Market Overview

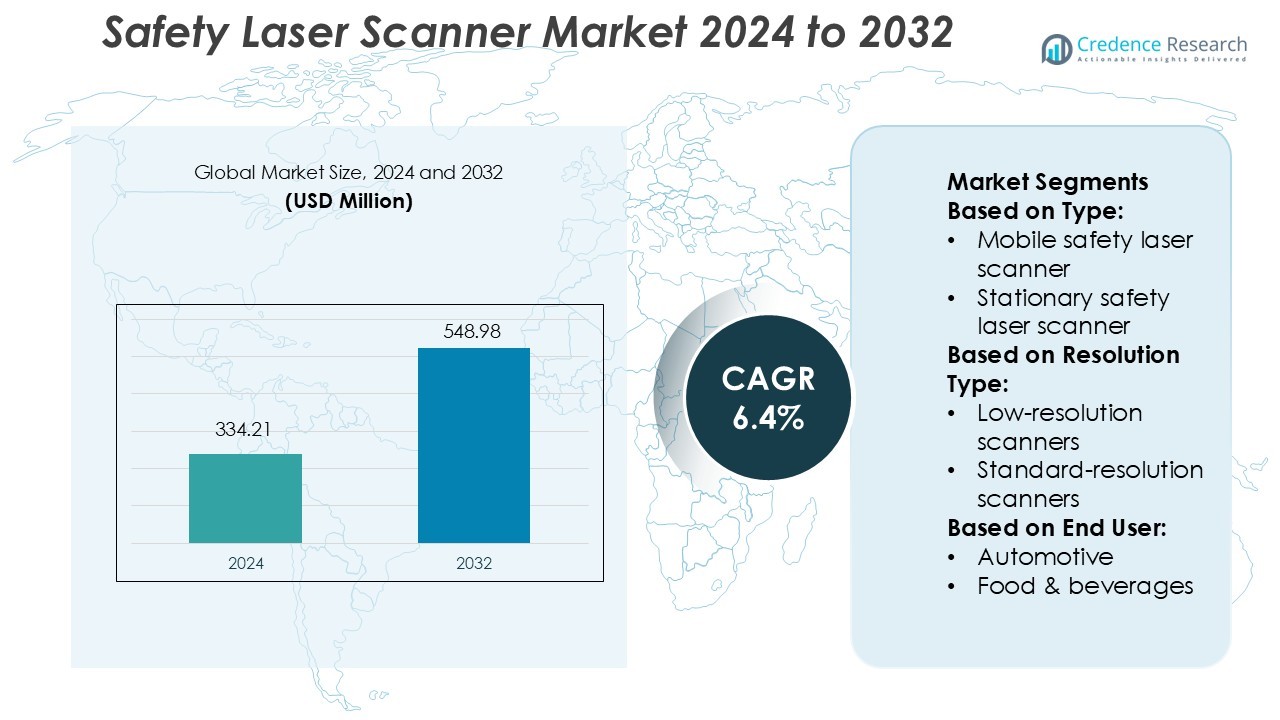

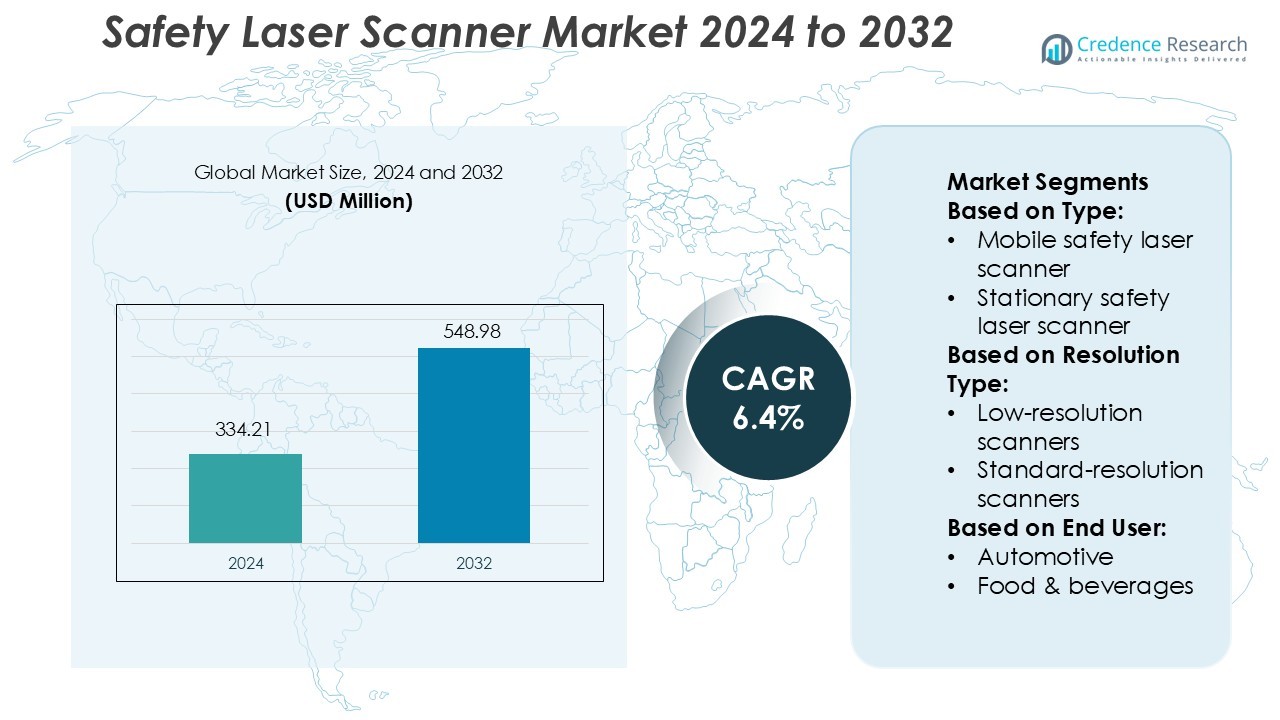

Safety Laser Scanner Market size was valued USD 334.21 million in 2024 and is anticipated to reach USD 548.98 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Safety Laser Scanner Market Size 2024 |

USD 334.21 Million |

| Safety Laser Scanner Market, CAGR |

6.4% |

| Safety Laser Scanner Market Size 2032 |

USD 548.98 Million |

The Safety Laser Scanner Market features strong competition among major players such as SICK AG, Omron Corporation, Rockwell Automation, Leuze Electronic, Panasonic Corporation, IDEC Corporation, Keyence Corporation, Hokuyo Automatic, Banner Engineering, and Pilz GmbH & Co. KG. These companies focus on innovation, product miniaturization, and integration of AI-based sensing for real-time monitoring and predictive safety management. Strategic partnerships and R&D investments support the development of advanced scanners suitable for industrial automation and robotics applications. North America leads the global market with a 32% share, driven by high adoption in manufacturing, logistics, and automotive sectors, alongside strict regulatory compliance and strong technological infrastructure supporting industrial safety advancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Safety Laser Scanner Market was valued at USD 334.21 million in 2024 and is projected to reach USD 548.98 million by 2032, growing at a CAGR of 6.4% during the forecast period.

- Market growth is driven by increasing industrial automation, adoption of robotics, and rising emphasis on workplace safety compliance across key manufacturing sectors.

- Ongoing trends include miniaturization, AI-based sensing integration, and predictive safety analytics that enhance detection accuracy and enable smart, connected safety systems.

- The market is moderately consolidated, with major players such as SICK AG, Omron Corporation, and Rockwell Automation focusing on partnerships and product innovation to expand their global footprint.

- North America leads with a 32% share, followed by Europe at 29% and Asia Pacific at 28%, while the stationary safety laser scanner segment remains dominant due to its high precision and wide use in industrial automation applications.

