Market Overview:

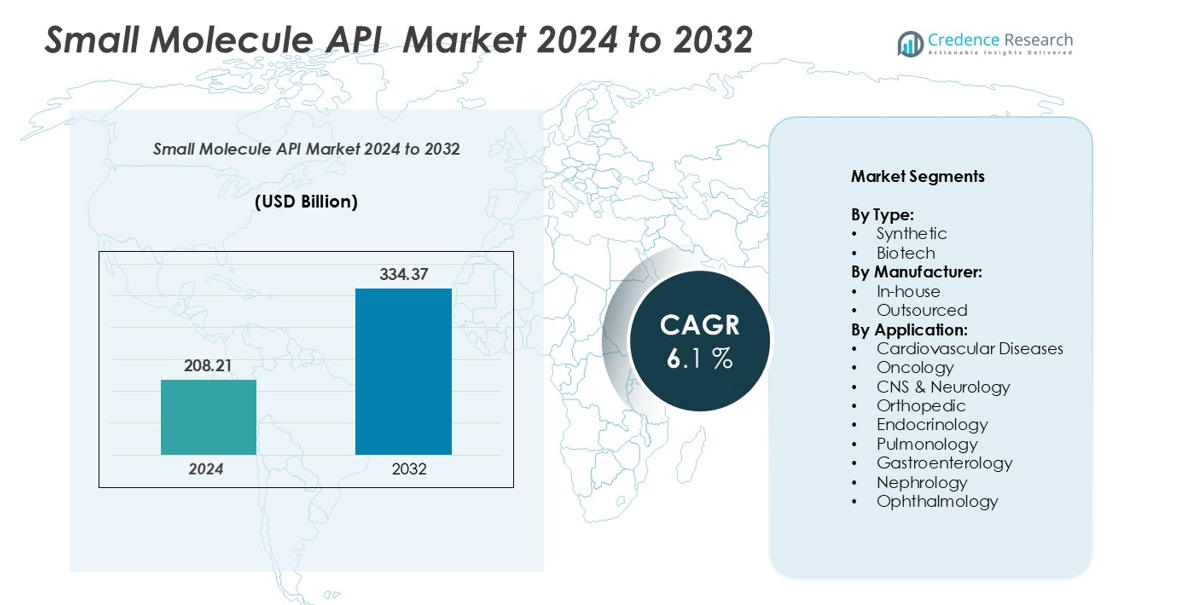

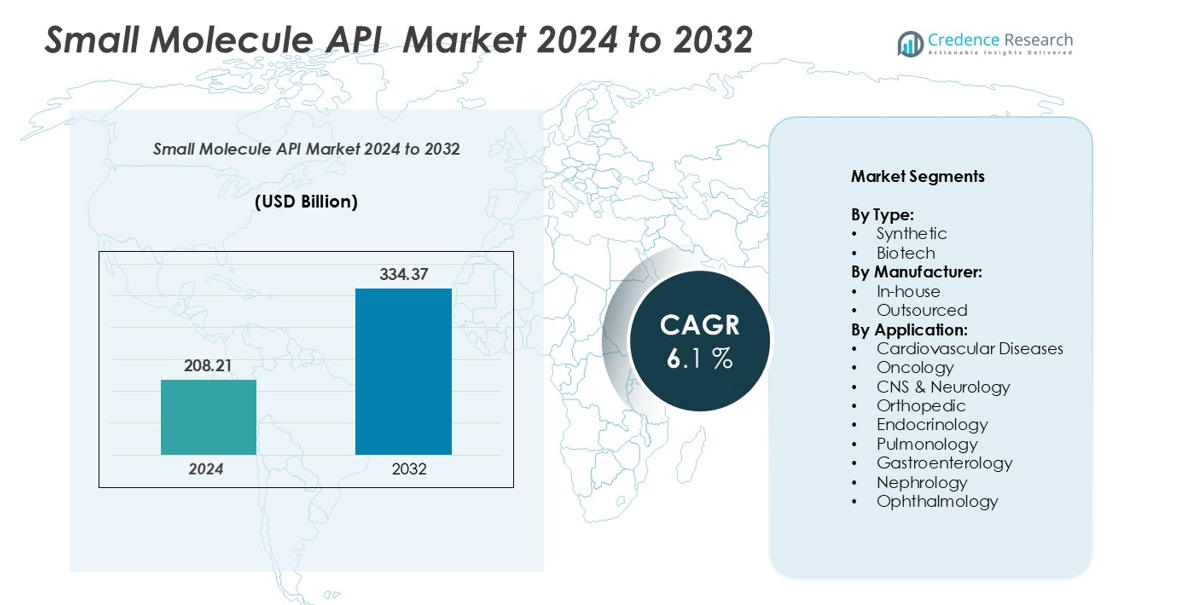

The Small Molecule API market size was valued at USD 208.21 billion in 2024 and is anticipated to reach USD 334.37 billion by 2032, growing at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Molecule API Market Size 2024 |

