Market Overview

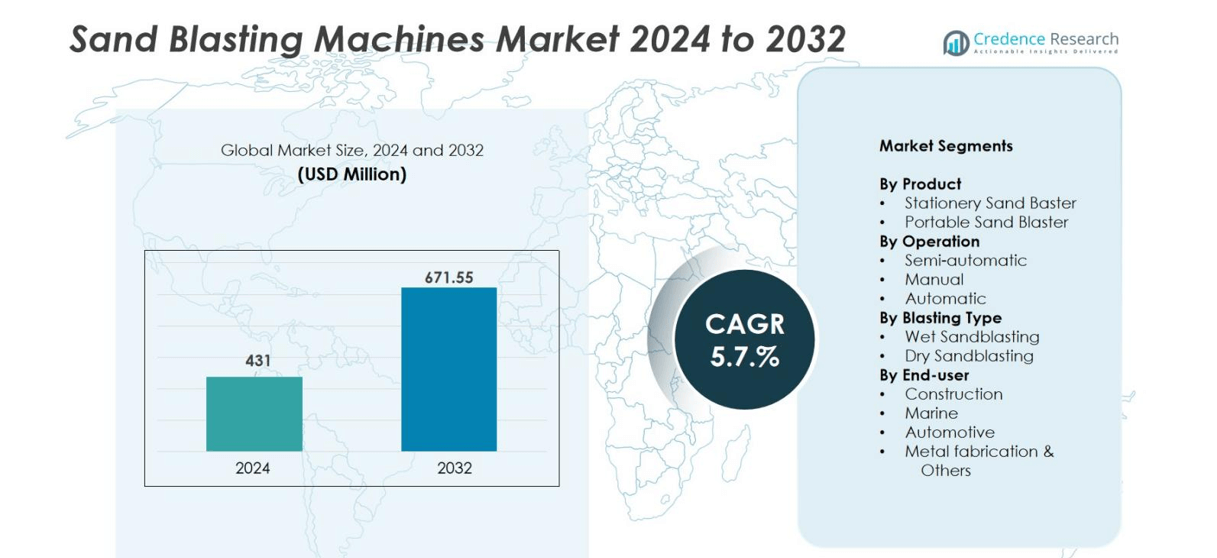

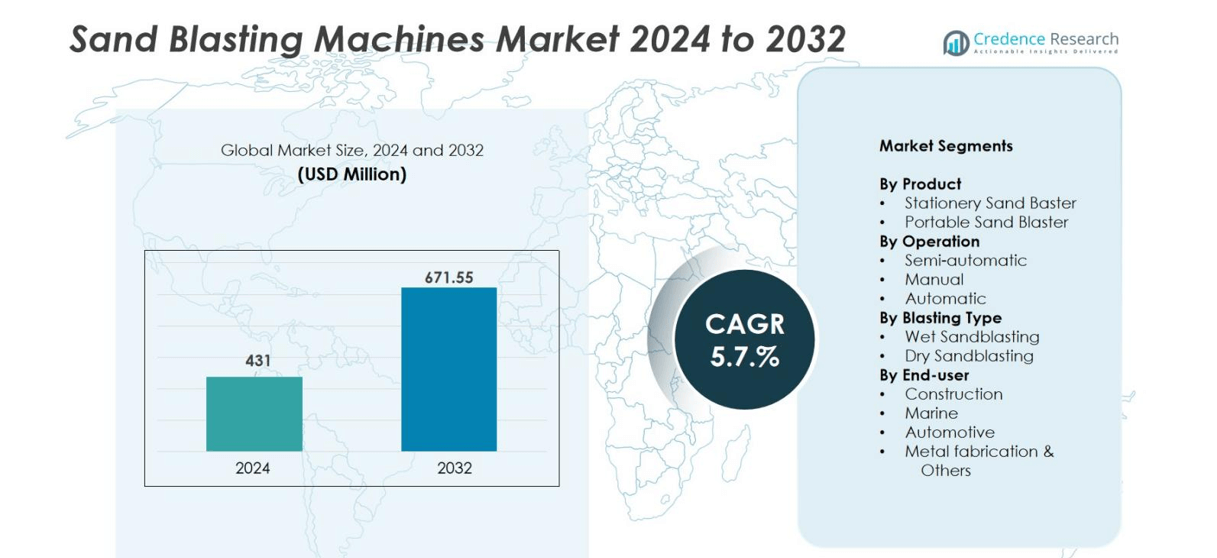

The Sand Blasting Machines market size was valued at USD 431 million in 2024 and is anticipated to reach USD 671.55 million by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sand Blasting Machines Market Size 2024 |

USD 431 million |

| Sand Blasting Machines Market, CAGR |

5.7% |

| Sand Blasting Machines Market Size 2032 |

USD 671.55 million |

The competitive landscape of the sand blasting machines market features leading manufacturers such as Clemco Industries Corporation, Graco Inc., Guyson Corporation, and Sinto Group, which cement their positions through strong R&D, broad distribution networks and product innovation. These players intensify competition by introducing automated, dust‑controlled and eco‑friendly blasting solutions tailored for automotive, ship‑building and industrial markets. Region‑wise, the Asia‑Pacific region stands as the dominant market, holding 37% of global share in 2023, driven by rapid industrialisation, infrastructure investment and growth in manufacturing sectors across China, India and Southeast Asia.

