Market Overview

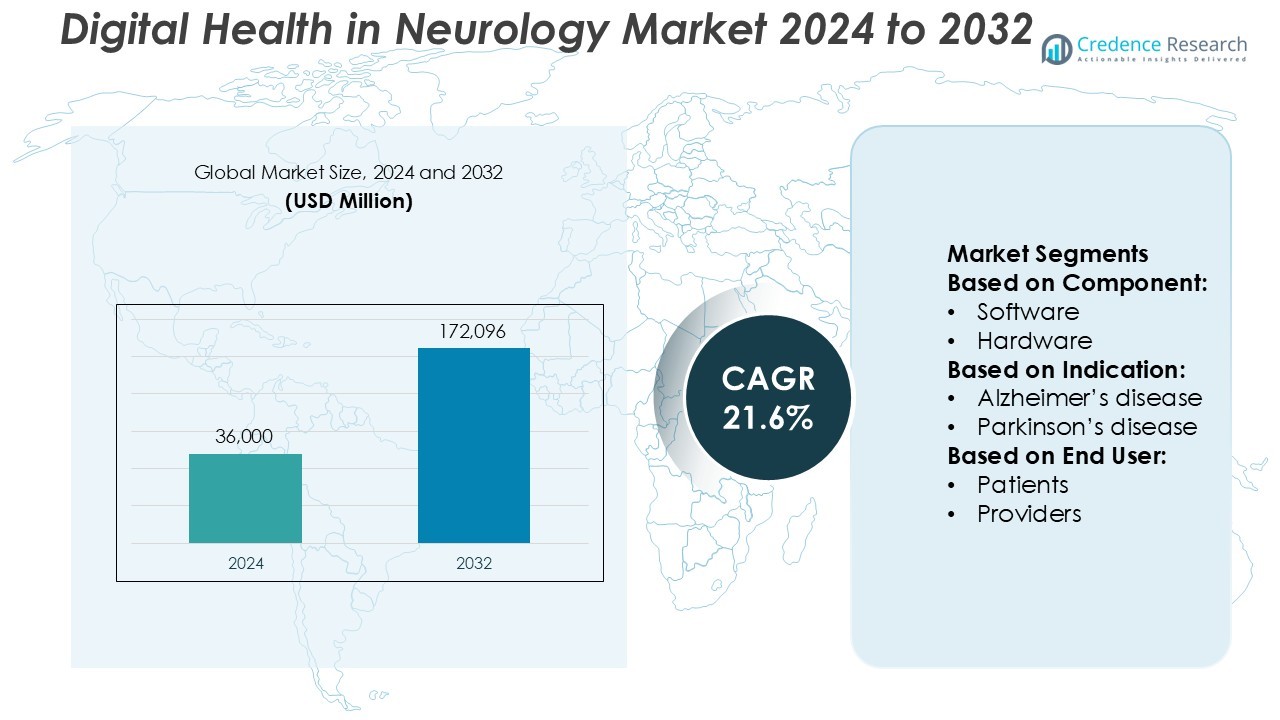

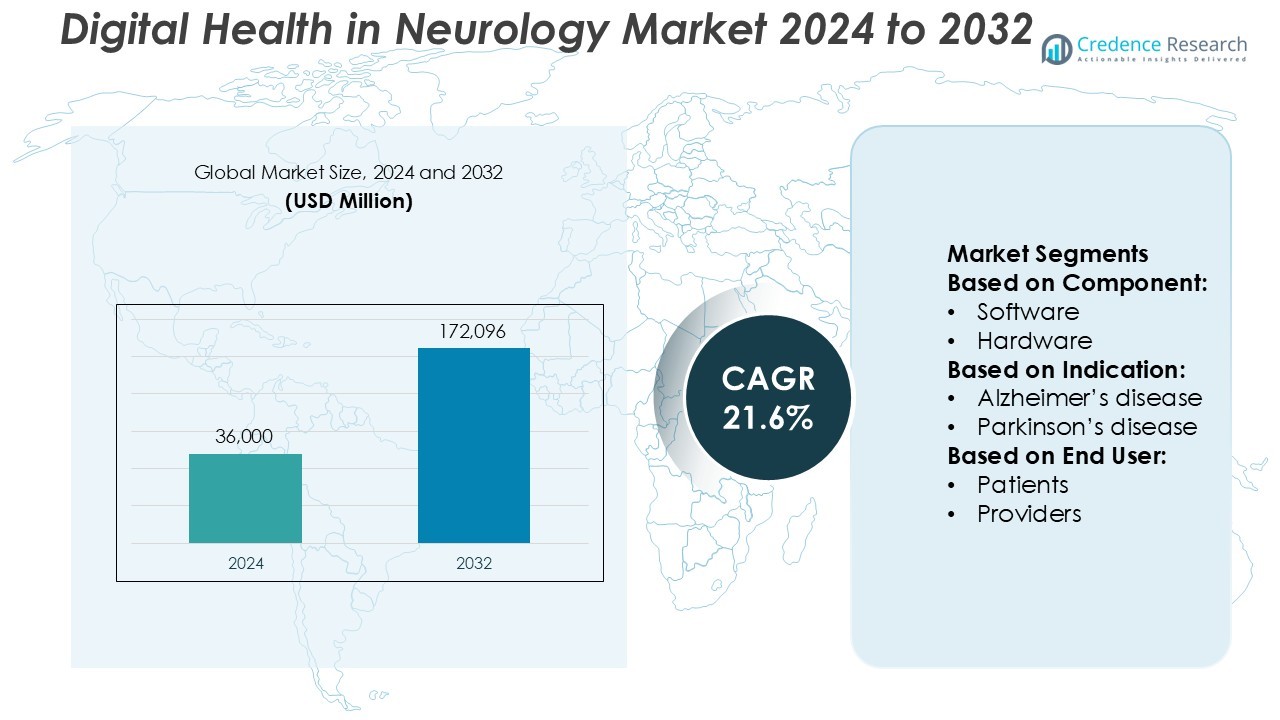

Digital Health in Neurology Market size was valued USD 36,000 million in 2024 and is anticipated to reach USD 172,096 million by 2032, at a CAGR of 21.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Health in Neurology Market Size 2024 |

USD 36,000 Million |

| Digital Health in Neurology Market, CAGR |

21.6% |

| Digital Health in Neurology Market Size 2032 |

USD 172,096 Million |

The digital health in neurology market is led by companies such as Teladoc Health, Inc., Omada Health Inc., Blackrock Neurotech, Akili, Inc., AppliedVR, Inc., Neofect Co., Ltd., Proteus Digital Health, Inc., BigHealth, Cognivive, Inc., and AdvancedMD, Inc. These players focus on digital therapeutics, tele-neurology, neurorehabilitation, and brain-computer interface technologies to enhance patient care. Teladoc Health and Omada Health dominate the tele-neurology and behavioral health segments through AI-enabled platforms and remote monitoring tools. North America leads the global market with a 38% share, driven by robust digital infrastructure, widespread telemedicine adoption, and strong research funding for neurological innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Digital Health in Neurology Market was valued at USD 36,000 million in 2024 and is projected to reach USD 172,096 million by 2032, growing at a CAGR of 21.6%.

- Rising prevalence of neurological disorders and growing demand for AI-driven remote monitoring systems are driving market expansion.

- Increasing adoption of digital therapeutics, wearable sensors, and tele-neurology solutions marks a key market trend across healthcare systems.

- The market remains competitive with players focusing on AI integration, digital biomarkers, and virtual rehabilitation platforms to enhance patient outcomes.

- North America leads the global market with a 38% share, while the software segment dominates with a 47% contribution, supported by advanced healthcare infrastructure and rapid digital adoption.

Market Segmentation Analysis:

By Component

Software dominated the digital health in neurology market, holding a 47% share in 2024. The segment’s growth is driven by rising adoption of AI-based diagnostic tools, mobile health apps, and remote monitoring platforms. Software solutions enable continuous tracking of neurological parameters, data analytics, and early detection of cognitive decline. For instance, Neurotrack’s digital memory assessment tool provides real-time analysis of eye movement data, improving early Alzheimer’s detection accuracy. The integration of predictive analytics and cloud-based platforms supports clinical decision-making and enhances personalized neurological care delivery.

