Market Overview:

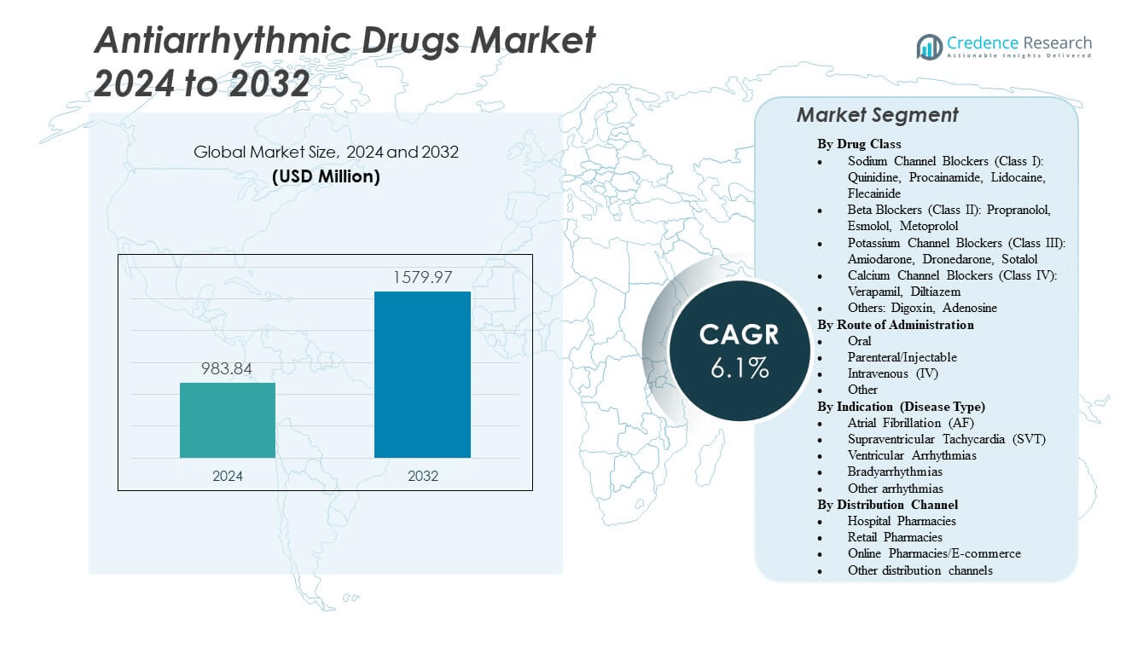

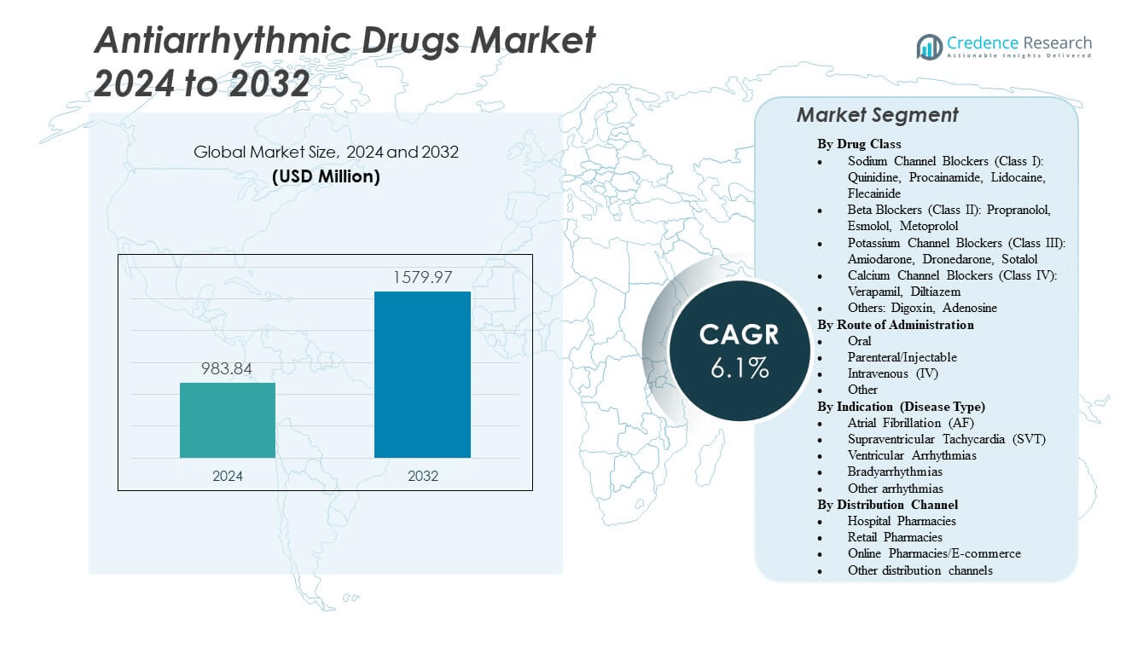

The Antiarrhythmic Drugs Market is projected to grow from USD 983.84 million in 2024 to an estimated USD 1,579.97 million by 2032, with a compound annual growth rate (CAGR) of 6.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antiarrhythmic Drugs Market Size 2024 |

USD 983.84 million |

| Antiarrhythmic Drugs Market, CAGR |

6.1% |

| Antiarrhythmic Drugs Market Size 2032 |

USD 1,579.97 million |

The market growth is driven by the increasing prevalence of arrhythmias, particularly atrial fibrillation and ventricular tachycardia. As populations age and lifestyle factors contribute to heart conditions, the demand for effective treatments grows. Advances in drug development, including targeted therapies and improved drug formulations, are further propelling market expansion. The rising awareness of cardiovascular health and the availability of advanced treatment options are also contributing factors.

Geographically, North America leads the Antiarrhythmic Drugs Market, driven by advanced healthcare infrastructure and high healthcare spending. Europe follows closely, with a steady market driven by aging populations and strong healthcare systems. The Asia Pacific region, particularly China and India, represents the fastest-growing market, fueled by improving healthcare access, rising disposable incomes, and a high burden of cardiovascular diseases

Market Insights:

- The Antiarrhythmic Drugs Market is projected to grow from USD 983.84 million in 2024 to an estimated USD 1,579.97 million by 2032, with a compound annual growth rate (CAGR) of 6.1% from 2024 to 2032.

