Market Overview

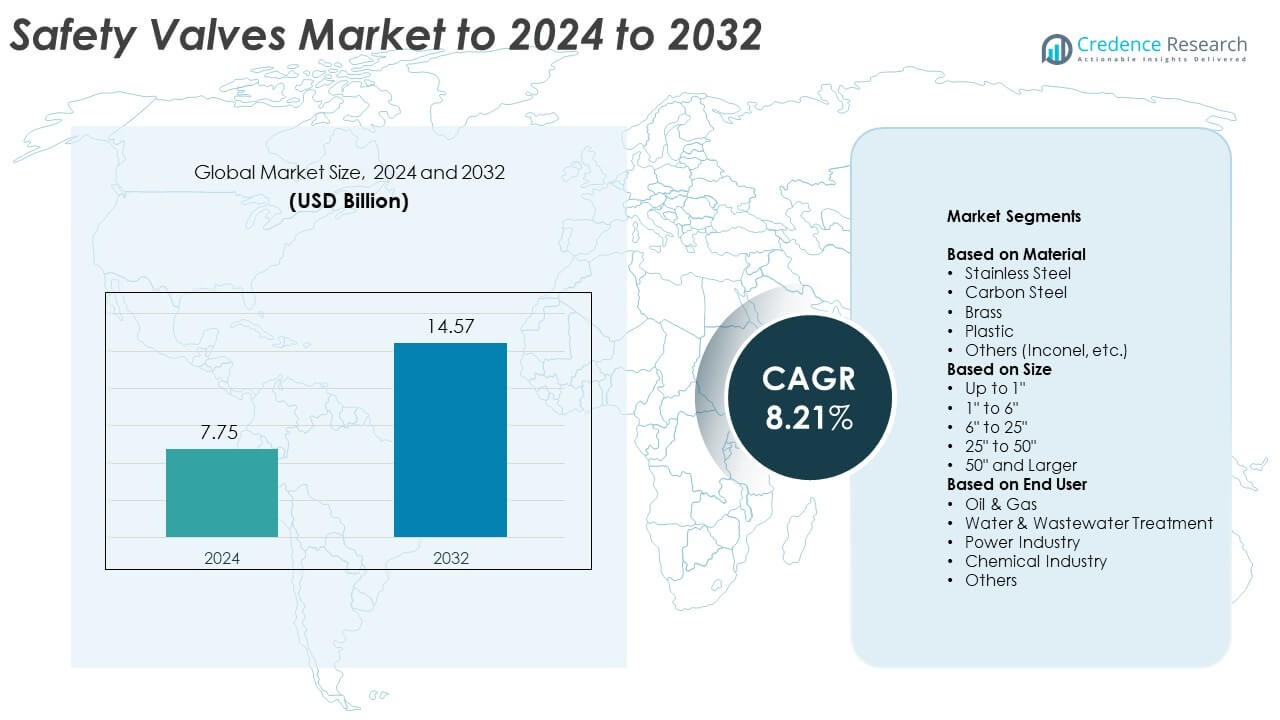

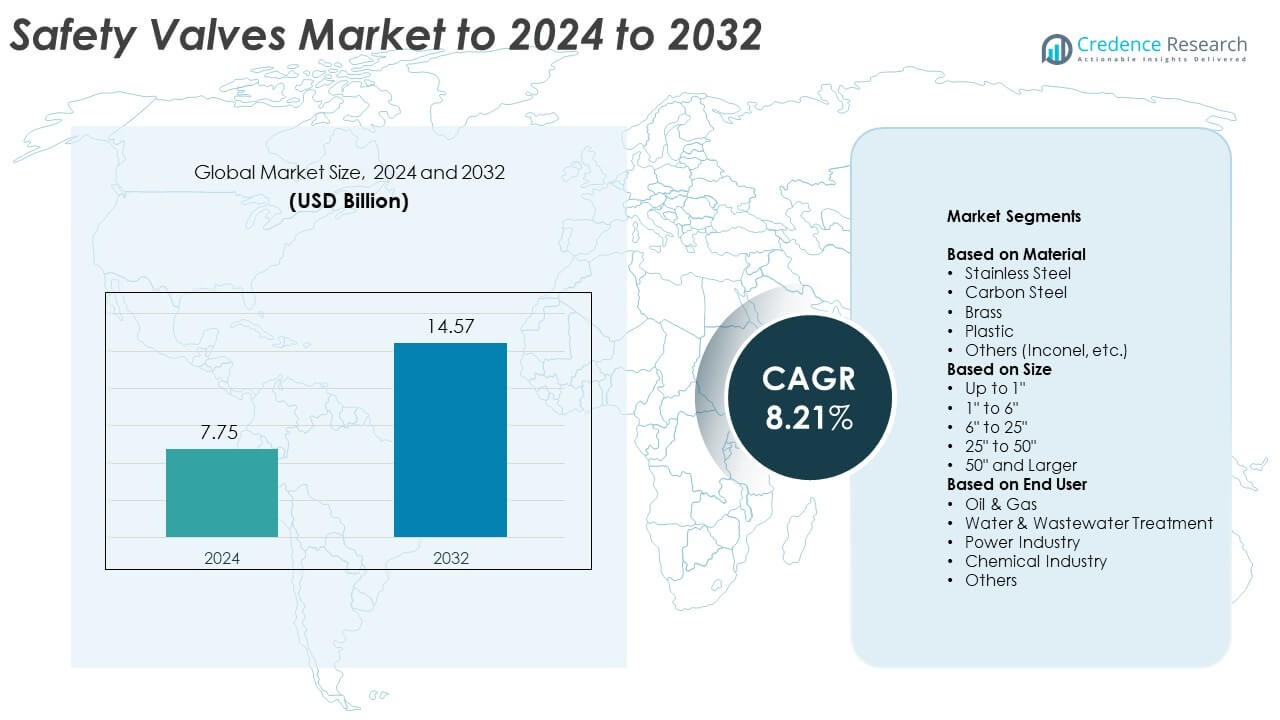

Safety Valves Market size was valued at USD 7.75 Billion in 2024 and is anticipated to reach USD 14.57 Billion by 2032, at a CAGR of 8.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Safety Valves Market Size 2024 |

USD 7.75 Billion |

| Safety Valves Market, CAGR |

8.21% |

| Safety Valves Market Size 2032 |

USD 14.57 Billion |

The Safety Valves Market is characterized by strong competition among leading manufacturers such as Emerson Electric Co., Flowserve Corporation, Parker Hannifin Corporation, Honeywell International Inc., and Schneider Electric SE. These companies focus on technological innovation, product reliability, and compliance with international safety standards to strengthen their market presence. Continuous investment in automation, digital monitoring, and smart valve technologies enhances their competitiveness across industries such as oil and gas, power, and chemicals. Regionally, Asia-Pacific dominated the global market in 2024 with a 33.8% share, driven by rapid industrialization, infrastructure expansion, and increasing adoption of safety systems across manufacturing and energy sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Safety Valves Market was valued at USD 7.75 Billion in 2024 and is projected to reach USD 14.57 Billion by 2032, growing at a CAGR of 8.21%.

- Rising enforcement of industrial safety standards and expansion in oil and gas, power, and chemical sectors drive strong market growth.

- Increasing adoption of smart monitoring and IoT-enabled valve systems is shaping new opportunities for efficiency and predictive maintenance.

- The market remains moderately consolidated, with major players focusing on automation, material innovation, and compliance with global pressure equipment standards.

- Asia-Pacific led the global market with a 33.8% share in 2024, followed by North America at 32.6% and Europe at 27.4%, while stainless steel held the dominant material segment with 46.3% share.

Market Segmentation Analysis:

By Material

