Market Overview:

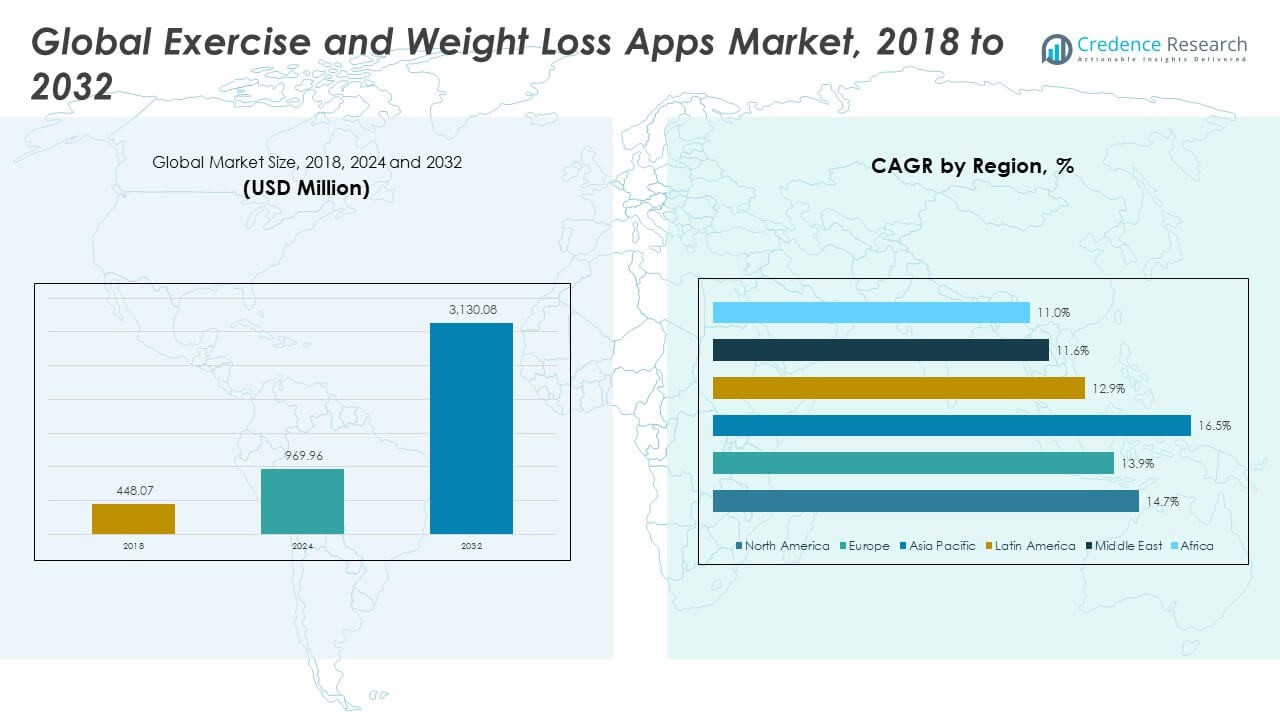

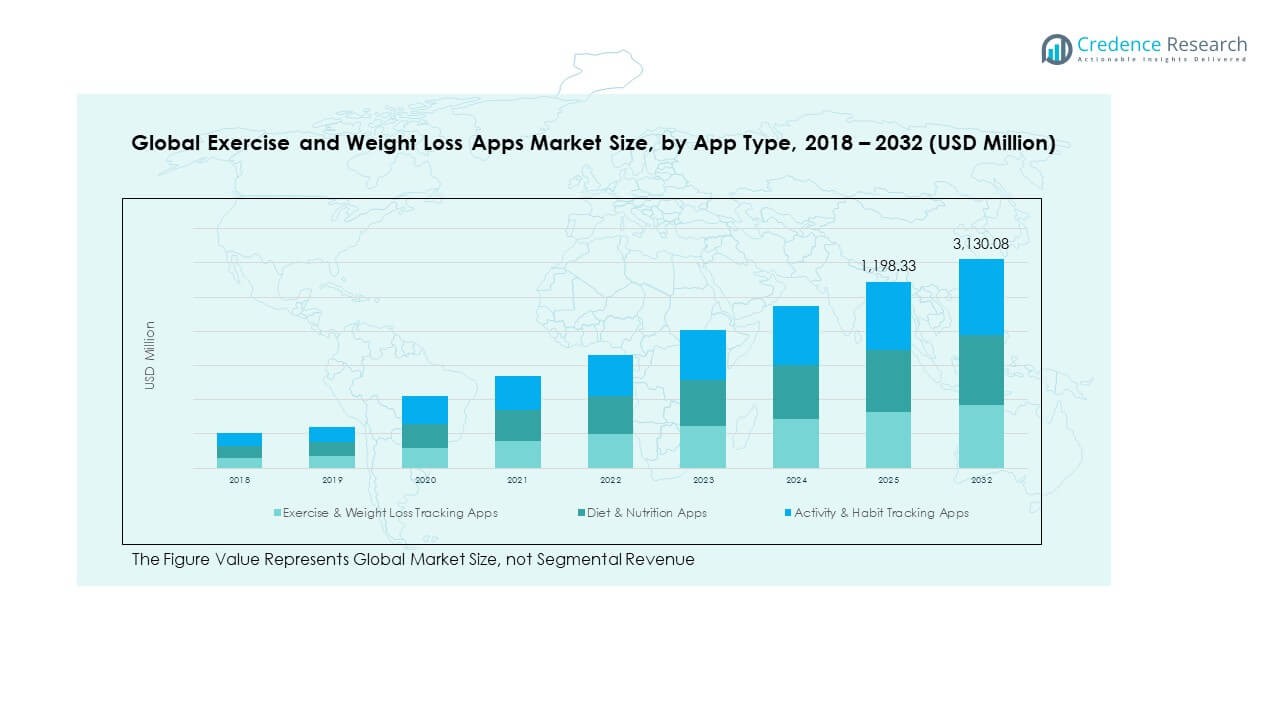

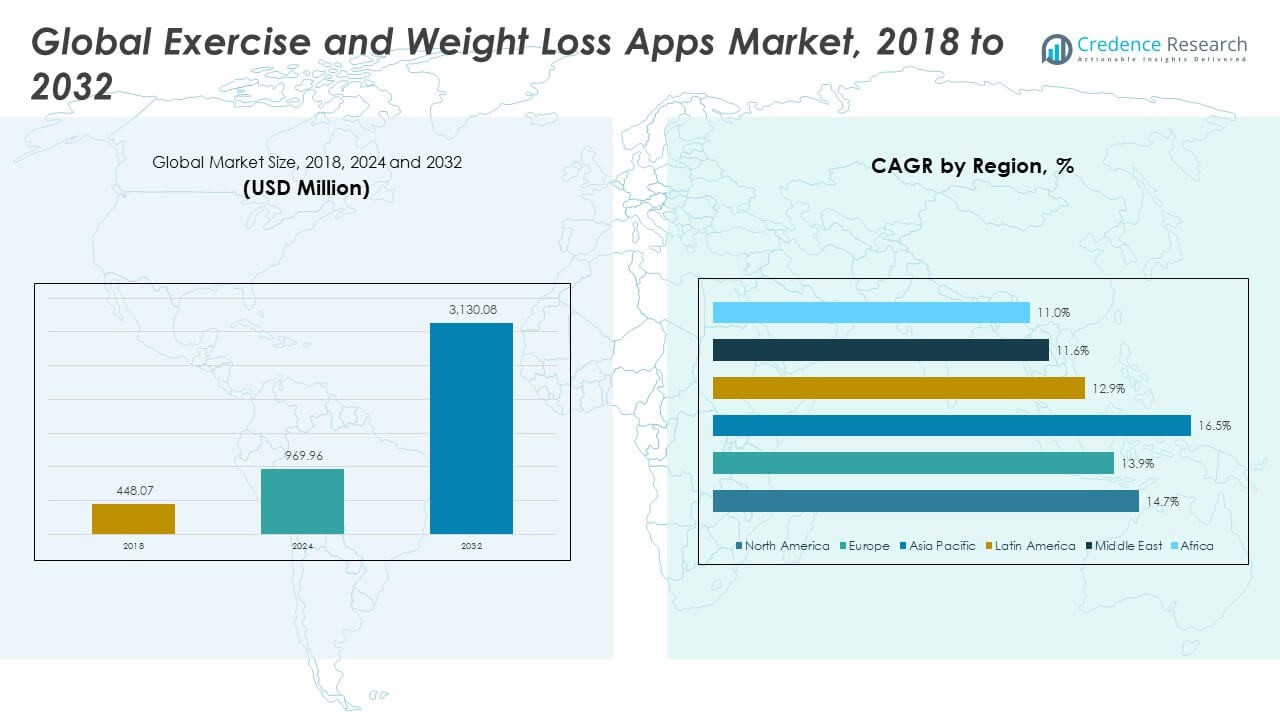

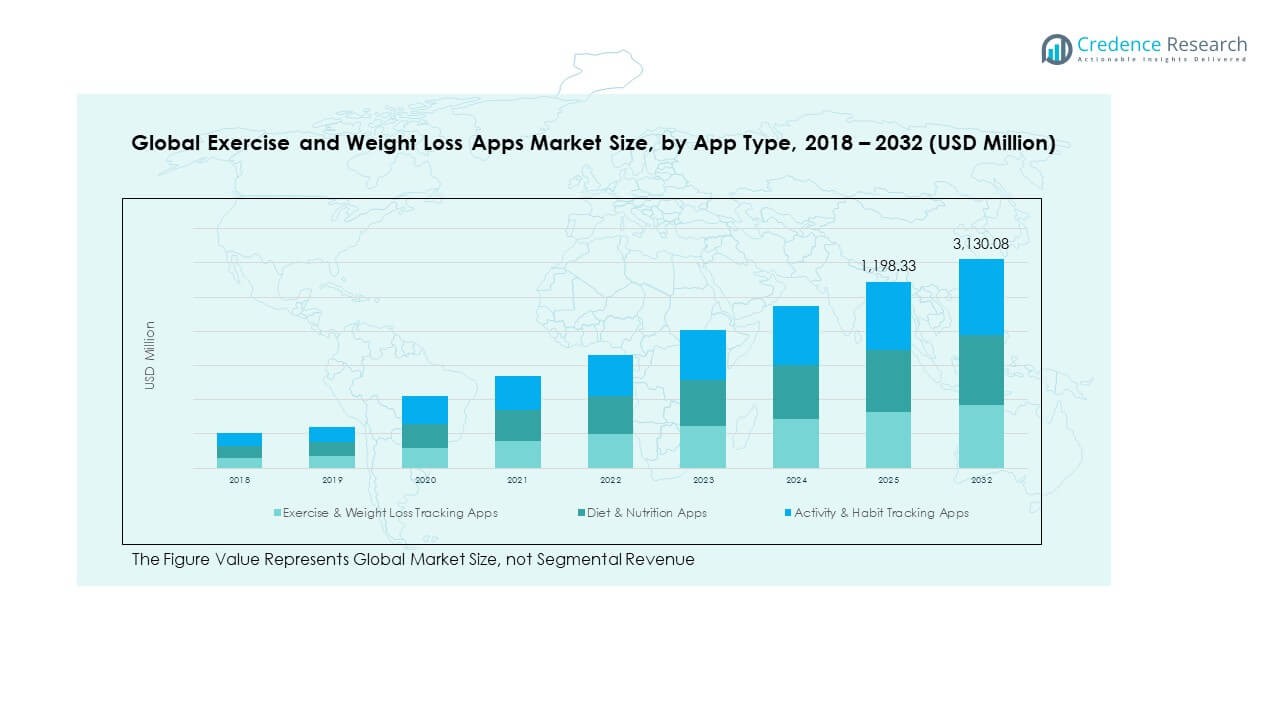

The Global Exercise and Weight Loss Apps Market size was valued at USD 448.07 million in 2018 to USD 969.96 million in 2024 and is anticipated to reach USD 3,130.08 million by 2032, at a CAGR of 14.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Exercise and Weight Loss Apps Market Size 2024 |

USD 969.96 Million |

| Exercise and Weight Loss Apps Market, CAGR |

14.70% |

| Exercise and Weight Loss Apps Market Size 2032 |

USD 3,130.08 Million |

The market is driven by the growing awareness of fitness, rising obesity rates, and the increasing use of smartphones and wearables. Consumers are embracing digital health tools for personalized workouts, diet tracking, and progress monitoring. Integration of AI, machine learning, and gamified features enhances user engagement and retention. Partnerships between app developers and fitness equipment brands further boost adoption across diverse age groups.

