Market Overview

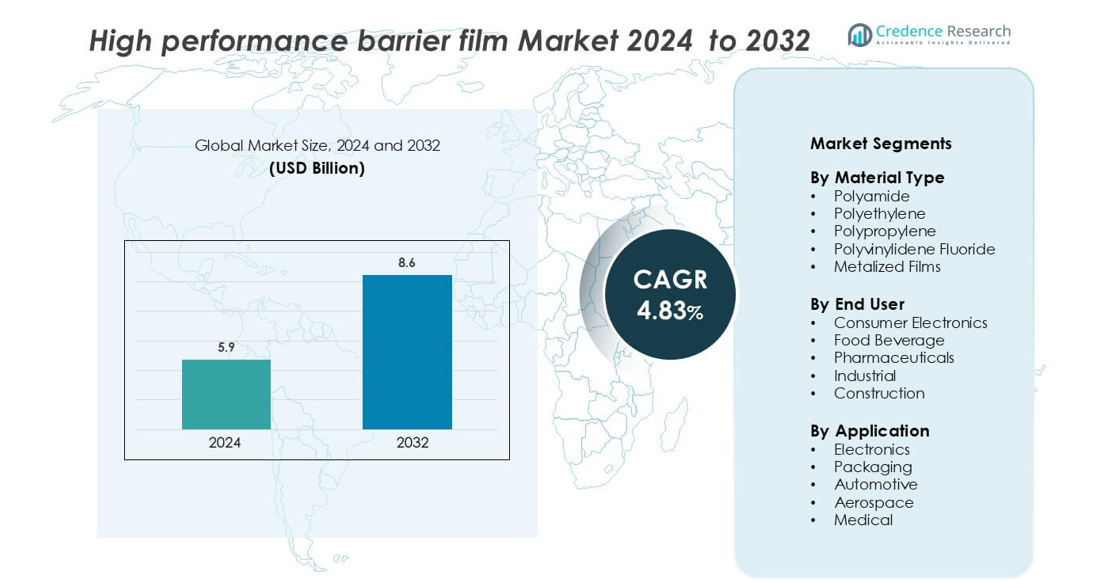

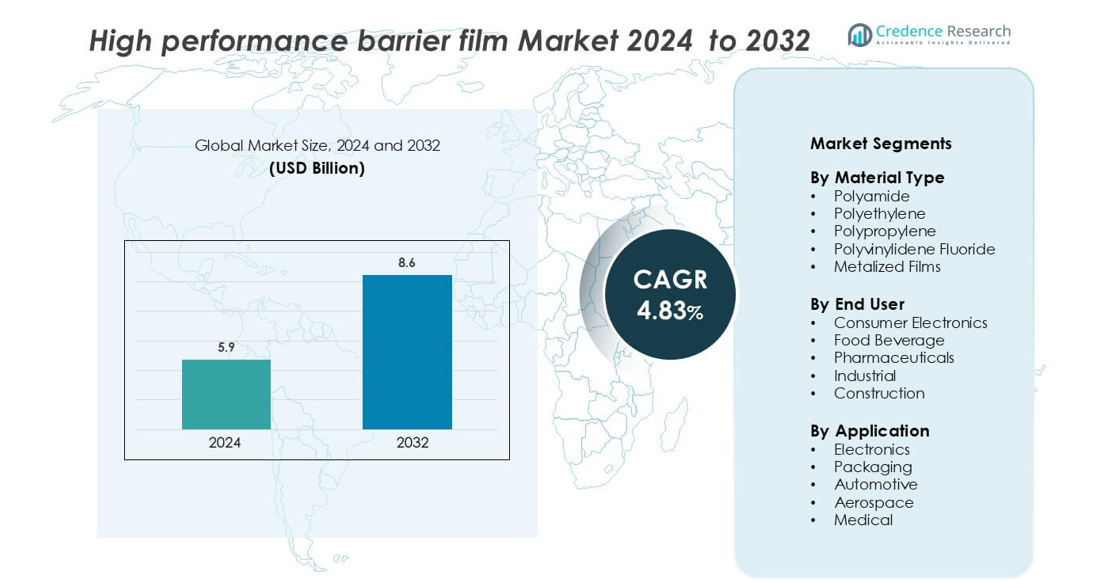

High performance barrier film Market size was valued USD 5.9 billion in 2024 and is anticipated to reach USD 8.6 billion by 2032, at a CAGR of 4.83 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Performance Barrier Film Market Size 2024 |