The stainless steel segment dominated the safety valves market in 2024, holding around 46.3% share. Its dominance stems from superior corrosion resistance, high durability, and suitability for high-pressure environments. Stainless steel valves are widely adopted in oil and gas, power generation, and chemical processing due to their ability to withstand extreme temperatures and aggressive media. The growing deployment of offshore drilling operations and refineries further supports demand. Increasing focus on long service life and reduced maintenance costs continues to strengthen the position of stainless steel safety valves globally.

- For instance, LESER India reports more than 300,000 safety valves installed across industries.

By Size

The 1″ to 6″ size segment accounted for the largest share of about 39.8% in 2024. This dominance is attributed to their extensive use in mid-range industrial pipelines, power plants, and water systems. These valves provide optimal balance between flow control efficiency and installation flexibility. Widespread adoption in oil refineries and wastewater treatment facilities supports segment growth. Additionally, increasing infrastructure projects and industrial expansions in developing economies drive continuous demand for medium-sized safety valves for both liquid and gas handling applications.

- For instance, Curtiss-Wright’s Farris Series 2700 offers valves with inlet sizes ranging from 1/2″ up to 1-1/2″ and can be configured with set pressure ranges from 15 to 6500 psig depending on the model and construction.

By End User

The oil and gas segment led the safety valves market in 2024 with approximately 41.5% share. The sector’s dominance is fueled by stringent pressure regulation requirements in upstream, midstream, and downstream operations. Safety valves play a crucial role in preventing equipment failure and ensuring operational safety in pipelines, refineries, and storage facilities. Rising global energy demand and ongoing investments in offshore exploration and LNG terminals are driving higher adoption. Increasing emphasis on safety compliance and asset protection reinforces demand for advanced safety valve systems in the oil and gas industry.