North America leads due to high health consciousness and strong digital infrastructure. Europe shows steady growth supported by wellness initiatives and tech-driven fitness startups. The Asia-Pacific region is emerging rapidly, driven by a large young population, expanding internet access, and rising urbanization fostering interest in digital fitness solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Exercise and Weight Loss Apps Market size was valued at USD 448.07 million in 2018, reached USD 969.96 million in 2024, and is expected to hit USD 3,130.08 million by 2032, growing at a CAGR of 14.7% during the forecast period.

- North America (43%), Europe (26%), and Asia Pacific (20%) together dominate the market due to strong digital infrastructure, advanced app ecosystems, and growing health awareness across key populations.

- Asia Pacific is the fastest-growing region, supported by rapid urbanization, rising smartphone adoption, and an expanding young demographic increasingly focused on digital fitness.

- Exercise & Weight Loss Tracking Apps hold the largest segment share of approximately 45%, driven by the popularity of structured workout programs and real-time performance tracking.

- Diet & Nutrition Apps account for nearly 35%, supported by increasing user interest in calorie management, personalized diet plans, and AI-powered food tracking capabilities.

Market Drivers:

Rising Awareness Toward Fitness and Lifestyle Management

Growing awareness about fitness, healthy lifestyles, and preventive healthcare strongly drives the Global Exercise and Weight Loss Apps Market. Consumers are focusing on self-monitoring, nutrition tracking, and goal-based workouts. Increasing cases of obesity and chronic diseases encourage individuals to adopt healthier habits. The shift toward mobile-based fitness solutions has made personalized health management easier. Developers are integrating smart reminders and motivational feedback to sustain engagement. Fitness influencers and social media challenges further promote app usage. Corporate wellness programs are supporting digital fitness integration. These combined factors reinforce long-term market growth.

- For instance, MyFitnessPal registered over 220 million users by 2024 and integrated weekly food intake tracking with real-time progress milestone features.

Growing Smartphone Penetration and Wearable Device Integration

The expansion of smartphones and connected devices supports widespread use of fitness applications. The Global Exercise and Weight Loss Apps Market benefits from easy access, user-friendly interfaces, and real-time performance tracking. Integration with smartwatches and fitness bands improves data accuracy and enhances the user experience. Consumers appreciate continuous progress insights and performance comparisons. Developers are designing lightweight, data-efficient apps for wider accessibility. The combination of hardware and software integration drives daily usage. Subscription-based models further strengthen app monetization. Such connectivity trends continue to expand the overall market footprint.

- For instance, in 2024, the smartphone segment dominated the move-to-earn fitness apps market with a 66.9% revenue share. Concurrently, the global wearable technology market was valued at approximately USD 70.30 billion, with the fitness tracker market projected to grow at a CAGR of 22.1% from 2025-2032.

Increased Adoption of Personalized Digital Health Platforms

The demand for tailored fitness experiences is pushing innovation in personalized platforms. The Global Exercise and Weight Loss Apps Market focuses on customization based on user goals, health history, and behavior. Artificial intelligence and data analytics allow precise workout recommendations and adaptive diet plans. Continuous user feedback helps refine individual plans for better outcomes. Companies are offering hybrid solutions that blend virtual coaching with live sessions. These features build trust and improve retention. Data-driven personalization ensures measurable results and encourages consistency. The trend enhances brand loyalty and strengthens customer engagement.

Rising Popularity of Subscription and Freemium Models

Flexible pricing models are enabling higher adoption rates across various user groups. The Global Exercise and Weight Loss Apps Market has seen strong demand for subscription and freemium services. Users can access premium features, advanced analytics, and exclusive content at affordable rates. The freemium structure attracts first-time users and promotes upgrades. It supports app developers in sustaining recurring revenue streams. Incentive-based programs and referral discounts add long-term value. Integration with payment gateways enhances smooth transactions. The business model diversification secures continuous growth within this competitive sector.

Market Trends:

Integration of Artificial Intelligence and Predictive Analytics

The integration of AI and predictive analytics is transforming fitness app capabilities. The Global Exercise and Weight Loss Apps Market is witnessing intelligent systems that analyze real-time data for precision coaching. AI helps assess user behavior and recommend activity adjustments automatically. Predictive algorithms forecast progress and suggest goal revisions. Voice assistants and chatbots improve app interactivity. Data visualization tools simplify performance tracking and comparison. Continuous AI model updates ensure more accurate insights. These smart functions are elevating user satisfaction and long-term adherence.

