Market Overview:

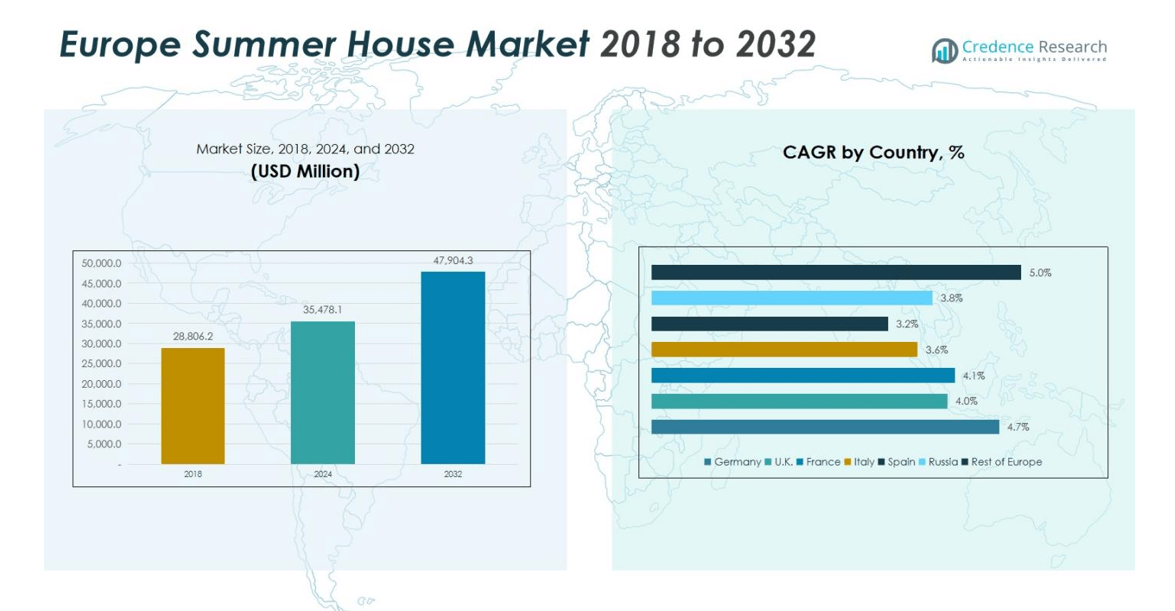

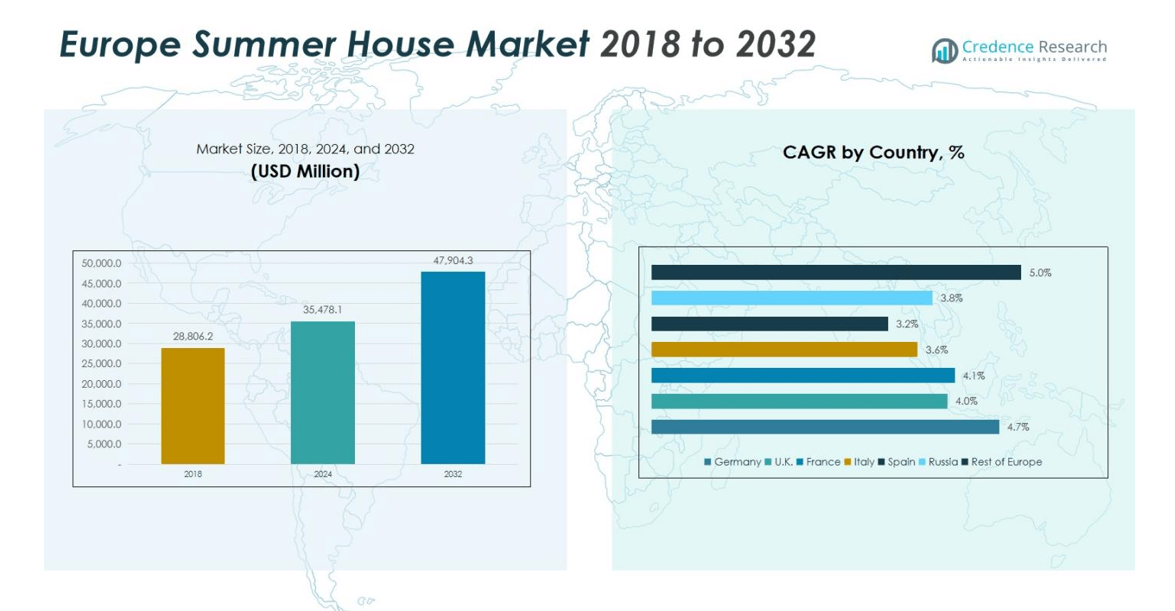

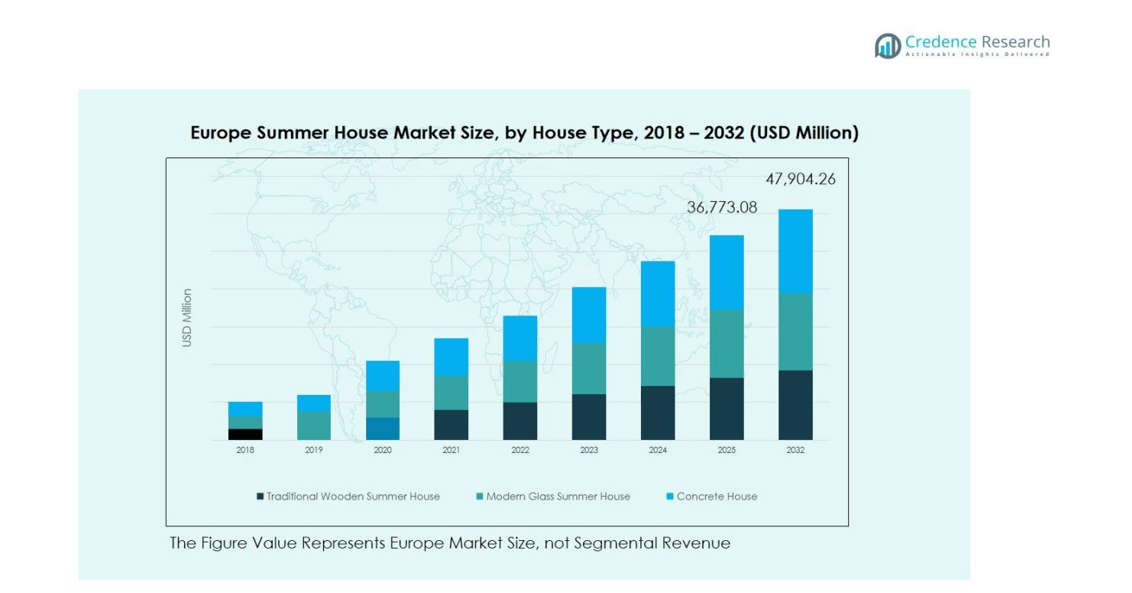

Europe Summer House Market size was valued at USD 28,806.2 million in 2018, rising to USD 35,478.1 million in 2024, and is anticipated to reach USD 47,904.3 million by 2032, at a CAGR of 3.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Summer House Market Size 2024 |

USD 35,478.1 million |

| Europe Summer House Market, CAGR |

3.85% |

| Europe Summer House Market Size 2032 |

USD 47,904.3 million |

The Europe Summer House Market is highly competitive, led by key players including Lugarde, BHB Bertsch Holzbau Sp. z o. o., Hansa Garden Ltd, Kybotech Limited, Sodo, Hansa24 Group, CONTMA, Polar Life Haus, and Baltic House. These companies focus on product innovation, sustainable materials, and modular construction to meet growing residential and commercial demand. The market is dominated by the United Kingdom, holding a 16% share, followed by France at 14% and Germany at 13%, driven by strong tourism, rising disposable incomes, and increasing preference for eco-friendly and leisure-oriented properties. Traditional wooden summer houses remain the most sought-after, while modern glass and concrete designs are gaining traction in premium segments. Companies are strategically expanding their presence across Southern and Eastern Europe to capture emerging demand, leveraging design differentiation, energy-efficient solutions, and luxury offerings to strengthen their market position.

Market Insights

- The Europe Summer House Market was valued at USD 35,478.1 million in 2024 and is projected to reach USD 47,904.3 million by 2032, growing at a CAGR of 3.85% during the forecast period.

- Rising demand for eco-friendly and sustainable homes, coupled with growth in tourism and leisure activities, is driving market expansion. Traditional wooden summer houses lead the house type segment with 48% share, supported by residential applications holding 70% of the segment.

