Market Overview

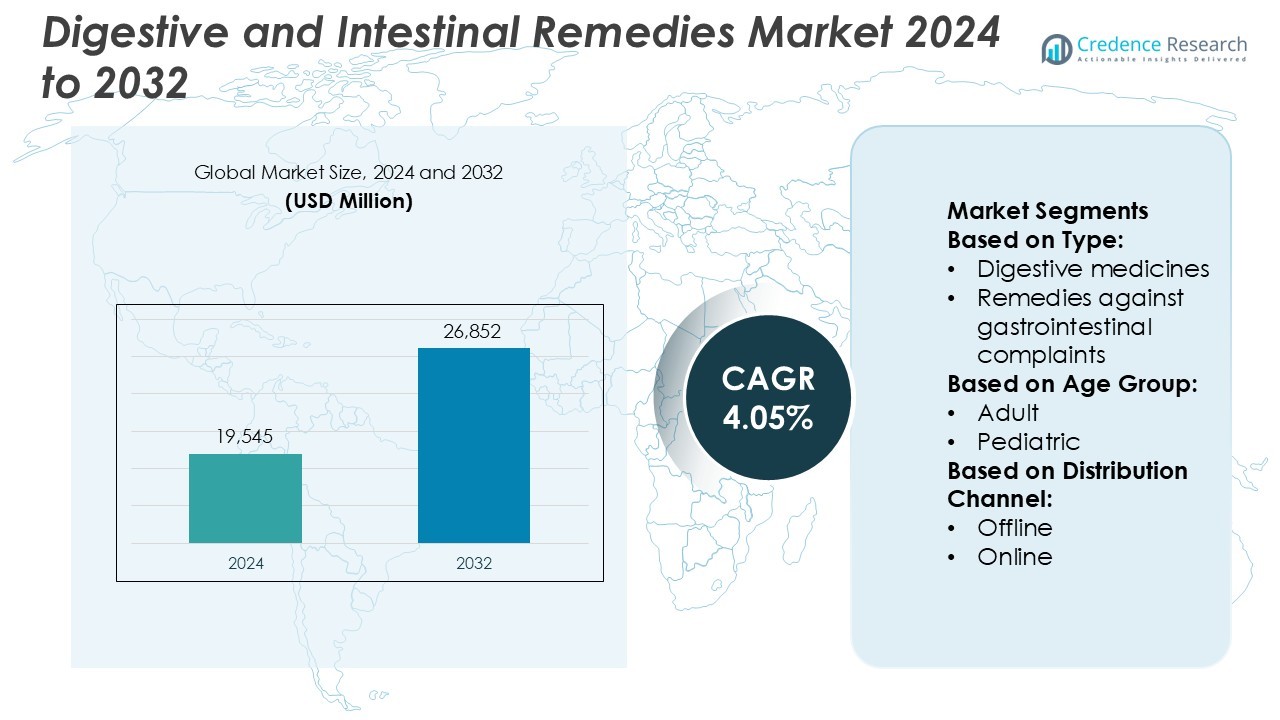

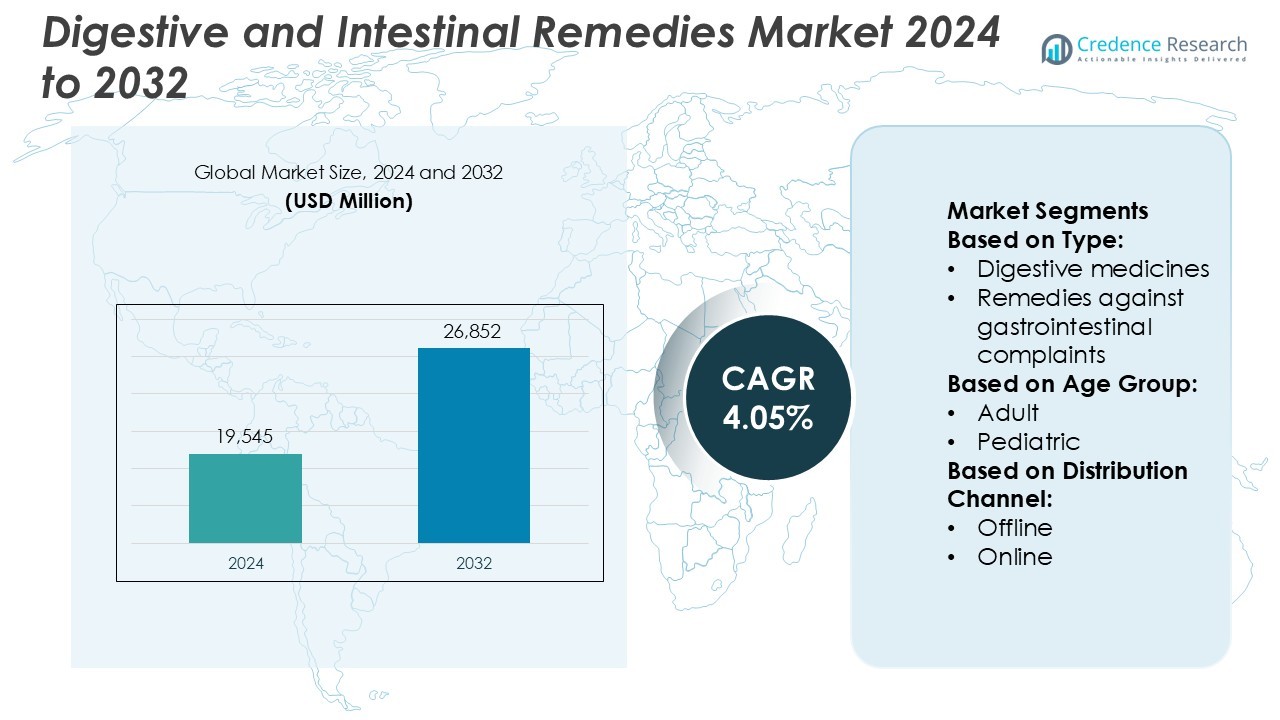

Digestive and Intestinal Remedies Market size was valued USD 19,545 million in 2024 and is anticipated to reach USD 26,852 million by 2032, at a CAGR of 4.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digestive and Intestinal Remedies Market Size 2024 |

USD 19,545 Million |

| Digestive and Intestinal Remedies Market, CAGR |

4.05% |

| Digestive and Intestinal Remedies Market Size 2032 |

USD 26,852 Million |

The digestive and intestinal remedies market is led by prominent companies including Pfizer Inc., Johnson & Johnson, Menarini Group, Eli Lilly and Company, C.H. Boehringer Sohn AG & Co. KG., Merck & Co, Inc., Bayer AG, GlaxoSmithKline plc, China Resources Pharmaceutical Group Limited, and Abbott Laboratories. These players dominate through broad product portfolios covering antacids, probiotics, and enzyme-based formulations. Continuous R&D investment and expansion of OTC and prescription drug lines strengthen their global presence. North America leads the market with a 38% share, supported by advanced healthcare infrastructure, strong retail pharmacy networks, and early adoption of innovative digestive health solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The digestive and intestinal remedies market was valued at USD 19,545 million in 2024 and is expected to reach USD 26,852 million by 2032, growing at a CAGR of 4.05%.

- Rising prevalence of digestive disorders and growing awareness of gut health drive market demand across all major regions.

- Increasing preference for herbal and probiotic-based formulations is shaping product innovation and consumer trends.

- The market remains competitive with leading players expanding OTC and prescription drug portfolios to strengthen global presence.

- North America leads with a 38% market share, while digestive medicines hold the dominant segment share due to strong demand for enzyme-based and antacid solutions.

Market Segmentation Analysis:

By Type

The digestive and intestinal remedies market is segmented into digestive medicines, remedies against gastrointestinal complaints, and natural and synthetic agents. Digestive medicines dominate the segment with a market share of 46%, driven by the high prevalence of indigestion, acidity, and bloating disorders. Increased availability of enzyme-based and probiotic formulations also supports their growth. Johnson & Johnson’s Pepcid and Abbott’s Creon enzymes have seen strong adoption in both prescription and OTC channels. Continuous innovation in fast-acting antacids and combination enzyme products further enhances the dominance of this sub-segment.

