Market Overview:

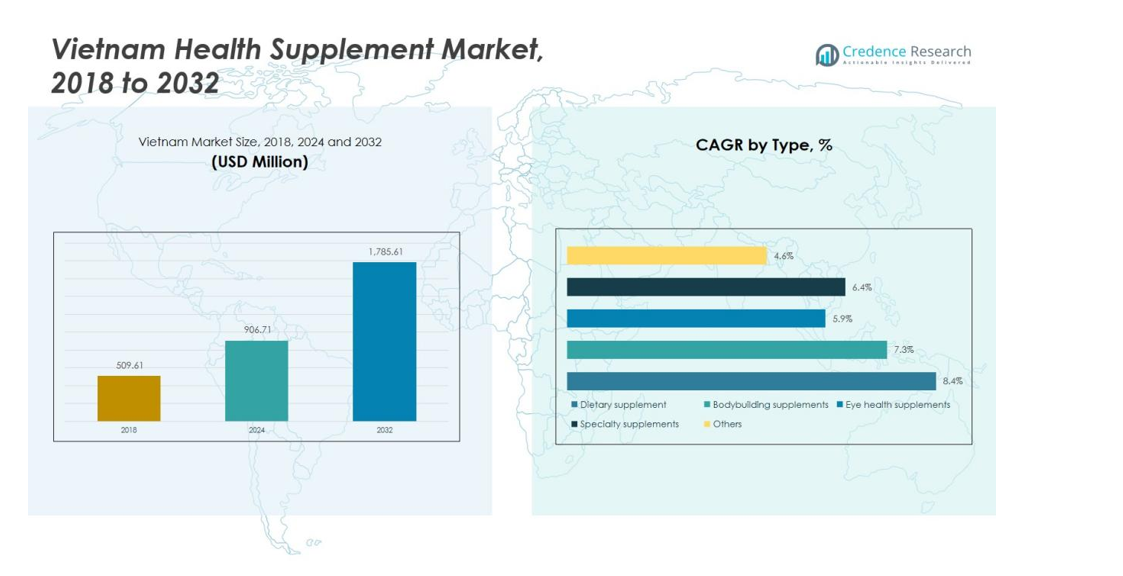

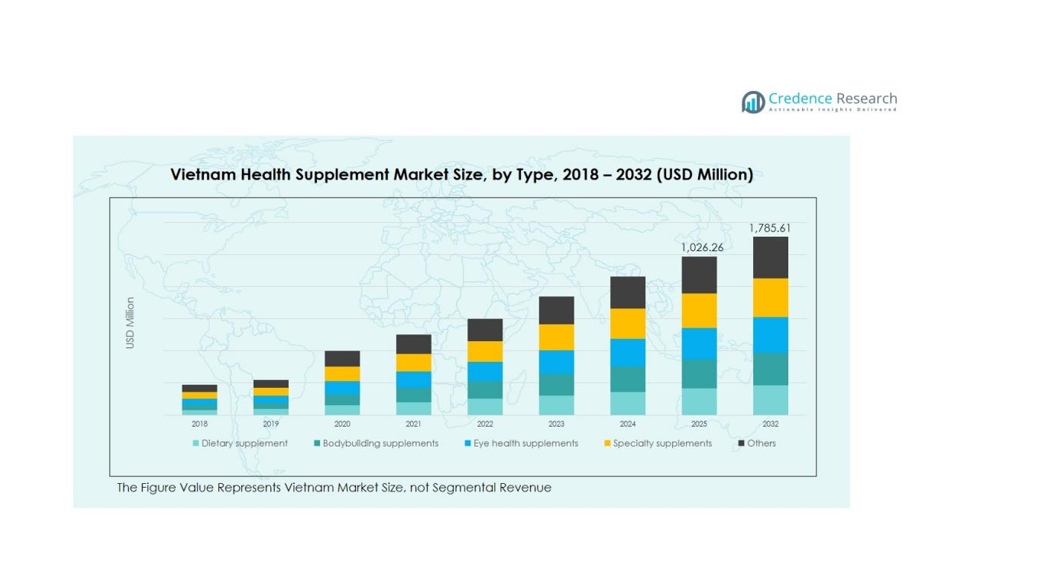

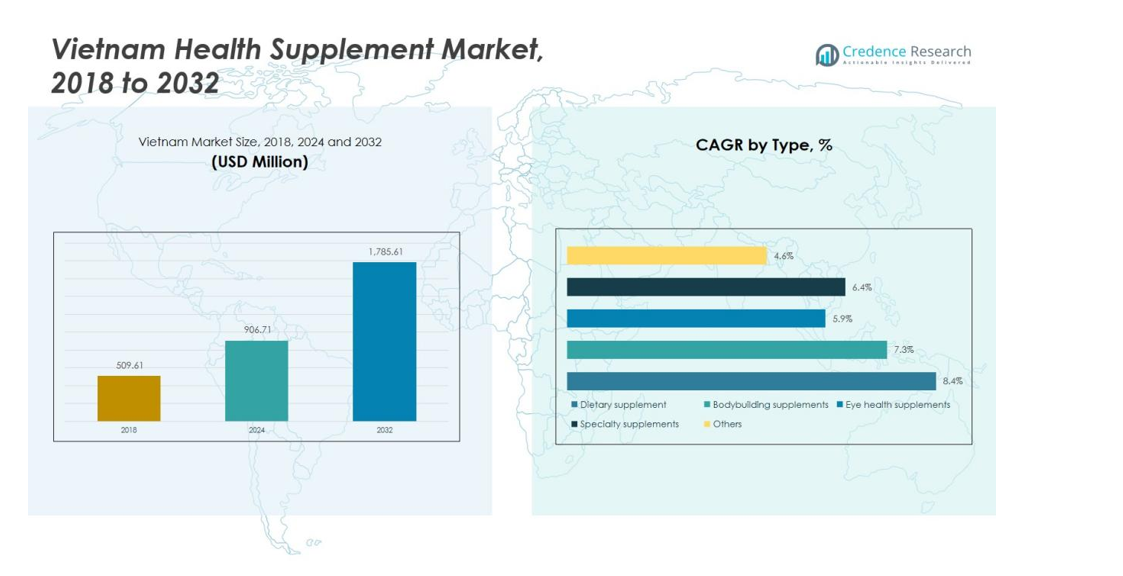

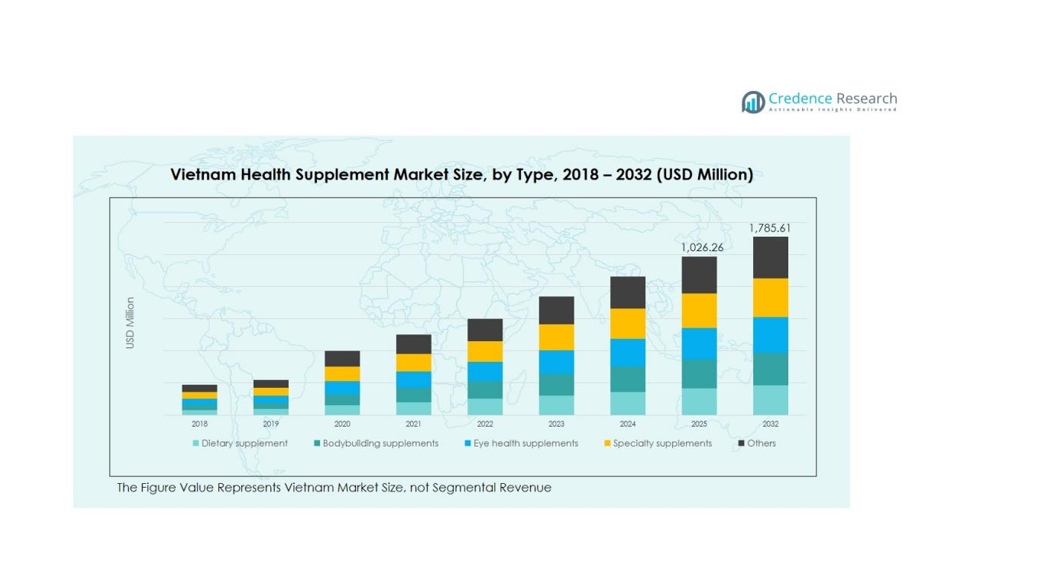

The Vietnam Health Supplement Market size was valued at USD 509.61 million in 2018 to USD 906.71 million in 2024 and is anticipated to reach USD 1,785.61 million by 2032, at a CAGR of 8.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Health Supplement Market Size 2024 |

