Market Overview

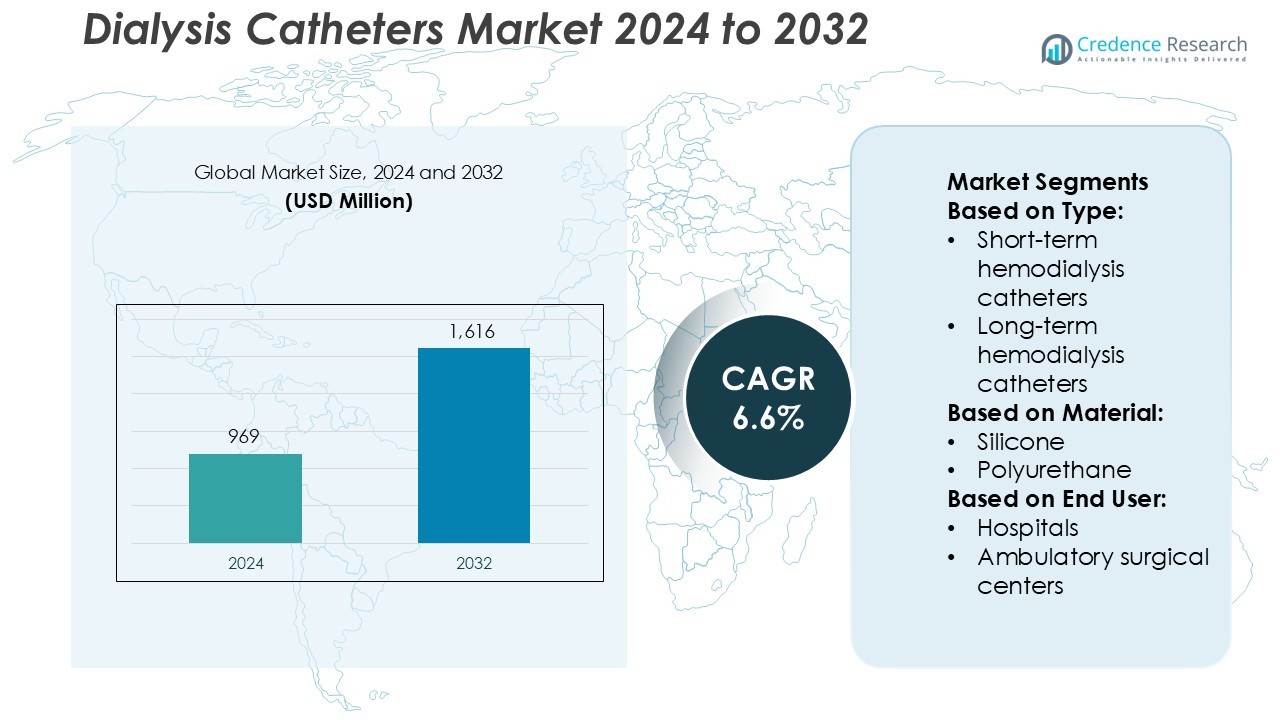

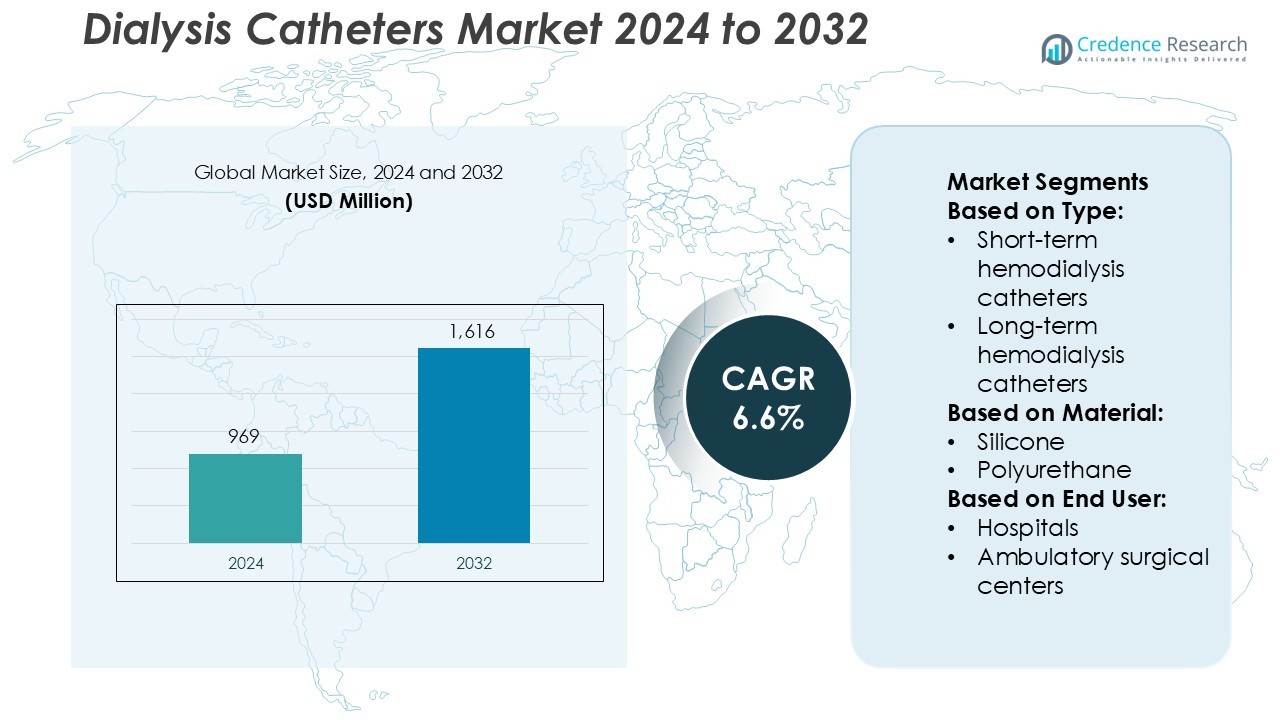

Dialysis Catheters Market size was valued USD 969 million in 2024 and is anticipated to reach USD 1,616 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dialysis Catheters Market Size 2024 |

USD 969 Million |

| Dialysis Catheters Market, CAGR |

6.6% |

| Dialysis Catheters Market Size 2032 |

USD 1,616 Million |

The dialysis catheters market is dominated by key players including Merit Medical System, Inc., Medtronic plc, Amecath Medical Technologies, Poly Medicure Ltd, Becton, Dickinson and Company, Cook Medical, Baxter International Inc., Angiplast Pvt. Ltd., B Braun Melsungen AG, and PFM Medical, Inc. These companies focus on continuous innovation, introducing antimicrobial, tunneled, and long-term catheters to improve patient safety and procedural efficiency. Strategic initiatives such as mergers, acquisitions, and regional partnerships enhance market reach and competitive positioning. North America leads the global market with a 31.6 % share, driven by high CKD prevalence, advanced healthcare infrastructure, and supportive reimbursement frameworks. The combination of technological advancements, robust distribution networks, and rising demand across hospitals, homecare, and ambulatory settings reinforces the region’s dominance while shaping the competitive landscape for global dialysis catheter suppliers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The dialysis catheters market was valued at USD 969 million in 2024 and is projected to reach USD 1,616 million by 2032, growing at a CAGR of 6.6 %.