- Market trends indicate increasing adoption of modular and prefabricated construction, growth in luxury and modern glass designs, and expanding interest in wellness-oriented leisure properties. Movable houses are gaining traction for seasonal use, while fixed houses remain dominant with 65% share.

- The market is highly competitive, led by players such as Lugarde, BHB Bertsch Holzbau, Hansa Garden Ltd, Kybotech, and Sodo, focusing on product innovation, sustainable materials, and regional expansion.

- Key restraints include high construction and maintenance costs and regulatory or zoning restrictions, while Northern and Western Europe dominate the regional market with strong adoption rates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

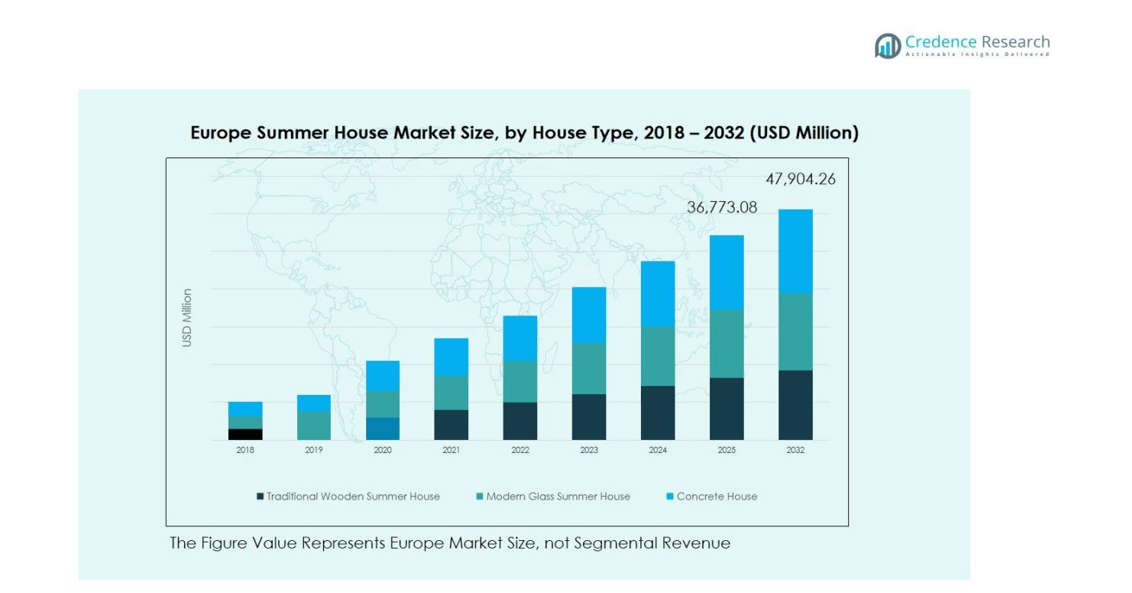

By House Type:

The Europe Summer House market by house type is led by Traditional Wooden Summer Houses, accounting for 48% of the segment share in 2024. Rising consumer preference for eco-friendly and aesthetically natural designs drives demand, particularly in Northern and Central Europe. Wooden houses offer durability, ease of customization, and faster construction compared to concrete alternatives, appealing to residential buyers and holiday resort developers alike. Modern Glass Summer Houses and Concrete Houses account for 30% and 22%, respectively, with glass designs gaining popularity for luxury applications, while concrete is preferred for long-term structural stability.

By Installation:

Within the installation segment, Fixed Houses dominate with a 65% share of the market. Their stability, long-term investment potential, and integration with permanent property developments make them highly favored among homeowners and commercial operators. Movable Houses hold the remaining 35%, driven by rising demand for flexible vacation homes and seasonal rental properties. Drivers for the segment include the increasing trend of weekend retreats and the adoption of modular construction techniques, allowing buyers to expand or relocate structures according to seasonal needs or changing property preferences.

- For instance, in South Australia, BoxMod’s modular homes in Kadina were quickly snapped up due to their appealing price points and features, making them especially attractive to retirees and first-time buyers.

