Market Overview

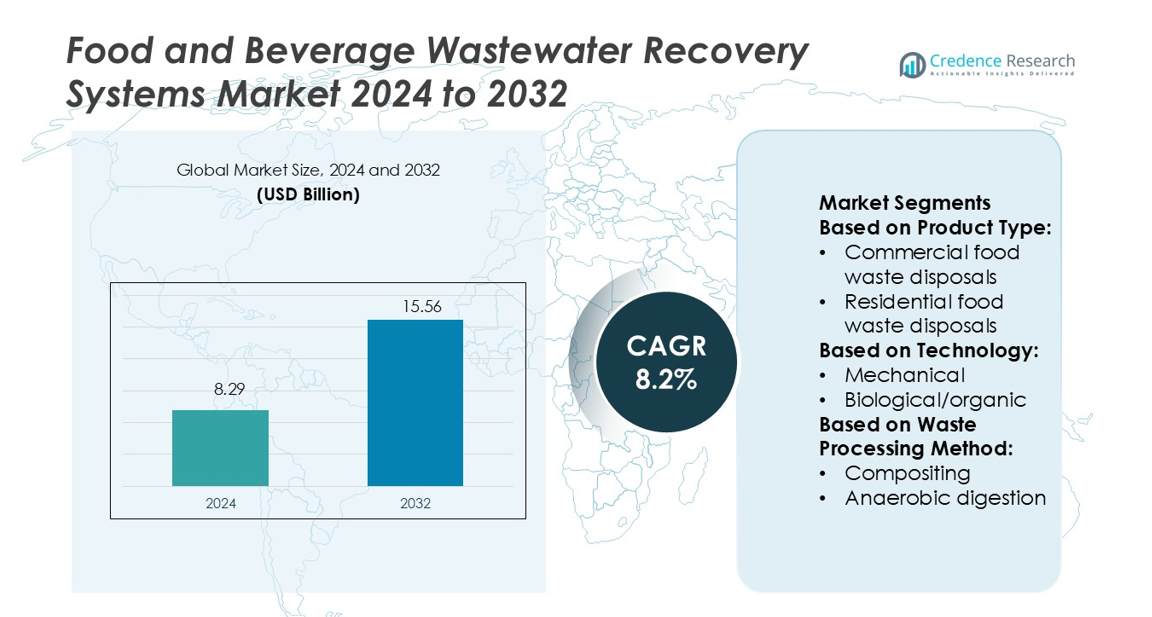

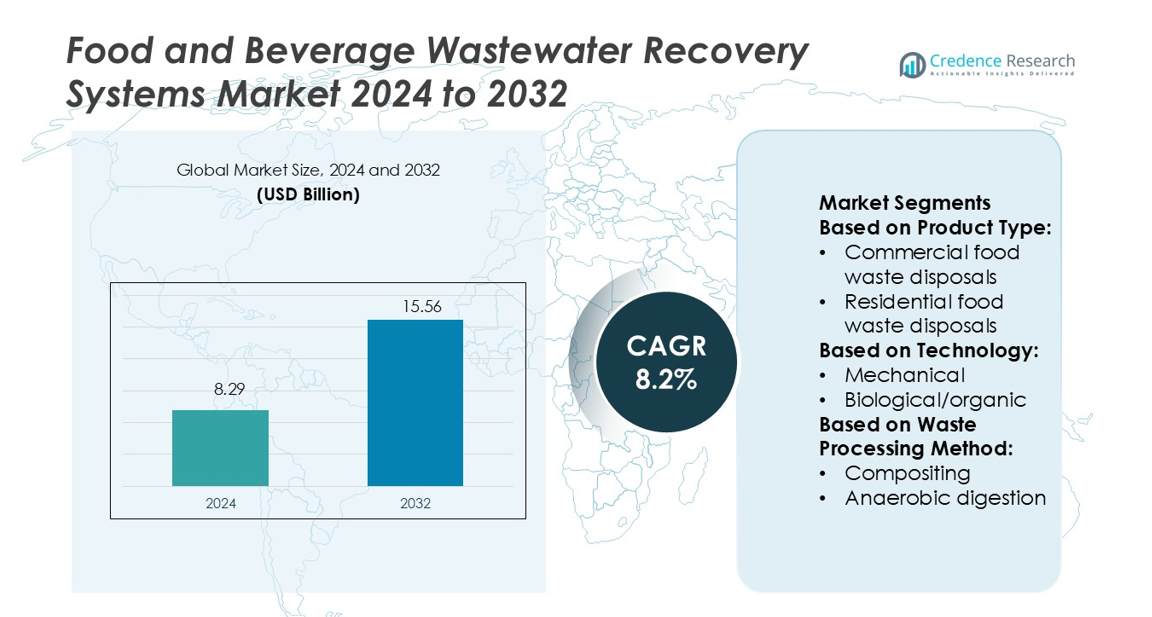

Food and Beverage Wastewater Recovery Systems Market size was valued USD 8.29 billion in 2024 and is anticipated to reach USD 15.56 billion by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food and Beverage Wastewater Recovery Systems Market Size 2024 |

USD 8.29 billion |

| Food and Beverage Wastewater Recovery Systems Market, CAGR |

8.2% |

| Food and Beverage Wastewater Recovery Systems Market Size 2032 |

USD 15.56 billion |

The Food and Beverage Wastewater Recovery Systems Market is dominated by key players, including Veolia Water Technologies, SUEZ Water Technologies & Solutions, Aquatech International, GE Water & Process Technologies, and Xylem Inc. These companies leverage advanced treatment technologies and strategic partnerships to enhance system efficiency and sustainability. North America leads the market, holding a 34.2% share, driven by stringent environmental regulations and growing adoption of water recycling solutions in food and beverage production. Europe follows closely, with investments in energy-efficient recovery systems supporting market growth. Top players focus on innovation, modular system deployment, and service expansion to strengthen regional presence. Increasing industrial wastewater management requirements and rising environmental awareness are expected to sustain competitive momentum, particularly in regions emphasizing regulatory compliance and resource optimization. This positions the market for steady growth over the next five years.

Market Insights

- The Food and Beverage Wastewater Recovery Systems Market was valued at USD 8.29 billion in 2024 and is projected to reach USD 15.56 billion by 2032, growing at a CAGR of 8.2%.

- North America leads the market with a 34.2% share, supported by strict regulations and high adoption of recycling systems. Europe follows, driven by investments in energy-efficient recovery technologies.

- Key players include Veolia Water Technologies, SUEZ Water Technologies & Solutions, Aquatech International, GE Water & Process Technologies, and Xylem Inc., focusing on innovation, modular systems, and service expansion.

