Market Overview

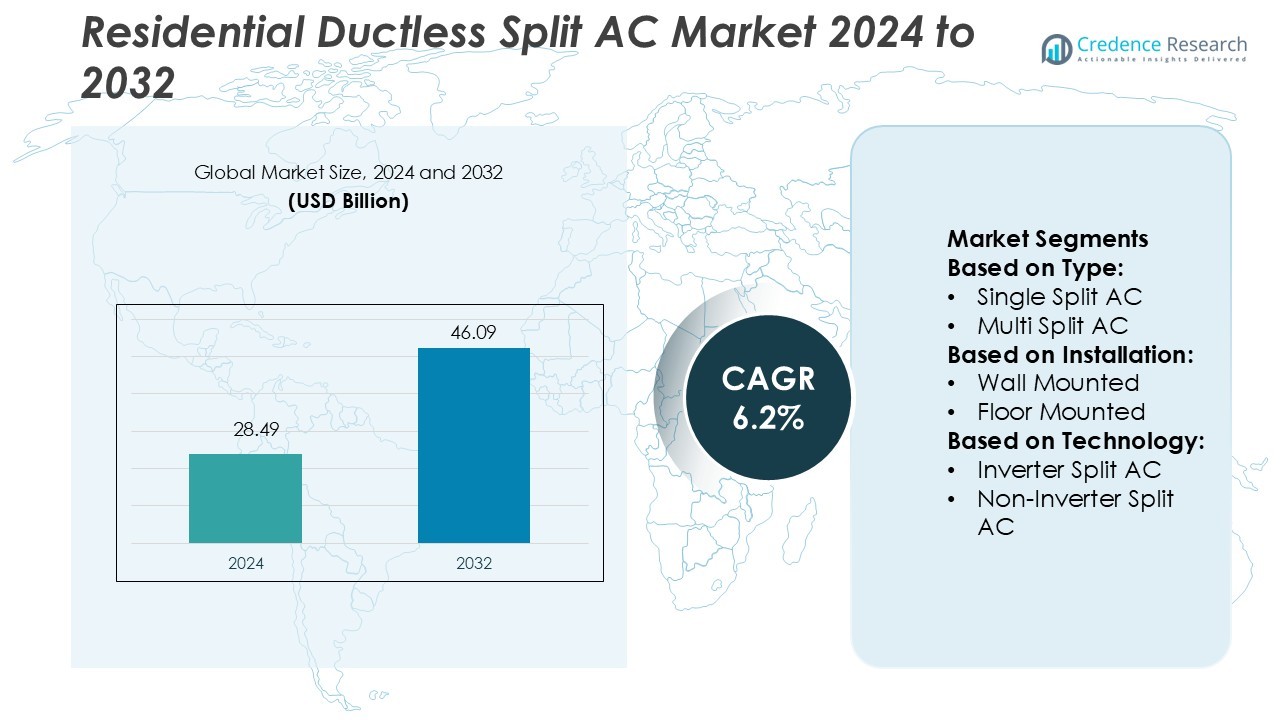

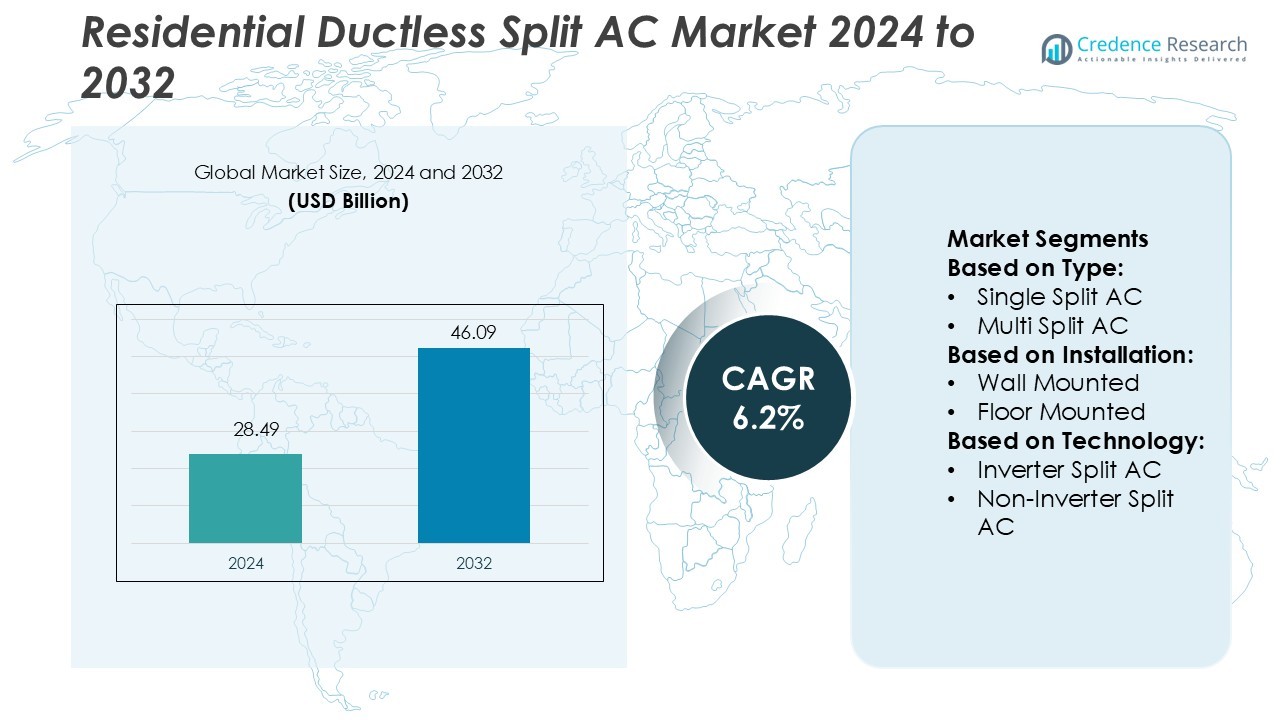

Residential Ductless Split AC Market size was valued USD 28.49 billion in 2024 and is anticipated to reach USD 46.09 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Ductless Split AC Market Size 2024 |

USD 28.49 Billion |

| Residential Ductless Split AC Market, CAGR |

6.2% |

| Residential Ductless Split AC Market Size 2032 |

USD 46.09 Billion |

The Residential Ductless Split AC Market is shaped by leading players such as LG Electronics, Johnson Controls International plc., Mitsubishi Electric Corporation, GE Appliances, Daikin Industries, Ltd., Fujitsu General, GREE Comfort, Samsung HVAC, LLC., Panasonic Corporation, and Hitachi, Ltd. These companies focus on energy-efficient systems, advanced inverter technologies, and smart home integration to strengthen their competitive positions. Their strategies include product innovation, capacity expansion, and enhanced distribution networks. Asia Pacific dominates the global market with a 38% share, supported by rising urbanization, increasing residential construction, and growing consumer preference for cost-efficient cooling solutions. This strong regional presence further accelerates product adoption and market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Residential Ductless Split AC Market was valued at USD 28.49 billion in 2024 and is projected to reach USD 46.09 billion by 2032, growing at a CAGR of 6.2%.

- Rising demand for energy-efficient cooling systems drives strong product adoption in residential spaces, supported by inverter technology and smart home integration.

- Leading players such as LG Electronics, Daikin Industries, Mitsubishi Electric, and Samsung HVAC focus on product innovation, capacity expansion, and advanced features to strengthen competitiveness.

- High installation costs and technical complexities in multi-unit setups limit faster market penetration, especially in developing economies.

- Asia Pacific holds a 38% share, leading the market due to rapid urbanization and rising home construction, while single split AC systems account for the largest segment share supported by lower installation costs and high energy efficiency.

Market Segmentation Analysis:

By Type

Single Split AC dominates the residential ductless split AC market with a 67% market share. Homeowners prefer single split units due to their lower installation cost, compact design, and easy maintenance. These systems suit single-room applications and offer better energy efficiency compared to traditional units. Multi split ACs are growing in demand but require higher upfront investments and complex installation. Rising urbanization, smaller residential spaces, and focus on cost-effective cooling drive the dominance of single split AC systems across key regional markets.

