Market Overview

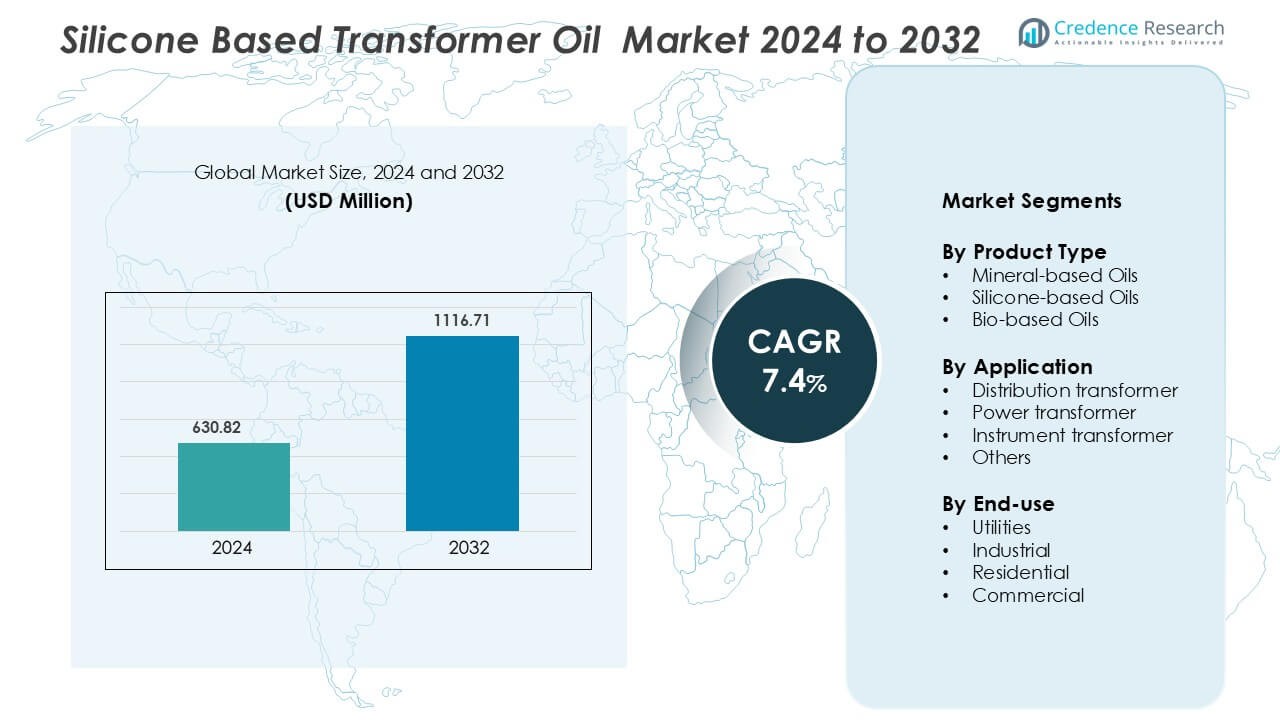

Silicone based Transformer oil Market was valued at USD 630.82 million in 2024 and is anticipated to reach USD 1116.71 million by 2032, growing at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone based Transformer oil Market Size 2024 |

USD 630.82 Million |

| Silicone based Transformer oil Market, CAGR |

7.4% |

| Silicone based Transformer oil Market Size 2032 |

USD 1116.71 Million |

The Silicone-Based Transformer Oil Market is characterized by strong competition among major players focusing on product innovation, performance reliability, and environmental compliance. Key companies include Dow, Cargill, Incorporated, Eden Transformer Oil, Changzhou Juyou New Material Tech, BENZOIL, Antala, Clearco Products, DRP Silicone, Aevitas, and JIT Silicones Plus. These manufacturers emphasize advanced silicone formulations that offer superior dielectric strength, fire resistance, and long service life under extreme conditions. Dow and Cargill maintain technological leadership through sustainable product portfolios and extensive distribution networks. Asia-Pacific leads the market with a 33% share, driven by rapid industrial expansion, renewable energy deployment, and growing transformer upgrades across China, India, and Japan, solidifying its position as the global growth hub.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Silicone-Based Transformer Oil Market was valued at USD 630.82 million in 2024 and is projected to reach USD 1116.71 million by 2032, growing at a CAGR of 7.4% during the forecast period.

- The market growth is driven by rising demand for fire-resistant insulating fluids and the expansion of smart grid and renewable energy networks across industrial and utility sectors.