Key Growth Drivers

Stringent Industrial Safety Regulations

Rising enforcement of industrial safety standards globally drives safety valve adoption. Governments and regulatory bodies mandate pressure relief systems in critical sectors such as oil and gas, power, and chemical industries. Compliance with standards like ASME and API enhances operational reliability and reduces accident risks. The need to prevent catastrophic equipment failures and ensure workforce safety continues to boost market demand, especially in facilities operating under high temperature and pressure conditions.

- For instance, Weir offers the Sarasin-RSBD Starflow P series safety valves, which are designed in compliance with API Std 526 and ASME BPVC Section VIII. Specific models are available with inlet sizes up to 12″ and ANSI Class ratings from 150 to 2500.

Expansion of Oil and Gas Exploration Activities

Increasing exploration and production activities worldwide strengthen demand for high-performance safety valves. Rapid growth in deepwater and shale operations creates strong requirements for durable, corrosion-resistant valve systems. Major producers are investing heavily in refining capacity expansion and LNG terminals. These developments support the use of advanced safety valves designed to handle extreme operational environments and high-pressure systems. The oil and gas sector remains a key revenue contributor for the global safety valve industry.

- For instance, ExxonMobil is producing about 650,000 bpd in Guyana and targets >900,000 bpd capacity in 2025, expanding high-pressure equipment needs.

Growing Focus on Power Generation Efficiency

Rising global energy consumption and the expansion of thermal and nuclear power plants significantly drive safety valve installation. These valves protect turbines, boilers, and pipelines from pressure surges and ensure efficient operation. Increasing modernization of aging power infrastructure in Asia-Pacific and Europe fuels replacement demand. Additionally, the integration of digital monitoring and predictive maintenance in safety valve systems enhances efficiency, reliability, and overall plant safety, fostering sustained market growth in power generation applications.

Key Trends & Opportunities

Adoption of Smart Monitoring Technologies

The integration of IoT-enabled and sensor-based safety valves is emerging as a major trend. These smart valves provide real-time pressure monitoring, predictive maintenance alerts, and remote diagnostics. Industries are adopting such solutions to minimize downtime and improve operational safety. Manufacturers are focusing on developing connected valve systems that comply with digital plant requirements, supporting automation and data-driven decision-making across industrial sectors.

- For instance, Emerson customers have purchased 3 million Fisher FIELDVUE digital valve controllers with online diagnostics for predictive maintenance.

Shift Toward Sustainable and Corrosion-Resistant Materials

Manufacturers increasingly develop safety valves using eco-friendly alloys and high-performance polymers. The use of advanced materials such as duplex stainless steel and Inconel improves resistance to corrosion, wear, and extreme pressure. This shift aligns with industry sustainability goals and reduces maintenance costs. Growing adoption in chemical processing and offshore industries further expands opportunities for material innovation in safety valve design.

- For instance, IMI Bopp & Reuther’s Si-0 compact stainless-steel safety valve is designed for high-pressure applications, covering a set pressure range from 0.45 bar g to 400 bar g.

Key Challenges

High Maintenance and Installation Costs

Complex installation procedures and high maintenance costs restrict adoption among small and mid-sized enterprises. Safety valves require regular inspection, calibration, and replacement to maintain performance reliability. Industries operating under tight capital budgets often delay upgrades, impacting operational safety. Additionally, downtime during maintenance increases production losses, creating cost-related barriers to widespread deployment of advanced valve systems.

Lack of Skilled Workforce and Technical Expertise

Shortage of trained technicians to install, calibrate, and maintain modern safety valves poses a major challenge. The increasing use of automated and smart valve systems requires specialized knowledge in control systems and sensor integration. Developing regions face a gap in technical training and certification programs. This shortage limits proper system management and affects the reliability of pressure control operations in critical industries.

Regional Analysis

North America

North America held around 32.6% share of the global safety valves market in 2024. The dominance is supported by strong demand from the oil and gas, power generation, and chemical sectors. The United States leads the region, driven by shale gas exploration, LNG expansion, and refinery upgrades. Canada’s growing investments in pipeline infrastructure and industrial safety regulations further contribute to growth. The presence of leading manufacturers and increasing adoption of advanced monitoring technologies reinforce North America’s position as a key market for high-performance safety valves.

Europe

Europe accounted for approximately 27.4% of the safety valves market in 2024, driven by strict safety regulations and industrial modernization initiatives. Countries such as Germany, the UK, and France are major contributors, supported by expanding chemical and energy industries. The region’s focus on sustainability and transition to renewable power plants promotes the adoption of durable and efficient valve systems. Ongoing retrofitting of aging industrial equipment and compliance with EU directives on pressure systems further strengthen demand across various end-use sectors.

