Market Overview

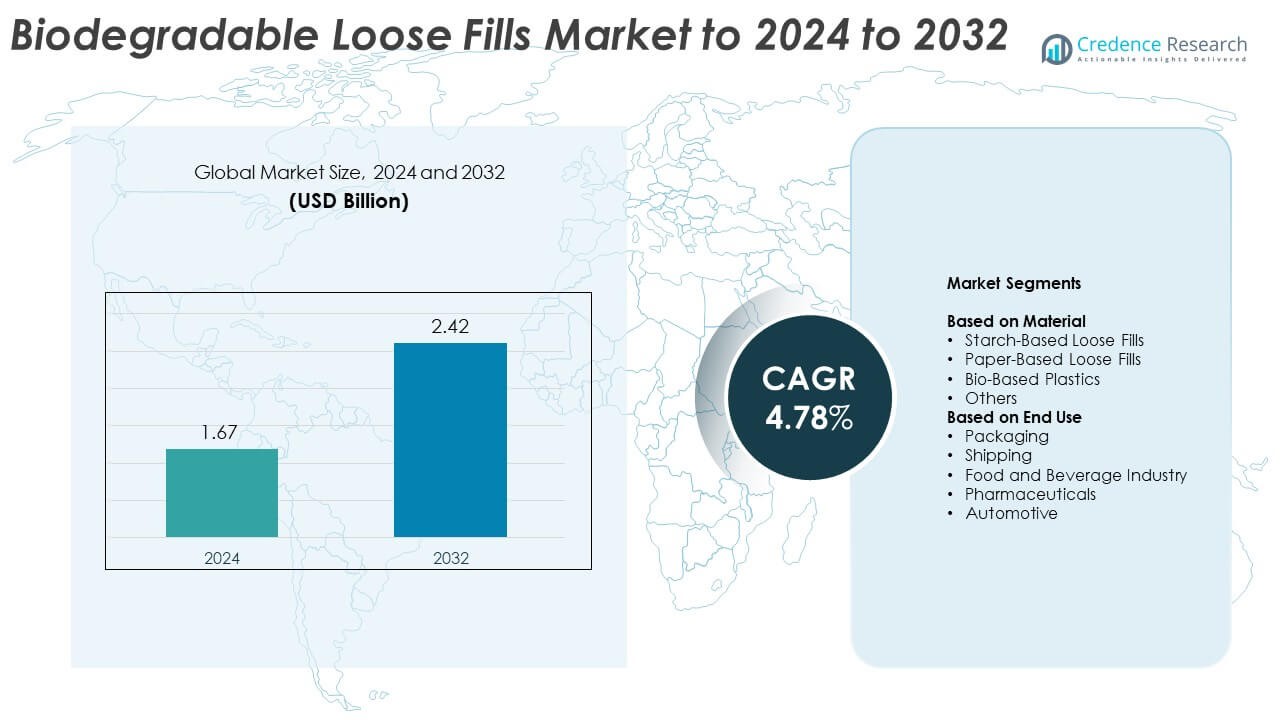

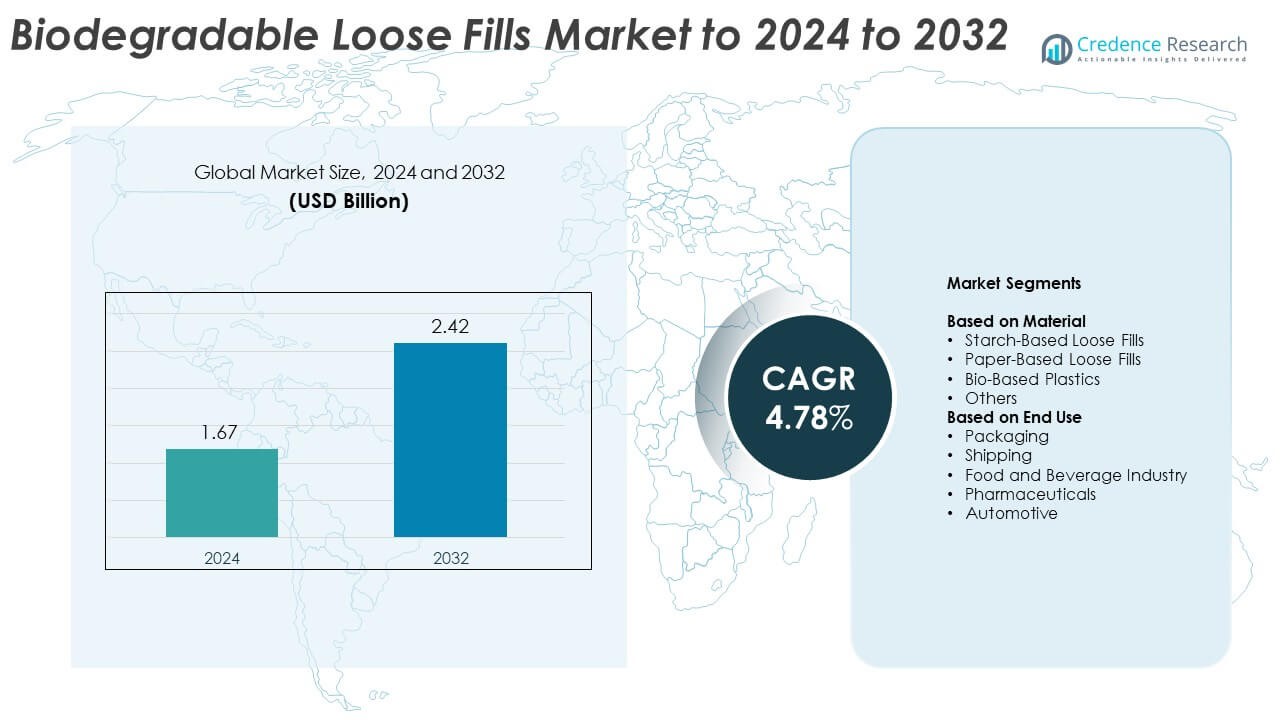

The Biodegradable Loose Fills Market size was valued at USD 1.67 billion in 2024 and is anticipated to reach USD 2.42 billion by 2032, at a CAGR of 4.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biodegradable Loose Fills Market Size 2024 |

USD 1.67 Billion |

| Biodegradable Loose Fills Market, CAGR |

4.78% |

| Biodegradable Loose Fills Market Size 2032 |

USD 2.42 Billion |

The biodegradable loose fills market is led by major players including BASF, Sealed Air Corporation, Ranpak Holdings Corp, Mondi, and Smurfit Kappa, which collectively drive innovation and sustainability in eco-friendly packaging. These companies focus on developing compostable materials, lightweight fillers, and cost-efficient bio-based solutions to meet increasing global demand. Strategic collaborations and regional production expansions support their competitive edge, particularly in e-commerce and logistics packaging applications. North America leads the global market with a 36.2% share in 2024, followed by Europe at 30.4%, driven by strict environmental regulations and consumer preference for sustainable packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The biodegradable loose fills market was valued at USD 1.67 billion in 2024 and is projected to reach USD 2.42 billion by 2032, growing at a CAGR of 4.78%.

- Rising demand for sustainable and eco-friendly packaging materials across e-commerce, logistics, and food sectors is driving market expansion globally.

- Key trends include increased R&D in bio-based polymers, wider use of starch and paper-based materials, and growing adoption of compostable packaging standards.