USD 906.71 million |

| Vietnam Health Supplement Market, CAGR |

8.23% |

| Vietnam Health Supplement Market Size 2032 |

USD 1,785.61 million |

Rising disposable incomes and urban lifestyles boost daily supplement use. Consumers favor immunity, digestive health, bone, and beauty formulas. Pharmacies, modern trade, and e-commerce improve product access and trust. Influencer marketing and doctor recommendations lift brand credibility. Local firms expand herbal and traditional ingredients, while global brands add science-backed lines. Stricter labeling and claims oversight reduce low-quality products and build confidence. Sports nutrition gains traction with growing fitness participation. Subscription models and personalized packs increase retention.

Ho Chi Minh City and the Southeast region lead sales due to higher incomes and dense retail. Hanoi and the Red River Delta follow, driven by healthcare awareness and modern pharmacies. Central Coast cities benefit from tourism and duty-paid retail exposure. The Mekong Delta sees rising demand through expanding drugstore chains. Central Highlands growth remains moderate but improves with better distribution. Cross-border e-commerce influences coastal markets with faster launches. Tier-2 and tier-3 cities show catch-up growth as organized retail spreads.

Market Insights:

- The Vietnam Health Supplement Market was valued at USD 509.61 million in 2018, reached USD 906.71 million in 2024, and is projected to reach USD 1,785.61 million by 2032, growing at a CAGR of 8.23%.

- Ho Chi Minh City and the Southeast region hold around 38% of the market share, driven by higher incomes, dense pharmacy networks, and strong retail infrastructure. Hanoi and the Red River Delta account for about 27%, supported by rising healthcare awareness and modern pharmacy expansion.

- The Central Coast region holds nearly 18% share and is the fastest-growing area, supported by tourism-driven demand and wellness retail growth.

- Dietary supplements dominate the market with over 45% share, driven by strong consumer preference for daily nutrition and preventive health.

- Vitamins and minerals lead the ingredient category with around 40% share, followed by botanicals at 28%, reflecting growing interest in natural and herbal formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Preventive Health and Wellness Awareness

Growing awareness of preventive healthcare drives the Vietnam Health Supplement Market. Consumers increasingly seek vitamins, minerals, and herbal products to maintain energy and immunity. It benefits from shifting preferences toward balanced diets and long-term health management. The pandemic accelerated the habit of supplement consumption for overall wellness. Younger consumers are also adopting preventive routines earlier in life.

- For instance, Abbott Laboratories launched the improved Ensure Gold formula in Vietnam in September 2023, featuring HMB (beta-hydroxy-beta-methylbutyrate) that supports muscle health after 8 weeks of use and yeast beta-glucan (YBG) that enhances immune health in 4 weeks.

Expanding Urbanization and Lifestyle Shifts

Rapid urbanization and changing dietary habits create higher demand for convenient nutrition. It witnesses growth as working professionals turn to supplements to compensate for poor eating patterns. The growing influence of fitness and beauty culture boosts demand for functional products. Rising disposable incomes allow consumers to spend more on daily health and beauty care. Urban lifestyles continue to push supplement adoption in both physical and online retail channels.

- For Instance, The online retail channel of the global dietary supplements market represented 25.45% of the total market share in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 13% through 2030

Widening Distribution Channels and Digital Engagement

Wider product access across pharmacies, convenience stores, and e-commerce platforms strengthens the market. It benefits from targeted marketing, influencer engagement, and health awareness campaigns. Brands are using digital tools to educate consumers about product benefits. Subscription models and bundled health packs help maintain consistent use. Increasing internet penetration supports online sales in smaller urban centers.