- For instance, Samsung added AI-powered sleep analysis and body composition tracking to its Galaxy Watch7 in July 24, 2024, enabling accurate monitoring for over 100 different workouts and providing AGEs Index readings to measure biological aging and metabolic health.

Gamification and Social Engagement Features Boosting Retention

Gamification has emerged as a strong engagement driver within this market. The Global Exercise and Weight Loss Apps Market benefits from features like badges, points, and leaderboards. These systems promote competition and motivate consistent participation. Social sharing options allow users to display achievements and encourage peer involvement. Group challenges strengthen community engagement and foster brand loyalty. Developers are designing dynamic in-app events for better participation. Socially driven design is transforming user motivation patterns. This cultural shift promotes sustained use and stronger app retention rates.

Growing Focus on Holistic Health and Mental Wellness

Fitness apps are expanding beyond physical exercise to address overall wellness. The Global Exercise and Weight Loss Apps Market now includes meditation, mindfulness, and stress management modules. These tools provide emotional balance alongside physical improvement. Users value integrated wellness programs that offer nutrition, sleep, and mental health tracking. Health experts support this holistic direction to promote balanced lifestyles. The trend aligns with growing awareness about mental well-being. App developers are partnering with mental health professionals to refine offerings. The combined approach ensures a comprehensive user experience.

Rising Adoption of Virtual Coaching and Live Workout Sessions

Virtual coaching is becoming a defining trend in the Global Exercise and Weight Loss Apps Market. Live training sessions provide users with direct interaction and professional guidance. They enhance accountability and engagement levels for remote users. Trainers use data insights to track performance and adjust programs dynamically. Integration of video streaming and AR-based motion tracking increases realism. These features simulate in-person training experiences effectively. Fitness brands collaborate with gyms and influencers to boost visibility. The hybrid model is reshaping the fitness ecosystem toward interactive digital experiences.

Market Challenges Analysis:

Data Privacy Concerns and Regulatory Compliance Issues

User data protection remains a primary challenge for the Global Exercise and Weight Loss Apps Market. Fitness applications handle sensitive health and location information that requires strict regulation. Any data breach can damage user trust and reduce engagement levels. Compliance with data privacy laws across multiple regions complicates operations for global developers. Security lapses or unauthorized data sharing lead to legal and reputational risks. Firms must adopt advanced encryption, secure APIs, and transparent privacy policies. Smaller developers face high costs for implementing strong security systems. Maintaining compliance consistency limits the scalability of cross-border operations.

User Retention and Market Saturation Challenges

Sustaining user interest over time is a growing difficulty for the Global Exercise and Weight Loss Apps Market. The abundance of similar apps creates fierce competition and limits differentiation. Many users abandon apps after short-term motivation fades. Developers must consistently update content, features, and incentives to retain users. High marketing costs are required to capture audience attention in this crowded field. Free alternatives further intensify competition for premium platforms. Limited internet access in developing markets restricts expansion opportunities. Balancing innovation, engagement, and affordability remains a major challenge for industry growth.

Market Opportunities:

Expansion into Corporate Wellness and Healthcare Partnerships

The Global Exercise and Weight Loss Apps Market presents major potential in corporate wellness integration. Companies are investing in digital fitness programs to improve employee health and productivity. Partnerships with healthcare organizations enable preventive care and chronic disease management. App developers are designing business-to-business models tailored for workplace deployment. These collaborations open new subscription channels and increase brand credibility. Wearable data synchronization supports large-scale wellness tracking. Such institutional adoption extends market presence across diverse industries. This growing collaboration trend creates sustained revenue opportunities.

Emerging Markets and AI-Driven Product Innovations

Emerging economies offer strong growth potential for the Global Exercise and Weight Loss Apps Market. Rising smartphone use and improving internet infrastructure fuel expansion in Asia-Pacific, Latin America, and the Middle East. Localized language support and culturally relevant content enhance accessibility. AI-driven innovations, such as adaptive workouts and nutrition bots, attract new audiences. Affordable premium plans increase adoption among younger users. Government health awareness campaigns encourage digital fitness participation. The combination of affordability, personalization, and innovation ensures a promising outlook for upcoming years.