Market Segmentation Analysis:

By Type

The stationary safety laser scanner segment dominates the market, accounting for the largest share due to its extensive use in fixed industrial applications such as robotic cells, conveyors, and material handling systems. These scanners provide a 360° field of view and reliable area monitoring, making them ideal for stationary machinery safeguarding. Their integration in automated production lines enhances worker safety and operational efficiency. Growing demand for workplace automation and compliance with stringent safety standards such as ISO 13849-1 and IEC 61496 continues to drive adoption across manufacturing and logistics sectors.

- For instance, Neusoft Medical Systems is a leading global developer and manufacturer of medical imaging equipment, including advanced AI-enabled CT scanners that meet international quality and safety standards such as ISO 13485 and FDA regulations.

By Resolution Type

High-resolution scanners hold the dominant market share owing to their superior precision and detection capability in complex environments. These scanners can detect small objects with accuracy, ensuring high-level safety and optimized space utilization in crowded industrial settings. Their advanced optics and signal processing make them suitable for applications requiring detailed contour detection, such as robotics and automated guided vehicles. Increased demand for accuracy and reduced false alarms in smart manufacturing environments continues to drive the high-resolution segment’s growth trajectory.

- For instance, Koning Breast CT (KBCT) system is a dedicated breast 3D CT scanner. In its high-resolution mode, it offers a reconstruction voxel size of 0.155 mm³. The system acquires 300 projection images in a single 10-second scan.

By End User

The automotive industry represents the leading end-user segment, holding the highest market share in the safety laser scanner market. Automotive manufacturers increasingly deploy scanners for perimeter monitoring, robotic safety, and automated material handling. These scanners ensure personnel protection and process safety in welding cells and assembly lines. The integration of Industry 4.0 and robotic automation has amplified their usage for hazard zone protection and navigation of automated guided vehicles. Rising production of electric and autonomous vehicles further strengthens the segment’s dominance in global installations.

Key Growth Drivers

- Rising Automation in Industrial Operations

The increasing automation across manufacturing, logistics, and warehousing drives demand for safety laser scanners. These devices ensure worker protection and collision avoidance in automated environments involving robots and AGVs. Their ability to create flexible safety zones without physical barriers enhances productivity and operational safety. The shift toward smart factories and Industry 4.0 standards continues to fuel the adoption of advanced safety scanning technologies for efficient, compliant, and secure industrial workflows.

- For instance, Planmed is primarily a medical-imaging company, its advanced CBCT unit Planmed XFI features a gantry bore of 85 cm and a field-of-view of 23 × 44 cm with a full 360° X-ray source rotation, enabling rapid capture of high-detail anatomical volumes.

- Stringent Workplace Safety Regulations

Global enforcement of workplace safety standards such as ISO 13849-1 and IEC 61496 significantly boosts the market growth. Industries are compelled to integrate certified safety laser scanners to prevent accidents and comply with regulatory frameworks. These scanners provide precise detection and customizable protection zones, minimizing injury risks in hazardous areas. Government emphasis on employee safety and the rising cost of non-compliance drive the widespread use of laser-based safety systems across multiple sectors.

- For instance, GE HealthCare’s “C-RAD Sentinel” laser-based surface scanning solution delivers a spatial resolution of 0.5 mm and captures up to 60 frames per second in its optical surface monitoring mode.

- Expanding Adoption in Robotics and AGVs

The growing use of collaborative robots and automated guided vehicles in manufacturing and logistics is a major growth driver. Safety laser scanners support obstacle detection, speed control, and zone monitoring, enabling safe human–machine collaboration. Their compact design and high reliability make them ideal for dynamic, mobile applications. The continuous evolution of robot-integrated safety systems strengthens market demand, as manufacturers focus on improving automation safety and mobility efficiency in industrial settings.

Key Trends & Opportunities

- Integration of IoT and Smart Sensing Technologies

Integration of IoT and smart analytics in safety laser scanners enables real-time data monitoring and predictive maintenance. These connected scanners provide insights into environmental changes and equipment health, improving operational reliability. Manufacturers are developing cloud-compatible models that support remote diagnostics and safety analytics. This trend creates new opportunities for data-driven safety management, helping industries enhance system uptime and prevent unexpected failures through continuous digital monitoring.

