Market Overview:

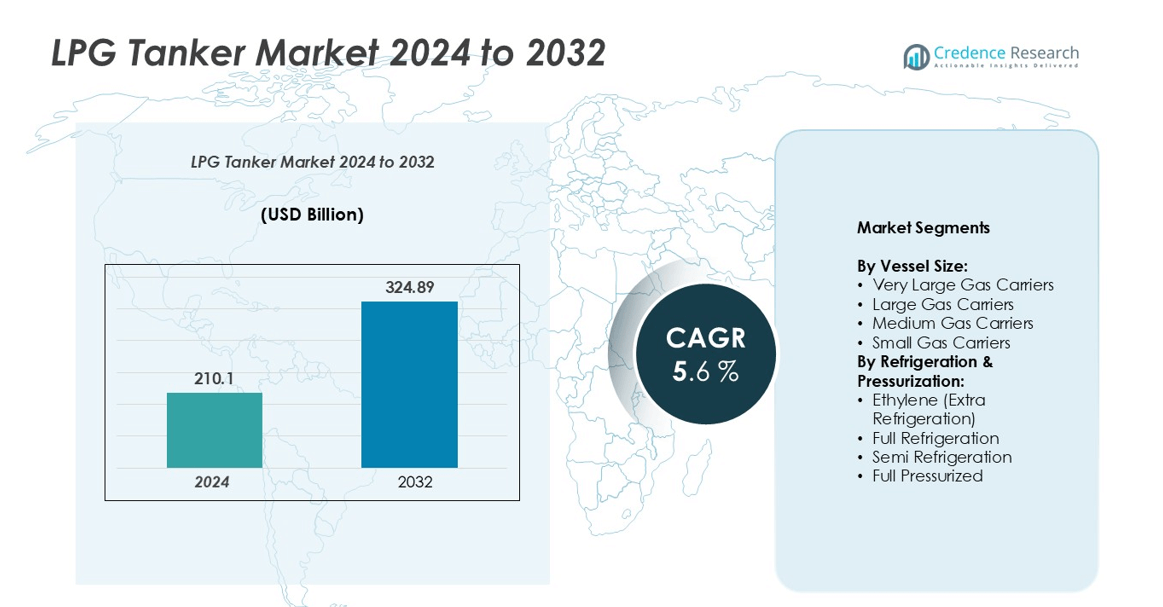

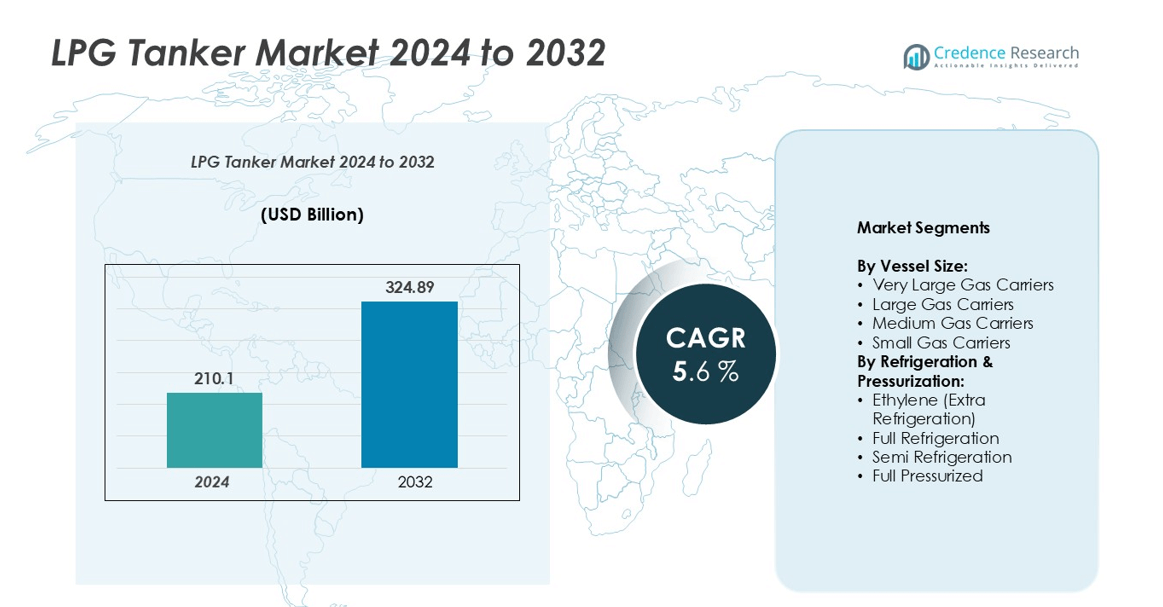

The LPG Tanker market size was valued at USD 210.1 billion in 2024 and is anticipated to reach USD 324.89 billion by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LPG Tanker Market Size 2024 |

USD 210.1 billion |

| LPG Tanker Market, CAGR |

5.6% |

| LPG Tanker Market Size 2032 |

USD 324.89 billion |

The LPG tanker market is led by prominent players such as BW Group, Dorian LPG Ltd., EXMAR, StealthGas Inc., Hyundai Heavy Industries Co., Ltd., Mitsubishi Heavy Industries, Ltd., Kawasaki Heavy Industries, Ltd., Namura Shipbuilding Co., Ltd., PT Pertamina (Persero), and The Great Eastern Shipping Co. Ltd. These companies collectively drive market growth through advanced fleet management, sustainable vessel design, and strategic global partnerships. Asia-Pacific emerges as the leading region, accounting for approximately 38% of the global LPG tanker market in 2024, followed by North America with 32% and Europe with 21%. The dominance of Asia-Pacific is attributed to its rising LPG imports, expanding petrochemical industry, and increasing demand for energy-efficient transport solutions.

Market Insights

- The LPG tanker market was valued at USD 210.1 billion in 2024 and is projected to reach USD 324.89 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

- Rising global LPG demand, driven by clean energy adoption and the expansion of petrochemical industries, fuels strong growth in tanker deployment and fleet modernization.

- Market trends highlight increased investment in Very Large Gas Carriers (VLGCs) and adoption of eco-efficient technologies such as LPG-fueled propulsion systems to reduce emissions.

- Competition intensifies among key players like BW Group, Dorian LPG Ltd., and EXMAR, focusing on capacity expansion, strategic alliances, and compliance with international maritime regulations.