- For instance, Johnson & Johnson’s product **PEPCID® (famotidine) — available in 20 mg and 40 mg tablets — achieved mean nocturnal gastric acid inhibition of 86 % with the 20 mg dose and 94 % with the 40 mg dose over at least a 10-hour period.

By Age Group

Adults account for the dominant share of 64% in the market, primarily due to lifestyle-related gastrointestinal issues such as acid reflux, constipation, and irritable bowel syndrome. The increasing consumption of processed foods, sedentary behavior, and stress contribute to higher digestive disorder prevalence in adults. Bayer’s Iberogast and Sanofi’s Buscopan target adult consumers with recurrent stomach and intestinal discomfort. The pediatric segment is also growing steadily, supported by improved diagnosis and awareness of digestive health in children.

- For instance, Menarini Group conducted its OBIS study on its own molecule Otilonium Bromide in adults with irritable bowel syndrome, where treatment over 15 weeks was followed by sustained efficacy up to 10 weeks post-treatment.

By Distribution Channel

Offline distribution channels, including pharmacies and hospital dispensaries, hold the largest market share of 71%, as consumers prefer direct pharmacist consultations and immediate product availability. The segment benefits from wide product accessibility and physician recommendations for prescription-based remedies. GlaxoSmithKline’s Eno and Reckitt’s Gaviscon remain top-selling products across offline retail outlets. However, the online channel is witnessing rapid growth due to increasing e-commerce penetration, discount offers, and growing consumer trust in digital pharmacy platforms.

Key Growth Drivers

Rising Prevalence of Digestive Disorders

The growing incidence of gastrointestinal diseases such as acid reflux, irritable bowel syndrome, and ulcers is driving market expansion. Increasing unhealthy eating habits, stress, and sedentary lifestyles have led to greater dependence on digestive medicines and enzyme-based products. For instance, Abbott’s Creon and Sanofi’s Maalox have witnessed higher prescription rates among patients with chronic digestive issues. The growing elderly population, which is more prone to digestive ailments, further supports market demand across both developed and emerging regions.

- For instance, Eli Lilly and Company’s biologic therapeutic Omvoh® (mirikizumab‑mrkz)—approved for adults with moderately to severely active Ulcerative Colitis—offers a 200 mg/2 mL once-monthly subcutaneous injection regimen.

Increased Consumer Awareness of Gut Health

Rising awareness of the importance of gut microbiota in overall health has accelerated the use of probiotics, prebiotics, and natural digestive aids. Consumers are adopting dietary supplements and functional foods to improve digestive well-being and prevent disorders. For instance, Nestlé’s Garden of Life probiotics and Bayer’s Align have seen strong retail growth due to increased preventive health awareness. This shift toward self-care and preventive treatment continues to expand the demand for over-the-counter digestive remedies globally.

- For instance, Bayer AG launched its flagship digestive-health product Iberogast, which is backed by more than 20 scientific studies involving over 7,000 patients, thereby reinforcing its evidence-base for gut-microbiome support.

Expansion of Over-the-Counter (OTC) Product Availability

The growing acceptance and regulatory support for OTC digestive remedies are boosting market accessibility. Consumers increasingly prefer non-prescription solutions for mild gastrointestinal issues such as heartburn and constipation. For instance, GSK’s Tums and Reckitt’s Gaviscon remain leading OTC brands due to their proven efficacy and strong retail presence. Expanding distribution networks, combined with aggressive marketing and e-commerce availability, are further strengthening the OTC segment’s contribution to overall market growth.

Key Trends & Opportunities

Shift Toward Natural and Herbal Formulations

Consumers are showing a clear preference for herbal and plant-based digestive products due to safety and fewer side effects. Manufacturers are launching formulations with ingredients like peppermint oil, fennel, and licorice for gastrointestinal relief. For instance, Himalaya’s Liv.52 and Dabur’s Pudin Hara have gained popularity as trusted natural digestive remedies. This trend opens opportunities for companies to innovate in botanical-based solutions and expand into preventive digestive healthcare segments.

