Market Overview

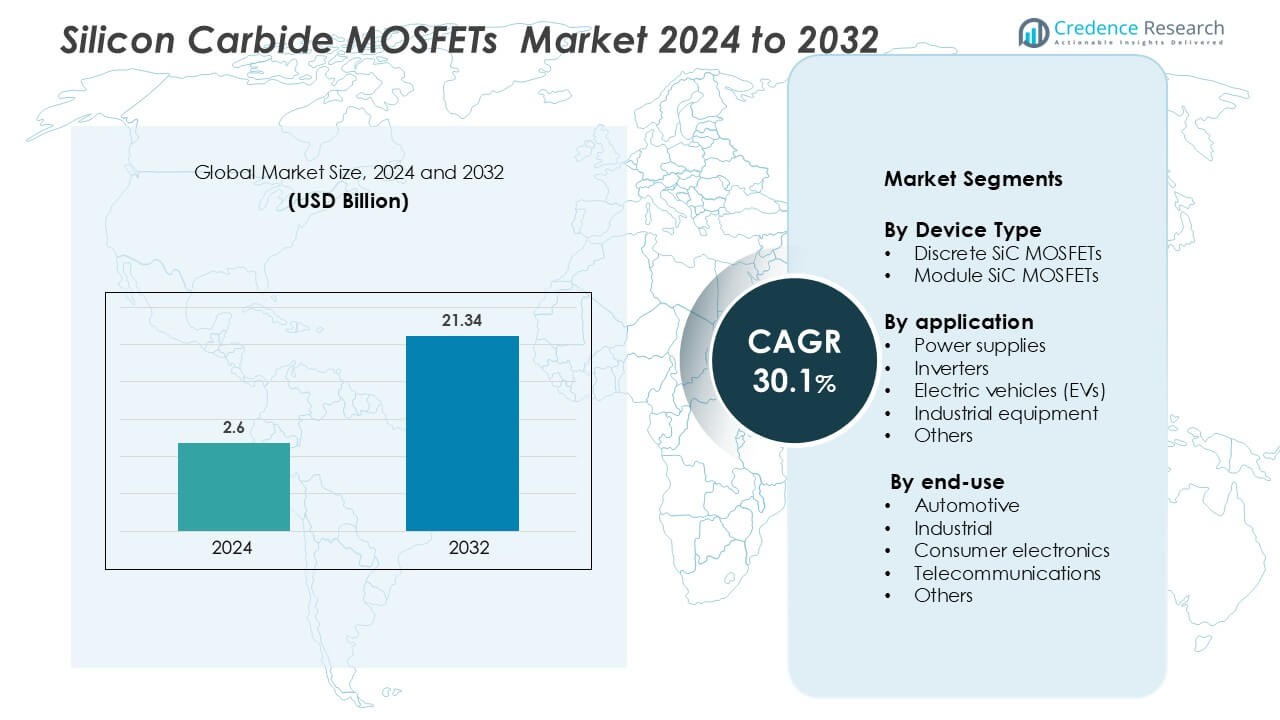

Silicon Carbide MOSFETs Market system market size was valued USD 2.6 billion in 2024 and is anticipated to reach USD 21.34 billion by 2032, at a CAGR of 30.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicon Carbide MOSFETs Market Size 2024 |

USD 2.6 Billion |

| Silicon Carbide MOSFETs Market, CAGR |

30.1% |

| Silicon Carbide MOSFETs Market Size 2032 |

USD 21.34 Billion |

The Silicon Carbide MOSFETs Market is highly competitive, with key players including ROHM Semiconductor, Renesas Electronics Corporation, Microchip Technology Inc., Infineon Technologies AG, Mitsubishi Electric Corporation, STARCHIP, ON Semiconductor, Hitachi Power Semiconductor Device, Ltd., Littelfuse, Inc., and II-VI Incorporated (now Coherent Corp.). These companies focus on developing high-efficiency power modules, expanding wafer production, and enhancing product reliability for automotive and industrial applications. Infineon Technologies AG and ROHM Semiconductor lead through strong portfolios of automotive-grade SiC MOSFETs and global supply capabilities. Asia-Pacific dominates the market with a 36.8% share, supported by robust semiconductor manufacturing, electric vehicle production, and government-driven clean energy initiatives

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Silicon Carbide MOSFETs Market was valued at USD 2.6 billion in 2024 and is projected to reach USD 21.34 billion by 2032, registering a CAGR of 30.1% during the forecast period.