- Increasing adoption of eco-friendly silicone formulations and technological advancements in dielectric stability are shaping major market trends, improving transformer efficiency and durability.

- Leading companies such as Dow, Cargill, Incorporated, and Eden Transformer Oil dominate the competitive landscape through innovation, regional expansion, and sustainability-driven strategies.

- Asia-Pacific leads with a 33% share, followed by North America at 29%, while the silicone-based oils segment holds the largest product share due to its superior performance and regulatory compliance advantages.

Market Segmentation Analysis:

By Product Type

Silicone-based oils dominate the silicone-based transformer oil market due to their superior thermal stability and fire-resistant properties. These oils maintain stable viscosity across temperature variations and provide enhanced dielectric strength compared to mineral-based oils. The demand is rising from high-voltage applications where safety and reliability are critical. Bio-based oils are gaining attention for environmental benefits but remain limited by cost and performance gaps. The preference for silicone-based variants continues to strengthen across industries prioritizing longer operational life and reduced fire hazards in transformer systems.

- For instance, Xiameter PMX-561 (from Dow Chemical Company) delivers a dielectric breakdown voltage of 50 kV and retains a viscosity of 50 mm²/s at 25 °C.

By Application

Power transformers account for the largest share of the market, driven by the growing need for reliable insulation materials in high-capacity transmission systems. Silicone-based oils are used to reduce maintenance frequency and ensure consistent dielectric performance under heavy load conditions. Distribution transformers also represent a significant segment, supported by expanding urban electricity infrastructure. The adoption in instrument transformers remains steady, where precision and stability are vital for accurate measurements. These applications collectively reflect the industry’s move toward high-performance insulating fluids with low environmental impact.

- For instance, LK‑STO 50 from Elkay Chemicals Pvt. Ltd. exhibits a dielectric breakdown voltage of ~50 kV and a viscosity of ~50 cSt at 25 °C, helping maintain stable performance under load.

By End-use

The utilities segment leads the market, fueled by large-scale grid modernization projects and substation upgrades. Power distribution companies rely on silicone-based transformer oils to minimize fire risks and extend service intervals. The industrial sector follows, driven by manufacturing and heavy-duty operations requiring stable performance under harsh environments. Commercial and residential users adopt these oils at a smaller scale, mainly for reliability and safety in compact transformers. Overall, the utilities sector remains the primary growth engine, benefiting from investments in sustainable and high-efficiency power networks.

Key Growth Drivers

Rising Demand for Fire-Resistant Transformer Fluids

The increasing emphasis on electrical safety is a major driver of the silicone-based transformer oil market. Silicone oils possess a high flash point exceeding 300°C, making them ideal for transformers installed in densely populated and enclosed areas. Their self-extinguishing properties reduce fire hazards, ensuring compliance with strict safety standards in power and industrial facilities. The ongoing urbanization and expansion of renewable energy grids are accelerating transformer installations in compact environments, where non-flammable oils are preferred. Utilities and industrial operators increasingly favor silicone-based formulations for critical applications to improve operational reliability and minimize risk of fire-related outages.

- For instance, STO‑50 from Clearco Products Co. Inc. reports a flash point (open cup) of > 300 °C and a fire point of 370 °C, enabling safer use in indoor or densely populated installations.

Expanding Power Transmission and Distribution Infrastructure

Global investments in grid modernization and renewable energy integration are creating strong demand for silicone-based transformer oils. These oils enable transformers to operate efficiently under high voltage and fluctuating thermal conditions, making them suitable for next-generation smart grids. Countries in Asia-Pacific, Europe, and North America are expanding their power transmission capacities to support industrialization and electrification. Silicone-based oils, due to their excellent dielectric properties and long service life, are increasingly replacing conventional mineral oils in high-load transformers. This shift is supported by government-led initiatives to reduce transformer maintenance costs and improve grid reliability across both urban and rural installations.

- For instance, the high fire point of 370 °C (open cup) of PMX-561 helps reduce fire-risk maintenance interventions in both compact urban and remote rural installations.

Increasing Focus on Environmental and Regulatory Compliance

Growing environmental regulations favor the use of non-toxic and biodegradable insulating fluids, boosting silicone oil adoption. These oils have low volatility and minimal environmental impact compared to mineral-based alternatives. Regulatory frameworks promoting sustainable energy practices, such as EU REACH and EPA standards, are compelling utilities to transition toward eco-friendly materials. Manufacturers are responding with advanced silicone-based formulations that combine performance stability and environmental safety. The reduced risk of oil leakage and contamination also supports compliance with wastewater and soil protection norms. As a result, silicone transformer oils are gaining traction in markets emphasizing sustainability and regulatory adherence.

