Market Overview

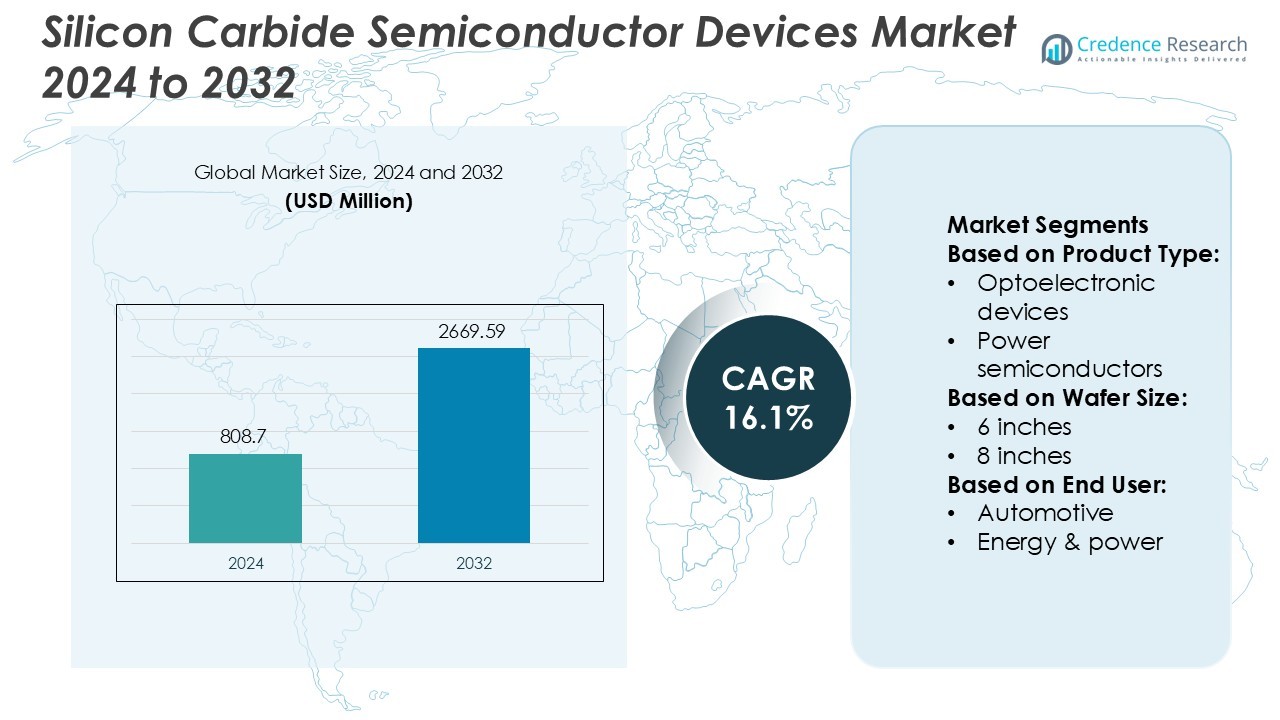

Silicon Carbide Semiconductor Devices Market size was valued USD 808.7 million in 2024 and is anticipated to reach USD 2669.59 million by 2032, at a CAGR of 16.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicon Carbide Semiconductor Devices Market Size 2024 |

USD 808.7 Million |

| Silicon Carbide Semiconductor Devices Market, CAGR |

16.1% |

| Silicon Carbide Semiconductor Devices Market Size 2032 |

USD 2669.59 Million |

The Silicon Carbide Semiconductor Devices Market is dominated by key players including TT Electronics plc., ROHM Co., Ltd., Mitsubishi Electric Corporation, WOLFSPEED, INC., Powerex Inc., Infineon Technologies AG, Toshiba Corporation, ALLEGRO MICROSYSTEMS, INC., STMicroelectronics N.V., and Gene Sic Semiconductor. These companies drive the market through advanced R&D, strategic collaborations, and capacity expansions, focusing on high-performance wafers, efficient power modules, and automotive and industrial applications. WOLFSPEED and Infineon lead in high-voltage and automotive segments, while STMicroelectronics and Mitsubishi Electric strengthen production scalability and packaging technology. The competitive environment emphasizes innovation, cost efficiency, and regional expansion to meet rising global demand. Asia-Pacific emerges as the leading region with a 32% market share, driven by rapid electric vehicle adoption, renewable energy projects, and strong local semiconductor manufacturing infrastructure. Regional incentives and government support further reinforce Asia-Pacific’s dominance in SiC device consumption and production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Silicon Carbide Semiconductor Devices Market was valued at USD 808.7 million in 2024 and is projected to reach USD 2669.59 million by 2032, growing at a CAGR of 16.1%.

