Market Overview:

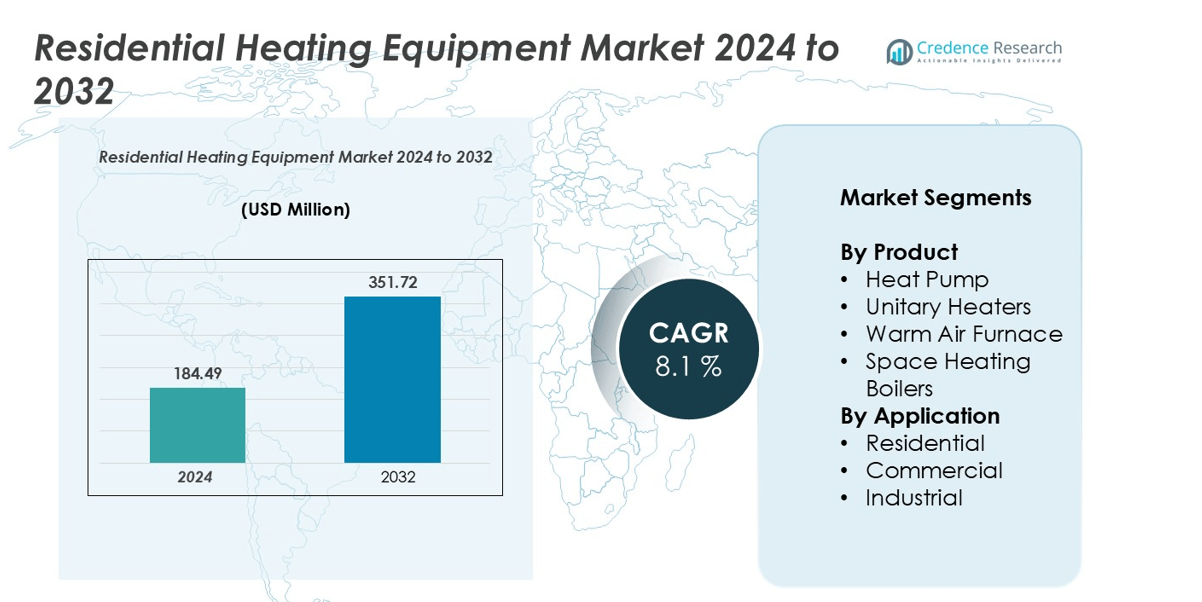

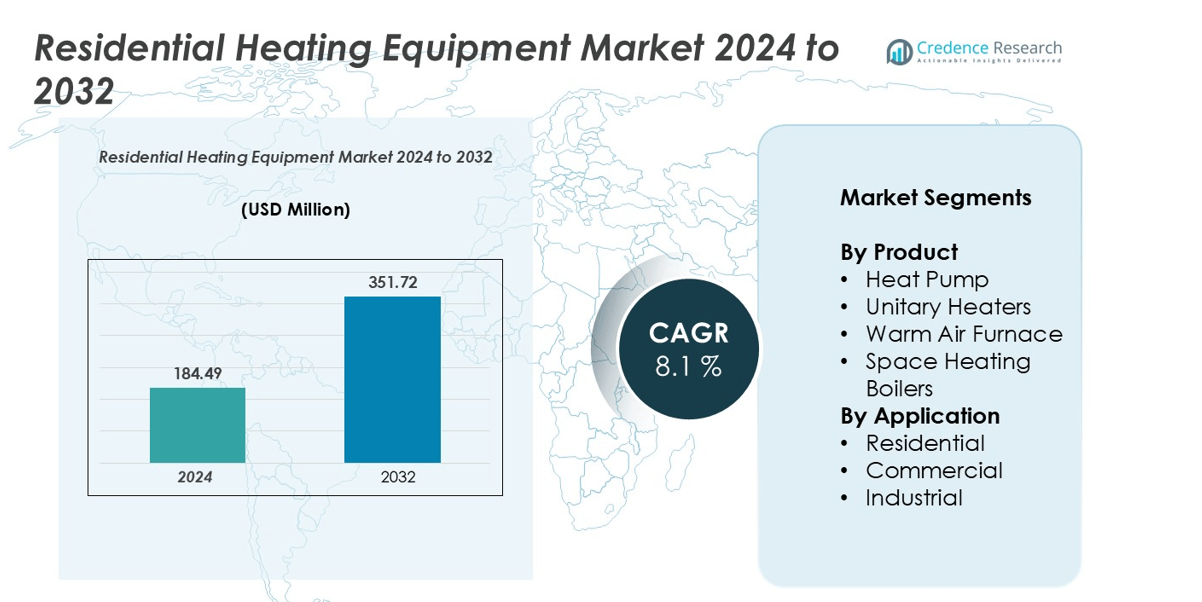

Residential heating equipment market size was valued at USD 184.49 million in 2024 and is anticipated to reach USD 351.72 million by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Heating Equipment Market Size 2024 |

USD 184.49 million |

| Residential Heating Equipment Market, CAGR |

8.1% |

| Residential Heating Equipment Market Size 2032 |

USD 351.72 million |

The residential heating equipment market is dominated by key global players, including Carrier, Mitsubishi Electric Corporation, Daikin Industries, Trane, Robert Bosch GmbH, Emerson Electric Co., Lennox International, Johnson Controls, Midea Group, Hitachi, Rheem Manufacturing Company, and Haier (General Electric). These companies drive growth through technological innovation, energy-efficient solutions, and strategic expansions across regions. North America leads the market with approximately 32% share, supported by high adoption of smart heating systems and regulatory incentives. Europe follows with around 28% share, driven by energy efficiency regulations and strong consumer awareness. Asia-Pacific accounts for 25% share, fueled by urbanization, rising disposable incomes, and modernization of residential infrastructure. Latin America (9% share) and Middle East & Africa (6% share) are gradually expanding due to increasing residential construction and adoption of cost-effective, energy-efficient heating solutions.

Market Insights

- The residential heating equipment market was valued at USD 184.49 million in 2024 and is projected to reach USD 351.72 million by 2032, growing at a CAGR of 8.1%.

- Growth is driven by rising urbanization, increasing residential construction, and adoption of energy-efficient heating solutions such as heat pumps and space heating boilers, particularly in North America (32% share) and Europe (28% share).

