Market Overview

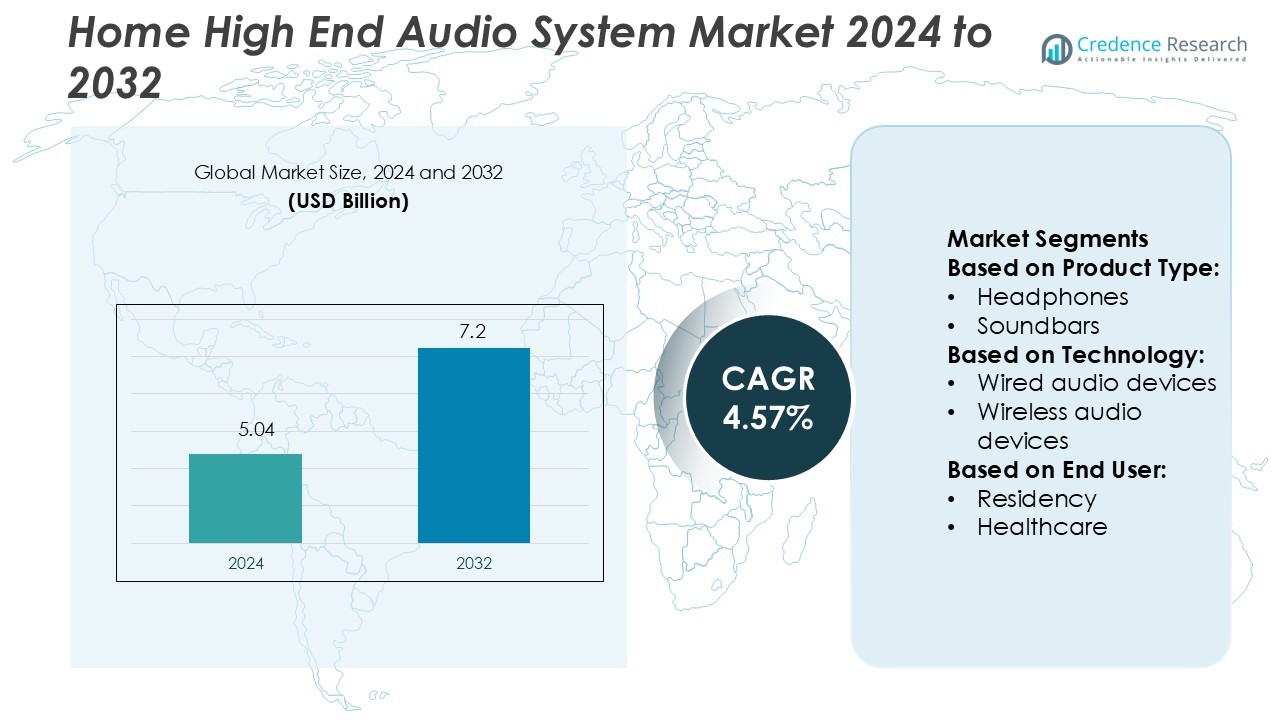

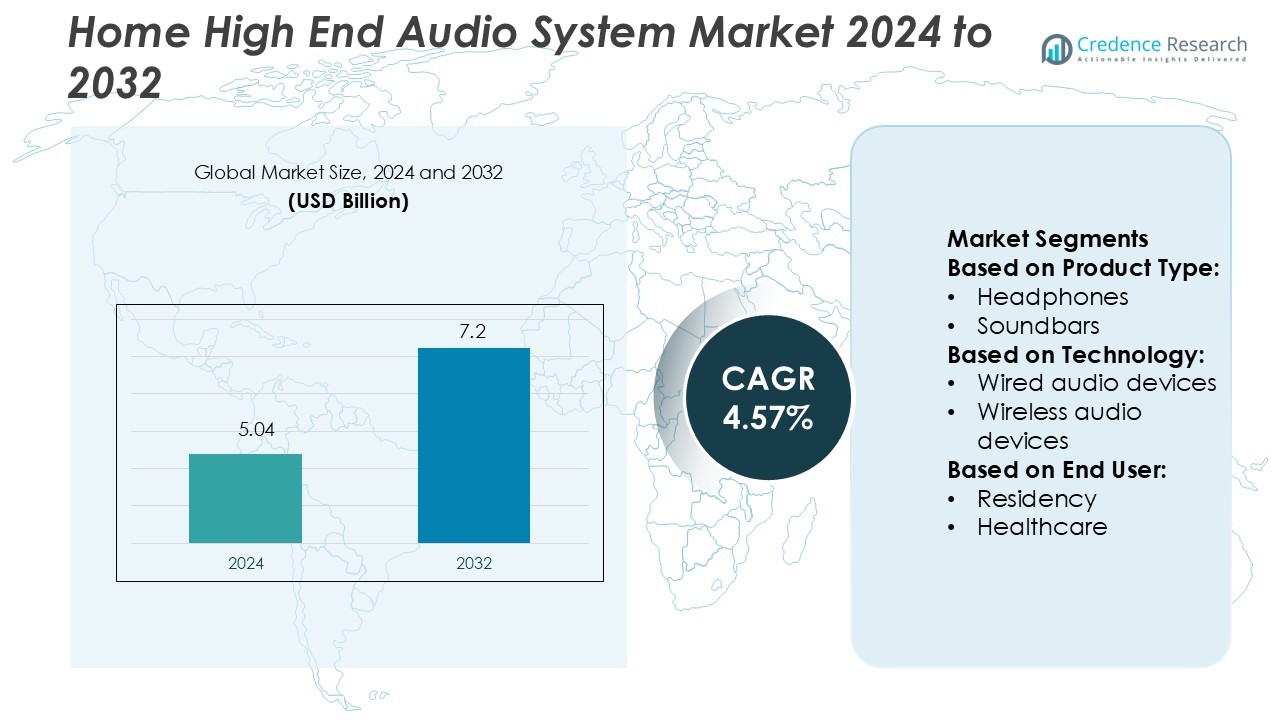

Home High End Audio System Market size was valued USD 5.04 billion in 2024 and is anticipated to reach USD 7.2 billion by 2032, at a CAGR of 4.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Home High End Audio System Market Size 2024 |

USD 5.04 Billion |

| Home High End Audio System Market, CAGR |

4.57% |

| Home High End Audio System Market Size 2032 |

USD 7.2 Billion |

The Home High-End Audio System Market is dominated by leading players such as Bowers & Wilkins, Harman International Industries, Audio-Technica, JBL, Dynaudio, Alpine Electronics, Bang & Olufsen, Panasonic Corporation, Bose Corporation, and Focal-JMLab. These companies compete through advanced sound engineering, wireless innovation, and premium product design. Their focus on smart connectivity, voice control, and energy-efficient technologies enhances consumer appeal across luxury and mid-premium segments. North America leads the global market with a 34% share, driven by high disposable incomes, strong adoption of smart home systems, and consistent demand for superior sound quality in residential and entertainment spaces.

Market Insights

- The Home High-End Audio System Market was valued at USD 5.04 billion in 2024 and is projected to reach USD 7.2 billion by 2032, registering a CAGR of 4.57%.

- Rising consumer demand for immersive entertainment and smart-connected devices drives market growth, supported by technological advancements in wireless and AI-enabled sound systems.

- Growing trends include sustainable product designs, luxury customization, and the expansion of multi-room and voice-controlled audio setups across premium households.

- Key players focus on innovation, premium sound quality, and smart integration to strengthen competitiveness, while high product costs and counterfeit goods restrain market expansion.