USD 5.9 billion |

| High Performance Barrier Film Market, CAGR |

4.83% |

| High Performance Barrier Film Market Size 2032 |

USD 8.6 billion |

The high-performance barrier film market is led by major companies such as Wipak, Coveris, Sonoco Product Company, Mondi, Constantia Flexibles, Berry Global Inc., Amcor plc, Sealed Air, Huhtamaki, and Klockner Pentaplast. These players focus on developing advanced, sustainable, and recyclable film solutions to meet the rising demand in food, pharmaceutical, and electronics applications. Strategic investments in co-extrusion, nanocomposite coatings, and bio-based materials strengthen their competitive advantage. North America leads the global market with a 35% share, driven by strong innovation in flexible packaging and established manufacturing infrastructure, followed by Europe and Asia-Pacific, which are rapidly advancing in sustainable film production.

Market Insights

- The high-performance barrier film market was valued USD 5.9 billion in 2024 and is projected to grow at a steady CAGR of 4.83 % through 2032.

- Strong demand from food and pharmaceutical packaging drives market expansion due to rising safety and shelf-life needs.

- The growing trend toward recyclable and bio-based films encourages sustainable production and material innovation.

- Leading players such as Amcor, Mondi, and Berry Global focus on product diversification and regional expansion to maintain competitiveness.

- North America leads with a 35% share, followed by Europe at 28% and Asia-Pacific at 30%, while polyethylene-based films hold the largest segment share due to high flexibility and moisture resistance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

The high-performance barrier film market is segmented into polyamide, polyethylene, polypropylene, polyvinylidene fluoride (PVDF), and metalized films. Polyethylene holds the largest market share due to its superior flexibility, moisture resistance, and cost-effectiveness. It is widely used in flexible packaging for food, pharmaceuticals, and electronics. Manufacturers increasingly prefer multilayer polyethylene films for their recyclability and strong sealing properties. Rising sustainability demands and advancements in co-extrusion technology further enhance polyethylene’s dominance, as it balances high barrier performance with lightweight packaging solutions suited for diverse industrial applications.

- For instance, Amcor plc developed its AmLite Ultra Recyclable PE film using advanced OPP technology, achieving an oxygen transmission rate of less than 0.1 cc/m²/day, enabling high-barrier performance while remaining fully recyclable under existing polyethylene recycling streams.

By End User

Among end users, the food and beverage segment dominates the high-performance barrier film market with the highest market share. These films are crucial for extending shelf life, maintaining freshness, and preventing contamination in packaged products. The growing preference for ready-to-eat and convenience foods has accelerated adoption. Additionally, increasing demand for vacuum and modified atmosphere packaging drives segment growth. Pharmaceutical and electronics sectors also contribute significantly, leveraging barrier films for moisture and oxygen control, which ensures product integrity and enhances durability during storage and transportation.

- For instance, Amcor developed its AmLite Ultra Recyclable film with an oxygen transmission rate below 0.1 cc/m²/day, enhancing product freshness for snack and dairy packaging.

By Application

Based on application, packaging represents the dominant segment in the high-performance barrier film market. Its extensive use across food, pharmaceuticals, and electronics industries drives consistent demand. The need for high moisture and gas resistance in multilayer film structures supports this growth. Innovations in flexible and sustainable packaging solutions further strengthen the segment’s leadership. The electronics and automotive applications are expanding rapidly, benefiting from superior chemical resistance and thermal stability. Meanwhile, aerospace and medical uses are emerging as high-value niches due to stringent protection and performance requirements.

Key Growth Drivers

Rising Demand from Food and Pharmaceutical Packaging

The growing need for high-quality packaging materials in the food and pharmaceutical industries is a primary driver for the high-performance barrier film market. These films offer superior protection against moisture, oxygen, and contaminants, ensuring extended shelf life and product safety. Food manufacturers rely on multilayer barrier films for perishable and ready-to-eat products, while pharmaceutical firms use them to protect sensitive drugs from humidity and oxygen degradation. Increasing global demand for convenient, portable, and sustainable packaging further fuels growth. Technological innovations in film extrusion and coating also enhance barrier efficiency and recyclability.

- For instance, Amcor developed its AmPrima™ PE Plus film, which meets pharmaceutical-grade moisture barrier standards with water vapor transmission rates below 0.5 g/m²/day.

Expansion of the Electronics and Automotive Industries

The rising use of flexible displays, OLED panels, and lithium-ion batteries in electronics is driving strong adoption of high-performance barrier films. These films protect sensitive components from moisture and oxygen, improving product reliability and longevity. In the automotive sector, their role in lightweight vehicle structures, battery insulation, and interior components strengthens market growth. The growing shift toward electric vehicles amplifies demand for durable barrier materials with excellent chemical and thermal resistance. Manufacturers are investing in advanced polymer formulations and nanocomposite coatings to meet stringent performance and safety standards.