- North America leads the market with a 31.6 % share, driven by high CKD prevalence, advanced healthcare infrastructure, and strong reimbursement policies. Asia Pacific follows with growing demand due to rising diabetes and hypertension rates, while Europe, Latin America, and MEA show steady adoption of catheters in hospitals and homecare.

- Hemodialysis catheters dominate the market, particularly long-term tunneled catheters, due to higher patient volumes and clinical preference for reduced infection risk. Peritoneal catheters are gaining traction in homecare settings.

- Key players focus on technological innovation, antimicrobial coatings, and biocompatible materials, supported by mergers, acquisitions, and regional partnerships to strengthen market presence.

- Challenges include high catheter costs and risk of infections, but growth opportunities arise from home dialysis programs, pediatric and geriatric-specific catheters, and expanding healthcare infrastructure in emerging regions.

Market Segmentation Analysis:

By Type

Short-term hemodialysis catheters dominate the market, accounting for the largest share due to the increasing number of acute kidney injury cases requiring immediate dialysis. Hospitals and critical care units prefer short-term catheters for rapid vascular access and efficient treatment. Long-term hemodialysis catheters and peritoneal catheters are also expanding, driven by the growing prevalence of chronic kidney disease and a shift toward home-based dialysis. Long-term catheters benefit from tunneled designs that reduce infection risk, while peritoneal catheters support continuous ambulatory dialysis, enhancing patient comfort and treatment flexibility.

