Market Overview

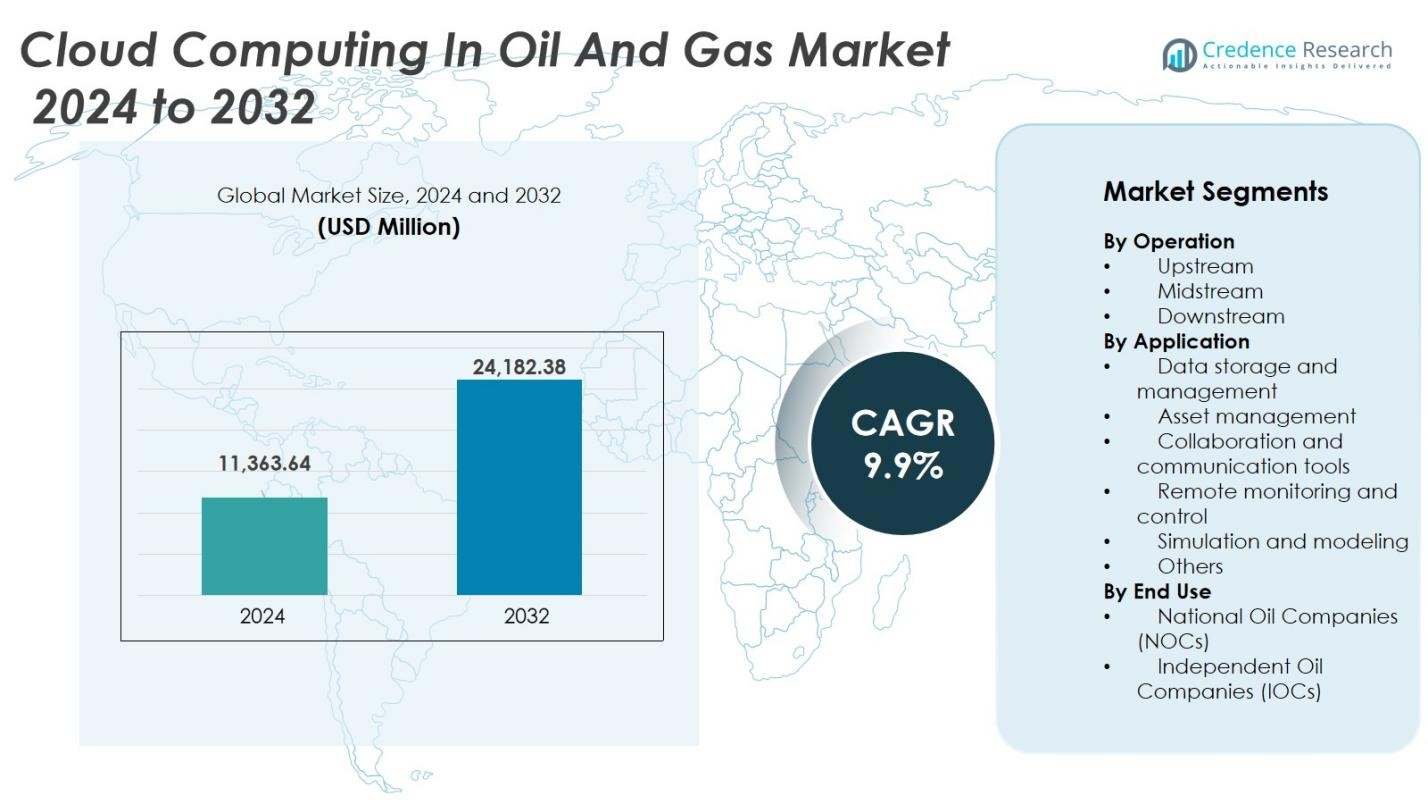

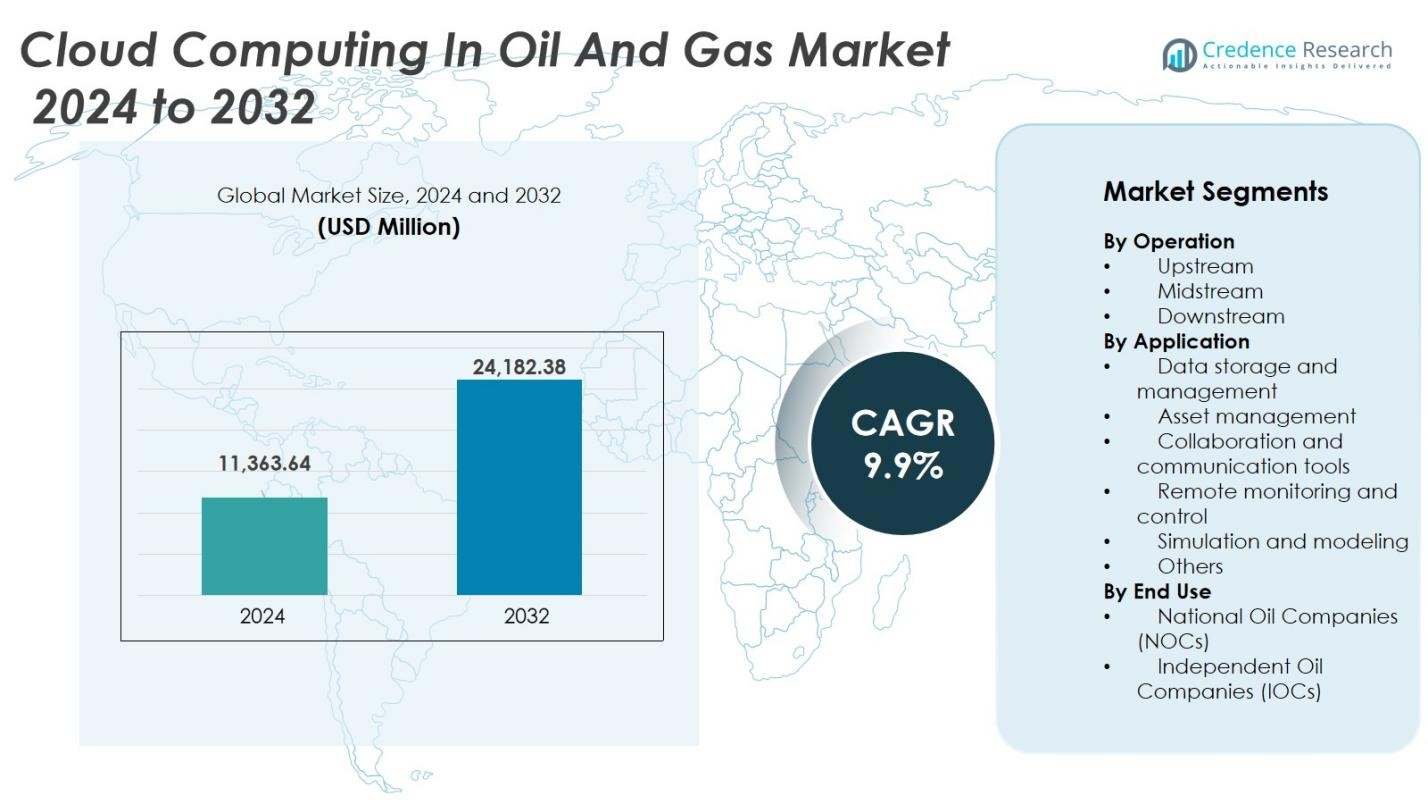

Cloud Computing in Oil and Gas Market size was valued at USD 11,363.64 million in 2024 and is anticipated to reach USD 24,182.38 million by 2032, growing at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Computing in Oil and Gas Market Size 2024 |

USD 11,363.64 Million |

| Cloud Computing in Oil and Gas Market, CAGR |

9.9% |

| Cloud Computing in Oil and Gas Market Size 2032 |

USD 24,182.38 Million |

The cloud computing in oil and gas market is shaped by major technology and energy solution providers such as Siemens Energy, ABB, Baker Hughes, Halliburton, Honeywell, AVEVA, IBM, SAP, Rockwell Automation, and Schlumberger. These companies offer cloud-based analytics, remote monitoring, and real-time asset management to enhance production efficiency and reduce operating costs. Strategic partnerships with platforms like AWS, Microsoft Azure, and Google Cloud strengthen their offerings in predictive maintenance, digital twins, and automation. North America remained the leading region with a 37% market share in 2024, supported by early digital adoption, strong IT infrastructure, and large investments by major oil producers in cloud-enabled operations.

Market Insights

Market Insights

- Cloud computing in oil and gas market size reached USD 11,363.64 million in 2024 and will grow at a 9.9% CAGR through 2032.

- Rising digital transformation is a key driver, as companies adopt cloud platforms for exploration, drilling, remote monitoring, and predictive maintenance, cutting downtime and improving production efficiency.

- Data storage and management held the largest application share, while upstream operations dominated the segment market due to real-time analytics and large-scale seismic data processing.

- Competition remains strong, led by Siemens Energy, ABB, Baker Hughes, Halliburton, Honeywell, AVEVA, IBM, SAP, Rockwell Automation, and Schlumberger, focusing on partnerships with AWS, Azure, and Google Cloud to expand advanced cloud solutions.

