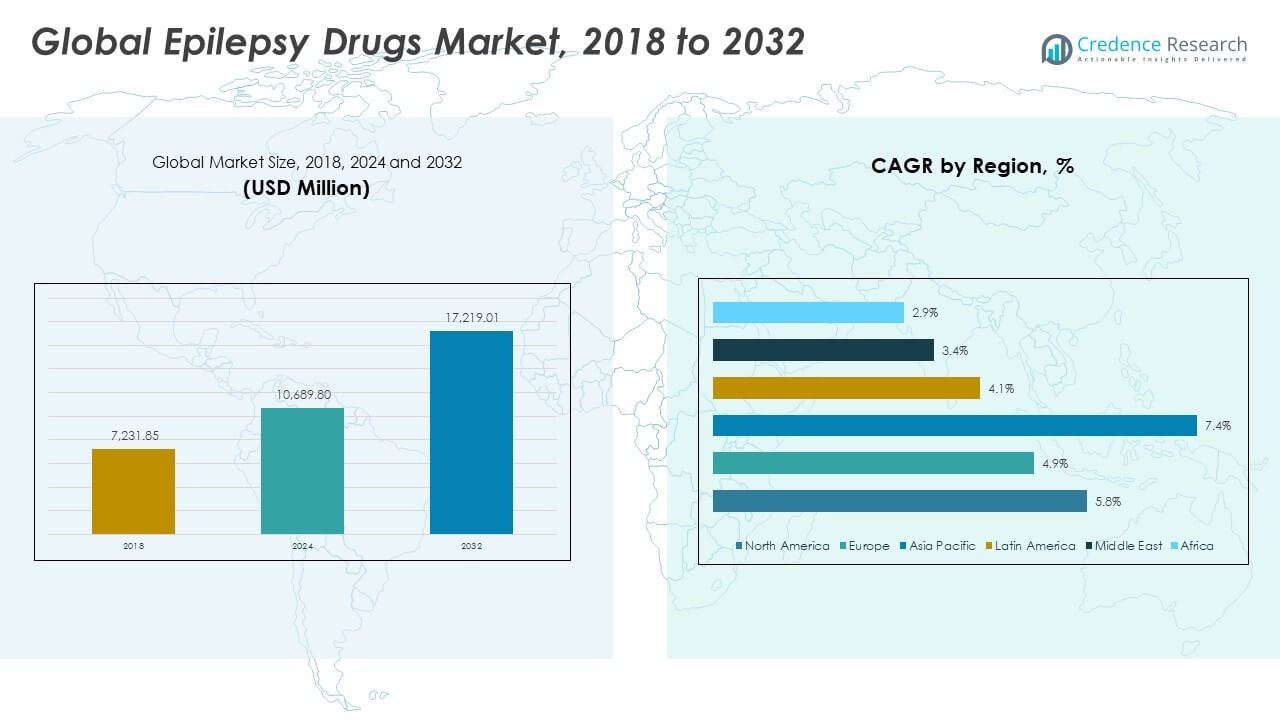

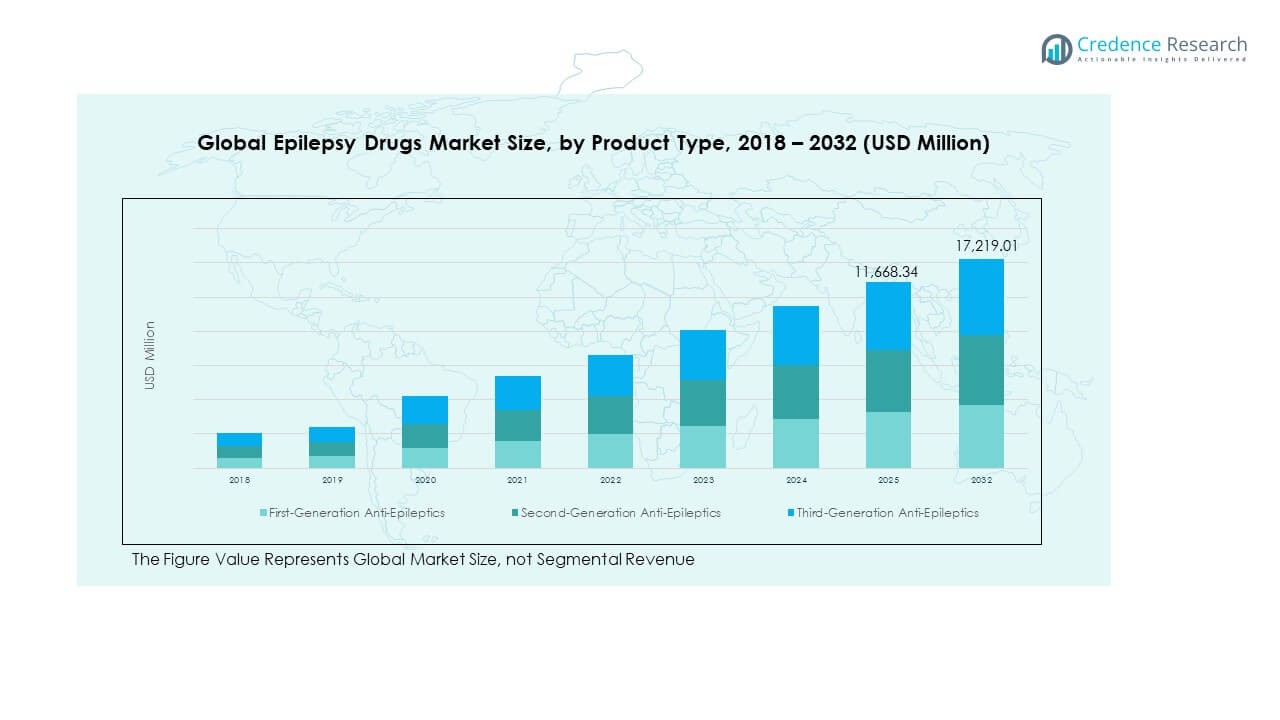

The Global Epilepsy Drugs Market size was valued at USD 7,231.85 million in 2018, increased to USD 10,689.80 million in 2024, and is anticipated to reach USD 17,219.01 million by 2032, at a CAGR of 5.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epilepsy Drugs Market Size 2024 |

USD 10,689.80 Million |

| Epilepsy Drugs Market, CAGR |

5.72% |

| Epilepsy Drugs Market Size 2032 |

USD 17,219.01 Million |

The market growth is driven by the rising prevalence of epilepsy and the growing awareness about early treatment options. Increasing access to healthcare, improved diagnostic capabilities, and supportive reimbursement policies are promoting drug adoption. Advancements in antiepileptic drug formulations offering better efficacy with fewer side effects are strengthening patient compliance. Furthermore, the ongoing research and clinical trials focused on precision medicine and novel mechanisms of action are expected to accelerate innovation in this therapeutic field.

Regionally, North America leads due to advanced healthcare infrastructure, strong presence of major pharmaceutical companies, and early adoption of novel therapies. Europe follows with high awareness and strong regulatory support for epilepsy management. The Asia Pacific region is emerging as the fastest-growing market owing to increasing healthcare expenditure, rising diagnosis rates, and expanding access to neurology care in countries like India, China, and Japan. Latin America and the Middle East & Africa are also witnessing steady improvements supported by health initiatives and patient education programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Epilepsy Drugs Market was valued at USD 7,231.85 million in 2018, reached USD 10,689.80 million in 2024, and is projected to attain USD 17,219.01 million by 2032, expanding at a CAGR of 5.72% during the forecast period.

- North America (43.3%), Europe (26.6%), and Asia Pacific (22.4%) collectively hold the majority share, driven by advanced healthcare systems, strong R&D activity, and widespread access to antiepileptic therapies.

- Asia Pacific, the fastest-growing region, is supported by expanding healthcare infrastructure, rising diagnosis rates, and increased availability of generic and branded antiepileptic drugs.