- Market growth is driven by rising electric vehicle adoption, renewable energy expansion, and industrial automation, increasing demand for high-efficiency SiC devices.

- Key trends include development of high-performance wafers, advanced packaging, energy-efficient power modules, and increasing focus on automotive and industrial applications.

- The market faces challenges such as high manufacturing costs, complex production processes, and limited local wafer supply in emerging regions.

- Competitive dynamics are shaped by TT Electronics plc., ROHM, Mitsubishi Electric, WOLFSPEED, Infineon, Toshiba, ALLEGRO MICROSYSTEMS, STMicroelectronics, and Gene Sic Semiconductor, while Asia-Pacific leads with 32% share, followed by Europe and North America. Automotive and energy sectors dominate segment share, with ongoing regional expansions supporting market growth globally.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Power semiconductors dominated the Silicon Carbide Semiconductor Devices Market with the largest share, supported by growing demand for high-efficiency switching devices in electric vehicles, renewable power systems, and industrial automation. These components offer faster switching speeds, lower heat loss, and higher voltage tolerance than silicon-based alternatives. Optoelectronic devices gained traction in LEDs and optical sensors, while frequency devices served radar, satellite, and high-frequency communication systems. The surge in EV charging infrastructure and grid modernization programs continues to strengthen power semiconductor adoption across global markets.

- For instance, TT Electronics launched its SML25SCM650N2B silicon‑carbide OSFET, rated for 650 V and designed for high temperature operation in industrial power conversion.

By Wafer Size

The 6-inch wafer segment held the largest market share due to its balance of manufacturing efficiency and production cost, enabling higher substrate availability compared to smaller wafer formats. Fabrication plants increasingly shift from 4-inch to 6-inch wafers to improve output and device performance for EVs, industrial power modules, and telecommunication equipment. Although 8-inch wafers promise long-term scalability, production remains in early development stages. Meanwhile, 1-to-4-inch wafers continue to support research and specialty applications. Strong investment in semiconductor fab expansions has accelerated 6-inch wafer adoption worldwide.

- For instance, ROHM’s 4th Generation SiC MOSFET, e.g. part number SCT4013DR, delivers a drain‑source voltage of 750 V and an on‑state resistance of 13 mΩ in a TO‑247‑4L package.

By End User

Automotive was the leading end-user segment with the highest market share, driven by rapid growth in electric vehicles, onboard charging systems, and powertrain electrification. Car makers prefer SiC devices for improved power density, fast charging capability, and reduced energy loss. Energy and power utilities adopted SiC for smart grids and renewable inverters, while consumer electronics used them for fast chargers and power supplies. Aerospace and defense applications relied on high-temperature and high-frequency performance, and medical devices used SiC sensors and converters for precision equipment. Rising investments in EVs continue to anchor automotive dominance.

Key Growth Drivers

Rising Adoption of Electric Vehicles

Electric vehicle manufacturers increasingly rely on SiC power devices to enhance energy efficiency, reduce heat loss, and support fast charging. These components allow smaller, lighter powertrains and improve battery range, which makes EVs more competitive against combustion engines. Governments promoting clean mobility and offering subsidies accelerate this shift. Automakers also integrate SiC-based inverters and onboard chargers to achieve higher switching frequency and improved thermal stability. As global EV production scales and charging infrastructure expands, demand for SiC semiconductor solutions continues to rise.

- For instance, Mitsubishi Electric’s N‑series 1200 V SiC‑MOSFET features a figure‑of‑merit of 1,450 mΩ·nC and self‑turn‑on tolerance improved by 14× compared with earlier products.

Growing Demand for Renewable Energy and Smart Grids

Expanding solar and wind installations drive the adoption of SiC components in high-efficiency power conversion systems. SiC devices operate at higher voltages and temperatures, enabling compact inverters, longer system life, and lower electricity loss. Utilities also deploy SiC-based converters in smart grid networks to regulate power distribution and reduce outage risks. Energy storage systems further rely on SiC to enhance charging and discharging performance. As countries pursue carbon-neutral targets, renewable investments and grid modernization programs strengthen market growth for SiC technologies.

- For instance, Wolfspeed’s 2300 V baseplate‑less SiC power modules, designed for 1500 V DC bus applications, deliver a 77 % reduction in switching losses over IGBTs and enable a 15 % higher voltage headroom than comparable SiC modules.

Advancements in Semiconductor Fabrication Technology

Manufacturers focus on larger wafer formats, improved crystal growth, and enhanced defect control to boost production output. The shift from 4-inch to 6-inch wafers reduces cost per device and increases supply for automotive and industrial sectors. New epitaxy methods deliver higher purity and better electric breakdown capability, improving device reliability and lifespan. Integrated device makers and wafer suppliers expand fabrication plants to scale commercial availability. Continuous R&D investments, strategic collaborations, and high-volume processing unlock further performance improvements and cost optimization for SiC device manufacturing.

