Market Overview

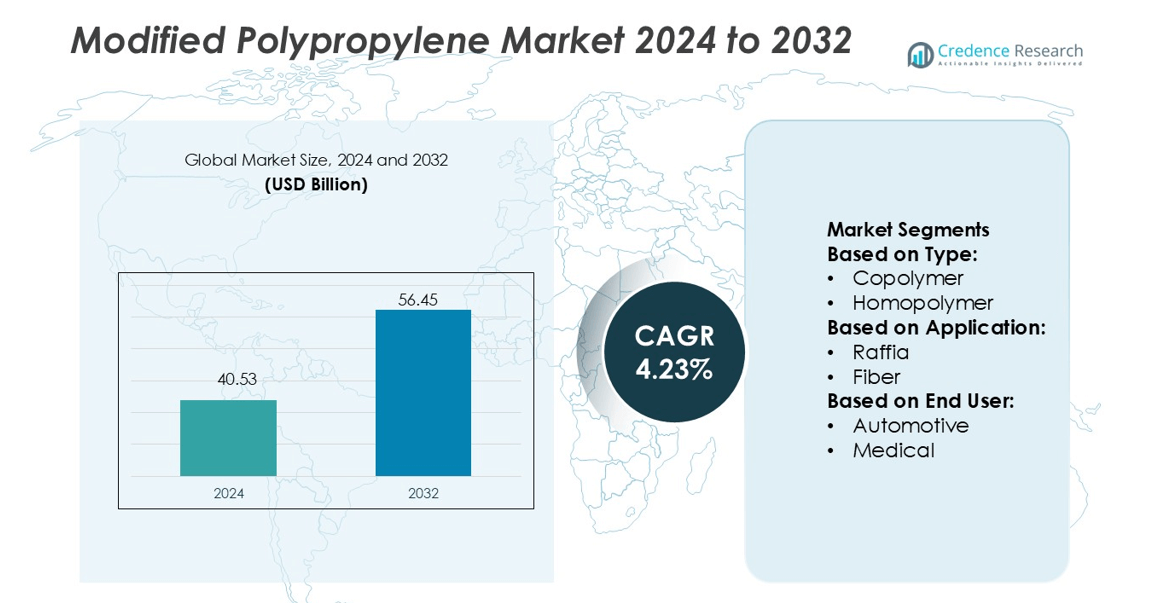

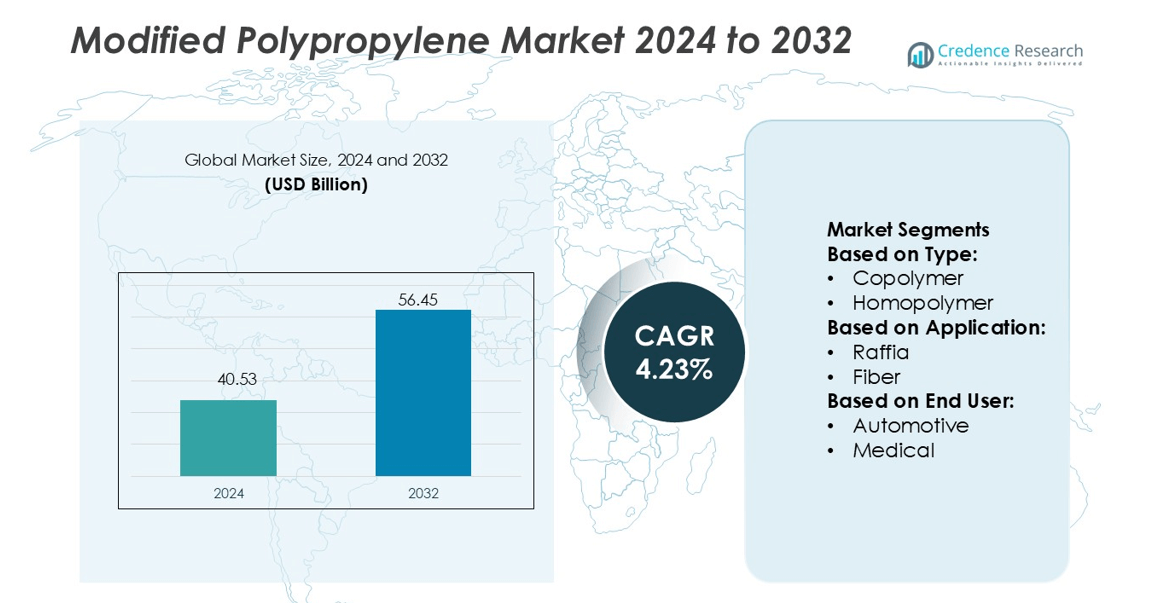

Modified Polypropylene Market size was valued USD 40.53 billion in 2024 and is anticipated to reach USD 56.45 billion by 2032, at a CAGR of 4.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modified Polypropylene Market Size 2024 |

USD 40.53 billion |

| Modified Polypropylene Market, CAGR |

4.23% |

| Modified Polypropylene Market Size 2032 |

USD 56.45 billion |

The Modified Polypropylene Market operate large production facilities, strong R&D centers, and global distribution networks. Companies such as Covestro AG, LG Chem, PolyPacific, SABIC, China XD Plastics Co., Ltd., Arkema, PetroChina Company Limited, Kingfa Sci. & Tech Co., Ltd., JIANGYIN EXCEN, and LyondellBasell Industries Holdings B.V. supply high-impact copolymers, reinforced homopolymers, and specialty compounds for automotive, electronics, packaging, and construction applications. Strategic collaborations with OEMs and investments in advanced compounding technologies strengthen product quality, durability, and heat resistance. Asia-Pacific remains the leading region with 42% market share, supported by growing automotive production, large polymer processing capacity, and low manufacturing costs.

Market Insights

- The Modified Polypropylene Market was valued at USD 40.53 billion in 2024 and will reach USD 56.45 billion by 2032 at a CAGR of 4.23%.

- High demand for lightweight automotive components and durable packaging products drives adoption of impact-modified and reinforced polypropylene grades across global manufacturing sectors.

- Market players expand capacity, invest in compounding technology, and form partnerships with automotive and electronics OEMs to deliver high-strength, heat-resistant, and cost-efficient materials.