By Application:

The application segment of the Europe Summer House market is primarily driven by Residential Use, which holds a 70% share of the segment. Demand is fueled by urban dwellers seeking private, tranquil spaces in rural or coastal areas, combined with growing interest in remote working and leisure retreats. Commercial Use accounts for 30%, supported by resorts, rental properties, and recreational facilities that leverage premium designs to attract tourists. Key drivers include the rising tourism sector, increased disposable income, and lifestyle changes emphasizing outdoor living and wellness-focused accommodations.

- For instance, Danish design brand Hay’s founders, Rolf and Mette Hay, along with their friends Barbara Husted Werner and filmmaker Martin Werner, purchased Villa Colucci, a 19th-century palazzo in Selva di Fasano.

Key Growth Drivers

Rising Demand for Eco-Friendly and Sustainable Homes

Europe’s growing focus on sustainability is driving demand for summer houses constructed from renewable and eco-friendly materials, particularly wood. Consumers increasingly prefer homes that minimize environmental impact while providing energy efficiency and aesthetic appeal. Governments across Northern and Western Europe are supporting green building initiatives, encouraging developers to adopt sustainable practices. This trend not only boosts the adoption of traditional wooden summer houses but also drives innovation in design, materials, and construction methods, contributing to overall market growth.

- For instance, in Tübingen, Germany, TriqBriq is creating eco-friendly homes from modular wooden blocks made with recycled materials, offering a low-carbon alternative to traditional construction methods.

Growth in Tourism and Leisure Activities

The booming tourism sector in Europe is a significant driver for the summer house market. Holidaymakers and vacation rental operators are investing in seasonal properties to cater to short-term stays in scenic and coastal regions. Rising disposable income and changing lifestyles, with an emphasis on weekend retreats and recreational travel, have accelerated demand for well-located summer houses. Resorts and private rental businesses are expanding their portfolios, further stimulating market growth and increasing the adoption of premium and modern summer house designs.

Rising Adoption of Modular and Prefabricated Construction

Modular and prefabricated construction techniques are transforming the summer house market by enabling faster, cost-effective, and flexible installation. Movable and fixed summer houses can now be customized to meet individual preferences while ensuring consistent quality. This approach reduces construction time and costs, making seasonal homes more accessible to a broader customer base. Developers are leveraging prefabricated solutions to address space constraints, urban expansion, and regulatory requirements, which in turn drives adoption across both residential and commercial applications.

- For instance, Sekisui House, a leading Japanese homebuilder, has introduced its SHAWOOD line, a premium wooden-framed modular home brand. SHAWOOD homes offer design flexibility and are built with a focus on structural strength and natural-disaster resilience, addressing the demand for customizable and durable summer houses.

Key Trends & Opportunities

Luxury and Modern Design Integration

The Europe summer house market is witnessing a shift toward luxury and contemporary designs. Glass-fronted, minimalist, and multifunctional structures are gaining traction among high-end consumers seeking unique leisure experiences. This trend provides opportunities for developers to introduce premium offerings with advanced amenities and energy-efficient features. By catering to evolving lifestyle demands and aesthetic preferences, market participants can expand their customer base, differentiate products, and capitalize on the increasing popularity of personalized and high-value summer homes across key European regions.

- For instance, Cagni Williams Associates transformed an Edwardian terraced house into a sustainable contemporary home with a curved Corten steel and glass extension, incorporating timber construction and air-source heat pumps

Expansion in Secondary and Emerging Regions

Emerging markets in Southern and Eastern Europe present significant opportunities for summer house developers. Regions with growing tourism potential and increasing urban-to-rural migration are attracting investment in vacation and seasonal properties. Developers can leverage lower land costs, supportive regulatory frameworks, and rising disposable incomes to capture untapped demand. Expanding distribution networks, offering modular solutions, and tailoring products to local cultural and environmental preferences enable companies to strengthen their presence, diversify revenue streams, and fuel long-term growth in the European summer house market.

- For instance, Romanian startup Dwellii launched a line of premium pre-built modular homes in July 2024, offering seven different models priced from €1,300 per square meter. These homes can be assembled in a single day, catering to the growing demand for quick and customizable vacation properties in the region.