- Rising industrial wastewater management needs and growing environmental awareness drive market growth, while high installation costs and complex maintenance pose challenges.

- Demand is increasing across food and beverage segments, particularly dairy, beverages, and processed foods, where efficient water recovery enhances sustainability and reduces operational costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The commercial food waste disposals segment dominates the Food and Beverage Wastewater Recovery Systems market, capturing approximately 45% of the share. Growth is driven by increasing adoption in restaurants, hotels, and food processing units seeking efficient waste management solutions. Rising regulatory pressures on sustainable waste handling and the need to reduce operational costs are encouraging businesses to invest in advanced disposal systems. Residential disposals are growing steadily due to urbanization and smart home adoption, while industrial disposals benefit from large-scale processing requirements and integration with wastewater treatment facilities.

- For instance, Urja Bio System Private Limited, offer industrial food waste crushers and composting machines with capacities reaching up to 1,000 kg/hr, which can reduce waste and enhance efficiency in waste management.

By Technology

Mechanical technology leads the market with a dominant share of around 50%, propelled by its simplicity, cost efficiency, and rapid adoption in commercial kitchens. Mechanical systems, such as grinders and shredders, provide reliable pre-treatment of food waste, enhancing downstream processing in biological and chemical systems. Biological/organic technologies are expanding due to sustainability initiatives, supporting anaerobic digestion and composting. Chemical disposal systems remain niche, used primarily in industrial settings. Emerging technologies, including plasma arc and thermal treatments, are gaining attention for energy recovery and zero-landfill objectives, further driving market innovation.