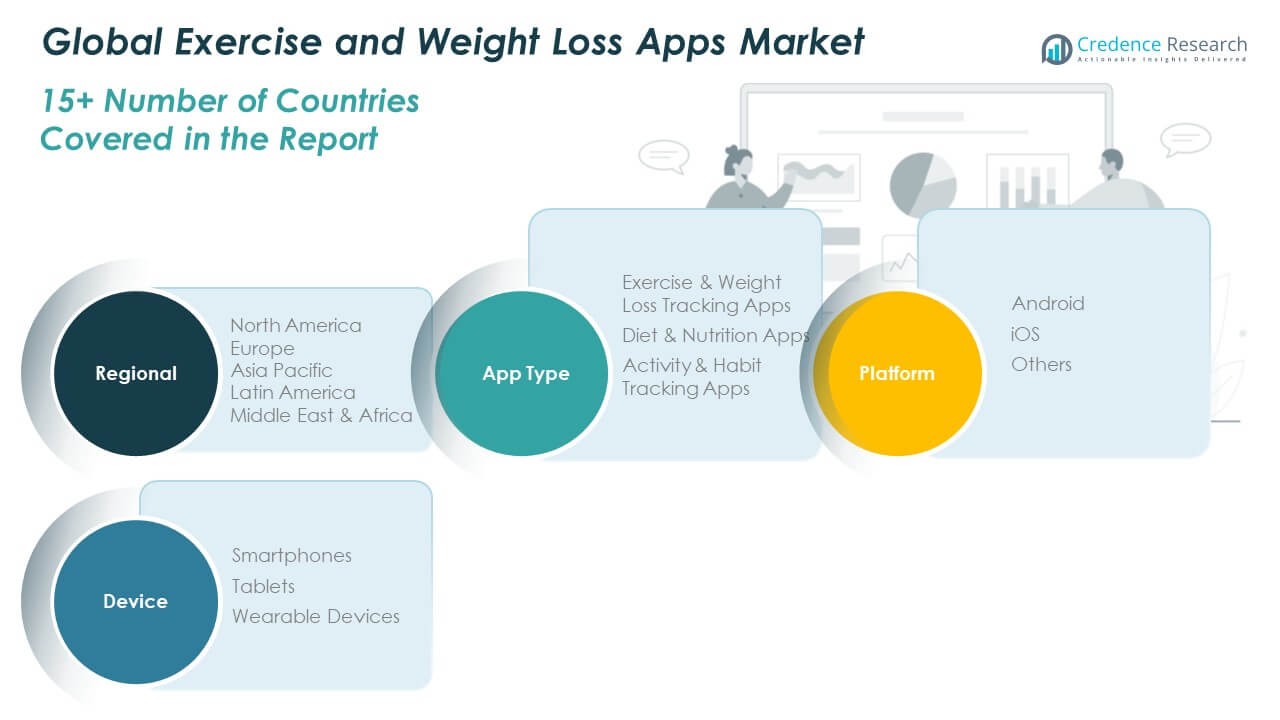

Market Segmentation Analysis:

By App Type

The Global Exercise and Weight Loss Apps Market is segmented into Exercise & Weight Loss Tracking Apps, Diet & Nutrition Apps, and Activity & Habit Tracking Apps. Exercise and weight loss tracking apps dominate the segment, driven by rising adoption among users seeking structured fitness plans and real-time progress monitoring. Diet and nutrition apps gain popularity due to growing demand for calorie management, food logging, and personalized diet programs. Activity and habit tracking apps are expanding quickly, supported by behavioral analytics that help users build sustainable wellness routines and maintain motivation through data insights.

- For instance, Lose It! has helped over 57 million users lose more than 150 million pounds. In the first quarter of 2024 (Q1 2024) in the United States on the Apple App Store, Noom had approximately 415,000 weekly active users at the beginning of the quarter (ending at 327,000 by March), and downloads started at around 39,000 monthly (decreasing to 11,000 by the end of March).

By Platform

Based on platform, the market includes Android, iOS, and Others. Android holds the largest share due to its global accessibility and cost-effective app ecosystem. iOS attracts premium users with high spending capacity and strong integration across Apple devices. Developers focus on both platforms to reach diverse audiences and ensure consistent user experiences. The Others category, including Windows and hybrid systems, maintains limited traction but caters to specific enterprise and regional needs.