- Increasing prevalence of arrhythmias, particularly in aging populations, is driving the demand for antiarrhythmic therapies.

- Advancements in drug formulations and the development of targeted therapies are boosting market growth.

- Limited access to healthcare in emerging regions may restrain the widespread adoption of antiarrhythmic drugs.

- North America leads the market due to a strong healthcare system and high treatment rates for arrhythmias.

- Europe follows closely, supported by robust healthcare frameworks and an aging population.

- Asia Pacific represents the fastest-growing region, with rising healthcare access and a high incidence of cardiovascular diseases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Incidence of Cardiac Arrhythmias

The rising prevalence of cardiac arrhythmias significantly contributes to the growth of the Antiarrhythmic Drugs Market. These conditions, including atrial fibrillation and ventricular tachycardia, have become increasingly common due to aging populations and unhealthy lifestyle habits. The increasing number of patients diagnosed with arrhythmias is driving demand for effective treatment options, thereby expanding the market for antiarrhythmic drugs. As more individuals seek long-term care, pharmaceutical companies are likely to continue developing tailored solutions to meet this growing demand.

- For instance, iRhythm Technologies’ Zio long-term continuous monitoring (LTCM) service, evaluated in the AVALON study, enabled a diagnostic yield of new arrhythmia diagnoses in 428,707 commercially insured U.S. patients and demonstrated the highest diagnostic yield, lowest retesting rate, and lowest rate of cardiovascular events compared to all other monitoring modalities in clinical practice.