- Key trends include integration of smart home technologies, adoption of renewable energy-compatible systems, and expansion of high-efficiency products in Asia-Pacific (25% share), meeting the growing demand for sustainable and cost-effective heating.

- The market is highly competitive, dominated by players such as Carrier, Mitsubishi Electric, Daikin, Trane, Bosch, and Midea, leveraging R&D, strategic partnerships, and product innovation to maintain regional and segment leadership.

- Restraints include high initial investment costs, installation complexity, and energy price volatility, which may limit adoption in Latin America (9% share) and Middle East & Africa (6% share).

Market Segmentation Analysis:

By Product

The heat pump segment dominates the residential heating equipment market, capturing the largest market share due to its energy efficiency, low operating costs, and environmentally friendly performance. Growing consumer preference for sustainable and cost-effective heating solutions drives its adoption. Unitary heaters, warm air furnaces, and space heating boilers are also witnessing steady demand, primarily in regions with extreme climates. Technological advancements, such as smart thermostats and inverter-based heat pumps, further enhance efficiency, reliability, and ease of installation, reinforcing the segment’s leadership and encouraging a gradual shift from traditional heating methods.

- For instance, Daikin Industries Ltd. introduced its Altherma 3 H HT heat pump series featuring an inverter compressor. It is designed to perform in cold climates, operating at ambient temperatures as low as -28°C. Some outdoor models can deliver high leaving water temperatures up to 70°C. The Altherma 3 series is known for its high efficiency, with some units achieving a seasonal energy efficiency class of up to A+++ for space heating, as measured under EN14825 standards. The specific Seasonal Coefficient of Performance (SCOP) varies depending on the model, climate, and water output temperature.

