Market Overview:

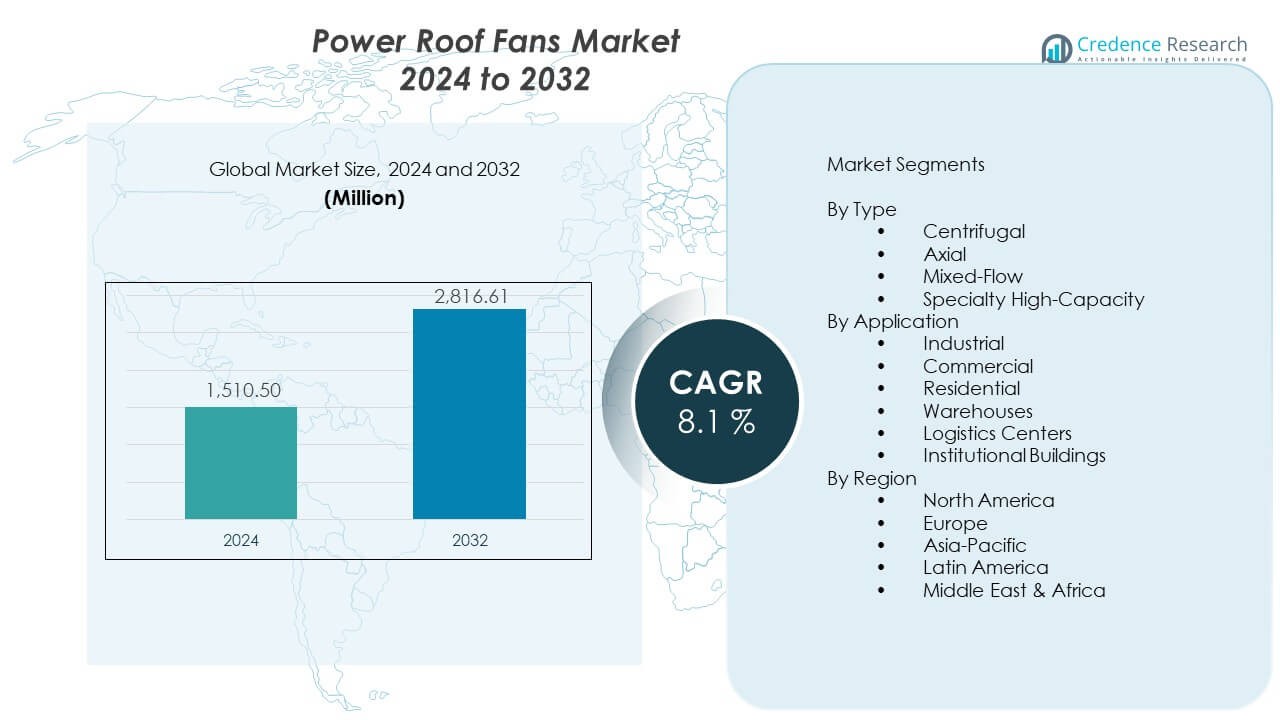

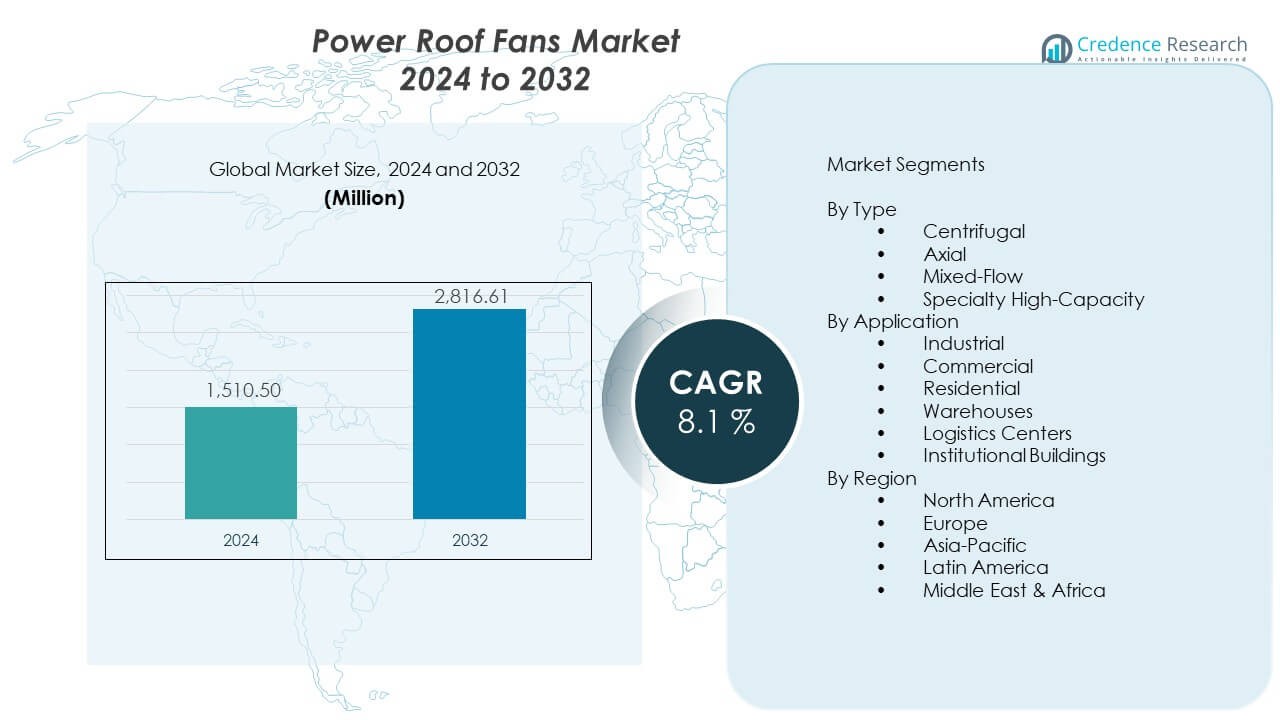

The Power Roof Fans Market is projected to grow from USD 1,510.5 million in 2024 to an estimated USD 2,816.61 million by 2032, with a compound annual growth rate (CAGR) of 8.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Roof Fans Market Size 2024 |

USD 1,510.5 Million |

| Power Roof Fans Market, CAGR |

8.1% |

| Power Roof Fans Market Size 2032 |

USD 2,816.61 Million |

The market grows due to strong demand for better air circulation across industrial and commercial buildings. Companies invest in high-efficiency ventilation systems to improve workplace comfort and reduce heat load in large facilities. Green-building policies push buyers toward fans that lower energy use and support cleaner indoor conditions. Manufacturers introduce smart controls that optimize airflow during peak operational hours. Warehouses upgrade ventilation to meet safety standards linked to heat and airborne contaminants. Rising construction activity across logistics hubs strengthens adoption. Product innovation improves motor durability and reduces maintenance needs, which encourages replacement purchases. These factors support steady demand across major end-use sectors.

North America leads due to strong industrial infrastructure and high adoption of energy-efficient ventilation solutions. Europe follows with demand driven by strict environmental rules and commercial renovation projects. Asia Pacific emerges as a fast-growing region due to rapid urban development and rising factory expansion across China, India, and Southeast Asia. The Middle East shows growing interest driven by climate conditions that require continuous airflow management. Latin America develops gradually as commercial construction expands in key economies. Africa remains in an early stage but gains momentum where industrial clusters grow.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market grows from USD 1,510.5 million in 2024 to USD 2,816.61 million by 2032, supported by a CAGR of 8.1%, driven by strong ventilation demand across industrial and commercial sites.

- Asia-Pacific leads with ~38% share, driven by heavy industrial activity and strong construction pipelines; North America holds ~28%, backed by ventilation standards and workplace safety rules; Europe captures ~24%, supported by strict green-building norms.

- Asia-Pacific is the fastest-growing region, backed by factory expansion, rising infrastructure spending, and high ventilation needs across dense urban zones.

- The industrial application segment holds the largest share, driven by high airflow needs across production floors and warehouses.