Integration of Local Herbal Ingredients and Product Innovation

The market is seeing strong integration of traditional Vietnamese herbs with modern nutrition science. Local producers use native botanicals to appeal to consumers seeking natural options. Global companies collaborate with domestic players to expand local sourcing and R&D. Innovation in capsule forms, gummies, and fortified beverages enhances convenience and taste. It continues to evolve toward clean-label, eco-friendly, and certified-quality products that build consumer trust.

Market Trends:

Growing Preference for Natural, Herbal, and Functional Formulations

The Vietnam Health Supplement Market is witnessing a strong shift toward natural and herbal-based formulations. Consumers prefer products containing ginseng, turmeric, spirulina, and other traditional Vietnamese herbs that align with local wellness beliefs. The demand for plant-based and clean-label products is increasing, driven by the growing distrust of synthetic additives. It benefits from the convergence of traditional medicine knowledge with modern nutritional science. Functional supplements targeting immunity, digestive health, and stress management are gaining wide adoption. Brands are also reformulating products to meet vegan, gluten-free, and sugar-free preferences. This trend supports premiumization across both domestic and imported product portfolios.

- For instance, Amway Vietnam’s Nutrilite Probiotic Health Protection Food received the Golden Product for Community Health award for the 12th consecutive time in January 2025, with the formulation providing 6.3 billion CFU of live probiotics from 5 clinically tested strains.

Rising Digitalization, E-commerce Penetration, and Personalized Nutrition

E-commerce and digital health platforms are reshaping supplement consumption patterns in Vietnam. Online channels enable greater product discovery, transparent reviews, and subscription-based delivery options. It gains traction from influencer partnerships and social media marketing that strengthen brand loyalty. Consumers increasingly seek personalized nutrition based on age, gender, and lifestyle, driving innovation in customized supplement packs. Mobile health apps and AI-based nutrition tracking tools encourage consistent usage and informed choices. Domestic and international brands are adopting omnichannel models that integrate online platforms with pharmacy retail networks. The digital shift continues to expand market accessibility and attract younger, tech-savvy consumers nationwide.

- For Instance, Leading pharmacy chains Pharmacity and Long Chau have introduced mobile applications and e-commerce sites offering home delivery, click-and-collect, and loyalty programs. As of 2019, approximately 62,500 pharmacies existed in Vietnam, and the country’s national e-prescription database system was under implementation by the Ministry of Health.

Market Challenges Analysis:

Regulatory Complexity and Product Quality Concerns

The Vietnam Health Supplement Market faces challenges related to inconsistent regulatory enforcement and product quality standards. Many small manufacturers struggle to comply with labeling, claims, and import documentation requirements. It suffers from the presence of counterfeit and unregistered supplements that weaken consumer trust. Regulatory overlap between food and pharmaceutical authorities causes delays in approvals and testing. Limited laboratory infrastructure affects quality verification for imported ingredients. Strengthening certification systems and public awareness campaigns are essential to improve confidence and ensure compliance.

Market Saturation and Intense Price Competition

The market experiences growing saturation with multiple local and foreign brands competing for shelf space. It faces price pressure due to low entry barriers and similar product offerings. Consumers often prioritize affordability over brand reliability, which impacts premium segment growth. High promotional costs and short product lifecycles challenge long-term profitability. Distribution margins remain thin, especially in online and convenience store channels. Brand differentiation through innovation, scientific validation, and customer engagement is becoming critical to maintain market share.

Market Opportunities:

Expanding Demand for Personalized and Preventive Nutrition Solutions

The Vietnam Health Supplement Market presents strong opportunities through personalized nutrition and preventive health solutions. Consumers increasingly seek tailor-made supplements based on lifestyle, diet, and age-specific needs. It benefits from rising demand for data-driven health insights through mobile apps and wellness platforms. Companies that integrate diagnostic tools, such as blood tests or DNA-based assessments, can differentiate their offerings. Preventive health campaigns by healthcare providers and insurers also expand awareness of proactive nutrition. The trend toward daily supplementation for immunity, stress relief, and digestive support provides a large consumer base for both local and international brands.