Market Insights

- The Sand Blasting Machines market was valued at USD 431 million in 2024 and is projected to reach USD 671.55 million by 2032, growing at a CAGR of 5.7%.

- Growing demand from automotive, aerospace, and industrial sectors is driving market expansion, with portable sand blasters holding 58% segment share.

- Technological trends such as automation, dustless blasting, and eco-friendly solutions are shaping product development, improving efficiency and safety.

- The market is competitive, led by Clemco Industries Corporation, Graco Inc., Guyson Corporation, and Sinto Group, focusing on R&D, automation, and service excellence.

- Asia Pacific dominates with a 37% regional share, followed by North America at 35% and Europe at 24%, driven by rapid industrialisation, infrastructure projects, and manufacturing growth in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The portable sand blaster segment dominates the Sand Blasting Machines Market with a 58% share in 2024. Its mobility, ease of operation, and suitability for on-site applications drive widespread adoption across construction, automotive, and shipbuilding industries. Portable units offer cost efficiency and flexibility in cleaning, surface finishing, and coating removal processes. Stationary sand blasters, though efficient in large-scale industrial setups, are primarily used in fixed facilities such as manufacturing plants. Growing demand for maintenance and refurbishment operations continues to strengthen the portable segment’s market leadership globally.

- For instance, Clemco Industries Corp. offers portable sandblasting systems that prioritize user safety and environmental sustainability, widely adopted for maintenance and refurbishing tasks.

By Operation

The semi-automatic segment holds the leading position with a 46% share in 2024 due to its balance between cost, efficiency, and control. Semi-automatic sand blasters are widely used in industrial and manufacturing sectors where partial automation enhances productivity while retaining manual flexibility. These systems offer consistent blasting performance and reduced labor dependency compared to manual machines. Meanwhile, automatic systems are gaining traction in high-volume applications for precision finishing. Increasing automation adoption across production facilities is expected to further support growth in both semi-automatic and automatic sandblasting systems.

- For instance, Fevi S.r.l., an Italian manufacturer, integrates semi-automatic sandblasters with automated filter cleaning and safety features, optimizing industrial surface treatment processes.

By Blasting Type

Dry sandblasting dominates the market with a 64% share in 2024, driven by its superior surface cleaning capability and efficiency in removing rust, paint, and contaminants. It is widely preferred in metal fabrication, aerospace, and automotive industries where high-speed abrasive cleaning is required. Wet sandblasting, though gaining momentum for dust-free operations, is mainly adopted for delicate surfaces and environmental compliance. The shift toward eco-friendly and dust-controlled operations is encouraging manufacturers to enhance wet blasting systems while maintaining dry blasting’s strong market presence across industrial applications.

Key Growth Drivers

Expanding Industrial and Automotive Applications

The rising demand from industrial and automotive sectors is a major growth driver for the Sand Blasting Machines Market. These machines are essential for surface cleaning, rust removal, and paint stripping before coating or welding. Automotive manufacturers use sandblasting to prepare metal bodies and engine components for better adhesion and finish. Industrial applications, including shipbuilding, aerospace, and metal fabrication, continue to boost product demand. For instance, aerospace maintenance uses sandblasting for precision cleaning of turbine blades. As industries prioritize surface quality and material integrity, the demand for efficient blasting solutions will continue to rise globally.

- For instance, Clemco Industries’ Classic Blast Pots and EcoQuip 2 vapor abrasive machines are widely used in shipyards, construction, and energy sectors for efficient rust removal and surface preparation, helping contractors meet higher safety and environmental standards.

Increasing Adoption of Automation and Robotics

Automation and robotic integration are transforming traditional blasting operations. Automated sandblasting machines enhance productivity, accuracy, and worker safety while minimizing downtime. Manufacturers are investing in robotic systems capable of performing repetitive and high-precision cleaning tasks. Automated control systems also ensure consistent media flow and surface uniformity. For example, robotic blasting systems in automotive paint shops have improved process speed by up to 40%. These advancements reduce labor costs and ensure compliance with strict quality standards, making automation a strong growth catalyst across industries focused on modernization and smart manufacturing.