- For instance, LG’s single-zone ductless model LUU420HHV offers a cooling capacity of 42,000 BTU/h. The system’s SEER rating can reach up to 19.6, depending on the indoor unit paired with it, demonstrating the technological maturity of its single-split systems.

By Installation

Wall mounted units lead the market with a 74% share, supported by their ease of installation, efficient airflow, and cost-effectiveness. These units blend well with residential interiors and require minimal floor space. Floor mounted units serve specific architectural needs but hold a smaller market share due to limited flexibility. The rising demand for compact and aesthetic HVAC solutions in modern homes continues to push wall mounted systems to the forefront, especially in urban housing projects and multi-story buildings.

- For instance, Johnson Controls’ “High Wall Units” (YHVP / YHGW series) offer airflow ratings from 130 to 979 m³/h and cooling capacities between 1.2 kW and 3.79 kW, using 2-pipe or 4-pipe coils, AC or EC motors.

By Technology

Inverter split AC dominates with a 69% market share, driven by its superior energy efficiency and lower operating costs. These systems use variable speed compressors, enabling precise temperature control and reduced power consumption. Government energy-efficiency programs and rising electricity costs encourage consumers to shift toward inverter models. Non-inverter units remain popular in price-sensitive markets but face steady decline as consumers prioritize long-term savings. The demand surge aligns with green building trends and energy labeling regulations.

Key Growth Drivers

Rising Demand for Energy-Efficient Cooling Solutions

Energy efficiency is driving strong adoption in the residential ductless split AC market. Consumers prefer inverter-based systems that reduce power consumption and lower utility costs. Governments support this shift through energy labeling programs and incentives for energy-efficient appliances. Manufacturers integrate smart inverters and eco-friendly refrigerants to meet these expectations. For instance, Daikin’s inverter series offers up to 30% energy savings compared to traditional models. This focus on sustainable cooling aligns with rising environmental concerns and regulatory compliance, supporting long-term market expansion.

- For instance, Mitsubishi Electric’s wall-mounted unit in its MSZ-FS (M-Series) range offers a SEER2 rating of up to 32.2 when paired with a compatible single-zone outdoor unit.

Rapid Urbanization and Housing Growth

Urban population growth and increasing residential construction strongly boost ductless split AC demand. Compact housing units and high-rise buildings favor ductless systems due to their flexible installation and space-saving designs. Homeowners prefer these systems for their quiet operation and improved temperature control. Rising disposable incomes in emerging economies further accelerate purchases. For example, Gree Electric Appliances expanded its residential product line in urban India, responding to strong consumer demand. The housing sector’s growth directly increases system installations, strengthening market penetration.

- For instance, GE Appliances offers single-zone ductless mini-split systems in various sizes, such as 9,000, 12,000, 18,000, 24,000, and 36,000 BTU. For example, a high-efficiency 12,000 BTU model pairing (outdoor unit ASH112URDSE and indoor unit ASYW12URDWD in the Endure series) achieves a 27 SEER2 and 12 HSPF2 rating.

Smart Home Integration and Automation

Growing adoption of smart home technologies fuels the ductless split AC market. Consumers seek Wi-Fi-enabled systems compatible with voice assistants and mobile apps. Smart features allow users to remotely control temperature, monitor energy use, and set automated schedules. This enhances convenience and improves energy management. For instance, Carrier’s latest smart inverter series integrates with Google Home and Amazon Alexa. Rising interest in connected living environments and the expansion of IoT infrastructure accelerate smart AC installations, driving revenue growth.

Key Trends & Opportunities

Expansion of Green and Sustainable Technologies

Sustainability is becoming a core trend in product development. Manufacturers are shifting to low-GWP refrigerants and recyclable components to meet environmental regulations. Solar-compatible AC systems are gaining popularity among eco-conscious homeowners. For example, Fujitsu General offers R32-based inverter units that comply with stricter emission standards. Green building certifications and net-zero housing initiatives create opportunities for suppliers to launch eco-friendly models. This trend supports regulatory goals and enhances product differentiation in a competitive landscape.

