Market Overview

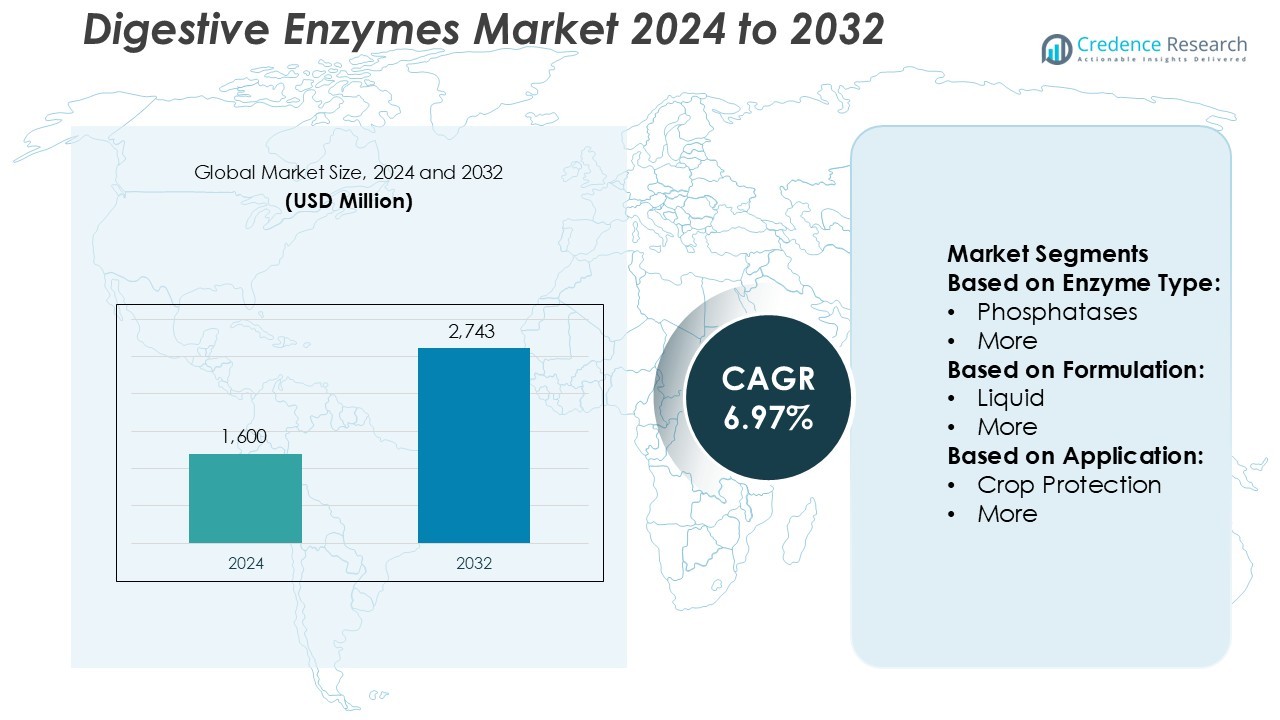

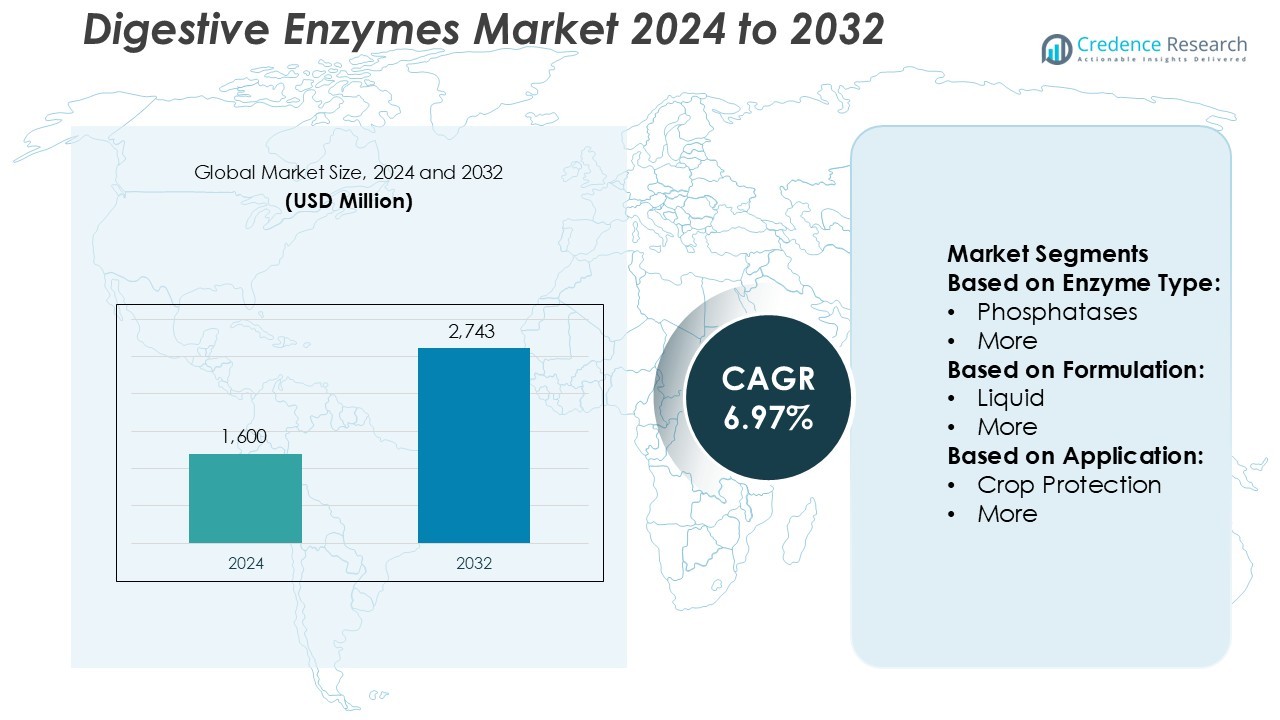

Digestive Enzymes Market size was valued USD 1,600 million in 2024 and is anticipated to reach USD 2,743 million by 2032, at a CAGR of 6.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digestive Enzymes Market Size 2024 |

USD 1,600 Million |

| Digestive Enzymes Market, CAGR |

6.97% |

| Digestive Enzymes Market Size 2032 |

USD 2,743 Million |

The digestive enzymes market features prominent players such as Amano Enzymes, Sanofi, Ab Enzymes, BASF, Codexis, Royal DSM, Kerry Group, Danisco, Novozymes, and Roche Holding. These companies lead through innovation in enzyme formulation, product diversification, and strong distribution networks across dietary supplements and pharmaceutical applications. North America holds the leading position in the global market with a 38% share, driven by high consumer awareness, advanced healthcare infrastructure, and growing demand for digestive health products. Continuous R&D investment, strategic collaborations, and the expansion of plant-based enzyme portfolios further strengthen the region’s dominance and competitive advantage in the global landscape.

Market Insights

- The digestive enzymes market was valued at USD 1,600 million in 2024 and is projected to reach USD 2,743 million by 2032, growing at a CAGR of 6.97% during the forecast period.

- Rising cases of gastrointestinal disorders and increasing awareness of gut health are driving the demand for enzyme-based supplements across both pharmaceutical and nutraceutical sectors.

- Key players focus on innovation, enzyme stability, and plant-based formulations to gain competitive advantage, supported by mergers and global distribution expansion.

- Limited consumer education in emerging regions and high production costs of advanced enzyme formulations act as major restraints for market growth.

- North America leads the market with a 38% share, followed by Europe and Asia-Pacific; the dietary supplements segment dominates application areas due to rising preventive health trends and growing adoption of clean-label digestive health products across developed and developing economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Enzyme Type

Phosphatases dominate the digestive enzymes market with a significant share, driven by their widespread use in enhancing nutrient absorption and improving gut health. Their role in breaking down phosphate esters supports better energy metabolism and cellular function, making them crucial in dietary supplements. For instance, DSM’s Maxilact enzyme range offers high purity and stability, enhancing enzymatic efficiency in digestion-focused formulations. The growing demand for enzyme-based therapies and nutraceutical products further accelerates phosphatase adoption across pharmaceutical and food applications.