- For instance, Abratech’s automated sandblasting equipment has been shown to enhance productivity and surface preparation effectiveness by reducing material consumption and operational downtime.

Growth in Infrastructure and Construction Activities

Infrastructure expansion worldwide is fueling the adoption of sandblasting machines for surface preparation and restoration. Bridges, buildings, and pipelines require effective cleaning to ensure coating adhesion and corrosion resistance. The use of portable sandblasters has grown rapidly in road, rail, and marine infrastructure projects due to their on-site operational flexibility. Governments investing in urban development and industrial renovation are further propelling market growth. For instance, large-scale bridge rehabilitation projects rely on sandblasting for removing rust and old coatings before repainting. This growing infrastructure activity continues to strengthen the global demand for sandblasting equipment.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Dustless Blasting Solutions

The increasing focus on sustainability is driving a transition toward eco-friendly sandblasting technologies. Dustless blasting machines use water and biodegradable abrasives to minimize airborne particles, improving safety and environmental compliance. This trend is gaining momentum in regions with strict emission and worker safety regulations. Manufacturers are introducing low-dust models that reduce abrasive consumption and waste generation. For instance, wet blasting systems are increasingly used in marine maintenance to prevent surface contamination. These innovations not only meet environmental standards but also open opportunities in green construction and surface finishing sectors.

- For instance, Dustless Blasting® uses crushed recycled glass that contains less than 1% free silica, greatly reducing dust emissions and water consumption compared to traditional methods.

Technological Advancements and Digital Integration

Digital monitoring and automation are reshaping the sandblasting landscape. Integration of IoT-enabled sensors allows real-time tracking of pressure, abrasive flow, and nozzle wear, optimizing machine efficiency. Predictive maintenance systems reduce downtime and improve operational reliability. Companies are also focusing on energy-efficient compressors and advanced control interfaces. For example, smart sandblasting units with digital dashboards enable remote performance analysis and parameter adjustments. These advancements enhance process precision and cost-effectiveness, presenting significant opportunities for manufacturers to offer intelligent, connected solutions across diverse industrial applications.

- For instance, MIZHI’s shot blasting machines embed IoT sensors that continuously track machine performance and media flow, enabling early detection of issues and reducing unexpected failures.

Growing Demand from Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing increased industrialization and construction spending. This creates substantial opportunities for sandblasting equipment manufacturers. Rapid growth in automotive production, metal fabrication, and ship repair activities has accelerated the adoption of both portable and stationary sandblasting systems. Infrastructure modernization projects, particularly in India and China, demand efficient surface cleaning and coating solutions. The availability of affordable labor combined with government-backed manufacturing initiatives enhances market prospects, making developing nations key growth hubs for future expansion and technology localization.

Key Challenges

Environmental Regulations and Health Concerns

Stringent environmental and occupational safety regulations present a significant challenge for the Sand Blasting Machines Market. Traditional dry blasting methods generate silica dust and hazardous particles that pose respiratory risks to operators. Many regions now mandate dust collection systems and protective enclosures, increasing operational costs. Compliance with international standards such as OSHA and EPA adds further pressure on manufacturers to innovate. Transitioning to dustless or water-based technologies requires investment and process redesign. Companies must balance cost efficiency with safety and sustainability, creating both compliance and innovation challenges for the industry.

High Equipment and Maintenance Costs

The high initial investment and maintenance costs associated with advanced sandblasting systems limit adoption among small and medium enterprises. Automated and robotic systems, while efficient, require skilled labor and periodic servicing, raising total operational expenses. Frequent wear and replacement of nozzles, hoses, and abrasive media further add to maintenance costs. Additionally, the need for reliable air compressors and dust collectors increases capital expenditure. These financial constraints hinder widespread adoption, particularly in cost-sensitive markets. Manufacturers are thus focusing on offering modular, energy-efficient, and low-maintenance solutions to enhance affordability and user accessibility.

Regional Analysis

North America

The North American market commanded a significant share of the global sand‑blasting machines market, with about 35% in 2023. Growth stemmed from strong automotive manufacturing, aerospace maintenance, and industrial surface‑preparation activities in the U.S. and Canada. Equipment suppliers expanded offerings of automated and dust‑controlled systems to meet stringent environmental and safety regulations. Manufacturers benefitted from steady demand for refurbishment and infrastructure upkeep, reinforcing North America as a mature yet resilient region for sand‑blasting machines.

Europe

Europe held 24% of the sand‑blasting machines market in 2023. Industrial production in Germany, France, and Italy drove demand for specialised blasting machines, especially in automotive and heavy machinery sectors. Tight regulation on emissions and workplace safety urged users to upgrade to enclosed and automated systems. While growth remained moderate compared to emerging markets, Europe’s focus on sustainability and high‑precision manufacturing supported stable equipment investment.