Key Trends & Opportunities

Integration of Silicone Oils in Smart Grid Systems

The adoption of digital and smart grid technologies is opening new opportunities for silicone-based transformer oils. Modern grid systems require high-performance insulating fluids capable of sustaining fluctuating loads and rapid switching frequencies. Silicone oils, known for their superior oxidation resistance and consistent dielectric behavior, fit these operational demands. With global investment in smart transformers and remote monitoring technologies, utilities seek fluids that enhance reliability and reduce maintenance frequency. The compatibility of silicone oils with digital monitoring sensors further supports predictive maintenance models, making them a critical component in evolving smart grid ecosystems.

- For example, the datasheet for XIAMETER PMX-561 shows a dissipation factor of 0.0001 at 25 °C and a flash point over 300 °C (open cup), demonstrating durability under variable conditions.

Technological Innovations in Silicone Fluid Formulations

Continuous R&D efforts are driving innovations in transformer fluid chemistry, leading to enhanced silicone oil formulations. Manufacturers are focusing on increasing oxidation stability, viscosity control, and heat dissipation to improve performance longevity. The development of hybrid silicone blends offers improved compatibility with existing transformer components while reducing energy losses. Emerging players are also investing in nanotechnology-based additives to enhance the dielectric strength of silicone fluids. These advancements provide opportunities for differentiation and cost efficiency, particularly in high-voltage and offshore power applications where long-term stability and minimal environmental impact are crucial.

- For instance, PMX-561 is documented to maintain volume resistivity of 1.0 × 10¹⁴ ohm·cm and dissipation factor of 0.0001 at 25 °C, aiding stable performance in demanding environments.

Growing Adoption in Renewable Energy Installations

Renewable energy projects such as wind and solar farms are increasingly using silicone-based transformer oils due to their high thermal endurance and environmental safety. These installations often face temperature extremes and remote maintenance challenges, requiring fluids that ensure reliability under fluctuating loads. Silicone oils provide long service intervals and superior moisture resistance, making them ideal for outdoor and offshore environments. Governments supporting renewable capacity expansion further drive this adoption. As renewable power penetration rises globally, the demand for silicone-based insulating fluids is expected to grow steadily across distributed generation and storage systems.

Key Challenges

High Production and Material Costs

The relatively high cost of silicone-based transformer oils remains a major barrier to widespread adoption. The production process involves premium-grade raw materials like polydimethylsiloxane (PDMS), which are more expensive than mineral oil components. This cost gap restricts usage mainly to high-value applications where safety and performance outweigh price considerations. Small and mid-sized utilities, especially in developing economies, often opt for lower-cost alternatives despite reduced durability. Moreover, limited large-scale production capacity among key suppliers contributes to price fluctuations. Overcoming this challenge requires process optimization, economies of scale, and technological advancements to reduce overall manufacturing costs.

Limited Compatibility and Retrofitting Challenges

Another challenge lies in the limited compatibility of silicone oils with existing transformer materials and mineral-based systems. Retrofitting older transformers requires careful cleaning and material replacement to prevent cross-contamination, which adds operational downtime and expenses. Some transformer insulation components, such as seals and gaskets, may degrade faster when exposed to silicone-based fluids. This limits their use in legacy systems not originally designed for such oils. Manufacturers are working to address this by developing universal-compatible silicone formulations and providing clear retrofitting guidelines. However, until these solutions are fully standardized, compatibility issues will remain a constraint on market expansion.

Regional Analysis

North America

North America holds a market share of 29% in the silicone-based transformer oil market, driven by grid modernization and renewable energy integration across the U.S. and Canada. The region’s utilities emphasize fire-resistant and long-lasting insulating fluids for substations and high-voltage applications. The U.S. Environmental Protection Agency’s strict regulations on dielectric fluids further promote the use of silicone-based oils. Key manufacturers such as Dow and Cargill, Incorporated are advancing high-performance formulations for industrial and utility sectors. Strong investments in smart grids and offshore wind projects continue to reinforce North America’s leadership in this segment.

Europe

Europe accounts for 25% of the market, supported by stringent environmental regulations and growing renewable power generation. Countries such as Germany, the U.K., and France prioritize eco-friendly transformer fluids to align with REACH and EU sustainability directives. Utilities are increasingly transitioning from mineral oils to silicone-based alternatives due to safety and performance advantages. The region’s emphasis on decarbonizing the energy grid and expanding cross-border power infrastructure drives continuous adoption. Major European players like BENZOIL and Antala are focusing on product innovations that enhance oxidation stability and extend transformer operational life cycles.