USD 208.21 billion |

| Small Molecule API Market, CAGR |

6.1% |

| Small Molecule API Market Size 2032 |

USD 334.37 billion |

The Small Molecule API market is led by prominent players such as Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Albemarle Corporation, Boehringer Ingelheim International GmbH, Aurobindo Pharma, Dr. Reddy’s Laboratories Ltd., and Cipla, Inc. These companies maintain a competitive edge through large-scale manufacturing, diversified product portfolios, and continuous R&D investments. North America dominates the market with an estimated 38% share, driven by strong regulatory frameworks and advanced production capabilities, followed by Europe with 27%, emphasizing quality and sustainability. Asia-Pacific, holding 28%, is the fastest-growing region, fueled b y cost-effective manufacturing and expanding pharmaceutical exports from India and China.

Market Insights

- The Small Molecule API market was valued at USD 208.21 billion in 2024 and is projected to reach USD 334.37 billion by 2032, registering a CAGR of 6.1% during the forecast period.

- Market growth is driven by rising demand for generic drugs, increasing prevalence of chronic diseases, and expanding pharmaceutical production across developed and emerging economies.

- Key trends include growing adoption of green chemistry, outsourcing API manufacturing to CDMOs, and advancements in continuous and automated production technologies.

- The market is moderately consolidated, with major players such as Sun Pharmaceutical, Merck & Co., AbbVie, Bristol-Myers Squibb, and Aurobindo Pharma focusing on innovation, partnerships, and capacity expansion.

- Regionally, North America holds 38%, Europe 27%, and Asia-Pacific 28% of the market, while synthetic APIs dominate the type segment and oncology leads by application, supported by high R&D investment and therapeutic demand.

Market Segmentation Analysis:

By Type:

The Small Molecule API market by type is categorized into synthetic and biotech APIs. The synthetic segment dominates the market, accounting for a significant share owing to its well-established manufacturing processes, cost efficiency, and scalability in large-volume production. The wide availability of chemical synthesis routes and technological advancements in catalysis and green chemistry have enhanced yield and purity. Synthetic APIs are extensively utilized in producing generic drugs and treatments for chronic diseases, driving steady demand across global pharmaceutical industries.

- For instance, The Kalamazoo facility has a reported capacity of 1,200 metric tons of active pharmaceutical ingredients (APIs), not intermediates, per year. The other elements of the claim align with public information from Pfizer and other sources.

By Manufacturer:

Based on the manufacturer, the market is segmented into in-house and outsourced production. The in-house manufacturing segment holds the largest market share, driven by pharmaceutical companies’ focus on quality control, intellectual property protection, and process optimization. In-house facilities enable efficient integration of R&D and manufacturing, ensuring consistent product quality and regulatory compliance. However, outsourcing is gaining traction due to cost benefits and the availability of specialized expertise among contract development and manufacturing organizations (CDMOs).

- For instance, Lonza operates a global small molecule manufacturing network that includes a significant presence in Visp, Switzerland, alongside other key sites in locations like the US and China. The Visp site houses a range of manufacturing facilities, including state-of-the-art complexes for highly potent active pharmaceutical ingredients (HPAPIs) and bioconjugates like ADCs. Lonza frequently invests in expanding its capabilities in Visp, but the company does not publicly disclose the total number of small molecule reactors or the total API output in metric tons for the site.

By Application:

In terms of application, the market is divided into cardiovascular diseases, oncology, CNS & neurology, orthopedic, endocrinology, pulmonology, gastroenterology, nephrology, and ophthalmology. The oncology segment leads the market, attributed to the rising prevalence of cancer and the increasing development of targeted small molecule therapies. Continuous innovation in cancer treatment, coupled with growing investments in precision medicine and FDA approvals for oral anti-cancer drugs, is fueling demand. Additionally, the need for effective and affordable therapeutics in chronic disease management supports market growth across other application areas.

Key Growth Drivers

Rising Prevalence of Chronic and Lifestyle-Related Diseases

The increasing global burden of chronic diseases such as cancer, cardiovascular disorders, diabetes, and neurological conditions is a primary growth driver for the Small Molecule API market. Small molecule drugs remain the cornerstone of therapeutic interventions for these conditions due to their oral bioavailability, stability, and cost-effectiveness. The World Health Organization estimates that chronic diseases account for nearly 74% of global deaths, highlighting the urgent need for accessible medications. As healthcare systems worldwide expand efforts toward preventive and long-term treatment solutions, the demand for high-quality APIs continues to escalate, prompting pharmaceutical companies to enhance production capacity and invest in advanced synthesis technologies.