- The market is moderately competitive, with leading players focusing on product innovation, regional expansion, and partnerships to strengthen distribution networks.

- North America held the largest share of 36.2% in 2024, followed by Europe at 30.4%, while the starch-based loose fills segment dominated with 52.4% share due to its high biodegradability and performance efficiency.

Market Segmentation Analysis:

By Material

The starch-based loose fills segment dominated the biodegradable loose fills market in 2024 with a 52.4% share. This dominance is driven by the high biodegradability, low static properties, and excellent cushioning offered by starch materials. These fills dissolve easily in water and are compostable, making them ideal for eco-conscious packaging solutions. Paper-based loose fills are also gaining traction due to recyclability and renewable sourcing. Bio-based plastics and other emerging materials continue to evolve with advancements in lightweight, high-strength, and moisture-resistant alternatives to conventional fillers.

- For instance, Storopack’s PELASPAN® BIO is NF T51-800 certified and 100% home and garden compostable.

By End Use

The packaging segment held the largest share of 41.8% in 2024, supported by rapid adoption in e-commerce and retail distribution. The growing shift toward sustainable protective packaging solutions drives the demand for biodegradable loose fills in consumer goods and electronics shipping. The food and beverage and pharmaceutical industries are expanding usage to comply with environmental packaging standards. Automotive applications are gradually increasing, where lightweight and non-toxic fillers help reduce waste and meet circular economy goals.

- For instance, Ranpak reported 141,200 installed protective-packaging systems serving 36,000+ end-users by Dec 31, 2023.