- Volatility in polypropylene feedstock prices and strict environmental regulations challenge producers and encourage a shift toward recycled and bio-based polypropylene solutions.

- Asia-Pacific leads with 42% share due to large polymer processing capability, while the automotive segment holds the largest application share with increasing use in bumpers, dashboards, and structural parts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Copolymer leads this segment with the highest share because it offers better toughness, flexibility, and crack resistance than homopolymer grades. Industries choose copolymer polypropylene for parts exposed to mechanical stress, impact, or extreme temperatures. Homopolymer grades still remain relevant in applications requiring stiffness, chemical resistance, and cost efficiency, but the widespread use of copolymers in automotive trims, packaging films, and industrial components supports their dominance.

- For instance, Covestro polypropylene-based copolymer grade used in automotive interior trims, noting a typical notched Izod impact strength of approximately 10-30 kJ/m² at 23 °C (ISO 180) and good puncture resistance.

By Application

Film and sheet applications hold the largest share due to high demand in food packaging, labeling, protective films, and medical-grade sheets. Modified polypropylene films show strong barrier properties, clarity, and heat resistance, which boost adoption in consumer goods and flexible packaging. Raffia and fiber applications follow, driven by use in ropes, woven bags, carpets, and geotextiles. The strong presence of the packaging sector keeps film and sheet processing ahead of other segments.

- For instance, LG Chem’s random-copolymer grade R3450 for CPP-film exhibits a Melt Flow Index of 8 g/10 min (230 °C, 2.16 kg load), tensile yield strength of 260 kgf/cm², elongation at break > 500 % and a Vicat softening temperature of 134 °C.