- Centrifugal and axial fans account for the majority share, reflecting strong use in heavy-duty industrial zones and large commercial buildings that require high-volume or high-pressure ventilation.

Market Drivers:

Rising Focus on High-Efficiency Ventilation Systems

Demand rises as industries need steady airflow to control heat in large structures. Stakeholders upgrade systems to support safer indoor conditions for workers. Buyers prefer fans that deliver consistent performance across long duty cycles. The Power roof fans market gains momentum from stricter building norms. It supports ventilation needs in warehouses, plants, and logistics hubs. Firms choose advanced motors that reduce stress on equipment. Construction projects increase adoption across new commercial blocks. Energy rules motivate faster replacement of outdated models.

- For instance, Greenheck states that its Vari-Green EC motors can cut energy use by up to 85% versus shaded-pole motors, verified across commercial ventilation tests.

Growing Adoption of Smart and Automated Airflow Controls

End users shift toward systems that monitor airflow for changing workloads. Automation helps maintain steady ventilation quality in dense industrial zones. Facility managers value controls that reduce manual oversight during peak hours. The Power roof fans market benefits from strong interest in connected systems. It improves the reliability of operations across modern plants. Cloud dashboards help track airflow across multi-site networks. Firms deploy predictive tools to reduce downtime risk. Smart systems support compliance with indoor air management rules.

- For instance, Johnson Controls offers building automation and control solutions to over one million customers globally. The company’s Metasys building automation system integrates various building technologies, including HVAC and security, and has been recently updated to support up to 1,000 IP devices per server, allowing for scalable deployment across large campuses or multi-site enterprises.

Expansion of Industrial and Commercial Infrastructure Projects

Increased construction drives stronger demand for high-capacity fans across multiple regions. Developers integrate ventilation early to meet structural design needs. Contractors specify robust units to handle heavy air extraction loads. The Power roof fans market benefits from steady project approvals across cities. It supports buildings that require stable cooling in high-traffic areas. Architects specify systems that align with efficiency targets. Urban zones record rising installations across retail, manufacturing, and transport hubs. New supply chain corridors raise long-term demand.

Rising Employer Focus on Worker Comfort and Safety

Industrial operators invest in improved airflow to lower heat exposure risk. Better ventilation helps reduce fatigue across labor-intensive zones. Firms choose fans that deliver stable circulation without heavy noise. The Power roof fans market gains from increasing attention to workforce safety. It supports compliance with internal facility guidelines. Upgraded systems prevent air stagnation during long operational hours. Buyers value equipment that maintains consistent cooling in warmer climates. Strong health requirements strengthen replacement rates worldwide.

Market Trends:

Shift Toward Low-Noise and Vibration-Optimized Designs

Buyers seek models that cut noise during long production hours. Engineers design blades that reduce turbulence across heavy airflow settings. Manufacturers refine housings to limit vibration during peak operation cycles. The Power roof fans market advances through steady acoustic improvements. It helps facilities maintain better comfort for on-site teams. Low-noise units support new design trends in logistics hubs. Retail developers adopt quieter units for customer-facing buildings. Product refinement fosters higher acceptance among premium buyers.

- For instance, the Loren Cook website and product literature highlight the Acousti-Wheel as a design feature aimed at reducing fan noise. The company is widely recognized for submitting its products for AMCA International certification for both air and sound performance, allowing customers to compare fan ratings based on verified data.

Integration of Renewable-Ready Power Configurations

Stakeholders explore fan systems that align with solar-linked building plans. Energy teams value models that operate efficiently under grid-managed settings. Engineers design motors that adapt to variable voltage supply patterns. The Power roof fans market moves toward enhanced power flexibility. It supports projects that use green energy across industrial estates. Facilities apply hybrid solutions to reduce peak power load. Renewable-ready units support long-term environmental goals. Adoption grows across regions with strong clean-energy targets.

- For instance, Solatube verifies that its solar attic ventilation units operate directly on rooftop PV power and use high-efficiency 24-V brushless motors for continuous airflow.