Advancements in Drug Development and Technology

Recent advancements in drug development technology have led to the introduction of innovative antiarrhythmic agents that offer improved efficacy and safety profiles. These advancements, particularly in genetic and molecular research, are enhancing the therapeutic outcomes of treatments for arrhythmic conditions. Furthermore, the continuous development of new drug formulations that target specific heart arrhythmia mechanisms is driving the market expansion. These technologies ensure that patients receive optimal treatments with fewer side effects, helping improve quality of life for patients with chronic heart conditions.

Rising Awareness of Cardiac Health

Growing awareness regarding cardiac health is encouraging early detection and management of arrhythmias, further boosting the Antiarrhythmic Drugs Market. Health campaigns and medical research have contributed to an increase in patient knowledge, prompting timely intervention. This increased awareness also leads to more patients opting for long-term management, which sustains demand for antiarrhythmic drugs. As the population becomes more proactive about their cardiovascular health, the market is expected to see continued growth with higher adoption of preventive treatments.

- For instance, the American Heart Association’s “Go Red for Women” campaign led to an average 494% increase (range: 211%-789%) in search volume for “Go Red for Women” and related cardiac terms every February during active campaign months over a 15-year period, as measured in a peer-reviewed journal study published in 2020.

Government Initiatives and Reimbursement Policies

Government initiatives aimed at improving healthcare infrastructure and providing reimbursement policies for arrhythmia treatments contribute to the market growth. Many countries are investing in the healthcare sector, expanding access to treatments for heart-related conditions. These favorable policies make antiarrhythmic drugs more accessible, particularly in emerging markets, stimulating further demand. Governments are also supporting research and innovation, ensuring that effective antiarrhythmic therapies reach a wider population in need of care.

Market Trends:

Shift Towards Personalized Medicine in Arrhythmia Treatment

A key trend in the Antiarrhythmic Drugs Market is the growing emphasis on personalized medicine. Tailoring treatments based on individual genetic profiles enhances the effectiveness of therapies. Pharmaceutical companies are focusing on developing drugs that cater to specific patient subgroups, optimizing outcomes for those with distinct arrhythmia conditions. This shift towards personalized care is expected to drive the demand for specialized antiarrhythmic treatments. These therapies offer more targeted and precise options, leading to fewer side effects and better long-term results for patients.

Integration of Digital Health Solutions in Treatment Management

The integration of digital health solutions, such as wearable devices and mobile health applications, is transforming the management of arrhythmia conditions. Patients are increasingly using these technologies to monitor their heart health and medication adherence. The data collected by these devices allows healthcare providers to make more informed decisions about antiarrhythmic drug prescriptions, creating a more connected approach to managing arrhythmia. The ability to track and adjust treatment plans in real-time helps ensure better control of the condition, improving overall patient outcomes.

- For instance, the STROKE AF study shows a 10-fold increase in atrial fibrillation detection rates for stroke patients using the Reveal LINQ™ ICM over three years, compared to standard methods. At 3 years, 21.7% of patients in the device arm had AF detected, compared to 2.4% in controls, with a significant hazard ratio of 10.0.

Focus on Combination Therapies for Enhanced Efficacy

There is a growing trend towards combination therapies in the Antiarrhythmic Drugs Market. Combining antiarrhythmic drugs with other therapeutic agents enhances the efficacy of treatment and reduces the risks associated with monotherapy. This trend is gaining momentum as researchers explore synergistic drug combinations that can offer superior results in managing various types of arrhythmias, ensuring improved patient outcomes. Combination therapies provide a multifaceted approach to treatment, offering more comprehensive management for patients with complex arrhythmia conditions.

- For example, in the ATHENA trial post-hoc analysis, dronedarone significantly reduced the annual stroke rate compared with placebo — 1.2% vs. 1.8% — with a hazard ratio of 0.66 (95% CI: 0.46–0.96; p = 0.027). This finding demonstrates dronedarone’s efficacy in lowering stroke risk among patients with atrial fibrillation or flutter.

