Market Overview

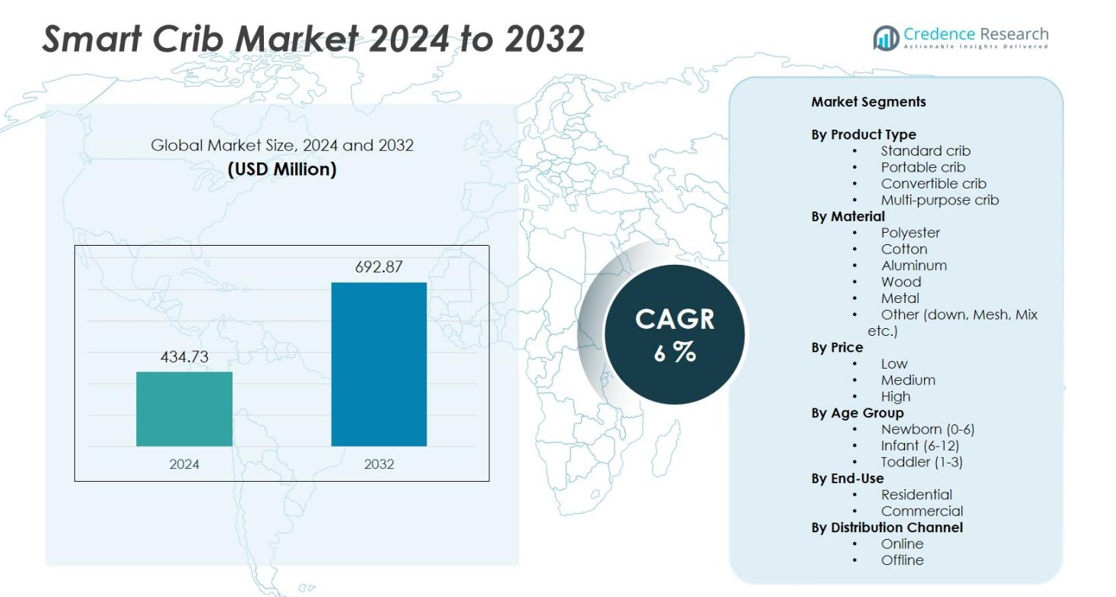

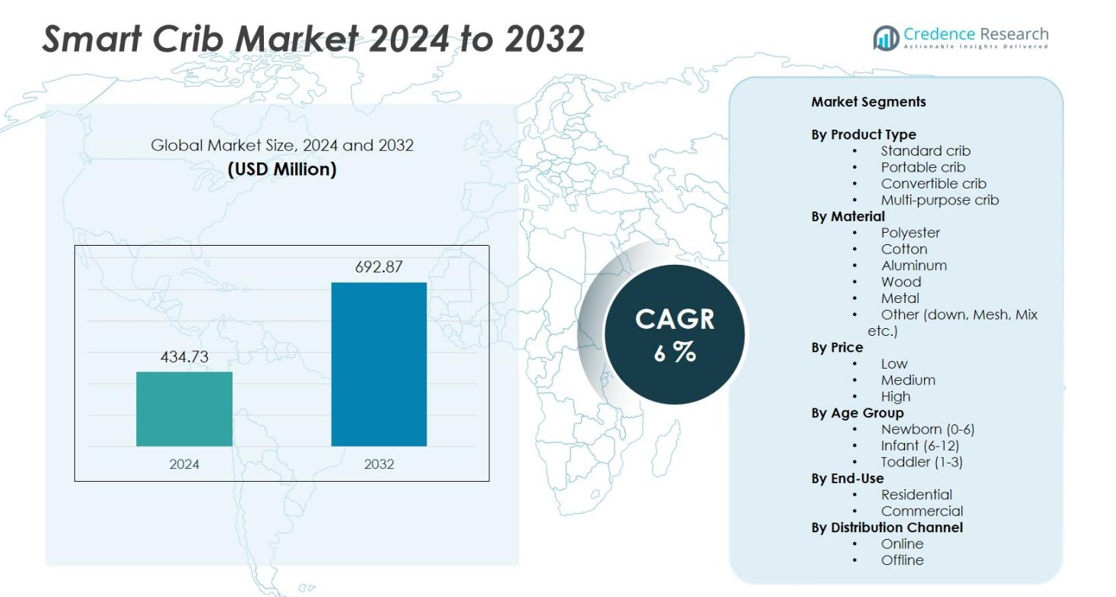

The Smart Crib Market size was valued at USD 434.72 million in 2024 and is anticipated to reach USD 692.87 million by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Crib Market Size 2024 |