- North America led the market with a 37% share in 2024, supported by early digital adoption and strong IT infrastructure, while Europe and Asia-Pacific are expanding through energy transition goals, hybrid cloud deployments, and increasing investments in digital oilfield modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Operation

The upstream segment dominated the cloud computing in oil and gas market with a significant share in 2024. The segment’s leadership stems from the adoption of advanced cloud platforms for exploration, drilling, and production optimization. Oil companies leverage cloud-based data analytics, IoT integration, and AI-driven predictive models to enhance reservoir management and decision-making efficiency. Upstream operations also benefit from real-time collaboration and scalable storage for seismic and geological data, reducing downtime and exploration costs. This technological integration has strengthened digital transformation and operational reliability in the exploration phase.

- For instance, Shell partnered with Microsoft Azure to leverage cloud-based data analytics and real-time monitoring, improving operational responsiveness and integration across upstream assets.

By Application

Data storage and management held the largest market share in 2024 due to the industry’s growing reliance on digital data systems. Cloud platforms offer scalable and secure storage for massive datasets generated from field sensors, production logs, and monitoring devices. Oil and gas companies use cloud-based storage to streamline workflows, ensure data integrity, and support analytics-driven insights. The increasing adoption of hybrid and private cloud models enhances control over sensitive operational data. This trend supports improved asset performance, compliance, and operational transparency across global oil networks.

- For instance, Cloud4C provides managed hybrid cloud solutions to major oil and gas firms, enabling seamless data integration while ensuring security and operational continuity.

By End Use

National Oil Companies (NOCs) accounted for the leading market share in 2024, driven by large-scale digital modernization initiatives. These enterprises are investing in cloud-based infrastructure to improve exploration efficiency, supply chain management, and energy production monitoring. NOCs benefit from strategic partnerships with technology providers such as Microsoft Azure and AWS to enhance data-driven decision-making. The adoption of cloud solutions supports cost optimization and energy transition goals. Independent Oil Companies (IOCs) are also increasing investments to gain flexibility in data operations and accelerate digital field integration.

Key Growth Drivers

Rising Digital Transformation Across the Oil and Gas Sector

Digital transformation initiatives are driving the adoption of cloud computing in oil and gas operations. Companies are shifting from legacy systems to cloud-based infrastructures to streamline exploration, drilling, and production processes. Cloud technology enables seamless data integration, advanced analytics, and real-time collaboration across multiple locations. For instance, Chevron and BP leverage Microsoft Azure to enhance operational visibility and predictive maintenance. This transformation reduces costs, minimizes equipment downtime, and optimizes asset performance. The growing demand for data-driven insights and automation continues to accelerate cloud adoption across the upstream, midstream, and downstream segments.

- For instance, BP employs Azure Machine Learning to accelerate the selection of precise prediction models, cutting the model development time from weeks to hours and boosting data scientists’ productivity globally.

Increasing Focus on Cost Optimization and Efficiency

The oil and gas industry faces mounting pressure to control operational expenses amid volatile energy prices. Cloud computing supports cost efficiency by minimizing on-premises IT infrastructure and enabling pay-as-you-go models. Operators use cloud-based solutions for data management, reservoir modeling, and supply chain optimization, cutting capital and maintenance costs. Platforms like AWS and Google Cloud provide scalable resources to manage fluctuating workloads efficiently. Moreover, integrating AI and machine learning through the cloud helps identify production inefficiencies and forecast maintenance needs. This focus on resource optimization and automation is a key factor boosting market growth.

- For instance, ExxonMobil leverages cloud platforms to process seismic data faster, enabling more accurate exploration decisions and reducing operational expenses.

Expansion of Remote Operations and Real-Time Monitoring

Cloud-based remote monitoring systems have become essential for managing geographically dispersed oil fields and offshore platforms. The technology enables continuous tracking of equipment performance and environmental conditions. Real-time analytics derived from connected sensors improve safety, reduce unplanned shutdowns, and enhance decision-making accuracy. For instance, Schlumberger and Halliburton utilize cloud-based digital twins to simulate field performance and optimize production remotely. This ability to control operations from centralized command centers lowers travel costs and safety risks. The rising adoption of edge computing and IoT integration further strengthens the scalability and responsiveness of cloud-based monitoring solutions.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

AI and ML integration into cloud platforms present major growth opportunities in predictive analytics and automation. These technologies analyze massive datasets to forecast equipment failures, optimize drilling parameters, and improve supply chain efficiency. For instance, IBM and Baker Hughes deploy AI-enabled cloud solutions to enhance predictive maintenance and reservoir modeling accuracy. Such integration enables proactive decision-making and reduces operational risks. As oil companies digitize their assets, the convergence of AI and cloud infrastructure supports a shift toward intelligent, self-optimizing operations, reinforcing sustainability and competitiveness in the long run.