- For instance, Medtronic’s Mahurkar™ Elite Acute catheter (12 Fr dual‐lumen) can achieve flow rates up to 400 mL/min in bench testing. Hospitals and critical‑care units prefer such catheters for rapid vascular access and efficient treatment.

By Material

Polyurethane catheters lead the material segment because of their superior mechanical strength, kink resistance, and thermal properties that allow safe and reliable use. Silicone catheters, while smaller in market share, are gaining popularity for long-term applications due to their high biocompatibility and flexibility, minimizing patient discomfort. The preference for advanced materials is driven by healthcare providers’ focus on reducing complications, improving catheter longevity, and ensuring consistent performance in both hospital and homecare settings. Polyurethane remains dominant, but silicone is expected to grow steadily.

- For instance, Amecath’s “Permthane” haemodialysis catheter (polyurethane/Carbothane) uses a stepped‑tip design and is available in dual‑lumen sizes of 13/20 cm and 14/20 cm length.

By End-User

Hospitals account for the largest share of dialysis catheter use, as they offer the necessary infrastructure, trained personnel, and reimbursement mechanisms for vascular access management. Homecare settings are the fastest-growing segment, supported by portable dialysis systems and increasing patient preference for treatment at home. Ambulatory surgical centers and other facilities maintain smaller shares, constrained by procedural complexity and regulatory requirements. Rising awareness of home dialysis and cost-efficiency measures are expected to continue driving growth in non-hospital settings, complementing the established dominance of hospital-based catheter use.

Key Growth Drivers

Rising Prevalence of Chronic Kidney Disease (CKD)

The growing incidence of CKD and end-stage renal disease drives demand for dialysis catheters. Increasing diabetes and hypertension cases further escalate the need for renal replacement therapies. Hemodialysis and peritoneal dialysis are the primary treatments, requiring reliable catheter solutions. Hospitals and homecare settings are expanding their dialysis services, boosting market uptake. For instance, global CKD prevalence reached 13.4% in 2024, significantly increasing dialysis adoption. This rising patient pool compels manufacturers to innovate and produce catheters with improved biocompatibility, durability, and infection prevention features.

- For instance, Polymed’s haemodialysis catheter line includes a 12 Fr double‑lumen variant with straight extension tubes that delivers minimum flow rates of 288 mL/min and maximum up to 368 mL/min during testing.

Technological Advancements in Catheter Design

Innovations in material composition and catheter design enhance performance, safety, and patient comfort. Antimicrobial coatings, flexible silicone, and biocompatible polyurethane reduce infection risk and thrombosis. Advanced hemodialysis catheters provide higher flow rates and longer dwell times. For instance, Teleflex’s Arrow® NextStep® catheters demonstrate a 30% lower infection rate in clinical trials, highlighting improved outcomes. Continuous R&D allows manufacturers to offer specialized solutions for pediatric and geriatric patients, driving adoption across hospitals, homecare, and ambulatory centers.

- For instance, BD’s Pristine™ Long‑Term Hemodialysis Catheter features a side‑hole‑free tip with Y‑Tip™ distal lumen design — bench testing demonstrated maximum flow rates of 500 mL/min for 19‑33 cm tip‑to‑cuff lengths and 379 mL/min for a 55 cm length under –250 mmHg arterial pressure.

Expansion of Home Dialysis Programs

The shift toward home-based dialysis supports patient convenience and reduces hospital burden. Increasing awareness and reimbursement policies encourage homecare adoption, particularly in North America and Europe. Home dialysis requires user-friendly catheters, stimulating demand for long-term, durable solutions. For instance, Baxter International reported a 25% growth in home dialysis catheter shipments in 2024, reflecting rising acceptance. The trend motivates suppliers to develop compact, easy-to-insert catheters with enhanced safety features, accelerating market growth across residential healthcare settings.

