Market Overview:

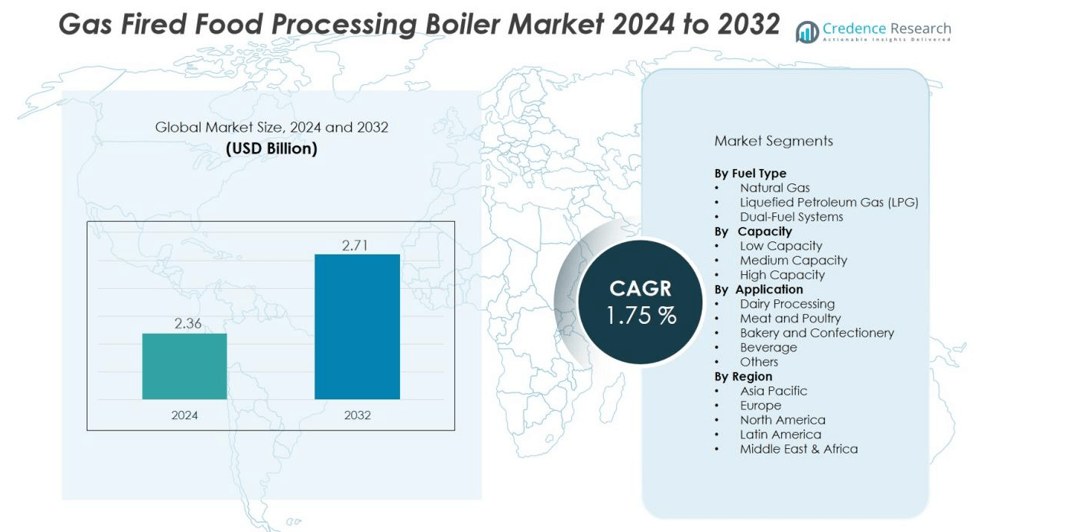

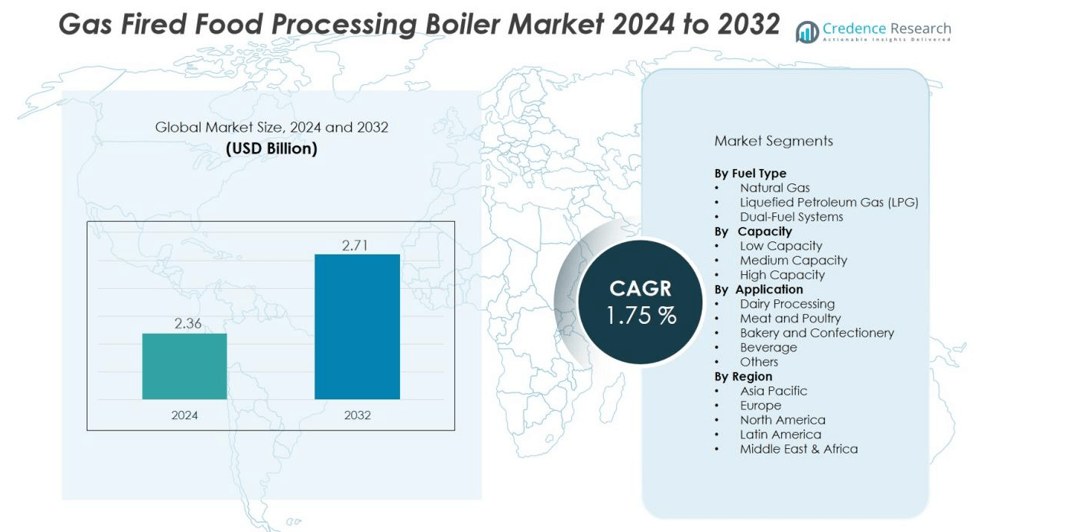

The Gas Fired Food Processing Boiler Market size was valued at USD 2.36 billion in 2024 and is anticipated to reach USD 2.71 billion by 2032, at a CAGR of 1.75 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Food Processing Boiler Market Size 2024 |

USD 2.36 billion |

| Gas Fired Food Processing Boiler Market, CAGR |

1.75% |

| Gas Fired Food Processing Boiler Market Size 2032 |

USD 2.71 billion |

Key growth drivers include rising demand for processed and packaged foods, increasing emphasis on hygiene and steam-generation reliability in food manufacturing, and stricter environmental regulations that favour gas-fired systems over oil or coal alternatives. Technological improvements in boiler efficiency, automation and heat-recovery systems further support adoption across food processing operations.