- For instance, Teladoc Health, Inc.’s integrated platform leverages the Livongo system’s ability to connect with more than 400 FDA-cleared connected devices to capture over 3 billion biometric data points annually, which are used to provide personalized insights and coaching for chronic conditions like diabetes and hypertension.

By Indication

Alzheimer’s disease led the market with a 36% share in 2024 due to the high global disease prevalence and increasing demand for remote cognitive assessment tools. Digital platforms aid in early diagnosis, behavioral monitoring, and treatment adherence. For instance, Eisai and Biogen’s digital platform integrates AI algorithms to assess cognitive function, enabling more precise tracking of disease progression. The rising use of wearables, tele-neurology consultations, and memory assessment applications continues to drive adoption across healthcare systems focused on elderly populations.

- For instance, Blackrock Neurotech’s core “Utah Array” implant supports up to 96 electrodes per array and 1,024 channels per system.In a clinical context, that array has been implanted in 29 human patients for up to 7 years as part of BCI systems targeting neural disorders.

By End-user

Providers accounted for the dominant 42% share of the market in 2024, supported by increasing implementation of digital tools in hospitals, clinics, and rehabilitation centers. These solutions streamline diagnosis, treatment planning, and patient engagement through remote monitoring and telemedicine integration. For instance, Cleveland Clinic’s remote neurology program allows physicians to track Parkinson’s symptoms using motion sensors, improving patient management efficiency. The growing focus on cost reduction, clinical workflow automation, and real-time data insights further enhances digital health adoption among neurological care providers.

Key Growth Drivers

- Rising Prevalence of Neurological Disorders

The increasing incidence of neurological diseases such as Alzheimer’s, Parkinson’s, and multiple sclerosis is driving demand for digital health technologies. Remote monitoring platforms, wearable sensors, and tele-neurology solutions enable continuous tracking of patient health and early intervention. For instance, wearable EEG headsets like EMOTIV EPOC+ capture brainwave data with 14 sensors, enhancing clinical decision-making. As global neurological cases rise, healthcare providers are adopting digital solutions to improve diagnosis accuracy, reduce hospital visits, and support long-term disease management.

- For instance, Omada Health reports that it has enrolled over 1 million members total, enabling its AI and analytics platform to train on that dataset for chronic-care programs.

- Advancements in Artificial Intelligence and Data Analytics

Artificial intelligence and predictive analytics are transforming neurology care by enabling precise diagnosis and personalized treatment. Machine learning models analyze imaging data and neurological patterns to detect diseases at early stages. For example, BioMind’s AI algorithm achieved 94% accuracy in identifying brain tumors from MRI scans, surpassing human specialists. The integration of AI in neurology supports efficient decision-making, automates clinical workflows, and enhances patient outcomes. Continuous innovation in data-driven platforms is expanding clinical adoption worldwide.

- For instance, Akili’s digital therapeutic platform, built on its proprietary Selective Stimulus Management Engine (SSME™), was evaluated in a Phase 3 clinical trial involving 164 paediatric patients aged 6-17 treating ADHD (Japanese version SDT-001) using approximately 25 minutes daily for 6 weeks, achieving statistically significant improvement in the ADHD-RS-IV Inattention score versus control (p < 0.05).

- Expansion of Tele-Neurology and Remote Patient Monitoring

The growing use of telemedicine and connected health devices supports remote neurological assessments and follow-ups. Digital platforms bridge accessibility gaps for patients in rural and underserved regions. For instance, Philips’ cloud-based tele-neurology solution enables real-time collaboration between specialists and local clinicians, improving stroke care response time. Remote patient monitoring systems enhance treatment adherence, reduce costs, and ensure timely medical intervention. The expanding telehealth infrastructure is strengthening the overall digital transformation in neurology care.