- For instance, ENCON’s product documentation for its MVC evaporators consistently states a typical operating energy cost of $0.01–$0.02 per gallon of distilled water, based on an assumed electricity cost.

By Waste Processing Method

Composting holds the largest share, approximately 42%, in waste processing methods, driven by its eco-friendly nature and regulatory incentives promoting organic recycling. This method efficiently converts food waste into nutrient-rich soil amendments, benefiting commercial and residential applications. Anaerobic digestion is also growing due to its ability to generate biogas, supporting circular economy goals. Grinding and shredding serve as preparatory steps, enhancing efficiency in composting and anaerobic systems. Waste-to-energy solutions are emerging in industrial setups, focusing on renewable energy recovery and reducing landfill dependency, which strengthens overall market growth.

Key Growth Drivers

Rising Regulatory Compliance and Environmental Policies

Strict government regulations on food waste disposal and wastewater management are driving market growth. Businesses are increasingly mandated to adopt sustainable waste treatment solutions to minimize environmental impact. Policies promoting circular economy practices encourage the use of recovery systems that reduce landfill dependency. Incentives for biogas generation and organic recycling further accelerate adoption. Commercial kitchens, food processing units, and municipalities are investing in advanced wastewater recovery systems to comply with environmental standards while optimizing operational efficiency, creating significant opportunities for market expansion globally.

- For instance, Pall’s Keraflux™ TFF technology enables breweries to recover up to 80% of extract from surplus yeast, reducing waste and allowing beer blending at ratios up to 5% without negatively impacting quality.

Increasing Adoption in Food Processing and Hospitality Sectors

The growing demand for efficient waste management in restaurants, hotels, and food processing units fuels market growth. High-volume food operations generate substantial wastewater, making recovery systems essential for cost reduction and operational efficiency. Integration of automated disposals and anaerobic digestion technologies minimizes downtime and enhances resource recovery. Sustainability initiatives in the hospitality and food processing industries, coupled with rising consumer awareness about environmental responsibility, further drive investments in wastewater recovery solutions, boosting adoption rates across commercial and industrial segments.

- For instance, Evoqua operates in more than 160 locations across ten countries, serving over 38,000 customers worldwide. Their extensive network enables them to provide localized solutions and support for water and wastewater treatment needs globally.

Technological Advancements and Energy Recovery Solutions

Innovation in mechanical, biological, and chemical treatment technologies supports market expansion. Advanced systems enhance processing efficiency, reduce operational costs, and enable energy recovery from food waste. Emerging methods such as plasma arc, waste-to-energy, and biogas generation offer added benefits for commercial and industrial users. Continuous R&D enables integration with smart monitoring, IoT, and automation, improving system reliability and performance. These technological advancements allow businesses to meet sustainability goals while optimizing resource use, positioning the market for sustained long-term growth.

Key Trends & Opportunities

Integration of Smart and Automated Systems

Automation and IoT-enabled monitoring are emerging trends in food and beverage wastewater recovery. Smart systems optimize waste segregation, grinding, and biological treatment processes, improving operational efficiency and reducing maintenance costs. Data-driven insights allow predictive maintenance and resource optimization, enabling commercial and industrial users to enhance sustainability. Integration with building management systems and cloud platforms creates opportunities for scalable deployment in restaurants, hotels, and industrial facilities. This trend aligns with digital transformation goals and supports regulatory compliance, increasing market attractiveness for innovative solution providers.

- For instance, KSS launched the INDU-COR™ HD tubular membrane system, designed for industrial wastewater treatment applications. This system offers a higher packing density of up to 300%, making crossflow filtration more economical while occupying less space.

