Market Overview

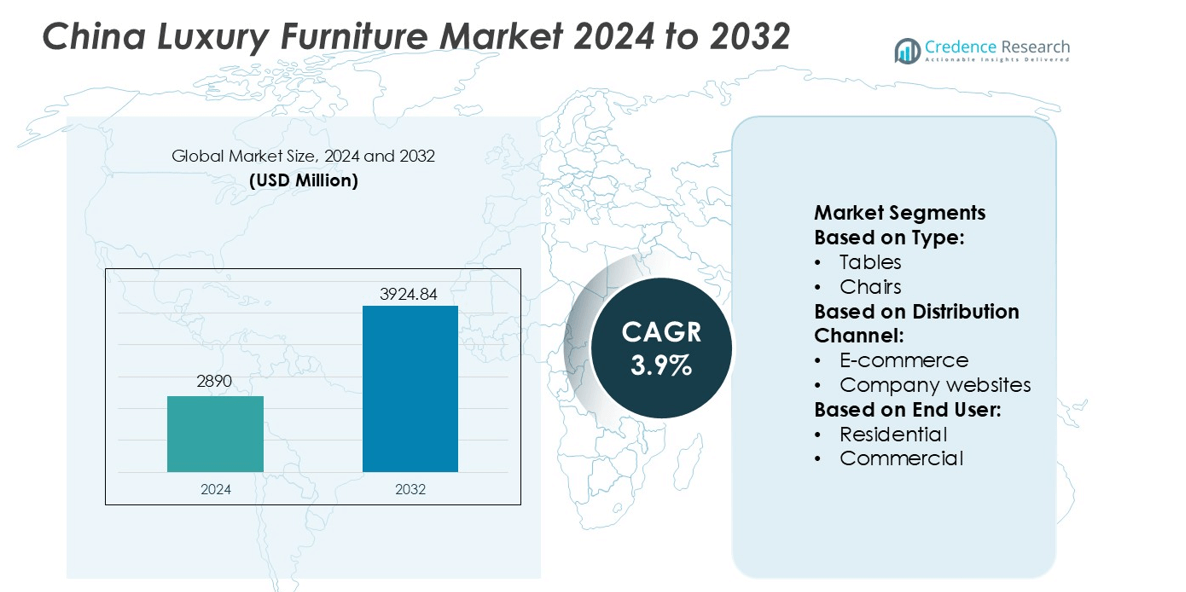

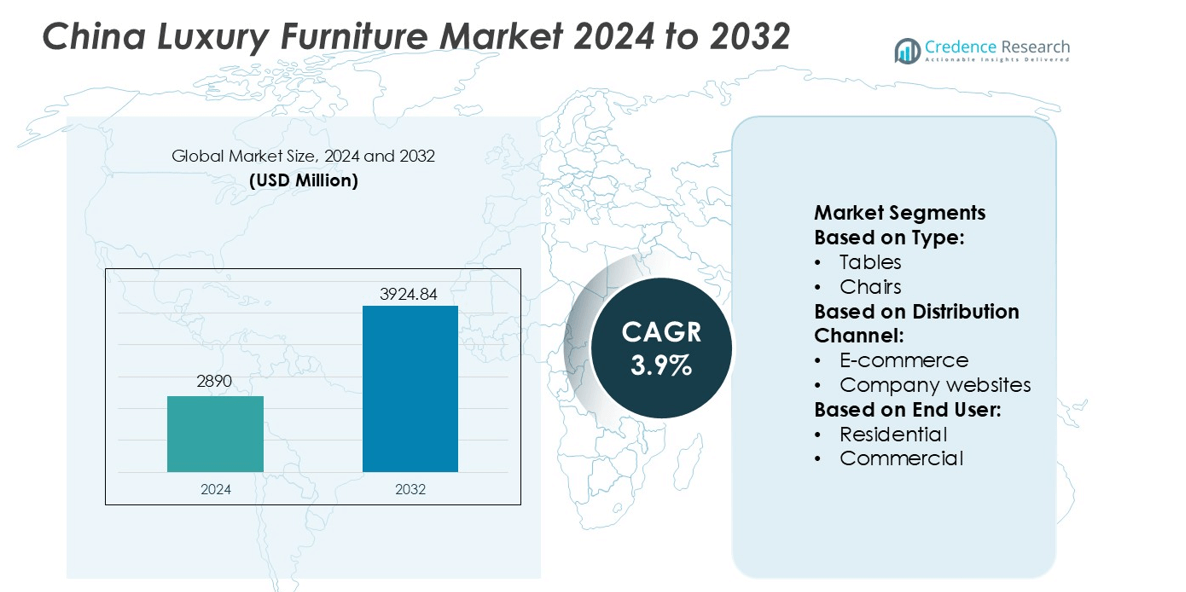

China Luxury Furniture Market size was valued USD 2890 million in 2024 and is anticipated to reach USD 3924.84 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Luxury Furniture Market Size 2024 |

USD 2890 million |

| China Luxury Furniture Market, CAGR |

3.9% |

| China Luxury Furniture Market Size 2032 |

USD 3924.84 million |

The China Luxury Furniture Market compete through premium craftsmanship, innovative designs, and branding strategies targeted at high-income consumers. Leading companies invest in customized modular furniture, smart features, and eco-friendly materials to strengthen their premium positioning. International brands expand through flagship showrooms and partnerships with luxury retailers, while domestic manufacturers leverage cost advantage and rapid production to capture market share. East China remains the leading region, contributing 35% market share due to strong purchasing power in Shanghai, Zhejiang, and Jiangsu. High concentrations of luxury residences, boutique hotels, and commercial interiors continue to make this region the strongest revenue contributor for luxury furniture suppliers.

Market Insights

- China Luxury Furniture Market size was valued at USD 2890 million in 2024 and is expected to reach USD 3924.84 million by 2032, at a CAGR of 3.9% during the forecast period.

- Demand grows as high-income consumers focus on premium craftsmanship, modular designs, and eco-friendly materials for luxury homes, villas, and branded residences, strengthening the residential segment’s dominant share.

- Smart furniture, imported materials, and personalized décor remain key trends, while international brands expand through flagship stores and online channels, increasing product visibility and premium positioning.

- Market competition intensifies as domestic manufacturers use faster production and competitive pricing, but high raw material costs and dependence on imports act as restraints for several players.