Key Trends & Opportunities

- Integration of Digital Biomarkers in Neurology

Digital biomarkers are emerging as valuable tools for tracking neurological activity through smartphones, wearables, and sensors. These biomarkers provide continuous, objective insights into motor function, cognition, and behavior. For example, Roche’s smartphone-based app uses accelerometer and voice data to monitor multiple sclerosis symptoms remotely. Such innovations support precision medicine, facilitate clinical trials, and improve patient engagement. The increasing integration of digital biomarkers represents a major opportunity for early disease detection and personalized therapeutic strategies.

- For instance, Neofect’s Smart Pegboard device recorded a completion time of ~170 seconds (mean) across 19 hemiplegic stroke patients during a 4-week, 30-minute per session protocol.

- Growing Focus on Personalized Neurological Therapies

The shift toward individualized treatment plans is creating new opportunities in digital neurology. AI-powered platforms analyze patient-specific data to tailor medication, rehabilitation, and cognitive therapy programs. For instance, MindMaze’s digital neuro-rehabilitation system customizes recovery exercises using real-time motion feedback. This trend enhances treatment adherence and accelerates recovery outcomes. Personalized digital tools are expected to dominate future neurological care by optimizing therapy effectiveness and improving quality of life for patients with chronic neurological conditions.

- For instance, AppliedVR’s immersive therapeutic platform RelieVRx® (formerly EaseVRx®) underwent a pivotal home-based programme of 56 sessions for adults with chronic lower back pain, where participants in one large RCT completed an average of 37.6 sessions out of the 56.

Key Challenges

- Data Privacy and Security Concerns

The growing use of connected devices and cloud-based platforms raises concerns about data privacy in digital neurology. Sensitive neurological health information requires robust cybersecurity frameworks to prevent breaches and unauthorized access. For example, the U.S. Department of Health reported over 500 healthcare data breaches in 2024, affecting millions of records. Ensuring compliance with regulations such as HIPAA and GDPR is critical for maintaining patient trust. Lack of standardized encryption and authentication protocols remains a significant challenge for developers and providers.

- Limited Reimbursement and Regulatory Barriers

Despite strong innovation, reimbursement limitations and fragmented regulatory approvals hinder digital adoption in neurology. Many healthcare systems lack structured reimbursement models for tele-neurology consultations and digital therapeutic tools. For instance, less than 35% of global insurers currently cover remote neurological monitoring programs. The absence of clear guidelines for clinical validation and data integration slows product commercialization. Overcoming these barriers requires coordinated efforts between regulators, payers, and healthcare providers to establish sustainable digital neurology ecosystems.

Regional Analysis

North America

North America dominated the digital health in neurology market with a 38% share in 2024. The region benefits from advanced healthcare infrastructure, high adoption of tele-neurology, and increasing prevalence of neurological disorders. Strong investment in AI-driven diagnostics and remote monitoring platforms supports market expansion. For instance, the U.S. National Institutes of Health (NIH) allocated over USD 2.3 billion to neurological research programs, enhancing digital innovation. Favorable reimbursement policies and widespread integration of digital platforms across hospitals and clinics further strengthen the regional market’s leadership.

Europe

Europe held a 29% share of the digital health in neurology market in 2024, driven by rising government initiatives promoting e-health and clinical digitization. The region’s healthcare systems actively adopt AI-based neuroimaging tools, teleconsultations, and remote rehabilitation programs. For example, the European Commission’s Horizon Europe program funds AI-based neurological research exceeding EUR 1 billion. Countries like Germany, the U.K., and France lead digital implementation through strong policy frameworks and robust data security laws. The presence of established technology providers and growing use of digital biomarkers drive continuous innovation.

Asia-Pacific

Asia-Pacific accounted for a 22% share in 2024 and is the fastest-growing region due to expanding healthcare digitization and rising neurological disease burden. Governments in China, Japan, and India are investing in telemedicine and wearable monitoring technologies to improve patient access. For instance, Japan’s Ministry of Health launched nationwide tele-neurology pilots using connected EEG devices for stroke detection. Growing smartphone penetration, AI healthcare startups, and supportive policy reforms fuel adoption. Increasing awareness and affordability of digital tools continue to boost regional market growth.