Asia-Pacific

Asia-Pacific dominated the global safety valves market with a 33.8% share in 2024, emerging as the fastest-growing regional market. Rapid industrialization, infrastructure development, and energy demand in China, India, and Japan drive strong growth. The expansion of oil refineries, power plants, and manufacturing facilities increases the need for reliable pressure control systems. Government-led initiatives promoting safety compliance and rising investments in LNG and petrochemical projects support long-term regional expansion. Local manufacturing and cost-effective production further enhance market competitiveness in Asia-Pacific.

Latin America

Latin America represented about 3.7% of the global safety valves market in 2024. Growth is primarily driven by Brazil and Mexico, supported by oil refining, petrochemical processing, and mining activities. Government efforts to attract foreign investments in the energy and industrial sectors boost equipment modernization. The expansion of offshore oil projects and infrastructure development enhances demand for corrosion-resistant and high-pressure valve systems. However, fluctuating economic conditions and limited local manufacturing capacity slightly restrain large-scale adoption across the region.

Middle East & Africa

The Middle East and Africa accounted for nearly 2.5% share of the safety valves market in 2024. Strong growth in the oil and gas sector, especially in Saudi Arabia, the UAE, and Qatar, drives the regional demand. Rapid construction of new refineries, pipelines, and desalination plants contributes to steady expansion. Africa’s emerging power generation and water treatment projects also create opportunities. However, dependency on imports and slower industrial diversification limit market growth potential compared to other regions.

Market Segmentations:

By Material

- Stainless Steel

- Carbon Steel

- Brass

- Plastic

- Others (Inconel, etc.)

By Size

- Up to 1″

- 1″ to 6″

- 6″ to 25″

- 25″ to 50″

- 50″ and Larger

By End User

- Oil & Gas

- Water & Wastewater Treatment

- Power Industry

- Chemical Industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Emerson Electric Co., Flowserve Corporation, Parker Hannifin Corporation, Honeywell International Inc., Burkert Fluid Control Systems, Schneider Electric SE, GE Measurement & Control Solutions, Pentair plc, Spirax Sarco Limited, IMI, Rotork Plc, Cameron, Crane Co., Moog Inc., ValvTechnologies, Inc., and Watts Water Technologies, Inc. are the major players operating in the global safety valves market. The market is moderately consolidated, with companies focusing on expanding production capacity and technological advancements. Leading manufacturers emphasize the development of high-performance valves that ensure operational reliability, durability, and compliance with international safety standards. Increasing adoption of automation, smart monitoring, and digital control systems is reshaping competition. Firms are also pursuing mergers, strategic alliances, and product innovations to strengthen regional presence and enhance supply chain efficiency. Continuous investment in R&D, coupled with efforts to reduce maintenance costs and improve service response times, remains central to sustaining competitiveness in the global safety valves industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Emerson Electric Co.

- Flowserve Corporation

- Parker Hannifin Corporation

- Honeywell International Inc.

- Burkert Fluid Control Systems

- Schneider Electric SE

- GE Measurement & Control Solutions

- Pentair plc

- Spirax Sarco Limited

- IMI

- Rotork Plc

- Cameron

- Crane Co.

- Moog Inc.

- ValvTechnologies, Inc.

- Watts Water Technologies, Inc.

Recent Developments

- In 2024, IMI acquired TWTG, a Netherlands-based company specializing in Industrial Internet of Things (IIoT) sensors, to integrate its technology into IMI’s process automation and safety valve offerings

- In 2023, Emerson launched the ASCO Series 262 and 263 combustion safety shutoff valves.

- In 2023, Moog introduced the new D927 proportional valve, completing its Direct Operated Servo-Proportional valve line.

Report Coverage

The research report offers an in-depth analysis based on Material, Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart and IoT-enabled safety valves will rise for real-time monitoring.

- Asia-Pacific will continue leading growth due to rapid industrialization and infrastructure expansion.

- Oil and gas exploration in deepwater and shale reserves will strengthen market demand.

- Adoption of corrosion-resistant and eco-friendly materials will improve product lifespan.

- Power generation modernization projects will boost replacement of outdated valve systems.

- Stricter global safety and emission standards will drive new installations across industries.

- Manufacturers will focus on digital integration and predictive maintenance solutions.

- Expansion in LNG terminals and refineries will fuel steady market growth.

- Automation and remote control technologies will enhance operational safety and efficiency.

- Collaborations and capacity expansion by key players will shape competitive dynamics.