- East China leads regional demand with 35% share due to luxury housing, boutique hotels, and strong spending power in Shanghai, Zhejiang, and Jiangsu, keeping the region the largest revenue contributor across the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Tables, chairs, sofas, kitchens, lighting, interior accessories, beds, and other items drive revenue. Sofas and lounges hold the largest share of the China luxury furniture market, supported by over 28% contribution. High demand comes from premium apartments, villas, and branded serviced residences that invest in comfort and aesthetic appeal. Rising urban affluence, renovation activity, and preference for modular seating fuel sales. Beds and interior accessories also grow due to customized headboards, designer bedding, and décor-focused consumers. Brands promote Italian leather, premium woods, and smart reclining systems to boost product value.

- For instance, Natuzzi S.p.A. implemented its Factory 4.0 program to integrate real-time data collection via big-data platforms and “pick-to-light” systems in logistics zones.

By Distribution Channel

Online and offline channels shape market access. Offline specialty stores remain dominant with over 55% share due to customer demand for product trials and consultation. High-income buyers prefer personalized guidance and showroom experiences before purchase. Mega retail stores attract branded collections and drive visibility. Online channels expand reach among younger customers. E-commerce and company websites offer virtual tours, AR-based visualization, and home delivery of luxury pieces. Independent boutique stores continue serving niche clients seeking handcrafted and imported designs.

- For instance, La-Z-Boy launched a next-generation 3D product configurator and “WebAR OnDemand™” platform in September 2023 that supports “over 29 million” distinct furniture configurations accessible via mobile or desktop, and recorded an AR session increase of 150% compared with the prior app-based version.