By End-user

The packaging industry remains the dominant end-user with the highest market share. Lightweight, durable, and recyclable modified polypropylene grades support consumer packaging, industrial packaging, and food-contact materials. Automotive applications are also rising due to weight reduction goals, fuel efficiency requirements, and the increased use of polypropylene in bumpers, dashboards, and interior components. Building and construction, medical, and electrical industries use modified polypropylene for insulation, molded parts, and chemical-resistant equipment, but packaging continues to drive the largest commercial consumption.

Key Growth Drivers

Rising Demand for Lightweight Materials in Automotive

Automotive manufacturers use modified polypropylene to reduce vehicle weight and improve fuel efficiency. The material replaces conventional metals in interior trims, bumpers, and under-the-hood components because it offers strength, heat resistance, and design flexibility. The shift toward electric vehicles increases demand for lighter parts to enhance battery performance and driving range. Modified polypropylene also supports cost-effective manufacturing with faster processing cycles and recyclability. These advantages push automotive OEMs and tier suppliers to expand usage in both passenger and commercial vehicles.

- For instance, PolyPacific’s PP-GF30 (polypropylene reinforced with 30 % glass fiber) used in instrument panels and structural trim parts offers a tensile strength of 110 MPa, a heat deflection temperature of 155 °C at 1.8 MPa, and a specific gravity of 1.16, making the material significantly lighter than steel components while maintaining durability under prolonged thermal load.

Growing Consumption in Packaging Applications

Packaging companies rely on modified polypropylene for food containers, labeling films, medical trays, and industrial wrapping. The material provides durability, transparency, and resistance to chemicals and moisture, helping protect and preserve products during transport and storage. Demand rises further with the growth of online retail and ready-to-eat food categories. Flexible packaging formats benefit from improved sealability and barrier properties. Since the polymer is recyclable, it aligns with sustainability goals and regulatory pressure on single-use plastics, strengthening market adoption.

- For instance, SABIC’s grade PP 526P for cast film applications features a Melt Flow Rate of 8 g/10 min (at 230 °C, 2.16 kg) and a density of 905 kg/m³. The same grade exhibits a Vicat softening temperature of 152 °C and a notched Izod impact strength of 25 J/m at 23 °C.

Expansion of Industrial and Construction Sectors

Modified polypropylene supports building and construction activities through pipes, sheets, insulation panels, and geotextiles. The material resists corrosion, weathering, and chemical exposure, making it suitable for long-term outdoor use. Rapid urbanization and infrastructure upgrades across developing economies boost consumption. Electrical and electronics manufacturers also use it for housings, connectors, and insulating components. Strong mechanical strength and flame-retardant grades help meet safety standards. Growth in these industrial sectors creates steady demand across multiple product categories.

Key Trends & Opportunities

Shift Toward Recyclable and Sustainable Polypropylene Grades

Governments and manufacturers push for circular economy models, resulting in higher investment in recyclable and bio-based polypropylene. Modified grades help reduce carbon footprints without compromising strength, clarity, or thermal stability. Packaging companies test new resin blends that support food-contact safety and reuse. Chemical recycling technologies unlock opportunities for high-quality recycled polypropylene suitable for demanding industries. This trend encourages material innovation, new product launches, and partnerships between polymer producers and packaging converters.

- For instance, Arkema’s OREVAC® 18751 maleic-anhydride modified polypropylene resin exhibits a density of 0.910 g/cm³, a melt index of 37 g/10 min (230 °C, 2.16 kg load), a tensile yield strength of 24.0 MPa, elongation at break of 500 %, and a Vicat softening point of 138 °C.

Technological Advancements in Material Customization

Producers develop modified polypropylene with enhanced impact resistance, UV stability, and melt flow characteristics. These improvements expand use in 3D printing, precision molding, and high-performance automotive parts. Product designers benefit from better surface finishes, color stability, and complex part geometries. Smart manufacturing and compounding technologies support faster production and lower defect rates. As industries look for engineered plastics with multi-attribute performance, customized polypropylene grades create opportunities for premium applications and new revenue streams.