Untapped Potential in E-commerce and Rural Expansion

E-commerce penetration offers a major growth avenue for supplement brands across Vietnam. Online platforms enhance product visibility and enable direct-to-consumer distribution at lower costs. It can reach untapped rural and semi-urban markets where pharmacy infrastructure remains limited. Strategic collaborations with digital health apps and influencers enhance engagement and repeat purchases. Expanding logistics networks and digital payment adoption support broader accessibility. Local brands focusing on affordable, herbal-based, and trustworthy products are well-positioned to capture these emerging markets. The growing online consumer base ensures sustained growth and deeper market reach in the coming years.

Market Segmentation Analysis:

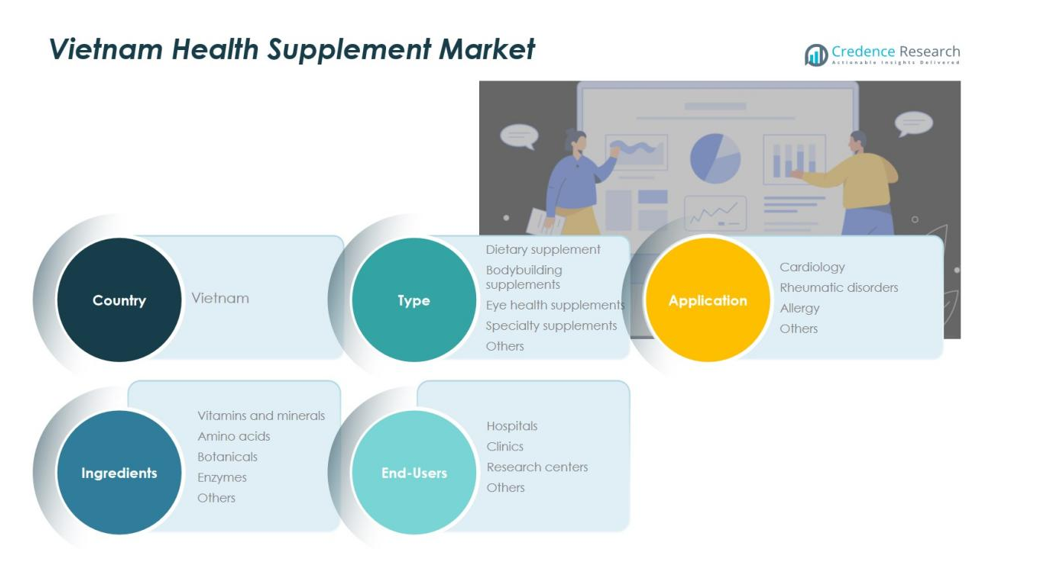

By Type

The Vietnam Health Supplement Market includes dietary supplements, bodybuilding supplements, eye health supplements, specialty supplements, and others. Dietary supplements hold the largest share due to daily usage across all age groups. It gains traction from rising awareness of preventive healthcare and nutritional deficiencies. Bodybuilding supplements are growing steadily with fitness culture expansion in urban centers. Specialty and eye health supplements are gaining visibility through pharmacy recommendations and targeted marketing.

- For Instance, Nutrition Depot Vietnam has distributed various sports supplements, including Optimum Nutrition’s Gold Standard 100% Whey Protein. The company operates at least two retail locations in Ho Chi Minh City and serves the urban fitness demographic.

By Application

Cardiology and rheumatic disorders represent major application areas in the Vietnam Health Supplement Market. It benefits from increasing cardiovascular and joint health concerns among aging populations. Allergy-related supplements see consistent growth, driven by environmental changes and growing sensitivities. Products supporting immune function, digestion, and bone health also attract consumer attention. The trend toward multifunctional supplements with combined health benefits continues to strengthen across applications.

- For Instance, VitaDairy became Vietnam’s #1 colostrum brand with its ColosBaby products, which use ColosIgG 24h exclusively supplied by the American company PanTheryx. By mid-2023, the collaboration between VitaDairy and PanTheryx was reported to have exceeded $200 million in value.

By Ingredients

Vitamins and minerals dominate the market due to their broad preventive and therapeutic use. It is followed by botanicals, which are increasingly preferred for their natural and traditional origins. Amino acids and enzymes segments show potential in specialized nutrition and sports categories. Demand for natural and plant-based ingredients continues to grow, supported by consumer trust and regulatory support. Local producers integrating native herbs with scientifically validated ingredients are gaining competitive advantage.

