Market Overview

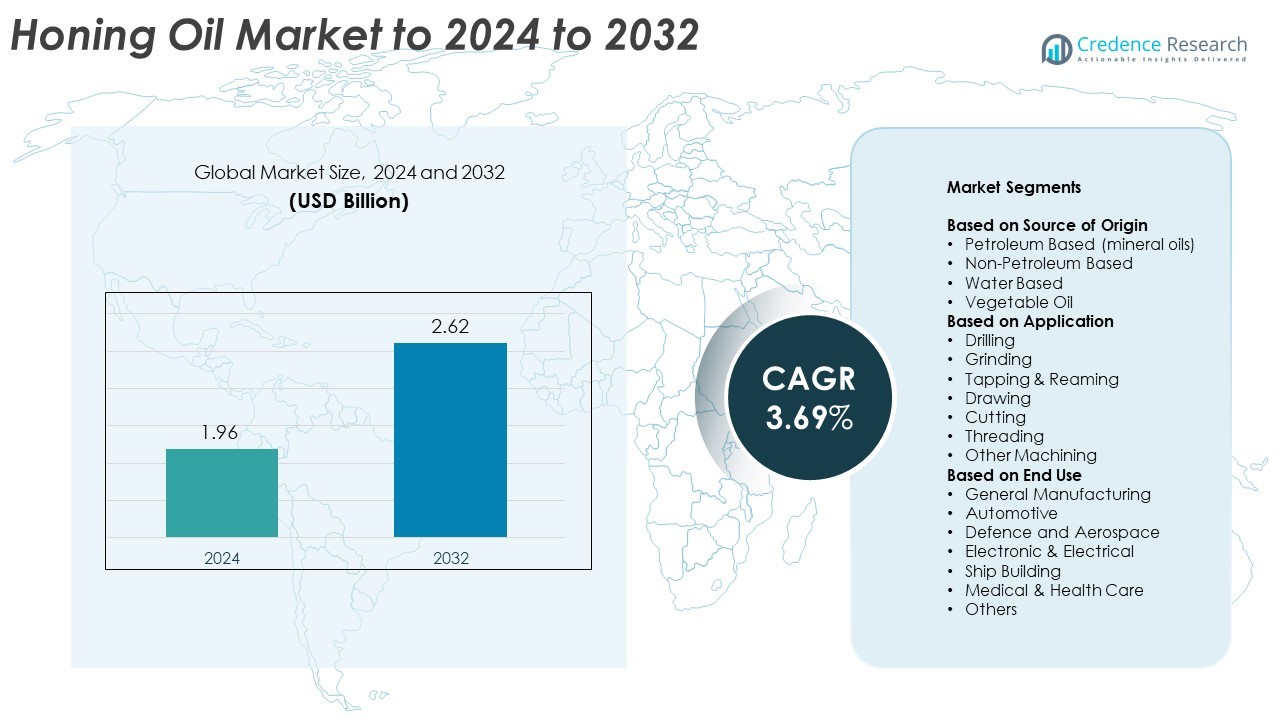

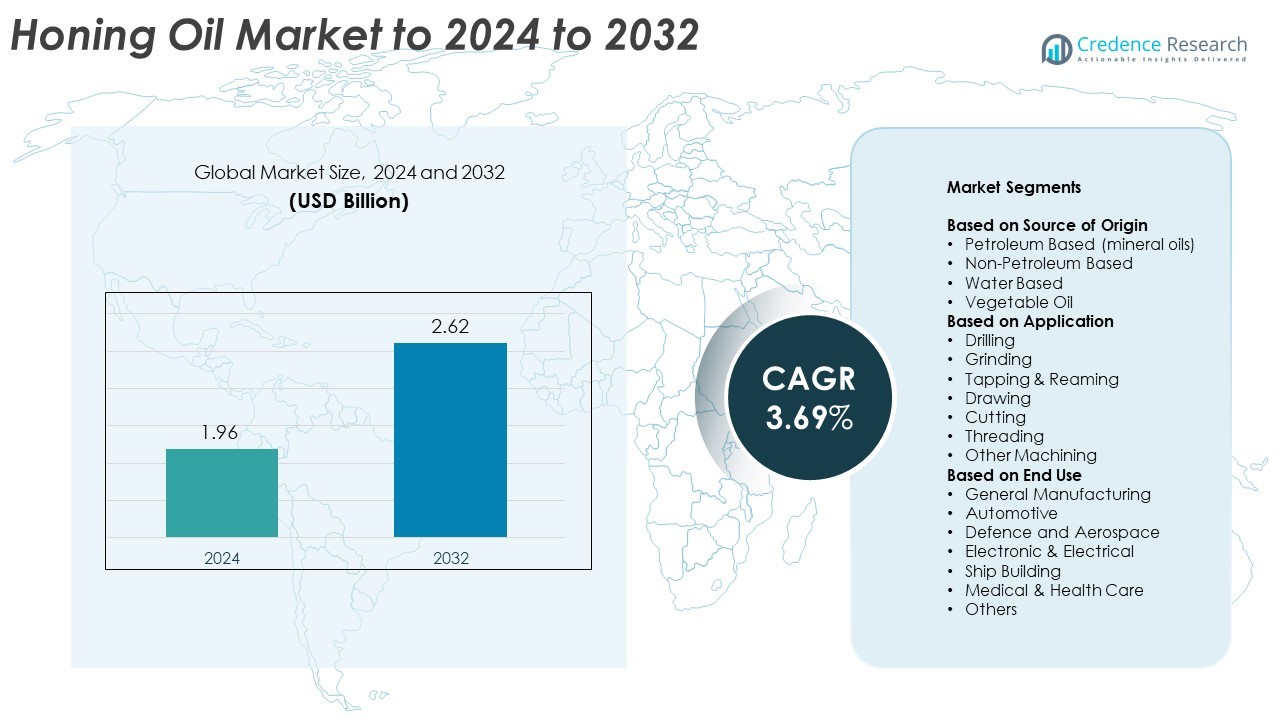

Honing Oil Market size was valued USD 1.96 billion in 2024 and is anticipated to reach USD 2.62 billion by 2032, at a CAGR of 3.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Honing Oil Market Market Size 2024 |

USD 1.96 Billion |

| Honing Oil Market Market, CAGR |

3.69% |

| Honing Oil Market Market Size 2032 |

USD 2.62 Billion |

The Honing Oil Market is characterized by strong competition among major players such as Shell Plc., Castrol (BP Plc.), Houghton International Inc., and Delapena Honing Equipment. These companies dominate through advanced product portfolios, sustainable formulations, and global supply networks. They focus on developing high-performance, low-emission, and bio-based honing oils to meet evolving industrial and environmental requirements. North America led the market in 2024 with a 34.7% share, supported by robust automotive and aerospace manufacturing sectors. Asia-Pacific followed closely, driven by rapid industrialization, expanding machining operations, and rising adoption of automation across production facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Honing Oil Market was valued at USD 1.96 billion in 2024 and is projected to reach USD 2.62 billion by 2032, growing at a CAGR of 3.69%.

- Rising demand from the automotive and manufacturing industries drives market growth, supported by the need for precision finishing and tool longevity.

- Technological advancements and the shift toward bio-based and water-soluble honing oils are shaping new sustainability trends.

- The market remains competitive with major players focusing on innovation, product diversification, and expansion in high-growth regions.

- North America led the market with a 34.7% share in 2024, followed by Asia-Pacific at 31.8%, while the petroleum-based segment held the largest share at 46.3%.

Market Segmentation Analysis:

By Source of Origin