- For instance, PetroChina’s K9928H high-impact copolymer polypropylene—used in appliance parts—delivers a typical Melt Flow Rate of approximately 24 g/10 min (at 230 °C, 2.16 kg load), a notched Izod impact strength of approximately 113 J/m (or 11.3 kJ/m²) at 23 °C, and a tensile yield strength of approximately 24 MPa, according to typical product data documentation.

Key Challenges

Fluctuation in Raw Material Prices

Polypropylene production depends on petrochemical feedstocks, which face sharp price changes due to crude oil volatility and supply disruptions. Rising raw material costs increase production expenses for manufacturers and converters. Sudden price hikes make long-term contract planning difficult for automotive and packaging companies. These fluctuations also affect profit margins and limit adoption in cost-sensitive markets. Many producers respond by expanding recycling capacity, but recycled feedstock availability remains inconsistent across regions.

Competition from Alternative Engineering Plastics

Materials like ABS, polyethylene, polycarbonate, and composites compete with modified polypropylene in strength-critical and heat-sensitive applications. In some sectors, buyers choose engineering plastics with higher rigidity or chemical resistance, reducing polypropylene’s share. New bio-based or biodegradable polymers also challenge its position in sustainable packaging. Manufacturers must innovate with better impact resistance, surface quality, and processing efficiency to stay competitive. Lack of differentiation may slow adoption in premium end-use industries.

Regional Analysis

North America

North America accounts for 28% share of the Modified Polypropylene market due to strong demand from automotive, electrical, and packaging industries. Automakers in the U.S. and Canada use lightweight copolymer and homopolymer grades to improve fuel efficiency and reduce emission levels. Growth in 3D printing materials and high-performance components in electronics also increases consumption. The region benefits from advanced compounding units, recycling infrastructure, and strict guidelines supporting sustainable plastics. Packaging producers adopt customized modified polypropylene for food containers and medical supplies due to regulatory focus on hygiene, durability, and chemical resistance. Market expansion continues with rising EV production.

Europe

Europe holds 24% share of the Modified Polypropylene market, supported by high adoption in automotive, industrial goods, and construction sectors. The region emphasizes lightweight vehicle parts to meet CO₂ reduction targets, creating steady demand from Germany, France, and Italy. Packaging and medical device manufacturers prefer copolymer grades for impact strength, processability, and heat resistance. Europe’s circular economy rules encourage recycled polypropylene use, pushing converters to invest in advanced compounding lines. Growth in electrical housings, consumer goods, household appliances, and high-speed manufacturing also drives steady uptake. Eastern Europe shows growing demand due to rising packaging production and infrastructure projects.

Asia-Pacific

Asia-Pacific dominates the Modified Polypropylene market with 42% share, driven by large-scale automotive manufacturing, electronics assembly, and booming construction activities. China, India, Japan, and South Korea have strong polymer processing industries and extensive OEM networks. Packaging producers invest in modified polypropylene for food-grade films, FMCG packs, and industrial containers. High population density and rapid consumption patterns increase demand for flexible packaging and consumer goods. Rising EV and electronics production accelerates usage in battery housings and electrical parts. Government incentives for manufacturing and low production costs make Asia-Pacific a key hub for global polyolefin exports, supporting market expansion.

Latin America

Latin America captures 3% share of the Modified Polypropylene market with steady demand from packaging, construction, and automotive aftermarket applications. Brazil and Mexico lead production and consumption due to established plastic conversion industries. FMCG producers use modified polypropylene films and rigid packs for food, beverages, and personal care products. Construction growth and infrastructure spending support pipes, fittings, and sheet applications. Imports from Asia-Pacific remain high due to cost advantages. Local recycling initiatives improve availability of reprocessed polypropylene, supporting domestic converters. The region shows moderate growth as manufacturing activities recover and packaged consumer products expand.