Asia-Pacific

Asia-Pacific dominates with a 33% market share, led by rapid industrialization and large-scale infrastructure development in China, India, and Japan. The region’s expanding power transmission networks and renewable energy capacity drive strong demand for high-durability transformer oils. Government initiatives supporting smart grids and fire-safe substations encourage silicone-based fluid usage. Local manufacturers such as Changzhou Juyou New Material Tech and JIT Silicones Plus contribute to cost-effective regional supply. The combination of high population density, growing electricity demand, and modernization of utility infrastructure positions Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America captures 8% of the silicone-based transformer oil market, primarily driven by grid upgrades and renewable energy investments in Brazil, Mexico, and Chile. Utilities are gradually adopting silicone oils to enhance transformer reliability in high-temperature and humid conditions. The region’s focus on reducing maintenance costs and improving fire safety standards is boosting the shift from mineral-based to silicone-based oils. Companies such as Eden Transformer Oil are expanding distribution partnerships to meet regional demand. Despite slower adoption compared to Asia-Pacific, Latin America shows steady growth potential supported by sustainable energy policies.

Middle East & Africa

The Middle East & Africa region represents 5% of the market, driven by expanding energy infrastructure and industrial development in the Gulf countries and South Africa. Demand for silicone-based transformer oils is rising in high-temperature environments where thermal stability and fire resistance are critical. Utilities and oil sector projects in Saudi Arabia, the UAE, and Qatar increasingly favor silicone-based solutions for long-term reliability. Aevitas and Clearco Products are strengthening supply capabilities across regional power sectors. Growing electrification initiatives and renewable investments are expected to gradually elevate market penetration across the region.

Market Segmentations:

By Product Type

- Mineral-based Oils

- Silicone-based Oils

- Bio-based Oils

By Application

- Distribution transformer

- Power transformer

- Instrument transformer

- Others

By End-use

- Utilities

- Industrial

- Residential

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The silicone-based transformer oil market is competitive, with manufacturers focusing on thermal stability, dielectric strength, and environmental performance. Dow leads the market with advanced silicone fluid formulations that provide superior oxidation resistance and long service life in high-voltage applications. Cargill, Incorporated emphasizes bio-based and sustainable dielectric fluids, aligning with global energy efficiency standards. DRP Silicone, JIT Silicones Plus, and Clearco Products specialize in high-performance silicone oils engineered for demanding transformer insulation and cooling environments. Changzhou Juyou New Material Tech and Antala expand their presence in Asia and Europe through customized formulations and technical service support. BENZOIL and Aevitas strengthen the supply chain through recycling and reconditioning services for specialty transformer fluids. Eden Transformer Oil focuses on eco-friendly silicone blends with high flash points and minimal environmental impact. Continuous innovation in high-temperature-resistant fluids and circular economy initiatives remains central to gaining a competitive edge in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow

- Changzhou Juyou New Material Tech

- Eden Transformer Oil

- Cargill, Incorporated

- DRP Silicone

- BENZOIL

- JIT Silicones Plus

- Antala

- Clearco Products

- Aevitas

Recent Developments

- In September 2025, Dow launched DOWSIL™ EG-4175 Silicone Gel, a new high-temperature, highly reliable protective solution designed for next-generation power electronics and transformer applications.

- In June 2023, Antala, a prominent industrial chemicals distributor, broadened its offerings by introducing advanced silicone-based transformer oils. This expansion addresses the surging demand for high-performance, eco-conscious insulating fluids in the electrical power industry. The shift underscores the industry’s pivot towards sustainable solutions, given silicone oils’ advantages: superior thermal stability, heightened fire resistance, and an extended lifespan over traditional mineral oils.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for silicone-based transformer oils will grow with increasing grid modernization projects.

- Utilities will continue adopting fire-resistant and long-life insulating fluids for high-voltage transformers.

- Technological advancements will improve dielectric strength and oxidation stability in silicone formulations.

- Asia-Pacific will remain the fastest-growing region due to expanding renewable energy capacity.

- Manufacturers will focus on developing eco-friendly and recyclable silicone oil blends.

- Rising safety regulations will drive replacement of mineral oils in densely populated urban networks.

- Integration of smart grid systems will boost demand for high-performance insulating fluids.

- Industrial and commercial sectors will adopt silicone oils to reduce downtime and maintenance costs.

- Strategic partnerships between chemical firms and utilities will enhance regional supply chains.

- Increasing investments in offshore and renewable power projects will sustain long-term market growth.