USD 434.72 million |

| Smart Crib Market, CAGR |

6% |

| Smart Crib Market Size 2032 |

USD 692.87 million |

The Smart Crib Market features strong competition among leading players such as The Happiest Baby, Inc., Fisher-Price, HALO Sleep, 4moms (Thorley Industries, LLC), Smartbe Intelligent Stroller Inc., Baby Bjorn (BabyBjörn AB), Silver Cross (D.F. Holdings Ltd.), SNOOZA, Hatch Baby Inc., Sleep Number Corporation, and Snoo Smart Sleeper. These companies focus on advanced connectivity, AI-driven monitoring, and ergonomic design to enhance infant safety and sleep quality. North America emerged as the leading regional market in 2024, capturing a 37% share, driven by high adoption of smart home devices and premium baby care products. Europe followed with a 28% share, supported by strong consumer preference for sustainable and technologically advanced childcare solutions.

Market Insights

- The Smart Crib Market was valued at USD 434.72 million in 2024 and is projected to reach USD 692.87 million by 2032, growing at a CAGR of 6% during the forecast period.

- Increasing awareness of infant safety and health monitoring drives market growth, with parents adopting AI- and IoT-enabled cribs for real-time tracking, sleep analysis, and comfort automation.

- Key trends include the integration of AI-based predictive sleep analytics and rising demand for eco-friendly wooden cribs, which held a 38% material segment share in 2024.

- The market is moderately competitive, with major players such as The Happiest Baby, Fisher-Price, and 4moms focusing on product innovation, app connectivity, and smart ecosystem compatibility.

- North America led with a 37% market share, followed by Europe (28%) and Asia-Pacific (24%), driven by increasing smart home adoption, digital parenting solutions, and expanding online retail presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The standard crib segment dominated the global smart crib market in 2024, accounting for over 42% of total revenue. Its dominance is attributed to strong consumer preference for durable, full-sized cribs with integrated monitoring systems, motion sensors, and automated rocking functions. Standard smart cribs appeal to parents seeking long-term usability and enhanced infant safety. Growing innovation in sensor-based sleep tracking and mobile app connectivity from leading brands has strengthened product reliability and convenience, driving consistent demand within residential and hospital applications.

- For instance, Cradlewise introduced its AI-powered smart crib equipped with a built-in baby monitor and an adaptive rocking mechanism that detects sleep disturbances and responds automatically.

By Material

The wood segment held the largest market share of approximately 38% in 2024, driven by its aesthetic appeal, structural stability, and eco-friendly nature. Parents increasingly prefer smart cribs made from sustainably sourced hardwoods integrated with IoT-enabled modules and smart features like temperature control and breathing monitors. Manufacturers are incorporating hybrid wood-metal designs to enhance durability without compromising style. The combination of sustainability, safety, and premium finish positions wooden smart cribs as the most popular choice among middle- and high-income consumers globally.

- For instance, 4moms’ “mamaRoo Sleep Bassinet” features five parent-inspired motion styles, five speed settings, and four white-noise options controlled via Bluetooth through a mobile app.

By Price

The medium-priced segment accounted for around 46% of the global market in 2024, emerging as the dominant price category. It balances affordability and advanced functionality, offering features such as automatic rocking, sleep tracking, and Wi-Fi-enabled monitoring. Consumers in this segment prioritize quality and technological convenience over premium aesthetics. Increasing product availability across online retail platforms and growing adoption among urban households contribute to steady growth. Brands are targeting this segment with value-driven smart crib models that integrate essential smart features while maintaining accessible pricing.

Key Growth Drivers

Rising Adoption of Smart Home Ecosystems

The increasing integration of smart home technologies is a major growth driver for the smart crib market. Parents are adopting connected devices that offer real-time monitoring, voice control, and mobile app synchronization. Smart cribs compatible with ecosystems like Amazon Alexa and Google Home enhance convenience and safety, allowing remote operation and instant alerts. This growing alignment with the broader Internet of Things (IoT) trend is encouraging higher adoption among tech-savvy consumers seeking comfort, security, and data-driven parenting solutions.

- For instance, Cradlewise’s smart crib automatically plays curated music (white, pink, and brown noise) to soothe babies and fully integrates with a mobile app for remote monitoring and control.