- For instance, Samsung Display utilizes ultra-thin barrier films in its OLED panels with water vapor transmission rates under 10⁻⁶ g/m²/day, ensuring long-term stability.

Technological Advancements in Film Production

Continuous improvements in film manufacturing processes, such as atomic layer deposition, co-extrusion, and plasma-enhanced chemical vapor deposition, are major market growth drivers. These technologies enable the production of ultra-thin, flexible, and high-barrier films with enhanced mechanical and optical properties. Advanced coatings like aluminum oxide and silicon oxide significantly improve gas and moisture resistance. Moreover, the adoption of sustainable production methods using bio-based polymers supports global sustainability goals. The integration of smart packaging solutions and recyclability enhancements also attract consumer brands seeking eco-friendly and high-performance alternatives.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Films

Growing environmental awareness and regulatory pressures are promoting the development of sustainable barrier film solutions. Manufacturers are increasingly producing recyclable multilayer films using mono-material structures or bio-based resins. The trend supports circular economy initiatives by reducing waste and improving post-consumer recyclability. Companies are also exploring biodegradable coatings that maintain strong barrier properties while minimizing ecological impact. Rising consumer preference for eco-friendly packaging drives opportunities for material innovation and sustainable product differentiation, encouraging collaborations across supply chains to develop compliant, low-impact film solutions.

- For instance, Huhtamaki documents highlight that its Push Tab® paper offers excellent barrier and sealing properties.

Rising Adoption in Flexible Electronics and Medical Applications

The expansion of flexible electronics, such as wearable sensors and foldable displays, presents new opportunities for high-performance barrier films. These films ensure reliability by preventing oxidation and moisture damage to sensitive components. Similarly, in medical applications, barrier films are used for sterile packaging, transdermal patches, and diagnostic devices. The demand for lightweight, transparent, and biocompatible materials is rising. The growing integration of these films in healthcare technologies and electronic devices opens lucrative opportunities for manufacturers specializing in high-strength, low-permeability solutions.

Key Challenges

High Manufacturing Costs and Complex Production Processes

Producing high-performance barrier films involves sophisticated technologies and costly raw materials, leading to elevated manufacturing expenses. Processes like atomic layer deposition and multi-layer co-extrusion require advanced machinery and precise control, increasing operational costs. Smaller manufacturers face entry barriers due to high capital investment requirements. Additionally, achieving consistent quality and maintaining optical clarity while ensuring barrier effectiveness remain challenges. These cost pressures may restrict adoption in price-sensitive markets, particularly in developing regions, limiting large-scale penetration across non-premium applications.

- For instance, Centre for Process Innovation (CPI) developed a roll-to-roll atomic layer deposition (ALD) barrier film with a water vapour transmission rate (WVTR) of 1 × 10⁻⁴ g/m²/day using a 20-nanometre coating on flexible substrates, marking a high-barrier output but requiring advanced deposition equipment.

Recycling Complexity and Environmental Concerns

Multilayer barrier films often combine polymers, metals, and coatings, making recycling technically challenging. The difficulty in separating materials during waste processing hinders recyclability and adds to environmental burdens. Growing regulatory restrictions on plastic waste and non-recyclable materials further impact market expansion. Manufacturers are under increasing pressure to develop eco-friendly alternatives that maintain barrier performance without compromising sustainability. Overcoming these challenges requires substantial R&D investment in biodegradable polymers and simplified mono-material designs to align with evolving environmental compliance standards.

Regional Analysis

North America

North America dominates the high-performance barrier film market with a 35% share. The region benefits from strong demand across food packaging, pharmaceuticals, and consumer electronics. Manufacturers invest heavily in sustainable and high-barrier materials to comply with strict FDA and environmental standards. The U.S. leads with technological advancements in co-extrusion and nanocomposite film development. The presence of major packaging companies and rising adoption of flexible packaging solutions strengthen market growth. Additionally, growing demand for high-barrier films in battery and electronic component protection supports further expansion across the region.

Europe

Europe holds a 28% share in the high-performance barrier film market, driven by stringent sustainability regulations and innovation in recyclable materials. Germany, the UK, and France lead adoption, supported by mature packaging and automotive industries. The European Green Deal promotes bio-based and recyclable film alternatives, encouraging R&D investments. Food and beverage producers rely on advanced multilayer barrier films for extended shelf life and reduced waste. The region’s focus on reducing carbon footprints and plastic use fuels strong demand for eco-friendly packaging films with superior oxygen and moisture barrier properties.