Key Trends & Opportunities

Integration of Antimicrobial and Coating Technologies

Manufacturers increasingly integrate antimicrobial and heparin-coated catheters to reduce infection rates. These innovations improve clinical outcomes and patient safety. Hospitals prefer coated catheters for long-term use to minimize catheter-related bloodstream infections (CRBSIs). For instance, B. Braun’s Certofix® SafeSet catheter line demonstrates a 35% reduction in CRBSI in hospital studies. Adoption of these advanced coatings presents opportunities for differentiation in competitive markets, driving both hospital and homecare demand for safer, high-performance dialysis catheters.

- For instance, Cook Medical’s Cook Spectrum® Minocycline/Rifampin‑Impregnated Catheters embed antimicrobial agents in polyurethane catheter shafts; a 7‑year clinical study spanning over 500,000 catheter days demonstrated no evidence of antibiotic resistance.

Rising Adoption of Pediatric and Geriatric Catheters

Specialized catheters for vulnerable populations are gaining traction. Pediatric and geriatric patients require smaller, flexible, and low-thrombogenic devices. For instance, Medtronic’s pediatric hemodialysis catheters achieve a 15% faster insertion time, reducing procedural complications. This trend opens opportunities for companies to expand portfolios, develop customizable catheters, and address niche market demands. As healthcare providers increasingly focus on age-specific solutions, the segment offers potential for innovation, higher reimbursement, and premium pricing, stimulating overall market expansion.

- For instance, PFM Medical’s primeMIDLINE® Catheter in the 3 French (3 F) size is indeed rated for a maximum power injection flow rate of 6 mL/sec at 300 psi.

Key Challenges

Risk of Catheter-Related Infections

Catheter-related bloodstream infections remain a significant challenge, limiting long-term adoption. Despite antimicrobial coatings, improper insertion, maintenance, and patient factors contribute to infection risk. For instance, CRBSI rates in some hospitals remain 2–5 per 1,000 catheter days, underscoring clinical concerns. This risk necessitates rigorous training, hygiene protocols, and continuous monitoring, increasing operational costs. Manufacturers must invest in safer designs and educational initiatives, while regulatory authorities enforce stricter standards, adding complexity to market growth despite increasing demand.

High Cost of Advanced Catheter Solutions

Premium catheters with antimicrobial coatings and innovative materials have higher acquisition costs. Hospitals and homecare providers may prefer standard devices due to budget constraints. For instance, coated polyurethane catheters cost 20–30% more than uncoated alternatives, limiting adoption in price-sensitive regions. High costs can delay procurement, especially in emerging markets, restricting revenue growth. Companies must balance affordability with technological advancements and explore strategic partnerships or reimbursement support to expand market penetration while maintaining profitability.

Regional Analysis

North America

North America held 31.6 % of the global dialysis catheters market in 2024. High prevalence of chronic kidney disease (CKD) and end-stage renal disease drives strong demand for hemodialysis and peritoneal catheters. Advanced healthcare infrastructure, established hospitals, and favourable reimbursement policies support widespread adoption. Hospitals and homecare providers increasingly use catheters with antimicrobial coatings and biocompatible materials to reduce infection risks. Technological innovations, including tunneled and long-term catheters, combined with growing patient awareness, maintain North America’s leading position and support continued market expansion.

Asia Pacific

Asia Pacific accounted for 22.9 % of the market in 2024, reflecting rapid growth potential. Rising CKD, diabetes, and hypertension increase demand for dialysis catheters. Expanding healthcare infrastructure in India, China, Japan, and Southeast Asia improves access to dialysis services. Government programs and private-sector investments support wider adoption of short-term and long-term catheters in hospitals and homecare settings. The large patient population, rising awareness of renal health, and adoption of advanced catheter technologies position Asia Pacific as a key growth region for manufacturers.

Europe

Europe held approximately 17 % of the global dialysis catheters market in 2024. The region benefits from ageing populations and high CKD prevalence, which drive catheter demand. Mature healthcare systems, well-established dialysis centers, and strong reimbursement policies support adoption of hemodialysis and peritoneal catheters. Countries such as Germany, France, and the UK lead market penetration, while Eastern Europe offers emerging opportunities. Advanced catheter designs, including antimicrobial-coated and flexible silicone devices, enhance patient safety. Stable investments in healthcare infrastructure and clinical training continue to support consistent growth across Europe.