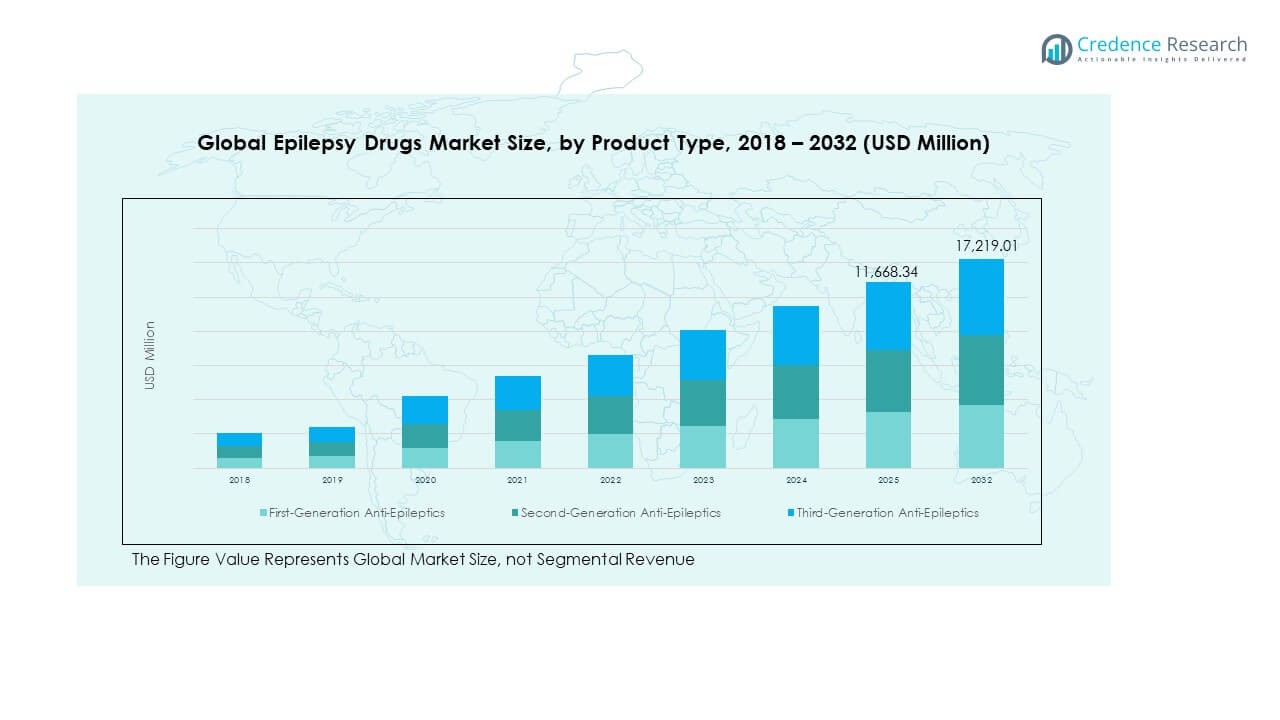

- Second-generation anti-epileptics account for approximately 50–55% of the total share, reflecting strong physician preference due to improved safety and fewer interactions.

- Third-generation anti-epileptics represent around 25–30% of market share and are expected to grow fastest owing to innovation in precision-based and extended-release formulations.

Market Drivers:

Rising Prevalence of Epilepsy and Expanding Awareness Campaigns

Growing cases of epilepsy globally are driving the demand for effective therapies. The rising diagnosis rates and awareness programs initiated by health organizations are improving early treatment adoption. Government and non-government bodies are investing in education campaigns to reduce stigma and promote medical consultation. Increasing screening in rural and underserved areas helps identify untreated patients. This widespread awareness contributes significantly to expanding patient access to modern antiepileptic drugs. Pharmaceutical companies are collaborating with healthcare foundations to conduct community outreach programs. The Global Epilepsy Drugs Market benefits from this enhanced awareness and stronger health infrastructure. Continuous public health efforts ensure sustained growth across both developed and developing economies.

- For instance, continuous public health efforts ensure sustained growth across both developed and developing economies. The Global Epilepsy Drugs Market benefits from this enhanced awareness, improved diagnostics, and stronger health infrastructure. Major epilepsy charities and pharmaceutical companies frequently collaborate on awareness campaigns that reach millions through various media, educational events, and digital platforms. This heightened awareness and patient support are key drivers of market expansion.

Growing R&D in Novel Drug Formulations and Delivery Mechanisms

Advancements in research and development are reshaping epilepsy treatment approaches. Drug manufacturers are focusing on improving efficacy, reducing adverse effects, and developing extended-release formulations. New drug delivery technologies, including transdermal and intranasal systems, enhance patient compliance. These innovations help reduce the frequency of seizures and improve quality of life for patients. Companies are increasing R&D investments in personalized and precision medicine to target genetic variants. Several pipeline drugs are showing promising results in late-stage trials. The Global Epilepsy Drugs Market continues to expand with these technological and clinical advancements. It encourages new entrants and collaborations between biotechnology and pharmaceutical firms.

- For instance, a 2024 intranasal agent showed a median time to first seizure reduction of 3.2 hours versus 6.8 hours for oral therapy in a head-to-head trial in adults. These innovations help reduce the frequency of seizures and improve quality of life for patients. Companies are increasing R&D investments in personalized and precision medicine to target genetic variants.