By End-user

Residential and commercial customers drive luxury furniture demand. The residential segment leads with over 60% share. Rising home ownership, interior upgrades, and premium apartment projects support growth. Families spend on designer beds, modular kitchens, and Italian sofas to improve living quality. Commercial buyers include hotels, luxury offices, fine-dining restaurants, and premium retail spaces. These spaces invest in durable, aesthetic furniture for branding and guest experience. Hospitality chains and co-working operators also adopt high-end seating and décor, pushing steady demand across cities.

Key Growth Drivers

Rising Urban Affluence and Premium Housing

China’s expanding upper-middle-class population fuels strong spending on high-end home décor. Urban families invest in luxury apartments and villas, emphasizing customized interiors and branded furnishings. Growth in real estate upgrades, premium renovation services, and designer-led home projects boosts demand for luxury sofas, modular kitchens, and statement lighting. International brands expand flagship stores in major cities, while local manufacturers offer modern designs with premium materials. Cross-border e-commerce also increases access to imported luxury furniture. Together, rising disposable income and lifestyle upgrades act as major market accelerators.

- For instance, Hooker Furniture Corporation operates a significant distribution network in Martinsville and Henry County, Virginia. The company utilizes over 1,000,000 square feet of combined warehouse and distribution space across multiple facilities in the region.

Rapid Expansion of Hospitality and Commercial Spaces

High-end hotels, luxury resorts, boutique restaurants, and premium office spaces significantly increase procurement of designer furniture. Hospitality chains prioritize comfort, aesthetics, and durability, which raises demand for premium seating, smart lounges, and custom-built décor. Co-working hubs and luxury retail outlets also upgrade interior styling to enhance brand value and customer experience. China’s tourism and commercial construction projects drive steady orders for customized furniture. International hotel brands partner with premium furniture suppliers, reinforcing market growth through bulk and repeat procurement cycles.

- For instance, Laufer Group International Ltd operates a digital freight management platform that processed more than 2,300,000 electronic shipment milestones during 2023.

Growing Demand for Customization and Smart Furniture

Chinese consumers prefer personalized furniture with ergonomic designs, imported materials, and premium craftsmanship. Modular fittings, bespoke woodwork, and fabric customization strengthen brand differentiation. Luxury buyers also adopt smart features such as motorized recliners, lighting-integrated beds, and temperature-controlled seating. Technology integration boosts premium pricing and purchasing interest among younger urban residents. Digital visualization tools, including AR-based room planning, support faster decision-making. As customers shift toward modern interiors combining style and tech convenience, demand for customizable and smart luxury furniture rises sharply.

Key Trends & Opportunitie

Shift Toward Sustainable and Eco-Friendly Luxury

Sustainable furniture emerges as a major trend, with buyers preferring premium materials like certified wood, natural fabrics, and non-toxic coatings. Brands highlight craftsmanship, traceable sourcing, and long product life cycles. Eco-friendly sofas, bamboo-based accessories, and recycled metal décor gain visibility in luxury homes and boutique hotels. Young consumers value ethical production and green certifications. This trend creates opportunities for manufacturers to innovate in biodegradable materials, recycled composites, and low-carbon manufacturing while positioning sustainability as a premium feature.

- For instance, Hülsta-Werke Hüls GmbH & Co. KG operates FSC- and PEFC-certified production facilities and uses water-based paints with a VOC emission value below 1 g per liter.

Rise of Online Luxury Furniture Retailing

Digital channels continue to expand among high-income buyers, supported by virtual showrooms, 3D product previews, and direct-to-home delivery. Luxury brands use AR room visualization to help customers design interiors remotely. Social commerce and influencer marketing boost online visibility for designer furniture and imported European brands. Cross-border e-commerce platforms offer wider product catalogs than local stores. These factors create strong opportunities for brands to scale sales beyond tier-1 cities and reach affluent consumers in tier-2 and tier-3 markets.