Key Trends & Opportunities

Emergence of 8-Inch SiC Wafers

Global semiconductor manufacturers are investing in 8-inch SiC wafer lines to meet future demand and enhance economies of scale. Although still in early development, this transition promises higher chip output per wafer, lower production cost, and broader adoption in mass-market applications. Companies that achieve stable yield and defect-free processing gain a strong competitive advantage. The shift also supports long-term commercialization of SiC in consumer electronics, industrial power modules, and high-volume automotive components. As production matures, 8-inch wafers create major growth opportunities.

- For instance, Powerex has introduced a new lineup of SiC power modules and discrete devices covering blocking voltages from 650 V up to 10,000 V. The launch underlines its transition towards wide‑bandgap semiconductor production.

Integration of SiC in Fast-Charging Infrastructure

Fast-charging stations require high-efficiency power modules capable of handling extreme voltage and heat. SiC devices address these challenges by minimizing energy loss and supporting compact, lightweight charger designs. Their use shortens charging times and increases station durability, which improves user convenience and operational cost. Utility providers and EV charging companies invest in SiC converters and rectifiers as nationwide charging networks expand. This trend creates strong potential for scalable deployment across highways, commercial hubs, and public transport networks.

- For instance, Infineon’s “CoolSiC™ M1H” power modules deliver a blocking voltage (VDSS) of 1200 V, an on‑state resistance (RDS(on)) of 4 mΩ, and a rated current (IDN) of 200 A while integrating an NTC temperature sensor and PressFIT contact technology.

Rising Penetration in Aerospace and Defense

Aerospace and defense systems require components that tolerate harsh temperatures, vibration, and high-frequency operation. SiC-based radar, satellite communication, and power systems deliver superior thermal resistance and compact architecture. Defense agencies also benefit from higher switching speed and energy density for mission-critical electronics. The shift toward advanced avionics, lightweight aircraft, and unmanned platforms expands the application scope. As military modernization accelerates across major economies, SiC solutions gain greater adoption in long-range communication, surveillance, and high-power propulsion systems.

Key Challenges

High Manufacturing Cost and Complex Production

SiC crystal growth, epitaxy, and wafer processing remain more expensive and technically demanding compared to silicon. Material defects, wafer brittleness, and strict temperature control increase fabrication complexity and limit large-scale yield. This leads to higher device cost, which restricts adoption among cost-sensitive industries. Although larger wafer formats help reduce expenses, the transition requires new equipment and long qualification cycles. Manufacturers must continue improving yield optimization and supply chain efficiency to overcome cost barriers and expand SiC penetration.

Limited Supply Chain and Material Availability

The supply of high-quality SiC wafers remains limited due to the concentration of a few global producers and long lead times for facility expansion. These constraints affect pricing, delivery schedules, and production planning for downstream device manufacturers. Power electronics companies face procurement challenges during high-demand cycles, especially in automotive and renewable energy. Any disruption in raw material availability can delay product development. Strategic partnerships, wafer capacity expansion, and vertical integration are critical to stabilizing supply and supporting long-term market growth.

Regional Analysis

North America

North America holds about 12% of the global market. Growth is driven by strong demand from automotive and industrial power-electronics sectors. The U.S. and Canada are investing in local manufacturing and research to improve efficiency and reduce imports. Electric vehicle adoption, industrial automation, and grid modernisation are major drivers. Leading companies are focusing on advanced SiC wafer production and packaging technologies. Government incentives for clean energy and EVs also support market growth. Overall, North America is expected to see steady expansion due to technological innovation and increasing use of SiC devices across multiple industries.

Europe

Europe accounts for roughly 20% of the market. Demand is driven by automotive OEMs, renewable-energy projects, and industrial electrification. EU policies promote clean mobility and low-carbon technologies, boosting SiC semiconductor adoption. Germany, France, and Italy are key hubs for manufacturing and R&D. Companies are expanding wafer and device production to meet rising EV and industrial demand. Supply-chain localisation is a strategic focus to reduce dependency on imports. Growth in Europe is also supported by infrastructure upgrades and government incentives. The combination of policy support and technological advancements positions Europe as a major region for SiC devices.

Asia

Asia dominates with about 32% market share. Strong EV adoption, renewable-energy expansion, and semiconductor manufacturing in China, Japan, India, and South Korea drive growth. Governments provide incentives for SiC production and adoption, strengthening local supply chains. Major automotive and industrial companies prefer SiC devices for high-efficiency applications. Capacity expansion in wafer fabrication and device assembly is ongoing. Asia’s dominance is supported by cost advantages and large-scale infrastructure projects. The region is expected to maintain leadership as EVs, renewable energy, and industrial automation continue to expand rapidly across Asia-Pacific countries.