- For instance, Abbott’s prescription enzyme product CREON (pancrelipase delayed-release capsules) specifies dosage forms including 3,000 USP units of lipase paired with 9,500 protease and 15,000 amylase units.

Technological Integration in Product Formulation

Advancements in pharmaceutical and nutraceutical formulation technologies are enabling the development of targeted-release and combination digestive products. Companies are focusing on controlled-release tablets, enzyme-stabilized capsules, and probiotic microencapsulation for enhanced efficacy. For instance, Procter & Gamble’s Pepto-Bismol reformulations improve absorption rates and user compliance. Such innovations are helping brands strengthen product differentiation while meeting diverse patient needs across demographics.

- For instance, DuPont’s probiotics portfolio—branded as HOWARU®—contained over 15 documented bacterial strains optimized for digestive and immune-health applications.

Rising Penetration of Online Pharmacies

The rapid growth of e-commerce platforms is transforming the distribution landscape of digestive and intestinal remedies. Online pharmacies offer convenience, price transparency, and a wide range of options for consumers. For instance, Amazon Pharmacy and 1mg have seen increased orders for antacids and probiotic supplements. This trend provides an opportunity for manufacturers to expand direct-to-consumer channels and enhance accessibility in remote regions.

Key Challenges

Stringent Regulatory and Quality Compliance

Manufacturers face challenges in adhering to complex global regulatory frameworks for both OTC and prescription digestive products. Differences in labeling, clinical validation, and safety testing requirements increase time-to-market and costs. For instance, herbal digestive remedies often face scrutiny from agencies such as the FDA and EMA over standardization and efficacy claims. Maintaining consistent quality while meeting diverse regional regulations remains a significant operational challenge.

Adverse Effects and Product Misuse

Long-term or excessive use of certain digestive remedies, such as laxatives and proton pump inhibitors, can lead to dependency or adverse health outcomes. Consumer misuse of OTC medications without medical supervision adds to the risk of side effects. For instance, chronic use of omeprazole-based products has been linked to nutrient deficiencies and gastrointestinal complications. Such issues highlight the need for better consumer education and stricter product usage guidelines to ensure safe and effective treatment.

Regional Analysis

North America

North America holds the dominant market share of 38% in the digestive and intestinal remedies market, supported by high healthcare expenditure, advanced distribution networks, and strong OTC adoption. The region benefits from the presence of major players such as Johnson & Johnson, Abbott Laboratories, and Bayer AG, which continue to expand their gastrointestinal product lines. Increasing cases of acid reflux, IBS, and lifestyle-related digestive issues further drive product consumption. Consumer preference for fast-acting and enzyme-based solutions strengthens the regional outlook, supported by strong retail pharmacy and e-commerce penetration.

Europe

Europe accounts for 27% of the market share, driven by a well-established healthcare infrastructure and a growing shift toward herbal and probiotic-based digestive remedies. Countries such as Germany, France, and the UK lead the market with strong regulatory support for OTC and natural formulations. Manufacturers such as Sanofi and Reckitt Benckiser dominate the region with brands like Gaviscon and Buscopan. Increasing demand for preventive care and digestive supplements among aging populations continues to support steady regional growth.

Asia-Pacific

Asia-Pacific represents 24% of the global market share and is the fastest-growing region, fueled by rising disposable incomes, urbanization, and growing awareness of gut health. India, China, and Japan lead demand due to higher consumption of antacids and herbal digestive products. Companies like Daiichi Sankyo and Himalaya Wellness are expanding their portfolios to address both traditional and modern healthcare needs. The region’s growing e-commerce sector and government initiatives for healthcare access further boost market penetration and product adoption.

Latin America

Latin America captures 6% of the global share, driven by the increasing prevalence of digestive diseases linked to dietary changes and urban lifestyles. Brazil and Mexico lead the regional market with expanding retail pharmacy networks and growing availability of OTC digestive medicines. Rising health awareness and local manufacturing of affordable antacids and probiotics are strengthening regional supply chains. Companies are focusing on partnerships with domestic distributors to enhance product accessibility and market reach in this developing healthcare landscape.