- For instance, Daikin became the first company to apply refrigerant R-32 in residential air conditioners, noting that R-32 has a global warming potential (GWP) roughly one-third that of R-410A (675 for R-32 vs 2,090 for R-410A).

Rising Popularity of Modular and Compact Systems

Space-saving modular systems are gaining traction in urban markets. Homeowners and builders favor compact units that reduce construction complexity. Multi-split systems with zoning control are particularly popular in apartments and small houses. For instance, Johnson Controls’ modular range allows users to control up to five indoor units with one outdoor unit. This flexibility reduces operational costs and boosts appeal in both new and retrofit projects. Increasing urban density amplifies the need for compact climate control solutions.

- For instance, Fujitsu General’s AIRSTAGE Multi-Room system supports 2 to 5 indoor units connected to one outdoor unit, enabling flexible zoning layout. One outdoor model (AOHG30LAT4) offers a cooling capacity of 8.0 kW and a heating capacity of 9.6 kW.

Growth of Aftermarket and Service-Based Models

Aftermarket services are emerging as a key revenue stream. Consumers increasingly prefer maintenance subscriptions and extended warranties for reliable performance. Manufacturers and service providers offer value-added packages that include smart monitoring, regular cleaning, and quick repairs. For instance, Blue Star launched a nationwide service program for inverter models to ensure long-term efficiency. This trend strengthens customer loyalty and opens recurring income opportunities for market players.

Key Challenges

High Initial Installation and Equipment Costs

High upfront costs remain a barrier for many residential buyers. Ductless split AC systems, especially inverter models, often cost more than window or traditional central units. Installation complexity, particularly for multi-split systems, further increases expenses. This limits adoption in price-sensitive markets despite long-term savings. For example, premium inverter units from Bosch Thermotechnology are priced higher than conventional systems. Price-conscious consumers may delay purchases or opt for cheaper alternatives, slowing market expansion.

Maintenance Complexity and Skilled Labor Shortage

Ductless systems require regular maintenance to sustain performance and energy efficiency. Issues such as refrigerant leaks, clogged filters, and sensor malfunctions demand skilled technicians. Many regions lack adequate service infrastructure, leading to longer repair times and higher service costs. For instance, rural areas in developing economies often face limited technician availability for inverter-based units. This gap in maintenance capacity affects customer satisfaction and can restrain adoption in underserved markets.

Regional Analysis

North America

The North America Residential Ductless Split AC Market holds a 29% share of the global market. Demand is supported by increasing energy efficiency regulations and growing replacement of traditional HVAC systems. Consumers prefer inverter-based solutions for lower energy consumption and noise reduction. Rising adoption of smart home systems further accelerates product penetration. Key manufacturers expand distribution networks and enhance product portfolios to meet evolving consumer preferences. The U.S. dominates the regional market due to strong residential infrastructure and favorable energy policies. Canada also contributes significantly with rising demand for sustainable and cost-efficient cooling solutions.

Europe

The Europe Residential Ductless Split AC Market accounts for a 22% share of the global market. Demand is driven by the shift toward energy-efficient and low-emission cooling systems. Countries such as Germany, France, and the U.K. are adopting inverter-based AC units to comply with strict energy regulations. The increasing focus on smart home integration also supports regional growth. Governments encourage heat pump and ductless technologies through subsidies and incentives. Manufacturers invest in R&D to offer advanced climate control features. The region’s aging infrastructure further boosts replacement demand across residential applications.

Asia Pacific

The Asia Pacific Residential Ductless Split AC Market leads globally with a 34% market share. Rapid urbanization and rising residential construction fuel market expansion. Strong demand in China, Japan, India, and South Korea drives unit sales. Consumers favor inverter and energy-saving technologies due to rising electricity costs and hot climates. Manufacturers strengthen their presence through local production facilities and price-competitive product lines. Government initiatives promoting energy efficiency boost product adoption further. Growing middle-class income levels support sustained demand for advanced and smart ductless systems in urban and semi-urban areas.