- Asia-Pacific leads the market with 38% share, followed by North America (32%) and Europe (21%); by vessel size, Very Large Gas Carriers dominate due to their cost-efficiency and ability to handle long-haul LPG transportation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vessel Size:

The LPG tanker market, by vessel size, is segmented into Very Large Gas Carriers (VLGCs), Large Gas Carriers, Medium Gas Carriers, and Small Gas Carriers. Among these, Very Large Gas Carriers (VLGCs) dominate the market, accounting for the largest share in 2024. Their dominance is driven by the growing international trade of LPG between the U.S., Middle East, and Asia-Pacific, supported by high-capacity transport efficiency and lower freight costs per ton. Increasing global energy demand and the development of large-scale export terminals further enhance the adoption of VLGCs for long-distance transportation.

- For instance, BW LPG, one of the world’s largest Very Large Gas Carrier (VLGC) operators, manages a fleet of more than 50 VLGCs with an average carrying capacity of approximately 81,000 cubic meters.

By Refrigeration & Pressurization:

Based on refrigeration and pressurization, the market is divided into Ethylene (Extra Refrigeration), Full Refrigeration, Semi Refrigeration, and Full Pressurized tankers. Fully Refrigerated LPG carriers hold the leading market share, primarily due to their suitability for large-volume storage and long-haul transportation. These vessels offer enhanced efficiency and safety in handling low-temperature cargo, making them ideal for global LPG trade routes. The expansion of petrochemical industries and growing demand for bulk LPG exports have further accelerated the deployment of fully refrigerated tankers across major shipping companies.

- For instance, Mitsui O.S.K. Lines (MOL) signed a time charter contract with TotalEnergies for two LPG/ammonia dual-fuel Very Large Gas Carriers (VLGCs). The 88,000 cubic meter vessels were ordered from Hyundai Samho Heavy Industries.