By Application

Within the application landscape, the residential sector holds the dominant position, accounting for the largest share of the market. Increasing urbanization, rising disposable incomes, and the growing need for indoor comfort fuel the adoption of residential heating equipment. Consumers are increasingly investing in energy-efficient and low-maintenance solutions to reduce utility costs while ensuring consistent heating throughout homes. Commercial and industrial applications are expanding steadily due to rising infrastructure development and modernization, yet residential demand continues to outpace other sectors, driven by evolving consumer expectations and supportive government initiatives for energy-efficient housing.

- For instance, Bosch Thermotechnology offers the Compress 7000i AW residential heat pump system, which includes models capable of delivering a 17 kW heating output. While an absolute sound level of 42 dB(A) is not a standard specification for the unit, it is recognized for its quiet operation and features low-noise modes, making it suitable for densely populated housing environments.

Key Growth Drivers

Rising Urbanization and Residential Infrastructure Development

The growth of urban populations and increased residential construction are driving demand for residential heating equipment. As cities expand, homeowners and developers prioritize energy-efficient heating solutions that offer comfort and cost savings. Modern residential complexes increasingly incorporate centralized heating systems, such as heat pumps and space heating boilers, to meet growing expectations for indoor climate control. Government initiatives promoting energy-efficient housing and incentives for sustainable heating adoption further fuel market expansion. Additionally, rising disposable incomes enable households to invest in technologically advanced and smart heating solutions, ensuring consistent performance and long-term savings. The combined effect of infrastructure growth, urbanization, and supportive policies establishes a strong foundation for residential heating equipment demand across global markets.

- For instance, Vaillant Group produces the ecoTEC plus range of condensing boilers. Under European Union (ErP) standards, these boilers achieve a seasonal efficiency rating of approximately 94%, earning them an “A” rating. The company has installed hundreds of thousands of boilers in European residential projects, including ecoTEC plus models, between 2021 and 2023.

Technological Advancements and Energy Efficiency

Innovation in heating technology is a significant growth driver, with manufacturers developing high-efficiency heat pumps, condensing boilers, and smart heating controls. Integration of IoT-enabled thermostats and sensors allows precise temperature regulation, remote monitoring, and energy optimization, reducing utility costs for end users. Energy efficiency regulations and environmental standards encourage adoption of low-emission and renewable-compatible systems, making technologically advanced products more attractive. Continuous R&D enhances equipment reliability, durability, and ease of installation, further driving consumer preference. The convergence of technology, sustainability, and cost-effectiveness accelerates market growth by enabling homeowners to balance comfort with energy savings while complying with increasingly stringent environmental standards.

- For instance, Daikin introduced its R-32-based Altherma 3 H HT heat pump, which is available in a 16 kW heating capacity. The model is highly efficient, capable of achieving a high COP (for instance, up to 5.1) under specific test conditions, and it is designed to achieve substantial reductions in energy consumption.

Increasing Consumer Awareness of Comfort and Sustainability

Growing awareness of indoor comfort, energy conservation, and environmental impact is encouraging households to invest in modern heating solutions. Consumers prioritize products that provide consistent heating, lower operational costs, and reduced carbon footprints. This trend drives demand for heat pumps, energy-efficient boilers, and smart heating systems, especially in regions with colder climates. Marketing initiatives highlighting long-term savings, sustainability, and performance reliability enhance adoption rates. Furthermore, educational campaigns and incentives from governments and manufacturers promote eco-friendly and energy-efficient heating solutions. Heightened consumer consciousness regarding comfort, cost efficiency, and environmental responsibility continues to propel residential heating equipment market growth.

Key Trends & Opportunities

Integration of Smart Home Technologies

Smart home adoption presents a major opportunity for the residential heating equipment market. Systems integrated with IoT devices and AI-driven thermostats allow homeowners to control heating remotely, optimize energy consumption, and receive predictive maintenance alerts. Manufacturers are introducing connected solutions that can be controlled via smartphones or voice assistants, creating convenience and efficiency. This trend aligns with broader consumer preferences for automation, energy savings, and personalized comfort. Companies investing in smart heating solutions can differentiate their offerings, capture high-value market segments, and establish a competitive edge in an increasingly tech-driven residential landscape.