Key Growth Drivers

Rising Demand for Sustainable Packaging

The global shift toward eco-friendly materials drives the adoption of biodegradable loose fills. Increasing government restrictions on plastic waste and consumer preference for green alternatives have accelerated the use of starch and paper-based fills. E-commerce and logistics sectors rely heavily on these materials to meet sustainability goals and reduce landfill waste. Their water solubility and compostable properties make them a practical choice for both large and small packaging operations.

- For instance, Amazon avoided 446,000 metric tons of packaging in 2023 and 3 million+ tons since 2015.

Expansion of E-commerce and Shipping Activities

The surge in online retailing has significantly boosted demand for sustainable void-fill materials. Biodegradable loose fills offer lightweight cushioning that reduces shipping costs and ensures product safety. Major packaging distributors are integrating bio-based materials into supply chains to comply with corporate sustainability commitments. The growth of cross-border trade and last-mile delivery networks further strengthens the market’s expansion potential in both developed and emerging economies.

- For instance, Sealed Air’s FasFil Jet dispenses paper at 375 ft/min for high-volume void-fill.

Technological Advancements in Bio-Based Materials

Continuous research in biodegradable polymers has enhanced the performance and durability of loose fills. Improved formulations using modified starch and PLA-based compounds have achieved better moisture resistance and compressive strength. These innovations make biodegradable fills comparable to synthetic alternatives, supporting broader use across industrial packaging lines. Collaboration among manufacturers and research institutions has accelerated product certification and adoption by large-scale packaging companies.

Key Trends and Opportunities

Integration of Circular Economy Practices

Manufacturers are adopting circular economy principles to minimize waste and promote recyclability. Companies now focus on sourcing renewable raw materials and optimizing compostability standards for their products. Growing investment in closed-loop recycling and biodegradable polymers offers new business opportunities. Retailers are also promoting eco-labels to attract sustainability-focused customers, creating additional market incentives.

- For instance, IKEA will phase out plastic in consumer packaging by 2028 and is replacing fitting bags to cut 1,400 tons/year of plastic

Adoption of Smart and Automated Packaging Systems

The rise of automated packaging facilities is opening opportunities for biodegradable loose fills compatible with high-speed systems. These materials are being developed with uniform size and density to ensure seamless performance in filling machines. The trend supports cost efficiency and consistent protection during transit. As automation in packaging grows, demand for biodegradable options tailored to advanced logistics operations is expected to increase.

- For instance, Packsize’s X6 system produces up to 1,500 boxes/hour, enabling on-demand right-sized packaging.

Rising Collaborations and Brand Commitments

Packaging producers are forming strategic partnerships to expand bio-based product portfolios. Global brands are pledging to use 100% sustainable packaging within the next decade. Such initiatives are driving innovation and investment in biodegradable loose fills manufacturing. The development of regional composting infrastructure and government-backed recycling programs further supports these efforts.

Key Challenges

High Production and Material Costs

Despite environmental advantages, biodegradable loose fills remain more expensive than conventional plastic alternatives. The cost of bio-based raw materials and production equipment limits widespread adoption among small packaging firms. Price sensitivity in emerging markets poses a challenge to scalability. Manufacturers are exploring low-cost starch blends and regional sourcing to reduce overall expenses while maintaining quality standards.

Limited Industrial Composting and Disposal Infrastructure

A major challenge lies in the lack of widespread composting facilities capable of handling biodegradable materials. In many regions, these products still end up in landfills due to inadequate waste segregation systems. This restricts the environmental benefits and hampers consumer confidence. Expanding municipal composting networks and implementing clear disposal labeling are crucial to maximizing product sustainability outcomes.

Regional Analysis

North America

North America held the largest share of 36.2% in the biodegradable loose fills market in 2024. The region’s leadership is supported by strong environmental regulations and widespread adoption of eco-friendly packaging by e-commerce and logistics companies. The United States dominates due to high consumer awareness of sustainable materials and advanced composting infrastructure. Canada is also witnessing steady growth through public and private initiatives promoting green packaging. Increasing investments in starch-based and paper-based filler innovations continue to enhance the region’s dominance in biodegradable packaging adoption.

Europe

Europe accounted for 30.4% share of the biodegradable loose fills market in 2024. Strict policies under the European Green Deal and single-use plastic bans have accelerated demand for bio-based packaging. Germany, the United Kingdom, and France are major contributors, driven by growing sustainability commitments from packaging producers. The region benefits from an established composting network and advanced recycling technologies. Ongoing research into paper-based and PLA-based materials is improving product quality, creating strong growth prospects across industrial and consumer packaging sectors.