Development of Long-Acting Formulations

The development of long-acting formulations is another important trend in the Antiarrhythmic Drugs Market. Extended-release formulations allow for fewer doses throughout the day, enhancing patient compliance and treatment effectiveness. These innovations are especially beneficial for patients requiring chronic treatment for arrhythmias, as they help maintain stable drug levels in the body and reduce the frequency of dose administration. Long-acting drugs help streamline treatment regimens, which leads to higher adherence rates and improved therapeutic outcomes.

Market Challenges Analysis:

Regulatory Hurdles in Drug Approvals

One of the main challenges faced by the Antiarrhythmic Drugs Market is the stringent regulatory requirements for drug approval. The approval process for new antiarrhythmic drugs is lengthy and expensive, often resulting in delays in bringing innovative treatments to market. These regulatory hurdles can deter companies from investing in the development of new antiarrhythmic agents, slowing down market expansion. Regulatory authorities’ strict scrutiny ensures patient safety but can also limit the speed at which new treatments become available to the public.

Side Effects and Safety Concerns

The use of antiarrhythmic drugs is often associated with side effects, including proarrhythmia, which can limit their effectiveness. Many of these drugs can cause severe complications if not properly monitored, leading to concerns over their safety. This presents a challenge for the Antiarrhythmic Drugs Market as healthcare providers must balance the potential risks and benefits of these treatments. With growing concerns about patient safety, there is an increasing focus on developing safer alternatives that offer improved efficacy with fewer side effects.

Market Opportunities:

Expanding Access to Healthcare in Emerging Markets

Emerging markets present a significant opportunity for growth in the Antiarrhythmic Drugs Market. Increased healthcare access and improvements in infrastructure are enabling more patients to receive timely treatment for arrhythmias. As healthcare systems in countries such as China and India evolve, there is a growing demand for affordable and effective antiarrhythmic drugs. This opens new avenues for pharmaceutical companies to expand their reach in these high-potential regions. The rise of middle-class populations and increased healthcare spending will continue to drive demand for these therapies.

Technological Innovations in Drug Development

Technological innovations in drug development, including artificial intelligence and biotechnology, offer substantial opportunities for the Antiarrhythmic Drugs Market. These advancements can lead to the discovery of more effective and targeted antiarrhythmic agents, especially for patients with resistant arrhythmias. Such innovations promise to revolutionize treatment strategies, increasing the market potential for pharmaceutical companies focused on developing cutting-edge drugs for arrhythmia management. These technologies can also accelerate the pace of research and improve the overall development cycle of new therapies.

Market Segmentation Analysis:

By Drug Class

The Antiarrhythmic Drugs Market is divided into several drug classes, each serving specific arrhythmia types. Sodium Channel Blockers (Class I), such as Quinidine, Procainamide, Lidocaine, and Flecainide, are commonly used to treat various arrhythmias by inhibiting the sodium channels that regulate heart muscle contraction. Beta Blockers (Class II) like Propranolol, Esmolol, and Metoprolol reduce heart rate and blood pressure, making them effective in controlling atrial fibrillation and other arrhythmic disorders. Potassium Channel Blockers (Class III) like Amiodarone, Dronedarone, and Sotalol work by prolonging the action potential, helping control irregular heart rhythms. Calcium Channel Blockers (Class IV), including Verapamil and Diltiazem, are used to treat supraventricular arrhythmias by blocking calcium influx in cardiac cells. Other drugs like Digoxin and Adenosine are also used for specific arrhythmia types, further enhancing the drug class diversity in this market.

- For instance, metoprolol succinate (Novartis) reduced relapses into atrial fibrillation to 48.7% versus 59.9% for placebo in a double-blind study of 394 patients after cardioversion, as published by Kühlkamp et al. in the Journal of the American College of Cardiology.