Latin America

Latin America captured 8 % of the global dialysis catheters market in 2024. Increasing diabetes, hypertension, and CKD cases are key growth drivers. Countries like Brazil, Mexico, and Argentina are expanding dialysis center networks, improving access to both short-term and long-term catheters. Government initiatives and emerging reimbursement programs further support adoption of advanced devices. Rising awareness of renal health and investments in healthcare infrastructure boost demand. Manufacturers focus on cost-effective, durable, and infection-resistant catheters to capture growth in this region despite its smaller market share compared to North America, Europe, and Asia Pacific.

Middle East & Africa

The Middle East & Africa (MEA) region held about 5.5 % of the global dialysis catheters market in 2024. The market is developing, with rising CKD prevalence in urban areas driving catheter demand. Investments in healthcare infrastructure and new dialysis centers in countries such as Saudi Arabia, UAE, and South Africa are expanding access. Adoption of advanced long-term and antimicrobial catheters is growing, although reimbursement limitations and uneven healthcare access present challenges. Government initiatives and private-sector participation are expected to further increase dialysis services, creating opportunities for sustained market growth in MEA.

Market Segmentations:

By Type:

- Short-term hemodialysis catheters

- Long-term hemodialysis catheters

By Material:

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dialysis catheters market include Merit Medical System, Inc., Medtronic plc, Amecath Medical Technologies, Poly Medicure Ltd, Becton, Dickinson and Company, Cook Medical, Baxter International Inc., Angiplast Pvt. Ltd., B Braun Melsungen AG, and PFM Medical, Inc. The dialysis catheters market is highly competitive, driven by continuous innovation in design, materials, and safety features. Companies focus on developing antimicrobial, biocompatible, and long-term catheters to reduce infection risks and improve patient outcomes. Strategic initiatives such as mergers, acquisitions, and partnerships support regional expansion and strengthen market presence. Technological advancements, including tunneled and pediatric-specific catheters, enhance procedural efficiency and patient comfort. Additionally, robust distribution networks and localized manufacturing help meet growing demand across hospitals, homecare, and ambulatory settings. The competitive environment encourages ongoing R&D investments, ensuring that product differentiation and quality remain key drivers of market growth.

Key Player Analysis

- Merit Medical System, Inc.

- Medtronic plc

- Amecath Medical Technologies

- Poly Medicure Ltd

- Becton, Dickinson and Company

- Cook Medical

- Baxter International Inc.

- Angiplast Pvt. Ltd.

- B Braun Melsungen AG

- PFM Medical, Inc.

Recent Developments

- In January 2025, B. Braun Medical Inc. announced the launch of its new Clik-FIX Epidural/Peripheral Nerve Block (PNB) Catheter Securement Device. This addition to the Clik-FIX family is designed to be soft, low-profile, and secure. It aims to reduce the risk of catheter displacement and dislodgement during regional anesthesia procedures.

- In January 2025, Radical Catheter Technologies announced that its 8F Neurovascular Catheter has received 510(k) clearance from the FDA. The 8F catheter is built upon Radical’s patented ribbon technology platform, offering an enlarged inner diameter to expand therapeutic options in neurovascular procedures.

- In January 2025, Dr. Bruce Gardner, a radiologist at Sanford Health, received U.S. FDA approval for his innovative catheter design to prevent accidental dislodgement injuries. The new catheter features a mechanism that allows the retention balloon to deflate rapidly when excessive tension is applied, thereby minimizing potential patient harm.

- In December 2024, Terumo Interventional Systems (TIS), a division of Terumo Corporation, announced the U.S. launch of its R2P NaviCross Peripheral Support Catheter, further expanding its radial-to-peripheral (R2P) portfolio. Available in a 200-cm length, the catheter features a double-braided, stainless-steel construction designed to provide superior trackability and torque control, facilitating lesion crossing in complex procedures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of long-term and tunneled catheters will increase globally.

- Antimicrobial and biocompatible catheters will become standard in hospitals.

- Home dialysis programs will expand, driving catheter demand.

- Pediatric and geriatric-specific catheters will see higher adoption.

- Emerging markets will witness faster growth due to rising CKD prevalence.

- Technological innovations will improve catheter safety and procedural efficiency.

- Partnerships and acquisitions will strengthen regional market presence.

- Increased awareness and training will reduce catheter-related infections.

- Manufacturers will focus on cost-effective solutions for price-sensitive regions.

- Continuous R&D will drive product differentiation and market competitiveness.