Supportive Healthcare Policies and Reimbursement Frameworks

Strong government policies supporting epilepsy treatment are bolstering drug accessibility. Reimbursement frameworks in developed regions make advanced therapies more affordable for patients. National healthcare programs in Europe and North America promote inclusion of epilepsy drugs under insurance coverage. Public health authorities are emphasizing the need for comprehensive neurological care networks. Expansion of epilepsy management centers also helps strengthen treatment outcomes. This structured support increases adoption across all demographics, including pediatric and geriatric patients. The Global Epilepsy Drugs Market gains momentum from favorable policies and continuous policy reforms. Improved patient affordability is creating long-term stability for the therapeutic segment.

Increasing Adoption of Generic Drugs and Cost-Effective Therapeutics

Rising demand for affordable antiepileptic medications drives market expansion. Patent expirations of major drugs have encouraged generic manufacturing across several regions. Generic drugs provide cost benefits while maintaining therapeutic efficacy, boosting accessibility in low-income nations. Healthcare systems worldwide are encouraging the use of generics to reduce treatment costs. Growing generic competition also promotes innovation among branded manufacturers. The Global Epilepsy Drugs Market experiences balanced growth between branded and generic segments. Pharmaceutical companies are diversifying portfolios to maintain competitive advantage in cost-driven markets. This dynamic balance strengthens the global supply chain for epilepsy medications.

Market Trends:

Growing Focus on Personalized Medicine and Precision Therapeutics

Personalized treatment strategies are gaining prominence in epilepsy management. Advances in genomics and biomarker-based diagnosis enable patient-specific drug selection. Pharmaceutical developers are utilizing precision medicine to minimize side effects and improve therapeutic efficacy. The integration of artificial intelligence in patient profiling supports data-driven medication customization. Hospitals are adopting predictive analytics to optimize dosage and therapy combinations. The Global Epilepsy Drugs Market benefits from these innovations in clinical decision-making. Collaborative research between academic and clinical institutions is enhancing molecular understanding of epilepsy. The trend supports better long-term outcomes and reduces drug resistance risks.

- For instance, recent consortium-funded studies have identified various novel biomarkers associated with treatment response in different diseases, such as the identification of ADIPOQ, HEY2, and FUT10 as potential predictive biomarkers in head and neck cancers in one 2024 study. The general trend in the use of such biomarkers supports better long-term outcomes and aims to reduce drug resistance risks by enabling more personalized medicine approaches.

Rising Use of Digital Health Platforms and Remote Monitoring Tools

Digital technologies are transforming epilepsy care by enabling continuous monitoring. Wearable devices and smartphone-based seizure tracking applications are improving patient management. Real-time data transmission supports physicians in adjusting treatment plans efficiently. Telemedicine platforms are helping patients in remote areas receive expert neurological consultations. Pharmaceutical companies are integrating digital adherence tools with drug programs. The Global Epilepsy Drugs Market evolves toward technology-driven patient engagement models. These tools also collect valuable data for post-market surveillance and pharmacovigilance. The trend ensures improved treatment outcomes and patient satisfaction.

- For instance, a regional tele-neurology network can connect rural clinics to specialists, often eliminating patient travel entirely for initial consultations. Pharmaceutical companies are integrating digital adherence tools with drug programs, such as those using smart blisters, sensor-enabled inhalers, and mobile apps to monitor and improve medication taking habits.

Expanding Pipeline of Next-Generation Antiepileptic Drugs

Research pipelines for antiepileptic drugs are becoming more diverse and advanced. Companies are targeting novel mechanisms such as synaptic modulation and ion channel regulation. The approval rate for innovative drugs with reduced sedation and cognitive effects is increasing. Partnerships between biotech start-ups and established firms accelerate product development. Regulatory agencies are providing fast-track approvals for drugs addressing drug-resistant epilepsy. The Global Epilepsy Drugs Market benefits from these collaborative research frameworks. New treatment classes are reshaping competitive dynamics across developed regions. The trend underscores a shift toward more targeted and efficient therapeutic approaches.

Integration of Artificial Intelligence in Drug Discovery and Clinical Trials

Artificial intelligence is improving the efficiency of drug development for epilepsy. Machine learning models help predict compound behavior and optimize clinical outcomes. AI tools accelerate the identification of drug candidates and potential biomarkers. Pharmaceutical R&D teams are using AI to design safer and more effective compounds. Automated data analytics enhance precision in clinical trial management. The Global Epilepsy Drugs Market is witnessing strong adoption of AI-powered innovations. This integration supports faster regulatory submissions and post-market analysis. The trend enhances overall productivity and transparency in the research pipeline.