- For instance, Samsung Electronics’ IoT platform offering includes the Brightics IoT software which supports over 120 analytical functions and processes high-volume sensor data from connected devices.

- Miniaturization and Design Optimization

Manufacturers are focusing on compact and lightweight safety laser scanners to fit modern automation systems. Smaller form factors allow installation in tight spaces and on mobile platforms like AGVs. Despite the reduced size, these devices maintain high precision and detection range. The trend toward space-efficient designs supports flexible plant layouts and advanced automation integration, offering a competitive advantage to companies investing in adaptive safety technologies.

- For instance, FUJIFILM’s portable digital radiography unit “FDR Go iQ” features a width of 22.5 inches (≈ 572 mm) and a weight of 970 pounds (≈ 440 kg), enabling maneuverability in tight clinical spaces.

- Growth in Emerging Manufacturing Economies

Expanding industrial automation in countries such as India, China, and Vietnam presents new market opportunities. Rising labor costs and government initiatives promoting smart manufacturing accelerate adoption of safety laser scanners. Local production facilities are increasingly investing in automated safety systems to improve productivity and meet export standards. This industrial expansion across emerging economies creates a lucrative growth environment for global safety scanner providers.

Key Challenges

- High Initial Installation and Maintenance Costs

The high cost of safety laser scanners, including installation and calibration, limits adoption among small and medium enterprises. Advanced scanners require integration with control systems and regular maintenance to ensure compliance with safety standards. These expenses increase the total cost of ownership, slowing penetration in cost-sensitive markets. Manufacturers are addressing this challenge by developing modular and cost-efficient designs to make safety scanning technology more accessible.

- Performance Limitations in Harsh Environments

Environmental factors such as dust, vibration, humidity, and ambient light can affect scanner accuracy and reliability. In industries like mining or food processing, such conditions lead to false detections or sensor degradation. These challenges demand robust, sealed, and temperature-resistant designs. Continuous innovation in sensor housing and optical components is required to maintain consistent performance in extreme conditions and expand the scanners’ applicability across diverse industrial environments.

Regional Analysis

North America

North America holds a 32% market share in the safety laser scanner market, driven by strong industrial automation and robotics adoption. The U.S. leads due to advanced manufacturing infrastructure, strict OSHA safety regulations, and a strong presence of key players such as Rockwell Automation and SICK AG. The region’s focus on worker protection and workplace digitization fuels scanner demand in logistics, automotive, and food processing. Additionally, high investments in warehouse automation and autonomous vehicle navigation technologies strengthen the regional market growth trajectory.

Europe

Europe accounts for 29% of the global market share, supported by stringent worker safety directives such as ISO 13849 and Machinery Directive 2006/42/EC. Germany, Italy, and the UK dominate the regional demand owing to their extensive industrial base and leadership in robotics innovation. The adoption of Industry 4.0 standards and automated logistics systems has intensified scanner installations in production and assembly lines. Continuous R&D investments and the integration of AI-enabled sensing technologies are further enhancing workplace safety and boosting the European market’s competitiveness.

Asia Pacific

Asia Pacific commands a 28% market share and is the fastest-growing regional market for safety laser scanners. Rapid industrialization in China, Japan, South Korea, and India, combined with expanding electronics and automotive sectors, fuels demand. Governments promoting smart manufacturing and robotics integration through initiatives like “Made in China 2025” and “Make in India” enhance adoption. Local manufacturers are increasingly implementing advanced safety technologies to align with global standards, making the region a significant production hub for laser scanner components and automation systems.

Latin America

Latin America captures a 6% share of the safety laser scanner market, supported by growing automation in food processing, packaging, and mining sectors. Brazil and Mexico lead regional adoption due to increasing investments in manufacturing modernization and safety compliance. Awareness of workplace hazards and regulatory reforms is pushing companies toward laser-based protection solutions. Although the adoption rate remains moderate compared to mature regions, technological partnerships and rising use of AGVs in logistics centers are expected to expand the region’s market presence.