- For instance, IBM’s Natural Resources Solutions Center collaborates with oil companies using AI to improve sustainability and operational efficiency through predictive maintenance and reservoir modeling.

Growing Adoption of Hybrid and Multi-Cloud Strategies

The shift toward hybrid and multi-cloud environments allows oil and gas enterprises to balance data security, performance, and flexibility. Companies increasingly deploy a mix of public and private clouds to store sensitive operational data while utilizing public platforms for analytics and collaboration. For example, Shell employs multi-cloud solutions from AWS and Azure to enhance efficiency and disaster recovery capabilities. This strategy mitigates data loss risks and ensures business continuity. The trend reflects a broader move toward adaptable digital ecosystems that align with evolving cybersecurity, compliance, and data governance standards.

- For instance, Shell leverages multi-cloud solutions combining AWS and Microsoft Azure to improve efficiency in subsurface data management and disaster recovery, supporting seamless access to large datasets and advanced AI-driven analytics.

Expansion of Edge Computing and IoT Integration

The growing deployment of edge computing and IoT devices is reshaping cloud applications in oil and gas operations. Edge computing enables faster data processing closer to the source, reducing latency in mission-critical environments. Companies such as Siemens Energy and Honeywell integrate edge-cloud frameworks for real-time production control and environmental monitoring. The combination of IoT sensors and edge analytics supports automation, enhances operational safety, and ensures regulatory compliance. This trend opens new opportunities for service providers to deliver advanced hybrid cloud solutions tailored for remote field operations.

Key Challenges

Data Security and Compliance Concerns

Data security remains a major concern in cloud computing adoption within the oil and gas industry. Companies handle vast amounts of sensitive geological, operational, and financial data that require stringent protection. Cyberattacks targeting critical energy infrastructure have intensified, increasing the need for robust security frameworks. Compliance with global data protection standards such as ISO 27001 and GDPR adds complexity to cloud implementation. Despite efforts by providers like AWS and Microsoft to enhance encryption and identity management, many operators remain cautious. The challenge lies in balancing cloud flexibility with reliable data protection and regulatory compliance.

High Initial Integration and Migration Costs

Although cloud computing reduces long-term IT expenses, the initial investment in migration, customization, and staff training poses challenges. Legacy system compatibility and the complexity of large-scale data transfers often delay implementation. Many mid-sized oil companies lack the technical expertise to manage hybrid cloud environments efficiently. Additionally, disruptions during migration can affect production continuity and operational reliability. Providers such as IBM and Accenture are offering managed migration services to address this gap, but the overall integration cost and downtime risk remain significant barriers to rapid adoption across smaller enterprises.

Regional Analysis

North America

North America dominated the cloud computing in oil and gas market with a 37% share in 2024, driven by early digital adoption and the presence of leading technology providers. The U.S. leads due to strong investments by companies like Chevron, ExxonMobil, and Halliburton in cloud-based analytics and asset monitoring. Widespread deployment of IoT-enabled oilfield systems and collaboration with AWS, Microsoft, and IBM strengthen the region’s leadership. Canada’s focus on remote operations in shale exploration also supports market growth. Regulatory emphasis on energy efficiency further accelerates cloud integration across upstream and midstream operations.

Europe

Europe accounted for a 27% market share in 2024, supported by ongoing energy transition goals and data-driven operational strategies. The U.K., Norway, and Germany are key contributors, emphasizing digital oilfield management and cloud-supported carbon reduction programs. Major oil producers like BP, Shell, and Equinor rely on hybrid cloud models for predictive analytics and sustainability reporting. The region’s strong data protection regulations foster the adoption of secure and compliant cloud systems. Investments in AI-integrated exploration and digital twin technologies continue to enhance productivity and sustainability within European oil operations.

Asia-Pacific

Asia-Pacific held a 24% market share in 2024, propelled by increasing digitization in emerging economies such as China, India, and Australia. Regional oil and gas enterprises are adopting cloud platforms to enhance efficiency and cut operating costs. Governments support digital infrastructure upgrades and energy modernization initiatives, driving cloud investments in national oil companies. Partnerships between regional operators and global providers like Huawei Cloud and AWS strengthen the market ecosystem. Rising offshore exploration activities and automation in LNG facilities also accelerate cloud adoption, particularly in upstream and refining operations.