Market Challenges Analysis:

High Cost of Branded Therapies and Limited Accessibility in Developing Regions

The high cost of branded antiepileptic drugs remains a major barrier for patients in low-income countries. Limited healthcare infrastructure and inconsistent reimbursement policies restrict access to essential medicines. Shortages in neurological specialists also delay diagnosis and treatment initiation. Patients often rely on outdated drug regimens due to affordability constraints. The Global Epilepsy Drugs Market faces disparities in drug distribution across regions. High pricing strategies discourage consistent treatment adherence, especially in rural populations. Governments are attempting to balance affordability with innovation incentives. The issue continues to limit equitable access to quality healthcare.

Adverse Drug Reactions, Tolerance Issues, and Regulatory Complexities

Side effects such as dizziness, fatigue, and behavioral changes reduce patient compliance. Tolerance development in long-term therapy reduces drug effectiveness over time. Managing polytherapy in drug-resistant epilepsy adds further complexity to treatment. Regulatory requirements for safety testing and pharmacovigilance remain stringent, increasing costs for manufacturers. The Global Epilepsy Drugs Market experiences delayed approvals due to rigorous clinical evaluation procedures. Smaller firms struggle to meet regulatory demands, slowing innovation. Adverse event reporting systems also require continuous monitoring investments. These challenges create hurdles for market expansion and sustained profitability.

Market Opportunities:

Emergence of Biologics and Innovative Therapeutic Approaches

Biologic drugs and neuroprotective therapies are opening new treatment possibilities. Advances in neurogenetics and molecular biology are fostering targeted drug development. Pharmaceutical companies are exploring antibody-based treatments and peptide modulators for refractory epilepsy. The Global Epilepsy Drugs Market is positioned to gain from these novel mechanisms. Expanding research in regenerative medicine and cell-based therapy offers long-term management potential. Collaborations with academic institutions are driving these clinical innovations. The focus on disease modification instead of symptom suppression creates lasting therapeutic value.

Expansion into Untapped Emerging Markets and Digital Health Integration

Growing healthcare investment in Asia-Pacific, Latin America, and Africa presents major opportunities. Rising awareness and improving diagnostic facilities are expanding patient pools. Digital health integration allows pharmaceutical firms to support remote care solutions. The Global Epilepsy Drugs Market is expected to benefit from telehealth-driven accessibility. Partnerships with local distributors and governments enhance market penetration. The increasing adoption of e-pharmacy channels further broadens product availability. These combined factors strengthen global outreach and long-term revenue sustainability.