Asia-Pacific

Asia-Pacific accounts for a 30% share, emerging as the fastest-growing region in the high-performance barrier film market. Rapid industrialization in China, India, Japan, and South Korea drives demand across food, electronics, and medical sectors. Expanding middle-class consumption and urbanization boost packaged food and e-commerce growth. Local manufacturers invest in cost-effective barrier solutions to serve global supply chains. Technological advancements in polymer science and large-scale production capacity strengthen regional competitiveness. Government support for sustainable packaging and electronics manufacturing further accelerates market development, positioning Asia-Pacific as a leading hub for innovation and exports.

Latin America

Latin America holds a 4% share of the high-performance barrier film market, supported by growing demand from the food, beverage, and pharmaceutical industries. Brazil and Mexico lead regional adoption due to expanding packaging and industrial applications. Increasing consumer preference for packaged food and rising healthcare awareness drive steady market growth. Local manufacturers focus on improving film quality and distribution networks to meet international standards. Gradual adoption of eco-friendly packaging initiatives and collaboration with global material suppliers enhance competitiveness, enabling Latin America to strengthen its position within the global supply chain.

Middle East & Africa

The Middle East & Africa region accounts for a 3% market share in the high-performance barrier film industry. The demand is driven by expanding construction, food processing, and healthcare sectors. Countries such as the UAE, Saudi Arabia, and South Africa are investing in modern packaging infrastructure and advanced manufacturing technologies. Rising disposable incomes and growing urbanization stimulate consumption of packaged food and pharmaceutical products. However, limited local production capabilities create dependency on imports. Strategic partnerships and foreign investments in polymer processing are expected to enhance regional self-sufficiency and support long-term market growth.

Market Segmentations:

By Material Type

- Polyamide

- Polyethylene

- Polypropylene

- Polyvinylidene Fluoride

- Metalized Films

By End User

- Consumer Electronics

- Food Beverage

- Pharmaceuticals

- Industrial

- Construction

By Application

- Electronics

- Packaging

- Automotive

- Aerospace

- Medical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The high-performance barrier film market is highly competitive, with global players focusing on innovation, sustainability, and advanced polymer technologies. Companies such as Amcor plc, Berry Global Inc., and Sealed Air lead through investments in multilayer recyclable films and enhanced moisture and oxygen resistance. Mondi and Constantia Flexibles emphasize eco-friendly and mono-material solutions that support circular packaging goals. Huhtamaki and Coveris expand their product portfolios by integrating bio-based and compostable materials for food and pharmaceutical applications. Wipak and Klockner Pentaplast are advancing nanocoating and high-barrier PET technologies to improve product safety and shelf life. Sonoco Product Company continues to strengthen its flexible packaging division through smart packaging and digital printing capabilities. Strategic mergers, R&D collaborations, and expansions in Asia-Pacific and Europe remain key competitive tactics, with most players aligning innovations toward regulatory compliance and high-performance sustainability standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wipak

- Coveris

- Sonoco Product Company

- Mondi

- Constantia Flexibles

- Berry Global Inc.

- Amcor plc

- Sealed Air

- Huhtamaki

- Klockner Pentaplast

Recent Developments

- In April 2024, UFlex launched a series of new high barrier packaging films, designed to provide superior product protection and extended shelf life while enhancing sustainability. These advanced packaging solutions cater to the growing demand for high-performance, eco-friendly materials in the flexible packaging industry.

- In March 2024, Toppan announced the launch of a new high barrier packaging film that combines recyclability with superior barrier performance, enhancing sustainability in the packaging industry.

- In December 2023, Amcor introduced a new recyclable high barrier packaging film, designed to deliver exceptional product protection while supporting sustainability efforts.

Report Coverage

The research report offers an in-depth analysis based on Material Type, End-User,Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand due to increasing demand for advanced packaging solutions across food and pharmaceuticals.

- Adoption of recyclable and bio-based barrier films will grow under global sustainability goals.

- Technological innovations will enhance film strength, flexibility, and gas resistance performance.

- Rising use in flexible electronics and battery packaging will drive industrial applications.

- Asia-Pacific will remain the fastest-growing region supported by strong manufacturing output.

- Companies will invest more in multilayer extrusion and coating technologies for efficiency.

- Regulatory policies promoting eco-friendly materials will influence product design and innovation.

- Strategic collaborations between packaging firms and polymer producers will strengthen global supply chains.

- The medical and healthcare sectors will generate new opportunities for sterile and high-barrier films.

- Digital printing and smart packaging integration will shape the next phase of product development.