By Route of Administration

The Antiarrhythmic Drugs Market includes several routes of administration that cater to different patient needs. Oral administration is commonly used due to its convenience and suitability for long-term treatment. Parenteral/Injectable methods are used when immediate drug absorption is required, particularly in emergency settings. Intravenous (IV) administration provides rapid action and is ideal for acute conditions requiring precise drug delivery. Other methods, including sublingual or transdermal delivery, are emerging but remain less common. The choice of route affects drug efficacy and patient compliance, influencing the market’s growth in these segments.

By Indication (Disease Type)

The Antiarrhythmic Drugs Market addresses various arrhythmias, including Atrial Fibrillation (AF), Supraventricular Tachycardia (SVT), Ventricular Arrhythmias, and Bradyarrhythmias. AF is the most common arrhythmia treated with antiarrhythmic drugs due to its widespread occurrence in the aging population. SVT and Ventricular Arrhythmias also represent significant markets as they are often associated with severe, life-threatening conditions. Bradyarrhythmias, characterized by a slower-than-normal heart rate, require treatment to prevent further complications. The diverse range of indications provides opportunities for drug developers to target multiple patient groups and drive growth in the market.

- For instance, intravenous amiodarone (Fresenius Kabi and others) controlled life-threatening ventricular tachyarrhythmias in 50% of patients within the first 24 hours of intravenous administration in a study of 22 critically ill coronary patients.

By Distribution Channel

The Antiarrhythmic Drugs Market benefits from various distribution channels, including Hospital Pharmacies, Retail Pharmacies, Online Pharmacies/E-commerce, and other specialized distribution avenues. Hospital pharmacies play a crucial role, particularly in the acute treatment of arrhythmias in clinical settings. Retail pharmacies ensure broad access to antiarrhythmic drugs for outpatient care. The growing trend toward Online Pharmacies and E-commerce platforms offers greater accessibility, convenience, and competitive pricing, especially in regions with expanding digital healthcare infrastructure. These distribution channels contribute to increased drug availability, enhancing market penetration and accessibility for patients worldwide.

Segmentation:

By Drug Class

- Sodium Channel Blockers (Class I): Quinidine, Procainamide, Lidocaine, Flecainide

- Beta Blockers (Class II): Propranolol, Esmolol, Metoprolol

- Potassium Channel Blockers (Class III): Amiodarone, Dronedarone, Sotalol

- Calcium Channel Blockers (Class IV): Verapamil, Diltiazem

- Others: Digoxin, Adenosine

By Route of Administration

- Oral

- Parenteral/Injectable

- Intravenous (IV)

- Other

By Indication (Disease Type)

- Atrial Fibrillation (AF)

- Supraventricular Tachycardia (SVT)

- Ventricular Arrhythmias

- Bradyarrhythmias

- Other arrhythmias

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies/E-commerce

- Other distribution channels

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Antiarrhythmic Drugs Market in North America held approximately 37.55 % of the global market share in 2024. The region benefits from well‑developed healthcare infrastructure and high prevalence of cardiovascular disorders, which increase demand for arrhythmia therapies. It features a strong pipeline of innovative agents and regulatory support from bodies like the Food and Drug Administration (FDA) that facilitate approvals and market access. Insurance coverage and reimbursement schemes increase patient access to antiarrhythmic drugs, boosting uptake. The United States dominates within the region thanks to high arrhythmia treatment rates and robust clinical research. High per‑capita spending on cardiovascular care drives further growth. The region maintains its leadership due to these favorable health‑system and demographic drivers.

Europe

In Europe the Antiarrhythmic Drugs Market accounted for about 29.5 % of global share in 2024. Aging populations and increasing arrhythmia incidence in countries such as Germany, the UK and France create sustained demand. Healthcare systems across the region emphasise cardiovascular disease management programs and expand access to arrhythmia therapies. Strong regulation by the European Medicines Agency (EMA) ensures safety and effectiveness of novel treatments, which supports adoption. Differences in reimbursement policies across countries affect uptake speed, but overall the trend remains positive. Manufacturers target the region with new formulations and long‑acting therapies, leveraging high patient awareness. The region positions itself as a stable growth market despite moderate pace compared to emerging regions.