Key Growth Drivers

Rising Global LPG Consumption

The increasing global demand for liquefied petroleum gas (LPG) as a cleaner alternative to conventional fuels is a primary driver of the LPG tanker market. Growing use of LPG for residential cooking, heating, and industrial applications—especially in developing regions such as Asia-Pacific and Africa—has amplified the need for efficient marine transportation. Additionally, the expansion of petrochemical industries in China, India, and South Korea has boosted LPG imports, fueling the deployment of larger and more advanced tankers. Government initiatives to promote clean energy adoption and the substitution of coal and kerosene with LPG further strengthen the demand outlook for LPG shipping and storage infrastructure.

- For instance, BW LPG retrofitted the dual-fuel VLGC BW Gemini with a MAN B&W 6G60ME-LGIP engine. This engine can run on LPG. The engine was retrofitted in 2020. Sea trials finished successfully in October 2020. During sea trials, the main engine consumed about 35.6 tons of LPG daily, not 30 tons.

Expansion of LPG Export Terminals and Trade Routes

The construction and modernization of LPG export terminals across North America and the Middle East are driving robust growth in global LPG trade volumes. The United States has emerged as a key exporter due to shale gas production, supporting the increased use of Very Large Gas Carriers (VLGCs) for transoceanic trade. Similarly, Middle Eastern producers such as Qatar and Saudi Arabia are investing in new export infrastructure to cater to Asia’s rising consumption. The development of deepwater ports and the expansion of Panama Canal capacity have also optimized shipping routes, enhancing transport efficiency and reducing transit time. This expansion of export and import networks continues to fuel tanker demand across global trade corridors.

- For instance, Enterprise Products Partners is expanding its Enterprise Hydrocarbons Terminal (EHT) along the Houston Ship Channel to increase LPG export capabilities. In an announcement made on July 30, 2024, the company stated that it is adding refrigeration capacity to increase propane and butane export capacity by approximately 300,000 barrels per day (BPD), with service expected to begin by the end of 2026.

Technological Advancements in LPG Carrier Design

Technological innovations in shipbuilding are significantly enhancing the operational efficiency and safety of LPG tankers. Modern carriers now integrate advanced refrigeration systems, energy-efficient propulsion technologies, and digital monitoring solutions that reduce emissions and operational costs. The adoption of dual-fuel engines capable of using LPG as marine fuel has further strengthened environmental compliance. Enhanced hull designs and automation technologies are improving cargo handling and voyage optimization, thereby reducing downtime and fuel consumption. These innovations align with international maritime emission standards, making technologically advanced vessels more attractive to shipowners and operators seeking long-term cost savings and sustainability.

Key Trends & Opportunities

Transition Toward Green Shipping Practices

Sustainability has become a central trend shaping the LPG tanker market. With tightening International Maritime Organization (IMO) regulations, shipping companies are adopting eco-friendly designs and cleaner propulsion systems. The increasing use of LPG itself as a marine fuel offers dual benefits—reducing greenhouse gas emissions while lowering fuel costs. Companies are investing in carbon-neutral initiatives, including carbon capture systems and hybrid propulsion technologies. These green shipping practices not only ensure regulatory compliance but also create a competitive advantage for operators prioritizing sustainable logistics, opening new opportunities for shipbuilders specializing in low-emission vessels.

- For instance, NYK Line’s LPG dual-fuel VLGC, the Liberty Pathfinder, achieved a CO₂ emission reduction of over 20% annually compared to conventional heavy oil–fueled ships. This was supported by a dual-fuel engine and a shaft generator, which improves efficiency and enables full LPG-fueled navigation.

Rising Investments in Fleet Expansion and Modernization

Global shipowners are expanding and upgrading their LPG carrier fleets to meet rising trade volumes and efficiency standards. The growing preference for Very Large Gas Carriers (VLGCs) and fully refrigerated vessels reflects the market’s shift toward larger, technologically advanced ships capable of transporting greater volumes. Strategic investments by leading shipping companies in digital fleet management, predictive maintenance, and automation further enhance operational reliability. The integration of smart navigation systems and AI-based monitoring tools creates opportunities for efficiency-driven growth, especially as demand for long-haul LPG transport continues to rise across international trade routes.