Growing Awareness of Infant Health and Safety

Heightened concern for infant well-being is fueling demand for smart cribs with advanced safety and monitoring features. Modern designs integrate breathing sensors, movement tracking, and temperature control to reduce risks such as Sudden Infant Death Syndrome (SIDS). Healthcare professionals increasingly recommend such technologies for neonatal care and home use. The combination of real-time health analytics and automated alerts is empowering parents to monitor infants more efficiently, contributing significantly to the expansion of this market segment globally.

- For instance, Bosch introduced its Revol smart crib at CES 2025, featuring millimeter wave radar sensors that accurately measure a baby’s heart rate and respiration, alongside VOC and particle sensors to monitor air quality, and AI to alert parents if a baby’s face is covered by objects.

Expansion of E-Commerce and Online Retail Channels

The rapid growth of e-commerce platforms has made smart cribs more accessible to a wider audience. Online channels allow consumers to compare features, read reviews, and access a diverse range of models with flexible payment options. Brands leverage digital marketing and influencer collaborations to boost awareness among millennial parents. The convenience of doorstep delivery and easy installation services further enhances online sales, driving strong growth in both developed and emerging markets as digital purchasing behavior becomes increasingly prevalent.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

The integration of artificial intelligence and predictive analytics represents a transformative trend in the smart crib market. AI-enabled cribs can analyze sleep patterns, detect irregularities, and automatically adjust motion or lighting to optimize comfort. This data-driven functionality appeals to parents seeking proactive infant care solutions. Companies are investing in machine learning algorithms to personalize sleep environments, creating opportunities for continuous product improvement and long-term customer engagement through subscription-based analytics services.

- For instance, Philips launched the Premium Connected Baby Monitor in late 2024, featuring SenseIQ technology that tracks sleep and breathing without wearables. Their AI-driven system provides sleep insights and cry detection, helping parents monitor infant well-being in real-time through a smart app.

Sustainability and Eco-Friendly Design Innovations

The growing preference for eco-friendly and sustainable baby products presents new opportunities for manufacturers. Consumers are favoring smart cribs made from responsibly sourced wood, non-toxic materials, and energy-efficient components. Brands focusing on recyclable parts and minimal carbon footprint production gain competitive advantage. Integrating sustainability with smart functionality not only aligns with global environmental standards but also enhances brand credibility among environmentally conscious parents, opening avenues for premium product positioning and long-term brand loyalty.

- For instance, Newton Baby’s Galileo 3-in-1 Crib is made from sustainably sourced solid Beech wood harvested from responsible forests in France, with non-toxic finishes and GREENGUARD Gold certification.

Key Challenges

High Product Cost and Limited Affordability

One of the primary challenges in the smart crib market is the relatively high cost of products, which restricts adoption in price-sensitive regions. Advanced features such as AI monitoring, IoT integration, and automated motion systems increase manufacturing expenses. As a result, consumers in developing markets often prefer traditional cribs. To overcome this, companies must focus on modular designs and cost-efficient technologies to expand accessibility while maintaining product quality and safety standards.

Data Privacy and Connectivity Concerns

Smart cribs rely heavily on connected technologies that collect and transmit sensitive data, including audio and video feeds. Concerns over data security, hacking risks, and unauthorized access hinder consumer confidence. Parents are increasingly cautious about cloud-based monitoring systems that may compromise personal information. Addressing these issues requires robust encryption protocols, compliance with international data protection regulations, and transparent privacy policies. Strengthening cybersecurity will be essential to ensure sustained consumer trust and widespread adoption.

Regional Analysis

North America

North America dominated the global smart crib market in 2024, holding a market share of 37%. The region’s leadership is driven by strong consumer awareness of smart parenting solutions and widespread adoption of IoT-enabled devices. High disposable income levels, coupled with the presence of major manufacturers such as Happiest Baby and Cradlewise, support sustained growth. The U.S. remains the primary contributor, with increasing hospital and residential use of automated cribs for infant monitoring. Expanding e-commerce distribution and early technology adoption further enhance market penetration across the region.

Europe

Europe accounted for a 28% share of the global smart crib market in 2024, supported by a growing preference for eco-friendly and technologically advanced baby care products. Countries such as Germany, the U.K., and France lead adoption due to rising birth rates and high standards of infant safety. European consumers prioritize sustainable materials and data-secure devices, encouraging innovation in connected crib technologies. Government regulations promoting child safety and the popularity of premium baby products among urban parents continue to drive demand across the region.