Expansion of Circular Economy and Energy Recovery Initiatives

The shift toward circular economy models drives adoption of waste-to-energy and biogas generation systems. Food and beverage operations are increasingly recovering energy and nutrients from wastewater, reducing reliance on landfills and fossil fuels. Opportunities exist for collaboration between technology providers, municipalities, and commercial users to implement large-scale energy recovery projects. Rising sustainability awareness among consumers and investors further encourages investments. Companies can leverage these opportunities to introduce integrated recovery systems that generate revenue streams from energy production while meeting environmental standards.

- For instance, Emerson’s Ovation™ distributed control system was utilized in a UK waste-to-energy plant. The plant processes 320,000 tons of waste annually, producing 28 megawatt-hours of electricity per hour, enough to power approximately 40,000 homes.

Key Challenges

High Initial Capital and Operational Costs

The Food and Beverage Wastewater Recovery Systems market faces challenges due to the high upfront investment in advanced disposal and treatment systems. Small and medium enterprises often find capital-intensive technologies financially restrictive. Additionally, operational and maintenance expenses for complex mechanical and biological systems may limit adoption. Cost constraints can delay large-scale deployment, particularly in residential and small commercial applications. Market players must focus on developing cost-effective, scalable solutions and offer flexible financing options to overcome these barriers and expand adoption across diverse segments.

Complex Regulatory Compliance and Technical Barriers

Navigating diverse local and international regulations presents a significant challenge for market participants. Compliance with environmental standards requires continuous monitoring and documentation, increasing operational complexity. Technical barriers such as integrating advanced recovery technologies with existing infrastructure or adapting systems to varying wastewater characteristics further complicate implementation. Companies must invest in skilled personnel, training, and technology upgrades to meet compliance requirements. These challenges slow adoption and create operational risks, emphasizing the need for reliable, adaptable solutions and support services for effective deployment.

Regional Analysis

North America

North America dominates the Food and Beverage Wastewater Recovery Systems market, holding an estimated 35% share. The region’s growth is driven by stringent environmental regulations, high adoption in food processing and hospitality sectors, and strong technological infrastructure. The U.S. leads with advanced mechanical and biological systems, while Canada focuses on energy recovery and sustainable waste practices. Rising investments in smart and automated wastewater recovery solutions further boost market expansion. Increasing awareness of circular economy models, coupled with government incentives for biogas and composting projects, positions North America as a primary market for innovative and large-scale wastewater recovery implementations.

Europe

Europe accounts for approximately 28% of the market, fueled by strict EU regulations on food waste disposal and wastewater treatment. Germany, France, and the UK are key contributors, adopting mechanical, biological, and chemical technologies in commercial and industrial applications. Sustainability initiatives, energy recovery projects, and composting programs drive market penetration. Growing consumer and corporate awareness of environmental impact encourages adoption of advanced recovery systems in hotels, restaurants, and food processing units. Technological integration, including automation and IoT-enabled monitoring, further enhances efficiency, enabling European players to maintain leadership in eco-friendly and resource-efficient wastewater recovery solutions.

Asia-Pacific

Asia-Pacific holds around 22% market share, led by rapid industrialization, urbanization, and expanding food processing industries. China, Japan, and India are key markets, investing heavily in mechanical and biological wastewater treatment solutions. Government policies promoting energy recovery, composting, and sustainable resource management accelerate adoption. Rising population, growing hospitality sector, and increasing awareness of environmental sustainability create opportunities for both residential and commercial systems. Technological partnerships, local manufacturing, and integration with smart city initiatives further strengthen market growth. The region is expected to witness accelerated expansion as investments in infrastructure and sustainable food waste management rise steadily.

Latin America

Latin America represents nearly 9% of the market, with Brazil and Mexico leading adoption in food processing and hospitality sectors. Market growth is driven by government incentives for sustainable waste management and increasing awareness of environmental impact. Adoption of mechanical and biological recovery systems is rising, particularly in commercial and industrial applications. Challenges include infrastructure gaps and limited technical expertise, though investments in training and technology transfer are increasing. Energy recovery from wastewater and composting initiatives present significant opportunities. Growing urbanization, regulatory improvements, and partnerships with international solution providers are expected to strengthen Latin America’s position in the Food and Beverage Wastewater Recovery Systems market.