Asia Pacific

Asia Pacific captured a 22.8% share in 2024, emerging as the fastest-growing regional market. Rising e-commerce penetration, urbanization, and environmental awareness across China, Japan, and India are fueling demand for biodegradable fillers. Government efforts to reduce plastic waste through circular economy policies further drive regional growth. Manufacturers are expanding production facilities to meet local and export demand. The presence of cost-effective starch sources and growing logistics activities make Asia Pacific a key region for future market expansion.

Latin America

Latin America held a 6.3% share in the biodegradable loose fills market in 2024. Brazil and Mexico lead the region, supported by packaging companies shifting toward compostable and recyclable alternatives. Increasing government awareness campaigns and consumer interest in sustainable products are influencing adoption. Limited industrial composting infrastructure remains a restraint but ongoing policy reforms are expected to improve waste management systems. Regional growth is projected to strengthen as local manufacturers begin integrating low-cost bio-based materials into packaging applications.

Middle East and Africa

The Middle East and Africa accounted for a 4.3% share of the biodegradable loose fills market in 2024. The region is gradually embracing eco-friendly packaging driven by import substitution policies and sustainability goals. South Africa and the United Arab Emirates are at the forefront of green material adoption, particularly in retail and logistics. Although infrastructure for composting remains limited, increasing partnerships with global packaging firms are improving accessibility to biodegradable solutions. The region shows potential for growth as environmental standards tighten across industrial sectors.

Market Segmentations:

By Material

- Starch-Based Loose Fills

- Paper-Based Loose Fills

- Bio-Based Plastics

- Others

By End Use

- Packaging

- Shipping

- Food and Beverage Industry

- Pharmaceuticals

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The biodegradable loose fills market features several prominent players such as BASF, Sealed Air Corporation, Ranpak Holdings Corp, Mondi, FKuR Kunststoff GmbH, DuPont, Smurfit Kappa, The Dow Chemical Company, Green Cell Foam, Storopack Hans Reichenecker GmbH, Pregis Corporation, Huhtamaki, Titron, and Victory Packaging. The market remains highly competitive, driven by continuous innovation and sustainability initiatives. Companies focus on developing lightweight, compostable, and high-performance packaging materials to meet environmental regulations and growing consumer awareness. Strategic collaborations with e-commerce and logistics firms are strengthening supply networks and expanding market reach. Several players invest heavily in bio-based polymer R&D to enhance mechanical strength and moisture resistance. Expansion of regional production facilities and mergers to optimize cost and distribution efficiency are common strategies. The emphasis on product certification and eco-labeling continues to differentiate market leaders, while smaller firms compete through customized, cost-effective biodegradable packaging solutions for niche applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF

- Sealed Air Corporation

- Ranpak Holdings Corp

- Mondi

- FKuR Kunststoff GmbH

- DuPont

- Smurfit Kappa

- The Dow Chemical Company

- Green Cell Foam

- Storopack Hans Reichenecker GmbH

- Pregis Corporation

- Huhtamaki

- Titron

- Victory Packaging

Recent Developments

- In 2024, FKuR Kunststoff GmbH Introduced new bio-based and biodegradable thermoplastic elastomers (TPEs) at trade shows, expanding its portfolio of sustainable materials suitable for various packaging applications, including components for loose fills or other protective packaging.

- In 2023, Ranpak completed a multi-year strategic investment that significantly expanded the production capacity and modernized its European facilities to address the growing market demand for sustainable, paper-based packaging solutions over plastic alternatives.

- In 2023, Storopack featured its PAPERplus® Classic paper cushioning as a key existing product within its established range of sustainable packaging solutions at various trade shows.

Report Coverage

The research report offers an in-depth analysis based on Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biodegradable loose fills will grow with stricter global plastic waste regulations.

- E-commerce expansion will continue driving large-scale adoption of eco-friendly packaging materials.

- Technological innovations in starch and bio-based polymers will improve product durability.

- Companies will focus on cost optimization to make biodegradable fillers more affordable.

- Partnerships between packaging producers and logistics firms will enhance market penetration.

- Investment in regional composting infrastructure will support higher end-user adoption rates.

- Consumers’ preference for sustainable brands will boost demand in retail packaging.

- Asia Pacific will emerge as the fastest-growing regional market with rising local production.

- Recycling and circular economy initiatives will encourage material innovation and reuse.

- Government incentives and eco-labeling programs will accelerate the shift toward biodegradable alternatives.