Regionally, North America currently holds a significant share owing to mature food processing infrastructure and strong regulatory support for low-emission solutions. Europe also accounts for a substantial portion, driven by energy-efficiency mandates and retrofitting activity. Meanwhile, the Asia-Pacific region is emerging fastest, propelled by rapid urbanization, expanding food processing capacity and rising disposable incomes in key markets.

Market Insights:

- The Gas Fired Food Processing Boiler Market size was valued at USD 2.36 billion in 2024 and is projected to reach USD 2.71 billion by 2032 at a CAGR of 1.75 %.

- North America holds 38 % share, Europe 22 %, and Asia-Pacific 18 %; North America leads due to mature infrastructure, Europe benefits from energy-efficiency mandates, and Asia-Pacific expands with rising food processing capacity.

- Asia-Pacific is the fastest-growing region with its 18 % share, driven by rapid urbanization, rising disposable incomes, and expanding food manufacturing in countries such as India and China.

- The natural gas fuel type segment commands 60 % share of the market, with LPG at 25 %, reflecting preference for cleaner combustion and lower operational cost.

- High-capacity boilers (over 2 000 kW) account for the largest share of capacity-based segmentation, serving large-scale food processing plants and reflecting demand for substantial steam output.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Energy-Efficient and Low-Emission Heating Solutions

The Gas Fired Food Processing Boiler Market is driven by the food industry’s shift toward cleaner and more efficient energy systems. Gas-fired boilers emit fewer pollutants compared to coal or oil alternatives, aligning with tightening emission regulations. Many food manufacturers are replacing outdated equipment to reduce carbon footprints and operational costs. This transition supports both sustainability goals and compliance with environmental standards.

- For instance, Nestlé’s Tutbury factory in the UK upgraded to advanced gas-fired boilers, resulting in a 40% reduction in greenhouse gas emissions from steam generation in 2023.

Growing Processed Food Consumption and Production Expansion

It benefits from the rising global consumption of packaged and processed foods. Expanding production lines require consistent, controllable steam and heat for cooking, sterilizing, and drying. Gas-fired boilers provide the stability and efficiency needed to maintain continuous food production. Rapid urbanization and changing dietary habits in developing nations further elevate demand for reliable thermal systems.

- For instance: Babcock Wanson’s BWR fire tube boiler series delivers steam outputs ranging from 10,000 kg/h to 30,000 kg/h with thermal efficiencies exceeding 98% when fitted with integrated economizers and heat recovery systems, while reducing electrical power consumption by 30-50% through variable speed control technology in food processing facilities.

Technological Advancements Enhancing Boiler Performance and Reliability

Ongoing innovations in burner design, automation, and heat recovery are transforming operational efficiency. Modern gas-fired boilers deliver better fuel utilization, faster startup times, and improved temperature control. Smart monitoring systems help reduce downtime and energy waste. These advancements strengthen industry confidence in adopting gas-based thermal technologies for food applications.

Regulatory Support and Shift Toward Sustainable Industrial Operations

Governments promote cleaner industrial heating through incentives and emission standards. It encourages manufacturers to adopt gas-fired systems that balance cost-efficiency and compliance. Strong policy support in key markets such as North America and Europe accelerates modernization of food processing facilities. Growing awareness of sustainability in food manufacturing continues to reinforce this trend globally.

Market Trends:

Adoption of Smart and Automated Boiler Control Systems

The Gas Fired Food Processing Boiler Market is witnessing a strong shift toward smart automation and digital monitoring. Food manufacturers are integrating IoT-based systems to track temperature, pressure, and fuel efficiency in real time. These technologies help reduce human error, improve process consistency, and lower maintenance costs. It supports predictive maintenance by identifying system faults before major failures occur. Automation also enhances energy management by adjusting combustion parameters for optimal performance. Growing investment in Industry 4.0 infrastructure is making intelligent boiler systems a new standard in modern food plants.

- For Instance, Arla Foods is one of the UK’s leading dairy companies, processing approximately 2 billion liters of milk annually. The Stourton Dairy is a real facility operated by the company. Arla is committed to environmental sustainability and monitors emissions as part of its operations.

Shift Toward Compact, Modular, and High-Efficiency Boiler Designs

Manufacturers are focusing on compact and modular gas-fired boilers to meet space and scalability needs in food facilities. It enables easy installation, quick startup, and flexibility for small to medium food processors. High-efficiency designs with condensing technology are gaining traction for their ability to recover waste heat and reduce energy losses. Demand for on-demand steam generation systems is also rising due to their faster response and improved operational control. Companies are launching products with lower NOx emissions and enhanced insulation to meet environmental goals. These advancements are positioning modern boilers as both sustainable and economically viable solutions for the evolving food processing sector.