- Rising adoption of electric vehicles and renewable energy systems is driving market growth, as SiC MOSFETs offer superior efficiency, higher temperature tolerance, and compact designs ideal for next-generation power electronics.

- Key trends include growing investment in wafer fabrication facilities, advancements in 200mm SiC wafer production, and increasing partnerships between semiconductor manufacturers and automotive OEMs for EV powertrain optimization.

- Leading companies such as ROHM Semiconductor, Infineon Technologies AG, and ON Semiconductor dominate the market through technological innovation, cost reduction initiatives, and large-scale SiC production capabilities.

- Asia-Pacific leads the global market with a 36.8% share, driven by strong EV adoption, followed by North America with 32.4%; by device type, discrete SiC MOSFETs hold the largest share due to their scalability and high efficiency.

Market Segmentation Analysis:

By Device Type

Discrete SiC MOSFETs dominated the Silicon Carbide MOSFETs Market with a substantial market share. Their widespread use in electric vehicles, renewable energy systems, and power supplies is driven by high efficiency and low switching losses. These devices offer superior thermal conductivity, allowing compact designs and reduced cooling requirements. Manufacturers are focusing on optimizing wafer yields and improving breakdown voltage performance. Module SiC MOSFETs are gaining traction in high-power industrial and grid applications, but discrete types maintain dominance due to easier integration and cost-effective scalability across multiple voltage ranges.

- For instance, Infineon Technologies introduced its CoolSiC MOSFET 650V series featuring an ultra-low on-resistance of 27 milliohms, achieving a 50% reduction in switching losses compared to silicon IGBTs.

By Application

Electric vehicles (EVs) emerged as the leading application segment in the Silicon Carbide MOSFETs Market. Their dominance stems from the ability of SiC MOSFETs to enhance inverter efficiency, reduce battery losses, and extend driving range. Automakers increasingly adopt SiC technology for traction inverters, onboard chargers, and DC-DC converters. These components support fast charging and compact design requirements. Power supplies and industrial inverters also show significant growth, driven by demand for energy-efficient power management systems. The expanding global EV ecosystem continues to reinforce SiC MOSFET integration across major automotive platforms.

- For instance, Tesla integrated STMicroelectronics’ SiC MOSFETs rated at 1,200 volts into its Model 3 inverters, achieving power conversion efficiency above 99% and increasing the vehicle’s range by nearly 16 kilometers per charge due to reduced switching losses.

By End-Use

The automotive sector accounted for the largest share of the Silicon Carbide MOSFETs Market. Rising EV adoption and government mandates for energy-efficient transportation drive demand. Automakers rely on SiC MOSFETs to achieve higher power density, lightweight design, and reduced thermal losses in propulsion systems. Industrial applications follow closely, supported by automation, renewable energy, and smart grid projects requiring robust power electronics. Consumer electronics and telecommunications use SiC MOSFETs for high-frequency and low-loss operations. However, the automotive industry remains the primary revenue contributor, driven by advancements in electric mobility and vehicle electrification technologies.

Key Growth Drivers

Rising Demand for Electric Vehicles (EVs)

The rapid expansion of the electric vehicle industry is a major growth driver for the Silicon Carbide (SiC) MOSFETs market. Automakers are increasingly adopting SiC MOSFETs to enhance power efficiency and enable compact inverter designs. These devices significantly reduce switching losses and improve battery utilization, supporting extended driving ranges and faster charging times. As global regulations push for lower emissions, EV manufacturers are investing in SiC-based components for traction inverters and DC-DC converters. Partnerships between semiconductor firms and automotive OEMs are further accelerating adoption, with companies developing automotive-grade SiC chips for next-generation EV platforms.

