Market Overview

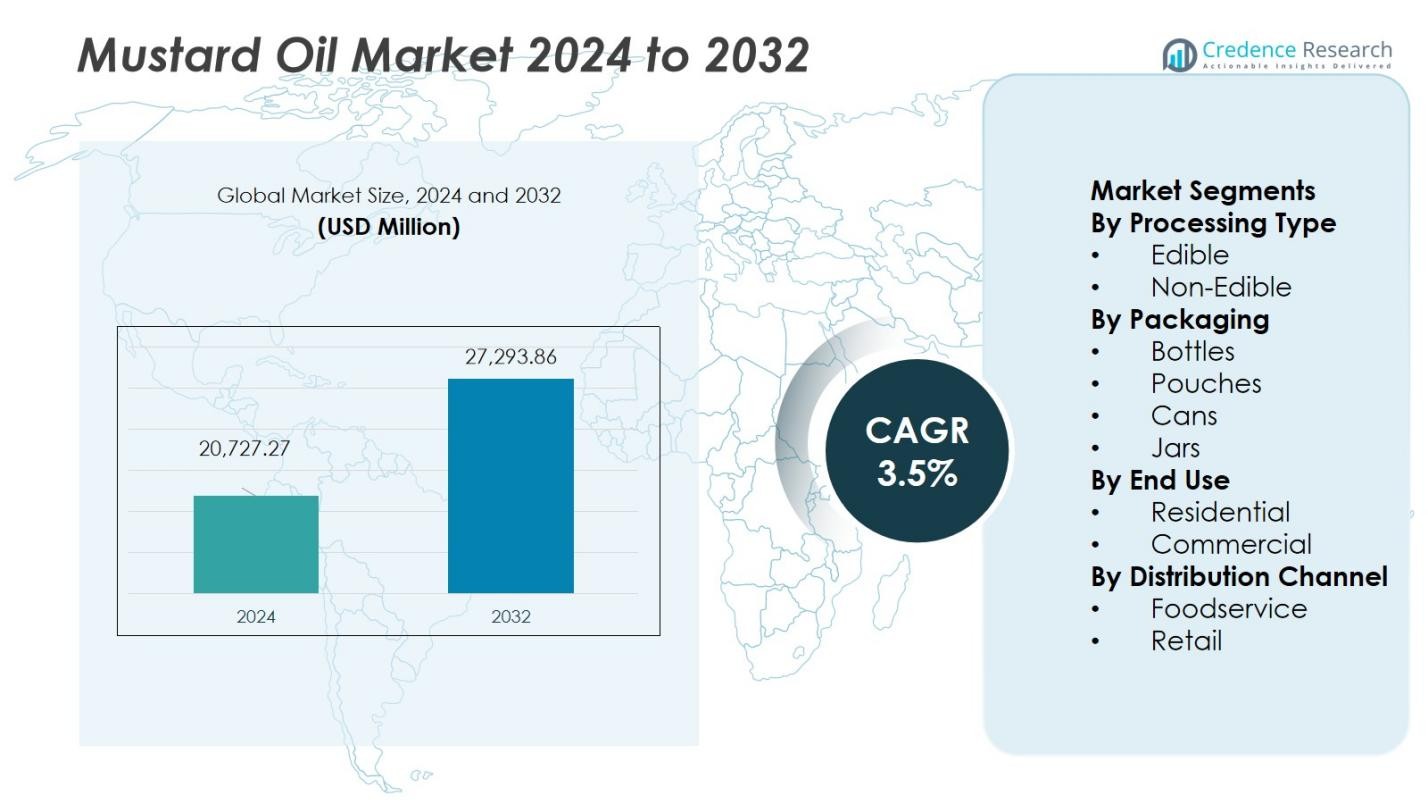

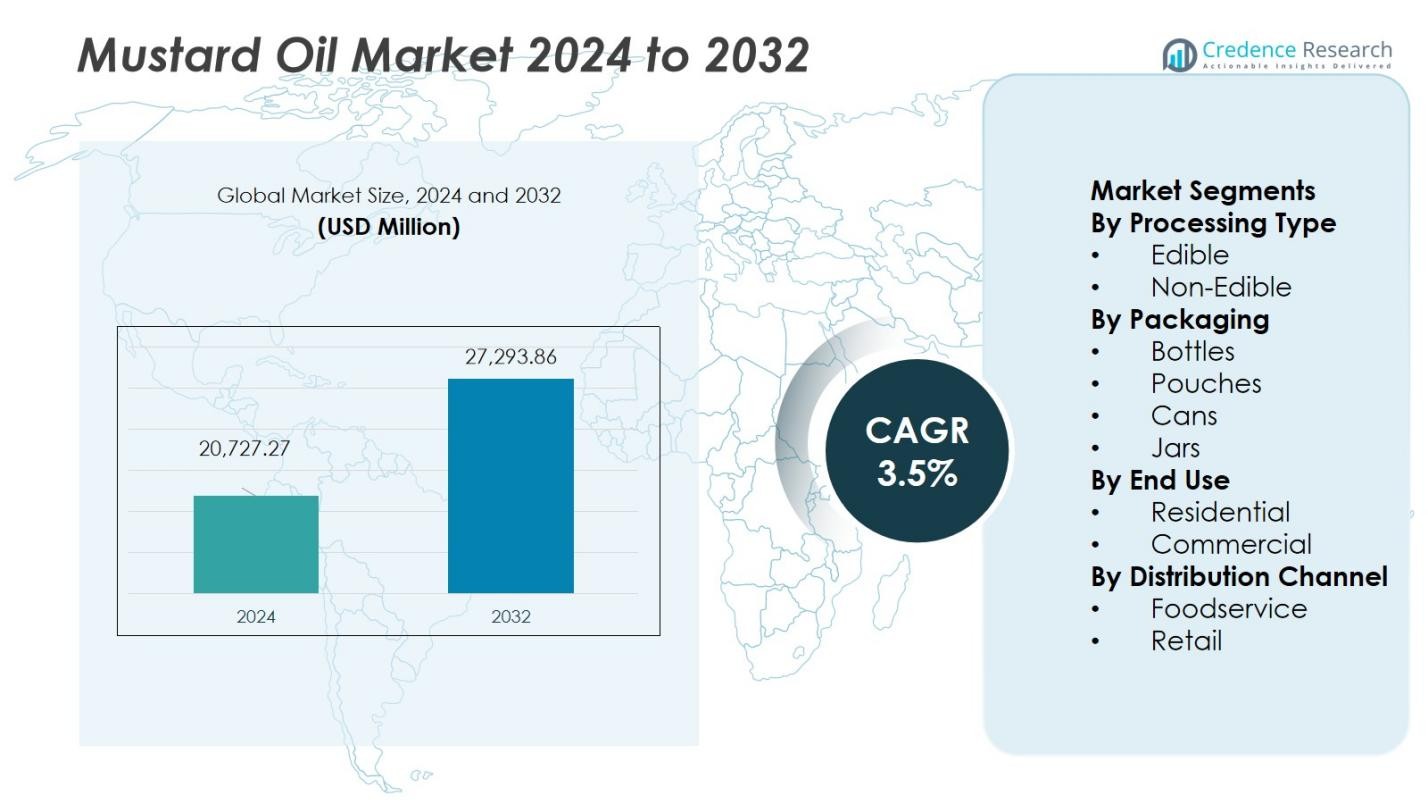

The Mustard Oil Market size was valued at USD 20,727.27 million in 2024 and is anticipated to reach USD 27,293.86 million by 2032, growing at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mustard Oil Market Size 2024 |

USD 20,727.27 Million |

| Mustard Oil Market, CAGR |

3.5% |

| Mustard Oil Market Size 2032 |

USD 27,293.86 Million |

The Global Mustard Oil Market is led by key players such as Adani Wilmar Limited, Dabur UK, Mother Dairy Fruit & Vegetable Pvt. Ltd, Emami Agro Ltd, Ajanta Soya Limited, Manishankar Oils Pvt. Ltd, Good Life’s (Reliance Consumer Brands), B P Oil Mills Limited, Kriti Nutrients, and Pansari Group. These companies focus on expanding product portfolios, enhancing packaging quality, and adopting advanced cold-pressing technologies to strengthen their brand presence. Strategic distribution through modern retail and e-commerce platforms further boosts competitiveness. Asia-Pacific dominates the market with a 58% share in 2024, driven by high consumption in India, Bangladesh, and Nepal, where mustard oil remains a cultural and dietary staple across households and foodservice sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Mustard Oil Market was valued at USD 20,727.27 million in 2024 and is projected to reach USD 27,293.86 million by 2032, growing at a CAGR of 3.5% during the forecast period.