- For instance, Amano’s published catalogue does not list a phosphatase aimed at human digestive supplements, the company defines a unit of activity for its enzyme “Esterase “Amano”2” as the quantity producing 1 µmol of p-nitrophenol per minute under defined conditions.

By Formulation

Liquid formulations hold the leading market share due to their rapid absorption, ease of dosage adjustment, and better bioavailability compared to solid forms. These formulations are preferred in pediatric and geriatric populations where swallowing tablets is difficult. For instance, BASF’s liquid enzyme formulations ensure uniform dispersion and stability during processing. The expanding use of liquid enzymes in functional beverages and nutraceutical products continues to drive market growth, supported by innovations in enzyme stabilization and flavor masking technologies.

- For instance, AB Enzymes’ product COROLASE® VP is a liquid-formulated bacterial endo-protease that performs reliably at temperatures up to 75 °C and within a pH-range of 5.5-8.5, enabling fast hydrolysis of plant-protein substrates like wheat gluten and soy.

By Application

Crop protection emerges as the dominant application segment, accounting for the largest share in the digestive enzymes market. Enzymes such as cellulases, proteases, and phosphatases play a vital role in improving soil fertility and enhancing nutrient uptake in plants. For instance, Novozymes’ bioinnovation solutions like BioAg enzymes optimize nutrient release and boost crop yield efficiency. Rising awareness of sustainable agriculture practices and reduced chemical pesticide usage is driving enzyme integration into eco-friendly crop protection products globally.

Key Growth Drivers

- Rising Digestive Health Awareness

The growing focus on digestive wellness among consumers is fueling enzyme supplement demand. Individuals are increasingly aware of gut microbiota’s role in nutrient absorption and immunity. The expansion of fitness culture and healthy aging trends supports preventive healthcare adoption. Manufacturers are responding with enzyme blends that enhance protein, fat, and carbohydrate breakdown for improved digestion and nutrient uptake. These developments drive market expansion, especially in functional food and dietary supplement sectors worldwide.

- For instance, Codexis announced that its ECO Synthesis™ platform achieved a coupling efficiency greater than 98 % in enzymatic oligonucleotide synthesis.

- Expanding Geriatric Population

An aging population with higher prevalence of gastrointestinal disorders is a major market driver. Older adults often experience reduced natural enzyme secretion, leading to digestive discomfort and nutrient malabsorption. This creates sustained demand for enzyme-based products that support digestive efficiency. Pharmaceutical and nutraceutical companies are introducing age-specific formulations, including dual-enzyme tablets and plant-derived blends, to meet elderly consumers’ needs. The aging trend in developed and emerging economies alike reinforces market penetration across healthcare and nutrition channels.

- For instance, DSM and Rohto Pharmaceutical jointly launched Vision R, a multivitamin supplement for Japanese seniors built on DSM’s patented Sprinkle It Technology™ (SIT) — the format uses multi-layered micronutrient granules, with the process backed by nine patent filings and nearly 90 % of ingredients sourced from Europe.

- Innovation in Enzyme Formulation Technology

Advancements in enzyme stabilization, encapsulation, and delivery systems are enhancing product performance. Manufacturers are adopting microencapsulation and pH-resistant coatings to protect enzymes from gastric acid degradation. These technologies improve enzyme stability and bioavailability, leading to better consumer outcomes. Companies are also integrating probiotics with enzyme supplements for synergistic digestive support. Continuous R&D investments by nutraceutical brands are enabling differentiated formulations that cater to both preventive and therapeutic health applications globally.

Key Trends & Opportunities

- Growth of Plant-Based Enzyme Sources

Rising veganism and clean-label preferences are driving the adoption of plant-derived enzymes. Fungal and microbial enzymes are gaining acceptance as sustainable alternatives to animal-based sources. These enzymes offer broader temperature and pH stability, making them ideal for food and nutraceutical applications. Brands are leveraging this opportunity to market eco-friendly digestive aids with natural sourcing claims. This trend aligns with the broader shift toward sustainable production and ethical consumer choices.