Middle East & Africa

The Middle East & Africa region holds an 5% market share, primarily supported by expanding healthcare infrastructure and increasing awareness of gastrointestinal health. The UAE and Saudi Arabia are leading markets due to strong consumer demand for branded OTC digestive products. The growing presence of multinational pharmaceutical companies and local herbal remedy producers supports product diversification. As healthcare spending rises and access to pharmacies improves, the region is expected to see gradual but consistent growth in digestive and intestinal remedy consumption.

Market Segmentations:

By Type:

- Digestive medicines

- Remedies against gastrointestinal complaints

By Age Group:

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the digestive and intestinal remedies market features key players such as Pfizer Inc., Johnson & Johnson, Menarini Group, Eli Lilly and Company, C.H. Boehringer Sohn AG & Co. KG., Merck & Co, Inc., Bayer AG, GlaxoSmithKline plc, China Resources Pharmaceutical Group Limited, and Abbott Laboratories. The digestive and intestinal remedies market is highly competitive, characterized by continuous innovation, strong brand positioning, and expanding product portfolios. Companies are investing in advanced formulations such as probiotics, enzyme-based therapies, and herbal remedies to meet diverse consumer needs. The rise in lifestyle-related digestive disorders and growing demand for OTC solutions drive firms to strengthen retail and e-commerce distribution channels. Strategic collaborations, R&D investments, and marketing campaigns focus on improving treatment effectiveness and consumer awareness. The industry also witnesses increased focus on safety, regulatory compliance, and patient-centric approaches to maintain market credibility and long-term growth.

Key Player Analysis

- Pfizer Inc.

- Johnson & Johnson

- Menarini Group

- Eli Lilly and Company

- H. Boehringer Sohn AG & Co. KG.

- Merck & Co, Inc.

- Bayer AG

- GlaxoSmithKline plc

- China Resources Pharmaceutical Group Limited

- Abbott Laboratories

Recent Developments

- In October 2024, Dulcolax, the laxative brand from Sanofi, launched a new campaign aimed at prioritizing digestive health. The Pooping Princesses initiative seeks to challenge the stigma surrounding constipation, particularly among women. The launch of Dulcolax’s Pooping Princesses campaign is likely to have a significant impact on the Digestive & Intestinal Remedies Market.

- In April 2024, Bayer AG introduced Iberogast, is a plant-based digestive relief solution now available in the U.S. This product features a unique blend of six clinically proven herbs designed to harness the benefits of nature. Iberogast offers dual-action support, effectively alleviating occasional digestive discomfort while promoting overall digestive health.

- In October 2023, Pfizer received U.S. FDA approval for Velsipity, which is selective sphingosine-1-phosphate receptor modulator taken orally. The oral pill aimed at treating adult patients with moderately to severely active ulcerative colitis highlights Pfizer’s commitment towards new product development and positions itself as a strong competitor in the market.

- In August 2023, Herbalife introduced Herbalife V, a new line of plant-based supplements to meet the growing consumer demand for plant-based products, including supplements. These products have obtained certifications such as USDA Organic, verified non-GMO, certified kosher, and certified plant-based and vegan by FoodChain ID.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increasing cases of digestive disorders worldwide.

- Rising consumer awareness about gut health will fuel demand for probiotic and enzyme-based products.

- Over-the-counter digestive medicines will gain stronger traction due to convenience and easy availability.

- Natural and herbal formulations will see higher adoption as consumers prefer safer alternatives.

- Digital and e-commerce channels will expand product accessibility and boost online sales.

- Pharmaceutical firms will invest more in R&D to develop fast-acting and long-lasting digestive solutions.

- Emerging economies will offer lucrative opportunities due to improving healthcare infrastructure.

- Technological advances in drug delivery will enhance treatment precision and patient outcomes.

- Strategic collaborations and mergers will strengthen product portfolios and market reach.

- Preventive digestive care and personalized nutrition will shape the next phase of market expansion.