- For instance, Wolfspeed manufactures and sells a wide variety of 1,200V SiC MOSFETs for high-power applications, including electric vehicles.

Expanding Renewable Energy Infrastructure

Growing investments in solar and wind power systems are fueling demand for SiC MOSFETs due to their superior power handling and thermal properties. In renewable energy inverters, SiC MOSFETs improve energy conversion efficiency and reduce cooling requirements. Their high-voltage tolerance supports compact, high-performance designs ideal for solar farms and wind turbines. As governments increase renewable capacity targets, power electronics suppliers are deploying SiC-based modules to achieve higher reliability and energy throughput. This technology enables better grid stability and minimizes energy losses during transmission. The shift toward sustainable energy generation continues to boost SiC adoption across power electronics applications.

- For instance, in 2012, it developed an all-SiC inverter with 50 kVA per liter for a different application. In 2017, a SiC inverter for HEVs was developed with a power density of 86 kVA/L.

Increasing Penetration in Industrial and Power Supply Applications

The growing demand for energy-efficient power systems in industrial automation, manufacturing, and data centers drives SiC MOSFET integration. These devices support compact power modules that deliver higher efficiency and thermal reliability in variable frequency drives, servo motors, and uninterruptible power supplies (UPS). The technology enables faster switching speeds, reducing power losses and improving system performance. Industries seeking to lower operational costs and comply with energy regulations prefer SiC-based designs. Moreover, the rise in high-power computing and AI data centers is accelerating adoption of SiC MOSFETs for efficient power conversion and heat management in server infrastructures.

Key Trends & Opportunities

Advancements in SiC Wafer Manufacturing and Cost Reduction

Continuous improvements in SiC wafer quality and production efficiency are reshaping market economics. Manufacturers are developing larger wafers—up to 200mm—to enhance output and reduce per-unit costs. Automated wafer inspection and advanced epitaxy technologies minimize defects, improving device reliability. These innovations enable mass production of high-voltage SiC MOSFETs for automotive and industrial applications. Strategic collaborations between semiconductor foundries and equipment suppliers are promoting scalable SiC production. As production costs decline, SiC components are becoming more accessible, opening opportunities for mid-range electric vehicles and industrial solutions requiring high-performance power devices.

- For instance, Wolfspeed operates the Mohawk Valley Fab in New York, the world’s first 200mm SiC wafer fabrication facility, capable of producing 25,000 wafers per month, and has achieved defect densities below 0.1 per square centimeter through advanced epitaxial growth techniques, improving yield and scalability for next-generation SiC devices.

Growing Integration with GaN and Hybrid Power Systems

An emerging trend in the market is the combination of SiC and Gallium Nitride (GaN) technologies to create hybrid systems optimized for performance and cost. SiC excels in high-voltage, high-temperature applications, while GaN offers fast switching at lower voltages. Together, they enable energy-efficient architectures for automotive, aerospace, and consumer power electronics. Research collaborations are exploring dual-material modules to enhance energy density and system lifespan. This synergy provides manufacturers flexibility in design and performance optimization. The trend supports diversification across applications such as EV charging infrastructure, renewable grids, and smart manufacturing equipment.

- For instance, TI s GaN devices are capable of high switching frequencies, with some products supporting frequencies over 500 kHz or even above 1 MHz in certain specialized converters. However, a 1 MHz frequency for a high-power inverter is ambitious, and not associated with any hybrid GaN-SiC inverter system from TI.