- Rising health awareness and preference for natural oils drive market growth, with the edible segment holding 78% share due to strong household consumption and nutritional benefits.

- A key trend is the growing demand for cold-pressed and organic mustard oil, supported by eco-friendly packaging and expanding online retail distribution.

- The market remains moderately consolidated, with leading companies such as Adani Wilmar, Dabur UK, Emami Agro, and Mother Dairy focusing on product innovation and regional expansion despite supply fluctuations and strict food safety norms.

- Asia-Pacific dominates with a 58% market share, followed by Europe at 15% and North America at 12%, reflecting regional variations in consumption patterns and culinary traditions.

Market Segmentation Analysis:

By Processing Type

The edible segment dominates the Global Mustard Oil Market, accounting for around 78% share in 2024. Its dominance stems from strong household consumption, especially across South Asia, where mustard oil is a staple cooking medium. The product’s high smoke point, rich flavor, and natural antioxidant properties support its demand in culinary applications. Non-edible mustard oil, holding the remaining 22% share, finds use in industrial, pharmaceutical, and cosmetic formulations due to its antimicrobial and lubricating properties. Growing use in herbal and ayurvedic products further enhances its non-edible segment growth.

- For instance, Adani Wilmar Limited reported robust sales of its cold-pressed mustard oil variant, emphasizing the oil’s high smoke point and rich flavor which appeal to culinary consumers.

By Packaging

The bottles segment leads the market with 42% share in 2024, supported by consumer preference for convenient, resealable, and hygienic packaging options. Bottles also enhance product visibility and preservation, making them ideal for retail sales. Pouches account for around 30% share, driven by their affordability and ease of transportation in rural markets. Cans and jars collectively capture about 28% share, appealing to bulk buyers and commercial users. Growing sustainable packaging adoption and rising demand for PET and glass bottles reinforce the segment’s expansion.

- For instance, Coca-Cola introduced bottles made entirely from recycled PET in Canada in 2024, reducing plastic use and CO2 emissions significantly, illustrating the sector’s sustainable innovation.

By End Use

The residential segment holds a dominant 67% share in 2024, attributed to its widespread use in home cooking, traditional recipes, and pickling practices. Increasing awareness of mustard oil’s health benefits, such as its omega-3 content and low saturated fat levels, supports demand in households. The commercial segment, comprising 33% share, gains traction from hotels, restaurants, and food processors seeking cost-effective, flavorful cooking oils. Expanding foodservice sectors and regional cuisine popularity further boost commercial consumption, especially in Asia-Pacific markets.

Key Growth Drivers

Rising Health Awareness and Nutritional Benefits

Growing consumer awareness of the health benefits associated with mustard oil drives market expansion. The oil’s rich content of omega-3 fatty acids, antioxidants, and monounsaturated fats appeals to health-conscious buyers. Its anti-inflammatory and heart-health properties further boost adoption across households. Consumers shifting from refined oils to traditional cold-pressed varieties enhance product acceptance. The increasing preference for natural, chemical-free edible oils in developing economies reinforces steady consumption growth in both rural and urban markets.

- For instance, Doctors Choice Oil reports that one tablespoon of their Kachi Ghani mustard oil contains 826 mg of omega-3 fatty acids, which help reduce inflammation and protect against heart disease.

Expanding Foodservice and Culinary Applications

The widening use of mustard oil in foodservice establishments and processed foods contributes strongly to market growth. Restaurants and catering services prefer mustard oil for its distinct flavor, long shelf life, and high smoking point. Traditional and regional cuisine revival across South Asia further strengthens demand. Food processors incorporate mustard oil into snacks, condiments, and ready-to-eat products to meet consumer taste preferences. This steady commercial demand, coupled with culinary innovation, sustains revenue generation and encourages large-scale production.

- For instance, Dabur, a leading natural healthcare company in India, offers cold-pressed mustard oil known for its distinctive aroma and flavor, favored by many restaurants for cooking traditional dishes.