- For Instance, Fulton’s Endura+ modular boiler system has a compact width of 30 inches for models EDR+ 2500 and 3000.

Market Challenges Analysis:

High Installation and Maintenance Costs Impacting Adoption

The Gas Fired Food Processing Boiler Market faces limitations due to high initial investment and maintenance expenses. Small and medium food processors often struggle to allocate budgets for modern gas-fired systems. Installation requires skilled labor, safety checks, and compliance with emission norms, which add to project costs. It also demands periodic inspection and part replacement to maintain efficiency. These factors can delay adoption among cost-sensitive manufacturers. Price volatility in natural gas further influences total operational expenditure, affecting long-term planning.

Stringent Regulatory Standards and Infrastructure Constraints

Tight environmental and safety regulations present operational challenges for boiler manufacturers and users. It must comply with national emission caps and boiler certification standards, which vary across regions. Limited availability of natural gas pipelines in developing areas restricts wider installation. Rural and remote processing facilities often rely on alternate fuels, reducing the scope for gas-fired boiler adoption. Manufacturers must also address challenges related to burner design and heat recovery efficiency. These factors collectively slow market penetration in emerging economies.

Market Opportunities:

Rising Demand for Sustainable and Energy-Efficient Food Processing Systems

The Gas Fired Food Processing Boiler Market holds strong potential due to the global focus on energy efficiency and sustainability. Food manufacturers are investing in advanced gas-fired boilers to cut emissions and fuel costs. It supports cleaner operations while meeting regulatory targets for low-carbon production. The growing adoption of condensing and hybrid boilers provides opportunities for technology suppliers. Demand for boilers compatible with renewable gas or biogas is expanding. These systems enable food processors to align operations with green manufacturing goals and attract sustainability-focused clients.

Expansion of Food Processing Facilities in Emerging Economies

Rapid industrial growth and urbanization across Asia-Pacific, Latin America, and Africa create new avenues for boiler suppliers. It benefits from the increasing number of food production plants requiring reliable steam systems. Governments in these regions support local food processing through infrastructure and investment incentives. Rising disposable incomes and shifting consumption patterns strengthen the need for advanced processing technologies. Companies introducing region-specific, compact boiler models can capture untapped market segments. These developments open long-term opportunities for manufacturers focused on cost-effective and efficient gas-fired solutions.

Market Segmentation Analysis:

By Fuel Type

The Gas Fired Food Processing Boiler Market is segmented into natural gas and liquefied petroleum gas (LPG) boilers. Natural gas dominates due to its wide availability, cleaner combustion, and cost efficiency. It provides steady heat output and supports large-scale continuous operations in bakeries, breweries, and meat processing plants. LPG boilers serve facilities in remote or off-grid areas with limited pipeline access. Demand for dual-fuel systems is also rising, offering flexibility in managing fuel costs and supply reliability.

- For instance, the Cleaver-Brooks CB-200-60 firetube hot water boiler is commonly deployed in brewery operations, delivering an approximate 2,511,000 BTU/hr input capacity with natural gas fuel, enabling large-scale continuous heating processes for malting, boiling, and fermentation cycles.

By Capacity

The market includes low, medium, and high-capacity boilers designed to meet different production scales. Medium-capacity units lead demand, offering an optimal balance between energy output and operational cost. It suits small to mid-sized food manufacturers focused on flexible steam generation. High-capacity boilers are used in large industrial plants requiring continuous and high-volume steam supply. Low-capacity models serve niche applications such as small dairies or specialty food units emphasizing energy savings and compact design.

- For instance, Chromalox’s CHPES-A electric steam boiler achieves steam generation capacity of 18–542 lbs/hr with operating pressures up to 235 psig, delivering precise temperature control for small-scale pasteurization and sterilization operations in specialty food production facilities with minimal operational footprint.

By Application

Key application areas include dairy processing, meat and poultry, bakery and confectionery, beverage, and others. It is most widely used in dairy and beverage sectors where precise temperature control is critical. The bakery segment also shows strong adoption due to the need for uniform heating in production. Expanding packaged food manufacturing worldwide continues to drive application diversity and market growth.