- North America holds a 34% regional share, followed by Europe at 28% and Asia-Pacific at 25%, with the residential segment dominating overall market demand due to strong adoption of high-performance audio systems in home entertainment environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Headphones dominate the Home High-End Audio System Market with a significant share driven by strong consumer preference for personal, immersive sound experiences. Demand for noise-cancelling, studio-grade, and wireless headphones has surged with the rise in remote work and entertainment streaming. Brands like Sony, Bose, and Sennheiser continue to innovate with adaptive sound control and long battery life. Meanwhile, soundbars and home theater systems witness steady adoption for home entertainment setups. Portable Bluetooth speakers and microphones hold niche appeal among travelers, creators, and podcasters.

- For instance, Bowers & Wilkins launched the Px8 wireless headphones featuring 40mm carbon cone drivers and 24-bit DSP processing, enabling high-resolution playback with a frequency response of 10Hz–30kHz.

By Technology

Wireless audio devices lead the segment, capturing the largest market share due to growing adoption of smart homes and IoT integration. Consumers increasingly prefer Wi-Fi and Bluetooth-enabled systems that offer flexibility, voice assistant compatibility, and multi-room connectivity. Companies such as Sonos and Bang & Olufsen focus on seamless pairing and high-fidelity sound performance. Wired audio devices remain relevant in audiophile and professional settings for their stable connection and superior signal quality, especially in recording and high-precision playback environments.

- For instance, Harman’s JBL BAR 1300X soundbar system offers 11.1.4-channel configuration with a total output power of 1170 W. The system features built-in Wi-Fi supporting Apple AirPlay, Chromecast built-in, and Alexa Multi-Room Music, enabling multi-room streaming via Wi-Fi or Bluetooth.

By End User

The residential segment dominates the market with the highest share, driven by growing investment in premium home entertainment systems. Consumers are upgrading to multi-room audio, soundbars, and surround systems for theater-like experiences. High disposable incomes and smart home integration further boost adoption. The hospitality and healthcare sectors are emerging segments, using high-end audio for guest entertainment and therapeutic environments. Educational institutions also integrate quality audio systems in auditoriums and e-learning facilities, enhancing the overall learning experience.

Key Growth Drivers

Rising Demand for Immersive Home Entertainment

The increasing popularity of streaming platforms and high-definition content is driving demand for premium home audio systems. Consumers seek enhanced sound quality and cinematic experiences within their homes. Advanced surround sound setups and Dolby Atmos-enabled systems have become key purchase factors. Manufacturers are developing products with higher fidelity and customizable acoustics to match room layouts. This shift toward immersive audio experiences, paired with growing interest in home theaters, continues to elevate product adoption and brand differentiation in the premium segment.

- For instance, Audio-Technica introduced the microphone model Audio-Technica BP3600 Immersive Audio Microphone. The unit houses eight microphone assemblies in a cube with 15 cm spacing between modules, each module with a 12mm hypercardioid capsule, enabling highly accurate three-dimensional sound capture.

Technological Advancements and Smart Integration

Integration of AI, IoT, and voice assistants is transforming high-end home audio systems. Devices with Alexa, Google Assistant, or Apple HomeKit support offer seamless control and smart home synchronization. Wireless connectivity, app-based customization, and adaptive sound technologies enhance user convenience. Leading brands focus on developing AI-driven auto-calibration and high-resolution audio streaming. These innovations deliver personalized sound experiences and multi-room synchronization, creating stronger consumer appeal and supporting rapid market expansion across tech-savvy households worldwide.

- For instance, Contour 20 Black Edition uses a tweeter upgrade from Esotar 2i to Esotar 3, a sensitivity of 86 dB, an impedance of 4 ohms and a frequency response of 50 Hz to 23 kHz.

Growing Consumer Spending on Luxury Electronics

Rising disposable incomes and lifestyle upgrades are driving investments in luxury audio equipment. Premium consumers view advanced sound systems as symbols of status and comfort. The trend of home renovation and interior integration of audio systems further fuels sales. Brands offering stylish, customizable designs—such as Bang & Olufsen and Bose—are capitalizing on this demand. The growing emphasis on premium aesthetics, combined with superior acoustic performance, continues to strengthen consumer preference for high-end audio systems globally.