Segmentations:

By Type:

- Dietary Supplements

- Bodybuilding Supplements

- Eye Health Supplements

- Specialty Supplements

- Others

By Application:

- Cardiology

- Rheumatic Disorders

- Allergy

- Others

By Ingredients:

- Vitamins and Minerals

- Amino Acids

- Botanicals

- Enzymes

- Others

By End Users:

- Hospitals

- Clinics

- Research Centers

- Others

Regional Analysis:

Dominance of Urban Centers and Growing Retail Infrastructure

The Vietnam Health Supplement Market is heavily concentrated in major cities such as Ho Chi Minh City and Hanoi. Urban consumers exhibit stronger purchasing power and higher health awareness, supporting steady demand for supplements across pharmacies and modern trade outlets. It benefits from widespread marketing campaigns, organized distribution, and a rising number of fitness and wellness centers. Ho Chi Minh City leads sales with a strong mix of international and domestic brands. Hanoi follows with expanding retail networks and government initiatives promoting preventive health. The southern and northern regions together account for a significant portion of total national revenue.

Emerging Growth in Central and Coastal Provinces

Central Vietnam, including Da Nang and Nha Trang, shows rising demand due to tourism and lifestyle changes. The Vietnam Health Supplement Market is expanding here through hotel pharmacies, wellness resorts, and digital retail access. Consumers are adopting supplements for energy, immunity, and stress reduction, influenced by exposure to foreign wellness practices. Growing middle-income households drive brand diversification and price segmentation. The region also benefits from improving healthcare infrastructure and new retail investments by national pharmacy chains.

Untapped Potential Across Rural and Semi-Urban Regions

Rural and semi-urban provinces remain underpenetrated but present strong growth opportunities. It is supported by improving internet connectivity, logistics, and local awareness campaigns. Local brands are introducing affordable herbal supplements targeting these consumers. E-commerce and social media play vital roles in bridging access gaps and promoting product education. Expanding distribution partnerships and health outreach programs continue to strengthen demand in these emerging regions. These efforts are expected to create long-term growth beyond Vietnam’s major urban centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Vietnam Health Supplement Market is moderately fragmented, featuring both domestic and international companies competing across product segments. Key players include Traphaco JSC, Hau Giang Pharmaceutical JSC, Nam Duoc JSC, Vietnam Healthy Co., Ltd, BEPHARCO GROUP, Amway Vietnam Ltd., and Abbott Laboratories. It is characterized by strong brand positioning, diverse product portfolios, and extensive retail networks. Local manufacturers focus on herbal and traditional formulations to cater to cultural preferences, while global brands emphasize scientifically validated and premium supplements. Companies invest in marketing, influencer collaborations, and e-commerce expansion to strengthen visibility. Strategic partnerships, product innovation, and quality certifications remain essential for long-term competitiveness in Vietnam’s evolving health supplement landscape.

Recent Developments:

- In July, 2024, Amway Vietnam launched its new G&H Body Care product line in Ho Chi Minh City, focusing on plant-based and environmentally sustainable skin care solutions.

- In June , 2025, Amway announced an expansion of its partnership with HEM Pharma, a microbiome solutions provider, to drive innovation in gut health and extend its microbiome research and product development efforts across Asia and the U.S..

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Ingredients and End Users. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising preventive healthcare awareness will continue to expand supplement consumption across all age groups.

- Digital health platforms and e-commerce will drive accessibility and strengthen consumer engagement.

- Local manufacturers will invest in herbal-based innovations aligned with traditional wellness practices.

- Global brands will expand portfolios through personalized and functional nutrition products.

- Pharmacies and modern trade channels will remain key retail contributors, supported by online integration.

- Consumer demand for clean-label, non-GMO, and vegan formulations will influence product development.

- Government focus on regulatory tightening will enhance product quality and consumer trust.

- Collaborations between healthcare professionals and supplement brands will promote evidence-based marketing.

- Rural and semi-urban expansion will emerge as a new growth frontier for affordable supplements.

- The Vietnam Health Supplement Market will evolve into a digitally connected, health-conscious ecosystem with diversified product offerings and stronger brand competition.