Increasing Adoption in Cosmetic and Industrial Applications

Mustard oil’s growing use beyond food applications is a major market driver. Cosmetic manufacturers utilize it in hair oils, skin serums, and massage blends due to its antimicrobial and moisturizing properties. Industrial demand rises from soap, lubricant, and biodiesel production sectors seeking sustainable raw materials. The non-edible variant’s affordability and availability further boost industrial utilization. Rising consumer preference for herbal and organic personal care formulations enhances opportunities for value-added mustard oil products in diverse end-use sectors.

Key Trends and Opportunities

Growing Demand for Cold-Pressed and Organic Mustard Oil

A strong trend toward cold-pressed and organic mustard oil is reshaping the market. Consumers prefer unrefined, chemical-free oils that preserve natural flavor and nutrients. Producers are introducing premium organic lines certified by global food safety standards. Retailers promote transparent labeling and eco-friendly packaging to meet clean-label expectations. Expanding e-commerce platforms enable direct access to artisanal and small-batch brands. This trend aligns with rising global interest in sustainable and traceable food sources, supporting long-term brand differentiation.

- For instance, Adani Wilmar launched “Fortune Pehli Dhaar,” a 100% first-pressed mustard oil, leveraging transparency and purity as key marketing points, aligned with the trend toward unrefined, natural oils.

Expansion in International and Export Markets

Emerging export opportunities present significant potential for market players. Growing recognition of mustard oil’s culinary and therapeutic value boosts exports to Europe, North America, and the Middle East. Diaspora populations drive international demand for authentic regional flavors. Producers from India, Bangladesh, and Nepal are strengthening supply chains and meeting global food safety norms. Government support through export incentives and quality certifications enhances trade growth, positioning mustard oil as a competitive natural oil in international markets.

- For instance, Patanjali Mustard Oil, known for its Ayurvedic branding, has expanded exports to the Middle East and North America, targeting diaspora communities and emphasizing its organic and traditional processing methods.

Key Challenges

Stringent Food Safety Regulations and Import Restrictions

The market faces challenges due to strict food safety standards and import restrictions in several countries. High erucic acid levels in mustard oil raise regulatory concerns in regions such as North America and Europe. These barriers limit its direct consumption and labeling as edible oil. Manufacturers must invest in refining technologies and compliance testing to meet international safety limits. Complex trade rules and certification costs also restrict export expansion for small and mid-sized producers.

Volatile Raw Material Supply and Price Fluctuations

Inconsistent mustard seed production due to climate variations and crop diseases affects oil availability and pricing. Seasonal dependency and fluctuating yield reduce supply stability, impacting both edible and non-edible segments. Rising input costs, including packaging and logistics, further squeeze profit margins for producers. Farmers’ limited access to quality seeds and modern cultivation practices adds uncertainty. Ensuring sustainable sourcing through contract farming and yield-improvement initiatives remains essential to maintain market balance and cost competitiveness.

Regional Analysis

North America

North America holds a 12% market share in the global mustard oil market, supported by growing demand among ethnic communities and rising awareness of natural cooking oils. The United States leads regional consumption due to increased availability in specialty and organic food stores. Consumers favor cold-pressed and unrefined variants for their health benefits. Expanding Indian and Bangladeshi populations further drive ethnic food adoption. The region also shows emerging use in cosmetics and wellness applications, with several niche brands promoting mustard-based skincare and aromatherapy products across premium retail and e-commerce platforms.

Europe

Europe accounts for a 15% share of the global market, led by the United Kingdom, Germany, and France. Demand rises among health-conscious consumers seeking natural oils rich in essential fatty acids. Stringent food regulations restrict edible consumption in some areas, but mustard oil finds growing use in cosmetics and aromatherapy sectors. European producers are introducing low-erucic acid variants to comply with safety standards. Importers source from India and Nepal to serve diaspora communities and niche organic markets. Rising preference for clean-label and sustainable oils supports the region’s gradual but consistent market growth.

Asia-Pacific

Asia-Pacific dominates the global mustard oil market with a 58% share in 2024, driven by high consumption across India, Bangladesh, Nepal, and Myanmar. The region’s cultural reliance on mustard oil for cooking, pickling, and massage applications ensures steady demand. India remains the largest producer and exporter, supported by favorable agro-climatic conditions and a strong domestic supply chain. Rising disposable incomes and urbanization increase packaged oil sales through organized retail. Consumers in China and Southeast Asia are also showing growing interest in cold-pressed and organic mustard oil, expanding the region’s overall consumption base.