- For instance, The Honeywell Home T9 Smart Thermostat, when used with up to 20 Smart Room Sensors, enables zone-based temperature control throughout your home. It uses geofencing and Smart Response technology to automatically adjust temperatures, learning your heating and cooling cycle times to optimize comfort and help reduce energy costs.

Shift Toward Renewable Energy-Compatible Systems

There is a growing trend toward residential heating solutions compatible with renewable energy sources such as solar thermal systems and heat pumps powered by green electricity. Consumers and developers seek environmentally friendly alternatives to traditional fossil-fuel-based heating to comply with sustainability regulations and reduce carbon footprints. This shift drives opportunities for manufacturers to innovate in hybrid systems, energy-efficient boilers, and heat pumps. Adoption of renewable-compatible equipment is particularly strong in regions with supportive government policies, subsidies, and incentives, enabling companies to tap into a market segment focused on green energy and sustainable living solutions.

- For instance, Viessmann’s Vitocal 100-AW residential air-to-water heat pump system is available in three sizes, with heating capacities of 20.5, 34.0, and 58.0 MBH and corresponding cooling capacities of 1.5, 3.0, and 4.3 tons. This variety in sizing demonstrates the company’s focus on providing versatile and efficient heating and cooling solutions for different residential needs.

Expansion in Emerging Economies

Emerging economies offer significant opportunities due to rising urbanization, disposable income growth, and increased construction activities. As these regions modernize residential infrastructure, there is strong demand for energy-efficient and reliable heating systems. Manufacturers can leverage this opportunity by introducing cost-effective yet technologically advanced products tailored to local climates and energy regulations. Market penetration in countries with growing middle-class populations allows companies to establish brand presence, drive volume sales, and capture untapped segments, thereby contributing to global market growth.

Key Challenges

High Initial Investment and Installation Costs

The residential heating equipment market faces challenges related to high upfront costs for advanced systems, including heat pumps, smart boilers, and integrated control solutions. Many homeowners hesitate to invest due to budget constraints, despite the promise of long-term energy savings. Installation complexity and requirements for skilled labor further deter adoption, especially in regions with limited technical expertise. These factors can slow market penetration, particularly in cost-sensitive areas. Manufacturers must focus on offering financing options, government incentives, or scalable solutions to address affordability issues while educating consumers on the long-term benefits of energy efficiency and operational savings.

Energy Price Volatility and Regulatory Compliance

Fluctuating energy prices can impact the operational cost advantage of residential heating systems, influencing consumer purchasing decisions. Additionally, navigating diverse and evolving environmental regulations across regions poses a challenge for manufacturers, requiring constant adaptation of product designs and technologies. Compliance with emissions standards, energy efficiency ratings, and safety certifications increases production costs and complicates market entry in some countries. These regulatory and economic uncertainties necessitate strategic planning, investment in R&D, and proactive policy monitoring to maintain competitiveness and ensure sustainable growth in the residential heating equipment market.

Regional Analysis

North America

North America holds a significant share of the residential heating equipment market, accounting for approximately 32% of global demand. The U.S. and Canada lead the region, with widespread adoption of energy-efficient heat pumps, space heating boilers, and smart heating systems in both urban and suburban households. Stringent energy efficiency regulations, government incentives, and growing consumer preference for sustainable and cost-effective heating solutions drive demand. Increasing residential construction, home renovations, and integration of smart home technologies further reinforce North America’s market dominance, maintaining its position as a key contributor to global residential heating equipment revenue.

Europe

Europe represents a major market, contributing around 28% of global residential heating equipment demand. Germany, France, and the UK are leading adopters due to colder climates and strict energy efficiency regulations. Energy-efficient heat pumps, condensing boilers, and smart heating systems are widely preferred. Government initiatives promoting low-carbon housing, subsidies for sustainable systems, and heightened consumer awareness of energy conservation enhance market growth. Expansion in residential infrastructure and renovation projects further fuels adoption. Europe maintains a leading share globally, supported by technological penetration, regulatory compliance, and increasing investments in renewable-compatible heating equipment.