Latin America

Latin America holds around 6% of the global market. Growth is supported by renewable-energy projects, industrial electrification, and EV adoption in Brazil, Mexico, and other countries. Limited local manufacturing and slower infrastructure development constrain growth. Investment in grid modernisation and energy projects is increasing demand for SiC devices. Companies are gradually expanding their presence in the region. Adoption is focused on industrial power applications and emerging EV markets. Over time, local production and infrastructure upgrades are expected to improve market share. Latin America presents long-term potential despite current market limitations.

Middle East & Africa

The Middle East & Africa hold roughly 5% of the market. Adoption is driven by power infrastructure upgrades, oil-to-clean energy transitions, and renewable-energy projects. SiC devices are preferred for high-temperature and harsh-environment applications. Manufacturing and local assembly remain limited, which restricts market growth. Investments in energy projects, grid modernisation, and industrial automation are gradually increasing demand. Government initiatives supporting clean energy and electrification further boost the market. While current share is small, strategic energy transitions and infrastructure investments are expected to enhance growth potential in the Middle East & Africa over the forecast period.

Market Segmentations:

By Product Type:

- Optoelectronic devices

- Power semiconductors

By Wafer Size:

By End User:

- Automotive

- Energy & power

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Silicon Carbide (SiC) Semiconductor Devices Market players such as TT Electronics plc., ROHM Co., Ltd., Mitsubishi Electric Corporation, WOLFSPEED, INC., Powerex Inc., Infineon Technologies AG, Toshiba Corporation, ALLEGRO MICROSYSTEMS, INC., STMicroelectronics N.V., and Gene Sic Semiconductor. The Silicon Carbide (SiC) Semiconductor Devices Market is highly competitive, driven by rapid technological advancements and growing demand across automotive, energy, and industrial sectors. Companies focus on enhancing power efficiency, high-voltage performance, and thermal reliability to meet evolving customer requirements. Strategic initiatives such as mergers, partnerships, and capacity expansions are common to strengthen market presence and geographic reach. Investment in R&D enables development of high-performance wafers, advanced packaging, and energy-efficient power modules. The market emphasizes scalable production, cost reduction, and adoption of SiC in electric vehicles, renewable energy systems, and industrial automation. Continuous innovation and regional expansion are crucial for maintaining competitiveness, with firms leveraging product differentiation, improved supply chains, and technological breakthroughs to secure long-term growth in a rapidly expanding global market.

Key Player Analysis

- TT Electronics plc.

- ROHM Co., Ltd.

- Mitsubishi Electric Corporation

- WOLFSPEED, INC.

- Powerex Inc.

- Infineon Technologies AG

- Toshiba Corporation

- ALLEGRO MICROSYSTEMS, INC.

- STMicroelectronics N.V.

- Gene Sic Semiconductor

Recent Developments

- In March 2025, RFMW, a division of Exponential Technology Group, Inc., formed a strategic partnership with CoolCAD Electronics in order to expand its line of high-power and high-voltage silicon carbide (SiC) semiconductor devices. This contract enhances RFMW’s capacity to provide clients with cutting-edge wide bandgap solutions, allowing for increased efficiency, performance, and dependability in high-temperature and high-power applications.

- In February 2025, Infineon Technologies AG’s plan for silicon carbide (SiC) at 200 mm has advanced significantly. The devices that are produced in Villach, Austria, offer top-notch SiC power technology for high-voltage applications such as electric vehicles, trains, and renewable energy sources. Furthermore, Infineon is on schedule to switch from 150-millimeter wafers to the bigger and more effective 200-millimeter diameter wafers at its manufacturing facility in Kulim, Malaysia.

- In January 2025, Wolfspeed, Inc., a global leader in silicon carbide technology, introduced its new Gen 4 technology platform, which enables design rooted in durability and efficiency, all while reducing system cost and development time.

- In June 2024, ROHM Co. Ltd., a power semiconductor device manufacturer based in Japan, has introduced the EcoSiC name as a trademark for silicon carbide (SiC) devices. The EcoSiC brand launch aims to achieve a number of strategic goals, including increased performance, sustainability, and technological innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Wafer Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as electric vehicle adoption accelerates globally.

- Renewable energy projects will increase demand for high-efficiency SiC devices.

- Automotive and industrial sectors will drive growth through advanced power modules.

- Technological advancements will improve thermal performance and high-voltage reliability.

- Increased wafer production capacity will strengthen regional supply chains.

- Emerging economies will offer new growth opportunities for SiC semiconductor adoption.

- Companies will focus on cost reduction through scalable manufacturing processes.

- Partnerships and collaborations will accelerate innovation and market penetration.

- Expansion in industrial automation and smart grids will boost device utilization.

- Research in next-generation SiC materials will enhance device efficiency and durability.