Rise of Modular and Easy-Serviceable Fan Structures

Demand grows for components that reduce service time across wide networks. Technicians prefer units with simple access points for periodic cleaning. Manufacturers introduce modular bodies that reduce installation delays. The Power roof fans market benefits from interest in simpler layouts. It supports faster deployment across remote sites. Production teams seek fans with interchangeable parts. Logistics facilities adopt designs that reduce technician workload. Modular structures push long-term operational efficiency gains.

Growing Popularity of Lightweight Composite Materials

Producers shift toward blades built with advanced composites for longer life. Lightweight designs cut stress on motors during extended operation. Improved materials support corrosion resistance in coastal or humid regions. The Power roof fans market adopts new material blends each year. It enhances durability across high-demand applications. Buyers value equipment that performs reliably under continuous airflow pressure. Engineers tune materials to maintain balance at higher speeds. Composite use strengthens endurance across harsh industrial zones.

Market Challenges Analysis:

High Energy Consumption Concerns and Rising Compliance Pressure

Users worry about power intensity during long ventilation cycles. Governments mandate tougher rules that require strict efficiency standards. Firms struggle to upgrade legacy units within limited budgets. The Power roof fans market faces pressure from evolving certification norms. It must adapt designs to meet regional regulatory differences. High-capacity models demand stronger motors that raise operational cost fears. Buyers hesitate where grid stability remains weak. Growing scrutiny increases testing and documentation needs for manufacturers.

Maintenance Burden and Limited Skilled Workforce Availability

Large-scale facilities operate fans under harsh conditions that accelerate wear. Service teams face difficulty handling repairs across high-mount locations. Operators report delays due to limited technician availability. The Power roof fans market experiences challenges from long repair cycles. It encounters rising downtime risk where parts availability remains poor. Harsh environments demand frequent cleaning to maintain airflow quality. Firms struggle with replacement timing during peak seasons. Workforce gaps slow adoption across complex industrial zones.

Market Opportunities:

Expansion of Green-Building Projects and Smart Infrastructure Plans

Developers adopt ventilation systems that match global energy standards. Planners incorporate efficient roof fans into new building codes. The Power roof fans market gains from rising green-certified construction. It supports technology upgrades that align with smart-facility roadmaps. Smart grids drive interest in adaptive airflow solutions. Cities push wider modernization that increases fan deployment. Growth accelerates across logistics centers and commercial towers. Buyers adopt high-efficiency units for long-term operational savings.

Increasing Adoption Across Emerging Industrial Zones Worldwide

Manufacturing growth improves demand across Asia, Africa, and Latin America. Expanding industrial clusters require ventilation that handles heavy heat loads. The Power roof fans market benefits from new plant setups across key sectors. It supports evolving supply chains that demand stable airflow. Governments invest in zones that attract global production. Firms prefer rugged fans that handle varied climate conditions. Growth in export-driven industries strengthens installation rates. New entrants adopt advanced fans to meet global standards.

Market Segmentation Analysis:

By Type

Centrifugal models lead demand where strong static pressure and steady airflow are required across dense industrial zones. Buyers choose axial units for large-volume ventilation that supports open commercial layouts. Mixed-flow fans gain traction due to balanced performance that fits both mid-pressure and mid-volume needs. Specialty high-capacity units serve facilities that handle extreme heat or heavy airborne loads. The Power roof fans market benefits from wider adoption of advanced materials that improve durability. It supports varied end users that seek long service life. Manufacturers refine blade geometry to raise efficiency across each type. Growth continues as buyers look for models that match changing building designs.

- For instance, Ziehl-Abegg uses a high-performance, lightweight composite material called ZAmid® for components like fan impellers, which provides high mechanical strength and corrosion resistance while reducing the overall weight compared to traditional metal alternatives.

By Application

Industrial facilities form the largest segment due to strong ventilation needs across production floors. Commercial buildings adopt roof fans to maintain stable indoor conditions in malls, hospitals, and offices. Residential demand grows where homeowners seek improved attic airflow to reduce heat buildup. Warehouses depend on high-capacity units to support large-volume air exchange. Logistics centers require fans that maintain operational comfort across long working cycles. Institutional buildings deploy durable models that ensure reliable ventilation in schools and public centers. The market gains adoption where airflow quality influences energy efficiency. It continues to expand across diverse applications that require consistent roof-mounted solutions.