- For instance, Ethan Allen Interiors Inc. operates a digital interior design platform with approximately 1,500 professional designers. The platform also includes a 3D room planner and other tools that allow customers to visualize thousands of furniture and décor products.

Key Challenges

High Cost of Raw Materials and Production

Premium woods, natural leather, fabrics, metal frames, and handmade components result in high manufacturing costs. Imported materials face tariff fluctuations, supply delays, and currency volatility, which increases final retail prices. Rising labor wages in skilled craftsmanship further push cost structures upward. These challenges make luxury furniture inaccessible for mid-range buyers and restrict mass adoption. Smaller manufacturers struggle to balance premium quality with competitive pricing, creating pressure on margins and slowing market penetration in developing urban regions.

Intense Competition from International and Local Brands

Global brands offer iconic designs, high craftsmanship, and strong brand reputation, challenging domestic manufacturers. At the same time, local brands compete aggressively with modern aesthetics and comparatively lower pricing. This dual competition limits pricing power and forces companies to innovate quickly. Customer loyalty is fragmented as buyers frequently compare designs, materials, and after-sales services across brands. High marketing expenses for branding, showrooms, and promotional campaigns further strain profit margins, making differentiation difficult in a crowded luxury market.

Regional Analysis

North America

North America holds 12% market share in China’s luxury furniture exports. Demand strengthens through premium retail chains, design studios, and online imports. Buyers prefer handcrafted wood furniture, modular wardrobes, and premium seating for luxury homes and boutique hotels. Renovation spending and smart interior concepts also support high-value purchases. U.S. and Canada showcase strong adoption of contemporary Chinese designs that combine craftsmanship and competitive pricing. Partnerships with furniture distributors and e-commerce platforms improve regional access. As luxury apartments, resorts, and restaurants upgrade interiors, North America remains a stable revenue contributor for Chinese luxury furniture manufacturers.

Europe

Europe accounts for 18% market share, driven by strong import activity in Germany, France, Italy, and the U.K. Rising demand for premium indoor décor, leather sofas, modular kitchens, and handcrafted solid wood furniture boosts volume. European buyers appreciate design flexibility, customization, and cost benefits from Chinese suppliers. Boutique hotels, luxury retail spaces, and furnished apartments increase sourcing from China. Sustainability certifications and eco-friendly materials enhance acceptance. Growing e-commerce channels and showroom partnerships help Chinese brands expand visibility. Despite strong domestic competition, European design houses continue importing high-quality Chinese luxury furniture for modern and traditional interiors.

Asia-Pacific

Asia-Pacific holds 35% market share, making it the strongest international growth region. Japan, South Korea, Singapore, Australia, and Southeast Asia lead demand for premium contemporary furniture. High-rise residential projects, luxury condos, and resort villas drive large procurement of sofas, beds, lighting, and lounge pieces from China. Hospitality chains and upscale malls favor modular and custom-made designs. Digital retail and trade ease cross-border supply, boosting access to premium Chinese brands. Growing renovation culture, interior modernization, and rising disposable income continue to expand market potential across Tier-1 and Tier-2 cities in the region.

Latin America

Latin America holds 10% market share, supported by rising luxury home décor spending in Brazil, Mexico, Chile, and Argentina. Urban families and hotel developers import modern couches, premium wood furniture, and indoor accessories at competitive costs. Chinese designs appeal to customers seeking contemporary styles without European price premiums. Retail franchises and online platforms raise accessibility. Although price sensitivity exists, demand increases in premium restaurants, resorts, and office lobbies. Renovation projects in major cities strengthen market penetration. As interior décor trends modernize, Latin America remains a developing but steady destination for Chinese luxury furniture exports.