- For instance, in the latest period, Google Play Store listed 54,546 health and fitness apps for Android users, while Apple’s iOS platforms contributed 52.13% of global fitness app revenue and remain the preferred channel for premium app launches.

By Device

By device, the market is divided into Smartphones, Tablets, and Wearable Devices. Smartphones lead the segment, offering convenience, portability, and continuous data synchronization. Tablets provide a secondary interface for users seeking enhanced visual experiences and larger interactive displays. Wearable devices, including fitness bands and smartwatches, are witnessing strong growth through real-time health tracking and seamless connectivity with fitness apps. Their expanding use in remote health monitoring enhances engagement and supports the market’s long-term evolution.

Segmentation:

By App Type:

- Exercise & Weight Loss Tracking Apps

- Diet & Nutrition Apps

- Activity & Habit Tracking Apps

By Platform:

By Device:

- Smartphones

- Tablets

- Wearable Devices

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Exercise and Weight Loss Apps Market size was valued at USD 196.41 million in 2018 to USD 420.78 million in 2024 and is anticipated to reach USD 1,361.62 million by 2032, at a CAGR of 14.7% during the forecast period. North America holds the largest market share of approximately 43% due to its advanced digital infrastructure, early technology adoption, and growing awareness of preventive health management. The United States leads the region with high penetration of premium fitness apps and smart wearables. Strategic collaborations between app developers, fitness brands, and healthcare providers drive innovation. High disposable income and subscription readiness among consumers strengthen market stability. Canada follows, driven by government wellness programs and fitness tracking trends. The presence of leading players such as Apple, Fitbit, and Noom enhances regional competitiveness. Strong regulatory standards for data privacy reinforce user trust in app-based fitness platforms.

Europe

The Europe Global Exercise and Weight Loss Apps Market size was valued at USD 131.49 million in 2018 to USD 274.72 million in 2024 and is anticipated to reach USD 836.45 million by 2032, at a CAGR of 13.9% during the forecast period. Europe accounts for around 26% of the global market share. Rising adoption of digital health tools, coupled with the European Union’s wellness initiatives, supports market growth. Countries like the UK, Germany, and France are major contributors, driven by fitness app integration with connected devices. Consumers prefer apps offering diet tracking and guided training programs. Growing popularity of home workouts and virtual fitness coaching enhances engagement. Companies are introducing multilingual interfaces and GDPR-compliant solutions to attract broader audiences. Europe’s focus on personalized health management aligns with sustainability and wellness goals. Strong investment in data-driven fitness ecosystems continues to strengthen market maturity.

Asia Pacific

The Asia Pacific Global Exercise and Weight Loss Apps Market size was valued at USD 83.50 million in 2018 to USD 196.40 million in 2024 and is anticipated to reach USD 720.29 million by 2032, at a CAGR of 16.5% during the forecast period. Asia Pacific contributes approximately 20% of the global market share and shows the fastest regional growth. Rapid urbanization, growing smartphone adoption, and increasing fitness awareness among youth are major drivers. China, India, Japan, and South Korea lead the expansion with strong digital ecosystems. Local app developers and international fitness brands are forming partnerships to localize features. Affordable premium subscriptions attract users across middle-income groups. Rising health concerns and demand for preventive care accelerate app adoption. Social media-driven fitness challenges amplify participation rates. The region’s vast population base presents significant long-term growth potential.

Latin America

The Latin America Global Exercise and Weight Loss Apps Market size was valued at USD 20.27 million in 2018 to USD 43.31 million in 2024 and is anticipated to reach USD 122.97 million by 2032, at a CAGR of 12.9% during the forecast period. Latin America captures nearly 6% of the global market share, led by Brazil and Mexico. The region is witnessing increased smartphone penetration and interest in wellness-focused lifestyles. Users are adopting fitness and diet-tracking apps to manage weight and improve health outcomes. Local developers are introducing budget-friendly platforms to cater to expanding user bases. Social fitness groups and community challenges support organic growth. Integration of Spanish and Portuguese interfaces boosts accessibility. Economic stabilization and awareness campaigns around obesity prevention are fueling market expansion. App collaborations with gyms and nutritionists enhance credibility and local engagement.