- For instance, Kerry’s new enzyme operations centre in Leipzig, Germany employs over 100 scientists, including 34 PhD researchers, focused on enzyme and strain engineering for food, beverage and pharma applications.

- Expansion in Functional Foods and Beverages

Digestive enzymes are increasingly incorporated into fortified beverages, protein bars, and dairy alternatives. The functional food sector is using enzyme blends to enhance nutrient release, texture, and digestibility. This integration helps food manufacturers create value-added products catering to health-conscious consumers. Strategic partnerships between enzyme suppliers and food producers are opening new distribution opportunities. The convergence of convenience, taste, and functionality continues to propel market growth in the food and beverage domain.

- For instance, IFF’s FOODPRO® enzyme range for co-product valorisation enables protein-extract yield improvements of up to 15 % in plant-based ingredient streams.

- Personalized Nutrition and Enzyme Supplementation

The rise of personalized nutrition offers significant opportunities for tailored enzyme formulations. Companies are leveraging genetic and microbiome testing to design individualized digestive enzyme blends. These products target specific food sensitivities, such as lactose or gluten intolerance. The use of data-driven diagnostics enhances consumer confidence and product efficacy. As digital health tools advance, personalized enzyme supplementation is expected to become a key differentiator in premium nutraceutical markets.

Key Challenges

- Regulatory Complexity and Product Standardization

Varying global regulations for dietary supplements create challenges in product approval and labeling. Inconsistent safety and efficacy standards across regions hinder market entry for new formulations. Manufacturers must comply with stringent testing requirements to validate enzyme activity and source transparency. These factors increase production costs and delay commercialization timelines. Achieving international harmonization of supplement regulations remains a critical need for ensuring market growth and consumer trust.

- Limited Consumer Knowledge and Misuse of Supplements

Despite growing awareness, many consumers lack proper understanding of enzyme functions and dosage. Misuse or overreliance on supplements without medical guidance can lead to side effects or reduced efficacy. The absence of clear educational initiatives limits adoption, particularly in emerging markets. Companies face the challenge of balancing marketing claims with scientific accuracy. Expanding consumer education through digital channels and healthcare professional engagement is essential to overcome this barrier.

Regional Analysis

North America

North America dominates the digestive enzymes market with a 38% share, driven by rising cases of gastrointestinal disorders and strong consumer awareness of digestive health supplements. The U.S. leads regional demand, supported by high supplement adoption, advanced healthcare infrastructure, and wide product availability through retail and e-commerce channels. Leading players like Amway, NOW Foods, and Enzymedica are expanding enzyme-based formulations with clean-label and plant-derived ingredients. Ongoing R&D and increasing physician recommendations for enzyme therapy further enhance market penetration across both dietary supplements and medical nutrition applications in this region.

Europe

Europe holds a 27% market share, supported by the growing emphasis on preventive healthcare and functional foods. Countries such as Germany, the U.K., and France lead adoption due to increased digestive health awareness and aging populations. Consumers prefer enzyme supplements derived from natural sources, prompting manufacturers to focus on plant-based and vegan formulations. Regulatory approvals for nutraceutical ingredients strengthen market growth and innovation. Companies like BioCare and Protexin are enhancing enzyme blends targeting lactose intolerance and gluten sensitivity, reflecting the region’s trend toward specialized digestive health products.

Asia-Pacific

Asia-Pacific accounts for 24% of the digestive enzymes market, experiencing rapid expansion due to changing dietary habits, urbanization, and rising disposable incomes. India, China, and Japan are major contributors, with increasing consumer interest in digestive health supplements and fortified foods. Regional manufacturers are investing in enzyme extraction from microbial and natural sources to meet clean-label demand. The growing prevalence of gastrointestinal disorders due to processed food consumption further drives uptake. Strategic collaborations among local nutraceutical firms and international brands are improving product reach and consumer awareness across diverse demographics.