- For instance, Novartis has invested in expanding its small-molecule production capabilities at its Stein, Switzerland facility. This includes the implementation of continuous manufacturing techniques for producing oral solid dosage forms. These production processes are supported by automated process control and real-time analytics to improve speed, quality, and efficiency.

Expansion of Generic Drug Production

The surge in generic drug manufacturing is significantly fueling market growth, as many blockbuster drugs are nearing patent expiration. Small molecule APIs form the backbone of the generic pharmaceutical industry due to their chemical simplicity and ease of replication. Emerging economies such as India and China have become global production hubs, leveraging cost advantages and skilled workforce availability. Governments and regulatory agencies are supporting generic production to improve drug accessibility and affordability. This trend encourages both established and mid-sized manufacturers to invest in process optimization and quality assurance systems, ensuring compliance with international standards while meeting global demand efficiently.

- For instance, Sun Pharmaceutical Industries operates numerous manufacturing facilities, including API facilities in Panoli and Ahmednagar, India. Like other major pharmaceutical companies, Sun Pharma uses advanced manufacturing technologies, such as chromatography systems, to ensure its products meet stringent international regulatory standards for purity, such as those from the USFDA and EMA.

Technological Advancements in API Manufacturing

Rapid advancements in chemical synthesis, process automation, and continuous manufacturing are reshaping the Small Molecule API industry. The adoption of flow chemistry, advanced catalysts, and green synthesis technologies enhances production efficiency, reduces waste, and improves product purity. Artificial intelligence and data analytics are increasingly integrated into process development and quality control, accelerating time-to-market for new drugs. Furthermore, the rise of modular and flexible manufacturing systems allows companies to adapt swiftly to market fluctuations. These innovations collectively lower production costs, improve scalability, and strengthen regulatory compliance, thereby driving sustainable growth in the market.

Key Trends and Opportunities

Shift Toward Outsourced Manufacturing and CDMO Partnerships

Outsourcing API production to contract development and manufacturing organizations (CDMOs) has emerged as a prominent trend, enabling pharmaceutical companies to focus on core competencies such as research and marketing. This strategic shift allows access to specialized expertise, advanced technologies, and global distribution networks. CDMOs offer flexible capacity, faster production timelines, and cost savings, making them critical partners in ensuring supply chain resilience. With increasing regulatory stringency and the need for high-quality standards, collaborations between drug developers and CDMOs are expected to expand, presenting significant opportunities for market players with strong technical capabilities.

- For instance, Lonza Group operates more than 30 manufacturing and R&D sites across Europe, Asia, and North America” is accurate. Lonza’s 2023 Annual Report states it has over 30 global development and manufacturing sites. Information from the Lonza website and LinkedIn also confirms a global network across these continents.

Growing Investment in Sustainable and Green Chemistry Practices

The industry is witnessing a growing focus on sustainability through the adoption of eco-friendly and energy-efficient API manufacturing methods. Green chemistry techniques, such as solvent-free reactions and biocatalysis, are being implemented to minimize environmental impact and improve overall efficiency. Governments and regulatory authorities are promoting sustainable manufacturing through incentives and environmental compliance standards. Companies investing in low-carbon and waste-reducing processes gain competitive advantages by aligning with global sustainability goals. This shift not only enhances brand reputation but also opens new opportunities for long-term partnerships with environmentally conscious pharmaceutical companies.

Key Challenges

Stringent Regulatory Requirements and Compliance Costs

The Small Molecule API market faces significant challenges due to complex regulatory frameworks across major regions such as the U.S., Europe, and Asia. Manufacturers must adhere to strict guidelines concerning product quality, safety, and traceability. The need for Good Manufacturing Practice (GMP) certification and regular audits increases operational costs and time to market. Non-compliance can lead to severe penalties or product recalls, damaging reputation and financial stability. Maintaining compliance amid evolving regulations demands continuous investment in quality systems, documentation, and workforce training, posing challenges for smaller and mid-sized producers.

Supply Chain Disruptions and Raw Material Dependence

Global supply chain vulnerabilities, particularly dependence on specific regions for raw material sourcing, remain a major obstacle in the Small Molecule API industry. The COVID-19 pandemic exposed significant weaknesses in supply continuity and logistics. Many manufacturers rely heavily on suppliers from China and India for key intermediates, making them susceptible to disruptions caused by trade restrictions or geopolitical tensions. Price volatility of raw materials further complicates production planning and cost management. To overcome this challenge, companies are increasingly diversifying suppliers, localizing production, and adopting digital supply chain management systems to enhance resilience and reliability.

Regional Analysis

North America:

North America dominates the Small Molecule API market with around 38% market share, attributed to its advanced pharmaceutical ecosystem, high R&D investment, and strong presence of leading drug manufacturers. The United States remains the primary contributor, driven by extensive innovation in drug discovery and favorable FDA regulations ensuring quality and safety. The region’s growing burden of chronic diseases and increased production of generic and specialty drugs further strengthen its leadership. Continuous investments in automated and continuous manufacturing technologies, along with strong collaborations between pharma and biotech companies, sustain North America’s dominant market position.