Key Trends & Opportunities

Expansion of Wireless and Multi-Room Audio Systems

Wireless technology adoption is reshaping the home high-end audio market. Multi-room setups allow users to control audio in multiple spaces through unified platforms. Companies like Sonos and Yamaha are investing in Wi-Fi mesh technology and app-based integration for smooth operation. This trend offers significant opportunities for smart home solution providers and encourages partnerships between audio and automation brands. The convenience of wireless connectivity, paired with minimal setup requirements, enhances appeal among modern homeowners seeking clutter-free designs.

- For instance, Alpine’s Turn1 portable speaker offers up to 12 hours of battery playtime and a 33-foot wireless pairing range to link two units via Bluetooth for True Wireless Stereo (TWS) sound. It does not support multi-room setups using unified platforms.

Growing Demand for Sustainable and Eco-Friendly Designs

Sustainability has emerged as a critical opportunity for high-end audio manufacturers. Consumers increasingly value eco-conscious materials, energy-efficient components, and recyclable packaging. Brands such as Harman Kardon and Bowers & Wilkins are incorporating sustainable production methods and renewable materials without compromising performance. Government policies promoting low-energy electronics also support this shift. This trend creates opportunities for differentiation through green certifications and positions brands favorably among environmentally aware consumers seeking ethical luxury products.

- For instance, Bang & Olufsen aims for at least 50 % of its aluminium usage by 2030 to be recycled and low-carbon produced; in 2023/24 it achieved 17 %, avoiding over 1,000 tonnes CO₂e.

Key Challenges

High Product Costs and Limited Affordability

Premium pricing remains a major restraint for market expansion, particularly in emerging economies. High-end audio systems often require substantial investment in both equipment and installation. This limits accessibility to affluent consumers and slows adoption in mid-income households. Additionally, maintenance and component replacement costs add to long-term expenses. Companies are responding by launching mid-tier variants and offering financing options, but achieving mass-market penetration remains a persistent challenge in the segment.

Intense Market Competition and Counterfeit Products

The market faces rising competition from both global brands and regional players offering cost-effective alternatives. Counterfeit and low-quality replicas further dilute brand credibility and consumer trust. These imitation products often lack certification and compromise sound quality, affecting customer experience. Leading manufacturers are enhancing distribution control, introducing authentication systems, and emphasizing brand warranties. However, maintaining brand exclusivity and pricing integrity continues to be a significant challenge in sustaining market leadership.

Regional Analysis

North America

North America leads the Home High-End Audio System Market with a 34% share, driven by high consumer spending and advanced technology adoption. The U.S. dominates due to strong demand for premium home entertainment systems and integration with smart home technologies. Brands such as Bose, Sonos, and Klipsch thrive on innovation and high-fidelity sound offerings. Consumers increasingly favor wireless and multi-room systems with voice control compatibility. The region’s growing streaming culture and preference for luxury home entertainment setups continue to boost market penetration across both residential and hospitality sectors.

Europe

Europe holds a 28% market share, supported by a strong base of luxury audio brands and discerning audiophile consumers. Germany, the U.K., and France drive growth through steady demand for sophisticated sound systems and designer aesthetics. The region’s focus on sustainable product design and energy-efficient technology aligns with evolving consumer values. Companies like Bang & Olufsen and Bowers & Wilkins lead innovation through premium materials and acoustic excellence. Smart home integration and growing adoption of high-resolution audio technologies are enhancing Europe’s position as a key hub for premium home audio adoption.

Asia-Pacific

Asia-Pacific accounts for 25% of the market share and stands as the fastest-growing region, fueled by rising disposable incomes and urbanization. China, Japan, and South Korea lead adoption with increasing consumer preference for high-quality home entertainment. Expanding middle-class populations and digital lifestyle trends drive investments in smart and wireless audio systems. Regional players are also expanding portfolios to compete with global brands. Demand for portable and Bluetooth-enabled devices among younger consumers further supports market growth, positioning Asia-Pacific as a high-potential market for future premium audio innovations.

