Market Overview

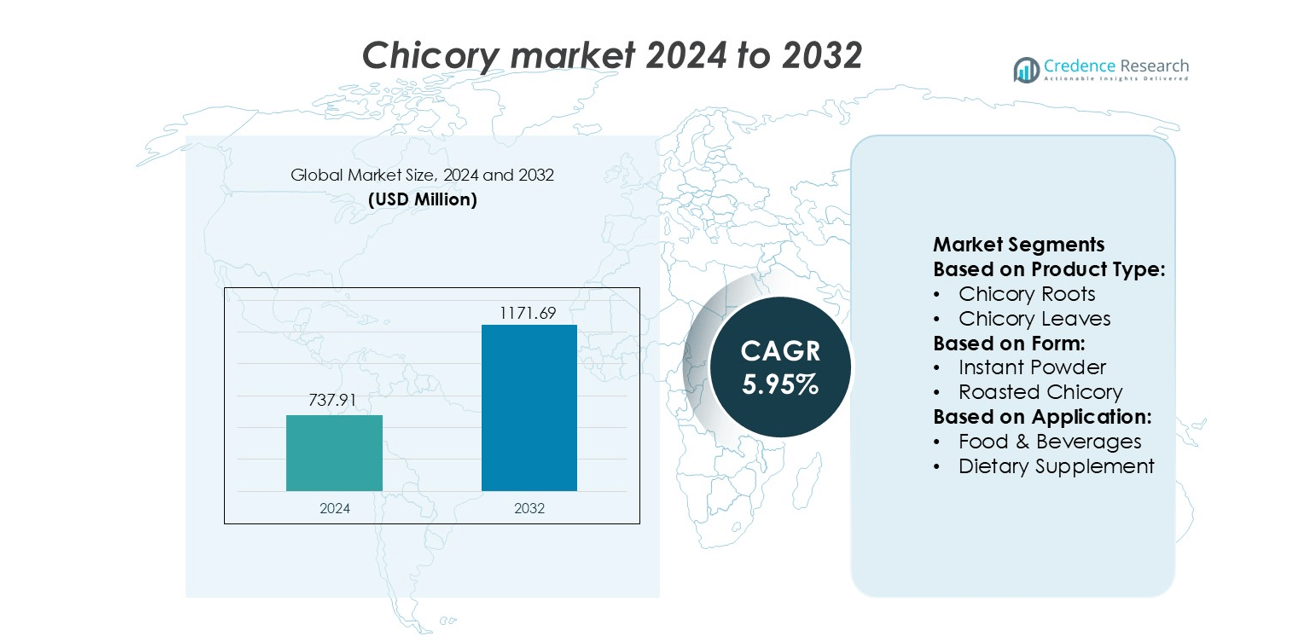

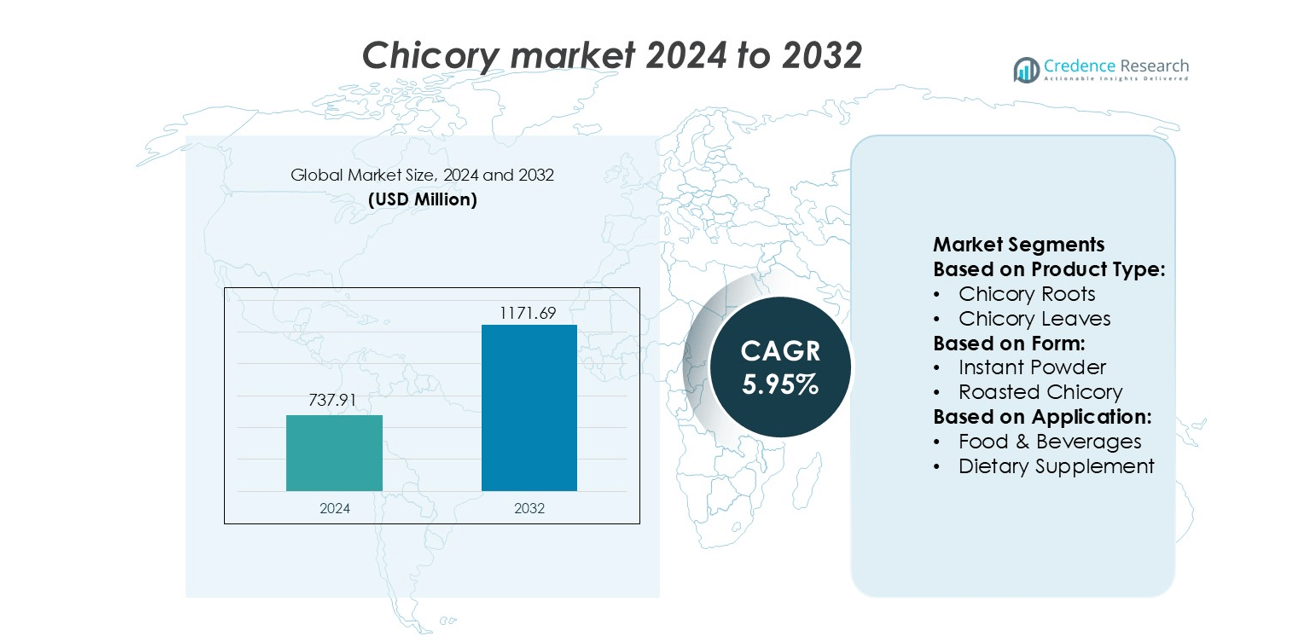

Chicory market size was valued USD 737.91 million in 2024 and is anticipated to reach USD 1171.69 million by 2032, at a CAGR of 5.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chicory Market Size 2024 |

USD 737.91 million |

| Chicory Market, CAGR |

5.95% |

| Chicory Market Size 2032 |

USD 1171.69 million |

The chicory market includes active participation from major ingredient suppliers, beverage processors, and organic herb manufacturers offering roasted chicory, inulin, and instant drink mixes to food, nutraceutical, and specialty retail brands. Companies focus on clean-label formulations, sugar-reduced recipes, and caffeine-free beverages to meet growing consumer demand for natural and functional ingredients. Product portfolios expand across bakery mixes, dietary supplements, dairy alternatives, and ready-to-drink coffee substitutes. North America remains the leading regional market with a 34% share, supported by strong consumption of chicory-based beverages, high awareness of digestive health, and well-developed distribution through supermarkets, cafés, and e-commerce channels.

Market Insights

- The chicory market was valued at USD 737.91 million in 2024 and is expected to reach USD 1171.69 million by 2032, at a CAGR of 5.95% during the forecast period.

- Rising demand for clean-label, sugar-reduced, and caffeine-free food and beverage products drives strong adoption of roasted chicory, chicory inulin, and instant drink mixes in bakery, dairy alternatives, snacks, and ready-to-drink beverages.

- Market players expand capacity through advanced roasting, extraction, and spray-drying technologies, while private-label brands and online retailers strengthen competitive pressure across domestic and export markets.

- Limited raw material availability due to seasonal cultivation and price fluctuations acts as a restraint, pushing manufacturers to invest in contract farming and supply-chain integration to maintain stable volumes.

- North America leads with a 34% regional share, while instant beverage blends and inulin powders dominate product segments because of strong demand from foodservice, nutraceutical, and household retail channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Chicory inulin holds the largest share in this segment due to its strong use in low-calorie sweeteners, prebiotic supplements, and functional food formulations. Food manufacturers favor inulin for its natural fiber profile and clean-label appeal. Chicory roots remain important for roasting, beverages, and herbal preparations, while chicory flour supports bakery applications as a gluten-free enhancer. Chicory leaves gain traction in salads and herbal blends. Rising demand for digestive health products and sugar-reduction solutions continues to support the dominance of inulin-based offerings across global markets.

- For instance, Organic Herb Trading supplies certified organic chicory inulin with a documented dietary fiber content of 89.0 grams per 100 grams, confirmed through laboratory nutritional analysis.