Key Challenges

High Construction and Maintenance Costs

Rising costs of construction materials, labor, and land remain a major challenge for the Europe summer house market. Premium materials like glass, wood, and energy-efficient components increase upfront investment, limiting affordability for middle-income buyers. Additionally, maintenance requirements for wooden and glass structures, including weatherproofing and seasonal upkeep, pose challenges for homeowners and developers. These cost constraints can slow market adoption, particularly in price-sensitive regions, and necessitate innovative financing, modular construction, and cost-optimization strategies to maintain competitive advantage.

Regulatory and Zoning Restrictions

Stringent building regulations, zoning laws, and environmental policies in many European countries restrict construction in certain rural, coastal, or protected areas. Developers often face lengthy approval processes, compliance costs, and limitations on design and property size. These restrictions can delay project execution and increase operational complexity. Addressing these challenges requires careful site selection, adherence to local guidelines, and proactive engagement with authorities, which may limit rapid expansion and pose barriers to entry for smaller or new players in the market.

Regional Analysis

United Kingdom

The UK accounts for a market share of 16% in the Europe Summer House market. The region benefits from a strong culture of holiday homes, weekend retreats, and recreational properties. Residential applications dominate, with fixed houses preferred for long-term use. Consumers increasingly demand modern wooden and glass designs that combine aesthetics with energy efficiency. High tourism activity in coastal and countryside regions fuels seasonal rentals, while rising disposable incomes and urbanization trends encourage suburban property development. The market also sees growing adoption of modular and prefabricated construction, supporting faster delivery and customization for individual buyers.

France

France holds a market share of 14% within the Europe Summer House market. Coastal regions, countryside retreats, and wine-producing areas are key demand hubs for residential and commercial summer houses. Traditional wooden houses dominate, while modern glass structures are gaining popularity among premium buyers. Drivers include increasing domestic tourism, lifestyle-oriented housing preferences, and government incentives promoting energy-efficient construction. Movable houses are becoming attractive for short-term rental operators and seasonal users. Developers are focusing on integrating luxury amenities, sustainable materials, and flexible designs to meet growing consumer expectations across urban and rural locations.

Germany

Germany commands a market share of 13% in the Europe Summer House market. The market is driven by high consumer interest in sustainable and energy-efficient homes, especially traditional wooden structures. Residential use dominates, supported by urban-to-rural migration and weekend retreat trends. Fixed houses lead the installation segment due to long-term investment preferences. Regional tourism, particularly in the Bavarian and Black Forest regions, supports commercial applications and seasonal rentals. Adoption of modular and prefabricated summer houses is increasing, enabling faster construction and cost efficiency, while rising disposable incomes and environmental awareness continue to boost demand across middle- and high-range price segments.

Italy

Italy represents a market share of 12% in the Europe Summer House market. Coastal and countryside regions such as Tuscany, Liguria, and Lake Como drive strong demand for residential and leisure properties. Traditional wooden houses are popular for aesthetic and eco-friendly reasons, while concrete and modern glass structures are preferred in premium segments. Movable houses are gaining traction for seasonal rental purposes. Market growth is fueled by rising domestic tourism, growing disposable income, and lifestyle trends emphasizing outdoor living and wellness retreats. Developers increasingly focus on sustainable construction practices and customizable designs to cater to regional consumer preferences.

Spain

Spain holds a market share of 11% in the Europe Summer House market. The Mediterranean coast, Andalusia, and Balearic Islands are key demand regions for residential and commercial summer houses. Traditional wooden houses dominate the market, while luxury glass and modern designs are capturing high-end buyers. Seasonal tourism, weekend retreats, and vacation rentals drive both fixed and movable house demand. Growth is further supported by rising disposable income, urban-to-rural migration, and the adoption of modular construction techniques. Developers focus on energy-efficient, climate-adapted designs to attract environmentally conscious consumers and expand market penetration across Southern Spain.

Russia

Russia accounts for a market share of 7% in the Europe Summer House market. Demand is primarily driven by urban residents seeking countryside retreats for leisure and recreational purposes. Traditional wooden houses are highly preferred due to availability of local materials and thermal insulation benefits. Fixed houses dominate installation, while movable structures are increasingly adopted in seasonal resorts. Market growth is supported by rising disposable incomes, expanding domestic tourism, and government incentives for rural property development. Developers focus on providing energy-efficient, durable, and aesthetically appealing homes to meet the growing demand in regions near Moscow, St. Petersburg, and other vacation destinations.