Segmentation:

By Type

- Centrifugal

- Axial

- Mixed-Flow

- Specialty High-Capacity

By Application

- Industrial

- Commercial

- Residential

- Warehouses

- Logistics Centers

- Institutional Buildings

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific

Asia-Pacific holds the largest share of the Power roof fans market, accounting for around 38%, driven by strong industrial expansion and steady construction activity across China, India, and Southeast Asia. Rapid growth in manufacturing units increases ventilation needs across large facilities. Urban development projects raise adoption across malls, hospitals, and residential buildings. The region benefits from supportive energy policies that encourage efficient ventilation systems. The Power roof fans market gains steady traction due to rising infrastructure upgrades. It records strong replacement demand in high-temperature zones. Long-term growth remains stable due to industrial diversification efforts across emerging economies.

North America

North America captures close to 28% share supported by strict ventilation standards and high awareness of workplace safety. Industrial firms prefer high-efficiency units that maintain consistent airflow in production environments. Commercial renovation drives steady demand across offices, logistics centers, and retail buildings. Buyers value advanced controls that support energy-saving goals. The Power roof fans market grows through strong adoption of low-noise and premium models. It benefits from regulatory pressure that promotes better indoor air quality. Market expansion continues across distribution hubs that require reliable airflow systems.

Europe

Europe accounts for around 24% share due to the region’s focus on green building standards and energy-compliant ventilation systems. Commercial buildings across Germany, the U.K., and France adopt advanced roof fans to support sustainability goals. Industrial operators replace legacy systems to meet efficiency targets set by regional frameworks. The Power roof fans market benefits from strong engineering capabilities among European manufacturers. It gains demand across warehouses that require noise-optimized solutions. Growth extends across southern Europe where climate conditions increase ventilation needs. Steady investment in infrastructure modernisation supports long-term adoption.

Key Player Analysis:

- Panasonic

- Nortek

- Systemair

- Greenwood Airvac

- Polypipe Ventilation

- Vent-Axia

- Greenheck Fan Corporation

- Soler & Palau Ventilation Group

- Broan-NuTone

- Swegon

- Johnson Controls

- ALDES

- Rosenberg Ventilatoren

- Elta

- MAICO Ventilatoren

Competitive Analysis:

The Power roof fans market features strong competition among global ventilation manufacturers that focus on energy efficiency, low-noise design, and advanced airflow control. Leading companies introduce high-performance models that fit industrial, commercial, and residential needs. Firms expand portfolios with smart-enabled systems that improve operational accuracy. Product differentiation relies on motor efficiency, material strength, and service support. The Power roof fans market benefits from steady innovation across premium segments. It sees active investment in modular structures that simplify maintenance. Partnerships with construction firms and distributors strengthen brand reach across major regions.

Recent Developments:

- Further, Panasonic completed its acquisition of the commercial air-conditioning business of Systemair AB in late February 2023, enabling stronger development, production, and sales of environmentally friendly air conditioning and hydronic systems, enhancing its offerings in commercial HVAC solutions.

- Soler & Palau Ventilation Group finalized the acquisition of United Enertech Corp and related companies in April 2024. This move expands their product portfolio with complementary ventilation systems including air control products like grilles, registers, and air terminal units, enhancing their single-source ventilation solution strategy for customers in residential, commercial, and institutional sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise due to stronger ventilation needs across industrial and commercial sites.

- Smart airflow controls will gain wider use across new infrastructure projects.

- Material innovation will improve durability and lower operational strain.

- Energy-efficient models will see growing acceptance across warm-climate regions.

- Warehouse and logistics expansion will drive large-capacity fan adoption.

- Manufacturers will invest in low-noise technologies for customer-facing facilities.

- Regional construction growth will support new installation cycles.

- Replacement demand will strengthen where older systems fail efficiency norms.

- Green-building policies will push upgrades to compliant roof fan systems.

- Global brands will expand production networks to meet rising project demand.