Latin America

Latin America represents a 7% share of the global market, with increasing adoption of mustard oil in culinary and personal care applications. Brazil, Mexico, and Argentina lead regional demand due to expanding awareness of natural and plant-based oils. Local manufacturers are incorporating mustard oil into niche food and wellness products. The region’s growing health-conscious population and rising middle-class income levels encourage the import of premium edible oils. Distribution through online and specialty channels strengthens product visibility, while partnerships with Asian suppliers help maintain consistent quality and supply reliability.

Middle East & Africa

The Middle East & Africa region holds an 8% market share, driven by cultural diversity and growing preference for traditional and herbal oils. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa exhibit rising demand from both food and cosmetic industries. Importers cater to expatriate populations from South Asia who use mustard oil in daily cooking. Expanding retail infrastructure and e-commerce penetration support steady product distribution. The region also shows potential for industrial and non-edible applications, supported by increasing interest in natural ingredients and sustainable manufacturing practices.

Market Segmentations:

By Processing Type

By Packaging

- Bottles

- Pouches

- Cans

- Jars

By End Use

By Distribution Channel

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Mustard Oil Market features key players such as Adani Wilmar Limited, Dabur UK, Mother Dairy Fruit & Vegetable Pvt. Ltd, Ajanta Soya Limited, Emami Agro Ltd, Manishankar Oils Pvt. Ltd, Good Life’s (Reliance Consumer Brands), B P Oil Mills Limited, Kriti Nutrients, and Pansari Group. The market remains moderately consolidated, with leading companies emphasizing product quality, packaging innovation, and distribution expansion to strengthen their market presence. Players invest in advanced cold-pressing technology and refining processes to enhance oil purity and nutritional value. Regional and domestic producers compete through price differentiation and brand positioning in rural markets. Partnerships with retail chains and online platforms help major brands increase accessibility. Growing consumer preference for organic, chemical-free oils has prompted strategic diversification into premium and cold-pressed product lines. Continuous marketing campaigns highlighting health benefits further support brand loyalty and market growth across key consumption regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2024, Adani Wilmar Limited (AWL) launched Fortune Pehli Dhaar First-Pressed Mustard Oil in May 2024. This premium mustard oil is made using 100% first extract from the finest mustard seeds sourced from Rajasthan, employing the traditional wooden kolhu technique.

- In July 2024, GRM Overseas, a leading Indian basmati rice exporter and FMCG company, launched “Gulistan Kachi Ghani Mustard Oil” under its 10X brand portfolio. The mustard oil is available nationwide in 1-litre bottles and 5-litre jars.

- In July 2024, Louis Dreyfus Company (LDC) relaunched its consumer-facing edible oil brand Vibhor in India. The refreshed product line includes Vibhor Refined Soybean Oil, Palm Olein Oil, Cottonseed Oil, Mustard Oil, and Premium Vanaspati, all enriched with essential vitamins A and D.

- In September 2025, AWL Agri Business (formerly Adani Wilmar Limited) entered into a Memorandum of Understanding (MoU) with the Solvent Extractors’ Association of India (SEA) and the Solidaridad Regional Expertise Centre (SREC) to spearhead the Regenerative Mustard Mission, aimed at promoting sustainable mustard cultivation practices across India.

Report Coverage

The research report offers an in-depth analysis based on Processing Type, Packaging, End Use, Dustribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for natural edible oils.

- Cold-pressed and organic mustard oil will gain stronger consumer preference.

- Urban retail expansion will boost packaged mustard oil sales across developing nations.

- Increased awareness of heart health benefits will support wider household adoption.

- Producers will invest in refining technologies to meet global food safety standards.

- Exports will expand as low-erucic acid variants enter regulated international markets.

- E-commerce platforms will enhance brand visibility and consumer accessibility.

- Non-edible applications in cosmetics and biodiesel will create new revenue streams.

- Sustainable sourcing and eco-friendly packaging will become key competitive priorities.

- Strategic partnerships and regional collaborations will strengthen global distribution networks.