The petroleum-based segment dominated the honing oil market in 2024 with a 46.3% share. Its dominance is driven by superior lubrication, high thermal stability, and effective metal chip removal. Petroleum-based honing oils are widely used in precision machining operations due to their ability to reduce friction and extend tool life. Non-petroleum, water-based, and vegetable oil variants are gaining traction for their eco-friendly nature and low volatility. Growing environmental awareness and strict disposal regulations are gradually encouraging manufacturers to develop biodegradable alternatives, particularly for applications in medical and aerospace industries.

- For instance, Castrol Honilo 981 shows 4.8–4.9 mm²/s kinematic viscosity at 40 °C and a flash point >125 °C, enabling stable lubrication under heat.

By Application

The grinding segment led the market in 2024 with a 33.8% share. Grinding operations require consistent lubrication and cooling to maintain dimensional accuracy and surface finish, which honing oils efficiently provide. Increasing demand for precision-engineered components in automotive and aerospace manufacturing drives the use of honing oils in grinding applications. Other machining processes such as drilling, tapping, and threading are also expanding, supported by the rise of advanced CNC machines. The growing need for high-speed production and reduced tool wear continues to strengthen demand in the grinding application segment.

- For instance, FUCHS ECOCUT HSG 211 LE lists 11 mm²/s viscosity at 40 °C and a 172 °C flash point, supporting high-load grinding duty.

By End Use

The automotive segment held the largest share of 38.5% in 2024. The segment’s growth is fueled by extensive use of honing oils in engine cylinder bores, gear finishing, and fuel injector component manufacturing. Automotive OEMs prefer high-performance honing oils for achieving tighter tolerances and smooth surface textures. The general manufacturing and defense sectors are also expanding due to ongoing industrial modernization and increased defense procurement. Rising adoption of precision machining in electronic, medical, and shipbuilding industries further enhances the demand for advanced honing oil formulations across diverse end-use applications.