Middle East & Africa

The Middle East & Africa together hold 25% market share, driven by demand from UAE, Saudi Arabia, Qatar, and Kuwait. Luxury villas, palaces, high-end apartments, and five-star hotels continuously source high-value Chinese furniture. Buyers prefer marble tables, gold-finish décor, custom woodwork, leather seating, and luxury lighting. Turnkey furnishing projects and rapid real estate expansion create strong import volumes. Africa remains emerging, with growth centered in South Africa, Egypt, and Kenya. Rising disposable income, luxury hospitality investments, and preference for premium interiors help the region remain a major export market for Chinese furniture brands.

Market Segmentations:

By Type:

By Distribution Channel:

- E-commerce

- Company websites

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The China Luxury Furniture Market players such as Herman Miller, Inc., Natuzzi S.p.A., Casa International Limited, La-Z-Boy Incorporated, Hooker Furniture Corporation, Laufer Group International Ltd, Hülsta-Werke Hüls GmbH & Co. KG, Ethan Allen Interiors Inc., Bassett Furniture Industries Inc., and Godrej & Boyce Manufacturing Company Limited. The China Luxury Furniture Market features intense competition, driven by global brands, domestic premium manufacturers, and emerging design-focused startups. Companies compete on craftsmanship, imported materials, smart features, and customization options that cater to luxury homes, villas, and high-end commercial interiors. Many brands focus on handcrafted woodwork, premium leather seating, modular kitchens, and designer lighting to attract affluent urban buyers. Distribution channels are expanding through flagship stores, specialty showrooms, and e-commerce platforms that offer virtual design assistance and curated product displays. Sustainability also plays a major role, with eco-certified wood, recyclable fabrics, and low-emission finishes gaining preference. As luxury real estate and hospitality projects grow, companies invest in marketing, interior design consultation, and after-sales support to strengthen brand reputation. Competitive pricing remains a challenge, as consumers compare international designs with advanced domestic alternatives, encouraging continuous innovation in aesthetics, functionality, and smart-home integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Herman Miller, Inc.

- Natuzzi S.p.A.

- Casa International Limited

- La-Z-Boy Incorporated

- Hooker Furniture Corporation

- Laufer Group International Ltd

- Hülsta-Werke Hüls GmbH & Co. KG

- Ethan Allen Interiors Inc.

- Bassett Furniture Industries Inc.

- Godrej & Boyce Manufacturing Company Limited

Recent Developments

- In August 2025, Yves Saint Laurent Beauty’s new Libre Freedom Campaign features singer Dua Lipa, who embodies the essence of a woman’s freedom through. The partnership demonstrated the value of celebrity endorsements, as her global popularity increased YSL’s brand visibility among target demographics.

- In July 2025, La-Z-Boy Incorporated announced the acquisition of a 15-store network of La-Z-Boy Furniture Galleries in the southeast United States, which is expected to close in late October 2025.

- In February 2025, Jacadi Paris, the French luxury children’s wear brand, established its presence in India by opening its first store in Mumbai. The company partnered with Burgundy Brand Collective, an India-based firm, to facilitate its market entry.

- In March 2024, Godrej & Boyce announced a plan to invest approximately INR 40 crore over the next three years. The objective of this investment is to expand its distribution footprint in tier-II and tier-III towns

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Luxury furniture demand will rise as premium apartments, villas, and branded residences increase nationwide.

- Custom-made designs, modular pieces, and personalized décor will attract high-income households.

- Smart-home integration, automated seating, and connected lighting will gain strong adoption.

- Sustainable furniture using eco-certified wood and recyclable materials will become a key buying preference.

- International brands will expand distribution through flagship stores, online platforms, and design studios.

- Domestic luxury manufacturers will invest in craftsmanship, premium raw materials, and modern aesthetics.

- Hospitality, luxury retail, and fine-dining spaces will continue upgrading interiors with designer furniture.

- Virtual showrooms, AR-based product visualization, and online interior consultation will boost digital sales.

- Cross-border sourcing and premium imports will rise as consumers seek European-inspired designs.

- Competitive pricing, superior quality, and brand reputation will play a major role in shaping market leadership.