- For instance, in 2024, Dorian LPG used Sofar Ocean’s Wayfinder platform for fleet-wide voyage optimization, leveraging real-time weather and vessel data to improve efficiency across its fleet of Very Large Gas Carriers (VLGCs). This initiative resulted in an average 9% fuel saving per voyage. The Cresques, an 84,000 cubic meter VLGC, was delivered to Dorian LPG in 2015 and is not a new addition to the fleet in 2024. It is equipped with sensors that contribute to the real-time monitoring used for optimizing voyages.

Key Challenges

High Capital and Operating Costs

The LPG tanker market faces significant financial barriers due to high vessel acquisition, maintenance, and operational costs. Building technologically advanced carriers with enhanced refrigeration and propulsion systems requires substantial upfront investment. Moreover, fluctuating fuel prices, port fees, and insurance premiums add to operating expenses. Smaller operators often struggle to compete with major global shipping companies that can absorb these costs through economies of scale. The long payback periods associated with shipbuilding investments also limit new entrants, posing a major challenge to market expansion despite rising global LPG demand.

Volatility in Global Energy Trade and Geopolitical Risks

Geopolitical tensions, trade restrictions, and fluctuating crude oil prices create uncertainties that impact LPG production, supply, and shipping demand. Conflicts in key export regions, such as the Middle East, can disrupt trade routes and delay shipments. Additionally, changing energy policies and tariffs affect global LPG trade flows, influencing freight rates and tanker utilization. These external pressures make it difficult for shipping operators to maintain stable profitability and long-term contracts. Managing these geopolitical and market fluctuations remains a key challenge for industry players aiming to achieve consistent fleet utilization and revenue growth.

Regional Analysis

North America:

North America holds a significant share of the global LPG tanker market, accounting for around 32% in 2024, primarily driven by the United States’ leadership in LPG production and exports. The shale gas boom has positioned the region as a major supplier to global markets, especially Asia-Pacific and Europe. Extensive export terminal infrastructure along the Gulf Coast and the expansion of liquefaction and storage facilities have strengthened its shipping capacity. Continuous investments in Very Large Gas Carriers (VLGCs) and advanced port logistics further reinforce North America’s position as a dominant player in global LPG transportation.

Europe:

Europe accounts for approximately 21% of the global LPG tanker market in 2024, supported by strong demand from industrial, residential, and petrochemical sectors. The region relies heavily on LPG imports from the U.S., the Middle East, and Africa to meet domestic energy requirements. Increasing energy diversification efforts and the shift toward cleaner fuels drive the demand for efficient LPG logistics. Major ports such as Rotterdam and Antwerp serve as critical distribution hubs. Additionally, regulatory emphasis on emission reduction and modernization of tanker fleets enhances the operational efficiency and competitiveness of European LPG shipping companies.

Asia-Pacific:

Asia-Pacific dominates the LPG tanker market with a market share of around 38% in 2024, driven by surging consumption in China, India, Japan, and South Korea. Rapid urbanization, population growth, and the shift toward cleaner household and industrial fuels have significantly increased LPG imports. The region’s growing petrochemical industry and expansion of storage and distribution terminals further fuel tanker demand. Strategic partnerships and long-term supply contracts with North American and Middle Eastern exporters strengthen Asia-Pacific’s import infrastructure. The deployment of larger and technologically advanced tankers supports efficient long-haul LPG transportation across the region.

Middle East & Africa:

The Middle East & Africa region accounts for about 7% of the global LPG tanker market in 2024, largely driven by the Middle East’s dominance in LPG production and exports. Key producers such as Saudi Arabia, Qatar, and the UAE play a vital role in supplying global markets. Investments in export terminals, storage facilities, and dedicated tanker fleets support large-scale outbound shipments to Asia and Europe. In Africa, increasing LPG adoption in residential and industrial sectors is expanding regional demand. However, infrastructure limitations and political instability in certain areas constrain overall market growth.