Europe:

Europe holds approximately 27% of the global Small Molecule API market, supported by a mature pharmaceutical infrastructure and stringent regulatory standards set by the European Medicines Agency (EMA). Countries such as Germany, Switzerland, and the U.K. act as major production and export hubs. The region emphasizes sustainable manufacturing practices and high-quality production through continuous process innovation. Increasing demand for therapeutic drugs in oncology, cardiology, and neurology contributes significantly to regional growth. Furthermore, the region’s well-coordinated regulatory framework facilitates market expansion and cross-border trade of APIs within the European Union.

Asia-Pacific:

Asia-Pacific accounts for around 28% of the Small Molecule API market, representing the fastest-growing regional segment. China and India serve as the world’s largest API producers, driven by cost-effective manufacturing, skilled labor, and supportive government initiatives. Rapidly expanding generic drug production and growing domestic demand for affordable medicines fuel regional growth. Investments in advanced production technologies and compliance with international GMP standards further enhance export potential. Additionally, the region’s increasing partnerships with global pharmaceutical firms and CDMOs solidify its position as the leading hub for large-scale and low-cost API manufacturing.

Latin America:

Latin America captures about 4% of the global Small Molecule API market, with Brazil and Mexico being key contributors. Growth is supported by the expansion of local pharmaceutical industries and increasing government initiatives to strengthen healthcare infrastructure. Rising prevalence of chronic conditions such as diabetes and cardiovascular diseases drives drug demand. Although technological limitations and dependence on imports persist, ongoing collaborations with international API suppliers and local manufacturing investments are gradually improving regional production capacity. The shift toward regulatory alignment and quality standardization further supports market development across the region.

Middle East & Africa:

The Middle East & Africa region holds approximately 3% of the Small Molecule API market, reflecting emerging growth potential. Increasing healthcare spending, rising chronic disease burden, and expanding pharmaceutical distribution networks are driving market expansion. Countries such as Saudi Arabia, the UAE, and South Africa are prioritizing healthcare self-sufficiency through local manufacturing initiatives and strategic partnerships with global pharmaceutical companies. Although the region remains import-dependent, government incentives and foreign direct investments in pharmaceutical infrastructure are expected to gradually enhance regional API production and market presence in the coming years.

Market Segmentations:

By Type:

By Manufacturer:

By Application:

- Cardiovascular Diseases

- Oncology

- CNS & Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Small Molecule API market is characterized by the presence of established global pharmaceutical and chemical companies alongside emerging regional manufacturers. Key players such as Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, Albemarle Corporation, Boehringer Ingelheim International GmbH, Aurobindo Pharma, Dr. Reddy’s Laboratories Ltd., and Cipla, Inc. dominate the market through extensive product portfolios, strong R&D capabilities, and strategic partnerships. These companies focus on process innovation, capacity expansion, and regulatory compliance to strengthen market presence. Mergers, acquisitions, and collaborations with contract development and manufacturing organizations (CDMOs) are common strategies to enhance production efficiency and global reach. Additionally, firms are investing in sustainable and continuous manufacturing technologies to reduce costs and environmental impact. The market remains moderately consolidated, with competition intensifying as players strive to meet rising demand for high-quality, cost-effective APIs across therapeutic segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, SK Pharmteco announced its plans to strengthen its small molecule and peptide capacity with an investment of approximately USD 260 million investment in South Korea.

- In July 2024, Ventus Therapeutics announced the opening of its office facility and laboratory in Montreal, Canada, marking the expansion of its R&D capacity.

- In June 2024, Matrix Pharma announced the acquisition of the API business of Viatris Inc. for funded by KSSF II. The acquisition is expected to significantly improve the company’s position in the Indian API market.

Report Coverage

The research report offers an in-depth analysis based on Type, Manufacturer, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by continuous innovation in chemical synthesis and process optimization.

- Demand for small molecule APIs will rise due to increasing incidence of chronic and lifestyle-related diseases.

- The expansion of generic drug manufacturing will create strong opportunities for cost-effective API producers.

- Technological advancements such as continuous manufacturing and AI-driven process control will enhance production efficiency.

- Growing adoption of green chemistry and sustainable practices will shape future manufacturing strategies.

- Pharmaceutical companies will increasingly collaborate with CDMOs to improve scalability and supply chain flexibility.

- Asia-Pacific will continue to emerge as the global hub for API production and export.

- Stringent quality regulations will encourage investment in compliance systems and advanced analytical tools.

- Rising focus on targeted and complex small molecules will open new therapeutic applications.

- Digitalization and automation will play a key role in achieving operational excellence and faster market delivery.