Asia-Pacific

The Asia-Pacific region captured a 24% market share in 2024 and is expected to experience the fastest growth over the forecast period. Rapid urbanization, increasing middle-class income, and expanding awareness of smart childcare technologies are key factors driving adoption. Countries such as China, Japan, and India are witnessing strong demand for connected nursery products. The rise of e-commerce and domestic manufacturing capabilities supports local market expansion. Growing millennial parent populations, coupled with interest in modern parenting tools, position Asia-Pacific as a major growth hub for smart crib manufacturers.

Latin America

Latin America held a 7% market share in 2024, with Brazil and Mexico emerging as primary markets. Increasing penetration of smart home devices and improving internet infrastructure are driving gradual adoption of smart cribs. While cost sensitivity remains a challenge, a growing segment of affluent consumers is embracing premium baby care solutions. Local distributors are partnering with global brands to expand product accessibility. The region’s expanding online retail presence and rising awareness of infant safety standards are expected to contribute to steady market growth.

Middle East & Africa

The Middle East & Africa accounted for a 4% share of the global smart crib market in 2024. The market is gaining momentum in high-income nations such as the UAE and Saudi Arabia, where consumers show strong preference for luxury and tech-enabled childcare products. Increasing birth rates, coupled with government investments in smart healthcare infrastructure, support gradual adoption. However, limited awareness and affordability challenges in several African countries restrict wider market penetration. Growing retail expansion and smart home integration trends are expected to create new opportunities in the coming years.

Market Segmentations:

By Product Type

- Standard crib

- Portable crib

- Convertible crib

- Multi-purpose crib

By Material

- Polyester

- Cotton

- Aluminum

- Wood

- Metal

- Other (down, Mesh, Mix etc.)

By Price

By Age Group

- Newborn (0-6)

- Infant (6-12)

- Toddler (1-3)

By End-Use

By Distribution Channel

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Smart Crib Market is defined by continuous technological innovation, design enhancement, and strategic expansion by major players such as Fisher-Price, Smartbe Intelligent Stroller Inc., HALO Sleep, Silver Cross (D.F. Holdings Ltd.), The Happiest Baby, Inc., SNOOZA, 4moms (Thorley Industries, LLC), Baby Bjorn (BabyBjörn AB), Hatch Baby Inc., Sleep Number Corporation, and Snoo Smart Sleeper. These companies focus on integrating IoT, AI, and sensor technologies to improve infant monitoring, comfort, and safety. Key players are introducing cribs with features such as automatic rocking, sleep tracking, temperature regulation, and app-based connectivity. Strategic collaborations with healthcare experts and retail distributors are strengthening market presence, while sustainability and premium aesthetics are emerging as differentiating factors. Furthermore, expanding e-commerce channels and digital marketing initiatives are helping brands reach tech-savvy parents globally, intensifying competition in both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fisher-Price

- Smartbe Intelligent Stroller Inc.

- HALO Sleep

- Silver Cross (D.F. Holdings Ltd.)

- The Happiest Baby, Inc.

- SNOOZA

- 4moms (Thorley Industries, LLC)

- Baby Bjorn (BabyBjörn AB)

- Hatch Baby Inc.

- Sleep Number Corporation

- Snoo Smart Sleeper

Recent Developments

- In September 2023, Breathable Baby expanded the availability of its Breathable Mesh Cribs and portable sleepers in celebration of Baby Safety Month.

- In May 2024, Graco launched its new product called SmartSense Soothing Bassinet and SmartSense Soothing Swing, equipped with patented technology that automatically detects and responds to a baby’s cries.

- In April 2023, Happiest Baby Inc. launched the SNOO Smart Sleeper, a cutting-edge crib that enables parents to monitor their baby’s every movement. Its automated rocking mechanism ensures infants remain safely on their backs, minimizing safety risks

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Price, Age Group, End Use, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The smart crib market will witness steady growth driven by rising adoption of connected parenting solutions.

- Integration of AI and IoT technologies will enhance real-time infant monitoring and predictive analytics.

- Manufacturers will focus on developing sustainable and eco-friendly materials to meet growing environmental standards.

- Expansion of e-commerce platforms will improve global accessibility and consumer reach.

- Increasing collaboration between tech companies and healthcare experts will strengthen product reliability.

- Mid-range smart cribs offering value-driven features will dominate future demand.

- Data security and privacy enhancements will become key priorities for manufacturers.

- Emerging markets in Asia-Pacific and Latin America will present strong growth opportunities.

- Customizable and modular crib designs will gain popularity among modern urban parents.

- Continuous product innovation and smart home integration will define long-term market competitiveness.