Rest of Europe

The Rest of Europe holds a market share of 7% in the Europe Summer House market. Countries such as Norway, Sweden, Denmark, Poland, and smaller Eastern European nations are witnessing gradual adoption of summer houses for residential and leisure purposes. Traditional wooden houses remain dominant, while modern glass and concrete designs are gaining traction in premium segments. Movable houses appeal to seasonal users and tourism operators. Growth is supported by increasing domestic tourism, eco-conscious construction trends, and lifestyle-driven demand for rural and recreational properties. Modular construction and cost-effective designs offer opportunities to expand market reach across these emerging regions.

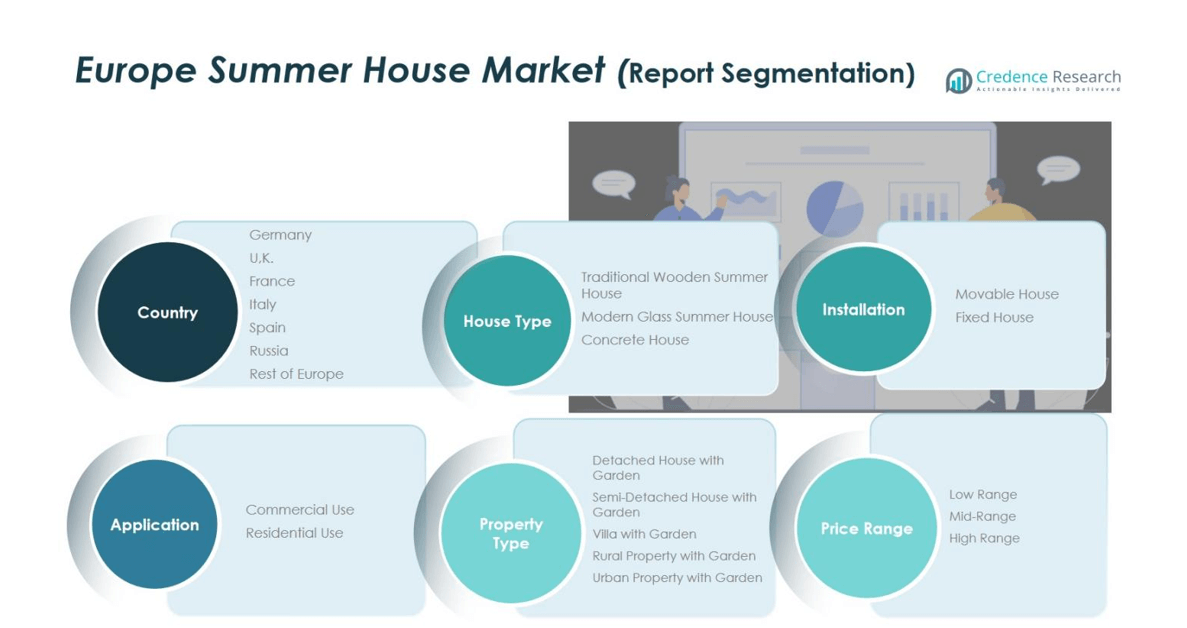

Market Segmentations:

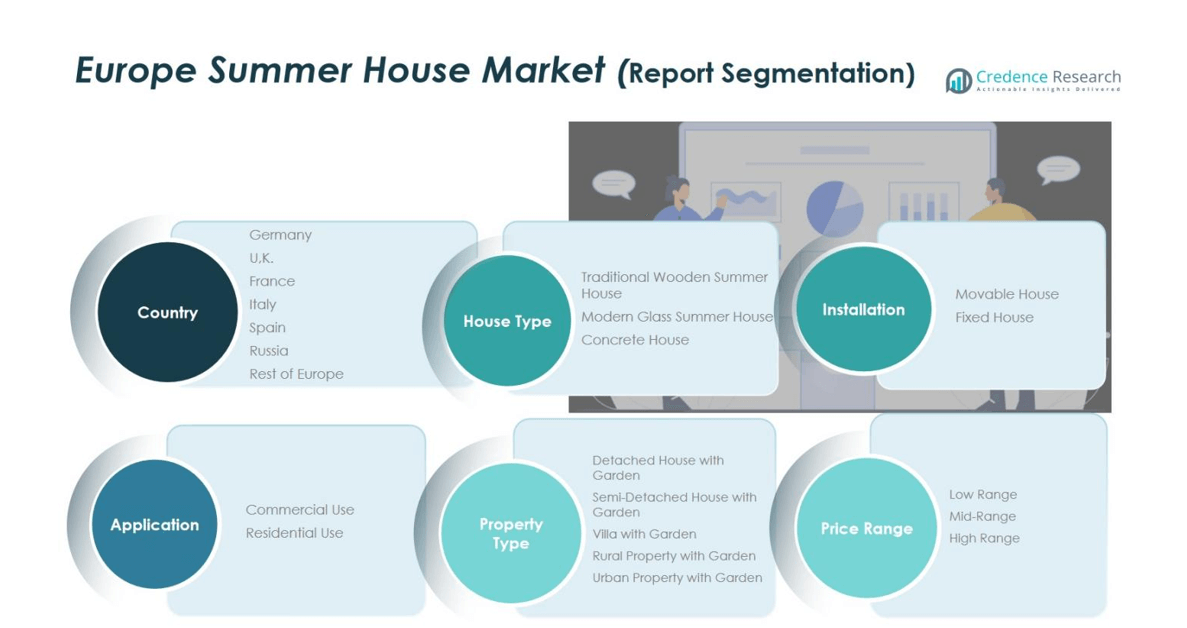

By House Type:

- Traditional Wooden Summer House

- Modern Glass Summer House

- Concrete House

By Installation:

- Movable House

- Fixed House

By Application:

- Commercial Use

- Residential Use

By Property Type:

- Detached House with Garden

- Semi-Detached House with Garden

- Villa with Garden

- Rural Property with Garden

- Urban Property with Garden

By Price Range

- Low Range

- Mid-Range

- High Range

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Summer House market is highly competitive, with key players including Lugarde, BHB Bertsch Holzbau Sp. z o. o., Hansa Garden Ltd, Kybotech Limited, Sodo, Hansa24 Group, CONTMA, Polar Life Haus, and Baltic House. Market competition is driven by product differentiation, quality, design innovation, and adoption of sustainable materials. Companies focus on expanding their product portfolios with traditional wooden, modern glass, and concrete summer houses while integrating modular and prefabricated construction solutions to meet diverse residential and commercial demands. Strategic initiatives such as partnerships, acquisitions, and geographic expansion help players strengthen market presence and brand recognition. Increasing focus on luxury and customized offerings, energy-efficient designs, and premium features intensifies competition, as manufacturers aim to capture growing demand in Northern, Western, and Southern Europe. The market remains fragmented, with both established and emerging players actively competing for market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lugarde

- BHB Bertsch Holzbau Sp. z o. o.

- Hansa Garden Ltd

- Kybotech Limited

- Sodo

- Hansa24 Group

- CONTMA

- Polar Life Haus

- Baltic House

- Other Key Players

Recent Developments

- In June 2025, PGIM Real Estate, in collaboration with Dekus and HNH Hospitality, acquired Hotel Leon d’Oro in Verona, Italy.

- In October 2025, Azuro (Swiss proptech startup) raised €5 million to launch Europe’s first user-owned portfolio of smart vacation homes.

- In January 2025, HomeToGo announced the acquisition of Interhome (a Swiss holiday rental management firm) from Migros.

- In January 2025, Landfolk (a Danish vacation rental marketplace) acquired Danitalia, an Italian vacation rental agency.

Report Coverage

The research report offers an in-depth analysis based on House Type, Application ,Installation, Property Type, Price Range and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and sustainable summer houses is expected to grow steadily.

- Traditional wooden houses will continue to dominate the market due to aesthetic and environmental appeal.

- Modern glass and luxury designs will gain traction among high-end consumers.

- Fixed hous es will remain the preferred choice, while movable houses will see moderate growth for seasonal use.

- Residential applications will continue to lead, with commercial rentals expanding in key tourist regions.

- Modular and prefabricated construction will drive faster, cost-efficient installation and customization.

- Southern and Eastern European regions will present new growth opportunities for developers.

- Integration of energy-efficient and smart home features will become increasingly important.

- Lifestyle trends emphasizing leisure, wellness, and outdoor living will support market expansion.

- Strategic partnerships, product innovation, and regional expansion will define competitive advantage for key players.