Latin America

Latin America captures a 7% share of the Home High-End Audio System Market, driven by increasing demand for entertainment upgrades and growing urbanization. Brazil and Mexico lead regional consumption, supported by rising household incomes and greater access to international brands. The popularity of music streaming and home cinema culture is influencing demand for wireless and surround sound systems. While price sensitivity remains a challenge, mid-premium product lines and localized retail strategies are improving adoption rates. Continuous expansion of organized retail and online platforms further supports regional growth momentum.

Middle East & Africa

The Middle East & Africa region holds a 6% market share, showing steady growth driven by rising luxury lifestyle trends and hospitality investments. The UAE and Saudi Arabia are key markets where smart homes and premium audio systems are integral to modern living spaces. High-end retail expansion and growing entertainment spending boost adoption. Global brands are targeting affluent consumers through premium showrooms and exclusive partnerships. Africa’s market remains nascent but is gradually expanding with urban development and rising awareness of high-quality home entertainment systems.

Market Segmentations:

By Product Type:

By Technology:

- Wired audio devices

- Wireless audio devices

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Home High-End Audio System Market is characterized by intense competition among leading players such as Bowers & Wilkins, Harman International Industries, Audio-Technica, JBL, Dynaudio, Alpine Electronics, Bang & Olufsen, Panasonic Corporation, Bose Corporation, and Focal-JMLab. The Home High-End Audio System Market is highly competitive, driven by continuous innovation and technological advancement. Companies focus on delivering superior sound performance, sleek designs, and seamless connectivity across devices. The shift toward wireless and smart-enabled systems has intensified R&D efforts, leading to integration with voice assistants and multi-room functionality. Manufacturers emphasize product differentiation through sustainability, customization, and immersive sound experiences. Strategic collaborations with smart home and entertainment technology providers further enhance brand presence. Growing consumer expectations for premium audio quality and personalized sound environments continue to shape market competition and product evolution.

Key Player Analysis

- Bowers & Wilkins

- Harman International Industries

- Audio-Technica

- JBL

- Dynaudio

- Alpine Electronics

- Bang & Olufsen

- Panasonic Corporation

- Bose Corporation

- Focal-JMLab

Recent Developments

- In July 2024, JBL, a leading brand of HARMAN, announced the launch of JBL Modern Audio AV Receivers and Stage 2 Loudspeakers to provide a premium home theater experience. The product offers easy installation and connectivity options for consumers and can be conveniently upgraded. The AV receivers are available in four different models, while the loudspeakers offer five options for buyers to choose from.

- In July 2024, Allen & Heath, in collaboration with Harrison Audio, unveiled Harrison LiveTrax, a cutting-edge software tailored for multitrack recording and virtual soundchecks. Seamlessly integrating with Allen & Heath’s mixers, the software captures scene changes as timeline markers, facilitating effortless virtual soundchecks and timecode automation.

- In May 2024, Dolby Laboratories and VIZIO announced their partnership for the integration of the Dolby Atmos technology in VIZIO’s complete range of soundbars launched in 2024. This development comes on the back of the introduction of Dolby Vision to the entire 4K TV range of VIZIO, which would ensure a more complete visual and aural experience for audiences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing demand for smart and connected home entertainment systems.

- Wireless and multi-room audio solutions will dominate due to convenience and compatibility.

- Voice assistant integration will become a standard feature across premium audio products.

- Advancements in AI-based sound calibration will enhance personalized listening experiences.

- Sustainable materials and eco-friendly production will gain importance in product design.

- Luxury consumer spending will drive growth in designer and custom-built audio systems.

- Emerging markets in Asia-Pacific will show the fastest adoption of premium home audio.

- Integration with AR and VR platforms will create new immersive entertainment experiences.

- Online retail and direct-to-consumer channels will strengthen global brand reach.

- Strategic mergers and collaborations will shape innovation and competitive differentiation.