Segmentations:

By Fuel Type

- Natural Gas

- Liquefied Petroleum Gas (LPG)

- Dual-Fuel Systems

By Capacity

- Low Capacity

- Medium Capacity

- High Capacity

By Application

- Dairy Processing

- Meat and Poultry

- Bakery and Confectionery

- Beverage

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Region

North America holds approximately 38% of the global Gas Fired Food Processing Boiler Market revenue share and maintains a leading position in the industry. The region benefits from advanced food processing infrastructure, well-established natural gas networks and strict emission regulations. Manufacturers in this area adopt high-efficiency gas-fired boilers to meet regulatory demands for cleaner steam generation. It leverages the presence of major boiler system suppliers and a large base of food and beverage manufacturers. Rising demand for processed food and emphasis on sustainability further reinforce the region’s dominance. Capital investments toward boiler upgrades and retrofits support steady market growth.

Europe Region

Europe represents nearly 22% of the market share in the Gas Fired Food Processing Boiler Market, driven by stringent environmental standards and a mature food manufacturing sector. The region leads in deploying gas-fired systems that meet low-NOx and condensing boiler criteria. It sees strong adoption among dairy, bakery and beverage processors that require consistent steam and strict hygiene compliance. Government incentives for energy efficiency encourage replacement of older fuel-oil or coal units with gas-fired solutions. The presence of established boiler manufacturers and service networks enables rapid technology diffusion. Market expansion in Eastern Europe adds further growth potential.

Asia-Pacific Region

Asia-Pacific accounts for roughly 18% of the market share in the Gas Fired Food Processing Boiler Market and exhibits the fastest growth rate among regions. Rapid urbanization, rising disposable incomes and expansion of food processing plants boost boiler demand. It faces expanding opportunities in India, China and Southeast Asian countries where modern steam systems are replacing older equipment. Infrastructure investments and government policies encouraging cleaner fuels further reinforce market potential. Suppliers targeting affordable, compact and modular gas-fired boilers gain significant traction. Growing consumption of processed foods in the region drives sustained demand for thermal-energy solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Babcock & Wilcox

- Thermax

- Hurst Boiler & Welding Company

- Fulton Boiler Works

- O. Smith Corporation

- Viessmann Group

- Fulton

- Hurst Boiler

- Miura Boiler

- Continental Boiler Works

- Cleaver-Brooks

- Vapor Power

- Spirax Sarco Engineering

Competitive Analysis:

The Gas Fired Food Processing Boiler Market is moderately consolidated, with key players focusing on efficiency improvement and emission control technologies. Major companies include Babcock & Wilcox, Thermax, Hurst Boiler & Welding Company, and Fulton Boiler Works. It emphasizes continuous product innovation, integration of smart control systems, and adherence to energy efficiency standards. Leading manufacturers invest in research to develop compact, high-performance boilers suitable for diverse food processing operations. Strategic partnerships and aftersales service expansion strengthen their market position. Regional players compete by offering cost-effective solutions and localized support to capture small and medium-scale industries. The competition centers on durability, automation, and reliability to meet evolving industry expectations.

Recent Developments:

- In November 2025, Babcock & Wilcox signed a limited notice to proceed with Applied Digital for the delivery and installation of natural gas technology to supply 1 GW of power to an AI Data Center, with the partnership also expanding their global opportunity pipeline to over $10 billion.

- In October 2025, Thermax approved the merger of its wholly owned subsidiary Buildtech Products India Private Limited with Thermax, focusing on optimizing the corporate structure and cost reduction.

Report Coverage:

The research report offers an in-depth analysis based on Fuel Type, Capacity, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising demand for sustainable and energy-efficient food processing systems will drive steady market expansion.

- Manufacturers will focus on condensing and hybrid gas boiler technologies to enhance fuel efficiency.

- Automation and smart monitoring systems will become standard features for process optimization and safety.

- Growing environmental regulations will accelerate the replacement of coal and oil boilers with gas-fired units.

- Asia-Pacific will emerge as the fastest-growing region due to rapid industrialization and food production growth.

- Integration of IoT-based predictive maintenance tools will reduce downtime and maintenance costs for operators.

- Manufacturers will expand product lines to include modular and compact designs suited for smaller facilities.

- The adoption of renewable gas and biogas-compatible boilers will strengthen the industry’s sustainability outlook.

- Partnerships between boiler manufacturers and food processing equipment suppliers will improve system integration.

- Rising investment in green manufacturing initiatives will continue to support long-term demand for gas-fired food processing boilers.