Asia Pacific and Other Regions

The Asia Pacific region held roughly 24.3 % share of the global Antiarrhythmic Drugs Market in 2024 and represents the fastest‑growing region. Countries such as China, India and Japan face rising cardiovascular disease incidence, expanding middle‑class populations and improving healthcare access, which drive market growth. Healthcare infrastructure improvements and regulatory reforms accelerate drug approvals and distribution. Latin America and the Middle East & Africa regions show smaller shares but present emerging opportunities as healthcare investment increases and arrhythmia awareness grows. In Latin America, growing healthcare spending and partnerships between local and global pharmaceutical firms are broadening access. In the Middle East & Africa region, government initiatives to tackle cardiovascular disease burden and upgrade systems spur uptake of arrhythmia therapies. These dynamics position these regions for long‑term growth in the global market context.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Pfizer Inc.

- Novartis AG

- Sanofi S.A.

- GlaxoSmithKline plc

- Bristol‑Myers Squibb Company

- Merck & Co., Inc.

- AstraZeneca plc

- Johnson & Johnson (Janssen Pharma)

- Mylan N.V. (now Viatris Inc.)

- Bayer AG

- Abbott Laboratories

- Teva Pharmaceutical Industries Ltd.

- Baxter International Inc.

- Mayne Pharma

- Upsher‑Smith Laboratories LLC

Competitive Analysis:

The competitive landscape of the Antiarrhythmic Drugs Market features several major pharmaceutical firms that drive innovation and portfolio expansion. Companies such as Pfizer Inc., Novartis AG, Sanofi S.A. and GlaxoSmithKline plc maintain strong positions through extensive research, well‑established brands and global reach. These players focus on developing next‑generation antiarrhythmic agents and securing regulatory approvals to expand market share. They negotiate broad distribution agreements and engage in strategic partnerships to extend geographic penetration. Mid‑sized firms and generics specialists enhance competitive pressure by offering cost‑effective options and accelerating market access. Pricing strategies and patent lifecycles further influence competitive dynamics by shaping entry timing for new drugs and generics. Continuous investment in clinical trials and the introduction of novel therapies determine long‑term market positioning and influence competitive intensity.

Recent Developments:

- In September 2025, Pfizer Inc. announced the acquisition of Metsera, a clinical-stage biopharmaceutical company focused on obesity and cardiometabolic diseases. This acquisition, valued at approximately $4.9 billion, propels Pfizer’s presence in the antiarrhythmic and broader cardiovascular drug market by adding differentiated oral and injectable therapy candidates to its pipeline.

Report Coverage:

The research report offers an in-depth analysis based on Drug Class, Route of Administration, Indication (Disease Type) and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continued development of targeted therapies will drive the market as precision medicine gains traction.

- Emerging markets, particularly in Asia Pacific, will fuel demand due to increasing healthcare access and rising arrhythmia incidences.

- Increased adoption of digital health solutions, including wearable devices for monitoring arrhythmias, will create new avenues for market growth.

- The growing geriatric population, with higher arrhythmia rates, will continue to expand the patient base for antiarrhythmic drugs.

- Combination therapies are expected to gain prominence, providing better efficacy and minimizing side effects.

- Ongoing advancements in biotechnology will lead to more efficient, personalized antiarrhythmic treatments.

- Regulatory support and faster drug approvals, especially for generics, will drive competitive dynamics in the market.

- The development of long-acting formulations will enhance patient adherence, further promoting market expansion.

- Increasing awareness about cardiovascular health will lead to earlier diagnosis and proactive treatment, expanding market opportunities.

- Strategic partnerships and collaborations among pharmaceutical companies will enable broader distribution networks and global reach.