By Form

Instant powder leads the segment because brands use it in coffee mixes, ready drinks, and vending products. It dissolves easily, delivers a mild roasted flavor, and offers longer shelf life. Roasted chicory also maintains a notable presence as a caffeine-free alternative to coffee. Chicory extracts serve nutraceuticals, herbal syrups, and functional beverages, supporting product innovation. The convenience, solubility, and large-scale distribution of instant formats help this sub-segment retain the highest demand across foodservice and household consumption.

- For instance, Pioneer Chicory produces an instant spray-dried chicory powder which is specified as “100 % soluble” once processed using their spray-tower system.

By Application

Food and beverages form the dominant sub-segment, driven by rising adoption of chicory-based coffee blends, fiber-rich bakery items, and natural sweetener solutions. Manufacturers introduce prebiotic snacks, dairy alternatives, and confectionery with inulin to improve taste and gut health benefits. Dietary supplements also grow as consumers look for plant-based fibers and digestive aids. Cosmetics and medicines use chicory extract for anti-inflammatory and skincare formulations. The strong role of chicory as a clean-label ingredient keeps food and beverages ahead in overall market share.

Key Growth Drivers

Rising Adoption in Food & Beverage Applications

Chicory gains strong demand in the food and beverage sector due to its use as a natural flavor enhancer, caffeine-free coffee substitute, and functional ingredient in bakery items, snacks, and dairy alternatives. Manufacturers use chicory inulin to improve mouthfeel, reduce sugar, and support low-calorie formulations without synthetic additives. Clean-label preferences help producers replace artificial sweeteners and flavoring agents with chicory-based ingredients. Global brands use roasted chicory blends to develop premium coffee products, supporting wider consumer reach and constant product innovation across retail and foodservice channels.

- For instance, STOKROS Company Ltd confirms that its roasted chicory is produced with moisture levels not exceeding 4 grams per 100 grams, ensuring longer shelf stability during storage and transport.

Growing Demand for Prebiotic and Digestive Health Ingredients

Chicory inulin is a leading prebiotic fiber used in supplements, nutrition bars, yogurt, infant formula, and functional beverages. Rising digestive health awareness increases demand for fiber-rich diets, boosting chicory consumption among health-focused consumers. Food manufacturers add chicory inulin to enhance gut health, improve mineral absorption, and support lactose-free or gluten-free formulas. Nutraceutical companies integrate chicory derivatives into immune-support blends, reflecting broader adoption within preventive healthcare. This trend aligns with growing regulatory approvals for chicory-based fibers in multiple regions, strengthening commercial acceptance.

- For instance, Farmvilla Food Industries Private Limited reports that its food-grade chicory inulin powder contains 90 grams of dietary fiber per 100 grams, based on internal analytical certification.

Expansion of Natural and Plant-Based Ingredients Market

Growing preference for plant-based ingredients drives chicory usage in vegan foods, dairy substitutes, and herbal beverages. The ingredient offers natural sweetness, stability, and low glycemic impact, making it suitable for diabetic-friendly and weight-management formulations. Producers market chicory-derived products as non-GMO, chemical-free, and environmentally sustainable. Retailers showcase chicory products alongside organic coffee and herbal drinks to attract clean-label buyers. Rising consumer shift toward herbal detox beverages and immunity-focused diets helps expand long-term demand across global markets.

Key Trends & Opportunities

Product Innovation and New Application Areas

Companies innovate with ready-to-drink chicory coffee, chicory-infused snacks, prebiotic chocolates, and dairy alternatives. Ingredient suppliers invest in improved roasting, extraction, and spray-drying technologies to enhance flavor, texture, and solubility. Chicory flour and chicory extract enter bakery, confectionery, and sports nutrition segments as natural sweeteners and fiber sources. Private-label brands launch instant chicory beverages in single-serve sachets for convenient household use. This widens adoption beyond traditional markets, creating new revenue streams for manufacturers and retailers.

- For instance, Leroux confirms in its roasted chicory technical sheet that moisture content is controlled below 4 grams per 100 grams to maintain product stability during storage.