Latin America

The Latin America Residential Ductless Split AC Market represents a 7% share of the global market. Rising temperatures and growing residential construction activities drive adoption. Brazil and Mexico lead the regional demand, supported by rising consumer spending on modern cooling systems. Growing awareness of energy-efficient technologies encourages the shift from window units to ductless split systems. Manufacturers focus on expanding their distribution channels to penetrate untapped markets. Economic growth and favorable climatic conditions further strengthen market expansion. The region’s developing economies create significant opportunities for affordable and efficient AC solutions.

Middle East & Africa

The Middle East & Africa Residential Ductless Split AC Market holds an 8% share of the global market. High temperatures and rising urbanization accelerate the need for efficient cooling systems. GCC countries lead the regional demand due to strong residential construction growth and infrastructure investments. Consumers prefer ductless split ACs for their energy efficiency, ease of installation, and advanced climate control. Key vendors expand product lines tailored to high ambient temperature conditions. Government programs encouraging energy savings support adoption. Growing disposable incomes and increasing real estate development further strengthen the regional market outlook.

Market Segmentations:

By Type:

- Single Split AC

- Multi Split AC

By Installation:

- Wall Mounted

- Floor Mounted

By Technology:

- Inverter Split AC

- Non-Inverter Split AC

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Residential Ductless Split AC Market is shaped by leading companies including LG Electronics, Johnson Controls International plc., Mitsubishi Electric Corporation, GE Appliances, Daikin Industries, Ltd., Fujitsu General, GREE Comfort, Samsung HVAC, LLC., Panasonic Corporation, and Hitachi, Ltd. The Residential Ductless Split AC Market is becoming increasingly competitive with rapid advancements in technology and growing consumer expectations. Manufacturers are focusing on enhancing energy efficiency, integrating smart home features, and improving product durability. Innovation in inverter technology and the use of eco-friendly refrigerants are key priorities to meet regulatory standards and consumer demand for sustainable solutions. Companies are expanding their regional presence through strategic partnerships, distribution network enhancements, and targeted marketing campaigns. Price competitiveness, product differentiation, and after-sales service quality are emerging as major factors shaping brand positioning. This intense competition drives continuous improvement and accelerates market growth.

Key Player Analysis

- LG Electronics

- Johnson Controls International plc.

- Mitsubishi Electric Corporation

- GE Appliances

- Daikin Industries, Ltd.

- Fujitsu General

- GREE Comfort

- Samsung HVAC, LLC.

- Panasonic Corporation

- Hitachi, Ltd.

Recent Developments

- In April 2025, Mitsubishi Electric Trane HVAC US LLC launched a new line of products utilizing a low global warming potential (GWP) refrigerant for environmental sustainability in light commercial and residential heating and air-conditioning solutions.

- In July 2024, LG Electronics (LG) announced plans to build a new Air Solution Research and Development (R&D) Lab in Frankfurt, Germany. This new state-of-the-art facility would join existing LG Air Solution Labs in Changwon, South Korea, and Atlanta, Georgia, U.S., to form a global R&D triangle.

- In May 2024, Samsung and Lennox Announce the Establishment of a Joint Venture for Ductless Mini Split, AC, Heat Pump, and Variable Refrigerant Flow HVAC Systems in the United States and Canada. The newly established joint venture will be called Samsung Lennox HVAC North America.

- In January 2024, Carrier Corporation acquired Viessmann Climate Solutions to expand its footprint in mini split air conditioning. Carrier now extends its operations in Europe residential and light commercial segment and will incorporate Viessmann’s energy-efficient and renewable HVAC technology, and this acquisition helped Carrier strengthen its global climate sustainable solutions position in the marketplace.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Installation, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient cooling systems will continue to grow across residential sectors.

- Smart home integration will increase the adoption of connected ductless split AC units.

- Manufacturers will focus more on eco-friendly refrigerants to meet sustainability goals.

- Inverter technology will become a standard feature in most residential product lines.

- Government energy regulations will push for higher efficiency standards globally.

- Expansion in developing markets will create strong opportunities for low-cost product ranges.

- Product innovation will emphasize noise reduction, compact design, and improved performance.

- Strategic partnerships and distribution expansion will strengthen market reach.

- Consumer preference will shift toward smart, app-controlled, and voice-enabled AC systems.

- Rising temperatures and urbanization will drive steady market growth worldwide.