Middle East & Africa

The Middle East & Africa region holds around 6% of the market, supported by growing industrial food production, hospitality expansion, and water scarcity challenges. The UAE, Saudi Arabia, and South Africa are key contributors, investing in mechanical and biological treatment systems for efficient wastewater recovery. Market growth is driven by government-led sustainability initiatives, water reuse programs, and energy recovery projects. Challenges include high capital costs and limited technical expertise. Opportunities exist in integrating advanced technologies, such as smart monitoring and waste-to-energy systems. Increasing regional focus on resource efficiency and environmental compliance is expected to drive steady market adoption.

Market Segmentations:

By Product Type:

- Commercial food waste disposals

- Residential food waste disposals

By Technology:

- Mechanical

- Biological/organic

By Waste Processing Method:

- Compositing

- Anaerobic digestion

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Food and Beverage Wastewater Recovery Systems market include BioChem Technology, Calgon Carbon Corporation, ENCON Evaporators, Westlake Vinnolit GmbH & Co. KG, Pall Corporation, KORTE Kornyezettechnika Zrt., Mech-Chem Associates, Inc., Evoqua Water Technologies LLC, Koch Separation Solutions, and ClearBlu Environmental. The Food and Beverage Wastewater Recovery Systems market is highly competitive, driven by innovation and technological differentiation. Companies focus on advanced mechanical, biological, and chemical treatment solutions to meet commercial, residential, and industrial needs. Emphasis on energy recovery, automation, and sustainability enhances product value and operational efficiency. Strategic initiatives, including mergers, partnerships, and regional expansions, support market penetration. Continuous investment in R&D enables the development of high-efficiency disposals, anaerobic digestion systems, and composting technologies. Service excellence, regulatory compliance, and smart monitoring integration further strengthen market positioning. Overall, competition is centered on delivering efficient, sustainable, and cost-effective wastewater recovery solutions that reduce environmental impact and meet growing regulatory and operational demands globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BioChem Technology

- Calgon Carbon Corporation

- ENCON Evaporators

- Westlake Vinnolit GmbH & Co. KG

- Pall Corporation

- KORTE Kornyezettechnika Zrt.

- Mech-Chem Associates, Inc.

- Evoqua Water Technologies LLC

- Koch Separation Solutions

- ClearBlu Environmental

Recent Developments

- In July 2025, SUEZ and SIAAP inaugurated France’s largest biogas production unit at the Seine Aval wastewater treatment plant near Paris. The facility processes 130,000 tonnes of sludge annually, generating 350 GWh of renewable energy. This covers over half the plant’s energy needs.

- In April 2025, Leanpath introduced a mobile reporting app designed for the foodservice industry. This app, which utilizes AI, makes it easier for chefs and kitchen managers to engage with food waste data.

- In January 2025, Calgon Carbon Corporation, a subsidiary of Kuraray Co., Ltd., announced a contract to supply activated carbon systems for wastewater treatment at a major beverage manufacturing facility in the Asia Pacific region. The systems are designed to remove organic contaminants from wastewater, enabling water reuse in food and beverage processing.

- In November 2024, Too Good To Go launched a service called “Parcels” aimed at reducing food waste at the manufacturing level by directly connecting FMCG (fast-moving consumer goods) brands with consumers in the UK.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Waste Processing Method and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of advanced mechanical and biological treatment technologies will increase across all sectors.

- Smart monitoring and IoT integration will enhance operational efficiency and predictive maintenance.

- Energy recovery from wastewater will become a key revenue and sustainability driver.

- Regulatory compliance and stricter environmental standards will continue to boost market growth.

- Commercial and industrial food processing units will drive the highest demand for recovery systems.

- Emerging markets in Asia-Pacific and Latin America will witness accelerated adoption rates.

- Investment in R&D will lead to more cost-effective and high-efficiency treatment solutions.

- Circular economy initiatives will promote composting and anaerobic digestion solutions.

- Integration with renewable energy and waste-to-energy projects will expand market opportunities.

- Partnerships and collaborations will strengthen regional presence and technological capabilities.