Strategic Partnerships and Vertical Integration

Key industry players are engaging in mergers, acquisitions, and vertical integration to strengthen control over SiC value chains. Semiconductor companies are expanding wafer fabrication, packaging, and module assembly capabilities to meet surging demand. Automotive OEMs are securing long-term supply contracts to ensure component availability amid rising EV production. Such strategic moves enhance production scalability and technology differentiation. Additionally, government-backed initiatives supporting domestic semiconductor manufacturing are accelerating investment. This collaborative ecosystem creates opportunities for innovation, cost efficiency, and faster commercialization of SiC-based solutions across industries.

Key Challenges

High Production Cost and Supply Chain Constraints

Despite technological advancements, SiC MOSFETs remain costly compared to traditional silicon-based devices. The high cost of crystal growth, wafer fabrication, and epitaxy processes limits adoption in cost-sensitive sectors. The supply chain is also constrained by limited availability of high-quality substrates and specialized manufacturing tools. Only a few global suppliers dominate SiC wafer production, creating price and supply volatility. Scaling up production capacity requires significant capital investment and technical expertise. These challenges hinder market penetration, particularly among small and mid-sized device manufacturers seeking affordable high-performance power solutions.

Complex Design Integration and Reliability Issues

Integrating SiC MOSFETs into existing power systems presents technical challenges related to circuit design, thermal management, and reliability testing. The high switching speeds can induce electromagnetic interference (EMI), requiring advanced design techniques and materials. Engineers must optimize gate drivers and protective circuitry to ensure stability under high voltage and temperature conditions. Additionally, long-term reliability testing remains crucial to meet automotive and aerospace standards. The lack of standardized testing protocols and design expertise slows adoption among traditional system integrators. These integration complexities increase development time and costs for new product launches.

Regional Analysis

North America

North America held a market share of 32.4% in the Silicon Carbide MOSFETs Market, driven by strong adoption in electric vehicles and renewable energy sectors. The United States leads due to large-scale EV manufacturing, smart grid modernization, and data center expansion. Major companies are investing in advanced SiC fabrication facilities and collaborations with automotive OEMs to ensure local supply. Supportive government policies promoting clean energy and EV incentives further enhance regional growth. Canada and Mexico also contribute through industrial automation and power electronics applications, reinforcing North America’s leadership in SiC innovation and deployment.

Europe

Europe accounted for 27.6% of the Silicon Carbide MOSFETs Market share, fueled by stringent emission regulations and the rapid transition to electric mobility. Germany, France, and the UK are key contributors, driven by strong automotive and renewable energy industries. European automakers are integrating SiC MOSFETs into next-generation EV platforms to improve efficiency and performance. Additionally, renewable initiatives such as wind and solar energy projects support adoption in power inverters and grid systems. Continuous R&D investments, along with regional semiconductor alliances, position Europe as a major hub for SiC technology innovation and sustainable industrial transformation.

Asia-Pacific

Asia-Pacific dominated the Silicon Carbide MOSFETs Market with a 36.8% share, led by China, Japan, and South Korea. The region benefits from large-scale semiconductor manufacturing, rapid EV adoption, and strong government support for clean energy initiatives. China’s aggressive EV expansion and Japan’s advancements in high-efficiency industrial systems drive strong demand for SiC devices. Local manufacturers are investing in wafer production and power module development to strengthen domestic supply chains. Expanding renewable energy installations and industrial automation in emerging economies further support market growth, making Asia-Pacific the fastest-growing and most competitive regional segment globally.

Latin America

Latin America captured a 1.8% market share in the Silicon Carbide MOSFETs Market, driven by growing renewable energy investments and electrification initiatives. Brazil and Mexico lead regional demand, supported by solar and wind energy projects and government incentives promoting green technologies. Industrial sectors are gradually adopting SiC MOSFETs for efficient power control and reduced energy losses. Although manufacturing infrastructure remains limited, partnerships with global semiconductor companies are emerging. The region’s focus on sustainable energy solutions and modernization of industrial power systems creates new opportunities for SiC technology expansion in the coming years.