Key Growth Drivers

Rising Demand from Automotive and Manufacturing Industries

Expanding automotive and general manufacturing sectors are major drivers for the honing oil market. Honing oils are essential for achieving smooth surface finishes, precision, and extended tool life during component production. The growing use of honing in engine blocks, gears, and fuel injectors enhances productivity and reduces maintenance costs. Increasing adoption of automated machining systems and CNC technology across automotive and industrial production facilities further accelerates demand for high-quality honing oils.

- For instance, Castrol reports Honilo 981 use reduced filter paper consumption by 50% in a production setting, evidencing lower upkeep needs.

Advancements in Metalworking Fluids Technology

Continuous innovation in metalworking fluid formulations is propelling honing oil adoption. Modern honing oils feature improved oxidation stability, reduced mist formation, and enhanced cooling performance. These innovations ensure higher machining accuracy and minimize tool wear under extreme conditions. Manufacturers are focusing on developing additive-enhanced and synthetic-based oils to meet advanced industrial performance needs. This technological progress supports the demand for efficient and environment-friendly honing solutions in high-precision machining processes.

- For instance, Sunnen SHO-500 eliminates sulfur, chlorine, and fluorine additives and is BioPreferred-listed for regulated environments.

Growing Shift Toward Sustainable and Bio-Based Oils

Environmental regulations are encouraging a shift toward biodegradable and non-toxic honing oils. Vegetable-based and water-soluble alternatives are gaining popularity due to their lower environmental impact and safe disposal. Industries such as medical, aerospace, and defense increasingly prefer sustainable lubricants to meet eco-compliance standards. This transition is driving innovation in green oil formulations, positioning bio-based honing oils as a long-term growth driver within the global market.

Key Trends and Opportunities

Integration of Smart Machining and Automation

The adoption of smart machining technologies and IoT-enabled systems is transforming honing operations. Automated lubrication systems that optimize oil flow and temperature improve process efficiency and reduce waste. Manufacturers are using data-driven monitoring tools to track oil degradation and extend service life. This trend is opening opportunities for honing oil suppliers to develop intelligent fluids compatible with connected manufacturing environments.

- For instance, Blaser prescribes electronic concentration management with typical coolant concentration between 3% and 15%, and at least weekly recorded checks to keep processes stable.

Expansion in Aerospace and Medical Manufacturing

Rising investments in aerospace and medical component manufacturing are creating new opportunities for honing oil suppliers. These industries demand ultra-precise surface finishes and high-quality materials for critical parts such as hydraulic components, implants, and surgical tools. Honing oils designed for stainless steel, titanium, and composite materials are in high demand. This trend supports the adoption of specialty oils that enhance performance and ensure compliance with safety and hygiene standards.

- For instance, TotalEnergies’ Folia biopolymer fluid is water-based, oil- and emulsifier-free, delivering up to 25 % longer tool life, 55 % lower coolant consumption, and 12 % higher machining speed, with a four-ball test load value of 2,000 N (or typically 2.0 mm wear scar diameter in the four-ball test, depending on the test method).

Key Challenges

Environmental Regulations and Waste Disposal Issues

Stringent global regulations on waste oil disposal pose significant challenges to honing oil manufacturers. Traditional petroleum-based honing oils contain additives that can harm aquatic life and soil quality if improperly discarded. Companies must invest in advanced recycling and recovery systems to comply with environmental standards. The need for sustainable waste management solutions increases production costs, particularly for small and mid-scale manufacturers.

Fluctuating Raw Material Prices

Volatility in crude oil and additive prices impacts honing oil production costs and market stability. Petroleum-based formulations remain dominant, making manufacturers vulnerable to supply disruptions and cost fluctuations. Price instability affects profit margins and challenges long-term contract pricing with industrial clients. To counter this, producers are diversifying sourcing strategies and increasing the use of synthetic and bio-based raw materials to stabilize product pricing.

Regional Analysis

North America

North America dominated the honing oil market in 2024 with a 34.7% share. The region’s growth is driven by the strong presence of the automotive, aerospace, and heavy machinery industries in the United States and Canada. Advanced manufacturing technologies and high adoption of precision machining processes support consistent demand for honing oils. Growing investments in electric vehicle component production further boost the market. Key manufacturers focus on developing synthetic and bio-based oils to meet stringent environmental standards, enhancing North America’s position as a leading market for high-performance honing oils.

Europe

Europe accounted for 27.9% of the honing oil market in 2024. The region benefits from a well-established industrial base and strict environmental regulations promoting sustainable lubricants. Germany, Italy, and France are major contributors due to their strong automotive and engineering sectors. Rising demand for precision machining in aerospace and medical manufacturing strengthens market growth. European manufacturers are increasingly shifting toward low-VOC and biodegradable honing oils to meet EU emission norms, reinforcing the region’s commitment to green production practices and sustainable industrial development.