Asia Pacific

The Asia Pacific region dominated with 37% market share in 2023 for sand‑blasting machines. Rapid industrialisation, rising automotive production, shipbuilding, and infrastructure expansion in China, India, and Southeast Asia fuelled regional demand. Local manufacturers offered cost‑competitive portable and stationary units, and government investments accelerated uptake of surface‑treatment technologies. Asia Pacific emerged as the fastest‑growing region, underscoring its strategic importance in the global market.

Latin America

Latin America accounted for 11.6% of the global sand‑blasting machine market in 2025, reflecting its broader position in sand‑blasting equipment. Developing infrastructure and mining operations in Brazil, Argentina, and Chile drove demand for surface‑preparation machinery. However, slower industrialisation and limited automation adoption tempered growth. Suppliers targeting Latin America offered modular and budget‑friendly units to capture the rising mid‑market segment.

Middle East & Africa

The Middle East commanded 12.45% and Africa 13.23% of the sand‑blasting machine market in 2025. Large infrastructure, oil & gas facility maintenance, and port constructions in the GCC and North Africa stimulated uptake of blasting machines. Nonetheless, affordability, local manufacturing constraints, and skills gaps hindered rapid automation adoption, making manual and semi‑automatic units the preferred choice in many settings.

Market Segmentations:

By Product

- Stationery Sand Baster

- Portable Sand Blaster

By Operation

- Semi-automatic

- Manual

- Automatic

By Blasting Type

- Wet Sandblasting

- Dry Sandblasting

By End-user

- Construction

- Marine

- Automotive

- Metal fabrication & Manufacturing

- Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global sand blasting machines market demonstrates a moderate concentration of key players, combined with a broad base of niche suppliers. Major companies such as Clemco Industries Corporation, Graco Inc., Guyson Corporation, Sinto Group, and Norton Sandblasting Equipment maintain leadership through strong brand recognition, established distribution networks, and consistent investment in R&D. These leading firms focus on innovations in automation, dust control, and eco‑friendly abrasives to differentiate their offerings. At the same time, many smaller regional players compete on price, niche applications, and service responsiveness. The result is a dynamic environment where product innovation, strategic partnerships, and efficient global supply chains define competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Guyson Corporation

- Hangzhou Color Powder Coating Equipment Co., Ltd.

- Surface Blasting Systems, LLC

- MMLJ, Inc.

- Beijing Coowor Network Technology Co., Ltd.

- Graco Inc.

- CONIEX SA

- Fratelli Pezza

- Norton Sandblasting Equipment

- Axxiom Manufacturing, Inc.

- Hangzhou Huashengtong Machinery Equipment Co., Ltd.

- Sinto Group

- Clemco Industries Corporation

- Micro Blaster’s

Recent Developments

- In July 2024, Graco Inc., known for its fluid handling systems, entered into a strategic partnership with BlastOne International, a prominent provider of surface preparation and protective coating solutions. The partnership is expected to drive innovation in the sandblasting market and offer enhanced solutions for demanding industrial applications.

- In 2023, the Company Graco Inc. allocated $83 million to product development across all segments, up from $80 million in both 2022 and 2021. Graco Inc. is eyeing a broader horizon, potentially diversifying its sand blasting machine offerings to serve industries such as automotive, construction, and oil & gas.

Report Coverage

The research report offers an in-depth analysis based on Product, Operation, Blasting Type, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will increasingly offer compact, portable sand‑blasting machines suited for on‑site repairs and maintenance.

- Integration of IoT and sensor technologies will enable real‑time performance monitoring and predictive maintenance of blasting equipment.

- Growing environmental and worker‑safety regulations will push adoption of eco‑friendly abrasives and dust‑suppressed blasting systems.

- Automation and robotics will extend into blasting operations, driving higher throughput and lower labour costs in industrial applications.

- Emerging economies will become key growth areas as infrastructure, shipbuilding and automotive sectors expand rapidly.

- Manufacturers will focus on modular and scalable systems to serve small‑ and medium‑sized enterprises with lower total cost of ownership.

- Cross‑industry applications such as renewable energy, rail refurbishment and heavy‑equipment reconditioning will broaden the use case for blasting machines.

- Service‑based models—leasing, maintenance contracts and refurbishments—will gain traction to reduce upfront investment barriers.

- Supply‑chain digitization will enhance component availability and reduce lead‑times for OEMs and end‑users.

- Product differentiation will hinge on smart user‑interfaces, energy‑efficient compressors and reduced abrasive consumption, enhancing competitive positioning.