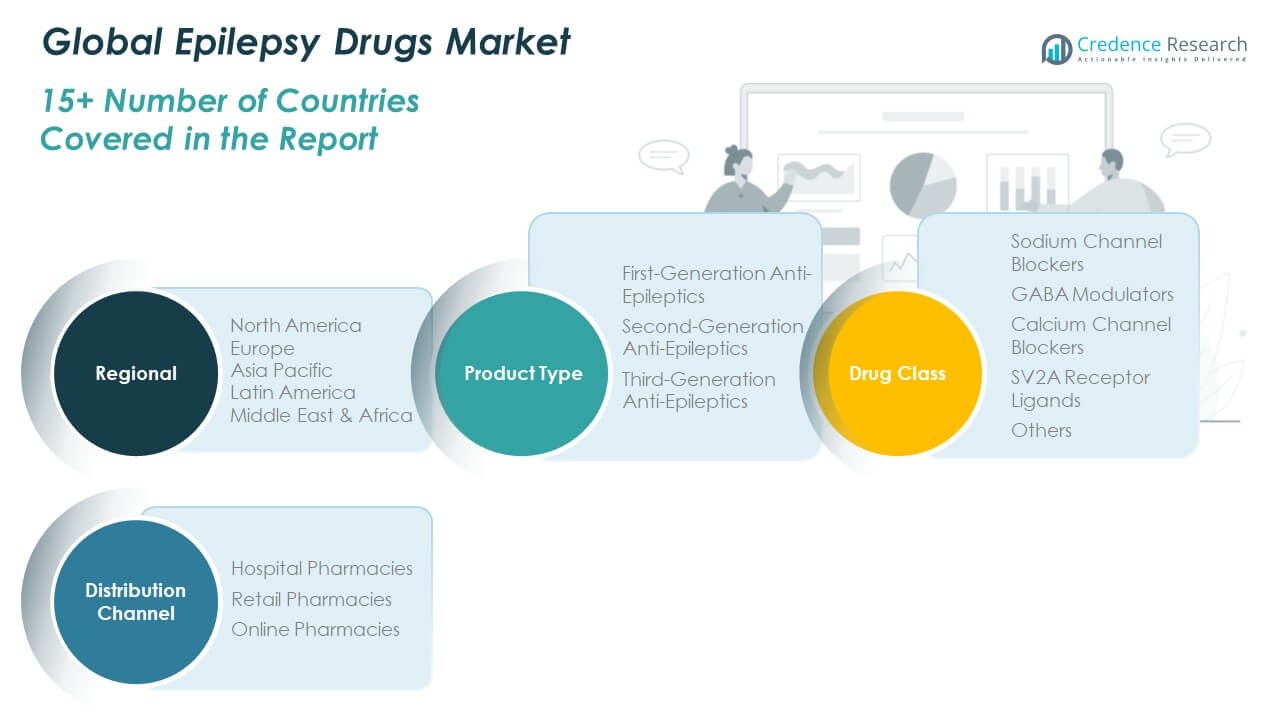

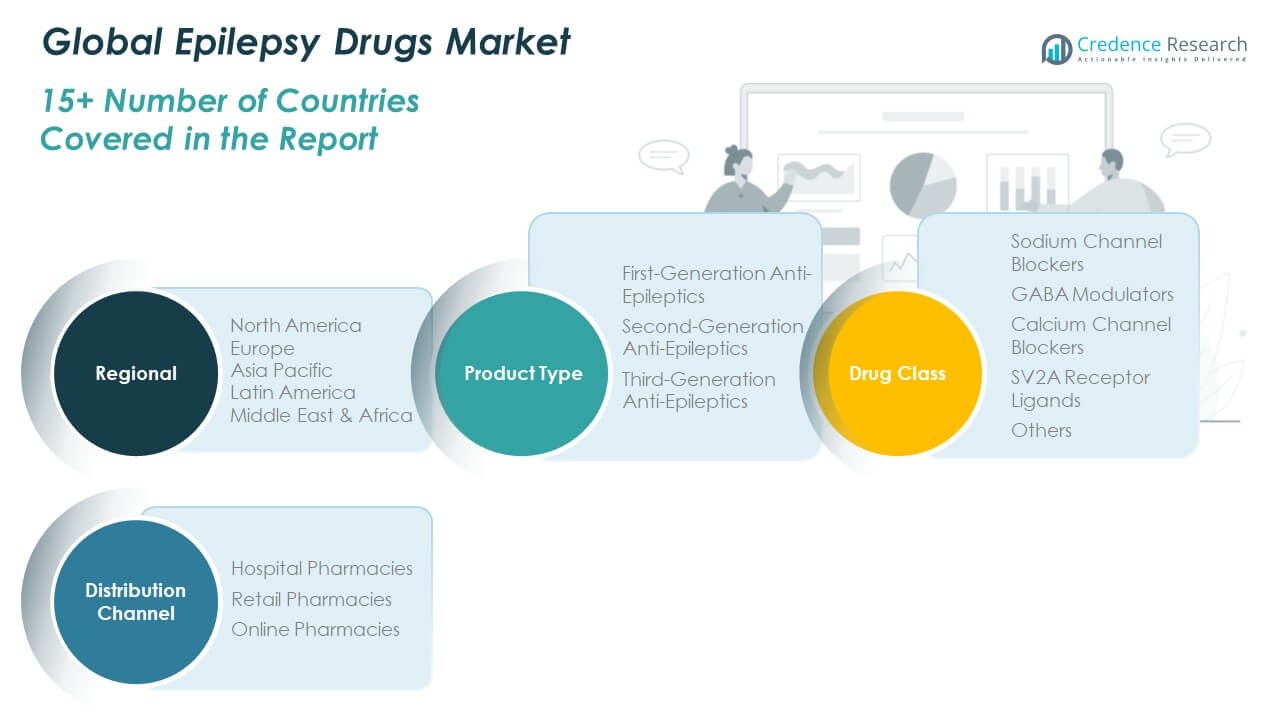

Market Segmentation Analysis:

By Generation of Anti-Epileptics

The Global Epilepsy Drugs Market is segmented into first-generation, second-generation, and third-generation anti-epileptics. First-generation drugs, including phenytoin and carbamazepine, remain widely used due to established clinical efficacy and low cost. Second-generation drugs such as lamotrigine and levetiracetam dominate current prescriptions owing to improved safety profiles and fewer interactions. Third-generation drugs, including perampanel and brivaracetam, are witnessing rapid adoption driven by advanced formulations and targeted mechanisms. It benefits from the continuous shift toward newer agents offering better tolerability and reduced cognitive side effects. Growing R&D investments in next-generation molecules further expand treatment options across patient groups.