Latin America:

Latin America represents nearly 2% of the global LPG tanker market in 2024, with growth supported by expanding LPG demand in Brazil, Mexico, and Argentina. The region’s improving energy infrastructure and rising emphasis on clean fuel alternatives are fostering LPG imports and intra-regional trade. Brazil and Mexico are investing in port modernization and new terminal projects to enhance storage and shipping capacity. Despite relatively modest market share, increasing partnerships with North American exporters and fleet modernization efforts are expected to strengthen Latin America’s participation in the global LPG shipping network over the forecast period.

Market Segmentations:

By Vessel Size:

- Very Large Gas Carriers

- Large Gas Carriers

- Medium Gas Carriers

- Small Gas Carriers

By Refrigeration & Pressurization:

- Ethylene (Extra Refrigeration)

- Full Refrigeration

- Semi Refrigeration

- Full Pressurized

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The LPG tanker market features a competitive landscape dominated by a mix of global shipping operators and shipbuilding companies focusing on fleet expansion and technological innovation. Leading players such as BW Group, Dorian LPG Ltd., EXMAR, and StealthGas Inc. operate extensive fleets of Very Large Gas Carriers (VLGCs) and refrigerated tankers to serve key trade routes across Asia, Europe, and North America. Shipbuilders including Hyundai Heavy Industries, Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and Namura Shipbuilding are actively investing in energy-efficient and low-emission vessel designs to meet evolving regulatory standards. Companies like PT Pertamina (Persero) and The Great Eastern Shipping Co. Ltd. are enhancing their logistics and export capabilities to strengthen regional market presence. Strategic partnerships, long-term contracts, and fleet modernization initiatives remain central to competitive differentiation, while sustainability and digitalization are increasingly shaping business strategies across the global LPG shipping ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BW Group

- Dorian LPG Ltd.

- EXMAR

- StealthGas Inc.

- The Great Eastern Shipping Co. Ltd.

- PT Pertamina (Persero)

- Hyundai Heavy Industries Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Kawasaki Heavy Industries, Ltd.

- Namura Shipbuilding Co., Ltd.

Recent Developments

- In October 2024, Hyundai Mipo secured a contract to build two LPG carriers, each with a capacity of 45,000 cubic meters, for a shipowner based in Oceania. The deal, valued at $164 million, includes scheduled deliveries in the latter half of 2027.

- In July 2024, PT Pertamina International Shipping (PIS) entered into a new partnership with global commodity trader BGN to enhance its fleet of large LPG tankers. This collaboration focuses on the joint development and operation of new vessels specifically designed for transporting liquefied petroleum gas.

- In July 2023, Indonesia’s Pertamina International Shipping (PIS) agreed to hire four LPG carriers named Gas Walio, Gas Widuri, Gas Arjuna, and Gas Ambalat LPG via its PIS Middle East subsidiary to three companies.

- In April 2023, China delivered the world’s largest dual-fuel LPG carrier while highlighting the advanced design feature of the new ships.

- In January 2022, the EU blocked the merger between Hyundai Heavy Industries and DSME on monopoly concerns. The European Commission stated its restriction of the union would lower competition in the LNG and LPG carrier market.

Report Coverage

The research report offers an in-depth analysis based on Vessel Size, Refrigeration & Pressurization and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The LPG tanker market will experience steady growth driven by expanding global energy trade and rising clean fuel demand.

- Fleet modernization will accelerate as operators adopt energy-efficient and low-emission vessel technologies.

- Very Large Gas Carriers will continue to dominate due to their superior cargo capacity and cost efficiency.

- Asia-Pacific will remain the primary demand hub, supported by increasing LPG imports and industrial expansion.

- North American exports will strengthen with growing shale gas production and terminal development.

- Digitalization and smart fleet management systems will enhance operational efficiency and safety.

- Shipbuilders will focus on advanced refrigeration systems and dual-fuel propulsion designs.

- Strategic alliances and long-term charter agreements will shape competitive positioning.

- Regulatory pressure on emission reduction will drive innovation in eco-friendly ship designs.

- Increased investment in port infrastructure and logistics networks will support global LPG supply chain resilience.