Middle East & Africa

The Middle East & Africa region held a 1.4% market share in the Silicon Carbide MOSFETs Market, supported by renewable energy development and industrial transformation. The UAE and Saudi Arabia are investing heavily in solar power and smart grid infrastructure, where SiC MOSFETs enhance energy conversion efficiency. South Africa’s industrial modernization and electrification projects also contribute to growing demand. Despite slower adoption compared to other regions, increasing focus on energy diversification and reduced carbon dependency drives long-term growth potential. Strategic collaborations with global semiconductor suppliers are expected to strengthen the regional SiC ecosystem.

Market Segmentations

By Device Type

- Discrete SiC MOSFETs

- Module SiC MOSFETs

By Application

- Power supplies

- Inverters

- Electric vehicles (EVs)

- Industrial equipment

- Others

By End-use

- Automotive

- Industrial

- Consumer electronics

- Telecommunications

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The silicon carbide (SiC) MOSFETs market is dominated by leading semiconductor manufacturers focusing on efficiency, reliability, and power density enhancement. ROHM Semiconductor and Infineon Technologies AG lead with advanced SiC MOSFET portfolios offering superior thermal performance and high switching speeds for electric vehicles and industrial power modules. Mitsubishi Electric Corporation and Renesas Electronics Corporation emphasize integration of SiC technology into automotive inverters and renewable energy systems, enhancing energy conversion efficiency. Microchip Technology Inc. and ON Semiconductor expand production capacity and introduce 1200V and 1700V SiC MOSFETs for high-voltage applications. Hitachi Power Semiconductor Device and Littelfuse, Inc. focus on compact designs that improve current handling and system reliability. II-VI Incorporated (now Coherent Corp.) supports the value chain with high-quality SiC substrates, ensuring material purity and scalability. Strategic mergers, capacity expansions, and long-term supply partnerships characterize the market’s competitive strategies amid accelerating EV and clean energy adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ROHM Semiconductor

- Renesas Electronics Corporation

- Microchip Technology Inc.

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- STARCHIP

- ON Semiconductor

- Hitachi Power Semiconductor Device, Ltd.

- Littelfuse, Inc.

- II-VI Incorporated (now Coherent Corp.)

Recent Developments

- In May 2024, Infineon unveils CoolSiC MOSFETs 400 V redefining power density and efficiency in AI SERVER power supplies. The new MOSFET portfolio was specially developed for use in the AC/DC stage of AI servers, complementing Infineon’s recently announced PSU roadmap. The devices are also ideal for solar and energy storage systems (ESS), inverter motor control, industrial and auxiliary power supplies (SMPS) as well as solid-state circuit breakers for residential buildings.

- In December 2023, Nexperia is developing its own SiC MOSFETs, marked by the introduction of two inaugural 1,200 V devices in three-pin packaging: the NSF040120L3A0 and NSF080120L3A. Nexperia have one of the key advantages of its new SiC MOSFETs is their relatively stable drain-to-source on-resistance (RDS (on)) over the operating temperature range of the device.

Report Coverage

The research report offers an in-depth analysis based on Device Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for SiC MOSFETs will increase with rapid adoption of electric and hybrid vehicles.

- Advancements in wafer manufacturing will lower production costs and improve yield efficiency.

- Renewable energy applications will expand as SiC devices enhance inverter performance and power density.

- Automotive OEMs will integrate more SiC components into onboard chargers and traction inverters.

- Industrial automation will boost usage of SiC MOSFETs in variable frequency drives and power control systems.

- Data centers will adopt SiC technology to improve energy efficiency and thermal management.

- Strategic partnerships among semiconductor companies will strengthen global SiC supply chains.

- Government initiatives promoting clean energy and EV infrastructure will accelerate market penetration.

- Continuous R&D will focus on reliability improvements and high-voltage performance optimization.

- Asia-Pacific will remain the key manufacturing hub, while Europe and North America drive innovation and adoption.