Growing Penetration in Nutraceutical and Functional Food Sectors

Consumers prefer plant-based fibers in daily diets to support gut health, metabolism, and immunity. Nutraceutical brands expand offerings including inulin capsules, functional powders, and chicory syrup for sugar-controlled products. Clinical research supporting prebiotic benefits strengthens regulatory acceptance and aids marketing strategies. Partnerships between ingredient suppliers and supplement manufacturers increase supply chain integration. Online healthcare retail boosts direct-to-consumer sales of chicory-based wellness products, especially in urban markets.

- For instance, Cargill’s soluble‐fiber product line uses a micro-reactor process (licensed from Karlsruhe Institute of Technology) to achieve a fiber content of minimum 80 grams of fiber per 100 grams in both powder and liquid forms.

Expansion Across Emerging Markets

Rising incomes, westernized diets, and higher coffee consumption fuel chicory growth in Asia-Pacific, Latin America, and Middle East. Domestic manufacturers introduce affordable instant chicory coffee mixes, attracting first-time buyers. Export opportunities rise as global companies source chicory roots and powder from expanding cultivation in India and parts of Europe. Government support for herbal farming and sustainable agriculture helps growers increase acreage and production efficiency.

Key Challenges

Supply Chain Dependence on Seasonal Cultivation

Chicory production relies on favorable climate, soil conditions, and harvesting cycles. Weather fluctuations, rainfall shortages, and soil degradation can reduce root yield, affecting raw material supply. Farmers require specialized processing and storage facilities to maintain quality, leading to higher operational costs for producers. Sudden shortfalls lead to price volatility and supply disruption, creating instability for food and nutraceutical companies dependent on consistent ingredient quality.

Competition from Substitutes and Alternative Ingredients

The market faces competition from coffee substitutes such as barley, dandelion, roasted grains, and synthetic flavoring agents. Prebiotic segments also include other sources such as fructooligosaccharides, resistant starches, and natural fruit fibers. These alternatives offer similar functionality and may have lower production costs or wider availability. Price-sensitive buyers may shift to cheaper substitutes in developing regions. To retain market share, chicory producers need stronger branding, quality assurance, and differentiated product formulations.

Regional Analysis

North America

North America holds 34% of the chicory market, driven by high adoption of caffeine-free beverages, prebiotic fibers, and clean-label food products. The U.S. leads demand with strong consumption of roasted chicory blends sold through supermarkets, cafés, and e-commerce platforms. Food producers add chicory inulin to dairy alternatives, bars, and cereals to reduce sugar and improve texture. Consumer focus on gut health and low-calorie diets strengthens its use in supplements. The presence of leading nutraceutical brands and advanced processing facilities supports steady expansion across retail and foodservice channels.

Europe

Europe accounts for 30% of global demand, supported by large-scale cultivation in Belgium, the Netherlands, France, and Germany. The region grows and processes chicory roots for inulin extraction, instant beverages, and export supply. Food and beverage brands use chicory in bakery fillings, confectionery, chocolates, and lactose-free applications. Organic and non-GMO trends influence premium product adoption in supermarkets and specialty stores. Regulatory approvals for chicory fibers in infant nutrition and functional foods encourage broader use. Strong export pipelines link European producers to high-demand markets in Asia-Pacific and North America.

Asia-Pacific

Asia-Pacific holds 24% of the market and is the fastest-expanding region, supported by rising coffee consumption and demand for plant-based ingredients. India is a major producer and exporter of chicory roots used in instant beverage blends. Manufacturers in China, Japan, and South Korea introduce chicory-based herbal coffees, digestive supplements, and prebiotic drinks. Online grocery and foodservice growth increases product visibility. As consumers shift to low-caffeine and gut-friendly products, chicory inulin finds wider use in nutritional powders and fortified foods. Government incentives for herbal cultivation further strengthen output.

Latin America

Latin America captures 7% of the chicory market, driven by adoption in instant drinks and herbal blends. Brazil, Chile, and Argentina integrate chicory powder into ready-to-drink beverages, confectionery items, and bakery mixes. Growing awareness of digestive health supports demand for chicory-based ingredients in nutraceuticals. Retail chains and private-label brands introduce chicory coffee mixes to expand household usage. Export growth rises as regional suppliers strengthen processing capabilities. Product visibility improves through cafés, supermarkets, and online retail platforms.