- For instance, a Phase III trial of cenobamate, results of which were published in 2020 and led to its approval, showed that 28% of patients receiving the highest dose achieved a seizure-free rate during the maintenance phase, compared to 9% on placebo in focal seizures [1]. It benefits from the continuous shift toward newer agents offering better tolerability and reduced cognitive side effects. Growing R&D investments in next-generation molecules further expand treatment options across patient groups.

By Drug Class

The market is divided into sodium channel blockers, GABA modulators, calcium channel blockers, SV2A receptor ligands, and others. Sodium channel blockers account for a major share due to their effectiveness in controlling partial and generalized seizures. GABA modulators maintain steady demand, supported by broad therapeutic coverage and favorable clinical results. Calcium channel blockers are gaining attention for their role in refractory epilepsy. SV2A receptor ligands, led by levetiracetam, continue to grow due to superior safety and pharmacokinetics. It demonstrates consistent innovation and diversification in drug mechanisms.

- For instance, a global registry in 2023 highlighted levetiracetam’s stable pharmacokinetic profile with minimal dose adjustments and low interaction risks in polypharmacy populations. It demonstrates consistent innovation and diversification in drug mechanisms. In the same period, several programs explored combination regimens leveraging SV2A and mTOR pathways to broaden therapeutic options. By 2024, these efforts illustrate ongoing diversification in mechanisms of action and therapeutic strategies.

By Distribution Channel

Distribution channels include hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies lead the market owing to higher prescription rates for complex epilepsy cases. Retail pharmacies hold a strong presence in urban areas with easy patient accessibility. Online pharmacies are expanding rapidly with increasing preference for home delivery and digital prescriptions. It reflects the growing influence of e-commerce in global healthcare distribution.

Segmentation:

By Generation of Anti-Epileptics

- First-Generation Anti-Epileptics

- Second-Generation Anti-Epileptics

- Third-Generation Anti-Epileptics

By Drug Class

- Sodium Channel Blockers

- GABA Modulators

- Calcium Channel Blockers

- SV2A Receptor Ligands

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Epilepsy Drugs Market size was valued at USD 3,154.78 million in 2018, increased to USD 4,614.78 million in 2024, and is anticipated to reach USD 7,454.10 million by 2032, at a CAGR of 5.8% during the forecast period. North America holds around 43.3% share of the Global Epilepsy Drugs Market. It benefits from strong healthcare infrastructure, early diagnosis systems, and extensive insurance coverage for neurological disorders. The presence of major pharmaceutical companies such as Pfizer, UCB, and Johnson & Johnson contributes to consistent innovation. Growing investment in research for drug-resistant epilepsy supports market expansion. The U.S. dominates the region with widespread awareness programs and access to advanced therapies. Canada and Mexico are improving their regulatory support for neurological treatment. Continuous adoption of third-generation anti-epileptics strengthens regional growth prospects.

Europe

The Europe Epilepsy Drugs Market size was valued at USD 2,106.96 million in 2018, increased to USD 3,005.09 million in 2024, and is projected to reach USD 4,565.06 million by 2032, at a CAGR of 4.9% during the forecast period. Europe accounts for about 26.6% of the global market share. It is supported by strong public healthcare systems, government reimbursement policies, and active neurological research programs. Countries like Germany, France, and the U.K. are key contributors due to high patient awareness and clinical expertise. Pharmaceutical innovation in precision medicine and supportive treatment policies drives demand. Collaboration between academic institutions and healthcare companies enhances clinical outcomes. Regulatory support from the European Medicines Agency accelerates new product approvals. Expansion of telehealth platforms is helping address treatment accessibility across Eastern Europe.

Asia Pacific

The Asia Pacific Epilepsy Drugs Market size was valued at USD 1,310.63 million in 2018, increased to USD 2,109.79 million in 2024, and is anticipated to reach USD 3,874.36 million by 2032, at a CAGR of 7.4% during the forecast period. Asia Pacific holds about 22.4% share of the Global Epilepsy Drugs Market. It is the fastest-growing region, driven by rising healthcare investment and increasing diagnosis rates. Expanding pharmaceutical manufacturing capabilities in China, India, and Japan strengthen drug availability. The region benefits from government-led healthcare modernization and awareness programs on neurological disorders. Growing penetration of online pharmacies is improving access to medicines in rural zones. Demand for affordable generic antiepileptics supports steady market growth. Collaborations between global firms and regional players enhance market penetration.