Middle East

The Middle East Global Exercise and Weight Loss Apps Market size was valued at USD 10.36 million in 2018 to USD 20.09 million in 2024 and is anticipated to reach USD 52.33 million by 2032, at a CAGR of 11.6% during the forecast period. The region represents nearly 3% of the total market share. Growing health awareness among urban populations and government wellness initiatives are key market stimulants. Countries like the UAE, Saudi Arabia, and Israel are witnessing strong adoption of mobile health applications. Fitness influencers and online coaching platforms are promoting lifestyle transformation. Cultural openness toward digital health is improving engagement levels. Developers are offering localized Arabic content to improve retention. Investment in wearable devices and AI-driven analytics supports market modernization. It continues to gain traction through personalized solutions and remote health monitoring.

Africa

The Africa Global Exercise and Weight Loss Apps Market size was valued at USD 6.05 million in 2018 to USD 14.66 million in 2024 and is anticipated to reach USD 36.43 million by 2032, at a CAGR of 11.0% during the forecast period. Africa holds an estimated 2% share of the global market, reflecting early-stage adoption. Expanding internet connectivity and affordable smartphone availability are driving slow but steady growth. South Africa leads regional adoption due to its urban population and awareness campaigns. Local fitness startups are promoting community-based digital health platforms. Challenges like low income levels and limited device penetration hinder faster growth. However, government health programs and international partnerships support digital wellness initiatives. Rising youth participation in fitness trends shows long-term potential. The market’s future lies in affordable subscription models and improved technological access across sub-Saharan regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- MyFitnessPal (Under Armour)

- Fitbit (Google LLC)

- Noom, Inc.

- Weight Watchers (WW International, Inc.)

- Nike Training Club

- Strava, Inc.

- Aaptiv Inc.

- Apple Fitness+

- Samsung Health

- Calm

Competitive Analysis:

The Global Exercise and Weight Loss Apps Market is highly competitive, featuring a mix of established fitness brands and emerging tech startups. Leading companies such as MyFitnessPal, Fitbit, Noom, and WW International dominate through innovation, partnerships, and data-driven personalization. It benefits from strong brand loyalty, extensive subscription bases, and ecosystem integration with wearables and digital platforms. Developers compete through AI-based features, live coaching, and community engagement tools. The focus on hybrid fitness models, real-time analytics, and health insights strengthens competitiveness. The market remains dynamic, shaped by evolving user expectations and rapid technological advancement.

Recent Developments:

- In February 2025, MyFitnessPal announced the acquisition of Intent, a personalized meal planning app, integrating advanced AI-driven planning tools to enhance food logging and grocery integration for its 270 million users worldwide. MyFitnessPal’s 2025 Summer and Winter Releases brought new personalization features, further solidifying its market leadership.

- As of October 2025, Google confirmed that Fitbit, under its leadership, plans several new device launches in 2026, building on its evolving integration with Google’s hardware and AI ecosystem. The acquisition of Fitbit, completed in 2021, continues to shape its product pipeline and positions Fitbit as a major pillar in Google’s expanding health hardware strategy.

- Noom launched two new AI-powered features, Face Scan and Future Me, in October 2025 for preventive health insights accessible to anyone with a smartphone. The company also announced a major partnership with health plan provider Highmark in October 2025 to deliver Noom Weight Management to nearly 2 million insurance members starting in 2026, highlighting Noom’s strategic expansion into enterprise partnerships.

- In October 2025, WeightWatchers announced a partnership with Amazon Pharmacy, facilitating fast, reliable home delivery of GLP-1 and other weight management medications for WW Clinic members, thus improving convenience and access for those on prescription-supported weight loss journeys.

Report Coverage:

The research report offers an in-depth analysis based on App Type, Platform, and Device segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising integration of AI and predictive analytics will redefine personalized fitness tracking.

- Demand for holistic health apps combining fitness, nutrition, and mental wellness will accelerate.

- Subscription-based revenue models will continue to drive financial stability for developers.

- Partnerships between app providers and healthcare systems will expand preventive care.

- Wearable synchronization and IoT connectivity will enhance real-time health insights.

- Corporate wellness programs will fuel large-scale app adoption.

- Data privacy and compliance advancements will strengthen consumer trust.

- Localization of content and language support will boost adoption in emerging economies.

- Virtual coaching and AR-enabled workouts will enhance engagement levels.

- Competitive innovation will push continuous product differentiation and user retention.