Asia-Pacific

Asia-Pacific is an emerging high-growth market, accounting for approximately 25% of global residential heating equipment demand. Rapid urbanization, rising disposable incomes, and modernization of residential infrastructure drive adoption in China, Japan, South Korea, and other key countries. Heat pumps, space heating boilers, and energy-efficient systems are increasingly preferred. Government policies promoting sustainable energy, coupled with growing awareness of indoor comfort, encourage consumer investment. The expansion of smart home technologies and high-rise residential complexes further supports growth. Asia-Pacific’s rising market share underscores its importance as a key driver of future global demand.

Latin America

Latin America accounts for around 9% of the global residential heating equipment market. Brazil, Mexico, and Argentina are leading contributors, driven by urban residential developments and a growing middle class. Heat pumps, unitary heaters, and compact boilers are gaining traction in urban households. Regional government incentives for energy-efficient housing and consumer focus on sustainable systems further stimulate demand. Despite economic fluctuations and infrastructure challenges, increasing modernization of residential buildings and rising interest in cost-effective, eco-friendly heating solutions are gradually expanding Latin America’s share of the global market.

Middle East & Africa

The Middle East & Africa region holds about 6% of the global residential heating equipment market. Growth is fueled by urbanization, expanding residential construction, and government initiatives supporting energy efficiency. Heat pumps, unitary heaters, and smart heating systems are gradually gaining adoption in areas with seasonal heating needs. Rising disposable incomes and awareness of low-maintenance, energy-efficient solutions drive consumer interest. While infrastructure challenges and economic variability persist, long-term opportunities exist in GCC countries and South Africa, where residential modernization and sustainability initiatives support incremental market growth and expansion.

Market Segmentations:

By Product

- Heat Pump

- Unitary Heaters

- Warm Air Furnace

- Space Heating Boilers

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The residential heating equipment market is highly competitive, with global and regional players striving to strengthen their presence through product innovation, strategic partnerships, and geographical expansion. Leading companies, including Carrier, Mitsubishi Electric Corporation, Daikin Industries, Trane, and Robert Bosch GmbH, focus on developing energy-efficient heat pumps, space heating boilers, and smart heating systems to cater to rising consumer demand for sustainable and technologically advanced solutions. Strategies such as mergers and acquisitions, joint ventures, and localized manufacturing enable companies to enhance market share, reduce costs, and expand distribution networks. Continuous investment in R&D ensures product differentiation and compliance with stringent energy efficiency and emission regulations. Additionally, regional players such as Midea Group, Haier, and Rheem Manufacturing leverage affordability and regional expertise to capture emerging markets. The competitive landscape is thus defined by innovation, sustainability, and strategic market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Midea introduced its Energy-Efficient Heat Pump Water Heater (HPWH) in North America. This innovative product highlights transitioning from conventional water heating methods to more sustainable, energy-efficient air-source technology.

- In December 2024, Daikin launched a new line of residential air-to-water heat pumps for single-family homes, utilizing propane (R290) as the refrigerant. This environmentally friendly solution offers efficient heating and hot water, supporting the growing demand for sustainable and energy-efficient heating technologies in residential markets.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient heat pumps and boilers is expected to rise globally.

- Smart heating systems with IoT integration will see increased adoption in urban households.

- Renewable energy-compatible solutions will gain prominence due to sustainability initiatives.

- Technological advancements will enhance system efficiency, durability, and user convenience.

- Growth in residential construction and urbanization in emerging markets will drive equipment demand.

- Manufacturers will focus on R&D to develop low-emission and eco-friendly heating solutions.

- Integration of AI and automation in heating controls will improve energy management.

- Strategic partnerships, mergers, and acquisitions will expand global and regional market presence.

- Consumer awareness of indoor comfort and long-term cost savings will continue to influence purchases.

- Market expansion in Asia-Pacific, Latin America, and the Middle East & Africa will create new growth opportunities.