Asia-Pacific

Asia-Pacific held the largest and fastest-growing share of 31.8% in 2024. Rapid industrialization in China, India, and Japan drives demand for honing oils in automotive and general manufacturing sectors. Expanding infrastructure and increased adoption of automated machining systems enhance market growth. The region also benefits from cost-efficient production and a growing focus on locally produced bio-based lubricants. Rising investments in precision engineering, coupled with large-scale machinery exports, position Asia-Pacific as a key growth hub for honing oil manufacturers seeking volume expansion and cost advantages.

Latin America

Latin America accounted for 3.6% of the global honing oil market in 2024. The market is supported by the growing automotive assembly and industrial machinery sectors in Brazil and Mexico. Increasing investments in manufacturing infrastructure and rising foreign partnerships encourage the use of advanced metalworking fluids. However, limited awareness about sustainable oil alternatives restrains faster adoption. The region’s gradual industrial modernization and growing preference for imported high-performance oils are expected to support moderate market growth during the forecast period.

Middle East & Africa

The Middle East & Africa region held a 2% share of the honing oil market in 2024. Industrial growth in the United Arab Emirates, Saudi Arabia, and South Africa supports demand in manufacturing and energy-related applications. Expanding defense and aerospace projects also boost market penetration. However, limited local production and dependency on imported raw materials pose challenges. Increasing government initiatives to promote industrial diversification and automation are expected to gradually drive demand for honing oils across regional manufacturing facilities.

Market Segmentations:

By Source of Origin

- Petroleum Based (mineral oils)

- Non-Petroleum Based

- Water Based

- Vegetable Oil

By Application

- Drilling

- Grinding

- Tapping & Reaming

- Drawing

- Cutting

- Threading

- Other Machining

By End Use

- General Manufacturing

- Automotive

- Defence and Aerospace

- Electronic & Electrical

- Ship Building

- Medical & Health Care

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Honing Oil Market is highly competitive and features leading players such as Shell Plc., Castrol (BP Plc.), Houghton International Inc., Delapena Honing Equipment, Chem Arrow Corporation, QualiChem Inc., Metalworking Lubricants Company, Falcon Industrial Inc., Eastern Oil Company, CC Jensen, Sunbelt Lubricants, and Cimcool Industrial Products. These companies focus on continuous innovation in lubrication technology, developing high-performance and eco-friendly honing oils for advanced machining operations. They emphasize improving oxidation stability, cooling efficiency, and biodegradability to meet industrial and environmental standards. Strategic collaborations, product diversification, and strong distribution networks help maintain market presence across automotive, aerospace, and manufacturing sectors. Additionally, investments in R&D to develop bio-based and synthetic formulations strengthen competitiveness in regions with stringent regulations. Expansion into emerging industrial economies and the introduction of customized lubrication solutions remain key strategies driving long-term growth and market consolidation among global and regional participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shell Plc.

- Castrol (BP Plc.)

- Houghton International Inc.

- Delapena Honing Equipment

- Chem Arrow Corporation

- QualiChem Inc.

- Metalworking Lubricants Company

- Falcon Industrial Inc.

- Eastern Oil Company

- CC Jensen

- Sunbelt Lubricants

- Cimcool Industrial Products

Recent Developments

- In 2024, Castrol (BP Plc.) continued to offer its established range of Honilo neat honing oils and Syntilo synthetic coolants, which included products formulated with advanced extreme-pressure (EP) additives for optimizing performance in various honing operations, including heavy-duty diesel engine blocks.

- In 2024, Houghton continued to offer its existing range of honing fluids, which included options designed to be more environmentally responsible and safer for operators, such as bio-based and mineral-oil-free alternatives.

- In 2023, Shell Plc. continued to offer its established Macron range of neat cutting and honing oils, which provided improved tool life and surface finish in precision engineering applications.

Report Coverage

The research report offers an in-depth analysis based on Source of Origin, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for bio-based and water-soluble honing oils will continue to grow due to sustainability goals.

- Advancements in synthetic formulations will enhance tool life and machining efficiency.

- Automotive and aerospace sectors will remain major consumers of high-performance honing oils.

- Automation and precision machining trends will increase oil consumption in manufacturing units.

- Manufacturers will focus on developing low-emission and recyclable oil products.

- Asia-Pacific will lead market expansion with rapid industrialization and production capacity growth.

- Rising adoption of CNC and automated honing machines will boost lubricant demand.

- Partnerships between oil producers and machine tool makers will strengthen product integration.

- Strict environmental regulations will encourage innovation in biodegradable oil compositions.

- Digital monitoring of honing oil performance will gain traction in smart manufacturing facilities.