Middle East & Africa

The Middle East & Africa region accounts for 5% of global demand, supported by growing interest in caffeine-free coffee, flavored instant beverages, and functional ingredients. Gulf countries stock chicory coffee in specialty cafés and retail outlets. North African farming clusters supply chicory to regional processors and export markets. Consumer interest in natural sweeteners and sugar-reduced bakery products supports chicory inulin usage. E-commerce adoption increases household consumption. Although smaller in scale, the region shows strong long-term potential as health-focused product categories expand.

Market Segmentations:

By Product Type:

- Chicory Roots

- Chicory Leaves

By Form:

- Instant Powder

- Roasted Chicory

By Application:

- Food & Beverages

- Dietary Supplement

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chicory market features active participation from Organic Herb Trading, Pioneer Chicory, STOKROS Company Ltd, Farmvilla Food Industries Private Limited, Leroux Flavored Brandies, Jamnagar Chicory Industries, Starwest Botanicals, Delecto Foods Pvt Ltd., Natures Gold, and Cargill, Incorporated. The chicory market includes a mix of global ingredient suppliers, regional processors, and branded beverage manufacturers competing across food, nutraceutical, and herbal drink applications. Companies focus on roasted chicory blends, inulin extraction, and organic powdered formats tailored for clean-label and health-focused consumers. Producers invest in roasting, cold extraction, and spray-drying technologies to enhance aroma, purity, and solubility across instant beverages, bakery mixes, and dietary supplements. Export-oriented manufacturers expand partnerships with FMCG brands and private-label retailers to strengthen distribution across Asia-Pacific, Europe, and North America. Rising demand for caffeine-free coffee, plant-based ingredients, and prebiotic fibers supports continuous product innovation and capacity expansion. Competitive strategies include cost efficiency, raw material sourcing, upgraded processing facilities, flavor innovation, and entry into e-commerce channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Organic Herb Trading

- Pioneer Chicory

- STOKROS Company Ltd

- Farmvilla Food Industries Private Limited

- Leroux Flavored Brandies

- Jamnagar Chicory Industries

- Starwest Botanicals

- Delecto Foods Pvt Ltd.

- Natures Gold

- Cargill, Incorporated

Recent Developments

- In August 2024, DKSH has expanded its exclusive distribution agreement with Cosucra, a leading producer of natural and healthy food ingredients, in Australia and New Zealand. This partnership will enable DKSH to offer Cosucra’s products, including Fibruline and Fibrulose (chicory root fibers), to these regions’ food and beverage industries.

- In May 2024, PJ’s Coffee announced the return of its popular Southern Wedding Cake flavor and the introduction of a chicory-infused beverage. Customers enjoy the Southern Wedding Cake Iced Latte, which combines espresso, almond, and vanilla syrups, or the Southern Wedding Cake Velvet Ice, made with cold brew and whipped cream.

- In November 2023, BENEO, a prominent provider of functional ingredients, has announced the expansion of a production line at its Pemuco plant in Chile. This enhancement boosts the processing capabilities for producing its liquid chicory root fiber, Orafti Oligofructose LL, boasting a notably extended shelf life of one year

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for caffeine-free coffee substitutes is expected to rise in retail and foodservice channels.

- Functional food manufacturers will continue using chicory inulin to improve fiber content and reduce sugar.

- More nutraceutical brands will introduce gut-health supplements and prebiotic blends using chicory extracts.

- Organic and clean-label product launches will grow in supermarkets and online grocery platforms.

- Export opportunities will expand as developing regions increase cultivation and processing capacity.

- Advances in extraction and spray-drying technologies will enhance product purity and flavor quality.

- Partnerships between ingredient suppliers and beverage brands will accelerate new product development.

- E-commerce and direct-to-consumer sales will strengthen adoption among health-focused buyers.

- Private-label brands will introduce affordable chicory-based beverages and fiber-rich packaged foods.

- Government support for herbal farming and sustainable agriculture will encourage long-term industry growth.