Latin America

The Latin America Epilepsy Drugs Market size was valued at USD 341.59 million in 2018, increased to USD 498.65 million in 2024, and is anticipated to reach USD 710.93 million by 2032, at a CAGR of 4.1% during the forecast period. Latin America represents about 4.1% of the global market share. It benefits from growing healthcare awareness and improved hospital infrastructure. Brazil leads the market, supported by robust public health initiatives. Expanding access to neurological care in Mexico, Argentina, and Chile supports treatment adoption. Rising focus on generic formulations is making epilepsy therapies more affordable. Regional governments are increasing efforts to integrate epilepsy care into national health programs. It is gaining from ongoing partnerships between local distributors and multinational pharmaceutical companies.

Middle East

The Middle East Epilepsy Drugs Market size was valued at USD 196.96 million in 2018, increased to USD 265.41 million in 2024, and is expected to reach USD 358.64 million by 2032, at a CAGR of 3.4% during the forecast period. The region contributes about 2.1% to the Global Epilepsy Drugs Market. It is driven by rising healthcare expenditure and improved access to specialized hospitals. GCC countries, including Saudi Arabia and the UAE, dominate regional demand due to strong healthcare investments. Increasing prevalence of epilepsy and awareness initiatives by government health agencies are improving diagnosis rates. Pharmaceutical imports from Europe and North America support treatment availability. Expansion of digital healthcare platforms and teleconsultations are improving treatment follow-up. The market shows steady progress through public–private healthcare collaborations.

Africa

The Africa Epilepsy Drugs Market size was valued at USD 120.93 million in 2018, increased to USD 196.08 million in 2024, and is anticipated to reach USD 255.92 million by 2032, at a CAGR of 2.9% during the forecast period. Africa accounts for nearly 1.5% of the global market share. It faces challenges in diagnosis and treatment accessibility due to limited medical infrastructure. Growing efforts by global health organizations are improving awareness and drug availability. South Africa and Egypt are emerging as key regional markets with rising healthcare reforms. Non-governmental programs are helping reduce stigma associated with epilepsy. Generic drug adoption is increasing in public healthcare facilities. It continues to expand slowly but steadily through international aid, medical training, and improved drug distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- UCB S.A.

- Pfizer Inc.

- Sanofi S.A.

- GlaxoSmithKline plc

- Novartis AG

- Eisai Co., Ltd.

- Johnson & Johnson

- Otsuka Pharmaceutical Co., Ltd.

- Jazz Pharmaceuticals plc

- AbbVie Inc.

Competitive Analysis:

The Global Epilepsy Drugs Market is characterized by strong competition among multinational and regional players. It includes major companies such as UCB S.A., Pfizer Inc., Sanofi S.A., GlaxoSmithKline plc, Novartis AG, and Eisai Co., Ltd. These firms compete on product innovation, clinical efficacy, and patient safety. It focuses on developing next-generation antiepileptic drugs with improved tolerability and minimal side effects. Strategic mergers, research collaborations, and regulatory approvals enhance market reach. Companies are expanding portfolios to address drug-resistant epilepsy and pediatric cases. Continuous investment in R&D and precision medicine sustains their market leadership.

Recent Developments:

- In October 2023 Sanofi sold Frisium (clobazam) along with ten other CNS brands to Pharmanovia. Frisium has been used as an adjunctive therapy in combination with other epilepsy medications, and the transaction marked a strategic shift in Sanofi’s CNS portfolio, with Pharmanovia assuming responsibility for ongoing commercialization and potential pipeline considerations in collaboration with regulatory and healthcare partners.

- In November 2024 Neurelis, Inc. shared insights on the study design from the enrollment process for the Stellina study, which investigates VALTOCO® (diazepam nasal spray) for treating seizure clusters in epilepsy patients aged 2 to 5. The discussion highlighted enrollment challenges specific to early-childhood populations with treatment-resistant epilepsy and proposed strategies intended to inform future pediatric trial designs and accelerate data collection for this younger age cohort.

Report Coverage:

The research report offers an in-depth analysis based on generation of anti-epileptics, drug class, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Precision medicine and gene-based therapies will redefine epilepsy treatment approaches.

- AI-powered clinical decision tools will enhance diagnosis and patient monitoring efficiency.

- Digital health integration will expand remote care and improve treatment adherence.

- Growth in biologics and peptide-based drugs will diversify available treatment options.

- Expansion of healthcare infrastructure in emerging regions will boost accessibility.

- Partnerships between pharma and biotech firms will accelerate drug innovation cycles.

- Increasing government support for neurological research will drive clinical advancement.

- Generic drug competition will continue to improve affordability and reach.

- Patient-focused care models will promote personalized therapy and safety monitoring.

- Ongoing R&D investments will sustain innovation in drug-resistant epilepsy management.