Latin America

Latin America captured an 7% share of the market in 2024, supported by growing telehealth penetration and expanding neurological care infrastructure. Countries like Brazil and Mexico are integrating mobile health apps and cloud-based solutions for early disease detection. For instance, Brazil’s public hospitals implemented digital platforms to monitor epilepsy patients remotely, improving continuity of care. Rising investments in connected health systems and training initiatives for digital literacy enhance adoption. However, uneven connectivity and regulatory disparities remain challenges for broader market expansion in the region.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share in 2024, showing steady adoption of digital neurology solutions. The Gulf Cooperation Council (GCC) countries are leading initiatives to develop smart healthcare systems and tele-neurology programs. For example, Saudi Arabia’s Vision 2030 plan prioritizes digital transformation in neurological care through AI-assisted diagnostics. Partnerships between hospitals and technology firms are improving remote monitoring and treatment access. Despite infrastructure constraints in parts of Africa, ongoing digital health investments and public-private collaborations are gradually expanding regional participation.

Market Segmentations:

By Component:

By Indication:

- Alzheimer’s disease

- Parkinson’s disease

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Digital Health in Neurology Market features major players such as Teladoc Health, Inc., Blackrock Neurotech, Omada Health Inc., Akili, Inc., Neofect Co., Ltd., AppliedVR, Inc., Proteus Digital Health, Inc., BigHealth, Cognivive, Inc., and AdvancedMD, Inc. The digital health in neurology market is characterized by strong competition among technology-driven healthcare innovators focusing on AI, telemedicine, and digital therapeutics. Companies are investing in advanced neurodiagnostic tools, wearable devices, and software platforms that enable real-time patient monitoring and personalized treatment. The growing emphasis on clinical validation, regulatory approvals, and data interoperability is shaping competitive differentiation. Strategic collaborations with healthcare providers and research institutions are enhancing product scalability and global reach. Additionally, advancements in digital biomarkers, virtual rehabilitation, and remote cognitive assessment tools are creating new avenues for growth, driving continuous innovation across the market landscape.

Key Player Analysis

- Teladoc Health, Inc.

- Blackrock Neurotech

- Omada Health Inc.

- Akili, Inc.

- Neofect Co., Ltd.

- AppliedVR, Inc.

- Proteus Digital Health, Inc.

- BigHealth

- Cognivive, Inc.

- AdvancedMD, Inc.

Recent Developments

- In February 2024, AdvancedMD announced over 30 updates to its EHR, practice management, and patient engagement tools. The release focused on enhancing operational agility and improving billing capabilities to optimize practice efficiency, ensure financial stability, and drive success and sustainability in healthcare practices.

- In February 2024, Aptar Digital Health, a division of AptarGroup, Inc., and Biogen Inc., reached an enterprise agreement to manage and create digital health solutions for neurological and uncommon disorders.

- In October 2023, The Alzheimer’s Drug Discovery Foundation’s (ADDF) Diagnostic Accelerator (DxA) launched SpeechDx, a longitudinal study to create the largest repository of voice and speech data to help speed up the diagnosis, detection, and monitoring of Alzheimer’s disease.

- In August 2023, Aspen Neuroscience partnered with Emerald Innovations and Rune Labs to integrate digital health (DHT) methods in the company’s Trial-Ready Screening Cohort Study launched in 2022. The study is developing a cell therapy to cure Parkinson’s disease.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Indication, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing integration of AI-driven diagnostic platforms will enhance precision and early disease detection.

- Expansion of tele-neurology services will improve access to neurological care in remote areas.

- Growing adoption of wearable sensors will enable continuous monitoring of patient health data.

- Advancements in digital biomarkers will support personalized therapy and clinical decision-making.

- Collaboration between tech firms and healthcare providers will accelerate digital innovation and scalability.

- Regulatory frameworks will evolve to improve reimbursement and data standardization for digital tools.

- Integration of cloud-based platforms will streamline real-time neurological data management.

- Virtual and augmented reality therapies will gain traction in neuro-rehabilitation and cognitive recovery.

- Increased investment in digital clinical trials will drive validation of new neurological technologies.

- Rising patient awareness and acceptance of digital health solutions will fuel long-term market growth.