Middle East & Africa (MEA)

The Middle East & Africa account for 3% share of the Modified Polypropylene market, influenced by industrial growth, infrastructure projects, and expanding plastic packaging. GCC countries invest in petrochemical capacity, creating competitive pricing for polypropylene derivatives. Demand rises from electrical goods, agriculture films, and pipes used in building and irrigation networks. Africa’s growing FMCG and pharmaceutical sectors adopt modified polypropylene for bottles, caps, and pouches due to durability and chemical resistance. Import dependency remains high, but new polymer processing plants improve local supply. Economic diversification, urbanization, and construction spending support future demand.

Market Segmentations:

By Type:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Modified Polypropylene market players such as Covestro AG, LG Chem, PolyPacific, SABIC, China XD Plastics Co., Ltd., Arkema, PetroChina Company Limited, Kingfa Sci. & Tech Co., Ltd., JIANGYIN EXCEN, and LyondellBasell Industries Holdings B.V. The Modified Polypropylene market features advanced material technologies, strong production capacities, and a rising focus on specialty compounds. Manufacturers expand portfolios that include high-impact copolymers, reinforced homopolymers, flame-retardant formulations, and long-glass-fiber composites for demanding automotive, electrical, and industrial uses. Research and development drives improvements in heat resistance, surface finish, chemical stability, and lightweight performance to meet the needs of EVs, consumer appliances, medical devices, and packaging products. Companies strengthen market presence through strategic collaborations with OEMs, capacity expansion, and investments in automated compounding facilities. Sustainability initiatives accelerate, with producers adopting recycled polypropylene, bio-based additives, and circular economy models to align with regulatory goals. Continuous quality upgrades, product certification, and customized grades support competitiveness in global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Covestro AG

- LG Chem

- PolyPacific

- SABIC

- China XD Plastics Co., Ltd.

- Arkema

- PetroChina Company Limited

- Kingfa Sci. & Tech Co., Ltd.

- JIANGYIN EXCEN

- LyondellBasell Industries Holdings B.V.

Recent Developments

- In March 2025, Dangote Refinery announced the imminent start of polypropylene production which it stated would significantly reduce Nigeria’s reliance on imported polypropylene. This is part of a broader effort to boost local manufacturing and strengthen the naira.

- In January 2025, PolyCycl, a circular economy technology start-up based in Chandigarh, announced the launch of its patented technology that converts hard-to-recycle plastics into food-grade polymers, renewable chemicals, and sustainable fuels.

- In November 2024, Cooper Standard expanded its product portfolio with the introduction of the groundbreaking FlexiCore Thermoplastic Body Seal. This new seal acts as a sustainable, fully recyclable, lightweight plastic alternative to conventional EPDM rubber seals that contain metal or aluminum carriers, without compromising performance.

- In November 2024, BASF launched Easiplas, a new brand of high-density polyethylene, while also achieving significant construction milestones at its HDPE plant located at the Zhanjiang Verbund site. These developments highlight BASF’s commitment to providing customer-centric and high-quality products that meet the increasing demand for HDPE in the Chinese market

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as automotive manufacturers replace metal parts with lightweight polypropylene compounds.

- Electric vehicle growth will increase usage in battery housings, interior trims, and under-hood components.

- Packaging producers will adopt more modified polypropylene for food, medical, and personal care applications.

- Growth in consumer electronics will support adoption of flame-retardant and reinforced grades.

- 3D printing and additive manufacturing will create new opportunities for engineered polypropylene filaments.

- Recycled and bio-based polypropylene grades will gain traction due to sustainability policies.

- Construction and infrastructure projects will drive demand for pipes, sheets, fittings, and fiber-reinforced parts.

- Automation in compounding plants will improve product consistency, output, and cost efficiency.

- Research will focus on higher heat resistance and chemical performance for industrial uses.

- Expansion of production capacity in Asia-Pacific will strengthen global supply and export availability.