Middle East & Africa

The Middle East & Africa (MEA) region holds a 5% market share, with demand primarily concentrated in oil & gas, logistics, and construction industries. The UAE and Saudi Arabia are investing in automation and industrial safety technologies as part of their economic diversification plans. Infrastructure development projects and expansion of industrial zones are promoting safety compliance and machine protection systems. While adoption is in the early phase, increasing imports of advanced automation equipment and safety devices are expected to accelerate market growth in the coming years.

Market Segmentations:

By Type:

- Mobile safety laser scanner

- Stationary safety laser scanner

By Resolution Type:

- Low-resolution scanners

- Standard-resolution scanners

By End User:

- Automotive

- Food & beverages

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Safety Laser Scanner Market features prominent players such as Neusoft Medical Systems, Medtronic, Koning Health, PLANMED, GE HealthCare Technologies, Samsung Electronics, FUJIFILM Holdings Corporation, Canon, CurveBeam AI, and Koninklijke Philips. The Safety Laser Scanner Market is characterized by strong innovation, strategic collaborations, and expanding automation adoption. Manufacturers focus on enhancing product precision, reliability, and adaptability to meet evolving industrial safety standards. Continuous advancements in AI, IoT connectivity, and sensor fusion technologies are reshaping system capabilities, enabling predictive maintenance and real-time monitoring. Companies are emphasizing compact designs and energy-efficient models to suit mobile robotics and AGV applications. Strategic mergers, global partnerships, and investments in R&D are further intensifying competition, driving the market toward smarter, integrated, and compliance-driven safety solutions across industrial sectors.

Key Player Analysis

- Neusoft Medical Systems

- Medtronic

- Koning Health

- PLANMED

- GE HealthCare Technologies

- Samsung Electronics

- FUJIFILM Holdings Corporation

- Canon

- CurveBeam AI

- Koninklijke Philips

Recent Developments

- In November 2024, Honeywell International Inc. entered into an agreement to sell its Personal Protective Equipment (PPE) business to Protective Industrial Products, Inc, a U.S.-based worker safety provider. The sale aligns with the company’s strategy to streamline its portfolio and focus on key growth areas, including automation, the future of aviation, and energy transition.

- In May 2024, Survitec launched a cutting-edge energy containment safety device designed to mitigate risks linked to catastrophic valve actuator malfunctions. This innovation bolsters safety protocols in sectors where such failures can result in serious injuries or considerable equipment damage.

- In April 2024, HexagonAB announced the acquisition of Xwatch Safety Solutions, a UK-based company specializing in construction machinery equipment. This strategic move aims to bolster Hexagon AB’s construction safety portfolio by integrating Xwatch’s advanced machine control hardware and software technologies.

- In February 2024, Philips CT 5300, an advanced X-ray CT system equipped with AI capabilities for diagnostics, interventional procedures, and screening. This system improved diagnostic accuracy, workflow efficiency, and uptime, reinforcing Philips’ position in the medical imaging sector and highlighting its dedication to healthcare innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Resolution Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as industries expand automation and robotics adoption.

- Integration of AI and IoT will enhance detection accuracy and predictive maintenance capabilities.

- Compact and energy-efficient scanners will gain popularity for mobile robotics and AGVs.

- Demand for customizable safety solutions will rise due to evolving workplace standards.

- Manufacturers will focus on multi-layer protection and intelligent zone configuration technologies.

- Emerging economies in Asia Pacific will become key manufacturing and adoption hubs.

- Strategic partnerships will strengthen R&D capabilities and accelerate innovation in safety systems.

- The healthcare and electronics sectors will increasingly deploy scanners for precision applications.

- Software-driven safety analytics will transform scanner functionality and data utilization efficiency.

- Rising global safety regulations will ensure continuous investments in advanced sensing technologies.