Middle East & Africa

The Middle East & Africa captured a 9% share in 2024, driven by modernization efforts in leading oil-producing countries such as Saudi Arabia, the UAE, and Qatar. National oil companies like Saudi Aramco and ADNOC are rapidly deploying cloud-based systems for real-time data monitoring, production optimization, and predictive maintenance. Collaborations with Microsoft and Google Cloud enhance regional digital capacity. The focus on smart refinery projects and energy diversification supports growth. However, infrastructure limitations in parts of Africa moderately hinder full-scale adoption despite increasing cloud investments.

Latin America

Latin America accounted for a 3% market share in 2024, with Brazil and Mexico emerging as key growth hubs. Regional oil companies such as Petrobras and PEMEX are investing in cloud solutions for exploration and production management. Cloud adoption enhances transparency, improves data accessibility, and strengthens decision-making efficiency. Government-backed initiatives to modernize oil infrastructure and attract foreign investment further boost digital transformation. Despite challenges related to connectivity and cybersecurity, the region shows steady progress in integrating hybrid and public cloud models to improve operational resilience and cost optimization.

Market Segmentations:

By Operation

- Upstream

- Midstream

- Downstream

By Application

- Data storage and management

- Asset management

- Collaboration and communication tools

- Remote monitoring and control

- Simulation and modeling

- Others

By End Use

- National Oil Companies (NOCs)

- Independent Oil Companies (IOCs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cloud computing in oil and gas market is characterized by strategic partnerships, technological innovation, and digital transformation initiatives. Leading companies such as Siemens Energy, ABB, Baker Hughes, Halliburton, Honeywell, AVEVA, IBM, SAP, Rockwell Automation, and Schlumberger are expanding their cloud-based portfolios to optimize production efficiency and data-driven operations. These players focus on developing integrated solutions combining IoT, AI, and analytics to enhance real-time decision-making and asset performance. For instance, Schlumberger’s DELFI cognitive E&P environment and Baker Hughes’ partnership with AWS enable advanced predictive insights and remote monitoring. Similarly, Siemens Energy and ABB leverage hybrid cloud models to improve scalability and reduce operational downtime. Strategic collaborations with cloud providers such as Microsoft Azure, Google Cloud, and AWS remain central to innovation, helping oil enterprises modernize IT infrastructure, streamline workflows, and accelerate sustainability goals while strengthening market competitiveness across upstream, midstream, and downstream operations.

Key Player Analysis

- Siemens Energy

- Rockwell Automation

- Baker Hughes

- ABB

- Halliburton

- AVEVA

- SAP

- Honeywell

- IBM

- Schlumberger

Recent Developments

- In October 2025, Titan Cloud announced its plan to acquire the maintenance solutions Urgent and Techniche EV from Techniche Limited to expand its cloud-based, AI-powered platform for managing energy and downstream assets; the acquisition is expected to close in early Q4 2025.

- In July 2025, Cloudera partnered with Saudi Aramco to develop AI-driven cloud and data-analytics solutions tailored for the oil and gas industry.

- In November 2024, AWS announced a partnership agreement aimed at helping organizations and customers leverage generative AI to foster innovation through cloud computing. This collaboration will merge AWS’s cloud infrastructure and solutions with E&’S network capabilities to meet the rigorous requirements of customers in the public sector and regulated industries, such as healthcare, finance, and oil and gas, in the Middle East.

- In September 2024, IFS, a leading enterprise cloud and industrial AI software company, stated that Moreld Apply, an engineering firm operating in the oil and gas sector, has chosen to move to the IFS Cloud Mark. Such a decision has been made with a view to assisting Moreld Apply in its drive for growth and penetration into new market segments, such as energy operators with environmentally friendly front-end and green solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Operation, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness accelerated adoption of hybrid and multi-cloud models across all operational stages.

- AI and machine learning integration will enhance predictive maintenance and asset performance analytics.

- National oil companies will continue leading digital transformation initiatives through strategic cloud partnerships.

- Edge computing adoption will grow to support real-time data processing in remote exploration sites.

- Cloud-enabled digital twins will become standard tools for simulation and production optimization.

- Sustainability goals will drive increased use of cloud platforms for energy efficiency and emissions monitoring.

- Cybersecurity enhancements will remain a priority to safeguard operational and geological data.

- Collaboration between oilfield service providers and tech firms will strengthen innovation in cloud infrastructure.

- Demand for cloud-based workforce training and virtual collaboration tools will rise among global operators.

- Regulatory compliance and data governance frameworks will shape future investments in cloud technology adoption.

Market Insights

Market Insights