Latin America

Latin America holds a 6% market share, driven by rising health consciousness and expanding nutraceutical retail presence. Brazil and Mexico lead the market, supported by increased supplement consumption and better access to digestive health education. Consumers are shifting toward probiotic-enzyme blends to manage bloating and indigestion. Local manufacturers are forming partnerships with global enzyme producers to strengthen product diversity. Growing distribution through online channels and pharmacies contributes to steady market expansion. Government initiatives promoting wellness nutrition and preventive care also support long-term market sustainability in this region.

Middle East & Africa

The Middle East & Africa region captures a 5% share of the digestive enzymes market, reflecting gradual adoption driven by rising gastrointestinal disease incidence and increasing awareness of dietary health. Countries such as the UAE and South Africa are emerging as key growth centers due to improved access to nutraceuticals and higher healthcare spending. Global brands are entering the region through pharmacy and e-commerce networks, offering tailored enzyme formulations for lactose intolerance and general digestion support. Expanding retail infrastructure and health education programs continue to foster regional market growth.

Market Segmentations:

By Enzyme Type:

By Formulation:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The digestive enzymes market is characterized by strong competition among major players such as Amano Enzymes, Sanofi, Ab Enzymes, BASF, Codexis, Royal DSM, Kerry Group, Danisco, Novozymes, and Roche Holding. The digestive enzymes market is highly competitive, driven by innovation in formulation technologies, expanding consumer awareness, and increasing demand for natural and functional supplements. Companies are focusing on enzyme stability, bioavailability, and targeted-release mechanisms to improve digestive efficacy. Strategic collaborations, mergers, and acquisitions remain key approaches to enhance market reach and diversify product portfolios. Continuous R&D investment supports the development of plant-based and microbial enzyme blends catering to vegan and lactose-intolerant consumers. Additionally, advancements in encapsulation and fermentation technologies are enabling the creation of high-performance enzyme products with improved shelf life and clinical effectiveness, strengthening the industry’s growth potential.

Key Player Analysis

- Amano Enzymes

- Sanofi

- Ab Enzymes

- BASF

- Codexis

- Royal DSM

- Kerry Group

- Danisco

- Novozymes

- Roche Holding

Recent Developments

- In March 2025, Allozymes, a pioneer in protein engineering, and Bonumose, known for innovative enzyme combinations that produce healthy monosaccharides from starch and sugar feedstocks, shared early results on enzyme improvements for Bonumose’s ingredient process.

- In March 2025, IFF and Kemira announced the formation of Alpha Bio, a joint venture to scale production of sustainable biobased materials using enzymatic technology. The news outlines their commitment to replacing fossil-based polymers with enzyme-enabled biopolymers derived from plant sugars. The aim is to meet growing demand for biodegradable, high-performance materials.

- In March 2024, Pure Encapsulations, one of the industry participants in vitamins, minerals, and supplements products, announced the launch of its products in Super Supplements stores and The Vitamin Shoppe. The step was driven by its commitment to enhance the availability of products through the physical marketplace.

- In January 2024, Novozymes and Chr. Hansen officially merged to form Novonesis, marking the creation of a global leader in biosolutions. The news highlights the successful integration of two major biotechnology players with a combined focus on sustainability, innovation, and enzyme-driven applications. The aim is to deliver transformative biosolutions across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Enzyme Type, Formulation Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising consumer focus on digestive health will continue to drive enzyme supplement adoption.

- Plant-based and vegan enzyme formulations will gain wider popularity among health-conscious users.

- Advancements in enzyme stabilization will improve product shelf life and efficacy.

- Integration of enzymes with probiotics and prebiotics will enhance functional supplement offerings.

- Increasing awareness of lactose and gluten intolerance will boost specialized enzyme demand.

- Online retail expansion will make digestive enzyme products more accessible globally.

- Pharmaceutical applications of enzymes in gastrointestinal therapies will see notable growth.

- Personalized nutrition trends will encourage customized enzyme formulations based on individual needs.

- Technological innovation in fermentation and encapsulation will strengthen product quality.

- Strategic partnerships between nutraceutical and biotech firms will accelerate innovation and market expansion.